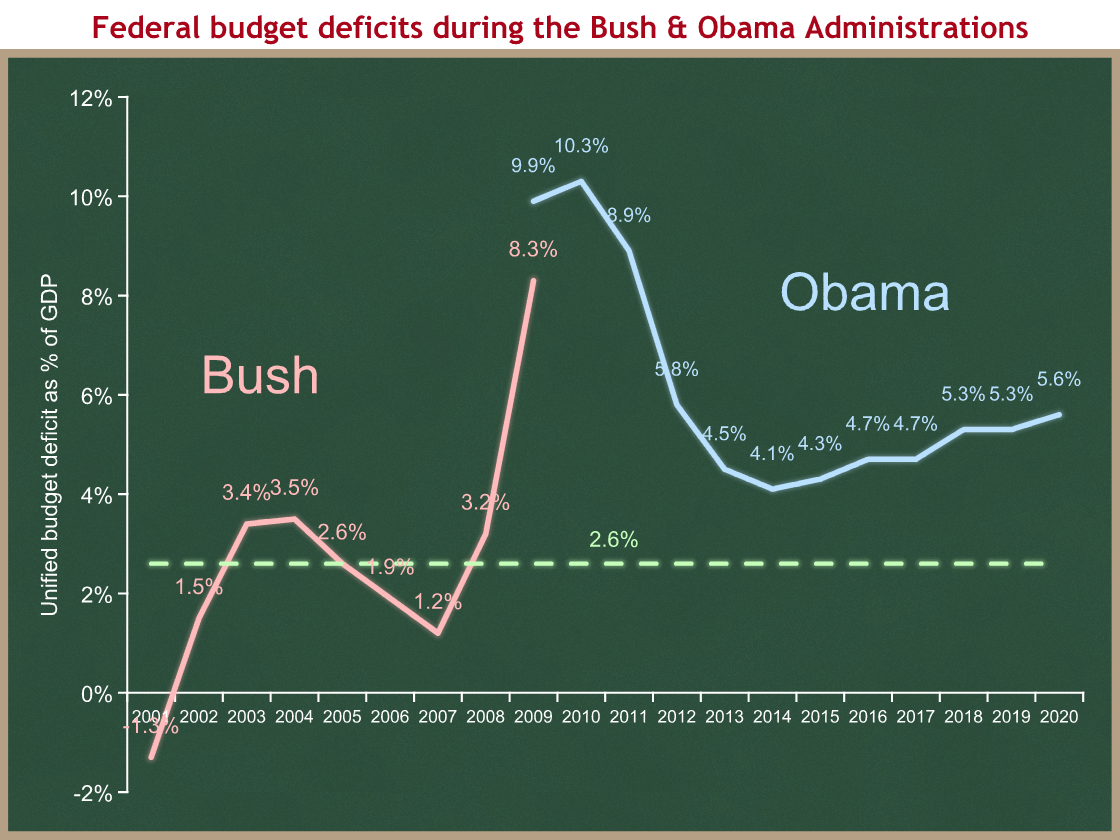

In this post, Keith Hennessey takes issue with President Obama’s assertion there were spiraling deficits during the President G.W. Bush years. He presents this graph.

Source: Hennessey (2010).

Well, I think context is everything. When people talk about spiraling deficits, they often compare against time past, which is something Mr. Hennessey did not do. So I’m going to do it (using cyclically adjusted budget balances, from the CBO). This is the resulting picture.

Figure 1: Cyclically adjusted budget balance as a ratio to nominal GDP. Tan shaded area, FY1994-2001; gray shaded area, FY2002-2009.Source: BEA (for GDP, 2010Q1 3rd release), CBO (for cyclically adjusted balance), and author’s calculations.

Note that some may object that the ARRA was a Democratic initiative, and the impact on the deficit should not be attributed to the Bush Administration. Taking out the ARRA (using quarterly figures from this CEA report) indicates the average cyclically adjusted balance over the FY2002-09 period was -0.0258 instead of -0.0273.

Note the change in the cyclically adjusted budget balance from 01Q3 to 09Q3 is 6.9 ppts of GDP (and still 3.5 ppts excluding ARRA measures!). I’ll let readers decide if this is spiraling or not. (I show additional graphs of the cyclically adjusted series from CBO in this post).

It seems to me that the larger issue is how much did each president add to the structural deficit. That is, how did each PERMANENTLY change the annual deficit.

Since most of the stimulus is temporary, it doesn’t add to the annual deficit permanently except for the interest on borrowing it creates.

