Typically, economists assume that news, defined as information that induces revisions to expectations of the future value of relevant variables, should affect asset prices simultaneously, and in a consistent manner. That’s why today’s announcement of QE2 has somewhat surprising effects, if one is to believe that QE2 had already been priced in [0].

QE2’s Impact on the Exchange Rate

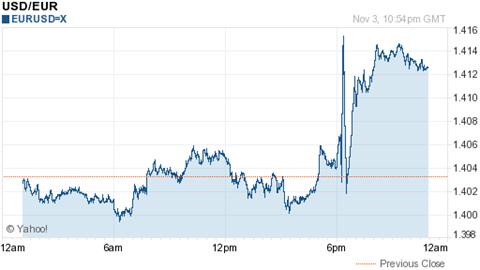

First, consider the impact on the USD/EUR exchange rate.

Figure 1: USD/EUR exchange rate. Source: finance.yahoo.com.

Note the fairly large impact on the exchange rate; the dollar depreciated by about 0.43% (log terms) by about 6pm Eastern time. If QE2 had been fully priced in, then (in a risk-neutral investor world) there should have been no impact on the exchange rate. It’s hard to argue that the amount of quantitative easing — $600 billion worth of purchases of long term treasuries — announced was much larger in magnitude than what the market expected; hence the puzzle. (Note, however, the USD/JPY did not move appreciably, while USD/GBP appreciated; but USD/EUR is the dominant currency pair so I’m putting greater weight on this rate.)

To see this, let the exchange rate equal current fundamentals and the interest differential and uncovered interest parity holds:

st = Mt + λ(Etst+1-st)

st = [1/(1+λ)]Mt + [λ/(1+λ)]Etst+1

Where s is the log exchange rate, expressed in terms of home currency required to buy a unit of foreign currency; and Et(.) is the mathematical expectations operator, conditioned on the information set available at time t.

Then note that:

st+1-st = (st+1-Etst+1) + {Etst+1-st}

Substituting in the expression for the exchange rate, one obtains:

st+1-st =[1/(1+λ)](Mt+1-EtMt+1) + [1/(1+λ)](Et+1st+2-Etst+2) + {Etst+1-st}

Note that “news” shows up in two places: first, as “surprises” in the fundamentals, namely realizations of the fundamentals that differ from what was expected; second, as information that forces revisions in the expectation of the exchange rate in period t+2, possibly due to expected changes in M in periods t+3 and t+4 and so forth. On 11/3, no actual purchases of long term Treasurys were implemented, so the first term drops out. However, the second term possibly remains — but news accounts suggest that there was no surprises in the magnitude of the planned purchases. [Note: there is a tension between using something that looks like a flex-price monetary model with UIP for motivation, and modeling quantitative easing — but I think it’s not an essential problem.]

My conclusion is that QE2 was mostly, but not entirely, priced into exchange rates. This is buttressed by a time series plot encompassing the period when QE2 was becoming increasingly discussed as a reality.

Figure 2: Log nominal value of USD, Bank of England index (blue), and Fed broad index (red), rescaled to September 1, 2010 = 0. Sources: Bank of England and Federal Reserve Board via FREDII.

A Different Response in the Bond Market

However, the puzzle reappears to the extent that the bond market seemed to take the announcement in stride, and indeed CR argued that the monthly purchases were in line with expectations (if not under-expectations, see here [1]). Thirty year yields actually rose; this was attributed to the fact that the purchases were expected to be in the 2.5 to 10 year maturities.

To those who work with models wherein asset markets are linked together by way of arbitrage, this is odd. One market responds and the other does not. Contrast this with the March 18, 2009 announcement of purchases of long term bonds.

Figure 6: Source: Neely, “The Large Scale Asset Purchases Had Large International Effects” (July 2010).

I can think of several reasons for this divergent outcome. One is that different markets have different market participants that have different expectations (not always — but in this episode). This view is anathema to adherents of many standard asset pricing models, as it implies big arbitrage profits are possible (and not exploited). I’m amenable to the idea that there are numerous institutional impediments to arbitrage which might allow for such deviations to persist. Alternatively, nominal interest rates might be incorporating offsetting liquidity and inflation expectations effects, so that the observed impact Treasury yields is essentially zero. Of course, why this occurred in this case, and not in March 2009, needs to be explained.

One possibility perhaps – QE directly impacts on bond purchases, but more indirectly on forex rates (after all if it works in stimulating the economy then presumably the dollar will rally). So is one perhaps more of a judgement call than the other, or are you saying they are literally mathematically linked?

