The WHite House has just released the Mid Session Review and the CBO the Budget and Economic Outlook: An Update. Here are the economic projections:

Excerpt from Table 2 from OMB, Mid-Session Review, August 25, 2009.

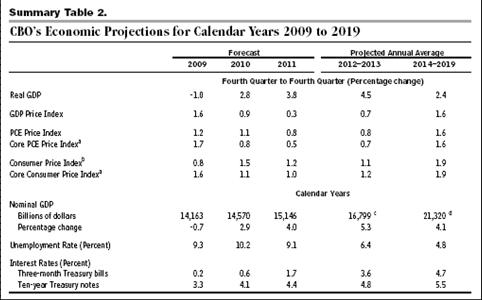

Table 2-1 from CBO, Budget and Economic Outlook, August 25, 2009.

Update 3:40 Pacific: Here are implied GDP trajectories, using q4/q4 growth rates.

Figure 1: Log GDP (Ch.2005$) from Advance 09Q2 release (blue), August mean WSJ forecast (red), OMB Mid Session Review (green *), and CBO August update (pink triangle). Sources: BEA Advance 2009Q2 release, August WSJ survey, OMB Mid Session Review and CBO August Update.

I wonder what assumptions they are making for consumption and saving.

Consumers in mature economies like the US and UK experienced a large decrease in the value of their home, home equity, and retirement portfolios. They will not feel wealthy enough to resume spending at pre-crash levels for years.

Lower consumption growth in mature economies will impact China and other high growth economies who rely on exports to fuel their growth. Further, their domestic markets are not developed enough to pick up the slack. It looks like more weight on a scenario with below average global economic growth for years to come.

Nominal GDP is going to grow faster in every year from 2011-2016 than it did in 2007? Real GDP is going to grow over 4% three years in a row? There won’t be a recession in the entire next decade? Does any of that make sense to anyone anchored to reality?

Ya ok.

Soooo… 4.5% real GDP growth next presidential election year, core inflation leveling out at 1% or less for the next 10 years, and I read elsewhere the accumilated new public debt goes up by $9 trillion over the next 10 years, bringing the USG debt total to $20.5 trillion, if we add in the social security trust fund that still needs to be financed with real money.

Sure, why not? Thx for the news.

Does economists anytime compare results of previous forecasts with reality? What is the average accuracy of the USA CBO forecasting, especially in times when there are rapid changes, like now? Are there any historic analysis of forecasting accuracy of different methodologies/bodies/persons?

In physics, when something is measured, there is always an error band. In economics , there seems to be no error bands, nevertheless, forecasts are usually erroneous. Does error bands diverge too fast as things develop to have any meaning?

Do you believe that real GDP can possibly grow at annualized rates of 4.5% over the three year period of 2012-2015 used in these forecasts, particularly since population and labor force growth will be a constraint, relative to historically remotely comparable periods of economic recovery? Between 1960-1970 real GDP grew at 4.2% annualized and per capita at 2.89% this has never been achieved since-one has to see a significant surge in productivity to get there. And if we are off by 1/2% or more than I would imagine we will see a dramatically larger terminal deficit (literally and figuratively. these estimates seem a tad too optomistic.

The 4%+ numbers are based on a return to full employment and utilization of the factors of production. There’s definitely slack on the supply side, so output could expand. If unemployment falls by 5% over those three years and plant utilization rises from its current 60% back to 75%, it’s not too hard to imagine those GDP growth rates…. but I like tj’s question in the first comment: what do consumption and savings look like? I suspect that older workers will cut consumption to rebuild their retirement savings; and among younger workers, the mindset has (partially) shifted away from conspicuous consumption and towards frugality.

The best route I see for the US is a significantly weaker dollar. That would fix our balance of trade, and domestic savings rather than foreign borrowing could support the gov’t deficits. The problem with the export-led recovery (or at least, trade-balanced recovery) is that everyone else wants to do it too.

In general, I favor CBO numbers over administration numbers. That was especially true in the Bush era, but remains true now.

One thing I don’t understand: Q4/Q4 real GDP growth for 2009 is forecast as -1.0 by CBO, +1.5 by the White House. Presumably they’re working from the same numbers through 2009H1 (preliminary) — are the WH forecasts really 3% higher (annualized) for the rest of this year?

peace,

lilnev

So, according to these projections by the US-administration, economic growth in United States will be subdued somewhat in 2010 and then the big troubles will be gone and the economy will roar ahead.

What about the total credit market debt to GDP ratio in US of about 375% (as of Q1 2009), which is unsustainable, since, based on the GDP projections, the economy won’t even deliver enough income for the net debtors just to pay off the aggregate interest on this mountain of debt? Does this administration and its advising economists believe this credit bubble can increase infinitely? And there won’t be any massive debt deflation at some point? Does this play any role in their thinking? How has this been taken into account in these projections? I doubt it has been at all.

rc

lilnev: WH projects -1.5% growth q4/q4 for 2009. See Table 2 above.