However, Bush reduced government revenues permanently with his tax cuts (unless they are allowed to expire) and by creating a new Medicare prescription drug plan without additional cuts, increasing education spending without cuts elsewhere and greatly increasing defense spending without cuts elsewhere.

The only argument that people have to say that Obama has increased the structural deficit is health care reform and the CBO disagrees with that argument. They say health care reform reduces the deficit.

Menzie,

Thanks for this. It once again shows that Bill Clinton was one of the best supply side Presidents in our nation’s history, much better than George Bush. Granted much of this was because the House and Senate were dominated by more conservative Republicans. This also demonstrates why the Republican loss in 2006 was so huge when they abandoned fiscal conservativism, and how the Democrats, with control of the House and Senate, were even worse.

I am curious why you left out the other Presidents, especially President Obama, when you gave your averages.

I believe federal revenues were up during Bush years not down as you assert. In addition, if we remove the war costs, we are close if not at positive cashflow. While I am no Bush fan, he looks like a piker next to Obama when it comes to deficit spending. Also you are talking about longterm trends, your own graph shows rising deficits for as far as the eye can see. The fortunate side is, the Obama agenda will have its legs cut out in November. This man may not make the finish line in 2012, if the economic crash I see coming ensues in 2011.

RicardoZ: We have projections on annual basis for Obama, while the data I have plotted are actual quarterly data. With a bit of work, I could’ve dug up the figures for Obama, but I suspect they would be only slightly smaller than the figures Hennessey cites (because he’s using actual and I’m using cyclically adjusted.

Steve: I didn’t assert anything about revenues — maybe you were referring to DS? But you should look at Table 2, at the cyclically adjusted revenues to potential GDP series, in the CBO document I referenced in the post. I think you will find that revenues were down relative to pre-Bush.

I would argue that you need to be looking at the primary on-budget deficit…or better yet, the primary on-budget structural deficit. Here is something I did a couple of years ago over at Angrybear that shows how GWB blew a hole in the budget. This chart only looks at the on-budget structural deficit, which is the part that the President and Congress control. The President and Congress do not control FICA contributions and they do not control interest payments…so that’s why we should look at the primary on-budget numbers. A lot of Bush’s deficits were hidden by the large FICA surplus during his years in office.

http://www.angrybearblog.com/2007/11/2slugbaits-looks-at-on-budget-primary.html

Note the huge fall off from a strongly positive surplus to a deficit. The last couple of years did show a very small uptick in the primary surplus, but given that this was at the peak of the business cycle the numbers were downright pitiful.

And I still don’t understand why Steve seems to think we should exclude the war costs. Are those costs somehow “special” and don’t contribute to the debt?

Menzie fascinating story in the charts. Clinton was luckier than most presidents. He rode two bubbles, IT and the Y2K, until they simultaneously burst. Nearly his whole term on an upswing.

Bush was definitely not so lucky. He took over just as the Clinton era bubbles burst. He had campaigned upon giving the excess revenues back to the wage earners. (He is a republican, after all.) So his first tax cut was implemented to do just that, then we went into a recession requiring even another deeper tax cut.

From the charts we can see his policies were working, and getting us near to a balanced budget. Of course we were also fighting a war that we did not actually choose, unless you are totally anti-war.

I will not discuss the housing bubble, because the cause for such a bubble belongs to each party.

Bush, bad economic policies or just unlucky?

CoRev: That’s pretty lame. Yes, Clinton had some good fortune, but the technology boom didn’t kick in until the end of his second term. And the higher productivity numbers that lowered the NAIRU rate didn’t peak until well into Bush’s term. Clinton just had sensible economic policies and Bush didn’t.

Strictly speaking Bush did not inherit a recession…NBER dates the beginning of the recession at March 2001; but you could plausibly make the case that by the end of 2000 the recovery was long in the tooth. A recession was likely, but not inevitable when Clinton left office. And the 2001 recession was very weak…it was over by November 2001, so that really doesn’t answer the other 7 years of Bush’s disastrous Presidency.

As to the war, the Afghanistan war should have been over by early 2002 and would have been if Team Bush hadn’t allowed OBL and the Taliban to escape. Most of the war costs under Bush were from the Iraq war, and that was entirely a war of choice.

Bush’s economic policies never added up…and I mean that literally…they never added up. The tax cuts created a structural deficit and had almost no stimulative effect because so much of the tax cuts leaked out of the economy.

I think you miss the lie buried in the linked post: he looks at percentage of GDP. That is intentional, a way to minimize the dollar amount of the deficit. Since the economy gets bigger over time, the deficit can get bigger and bigger and the percentage of GDP can actually shrink. It’s a lie.

