(With apologies to Mussorgsky.) Here’s the first:

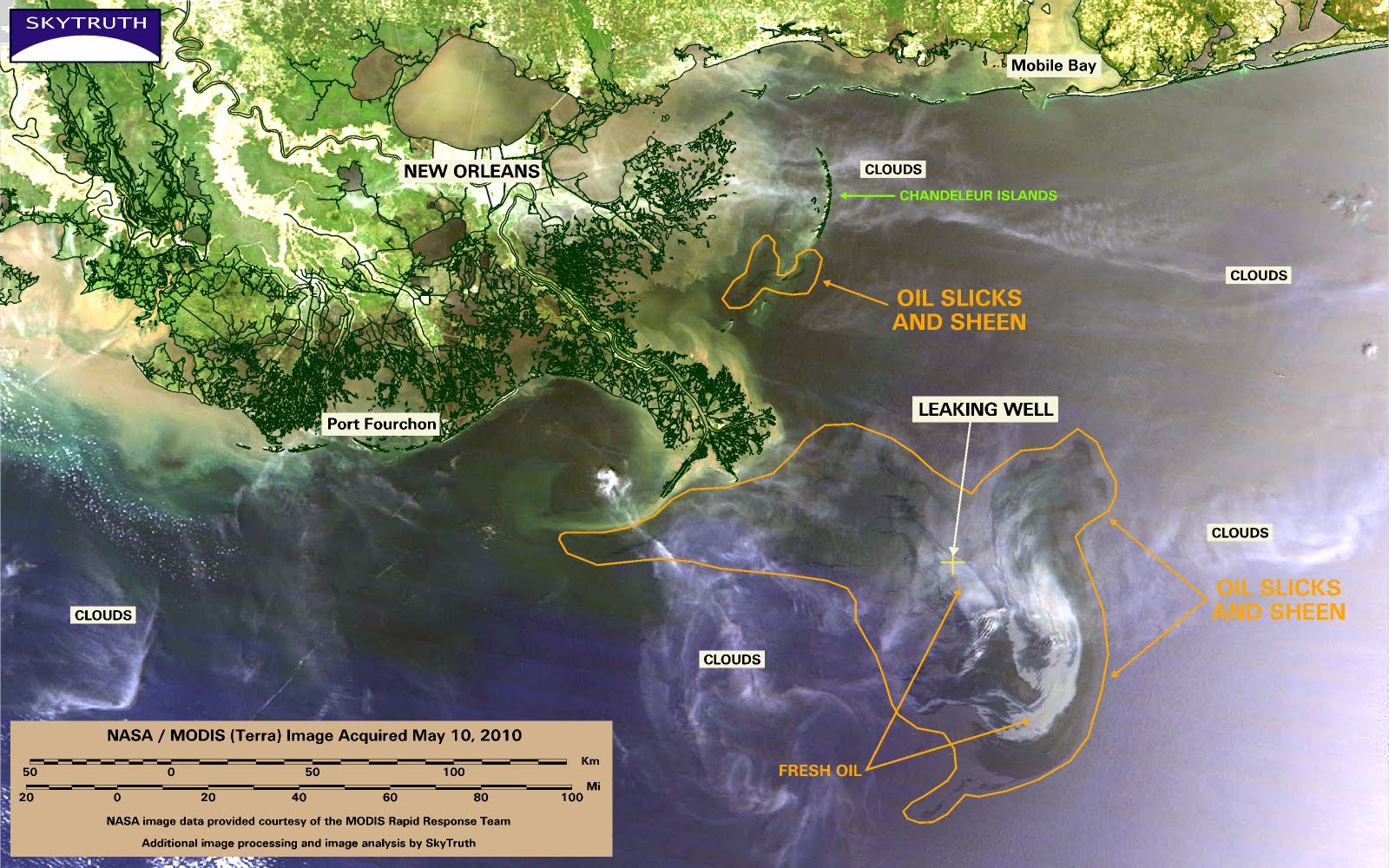

Figure 1: MODIS/Terra image/Sky Truth, May 10, 2010.