Ivars: For CBO, see here.

I strongly share the skepticism expressed in the above posts.

But let’s assume this nonsense has some kind of validity. It is definitely time to get out of bonds and load up on equities. We are about to experience the snortiest bull market imagineable!

If some of you have a little corner of wilderness Canada you enjoy visiting or would like to visit, please get out and do it! This kind of growth will lead to enormous habitat destruction in the rush to monetize the natural assets and get-rich-quick.

Ah, my bad — but part of the blame goes to my browser’s rendering, which eliminated the minus sign when displaying that graphic. “View Image” to get the full size restores it.

“Real GDP is going to grow over 4% three years in a row?”

Why not? Starting with near (or over) 10% unemployment, there’ll be plenty of underutilized resources readily available. We had stronger, longer growth than that after the ’82 recession.

I remember back in 1996, when the economy was “normal” (probably for about the last time since then), not depressed, and Krugman mocked the “four percenters” who thought 4% growth was possible from there, for not understanding that even the simplest economic models showed 4% growth for five years would reduce unemployment to only 1.5%, which was absurd. Thus, 4% growth for five years was absurd.

What followed immediately? Growth over 4% for five years, with unemployment falling nowhere near 1.5%.

As Casey Stengel used to say, making predictions is difficult, especially about the future. Even if you are an “expert”. Especially if you are an expert, because you will be sorely tempted to overestimate how your genuine expertise also serves you as a crystal ball (see Krugman’s faith in his “model” there) while forgetting that all crystal balls are bogus.

So a strong extended recovery is certainly plausible … but who knows?

“core inflation leveling out at 1% or less for the next 10 years”

OTOH, that sounds a lot more like the Japanese experience. Let’s hope not. I hope the fed can do better than that.

“Does economists anytime compare results of previous forecasts with reality?”

Sure. Just a bit over exactly one year ago oil was $145 and lots of serious people were predicting it would be >$200 by now. I have year-old copies of The Economist warning the Fed was at risk of being too soft on inflation. Remember when the big economic problem in the media was the “oil speculators”? That was just last year.

People then didn’t even know they were in a recession that had started eight months earlier. If Casey were still around today, he’d be saying that making predictions about the present is difficult too!

“In physics, when something is measured, there is always an error band….”

Don’t brag about its small error bands. Physics has it easy: It doesn’t have to predict changes in human behavor, and has a lot less random chance to deal with.

As I’ve noted before, even NFL football games, with all relevant data right there in front of everybody in advance to model to one’s heart’s content, are determined

50% by chance. That means 50% of game outcomes are totally unpredictible, which gives a pretty fat error band to anyone who tries to predict them. And even physicists can’t reduce it! (Any who could would quit physics, move to Vegas, and own a casino.)

Now, for purposes of modeling and making predictions, for which do we all have less information about all the data and processes involved: an NFL football game or the economy? (In economics, we often don’t know even the simplest fact of whether the economy is growing or shrinking, until months afterward!) If NFL games are 50% unpredictible, and we have so much less complete information about the economy, is it surprising to find a major error margin in economic predictions? What else would you expect?

This actually has quite significant implications for policy … but that would be for another time.

However, here’s one fun implication. The future is determined by factors both known and unknown. Thus, as has been pointed out by Scott Sumner, if economic shocks always hit as a surprise, as a “wrong prediction”, this can be read as a good thing — policy makers successfully adjust for all known risks, and the economy is hit only by unknowns. Which is the best possible result.

(Of course, the popular reaction will be to interpret it rather the opposite: “These idiots never see the problem coming. How can they be so forever incompetent? We all plainly see after the fact what went wrong, if it’s so clear to us amateurs now, why couldn’t they have had a clue beforehand when it’s their job?” So getting the best possible result will get people castigated and fired. But nobody said life is fair.)

Joe,

There won’t be a recession in the entire next decade? Does any of that make sense to anyone anchored to reality?

The fact that Obama’s approval rating is still 48% shows that almost half of all Americans (including 96% of African Americans) are not anchored in reality.

I really forsee a financial collapse in the US with the endless cycle of politicians buying elections with tax dollars that never materialize. A russian analyst projected that the US will be in a wholesale revolt by 2011. The more I hear from this administration, the more I agree with what I originally thought was a nutball.

Round 2 of the stimulous is going to be the 90,000 dollar a year grass cutters and othe temp jobs. Those jobs will all end and we’ll be talking about the jobless recovery in 2013.

