Real output grew significantly this quarter. Will employment follow?

|

I first called attention on April 9 to the regularity that a peak in new claims for unemployment insurance usually means that a recovery from the recession will begin within two months. On May 7, I calculated that there was an 85% probability that the peak in new claims was behind us. Although August brought some setbacks to new claims, the last few weeks have confirmed the pattern of a significant drop in unemployment claims typical of economic recovery. Unfortunately, the level remains high enough that net job growth is likely still quite negative.

|

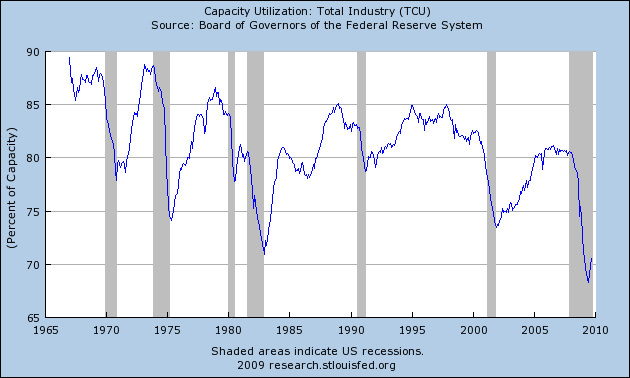

On Friday we received two quite favorable indicators from the Federal Reserve. The first is that the nation’s capacity utilization rate has been steadily climbing since June. Calculated Risk regards that as another reliable indicator that the recession is over.

|

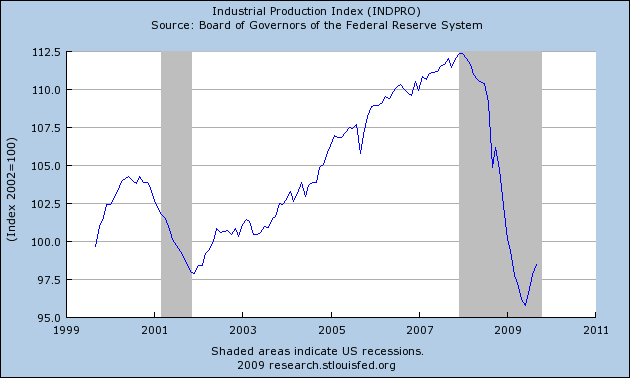

Even more encouraging was the Fed’s report that its index of industrial production rose by 0.7% in the month of September and at a 5.2% annual rate during the third quarter. Paul Krugman thinks that could mean a third-quarter GDP annual growth rate above 4%.

|

That kind of growth is inconsistent with a jobless recovery. After the 2001 recession, we didn’t see a GDP growth rate of that size until 2003:Q3. There are two separate feedback mechanisms operating. The first is that rapidly rising output will eventually bring hiring up with it. The second is that the high unemployment rates will bring more foreclosures and cause spending and output to sputter.

Which is it going to be? Nonfarm payroll employment is the key indicator to watch from here.

On the last point, the fact that housing prices have bottomed and might be rising also helps on the foreclosure/spending front.

instead of measuring in nominal dollars, why don’t you use a constant yardstick? for example gold, oil, M0, s&p500, etc. so you account somewhat more properly for the increase in base money.

While industrial production is normally a lagging indicator, that is based on the historical pattern of personal consumption and residential investment leading us out of recessions. While some improvement in personal consumption has been reported and residential investment has either stabilized or slowed its decline, this is far from the typical recovery.

Rather the industrial production figures are responding to the improvement in trade, with exports rising strongly. And so far this improvement in industrial production has not seen an improvement in manufacturing employment or even hours worked. Given that the global economy remains fragile, I would not rely too strongly on this bounce in production. It may prove to be a dead cat bounce.

What is the contribution of the cash-for-clunkers and the first-time-home-buyers-tax-credit programs to all this? Businesses will wait for the buying frenzy induced by these programs to die out and see at what level the economy really settles and then make decisions on hiring.

…so, does this mean that when the newly unemployed numbers surge in 1Q2010–seasonally and certainly non-seasonally adjusted–you will surmise that we will soon turn back to recession (if we, in fact, are coming out of one right now)?

Does this unemployment theory of economic growth work both ways?

I think one of the reasons why this should not be a “jobless recovery” in the sense of 12+ months of job losses beyond the end of the recession as in 1991 and 2001 is that job losses were so severe.

There’s no way that companies can pile as much work as they should get onto the backs of as few employees as they have relative to those recessions.

Very high rates of part-time employment will insulate the unemployment rate from any heat generated by rapid growth due to inventory adjustment.

I’m watching price/wage data. We’re skating very close to the edge of a cliff, there.

Generally positive news. Let’s see what the economy can handle in oil prices…

This is compatible with jobless recovery, as there is very large idle capacity.

“On the last point, the fact that housing prices have bottomed”

Housing may be bottoming in sales but its no where near a price bottom.

Looking at Chicago house prices for the past year in the Tribune today, the largest percentage drops occurred in the poorer sections of the city with the richer sections holding up better. I am inferring that the poorer people of the city are in worse relative money shape than the rest. I still do not see where the new jobs will come from for the poorly educated low wage American male population. Between low-cost low-skilled Chinese factory labor and low-cost high-skill Indian professionals, will American companies necessarily hire here in the USA when they can hire abroad so much more cheaply? Even in investment banking, an Indian finance professional can be supported in Mumbai for 120,000 euros/year at full cost, but in London or NYC the same level of professional costs the bank 1.2million euros/year. When employment expands, it may not expand here in the USA.