I find people get hung up on arguing with the points made rather than dig out the lie. For example, I read a recent report by Heritage Foundation that argues for keeping the Bush tax cuts. Their main point – the 2nd of their 3 myths in that report – was based on a single lie buried in the text: that the budget deficit had “stabilized at $161B” in 2007. This is not merely wishful thinking but is an intentional distortion, just as the linked post is a willful lie. In fact, if you look at Heritage’s own figures, you see that the tax policies generated the largest dollar deficits in peacetime history and these only managed to reduce to a still very high $161B at the peak of the business cycle.

It is a lie to point to percentage of GDP without noting the amount of the deficit, without noting the trend of the business cycle and its peak.

Another point that these people never make is that war spending amounted to a huge stimulus and this ramped up over time so one could perhaps attribute some growth in the GWBush business cycle to Keynesian effects. The alternative is to believe that war spending crowded out private investment and reduced economic growth. You can’t argue it both ways and so they choose never to mention this.

2slugs said: “…but the technology boom didn’t kick in until the end of his second term.” Ha, ha, ha! Now that’s one of the funniest things you’ve said in many, many comments.

What amazes me, is someone in the bidness could say that.

For those unaware, Y2K was a five to six year IT buying spree that ended in 1999, as the last H/W upgrades and the final S/W upgrades were finishing. Since IT was so prevalent in the many business/technology areas, Y2K perturbed them for several years.

BTW, 2slugs, during the early Y2K days I was offered the DOD Y2K manager job. I was smart enough to turn it down.

The comments sound like blind economists describing the economic elephant. Yikes! The elephant is standing there – 10% unemployed, 8 trillion dollar loss in housing values, bank bailouts, a war of choice and a failed one. Team bush had 8 years to work their magic. They owned the whitehouse, senate, house and supreme court and still F’d up the economy.

Well we’ll see. I for one believe that Health Care Reform will lead to very high deficits. I have no evidence, other than I’m intimately familiar with Medicare and I know its large inefficiencies and unintended consequences. Both M-Care and HC Reform are, among other things, price fixing mechanisms, and those tend to be very inefficient, regardless of whether you’re talking about airline travel, the price of wheat or whatever. I view HC Reform as basically M-Care on steroids. My gloomy assessment is not the sort of forecast that falls out of an actuarial model. Time will tell, but I think you’re wrong Menzie.

CoRev: When economists talk about the tech boom driving the economic boom of the Clinton years they are not talking about they buying of hardware and software upgrades. The effect of the “tech boom” was to increase productivity and it was that productivity increase that allowed a lower NAIRU rate.

And you might want to check the BEA website for the value added contribution of information management services during the late 90s and through the Bush years. During the latter part of the Clinton years information management and data processing services accounted for about 0.3% of value added to GDP. During the Bush years it accounted for about 0.6% of value added to GDP. So your opinions on the tech boom seem to be strongly colored by your personal anecdotal experience.

Krugman had a piece that perfectly summarizes the problem. Sen. Kyl was making the claim that while you do need to offset deficit increases due to increased spending, you don’t have to find offsets if the deficit increases because of tax cuts. Clueless as always. And tonight Krugman points to Sen. Mitch McConnell backing up Kyl’s stupid comment, and going one better. McConnell is claiming that the tax cuts increased revenues. Reminds me of the used car dealer telling the naive customer that he loses a little on each deal but makes it up in volume. Revenues may go up, but the increase will always be less than the amount of the tax cut, so the deficit will always increase.

2slugs, yup! Anecdotal.

Various: look at the other nations with universal coverage and note how they have lower health care costs and better outcomes.

To put it another way, the US has the least efficient health care system of any nation in the world, and we get nothing for the inefficiency.

This has occurred since about 1980 when Republicans really began blocking health care reform, yet were happy to fund pet diseases and projects and bandaids that papered over the problems and added incredible complexity and cost.

Mitt Romney, a business man, looked at the problem from a small business standpoint and sought to fix the problem as governor of Mass. The result is Romneycare, the Mass health reform that became the basis of national Romneycare that is nation health reform.

But Romney really just followed the Swiss health reform plan in many respects. Passed circa 1995, they are bringing costs under control.

But then again, Republicans will likely see it as a way to pork up to benefit their donors in the drug industry or hospital chain corporations or doctor specialties, as they’ve done multiple times.

Well, I have a solution Keith Hennessey should approve of: eliminate all the tax cuts since 2000 and then pass a carbon tax.