I think it would be instructive to show how much of the deficit is cyclical (due to high unemployment and added need for food stamps, unemployment payments), and how much is structural. I’m not sure if the OMB or CBO make those calculations.

To me, it was always very telling that under Dubya, we allegedly had full employment and 2-4% growth for a couple of years due to the bubble economy, and we STILL had a sizable deficit. As sure a sign of any of that administration’s fiscal failure. It’ll take quite an effort to get out of the hole that has been left.

The fact that growth isn’t projected to fall to its usual 2.5% until 2019, together with much else I’ve heard, seems to indicate we are expected to have an output gap for the next decade.

Why?

The old-Keynesian stuff, which is about how caught up I am, gives no clue as to how fast a gap should close, just that it might not do so on its own over the horizon during which prices are downward-sticky. The New Keynesian would seem to be a start, since unlike the old it is genuinely dynamic. But if that’s the start, I can’t find the finish.

In short – where can I find the theory that relates the size of a demand shock (or whatever) to an output-gap duration? And where is the related empirical work?

Citations, anyone?

At bottoms forecasters consistently underestimate growth and always project a weak recovery.

But the historic record is that recoveries are proportional to the recession. That is severe recessions have strong recoveries and mild recession have weak recoveries. the historic record implies that we should expect two-three years of above trend growth.

@Jim Glass:

“‘Real GDP is going to grow over 4% three years in a row?’

Why not? Starting with near (or over) 10% unemployment, there’ll be plenty of underutilized resources readily available. We had stronger, longer growth than that after the ’82 recession.”

Except in 1982, unlike today, the economy of the United States wasn’t sitting on a mountain of debt, the biggest debt bubble maybe in history.[1] This major pre-condition that led to the recent recession hasn’t been eliminated yet. Based on logic, such a debt bubble is not sustainable and will inevitably deflate. Since GDP-growth for the last decades has depended on the creation of credit to an increasing degree, debt destruction will have a reversed effect on GDP-growth.[2] So far, the government has shifted debt from private balance sheets to government’s balance sheets and, by doing this, compensated for the deflation of private debt, which has already happened during this recession. Secondly, there is apparently an effort to reflate assets again and get credit creation going again, i.e. trying to solve the problem by creating even more credit. These are desperate moves by the government, and although, it seemed to have some success so far, after all, it’s still some room left until the federal debt of the United States will have reached Japan’s government debt of almost 200% of the GDP, nothing of this will prevent the eventual bursting of the debt bubble. I consider the hopes that the economy just could grow itself out of these problems, on which the responses to the crisis seem to be based, as delusional. I am afraid the worst recession after WW II will be nothing compared to what will happen, when massive debt deflation occurs.

[1] http://www.economagic.com/em-cgi/charter.exe/var/togdp-totalcreditdebt

[2] See also: http://www.debtdeflation.com/blogs/2009/01/31/therovingcavaliersofcredit/

rc

J.Miller: As noted in the CBO document, since BEA has not provided updated capital stock estimates to conform to the newly revised GDP series in Ch.2005$, they cannot undertake a comprehensive analysis of the output gap and the cyclically adjusted budget balance. However, you can get a feeling for what the cyclically adjusted budget balance looks like in 2013 (p.27), which is when CBO projects the output gap will close.

In my previous comment I wrote a sentence with which I am not happy. I wrote,

“So far, the government has shifted debt from private balance sheets to government’s balance sheets and, by doing this, compensated for the deflation of private debt, which has already happened during this recession.”

It sounds like the deflation of private debt has been through already. This certainly isn’t right. Also private debt in US is still very high relative to US GDP. So, I should have written instead, “which has already started during this recession”, to avoid a possible misunderstanding of what I have been saying.

rc

“I only believe in statistics that I doctored myself.”

W. Churchill

spencer: Thanks for reminding us of those stylized facts concerning the behaviour of equity markets following recessions. Could the fact that this deep recession was finance-sector propogated significantly alter those stylized facts?

Just curious. Market participants are behaving like sustained robust real growth is a strong likelihood. FWIW, my USO oil fund put options keep expiring worthless while almost everything else in the portfolio keeps climbing up including the base metal plays. I don’t know whether to be pleasantly surprised or terrified.

I do come across writings from fans of the “output gap” now and then, and they talk in terms of two things:

1)We cannot have inflation if the output gap is large(68% was the last number I saw.)

2)We will fill up the output gap with employment, and GDP goes up.

I have seen news lately that indicates there is a third way to close the output gap. GM said the US auto industry was sized for 15 million units a year, and GM decided going forward a more realistic figure is 12 million units a year. So they are downsizing with this new market size in mind.

A related news item was that not all auto parts production has left for China yet, and this still represents a significant portion of the US economy, which is why the taxpayer needed to buy GM, and Chrysler.

