I’m behind the curve on recommending Phillip Swagel‘s BPEA paper on the Administration’s response to the financial crisis. But today he talked to the students in my macro course, and his presentation just reinforced my view that his account is one that everbody should read.

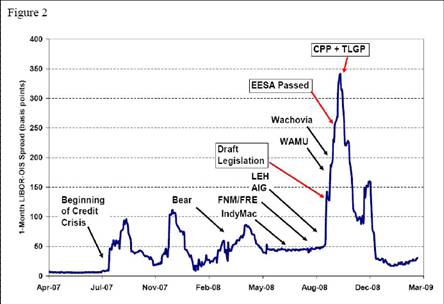

Here’s a picture showing the evolution of the one-month Libor-OIS spread.

Figure 2: from P. Swagel, “The Financial Crisis: An Inside View,” paper presented at Brookings Panel on Economic Activity, March 2009.

Other commentary on the paper: [0], [1], [2], [3].

Technorati Tags: Phillip Swagel, Hank Paulson,

financial crisis, Treasury Department, and housing crisis.

Overlay the oil price rise on top of this chart and we might get a better sense of cause and effect.

Menzie,

Thanks for this. I am still working my way through the paper but it looks very interesting concerning the thoughts and processes that turned George W. Bush into Herbert Hoover.

Menzie, Phillip Swagel is not an insider.

Rather, he has been the tea cup holder for Paulson.

Better you try to get this rotten bankster Paulson to talk to your students, you would hear nice stories for sure.

This document fills in a lot of gaps in my understanding of why they did not do what I thought they should have done. This will be a very useful paper for economic decisioning making classes.

I got bored after about 2/3rd of the way through. More detail than I needed to know. By that time, it was clear that they were simply trying to hang on – not make any big mistakes.

But the question of what should be done next is not answered by understanding why and how we got were we are.

I noted this sentence: “As time went on, it became

clear that AIG was a black hole for taxpayer money and perhaps a retrospective analysis

will demonstrate that the cost-benefit analysis of the action to save AIG came out on the

other side. But this was not apparent at the time”.

I noticed this sentence because I think, again as an outsider, that enough has changed since the original decision, that someone in the Congress or the President should consisder again the issue of letting AIG collapse. This time, surrounding conditions should be specified in advance so the consequences fall in a way that favors U.s. taxpayers. Specifically, both the Fed and the Treasury should announce that no more governmental funds will be allowed to be transferred to counterparties to pay for insurance taken against any form of derivatives. Derivative insurance must be paid for only by the private firms that accepted these contracts.

So, Paulson apparently knew (or at least suspected) that his bonus money was based on bogus profits. Do you suppose that he will return any of it?

I’m with ReformerRay and John Lee. This was an overly verbose and stultifyingly detailed rehashing of the same platitudes and rationalizations mouthed by politicians, government officials, “professional” economists, and financiers, while avoiding any discussion of the systematic abrogation of financial regulatory controls. Most telling, is the avoidance of any discussion of criminality or ethical lapse in the bad mortgage/securitization/OTC-derivative fraud, or the direct looting of US government credit by subsidizing private loan and security losses, as well as extending FDIC and FRB guarantees to investment banking operations.

I become more despondent every day, as I realize that virtually every significant institution involved in the financial/economic system of America, has been captured by the same plutocrats who are responsible for the massive frauds recently exposed.

It doesn’t take a rocket scientist to realize that it wasn’t a coincidence that investment bankers like Rubin and Paulson were installed at the Treasury, or that a libertarian free marketer like Greenspan ran the FRB, or that O’Neil and Snow were pushed out of the Treasury when they didn’t play ball or that Brooksley Born was marginalized at the CFTC. Indeed, it beggers understanding, how the US could have two massive residential real estate looting operations within 20 years!

If you haven’t seen it, Bill Moyer’s interview with William K. Black

provides a very painless and far more eloquent exposition of my feelings on the subject.

Reformer, John and Mark,

I am only 10 pages into the report and I am amazed. It is one of the most illumination reports I have seen on this issue because it comes from the inside and talks about how policy decisions were made.

That said my stomach started churning almost from the beginning as I realized how stupid these people were. Swagel openly admits that the people at Treasury who are supposed to be the brightest economic minds in our country had no idea what they were doing. My daughters could have run things better.

He admits that they used wrong models and because of that they made huge mistakes. I assume that he things that pointing this out somehow makes it okay to bring down the largest economy in the world. It actually powerfully supports the position of those of us who say that only the market can manage the economy. Men screw it up.

He admits that they made decisions and instituted policy not knowing what the results would be, and he admits that they knew precisely the cause in some of the problems, but instituted policies that only made these problems worse.

