Econbrowser reader Bob_in_MA has argued that Governor Walker’s [the] (edit 7:50am 2/22) desire to strip collective bargaining rights from Wisconsin public employees is derived in part from the high labor costs, hidden in part by large unfunded liabilities (e.g. pensions) in the state. This might be an apt characterization for Massachusetts. It is not for Wisconsin. From the Pew Center for the States:

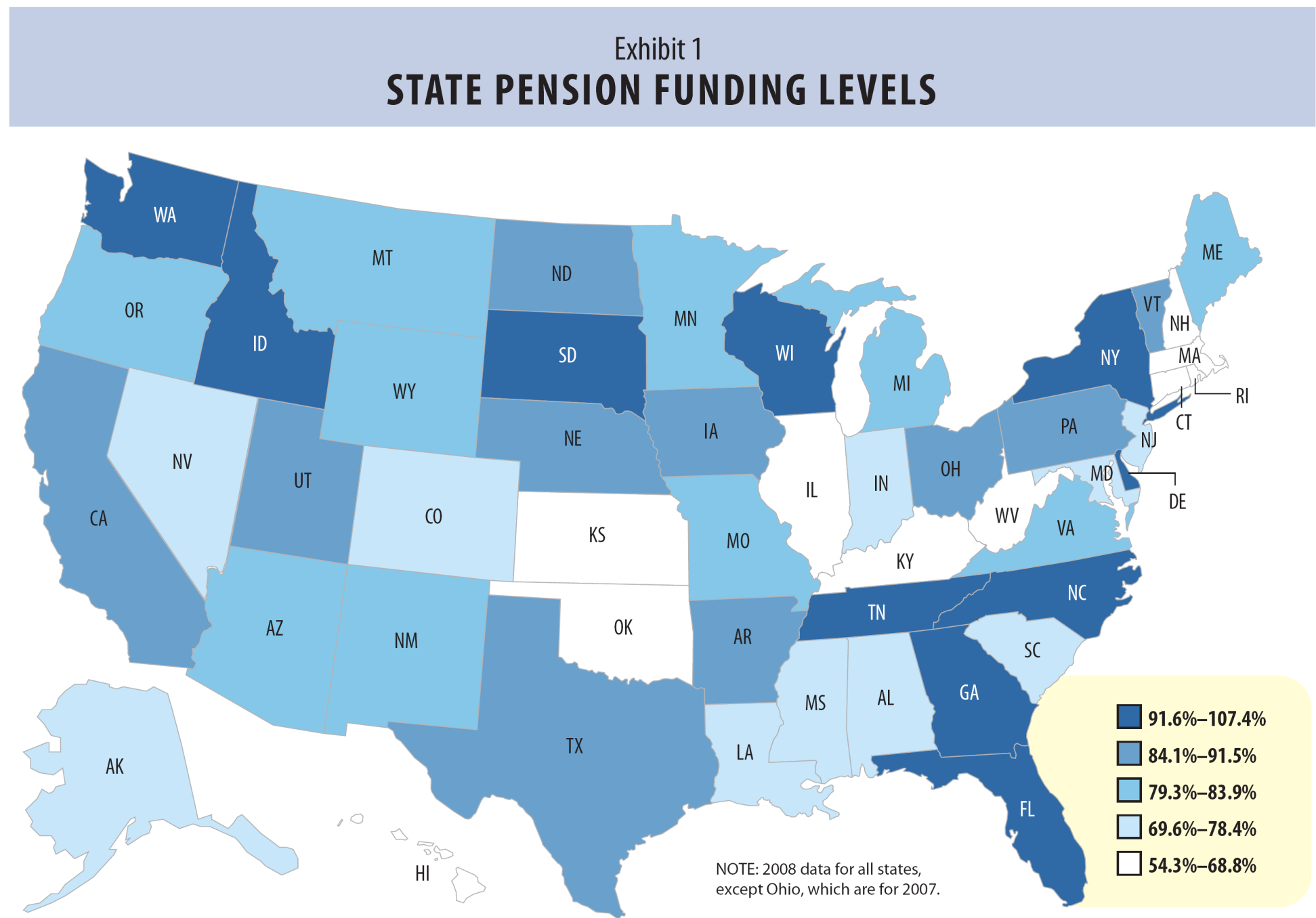

Some states are doing a far better job than others of managing this bill coming due. States such as Florida, Idaho, New York, North Carolina and Wisconsin all entered the current recession with fully funded pensions.

The following graphic depicts how Wisconsin fares, in terms of funding its pensions.

Exhibit 1 from Pew Center for the States, The Trillion Dollar Gap: Underfunded state retirement systems and the roads to reform, February 2010.

To put matters in context, Bob_in_MA argued:

…

What I don’t think you and many other public employees seem to realize is how different the retirement benefits are from the average worker in the private sector. Your previous post using BLS stats completely ignored the enormous unfunded liabilities. I posted a comment on that asking you to clarify, but I assume it’s not a point you would argue.

The average white collar worker today is given a 401k with (sometimes without) a fixed contribution from the employer. If he wants to retire at 55 he will need to pay the costs of health insurance out of his savings until medicare kicks in, and then probably supplement that. Meanwhile, the teacher who retires at 55 has no worry on that front.

I think if most public employees were shown the amount that would need to be socked away in a 401k to assure the equivalent of benefits they will enjoy, they would be shocked.

