I see many financial commentators bravely trying to explain recent ups and downs in asset and commodity prices in terms of news coming out of Europe. But a Eurocentric perspective misses an important part of the story.

My primary concern about the situation in Europe has been that as the probability of default in one country increases, that can increase the risk premium on sovereign debt for other countries as well. Rising interest costs could then force those other countries to restructure their debt. The falling dominos would undermine the net worth of banks that extended the sovereign loans, hindering the banks’ access to short-term credit and their ability in turn to fund private-sector loans in a potential replay of the events of 2008.

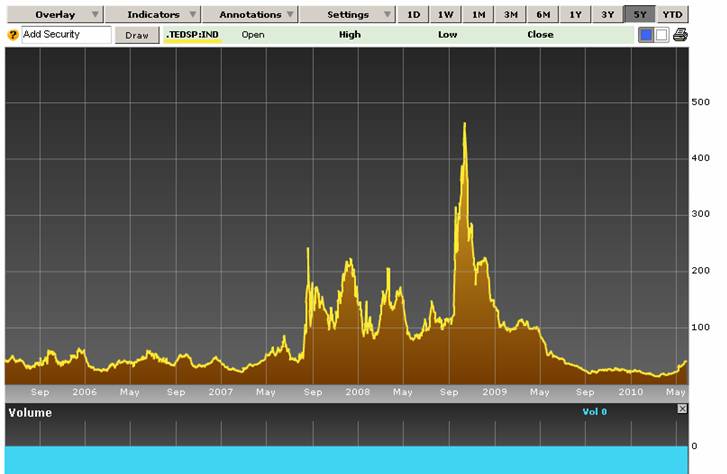

The excess in the 3-month LIBOR bank borrowing cost over the 3-month T-bill rate, known as the TED spread, would be one potential indicator of such concerns. This has risen to new highs for 2010, but is still far below the values we saw in 2007-2009.

|

One fact that seems difficult to reconcile with a purely Eurocentric interpretation of recent developments is the behavior of the Chinese stock market, whose decline in percentage terms has been about the same as that in Europe. Does it really make sense to interpret this drop on the Shanghai Stock Exchange solely as a reaction to developments in Europe?

|

Prices of stocks, property, and commodities in China had been looking rather bubbly to many observers. In some models of price bubbles, what keeps the appreciation going is everybody’s belief that everybody else believes it will keep going. If that describes the situation, worries that started in Europe could prove to be a mechanism to coordinate the inevitable revision to expectations. In any case, a growing resolve by the Chinese government to try to discourage asset price appreciation has coincided with the news about Europe on which many observers are focused. Bloomberg reports that recent tightening measures in China include:

reining in loans for purchases of multiple homes, increasing mortgage rates and raising down payment requirements. The central bank ordered lenders this month to set aside more deposits as reserves for a third time in 2010.

There is also discussion of a plan to introduce a new property tax in selected Chinese cities on a trial basis. If there is a bubble component to current property values, that could be a pretty sharp pin.

Europe isn’t the only drama to be keeping an eye on.

One thing I would say about China is that foreign banks have very little exposure to Chinese assets. I think China could undergo a fairly significant financial crisis and only have modest effects on the rest of the world. Some commodities exporters would suffer no doubt and there are the secondary effects from that, but on the whole it would be largely a national phenomenon.

The thing to note about China as well is that its economic bubble has only recently extended into its housing markets.

Perhaps where that bubble could be seen more clearly is in its what China imports – it has been pulling in massive amounts of goods and services from elsewhere in the world, but is not exporting at similar levels.

Looking at the world’s stock markets, if we assume the Chinese stock market is like the U.S stock market in that it is providing a coincident-to-lagging indication of current economic conditions, it’s likely that an increasingly less prosperous China is pulling down the economic prospects for the European companies who have been benefiting from China’s demand for imports.