For example he says on page 10, “Too many borrowers were in the wrong house, not the wrong mortgage.” Then in the very next sentence, “The FED cut interest rates…” then he makes the stupid assessment of the results of the FED actions as “eliminating the payment shock for many subprime borrows.” That is such a stupid statement when less than one year the whole thing collapsed and foreclosures went through the roof.

And lest some think that this was because it was the Bush administration on page 9 he points out that the Obama Treasury plan has the same elements as the Bush Treasury plan.

Hopefully I can finish this and report back again before the nausea overwhelms me. Central planning is so stupid.

I’ve never met Phillip Swagel. I assume he is bright, honest, ambitious and hardworking. I also think that his paper is valuable in helping understand the mindset of those in the Treasury bureaucracy. I’ve also been teaching it to my students. However, although he states that “…a paper such as this will inevitably be seen as defensive, if not outright self-serving…”, I’m not sure that he understands the extent to which it does.

Take, for example, the first page where he emphasizes the role of legal constraints and castigates economists for using the word “force.” I wonder where Prof. Swagel thinks laws come from. I had thought that a legitimate role for highly-educated economists with titles like “Assistant Secretary for Economic Policy” would include shaping proposals for new laws and regulations. He too might agree that it would be of substantial interest (perhaps the most) to economists.

Other aspects of his emphasis surprised me. The 13-page discussion of aid to homeowners was, I think, a buzz-kill for many readers. The failure to put into perspective its overall importance and success in addressing the crisis (i.e. next to none and none, respectively) made me wonder what the author was thinking.

One passage I quoted for my students was By early 2007, we were well aware of the looming problems in housing, especially among subprime borrowers as foreclosure rates increased….

which is quickly followed by The prediction that we made ….in May 2007 was that we were nearing the worst of it in terms of foreclosure starts…but that the problem would subside after a peak in 2008. An editor needs to sit down with Prof. Swagel and explain to him what “well aware” means. He is dangerously close to self-parody here.

To me, the most damning and useful feature of the paper was exemplified by his quote of Fed. Governor Kevin Walsh [I’d love to get the precise citation so that I can use it] “Once youve seen one financial market crisis….youve seen one financial market crisis This is mentioned shortly after the statement that “Secretary Paulson on this arrival in summer 2006 (DATE) told Treasury staff that it was

time to prepare for a financial system challenge.” and “Rather than trying to prepare plans for particular scenarios, the focus at Treasury was on risk mitigation beforehand…” With the benefit of hindsight, we can say that this probably cost the US government and economy a year (at least?) in learning how to respond to a banking crisis. Financial market crises in the US (the thrift crisis, the LDC debt crisis, LTCM, the ’87 crash) don’t have very much in common. However, developed country banking crises do. [For example, see the 2004 report of the Basle Committee on Banking Supervision “Bank Failures in Mature Economies”] No one at Treasury appeared to know anything about handling a full-blown banking crisis; the words “Japan” or “Sweden” do not appear anywhere in Swagel’s 52 pages. Banking crises instead are studied by international economists, and ambitious international economists do not work at the US Treasury. I still wonder whether anyone at Treasury has spent any meaningful amount of time talking to anyone with experience in successfully resolving a banking crisis. If not, why not?

Interesting to see where the graph starts and the beginning of the banking crisis. It would be more instructive to review M1 & M2 supplies. Blowups like this start as explained with the person being in the wrong house. This started with policies instituted with the Clinton administration.

Inaction to this fiasco begins with the Franks, Waxmans and Waters of the world. And this White House staff, many holdovers from the Clinton years, want to expand government even more? Lets do the bidding of the idiots in control of Congress.Help us!

I am inclinded to cut some slack to people who are in middle management postions in any bureaucracy. The overall direction comes down from the top. I think the document is very useful and contains much information that should be pondered and examined.

Just as in the fog of war, lack of information was the main problem. No one knew how much insurance was sold for derivatives, what kind of contracts existed. The 2000 Futures Modernization Act forebid federal agencies from collecting any information about the derivatives that were legetimated in that law. At the same time, the wall between regulated agencies, banks and insurance agencies, that should have been safe repositories of wealth, was destroyed. This allowed the securitizaation cowboys to have access to cheap money to play with and leverage up their bets.

My solution is to not try to regulate hedge funds or derivatives or the securitization process but to wall these activities off from the funds held in banks and insurance companies, that should be regulated as after the Depression, so as to make banking and insurance boring again, as Paul Krugman advoctes.

I do think we should allow speculators to play, just not with wealth stored in the regulated system.

