Several months ago, I discussed the indicators of financial stress developed by the IMF in two posts [1] [2]. The working paper documenting and extending the results in the World Economic Outlook has just been released.

Figure 4. Financial Stress in Emerging and Advanced Economies. From R. Balakrishnan, S. Danninger, S. Elekdag, I. Tytell, “The Transmission of Financial Stress from Advanced to Emerging Economies,” IMF Working Paper No. 09/133.

From the abstract:

This paper studies how financial stress, defined as periods of impaired financial intermediation,

is transmitted from advanced to emerging economies using a new financial stress index for

emerging economies. Previous financial crises in advanced economies passed through strongly

and rapidly to emerging economies. The unprecedented spike in financial stress in advanced

economies elevated stress across emerging economies above levels seen during the Asian crisis,

but with significant cross-country variation. The extent of pass-through of financial stress is

related to the depth of financial linkages between advanced and emerging economies. Higher

current account and fiscal balances do little to insulate emerging economies from the

transmission of financial stress in advanced economies, although they may help dampen the

impact on the real economy. Case study evidence of past banking sector financial stress in

advanced economies implies that the decline capital flows may be large and drawn-out.

The analysis is quite comprehensive, and the IMF researchers have made the data available to those who wish to analyze the data themselves.

A few observations.

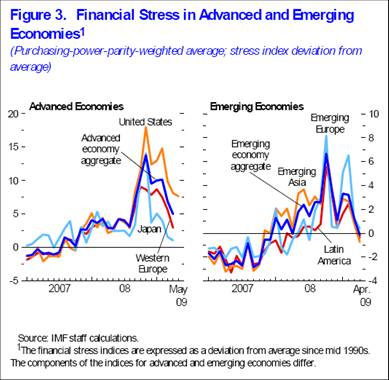

First, the stress indicators extend to 2009Q1, and show stress in both advanced and emerging market economies declining.

Second, the methodology of breaking down the data into tranquil and crisis periods has yielded interesting results. In discussing the two step Forbes-Chinn approach, they find the following:

- Although all the linkages were individually significant determinants of stress

transmission in previous crises, it was hard to pinpoint the most important linkage, in

part because of positive correlations among the different types of linkages. That said,

all three financial linkages taken together were jointly significant as determinants of

stress transmission. The strength of comovement was similar with the United States

and Canada, on the one hand, and with western Europe on the other, consistent with

broadly similar roles of portfolio and bank linkages.- Bank linkages emerge as a more important transmission channel during the current

crisis. For instance, an increase in bank liabilities to western Europe from 15 percent

to 50 percent of GDP (approximately the difference between emerging Europe and

the other emerging regions) raises the comovement parameter by more than 1.

Notably, this result is not driven by the overall financial openness of emerging

economies, which does not seem to play a significant role in stress transmission (last

column). Comovement with western Europe is a lot stronger than with the United

States and Canada, consistent with the dominant role of bank linkages in the current

crisis.

…

Interestingly, and contrary to the original study by Forbes and Chinn (2004), we find that

financial linkages appear more important than trade linkages as determinants of stress

transmission in our sample. In addition, while linkages appear to play an important role,

further testing showed that country-specific vulnerabilities (such as current account or fiscal

deficits) are not an essential part of the stress transmission mechanism (that is, they are not

associated with betas). A further analysis of the role of country-specific vulnerabilities as

determinants of financial stress is undertaken in the following section.

Third, the paper sheds some additional insight on how much “good policies” can help insulate an economy from global financial turmoil.

Emerging economies are able to obtain some protection against financial stress from lower

current account and fiscal deficits during calm periods in advanced economies. However,

during periods of widespread financial stress in advanced economies, the calming effects are

too small to prevent stress transmission. That does not mean that such policy buffers are

ineffective. Rather they influence the transmission to the realeconomy (for example, by

using reserves to buffer the effects from a drop in capital inflows) and the duration of the

crisis, links that were however not studied in this paper.

The IMF’s updated WEO that came out today included the latest readings on the stress indices. Here’s a picture detailing some of the individual stress indices:

Technorati Tags: financial stress, yield spread,

exchange market pressure, financial crises.

Stress will be almost gone by Q3 in all economies.What goes up, must come down. If e.g. zloty will appreceate to 4PLN/EUR, consider financial stress in emerging Europe gone as well, as risks for West Europe banks to loose money due to devaluation will abate dramatically.

This financial stress after Lehman is the single source of current depth of recession, and is purely a psychological one.

It seems US will lag behind , maybe because they have (been forced) to make it so complicated.

It is an ebb and flow, like the tide or the seven-year water level circuit in Midwestern lakes and rivers. There is always a huge push followed by an undertow to pull it all back in the crock-pot. The only problem is that when the global marketplace stops pushing and starts pulling it collects debris and ruckus along the way. Only to be washed clean.

The global marketplace in some serious stuff right now and a little financial Darwinism may be in order– but that is the name of the game. I agree with the above post– US will lag a bit but (as usual) we will have the brains and drive to rewrite the industry, piloting off of our friends around the world. We’ll probably take credit for it too! hahah