We can see some of that in the Shanghai Stock Exchange data chart above – the changes in the Chinese market appear to be slightly leading those in the European ones. Which suggests that as China goes, so will the world….

The best option for China and other countries with huge dollar denominated reserve is to use their dollar to buy euro. This will not change the RMB to dollar peg. However, it will strengthen the euro and stabilize the European financial conditions. It will also buy time for US and China to correct their internal imbalances.

Continue Euro weakness will only benefit Europe’s huge trade surplus countries such as Germany. A weak Euro does not help Greece, Spain, Portugal, and other weak European countries. These trade deficit countries simply don’t sell much to the rest of the world.

A weak euro only exacerbates the imbalance between Germany with the rest of Europe and Germany with the the world. Germany’s low domestic consumption and export driven economy is part of the cause of the current global imbalance. Germany’s Angela Merkel has stated on a Bloomberg interview that Germany will not give up it’s strength. Furthermore Germany’s self righteous finger wagging is suffocating.

On a side note, China also contributed to the global imbalance leading up to the current crisis. However, China has pro-actively correct this by encouraging domestic consumption.

The latest data shows clearly China’s trade imbalance with the world has been correcting for a year. China’s latest monthly trade surplus is tiny.

http://econgrapher.blogspot.com/2010/05/china-international-trade-review-april.html

Germany’s monthly trade surplus is still huge. With a weak euro, it will get bigger.

China is the 2nd largest US trading partner. US export to China is the 3rd largest. Furthermore, US export to China is the fastest growing of all US trading partners.

http://dataweb.usitc.gov/scripts/cy_m3_run.asp

Similar stats applies to China with other nations. In fact, it was the demand from China that help powered the current recovery of many countries around the world (many emerging market nations and commodity export nations).

If China goes down hard, the US and the world will follow. There is no hiding from the soon to be 2nd largest global economy. This is globalization front and center!

Professor,

When you said: “My primary concern about the situation in Europe has been that as the probability of default in one country increases, that can increase the risk premium on sovereign debt for other countries as well.”

I guess you are not talking of countries that have their own floating currency like Canada, UK, Japan, Australia, United States, Switzerland, etc since these countries have all witnessed a substantial reduction in their bond yields in the last few weeks.

Economists that think that Japan, the UK or the US will go the way of Greece are talking total nonsense.

It seems to me, the significance of events in Europe have more to do with their effect on consumption than whether Greece or Portugal defaults.

The past year has seen national governments try to replace, or maintain, what was unsustainable private consumption. Now the example of Greece has made governments realize this is unsustainable. There was an article on Bloomberg a few weeks ago quoting the Australian Treasurer on the need to curb spending, and Australia probably has the lowest debt-to-GDP ratio in the OECD.

The bubble in China, as Chanos has pointed out, is investment. One part of it is property, another is over-capacity. The problem isn’t simply that high-end apartments are unaffordable, it’s that deriving 50% of GDP from fixed investment is unsustainable.

The economic free-fall of ’08-’09 was so dramatic because it occurred simultaneously throughout the world. The “recovery” of June 2009-June 2010 was just as dramatic because of simultaneous fiscal, monetary and cyclical responses.

Now the cycle has turned and governments are over-extended and worried. We are back where we were in 2008, with an unbalanced, even more over-indebted world economy and even more massive over-capacity.

We were so fearful of having to pay the piper we ran up the tab.

There is another China – Europe link. We always hear about how many of our bonds they hold, but they hold lots of Europe’s as well.

Of course the reason they have them is when the Yollar was weakening against the Euro, China started doing much more biz in Europe. Now that things are going the other way, maybe biz is not so good anymore, especially if European demand dries up altogether.

Ives Smith just did an article on it.

http://www.nakedcapitalism.com/2010/05/when-will-europe-have-its-wile-e-coyote-moment.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

So the Chinese government is “reining in loans for purchases of multiple homes, increasing mortgage rates and raising down payment requirements. The central bank ordered lenders this month to set aside more deposits as reserves for a third time in 2010.”