But that would mean the rest of the US auto supplier industry would need to downsize by a similar percentage.

Then on a sort of related issue, China did recently say they have about another 400 million people(give or take a few) that the Party would like to find a job for. My back of the envelope calculation indicates that that could mean employment in the US drops to negative 100 million. I realize that calculation could use some refinement, but I’ll leave that for real economists to work on.

John Lee Hooker,

I also have read a nice quote just recently. I forgot who said it and I am quoting from memory, so it’s not the exact quote. It goes like this:

“To believe everything and to believe nothing are equally convenient approaches. They both acquit oneself from the necessity for thinking.”

rc

The government announced its frightening prediction the federal deficit would total $9 trillion in the next decade, increasing the current $12 trillion debt to $21 trillion in 2019, a 75% debt increase in only 10 years.

By comparison, the federal debt in 1979 was $800 billion. During the next decade it rose to $2.7 trillion, a 235% increase in only 10 years. As that increase was three times greater than the increase currently predicted, it might be instructive to see what it did to our economy.

In 1979, GDP was $2.5 trillion. Ten years later, GDP was $5.5 trillion, a 120% increase. That 235% increase in federal public debt resulted in a 120% GDP increase.

To achieve the same debt and GDP growth, today’s federal total public debt would have to increase 235% to $40 trillion by 2019, a total deficit of $28 trillion.

Please tell me again what historical evidence (not popular opinion) exists to show the projected deficit is a matter of concern.

Rodger Malcolm Mitchell

rmmadvertising@yahoo.com

So here’s another forecast, this time from Ben Bernanke.

Our forecast is for moderate but positive growth going into next year. We think that by the spring, early next year, that as these credit problems resolve and, as we hope, the housing market begins to find a bottom, that the broader resiliency of the economy, which we are seeing in other areas outside of housing, will take control and will help the economy recover to a more reasonable growth pace.

But no, this isn’t last week’s forecast from Ben, it is his forecast from November 8, 2007 – before the recession started. Its the Fed’s forecast for 2008. Sure isn’t the 2008 that I remember.

Lesson: Official forecasts are seriously flawed in tumultuous times. The reasons for this phenomenon are too numerous to list in a bulletin board, but caveat emptor.

Ivars: “In physics, when something is measured, there is always an error band….”

JG: “Don’t brag about its small error bands. Physics has it easy: It doesn’t have to predict changes in human behavor, and has a lot less random chance to deal with.”

I think Ivars was just asking for some confidence intervals for the projections – a very reasonable request IMO. Too bad policy makers can’t be trusted to grasp the significance of such. (For the same reason, official revenue estimates from Treasury and the JCT are presented as point estimates.)

Agree with the pessimistic views above.

RMM: Historical evidence that fiscal deficits matter needs to come from non-U.S. experience, but that does not make it any less valid (though California may yet give us a local peek). If we come to such straits, it will be a very, very bad result. I’m just afraid we may, simply because too many serious players lack the imagination to anticipate the consequences. It is not a matter of what we can afford – it is a matter of what taxpayers will be willing to pay and perceptions about when that limit is reached. The force that may push us to that point is reluctance by Asian countries to give up reliance on external demand (Bens’ savings glut).

RE: Jim Glass

I think Krugman may have been right back in 1996. I would like to see research (perhaps already done) that addresses whether the Internet bubble of 1997-2000 and the housing bubble of 2002-2007 led to inflated GDP growth, due to asset monetization and subsequent consumption, now reversed. Maybe the NAIRU of 6% or the “natural rate” of unemployment wasn’t wrong after all, and the IT-productivity theory a mirage, a la Prof. R. Gordon.

Peter Balash:

Very interesting topic, and strikes a chord with me, since I was in the IT biz at the time as a contract programmer, and have also become an economics heretic after working for a few decades.

Haven’t read Gordon’s view of things, but numerous corporate studies questioned the ROI of large IT modernization projects among the major corporations. I think productivity may have improved over time, but you can still pay a dear price for improvement.

The econ heretic side of me is always looking for where the money came from that fueled the bubbles. After the IT spending boom, corp debt of the S&P 500 had gone up to very high levels. Then everyone knows the rest, like dot.coms, tech hardware guys, biz to biz software guys, etc…where money came from equity markets.

The housing boom money came from GSEs, banks, securitization, and foreign central banks.

This was more damaging when it popped, due to probably size first, then an over leveraged financial system took the hit instead of corporate balance sheets or equity investors, where leverage is less and there is much less chance of “contagion”.

This is not an exhaustive analysis of course, but just a quick highlight of how I’ve tried to make sense of it all.

Thanks. Good for chuckles.

The Baltic Dry Index has been double-dipping since early June.