Not only will it reduce the deficit, it will create millions of jobs if history is any guide.

And Menzie:

Can you explain why so many people believe tax cuts create jobs?

Where is the evidence this is true?

When have increases in employment followed tax cuts soon enough to eliminate the Keynesian deficit stimulus or the natural population increase driving demand and thus job creation, or a massive reconstruction boom occurs from a massive hurricane?

We have had a decade of tax cuts, and it took a year for enough jobs to be created after millions of job losses, that barely keeps pace with population growth.

I can not find a single time that job creation followed tax cuts.

To the contrary, what I find are increases in employment following tax hikes. Like in 1982 and 1983, and 1990 and 1993, and 1932 through 1942.

When have tax cuts ever resulted in job creation???

Menzie — this is a great post, but do you think you can put it in less technical language? I don’t know that I would be able to point someone who’d read Hennessey to this post and have them understand what’s going on with cyclically adjusted budget balances. In fact I’m not positive I understand — the point is that you need to smooth out the business cycle if you’re looking at the structural changes in the deficit, right?

It’s profoundly depressing to see people in the comments trying to defend Bush’s record and blame the deficits on Congressional Democrats. It seems as though no amount of evidence will change their mind.

I previously made this point: “For those unaware, Y2K was a five to six year IT buying spree that ended in 1999, as the last H/W upgrades and the final S/W upgrades were finishing. Since IT was so prevalent in the many business/technology areas, Y2K perturbed them for several years.”

2slugs said in econ speak: “The effect of the “tech boom” was to increase productivity and it was that productivity increase that allowed a lower NAIRU rate.”

Yes, that is a very good measure of effect of an increase in technology spending (a technology boom/bubble.) It definitely does not define the Tech boom.

But a technology boom has an almost immediate effect on GDP. And BEA says:

Equipment and software

1994 – 44.227

95 — 49.519

96 — 54.782

97 — 62.315

98 — 71.358

99 — 81.451

00 — 89.976

01 — 87.073

02 — 83.397

Reference: http://www.bea.gov/national/nipaweb/TableView.asp?SelectedTable=33&ViewSeries=NO&Java=no&Request3Place=N&3Place=N&FromView=YES&Freq=Year&FirstYear=1994&LastYear=2002&3Place=N&Update=Update&JavaBox=no#Mid

Notice a peak associated with … Y2K corrections???? Notice a negative perturbation in the IT industry after Y2K?

Think that Y2K/tech bubble had an effect on the ensuing recession? Many economists think so.

Is 2slugs correct? Did productivity go up? Let’s hope so. Nearly every public and private entity had just invested several in new H/W, S/W upgrades, and a huge increase in attention to reviewing and improving their internal business processes.

A better economic question may be, did the Y2K investment have a benefit in increased production that exceeded cost?

MattW said: “It’s profoundly depressing to see people in the comments trying to defend Bush’s record and blame the deficits on Congressional Democrats. It seems as though no amount of evidence will change their mind.”

Matt, what part of cutting the annual deficit by 2/3s in a little over two years is so difficult to understand. Look closely at the charts. That’s what they show.

My contention was that if Bush gotten just two more good years, he would have ended with a balanced budget. That is what the charts indicate.

Was it only Bush policies responsible for the housing bubble? Were there any Dem policies also responsible? I contend both parties had a part in creating that bubble. Without the housing bubble crash there would probably not have been a financial system crash.

This is exactly what I mean. You give Bush credit for cutting the deficit in 2/3 without acknowledging that, according to the very charts you are citing, the deficit was his fault in the first place. I suppose that if BP cleans up 2/3 of the oil they spilled you will think they did a great job.

Here is a chart that explains how Bush policies and the recession are responsible for the deficit:

http://yglesias.thinkprogress.org/2009/06/what-caused-the-budget-deficit/

mattw said: “You give Bush credit for cutting the deficit in 2/3 without acknowledging that, according to the very charts you are citing, the deficit was his fault in the first place.”

Some was definitely his fault, but most was from the recession and the 9/11 attacks. A recession that was impending during Clinton’s last year. Bush’s biggest mistake was not funding the medicare bill and the wars. We conservatives are most upset about those.

You still can not deny that he was on a path to balance the budget. That is not true for this administration. Remember, the concern in the Bush campaign was surpluses for as long as we could see. Now we have ever growing deficits as far as we can see, and yes, that is a concern.

Look at the charts and compare results from the economic policies. Then from the data in those charts answer this question, which party cares most about the pain and suffering caused by recessions?