Funny, the U.S. Federal Reserve Chairman says that asset bubbles are impossible to identify and that attempts to restrain them are futile. Stupid communists. Don’t they know anything?

A record of public debts and short term evolution is available at this address

World Bank Quarterly External Debt Statistics (country data tables)

http://web.worldbank.org/WBSITE/EXTERNAL/DATASTATISTICS/EXTDECQEDS/0,,contentMDK:20721958~menuPK:4704607~pagePK:64168445~piPK:64168309~theSitePK:1805415,00.html

The multiple conclusions from these readings, involve the less than sanctified trilogy States,Central banks,Banks

UK ranks second after the USA when it comes to the outstanding gross debts with 9.153 trillion usd. Its government debts are quiet modest when compared to its dependant capital intensive financial sector debts 5.2 trillion usd.One may wonder how much more the CBE can expand its financial paper absorption without being noticeable.

France and Germany are more modest with 5.2 trillion usd but less modest when it comes to their government debts.

All in, the financial systemic risks are alive through inter affiliated banks loans and borrowings,assets liabilities exposures and no countries are immune to structural financial chocks . The capital adequacy shortfall is blatant

in the financial world.

PS I liked the movie Wag the Dog a 1997 black comedy film starring Robert De Niro and Dustin Hoffman

I agree with the title of this article. The problem is not just in Europe but the United States and Canada. In general terms, the entire world is bankrupt. Canada is half a trillion dollars in debt and, of course, the U.S. is in $13 trillion in debt.

No wonder why, since we spend $12 on coffee!

JDH:

Awhile back you wrote a paper on macro applications of GARCH models. The paper included a laundry list of various and sundry GARCH models that covered just about everything imaginable. Looking at your TED spread chart and your comment:

“…as the probability of default in one country increases, that can increase the risk premium on sovereign debt for other countries as well.”

Should we be expecting a TED-GARCH model in the near future?

I wonder if they have NINJA loans in China or if that is just a Japanese-American thing?

About U.S. trade with China, rankings do not tell the story about relative importance there. In terms of total volume, it is a $70 billion export market as of 2009. Even if that declined 50% to $35 billion, it would not knock the U.S. into recession. There would be some additional effects of course as the laid off manufacturing workers would stop spending and so on, but we are not talking about a recessionary impact. The idea that we are reliant on exports to China as a primary engine of economic growth is questionable at best.

“it’s that deriving 50% of GDP from fixed investment is unsustainable”

Maybe. Maybe not. You can’t judge it with US experience. In China 1mm+ population cities are the norm and there are many 30mm+ metros. When you have this kind of scale, private consumption (transportation, public space, recreation etc) could easily manifest as public investment. And since property owners are the ones that really benefit from the public investment in infrastructure, properties should be rather highly valued. This is the Hongkong model as well and that has gone on for many decades.

$12 for a CUP of coffee?

Fortunately, I’ve discovered “ZIRP Coffee for the Non-Investment Banker”.

$5.50/lb for Colombian Supremo.

Then they say the really cool way is to buy green coffee beans and roast them yourself. $4.00/lb this way, even less when you buy a 25 lb bag and green beans can be stored up to a year. But the main reason to roast it yourself is flavor. Better than what you will get in even the best coffee shops.

So I’ve been trying it and concluded that claim is true. The no equipment way to roast is spread the beans on a large flat pan (I use a perforated pizza pan) and then roast at 500F in your stove. The beans start to make a popping noise. This is the medium to light roast stage. Then go another 3 minutes max for French roast. The beans start to make a lot of smoke at this point and you need to have windows open and fans going. This is the big disadvantage of using a stove. They say you can do it in s popcorn maker outdoors. Or you can pop for a $125 coffee roaster. Google for more details on roasting.

