The Reuters/Michigan index of consumer sentiment tumbled four points in April. Could just be measurement noise, or could be that something new is pressing down on consumers.

|

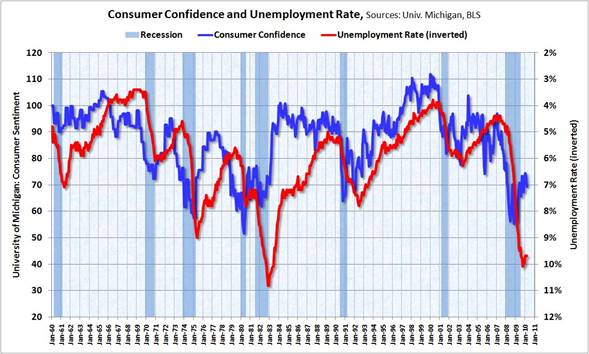

Bill McBride notes that one reason consumer sentiment remains low is that unemployment remains high. He graphs unemployment on an inverse scale below to emphasize the correlation. But with no further deterioration in unemployment, why would consumer sentiment be falling again?

|

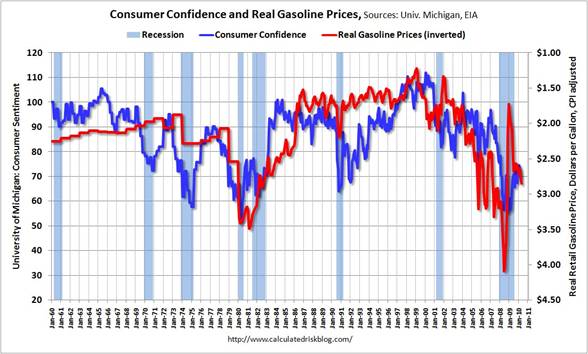

Bill suggests the answer may be the recent uptick in gasoline prices, which he again plots on an inverse scale below (with gas prices deflated by the CPI).

|

A recent study by Paul Edelstein and Lutz Kilian (published version here, working paper here) estimated a simple model of the relation between energy prices and consumer sentiment. For current expenditure patterns, their model implies that a 1% increase in the relative price of energy will over time be associated with a half-point drop in the index of consumer sentiment. In a recent study in the Brookings Papers on Economics Activity (published version here, working paper version here), I used their model as estimated using data over 1970:M1 to 2006:M7 to simulate to contribution of energy prices to consumer sentiment over 2007:M9 to 2008:M9. According to the historical correlation, the 20% increase in the relative price of energy over this episode would have been predicted to result in about a ten point drop in the index of consumer sentiment, suggesting that energy prices were one factor, though certainly not the only factor, contributing to the drop in consumer sentiment observed in the first year of the downturn.

|

Between October 2009 and February 2010, relative energy prices as measured by Edelstein and Kilian rose 5%, and the gasoline price increases seen since could bring the cumulative change to about 8% by now. So the latest four-point drop in consumer sentiment could just be noise. On the other hand, it’s exactly the size of the effect we would expect the recent run-up in energy prices to have.

|

So if Jeff Rubin is correct and crude goes to new highs in 2011, we could expect consumer sentiment to fall off the cliff?

So? Can we ignore it, or should we be dismayed? And, would it make a difference?

Too much Fox News….if did a poll with no Republicans the numbers would be very different…

“Too much Fox News….if did a poll with no Republicans the numbers would be very different…”

Yes, Bill, because as you’ve explained on other econ blogs where your hyperpartisanship repeatedly derails otherwise cogent discourse, Republicans are responsible for everything that so much as looks bad.

Are the Republicans so insightful or is it they

have let their political views blot out any possible

acknowledgement of economic progress….would it help if the President has an (R) by his name instead of a (D)???

The relationship of sentiment to oil price is not linear. Most likely it’s some form of exponential relationship.

At low levels, when oil is 1-2% of GDP, the statistics suggest that consumers are largely indifferent to price. As a share of household budget, it’s just not that much. That’s why you saw people buying bigger vehicles, rather than saving money on fuel during the 1990’s.

Around 4% of GDP, crude oil expenditures become a drag. Since oil crossed the $80 threshold, we’ve all been fretting about the oil price, a signal that we’ve reached some sort of psychological limit.

Much above 4% of GDP, and the historical record shows consumers actively shedding oil consumption, and there’s a grinding feeling to it all. I remember this feeling well from the 1979-1983 period.

So I think we have to be a bit careful with simple linear relationships.

BTW, look at consumer confidence during the Clinton administration. The numbers (as other numbers elsewhere) say he was a good president. Obama could do worse than take a page from Clinton’s play book.

Steven Kopits: Actually, the Edelstein-Kilian model isn’t linear, it weights the energy price change by the energy expenditure share. It’s also dynamic. I’m abstracting from all that to give a rough summary appropriate for the current energy expenditure share and for a sustained increase like the one we’re seeing.

Five things to consider.

1. Most jobs added have been temporary. Consumer confidence won’t get stronger if those temporary employees don’t consider that the job will become permanent. In the case of Census workers it is certain those aren’t permanent jumps so there is not much optimism for the long run.

2. We have seen worse conditions in the weekly reports. There may be something going on other than backlog from Easter and the other California holiday that the government has been using for the excuse – and before that it was snow.

3. The inventory to sales ratio is at levels not seen since before the collapse and lower than what seems “stable”. Previously the inventory to sales ratio went back up to 1.3 to settle not too long before the collapse. If consumer demand for goods and services at the retail end is the driver for jobs we are probably going to have a slow crawl coming off a 1.3 inventory to sales ratio once the wholesale inventory uptick rolls to the retail end. Job creation will come with increased demand as opposed to hypothetical pent up demand.

4. If the driver of the recent job growth had been exports then the stronger dollar is destroying that growth and possibly even reversing it. With the slow pace of job creation via retail we may see some declines after the temporary Census push is over and that spending declines if the dollar remains strong.

5. Remember that since 2007 various retail chains and wholesale supply chains have cut the number or stores and/or warehouses. Less inventories are necessary to stock shelves to capacity. This allows the retailers and wholesalers to maintain or raise prices. With reduced locations these businesses need fewer employees. These locations end up looking busier than ever while a few miles away there is a vacant shopping plaza. This is partly why year over year sales for stores open at least a year look so much better than the prior year or even the year before. It is mostly illusory.

Gasoline prices have mostly diverted spending. At this point I doubt it affects consumer confidence much at all. However, with all of the PR push for this being a recovery, some calls that the recession is over, etc. there is the risk that continued improvement (perceived or otherwise) in unemployment and consumer spending will cause the oil speculators to push up prices heading into the summer.

If that leads to a third (or even fourth) consecutive year of “staycations” well then you will have that ugly correlation. And were that to occur and the government did not step in and at least create the public perception that they were looking out for the little guy then we will see further erosion of consumer confidence.

One thing to search out is how the “GDP” is not a good reference for the economy. The GDP can distort and hide problems due to the way it is calculated.

Hurricane Katrina was great for the GDP because of all the spending but it didn’t take into account all the people who died or lost property.

It also ignores the debt load that is being carried by the citizens and government to keep the GDP going up.

I suspect that its simply an anomaly owning to a caesura in the constant stream of propaganda emanating from ruling class owed and operated media. Some slip, someone’s taking their eye off the ball for a few days, perhaps? After all, the lie needs to be sustained if we’re to create new realities, eh?