I just gave you two data points conservatives fault Bush on, so ask yourself, which policies do the Dems blame on Bush for having such a economy? Because those policies have to explain the 2/3 reduction in annual deficits and 4% unemployment. Which of the current policies show any hope of coming close to those numbers?

CoRev: Your recollection of the Bush years is different than mine, regarding the projected trajectory of the budget deficit, including Bush’s plan to extend EGTRRA/JGTRRA. See this post and this post, based on CBO data. See also this post on tax revenues.

“My contention was that if Bush gotten just two more good years, he would have ended with a balanced budget. That is what the charts indicate.”

What measures would he have done to continue the pump and dump economy that he depended on to reduce the deficit? Or his flood and pump economy?

“Was it only Bush policies responsible for the housing bubble? Were there any Dem policies also responsible? I contend both parties had a part in creating that bubble. Without the housing bubble crash there would probably not have been a financial system crash.”

At the end of the 20s, the means of financing farming, small business, and housing was called into question, and a banker outside of Wall Street identified the problem as the high risk of the short term mortgage when price of goods offered by farmers and small business could fall at the wrong time, and with it wages. That banker saw that mortgages needed to be for longer terms and have payments that never exceeded the ability of these individuals to pay. Sound familiar?

Out of that came the long term mortgage replacing the 5yr mortgage of the time. Even Hoover recognized that business couldn’t loans, so he setup part of TARP – the authority to lend to business. FDR expanded that, but the banks wouldn’t renegotiate the mortgages that were in default, so the lending authority was expanded to take over debt and restructure into affordable mortgages. That was repeated circa 1990 to fix the S&L mortgage that banks wouldn’t restructure. The agencies involved in the mortgage restructuring were FHA and FNMA.

In the 70s and 80s, the argument was that FNMA needed to be made privately owned so that stockholders would make sure it didn’t insure high risk loans. And it needed competition, with Freddie created with portfolio authority. But the lack of portfolio authority limited the profits of Fannie, so it was given that in the early 80s. The reason for making all these changes wasn’t because the government lending and insurance had caused an asset bubble or generated a lot of debt that was in default, but rather that the lending the GSAs was doing wasn’t growing fast enough and the banks weren’t able to keep up because they were losing their source of mortgage funding, demand deposits, to non-bank deposit banking. I’m old enough to remember the debate over allowing money market funds to offer demand deposit services, and how that would hollow out the banks.

The Reaganomics argument is that if you get the government out of it, the poor will benefit more than with government regulation. So, whenever the private banking offers loans to the poor, even if the loans are predatory, the argument is that this is really helping the poor. After 2001, the Bush policy pushed that to the limit. If banks make predatory loans to people with no income and no assets, this is helping the poor, and the evidence was the rapidly increasing asset prices which meant that the predatory loans were profitable to both the lender and the borrower.

But the government regulation of Freddie and Fannie prohibiting them from make predatory loans cut their market share. But the government regulation prohibiting such lending was unneeded because the history to 2004 had proved predatory lending was good for the borrower, and the reason for stockholder ownership was to prevent bad lending decisions, so both were allowed to make predatory loans. As stockholders would lose money if predatory lending was risky, any predatory lending is by definition not risky.

And with the free market making sound and mutually beneficial predatory lending and creating money from nothing, why shouldn’t the Bush administration cheer and encourage the fruit of Reaganomics?

You are saying that because liberals wanted to make sensible loans to the poor and prohibit predatory loans – those to people with no income or assets – liberals are responsible for the predatory lending to the poor because Bush had proved that predatory lending was not predatory because the poor profited from the asset price inflation.

In other words, liberals who objected to predatory lending because they saw that as bad for the poor, and that the asset prices were signs of a bubble, were wrong and Reaganomics is right – let the free market profit and the poor benefit – but it is the liberals fault when the poor ended up getting screwed because predatory lending lead to an asset bubble and making loans to the poor to make profit resulted in unsustainable pump and dump. All the predatory lending depended on the property or debt being flipped in a couple of years for a huge profit – classic pump and dump.

To argue that the liberals who argue for government regulation of lending because profit incentives are too short term are wrong and that the profit motive is better than government, and this is proved by government regulators transferring the long term oversight to the stockholders seeking short term profits proves that government regulation doesn’t work because when the government transferred oversight to the stockholders the short term interests destroyed the long term. Therefore, it is the fault of the government that the private profit motives does not protect the long term stability.