When is it quantitative easing QE, when is it merely expansive money supply?

Please see J Williams charts,annual money supply growth.

http://www.shadowstats.com/alternate_data/money-supply-charts

May be, when excessive debt,excessive leverages,lower return,lower yields,over capacities are asking their float.When central banks are required to fund the financial assets and liabilities in lieu of the inter banks markets,in lieu of the private markets.It did not occur in March 2009, as interbank and money markets did not give a notice of a financial markets freeze.

The situation remains the same as of march 2009,prices are disconnected with revenues, incomes.Balancing of current accounts,debts to cash flows will require a real depreciation of financial assets prices.

In essence Central banks,Banks,financial corporations,states, are playing the financial markets, when the real issues are in the real economies.Central banks are providing funding at zero interest rates and liquidity has become a constant,hopes are striving for a solution as a function of time (financial markets) and not a function of prices.

As for the debate around the banks solvency and capital requirement,please publish:

Quarterly 60,90,180 days statement on unpaid interest and commissions.

Quarterly statements on loans and credits restructured with differed repayments schedules.

The same on contingent liabilities.

This crisis is now, officially three years old.It is time to let the professional investors such as shareholders,bond holders to make their assessment,and take their responsibilities.

After the G-20 meet I scrolled through 2,600 articles on the subject on Google news. I read the Headlines on all 2600 of them and lead-ins on most every article although after a while I became adept at spotting the redundant feeds. This all took about 2 hours but I found most of the pieces to the puzzle.

The thing is, reading only the US/UK/MSM take on any story with geopolitical implications is perhaps the most misleading experience a person can have. For instance there were actually 2 Fin Mins who sent subordinates, (Brazil, Indonesia) but of course only one of these cases was widely reported.

More importantly, the US delegation came back with their tales tucked between their legs but that was almost impossible to notice from most of the reporting worldwide. But of course the puzzle pieces were available, just not easy to find. The main clue was in the closing communique but the key points were excluded from nearly all of the 2600 articles:

…”move towards more market determined exchange rate systems that reflect underlying economic fundamentals and refrain from competitive devaluation of currencies. Advanced economies, including those with reserve currencies, will be vigilant against excess volatility and disorderly movements in exchange rates. These actions will help mitigate the risk of excessive volatility in capital flows facing some emerging countries. Together, we will reinvigorate our efforts to promote a stable and well-functioning international monetary system and call on the IMF to deepen its work in these areas. We welcome the IMF’s work to conduct spillover assessments of the wider impact of systemic economies’ policies;…”

The key clue is exemplified by this: “Advanced economies, including those with reserve currencies,…” And in the word:”spillover”, the importance of those words though must be contrasted against what Sec. Geithner said, repeatedly, leading into the summit, that being his insistence that the US had not intentionally devalued the dollar with QE. But of course, since the summit, it has become increasingly clear that the FED now intends to take an incremental approach to QE. But if the MSM version of the summit was all that a reader had considered, that reader would most likely interpret the meeting as yet another instance of a US delegation saving the world, or, a more measured view might be that it was presented by the press as ‘business as usual’. But in truth something very unusual happened… the US was in fact taken down a notch. The emerging nations maneuvered the developed nations into a position where there was no choice but to formally agree to limit quantitative easing, and, the existing spillover effect has given the emerging nations a hassle-free opportunity to customize their capital markets with controls. There are in fact some efforts underway to use capital controls in some new and innovative ways, and the unfettered freedom to experiment with these without criticism or fear of retaliation is enabling these efforts. (Capital controls do not specifically violate WTO regulations although there are provisions which can be applied in the event of a complaint. The IMF has no jurisdiction over Capital controls, but like the WTO, the IMF position on capital controls has been negative and so there is simply negative political pressure mostly, although both institutions have stated recently that these types of protections are useful in limited applications. Most US trade agreements on the other hand require the liberalization of all cross-border financial services without exceptions). So, I suppose it is safe to say that the US has become more lenient in regards to capital controls. And this leniency was what the emerging nations wanted maybe as much as they wanted the QE curtailed.

More importantly though, the US has now, with the announcement of QE2, given all nations the unimpeded right to manipulate their currencies as they see fit. Within hours of the FOMC announcement there was a rumor coming out of Brazil of intentions to purchase dollars with reals in order to fight against dollar depreciation, and, the amount being the same as the Fed’s chosen number of 600 billion sends a clear message that the Brazilians intend to neutralize the FED’s efforts.

