Some good news, some bad, in the indicators we follow this week.

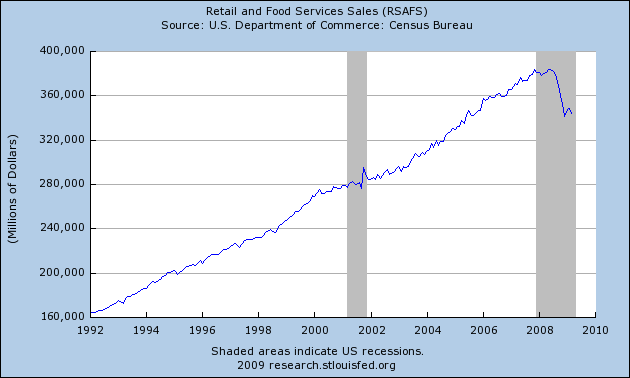

First, the bad news. Monthly sales for retail and food services, which had been up a bit in January and February, fell 1.1% on a seasonally adjusted basis between February and March, leaving the first quarter 8.8% below 2008:Q1. That’s a particularly discouraging development, since given the cyclical behavior of the other components of GDP, it’s hard to envision a recovery without an upswing in consumer spending.

|

On the other hand, new claims for unemployment compensation were reported today to have fallen by 53,000 in the week ending April 11, bringing the 4-week average down by 8,500 from what the revised numbers show to have been the recent peak the week before. If April 4 ultimately proves to be the peak for the entire year, and if this recession behaves like each of the previous 6 recessions, we could expect the NBER eventually to declare that the economic recovery began within 6 weeks of today.

|

Calculated Risk notes Goldman Sachs economist Seamus Smyth’s estimate that a decline of 20,000 in the four-week average signals we’ve passed the real peak with probability 0.5, and a decline of 40,000 would give us 90% confidence. CR accordingly cautions not to get excited over the 8,500 drop seen so far.

Excited or no, bad news it’s not, and the new claims data release was enough to allow the Aruoba-Diebold-Scott Business Conditions Index to climb up to -2.04% on April 11 from the previous assessment of -2.44% for April 4.

|

Technorati Tags: employment,

recession,

macroeconomics,

economics

Could the drop in unemployment claims be due to the seasonal effect of the easter holidays?

So what are you looking to see before you change the “Econbrowser faces the data” smiley face?

Cautious? Buy emerging markets before its too late…The rebound there will be/is much stronger.

I never trust people who correctly predict downturns to correctly predict upturns. That NEVER happens, what ever models they might have.

March’s poor retail sales report can be almost completely explained by the fact that Easter fell on April 12 this year vs. March 23 in 2008.

Steve: We’re waiting for more concrete and compelling evidence before changing the Econbrowser Emoticon.

Professor:

Many thanks for a great note highlighting the importance of the initial claims data. However I think a little clear thinking leads one to be very cautious about the 6-week to recovery forecast even if claims have peaked. (And claims may not have peaked. I share Sergei’s concerns about the effect of Easter ‘holidays’ – but there are no Federal holidays for Easter in the US are there? help anyone?) Anyway, consider the following thought experiment. If initial claims 4-wk average was running at 1m per week and dropped to 950k per week would you still think recovery likely in 6 weeks time. I think not. The economy would be tanking, just not quite as fast. A positive second derivative does not necessarily imply a recovery. Initial claims are a crude (and negative) first derivative of employment, and payroll employment over the last 4 months has been contracting steadily at over 500k per month. If employment losses get smaller in line with last weeks initial claims then perhaps we could see monthly employment losses of only 450k or so, but can this be consistent with the start of a recovery? If so it would be a strange recovery, in which the unemployment rate rose at a level faster than the average rise during past recessions. What we need to see for recovery is a fall in initial claims that is commensurate with milder falls in employment. Such a level for claims would I suspect be well below 500k per week.

Even though claims improved, I am still concerned about the drop in the number employed vs. the population. In the internet bubble, the ratio peaked at 64.7%. In the 2002 recession, it went down to 62%. It is now at 59.9%. This is going to have a negative affect on discretionary spending.

This recession will end with a bang, and not a whimper. Too much money is sitting on the sidelines not to jump in when the talk turns to the shape of the recovery rather than the depth of the recession.

The process of deleveraging–and it looks like we need a fair bit of that, particularly in housing–is still unclear to me. Could we not get a note on ‘historical de-leveraging paths’ or something like that?

I wish I had the confidence that MikeR has in the 3 significant digits…those ~10M illegals get in my way, ~10% of the work force, but what are you going to do?

Those illegals might come in handy for bulldozing all that inventory, the Next Big and Dusty Thing when it becomes plain that housing is going to be unconscionably delayed with a lot of “illiquid” and deteriorating, possibly even hazardous, housing stock.

Measures to keep house prices from falling into line with wages seem to be having the effect of increasing wage earners/household…and possibly disharmony, starting with parking problems and extended working hours…items most people thought they left behind as students.

A decade of bull does not come undone in a couple of bear years.