That the liberal model of regulation worked from the 30s through 70s with limited trouble, while the Reaganomic model has resulted in at least two big financial crisis from the 80s through 00s suggests that the liberal model of regulation of the 30s it the one to return to, and the fault is with the Reaganomic model.

With all due respect Menzie, that is some really weak argumentation. Your first reference was to an article the quibbled over the 07 Bush budget prediction which was essentially what I have been saying. Then you follow up with an article that further confirms what I have been saying. I’m not at all sure how your third reference applies. Revenue is only one component of calculating deficits.

So, what have I said? This is the core of it: “Matt, what part of cutting the annual deficit by 2/3s in a little over two years is so difficult to understand. Look closely at the charts. That’s what they show.

My contention was that if Bush gotten just two more good years, he would have ended with a balanced budget. That is what the charts indicate.

Was it only Bush policies responsible for the housing bubble? Were there any Dem policies also responsible? I contend both parties had a part in creating that bubble.”

I am essentially repeating the 07 Bush projections. Do you disagree that had the economy continued at its pace (07 budget written in 06) the budget would not have been balanced?

Why? Show your work 😉

CoRev: Hmmmm…I can I put this politely? To begin with, line 30 includes more than just computers…it includes all equipment, like drill presses and industrial machinery. What you really wanted to post was line 32. Oh wait, that shows that computers and software actually increased during Bush. So did information services. That doesn’t agree with the story you’re trying to tell. The issue wasn’t whether or not there was a surge in computer and software purchases leading up to Y2K; the issue was whether or not it dropped off during the Bush years. You said it did. BEA says it didn’t.

Another problem is that what you posted was Table 1.5.3, which is a quantity index. The question is whether that translates into an increase in GDP. Table 1.5.3 is a quantity index; GDP is a dollar value index. Quantities went up, but prices also went down. It’s all part of the hedonic calculation that the BEA has to do. The relevant table is Table 1.5.2, which shows the contribution to percent change in GDP. And here your story looks a little better…at least at first blush. Here we do see a sharp drop in the rate (but not the level) of spending for computers after Y2K. Note that it was still barely positive…and one of the only sectors that was positive. But first, the drop in the rate only accounts for 0.2 to 0.3 percent of GDP, which explains less than 10 percent of the total fall of in GDP. In fact, the kind of investment that fell through the floors was the old fashioned kind…industrial equipment and transportation. A far bigger fall off in the rate of growth (but not the levels) was in the financial sector. Sorry, if you use the right tables and interpret them correctly, then the BEA data does not support your claim that the drop off in Y2K spending caused the 2001 recession. Y2K spending may have been a big part of your personal life, but the dollars involved were way to small to account for the 2001 recession.

As to labor productivity, yes, it increased.

Year: Output per Hour Multifactor

1995 0.6 0.1

1996 2.6 1.4

1997 1.6 0.7

1998 2.8 1.3

1999 2.9 1.3

2000 2.8 1.1

2001 2.7 0.4

2002 4.2 2.1

2003 3.7 2.6

2004 2.8 2.6

Multifactor productivity is associated with “working smarter” because of technology inputs.

MULP, I’m not too sure its all about lending, but I do agree that we probably need to go back to the prior regulatory environment. There is way too much trading of high risk paper within the industry.

Bush inherited a balanced budget, and used that as an excuse to cut taxes for the rich over a ten-year frame (they had to expire in ten years as an accounting gimmick). Shortly after he assumed office, it became apparent that we were in a recession, and he used that as an excuse for more structural tax cuts for the rich, even though those measures provided no stimulus for the economy at all. He also fought a war of choice in Iraq, a country which had nothing to do with the September 2001 attacks, and chose to keep the costs off-budget. Once the recession had ended, we had a substantial deficit, where before it had started, we had a balanced budget. The recession was not the cause of the Bush deficits, as can be seen by the fact that the deficit was well above where it started years after the recession ended.

This is all basic stuff, and as I said, the fact that you are debating it shows that you simply aren’t interested in evidence.

matt w: Strictly speaking Bush did not inherit a “balanced” budget. Bush inherited a budget that was running a significant surplus. In fact, the surplus was so large that the Republicans argued it was a fiscal drag on the economy and that fiscal drag argument was offered up as one of the justifications for cutting taxes. So back in 2001 the GOP and conservative pundits seemed to believe in the efficacy of the Keynesian multiplier. Today it’s a different story.