The more worrisome picture is below. It depicts the cumulative spill, using the initial estimate, and the more recent estimates based on analyses of the footage of the leaks.

Figure 2: Estimated cumulative oil spill, according to NOAA (blue line), according to Wereley (red line), with plus/minus 20% bands (gray lines), Exxon Valdez spill (black line), and Ixtoc-1 spill (black line), all in thousands of barrels. Wereley estimate is from Steven Wereley/Purdue University. Source: Harris, “Gulf Spill May Far Exceed Official Estimates,” NPR, May 14, 2010.

The implications of the higher rates are obvious, but to be explicit, here are some threshold dates. Under the original estimate, the Exxon Valdez spill at 250,000 barrels is exceeded on 6/8; under the Wereley midpoint estimate, it was exceeded between 4/22 and 4/23.

The biggest Gulf of Mexico event, the 1979 Ixtoc-1 spill (3.5 million barrels), will be exceeded on 6/8 using Wereley estimates. Eugene Chiang (Berkeley) provides an estimate between 20 thousand and 100 thousand barrels per day; the high estimate implies the Ixtoc-1 threshold will be breached within about a week — on 5/24.

The implications of these differing estimates are potentially enormous. From NYT:

“There’s a shocking amount of oil in the deep water, relative to what you see in the surface water,” said Samantha Joye, a researcher at the University of Georgia who is involved in one of the first scientific missions to gather details about what is happening in the gulf. “There’s a tremendous amount of oil in multiple layers, three or four or five layers deep in the water column.”

The plumes are depleting the oxygen dissolved in the gulf, worrying scientists, who fear that the oxygen level could eventually fall so low as to kill off much of the sea life near the plumes.

Dr. Joye said the oxygen had already dropped 30 percent near some of the plumes in the month that the broken oil well had been flowing. “If you keep those kinds of rates up, you could draw the oxygen down to very low levels that are dangerous to animals in a couple of months,” she said Saturday. “That is alarming.”

Clearly, if the estimates at the higher end turn out to be more accurate, and BP is unable to effect an early end to the leaks, then the issue of internalizing externalities should become even more pressing. Here is one last picture in which to frame the argument.

Figure 3: Small country domestic production, consumption, imports, in a product market with externalities.

If there are negative consumption externalities, then the Marginal Social Benefit (downward sloping bold line) curve is below the demand curve; if there are negative production externalitites, then the Marginal Social Cost (upward sloping bold line) curve is above the cost curve. The private market delivers the amount of imports indicated. The optimal level of imports might be smaller or greater than that delivered by the private market, but is indicated by the gap between the bold dashed lines.

The standard, textbook, solution is to internalize the externalities by a combination of taxes and/or subsidies (well, in this case, just taxes).

What is disturbing is that we shouldn’t have to guess the leak rate. There are lots of instruments that could make the measurements easily but BP has simply chosen not to. BP has also restricted access to videos that could at least provide better estimates. Without good data, scientists can’t make good models either for this incident or to evaluate risks for possible future incidents. Whether we like it or not we have the occasion of a unique environmental experiment and we should be taking advantage of it. It is shameful that the Obama administration has totally deferred to BP in the management of information. They should be demanding more transparency and timeliness in release of data and information to scientists.

I cant belive after this oil disaster they would even consider any more offshore drilling anywere. These greedy s.o.bs.Why dosnt Obama sock it to them? Or is he in on it too? He probably has stock in BP. They all need to face a fireing squad. I hope they are all proud of them selves great job guys, and how much an hour are all these yahwhos making. DO NOT BUY BP GAS……… I AM JUST SICK TO MY STOMACH OVER THIS..All the marine life lost because of STUPIDITY………..

There is a dead-zone that is about the size of New Jersey that is very close to, if not overlapping the spill-site. It seems suspicious to me that the existing dead-zone is not being mentioned much, nor is it being shown on any of the maps or overviews such as the one above.(the existing dead-zone is just to the North of the spill-site and maybe a little East as well.)

