The Federal Open Market Committee announced today that:

the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.

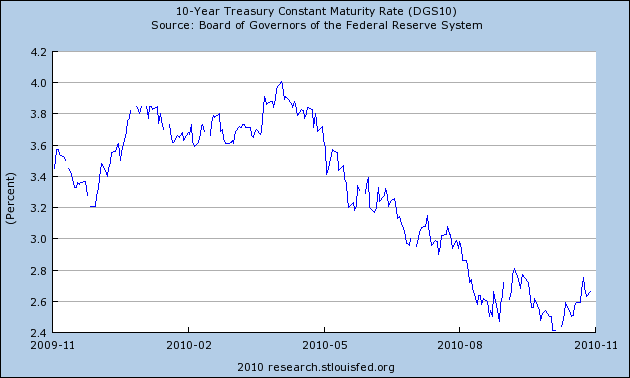

The market often figures out what the Fed is going to do before the Fed itself figures out what it’s going to do, and this time was no exception. Today’s announcement was very much what most analysts were expecting. And for that reason, the effects of the new program were in my opinion already priced into bond yields.

Specifically, one estimate is that this level of security purchases might be enough to depress the 10-year yield by 20 basis points or so. But that’s exactly what may have already happened as the conviction grew over the last few months that such an announcement would be forthcoming today.

|

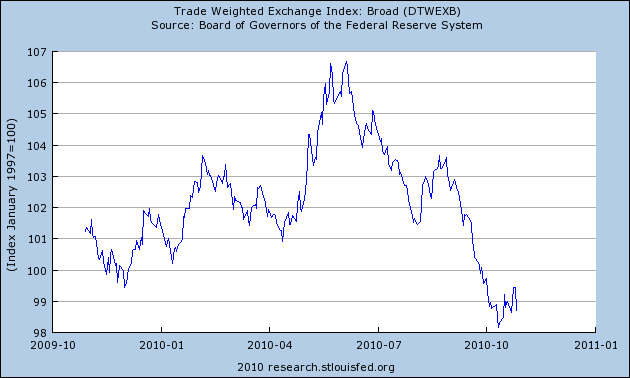

Another possible effect of QE2 is some depreciation of the dollar. But that too appears to have been already priced in.

|

I believe that the recent rise in commodity prices also anticipated today’s announcement from the Federal Reserve.

So if QE2 has already done what it’s going to do, does that mean that our problems are already solved? Certainly not, because our problems were much bigger than any of the weapons in the Fed’s limited arsenal. I do think that QE2 may be modestly helpful in terms of making credit more available to small businesses, encouraging a little more refinancing to enable more spending, encouraging net exports, and breaking the deflationary psychology that may have been a factor in so much cash sitting idle.

More than that, I do not ask or expect from the Fed.

The USA has a government as well, right? That seems to have done nothing.

When I took introduction to economics at the U of Chicago in the mid-1960s, Milton Friedman explained the Fisher equation to us. M*V = P*Q, where, M is the quantity of money, V is the velocity of money, P is the price level, and Q is the quantity of transactions. Mr. Friedman said at that time that V is exogenous to the system. and is based on the banking system and social habits.

Since that time, a lot has changed. The banking system has assumed a completely different configuration than it had 45 years ago. E.g., there were no interstate branch systems back then. Money market accounts were invented. Credit cards expanded greatly and debit cards have become nearly universal. Then there are the revolutions in communication and computation.

I would argue that V is not only mutable, but that it could increase quickly and exponentially, in an inflationary environment. This means that if there are excess reserves and currency in existence, and inflation is perceived to be a problem, increasing V could turn it into hyper inflation in a heartbeat.

It seems to me that the Fed is putting more gasoline into the tank and praying that no one throws in a match.

So the obvious question is why did the Fed pull the trigger today and not last week? The next obvious question is to ask whether or not the Fed would have pulled the trigger if the election results had been different and the Democrats had managed to hold onto the House. My guess is that the Fed would not have pulled the trigger…at least not yet. I think the Fed would have preferred to wait and see if there was a snowball’s chance in hell of getting some fiscal stimlus through the next Congress. I interpret the Fed’s actions as a signal that the patient is code blue, so go ahead and administer risky medicine. This is a Hail Mary pass.

There is a rumor coming out of Brazil that Guido Mantega (fin min) is planning to announce a dollar purchase program in the amount of 600 billion. Things are about to get interesting.

http://www.bloomberg.com/news/2010-11-03/brazil-bank-may-sell-reverse-swaps-after-fed-quantitative-easing-ig-says.html

match?

there is no match.

the Fed is trying to create a match (boost aggregate demand) out of gasoline.

therein lies the rub.