I think the truth is that in early 2000 the Fed got a little skittish about the prospect of inflation because they weren’t entirely convinced that the productivity growth was real and would be sustained. Back in the day this was referred to as the “speed limit” question. So the Fed started hiking rates. The markets tanked, which precipated a fall in wealth along with deleveraging. A lot of firms went bust and the ones that were most highly leveraged were tech firms, so they really went bust. But the productivity from the high tech was real and this higher productivity had a lot to do with the slow job growth in the early 2000s.

“You still can not deny that he was on a path to balance the budget. That is not true for this administration. Remember, the concern in the Bush campaign was surpluses for as long as we could see. Now we have ever growing deficits as far as we can see, and yes, that is a concern. ”

Bush was on path to balance the budget only if pump and dump asset inflation to make predatory lending profitable to both the lender and borrower could be sustained for a few more years.

Bush made the choice in the first year to block an energy technology boom from occurring in the US and to inhibit it world wide because that would be bad for the established dominant corporations.

The technology boom was a continuous boom that began in the 60s with the rise of minicomputer startups that started eating away at the dominant technology companies: IBM, RCA, Singer, Honeywell, Sperry-Rand, Burroughs, GE, NCR, and a few more. But the 80s the dominant technology companies were the mini and workstation companies, and now it was the PC software and cheap chips makers like Intel, Motorola, and a dozen others plus some software people like Gates and others, combined with system integrators like Apple and little companies making generic pc’s running Gates’ Basic, etc. They grew into Compaq, Dell, Gateway, after IBM tried to just ahead and control the pc market having lost control of the minimarket two decades earlier.

Tech booms leave behind graveyards of lots of big companies. Clayton Christianson made the point this is a historic pattern in his book The Innovator’s Dilemma.

An energy tech boom will hollow out and in the end send BP, Exxon, Peabody Coal, et al, the big power utilities, the gasoline dealers, the heating oil suppliers, auto dealers and repair shops, stick built homes, and who knows what else to the grave yards, just as the horseless carriage did.

And thus it is in interest of the established and dominant cheap fossil energy producers and dependent players to prevent an energy tech boom. That was what Cheney’s secret meetings were all about. That is one of the factors that created so much support for Reagan in the 80s.

Let’s be clear, the tech boom in electronics forced every American and really everyone in the world, to pay more for technology. The tech boom has been a tax on every person on the planet. If you can not or will not pay money you don’t have or can’t really afford for tech, whether in the US or the wilderness, you are taxed by not being able to participate in the global economy. So, everyone on the planet has been taxed by the action of Steve Jobs and Bill Gates. If you looked at the tech budget of the typical American in 1980, it was a fraction of what the typical American spends today. If you see sustainable energy policy as being a tax, then it is no different than the tech boom which imposed a tax on everyone on the the planet.

The tech boom destroyed hundreds of millions of jobs. The US electronic makers destroyed manufacturing jobs as they moved them to Asia, and then as RCA and GE could no longer make electronics they killed jobs in Asia. As US computer makers moved jobs to Asia, they killed millions of jobs in the US, and then as they went out of business, they killed jobs in Asia. As the minicompanies hollowed out the mainframe market, they killed jobs supporting mainframes. The PC industry killed jobs in the minicomputer industry.

Our current energy policy has many subsidies for fossil fuel production that were put in place to promote expansion for various reasons, for the cold war defense policy, for the economic growth, for industry profits, to extend tax dodges. Nuclear power was heavily subsidized as part of a strategy to help cover the costs of maintaining the capability of destroying all human life.

Ending the current subsidies for current energy is seen a tax on energy and consumers. Subsidizing sustainable energy in the same ways oil and nuclear was subsidized is seen as a tax. But the tech boom has been driven at various times by taxes or subsidies or both. Telephone was taxed to expand telephone serve to everyone. Nuclear plants were justified based on the rate payers paying a rate of return no matter what it cost. The termination of that decades long contract with utilities in the 80s hurt not only the utilities, but the retired who had for decades bought utility stocks and bonds to retire on because the return was assured by government policy.

Al Gore was part of a group of tech promoting Congressmen in the late 80 who promoted subsidies for the tech industry, and Clinton-Gore actively nudged and subsidized the tech boom. The administration and Congress drove a lot of the tech boom by requiring industry proactively address Y2K. That forced a total review of business processes which ultimately killed millions of jobs. The government could have let the market playout, and in 2001 the industry would have been reacting to problems with companies going out of business because their business was so disrupted that the proactive firms took over their market share.