Are you suggesting that if we add a tax to offshore drilling that companies should no longer be liable for the cost of the damages? Otherwise, you are taxing producers twice, once with a ‘spill tax’ and once with clean-up/compensatory/punitive damages following a spill. Taxing prodcuers twice will cause the industry to produce less than the socially optimal level of output at a price that is greater than the socially optimal price.

Is it too late to change the $75 million limit on damages going forward? That is, make the limit applicable only to the oil that was spilled prior to the new legislation? We need to get BP’s incentives straight. Of course, BP would say they will make good on all damages, so as to reduce urgency for such legislation, especially if they plan to use the law to their advantage.

It looks like a dolphin. 🙂

“It looks like a dolphin. :)”

That really good 🙂

I would like to repeat my question – would a change in the law (getting rid of the $75 million cap on damagers) make BP responsible for oil spilling out after it was passed, even though the original accident precedes it? Anyone who takes BP’s word that they will make good on damages beyond what they are forced to pay by law is being exceedingly simple. If new legislation would matter, it needs to be done immediately, on an emergency basis.

NOAA just expanded the no fishing zone, tar balls are washing ashore in the Keys, but on the bright side, BP is now recovering 2,000 barrels a day!

Don, check marginal revolution. He did a post on the $75m limit–it turns out it’s not, especially if negligence is proven.

altereggo – thanks.

“But there is no limit, even under the OPA, on economic damages in the event that BP failed to follow regulations or is otherwise shown to be negligent (same as under common law).”

I find this a sorry state of affairs – the way lawyers are apt to think about economic questions. The idea shouldn’t be to punish malfeasance, but simply to make economic actors pay the true social costs of their actions. If a type of production is subject to “pure” accidents entirely beyond control of the producer, the producer’s cost of doing business should reflect the probability-weighted cost of such accidents.

The fear of hurting “small” oil producers cited as a cause for the legislation imposing the $75 million cap is just completely silly, typical of Congressional reasoning when it comes to economic issues (or perhaps it is merely an excuse that they think sounds good to the economic illiterate and that allows them to cave to special interests. If a small company can take actions that potentially impose billions of dollars in economic damages, they should be put out of business if they make such a mistake.) The type of ignorance that enrages economists. I bet BP is even now getting its legal defense ready to prove there was no negligence. This makes clear the source of the ‘unseemly’ arguments BP had with their contractors in the Congressional testimony. It is surely on the top of their minds – as much so, I would guess, as stopping the spill.

The tar balls were not linked to the spill

http://www.cbc.ca/world/story/2010/05/19/florida-tar-balls.html

The _background_ seepage in the Gulf is ~2 Exxon Valdezes a year:

http://www.sciencedaily.com/releases/2000/01/000127082228.htm

My understanding is that the best well ever in the deepwater Gulf (Thunderhorse) flowed at 25,000 bbls/day when opened all the way up.

Are we to believe that this well is flowing at multiple times that amount despite all the constraints in the well? The BOP is partially closed, the riser is still in there, but is broken, the well was cemeted closed, although clearly not completely. These high end “estimates” don’t really pass the common sense test for me.

“My understanding is that the best well ever in the deepwater Gulf (Thunderhorse) flowed at 25,000 bbls/day when opened all the way up.”

It was constrained by a large length of pipe and was cooling, getting thicker, all the way to the surface. Also, the diameter of the leak keeps getting bigger due to erosion. So, regardless of the present rate, it will only get larger until it is plugged.

“It was constrained by a large length of pipe and was cooling, getting thicker, all the way to the surface. Also, the diameter of the leak keeps getting bigger due to erosion. So, regardless of the present rate, it will only get larger until it is plugged.”

A well is cased and lined as it is drilled. Its not just an open hole in the ground. Some may be leaking outside the well casing, but it would have to permeate through all the concrete between the casing and the rock surrounding it. Also, the oil is currently leaking out of a long length of pipe – the riser on the sea floor. Its much cold on the sea floor than the surface. And there is a couple thousand psi of water pressure at that depth.

All that said, yes, more of the well could break and the leak could get larger if not contained.

I don’t think the estimates from Purdue or Berkeley, etc. are credible when compared to other oil wells. In the end its all talk. They have to get it closed.