ReformerRay wrote:

I do think we should allow speculators to play, just not with wealth stored in the regulated system.

So if I understand you, the speculators are allowed to play while the losses are stored away to be paif for by the taxpayers. That is not speculation. That is a confidence game. I win, you lose. I lose? Nope you lose, I break even.

This is one of the biggest problems with those who attack the free market (Ray, I am not saying you necessarily) They short circuit the discipline of the market then blame the market for failing.

dickF – If the banks and insurance firms are walled off from the unregulated system, they cannot be destroyed by the unregualted system. No matter what happens in the unregualted system, the regulated system will still be standing as a safe place to store wealth. The market will have full rein to discipline folks in that domain. Under this scheme, one would expect to see voluntary association spring up, to provide some kind of assurance for investors.

It would follow that the U.S. government would have no incentive to keep any firm in the unregualted system alive.

My proposal will avoid the problems we have today. It was the ability of the banks and AIG to insure derivatives and to engage in securitization of mortgages that got them in trouble.

My proposal would work if it could be implemented. The big problem is that walling off the regualted from the unregulated system will take a lot of careful work and probably revisions of first attemtps. Some money should be allowed to flow from the regulated to the unregulated system and back again. The trick is to devise a way to permit financial exchanges between the two system while at the same time insuring that the regulated entities cannot be brought down by anything that happens in the unregualted system.

One option is to allow investment to flow between the two systems in terms of purchase of equity and paymnent of dividends but to prevent loans or insurance to flow between the two system. If that is too restrictive, someone better informed that me will need to say how the flow should be constrained.

The hedge fund Long Term Capital Management was rescued by a consortium of banks because the banks had too much money loaned to LTC to allow it to fail.

If the U.S. had not been so enamored with extending deregulation, that experience would have been a wake-up call The Congress and the President would have tried to to figure out a way to wall off the regulated system from the hedge funds.

The powers that be learned nothing from the LTC experience.

Ray,

What do you mean when you say LTC was rescued? The owners of LTC might beg to differ, as they lost the firm and what they put into it.

Likewise, employees at firms receiving government aid today are not happy about it. I work for one. Over the past two years we have all lost a larger portion of our net worth than an investor in index funds would have lost over the same period.

It’s mythology that the GSE balance sheets were a systemic threat. These entities have been duration-matched within several months during this entire decade ! (unlike most of the investment banks whose balance sheets were severely duration mismatched). This portfolio focus — with its hedge fund carry trade accusation–is a canard. The losses in the GSEs were from credit risk-taking after 2004 (ie, its off balance sheet guaranty book). I make not a minor point here. A Treasury official has not done his homework and the next housing finance system will likely be improperly structured because too many officials are looking in the wrong places. To finish a major fact tossed around by AEI and its accolades,yes, the GSEs had a funding advantage over banks in the intermediate & long areas of the curve but their mortgage investments had a commensurate reduction in yield because they were buying their own GSE whole loans & MBS !

MikeR : The banks that had lent money to LTC provided LTC with enough emergency money that they could liquidate in an orderly way, over time. The banks protected themselves, not the owners or employees. That is the sense in which they were rescued. They were not allowed to go directly into bankruptcy.

Most of us have lost some of our net worth. The bottom line is : “How much is left?”. Those of us who did not participate in the gains during the bubble suspect that the participants remain well off today – at least most of them.

During the previous stock market bubble – 1998 – 2000, participants took so much profits off their gains that the capital gains they paid eliminated the fiscal deficit (ignoring the money taken from the Social Security trust fund). I hope you put some of your gains in a safe place.

i thought swagel’s paper was interesting, mostly in terms of showing the mindset at the treasury at the time.

it’s clear they were muddling through, trying to figure out something that would work and that was compatible with current law and with limited political clout. the law was not written to gracefully handle financial crises. in fact the law was written by the same people who got us into the mess. and as for japan and sweden, every crisis is different and requires a different response.

RR: the ‘powers that be’ did learn from the LTCM experience, but they didn’t learn what you think they should have learned. LTCM was very different from this crisis. LTCM was a rogue player / idiosyncratic risk situation, and adding liquidity to the system was really all that was necessary to avoid massive failure. in the current crisis we have mass insolvency driving massive failure. and many small, leveraged vehicles have lost huge amounts of money and have been liquidated without causing systemic problems. so i am curious as to what you think they should have learned.

“so i am curious as to what you think they should have learned.”

The should have learned that regulated banks should not be allowed to loan so much money to hedge funds that the survival of the regulated bank is threaten by the possible collapse of the hedge fund.

Unregulated activities should be separated from regulated ones.