In the 90s, Gore was pushing for an energy tech boom. Instead we ended up letting the market solve it, and the result has been rapidly rising energy prices that have had severe negative consequences on many. Jimmy Carter, and Nixon to be fair, predicted the energy crisis including in effect 911 in the 70s. Bush in the 90s was implementing the Carter Doctrine, and Bush in 2003 was implementing the Carter Doctrine, but Carter also called for energy independence through sustainable energy to end the Carter Doctrine.

Let’s bash Carter as he is an old punching bag for bad economic times. Why did Reagan, Bush, and Bush continue the failed Carter Doctrine that got us mired in Afghanistan and caused the 911 attacks after occupying Saudi Arabia to defend it from Saddam and then to contain Saddam because the Carter Doctrine was a liberal big government program to provide cheap oil to the US and allies?

2slugs, you enjoy the joust! 😉 As for which BEA table is best, well none really. I picked one that made the impact obvious, only because there is no set of tables that collected the data. How does one estimate the impacts over the decade of changing out, updating, modifying and reviewing each and every automated system in the US (world actually?) Oh, and most of the processes they supported? Total impacts included nearly every private and public sector entity, and a high percentage of their products and services.

Since you quoted the .3 impact of line 30, that should also be increased by some portion of the Fed/state/local spending totals that are not included in 30.

A conservative estimate would be a simple doubling to .6, and I still think that was quite low. Add to that the lost income from those who were laid off right after Y2K, and the loss of overtime for those working Y2K, I think we get into significant hit territory. Note: these are just the obvious impacts. The hidden impacts are impossible to calculate.

An economic slow down was inevitable as much of the US took a long breath and realized the Y2K bullet had been dodged. A huge out of cycle capital investment had just been made in near record time, and much of that investment needed to be absorbed and paid for.

Additionally, I think the success of Y2K as measured by the lack of impact on Day 1, 2000, opened many eyes to the other obvious failures, dot coms. They were already recognized as risky, bad investments, but my feelings are that those insights were intensified. I have zero evidence for this last, just my own intuition.

So instead of getting into an argument over which BEA table best represents the Y2K impacts, I concede. None do. The data is not there. I do know this looking at productivity to define the tech bubble is just as meaningless as looking at H/W buys to define Y2K.

Mr. Chinn,

I read the CBO report. Looking at Figure 1, only a small proportion of the swing from deficits to surpluses in the 1990s is attributable to policy changes. Do you believe that? It looks a lot more like the Clinton boom to me.

The overall budget swing from 1992 to 2000 is from $-290 billion to $+236 billion. That’s $526 billion. Of that swing only $202 billion is attributable to “automatic stabilizers”. That means that the rest must be because of policy changes (in the CBO model).

Column 4 in Table 1 is the Budget Deficit or Surplus Without Automatic Stabilizers. In theory this value should be constant (at least as a percent of GDP), save for policy changes (tax hikes, spending cuts, etc.).

However, the numbers in column 4 aren’t flat at all. They follow the Clinton boom up and back down.

You suggest that the swing in the cyclically adjusted budget balance from 01Q3 to 09Q3 is 6.9 ppts of GDP. Certainly no tax or spending policy changes that large occurred in that time frame. Once again that raises the question of whether the numbers are truly the cyclically adjusted budget balance or just a proxy for the actual budget balance.

menzie: just like the premise that unemployment would only go to 7% if we passed the “stimulus” as well as transfer payments have 1.5 multiplier.

The govt has spent trillions trying to stimulate aggregate demand with little GDP affect. we will be less than 3% growth (which equates to 420B annually) for 3T in additional debt. certainly not the 1.5 multiplier envisioned. a corporation would go bankrupt and ceo fired for those results. i fear the US may get the same result.the bond bears will run loose.

I guess your response to both is to move the baseline down. The reality at the end of the day is that keynsian is dead which probably makes your economic teaching irrelevant. dinosaurs still die no matter how much you want to ignore it.

Peter Schaeffer: The cyclically adjusted budget balance can change even if tax policies don’t change. Think Iraq/Afghanistan for instance. Discretionary spending growth slowed under Clinton; accelerated under Bush (think post-9/11 “security” spending, e.g. Also think Medicare Part D).

If you remember automatic stabilizers are less pervasive in the US relative to Europe, you shouldn’t be too surprised that actual and cyclically adjusted don’t differ that much.

You should read the documentation on how a cyclically adjusted budget balance; you can also refer to the OECD estimates. In my experience, you see a similar pattern.

See also: [1] [2].

“Let’s be clear, the tech boom in electronics forced every American and really everyone in the world, to pay more for technology.”

Slugbait… thats incredibly wrong. It increased the quality and decreased the price of technology.