There will be plenty of hirings. Just no net new hirings. The twin pressures from interest rates and oil prices will ensure that this asset-reflation based “recovery” will get killed in any infancy. Americans in the aggregate cannot consume. In addition, the two levers used since WW2–housing and autos–cannot be called upon. And even if they could, we already used them to get out of the last recession, with predictable results. So, a housing and automobile led recovery might goose data for maybe 6-12 months at best.

The problem remains the breadth of the private debt, and, the fact that as a nation we’ve not created anything new in some years and took a pass on doing so coming out of the last recession. Finally, only by arbitrage of cheap energy inputs could we recover. But we don’t have those inputs to call upon now. We are still too leveraged to liquid energy–oil–and not leveraged enough to gaseous energy. We have NG, we just don’t have a system that can run on it.

Monster asset reflation rally underway, therefore, that will do zero to create prosperity through production. This will all terminate in May/June of 2009, and we’ll do a repeat of 2008. Only this time it won’t be Lehman and Bear that will fail. It will be another institution that goes down this time.

Regards,

Gregor

As others note, the peak in claims is so high that even the dip leaves us in job destruction territory. The question is, when inventory rebuilding ends, where will the pickup in End User Demand come from?

Add to this elements of debt hangover that have yet to fully materialize – vacancy-driven commercial mortgage defaults, various residential mortgage rate resets, and a large “pent up supply” of residential homes due to mortgage backlogs and other factors. Plus, we are already seeing cuts to state/municipal budgets for 2010 budgeting cycle.

Exports is a bright spot.

Even in investment banking, an Indian finance professional can be supported in Mumbai for 120,000 euros/year at full cost, but in London or NYC the same level of professional costs the bank 1.2million euros/year.

This is why a weakening of the dollar is being allowed. Europe will be the one in trouble, not the US.

The U.S. government/Fed don’t really want a strong recovery. They want balanced trade, which means a weak U.S. consumer.

In 1Q02 (the first full quarter after the recession ended in Nov. ’01), GDP growth was 3.5% q/q annualised. 3.5% is not very different from 4%. So to say “we didn’t see a GDP growth rate of that size until 2003:Q3” is technically correct, but, I would argue, somewhat disingenuous.

Some folks dismiss inventories as temporary and manufacturing only. Yes, but their contribution now will be huge. Unprecedented. like close to 3% pts pf gdp 3q: and 4% pts in the current quarter.

Next years outlook a question. But at least we have the govt infrastucture spending that many whined was too delayed showing up nicely.

Is it not the case that there is a great deal of excess capacity among existing employees? That employers have cut back hours and instituted furloughs to a much greater degree than in the last (and perhaps any) recession, and that when things really get going again they’ll just go back to 40 hours a week for current employees rather than have to hire? I think this factor will hold back job growth for some time.

I wonder..When job loss increase will slow still further, people who has work will feel more secure and start spending again.

I doubt that 10% jobless decide on consumption levels in the USA ( as opposed to usual 5% or so).

It is the 90% with jobs whose behaviour changes in anticipation of job losses due to information they receive.

Once that fear is over=the speed of job losses is down-> they will start spending again, the ones with work and with money, and will use opportunities brought by price declines and mortgage rate reductions.

That is the reason why speed of job loss, not total unemployed correlate with crises. In some countries the number of jobless is always close to 10% , even in best times ( e.g. Germany) but it does not deter these countries from neither going in nor our of crisis in a similar orderly manner, correlating with job loss RATE.

The kick many in economic indicators were based on extraordinary stimuli+QE by govts/CBs around the world. The structural problems have not been addressed and merely postponed.

It is instructive to see these indicators perking up in 1981 as well, only to fall down to its natural trajectory.

QE induced euphoria & dollar carry trade is now forcing MMs to dance when bernanke etc are playing the music (Prince, 2007). But such acts of extravagance end miserably.

who coined this phrase ‘jobless recovery’?

this is something that exists only in fiat currency systems, where the amount of money can be augmented to game the GDP numbers. i guess the other option was for ‘growthless recovery’, but since there is no such word as ‘growthless’, some keynesean head came up with ‘jobless recovery’.

Professor Hamilton, Most work I have seen suggests that employment follows recovery, not the other way around. A recovery in employment is not a necessary condition for a return to growth in the economy. I have seen work that shows similar results for credit, i.e. that credit is at best contemporaneously endogenous and definitely not a necessary condition for recovery much less a leading indicator. Would your work agree?

rf: New claims for unemployment insurance and hours worked have traditionally been regarded as leading indicators, total employment as a coincident indicator, and the unemployment rate as a lagging indicator. The slow recovery of employment in the 1990 and 2001 recessions was different from earlier experience, and moreover were very different from the big drops in employment that continue to characterize the most recent nonfarm payrolls numbers. This is why I regard the latter as the key indicator to watch at the moment.

Not an L; the odds-on pattern is still a tick. Sharp downstroke, followed by upward bounce which quickly tails off into a long upstroke whose ascent becomes more and more gradual.

If the authorities had acted to recapitalise before Lehmans failed, we might have got away with a V. Since then a tick has been the best that could be hoped for, given the mass of balance sheets to be sorted out.

Oil near 80 USD worries and drags. At 100 USD, it will become a real problem. Household budgets are already stunted and ill-positioned to absorb another price shock. Of course, if you don’t have a job, you don’t have to drive to work. Now there’s a silver lining.

Just thinking about all I’ve learned from Professor Hamilton.