So, insofar as the Fed’s move being priced in, it seems that it was more-so anticipated in the US than in the ROW, (based on market reactions). I suspect that this had a fair amount to do with how little US investors knew about the global sentiment in regards to QE2. The US/MSM has left US citizens vastly misinformed about the hypocrisy aspect of QE2. The ROW though, being better informed, sees that QE2 runs the risk of doing irreparable harm to Bretton Woods II, and there has been lots of blog-talk throughout the world that the US reserve currency status and dollar hegemony is on its last legs. So I suppose that investors outside of the US were somewhat surprised with the insensitive boldness of the Fed and hence a great deal of money movement in the past 18 hours or so, globally speaking.

Ray L-Love

Those of us who follow supply side economics recognize that there are two primary elements to a growing economy. First is to keep taxes below point E on the Laffer curve so that almost always means tax cuts, and second a stable currency.

It appears that with the recent election lower taxes is actually in the cards. There appear to be enough “conservative” Democrats to push for a retention of the Bush tax cuts and there seems to be enough support that we may see other reductions.

The biggest problem is the current gaggle of monetary authorities who believe against all evidence that another $600trillion of meaningless money will stimulate growth.

But the last election creates an amazing situation. Here is an excerpt from the article in Politico.

Ron Paul in charge of Federal Reserve oversight?

November 03, 2010

Here’s a little irony in the House GOP sweep: The next chairman of the monetary policy subcommittee — overseeing the Federal Reserve?

None other than Ron Paul (R-Texas), who’d just as soon abolish the Fed.

Paul is the ranking member of the Subcommittee on Domestic Monetary Policy and Technology on the Financial Services , which oversees the Federal Reserve, the U.S. Mint and American involvement with international development groups like the World Bank. Unless someone bumps him, he’s next in line for the subcommittee gavel.

Paul is critical of all the institutions he would oversee. He’s long called for killing the Federal Reserve, and this year tried to get an audit of the Fed into the Wall Street reform bill. He’s asserted that the dollar should be tied to the gold standard in order to keep it from losing its value.

http://www.politico.com/blogs/glennthrush/1110/Ron_Paul_in_charge_of_Federal_Reserve_oversight.html

I am not a huge Ron Paul fan but with him in this position he could shake things up in just the right way.

I am much more hopeful that recovery just might finally be on the way.

A thoughtful article, let me add a couple of my own tentative thoughts

.

Having traded FOREX and watched policy, my feeling is that other markets like the bond market can price in expected policy and interest rates better. in forex a traders daily swap cost does not show up till the policy is in place. the old bundesbank used to act on this for example. they would cut short term rates but with effect the NEXT DAY. while that might have weakened the DM, they made sure the DM went up the rest of that day, breaking the lower rates/ weak currency link in traders minds

the problem now? this is all announcement, no action. traders really dont know how to price, especially in forex. And cant weaken the dollar too much till the $75 bio month supply flood shows up. bonds prices can guess where policy will take them. their problem is they cannot price closely what a substantial future supply contraction will bring? not much data?

but bond dealers can make a decent guess and already have.

One possible explanation is that the market had priced in QE2 but was uncertain about possible ECB countermoves. There were some who were expecting that an announcement on the larger end of expectations would require the ECB to either purchase bonds or lower interest rates to prevent the Euro from becoming over-valued. The size of the Fed announcement and the lack of any change in ECB policy in reaction meant that the interest spread between Dollar bonds and Euro bonds would widen, leading to a stronger Euro.

A couple of thoughts.

1. It seems to me that the “priced in” value of an event such as the QE2 announcement would not only be a reflection of the value of the announcement itself, but also a reflection of the risks (which may not be normally distributed) associated with taking a position in anticipation of the expected outcome. In other words, in order for “bets” to be successful, players must not only guess the value of the announcement, but also be able to survive volatility around some range of outcomes.

2. As the volatility value comes out of the pricing post-event, momentum bets come in, which tends to skew pricing in whichever direction the derisking happens to take price.

Market is not a human(and certainly not divine) It consists of many groups of players: from rational to irrational, knowledgeable to ignorance, from speculators who use charts and indicators to computers that can sniff order infor and front run such others if criteria is met. In short, it is not useful most of time to understand why market behave in certain manner, particularly in short term, but just a net resultant behaviors of all groups…sometimes exhibit expected and unexpected behaviors.