Walter Sobchak said: “M is the quantity of money”

Could you define that M for me?

It seems to me that the Fed is putting more gasoline into the tank and praying that no one throws in a match.

The match (writing IOUs to oneself) has been lit and the bomb is going off (dollar devaluation).

Get: Various monetary aggregates are described here:

http://en.wikipedia.org/wiki/Money_supply

The only one the Fed controls directly is MB the monetary base. The relation between MB and the higher order Ms is controlled by many of the same factors that control V, e.g. banking technology, but all of them are proportional to MB.

There is no stabilizer that will reduce any of the Ms if V takes off.

Another thought. Could the Foreign creditors of the US counter attack by short selling into the the Feds purchases?

Monetarism has always been rubbish as it ignores the fundamentals. By fundamentals I mean the real inputs to production – simple things like capital (factories and machines), Labour (trained workforce), appropriate tax structure, etc. These things cannot be created out of thin air and throwing no amount of money as what is a structural problem will address the issue. All that will happen is cash hording by the banks, internal inflation as capacity constraints are hit and a fall in the dollar that will not stimulate exports as there are no factories ready to hum into life – they are all in China. The US needs a nation strategy of reconstruction that brings capital home, ends outsourcing, reduces taxes for small business and trains US workers. I’m a foreigner so I really should not care but it is so obvious – once you stop making things that is the end.

Why they gave Friedman a nobel is a joke – look up the economic history of Chile.

“The only one the Fed controls directly is MB the monetary base. The relation between MB and the higher order Ms is controlled by many of the same factors that control V, e.g. banking technology, but all of them are proportional to MB.”

What about excess reserves?

Which M matters the most?

“Another thought. Could the Foreign creditors of the US counter attack by short selling into the the Feds purchases?”

What if the foreign creditors and the fed are aligned against some other group?

A look at the international historical data shows that V (the velocity of money) increases strongly as inflation rates increase above 10% or so annually, but I seem to remember (from browsing various velocity equations as grad student) that the relationship was pretty weak below this level. Of course, the usual caveats apply (different countries will have different thresholds and the threshold could change over time as technology and tastes change for reasons unrelated to inflation).

In fact, the velocity of money has fallen a huge amount during the recession and not moved up that much in recent quarters. Here are some money velocity figures from the St. Louis Fed:

M1 Velocity: http://research.stlouisfed.org/fred2/series/M1V

M2 Velocity: http://research.stlouisfed.org/fred2/series/M2V

MZM Velocity: http://research.stlouisfed.org/fred2/series/MZMV

JDH: One thing you didn’t comment on here, which you have expressed concern about in the past, is the scope and scale of Fed operations over the past few years given that the Fed is an unelected body.

I thought of this yesterday when the Reuters correspondent in this piece on NPR yesterday is essentially arguing that the Fed is implementing the stimulus that Congress and the White House could not, or would not, come up with.

http://www.pbs.org/newshour/bb/business/july-dec10/economy_11-03.html

Beware Giffen Behavior.

As necessities prices rise, less will spent on superior good. Expectations of rising prices will require more savings. And since equities rise so much and so early, investment doesn’t look so good for broader population.

The policy of paying interst on excess reserves is the single biggest mistake in monetary history. The FED’s LSAPs (QE2), by further decreasing long-term interest rates, will to some extent, feedback on the yield curve to the level of short term interest rates. By increasing the volume of competitive instruments and yields (vis a’ vis IORs, i.e., excess reserves), the FED makes it increasingly, less, and less likely, that the member banks will want to make new commitments for loans, or investments (i.e., it is increasingly, less, and less, likely, that the money stock, & bank credit, will grow commensurate with the FED’s inflation mandate. This is euphemistically referred to as “pushing on a string’, in Keynes’ words: ZIRP, liquidity trap, liquidity preference curve, etc. I.e., excess reserves are contractionary.

Walter – Not sure how far you want to carry the metaphor, but a mechanic once told me that he would always fill the gas tank of a car on which he would be doing “hot” work. A tank that is between half full and empty is more dangerous because of the vapors.

Atlanta Fed is holding a conference about “the origin, history, and future of the federal reserve” with the final panel discussion tomorrow morning, and you can watch it live:

WATCH LIVE

The final session of the conference features a panel discussion with Federal Reserve Chairman Ben Bernanke, past Chairman Alan Greenspan, and former New York Fed president Gerald Corrigan. Panel members will share their personal perspectives on the Fed’s purpose, structure, and functions. This segment will be webcast live on:

• Saturday, November 6

• 10:45 a.m. Eastern

• Link to Watch: http://www.frbatlanta.org/news/conferences/10jekyll_webcast.cfm