But then you let the roasted beans sit for 2-5 days and they develop max flavor. Grind as many as you want and put them in the Mr. Coffee. I no longer want to go to Starbucks.

https://www.ccmcoffee.com/index.php

And here’s a under the hood look at how the recovery is going in the good ‘ole USofA. They say the banks have to get better first, then the rest of us will eventually bask in the good works of the banking system.

Ives Smith on how that looks so far.

Here

Nice article

China may give the world the same foreign creditor to the housing sector haircut the US did when prices fell. But it will only be bad if they have a banking crisis and stop consuming like we did. Not likely as they appear to know what they are doing. they can shrink building and still grow nicely.

I do not know if europe will keep bank credit up, but they know how to. just bail them out, after Greece etc de facto reschedules. Tim G can explain, along with how to do a “stress” test.

As some have noted above, the problem is deficient global AD. We over extended consumption based on unrealistic expectations of asset appreciation. There was a sharp drop in output and consumption that has been halted, in part through an exchange of public for private borrowing, with a meager jobless “recovery.” But the old model is broken. The trade surpluses of export powerhouses (and sources of saving glut – Japan, China, other Asian countries, Germany, and some oil exporters) that supplied the over extended consumption and helped the asset appreciation can no longer depend on debt growth abroad. (Martin Wolf has an apt paradigm about ants and grasshoppers.) Until we find a new model, or simply wait and outgrow the overindebtedness that the old one produced, there can be no self-sustaining recovery.

The problems with China’s economic policies go far beyond its property price bubble. China has for some 20 years been taking advantage of its own excess supply of labor, the availability of relatively cheap raw materials imports after the collapse of the Soviet bloc, the growing demand for consumer-goods imports in developed countries. All four of these growth factors are now severely challenged.

China’s government is not all that worried by the property price bubble, which affects only the elite residential neighborhoods and commercial and office centers of major cities. Although this part of the property sector is financially important, owing to the involvement of major publicly traded banks and developers, it is after all a very small part of the Chinese economy.

China’s government is much more worried about the rising costs of relocating people from rural areas to production centers, and about the widespread resentment of corruption in the working-class residential property market. In this privatised but politically controlled market, local governments sell land to a developer and use the money to make “resettlement” payments to young people moving in from rural areas, who use the money to make down payments on flats built by the developer, and then earn their monthly payments with the job they had lined up before they arrived. The developers are inevitably cronies, who use every trick available to ensure that the workers pay as much as possible. This includes having minor cronies pose as phony mom & pop “investors” and buy up all the flats, then flip them to the workers, while kicking up to the top cronies. I wouldn’t call this a “bubble”, as the workers are not betting on flat price appreciation. It is simply a way for the developer to show a low price to authorities and a high price to the worker buying the flat. If you look at what China’s government has been doing lately re: housing, you’ll see that it’s really mostly central authorities trying to rein in the excesses of local authorities and restrain the rising costs of relocating workers to cities.

But corruption isn’t the only rising cost factor. Raw materials imports, especially iron ore and coking coal, are shooting up in price. The slack in resources markets after the collapse of the Soviet bloc was used up by about 2004, and the slack from the recent recession was used up by early this year thanks to China’s own massive stimulus program, which consisted mainly of accelerating the pace of building of working-class housing, transport infrastructure and steel mills.

Meanwhile developed country consumers have on the whole used up their leverage, and so their demand for consumer goods is topping out. And the offshoring of production lines from developed countries has about run its course, as the types of production that are most easily moved have moved already, and as costs fall in developed markets and rise in emerging markets.

It has always been obvious that the huge gaps in earning power between developed and developing countries would have to start closing eventually. But the adjustment will not necessarily be smooth or easy, especially if governments in both developed and developing countries insist on pretending that they can carry on with business as usual. China and other developing countries need to radically revamp their growth models to focus on supplying their own and each others’ consumers with minimum use of resources. The developed countries need to focus on innovative technology that can reduce the labor component of production, or else the coming upward adjustment in the relative cost of foreign labor will result in lower living standards.