…

Bob_in_MA castigates me for not pointing out that in Figure 2 of this post, the total cost of benefits were not included. If the Pew Center for the States calculations are to be believed, then in fact, those costs are included.

Just as a reminder, here, once again, are the comparative compensation costs for public versus private sector, according to a study by Keefe (2011).

Figure 2: Annual total compensation for full time employees, by level of education attainment, in private sector (blue) and public sector (red). Source: Keefe (2011).

Bob_in_MA is correct, however, that Massachusetts seems to have substantially underfunded its pension liabilities.

I’d prefer to disband all unions regardless, but so what if the current liabilities are fully funded? What are the future? Can you spend two seconds to extrapolate?

One also has to look at wage volatility in addition to average wage. Real wage volatility is increasing in the US, e.g. see The Great Increase in Relative Volatility of Real Wages in the United States by Julien Champagne and André Kurmann.

Increased volatility in real wages is an increase in risk to a wage earner of lower income and periods of unemployment.

Private sector versus government worker and teacher wages needed to be risk adjusted for valid comparisons. An equal numerical real wage between private and public is not equal if public workers face much less real wage negative adjustment risk.

Champagne and Kaufman state:

“We document that the increase in absolute volatility of the real wage is not generalized but concentrated among male, skilled and young workers. Also, there are large differences across industries…”

With cost of living increases embedded in government employee contracts and difficulty in cutting wages or firing of government employees (and teacher tenure), give government workers a lower wage volatility than private sector male or female workers (especially if one includes the difference in retirement income).

Private sector employees, after adjusting for age, experience, education, regional variations in cost of living, etc., should make more than comparable public sector employees make to compensate for the increase in wage risk. If the numbers on their face are equal, they are in reality unequal.

mla: you raise an important problem. if i extrapolate from current trends, this is what i see: by wiping out unions, we pretty much clear our economy and political system of any organized opposition to the power of the Capital. with the decks clear, then the trends of the past thirty years or so can continue unimpeded: stagnant or falling incomes for 90% of the population, increasing concentrations of immense wealth in the hands of a few, untaxed corporate profits either returned to these few or invested overseas, and the continued fleecing of the Americans by banks, insurance companies, pharmaceuticals, energy, media and any other large-scale corporate entity. or we can attempt to return to a vision of the world where great concentrations of power are understood to be inherently anti-democratic, that we all have obligations to each other, that the best use of wealth is as a means to provide justice for all, and that the best Americans are not the most sociopathic. it is speaking volumes that for many people today, this is a tough choice.

The facts are persuasive. What also interests me is why so many states have underfunded pensions. I’d guess it’s because state legislators were so tax adverse that they “borrowed” from the pension funds to cover up their fiscal irresponsibility. Now, we are blaming the people who will probably be screwed by that irresponsibility rather than those responsible for it.

Generally when making a fact-based academic argument, mla, one starts with the facts and seeks to draw a conclusion from them. One would not start with “I’d prefer to disband…” and then try to seek facts/fit facts to back one up. You are just an example of the problem here. And yes, I do belong to a union because I have to in MA to teach at any State institution and my 22 year history there has taught me that, without the collective bargaining abilities, we’d be ignored.

Bob_in_MA (embarassingly) also doesn’t realize that starting salary at, say, the Community College level (WITH a PhD!) is UNDER 40k. It isn’t much higher at the State Colleges. UNDER 40k. But hey, I’m sure that if you can afford to send your kids to private school (or want to burden them with debt for 30 years in loans to do so) this doesn’t matter to you and this faculty should just take the job right? I mean, if I can make 150k in Engineering in industry, why wouldn’t I take 38k to teach that to at-risk kids who would probably end up on some form of Federal subsidy later in life?

The absolute short-sightedness here is mind-blowing. As is the ability to see where to money flows, and where it WILL end up flowing in the future. Perhaps if their teachers had been paid more we’ve have more understanding? Maybe not. This is, after all, about “I’m afraid someone is getting something I’m not”.

Wisconsin sold bonds of approximately $750 million dollars sometime around 2003. The proceeds were were for and placed into the fund for future state obligated retirement benefits of state workers. Do you believe that the 6.5% interest on the bonds were included in the study’s compensation of workers?

I also found it interesting that the study could make “Comparisons controlling for education, to the experience, organizational size, gender, race, ethnicity, citizenship, and disability” in the cross study of different work environments. But even when acknowledging that “While we ideally would compare public sector workers

with private sector workers performing similar work,” it could not do so because “Public schools

accept all students, while private schools are sometimes highly selective and may exclude or remove poor performing, special needs, or disruptive students.” Even if the “sometimes” is significant, the study could not control for that factor? But of course, the 23% differential for teacher pay would have been, (trying to find the words), uncomfortable.

Final observation, this study is a great example of education bias.

You’re throwing that graph around, but I think it actually is a case against unions.

Unions cater to the lowest common denominator. They attempt to excessively compensate the low end worker, often at the expense of the high end.

Another thing to consider is that educational achievement is the wrong metric for the X axis. Unlike the private sector, union pay scales increase pay for increasing education.

For example, teacher pay scales are higher if you have a masters degree, and are even higher if you have a PhD.

Thus, one would expect that there are literally millions of public employees, mostly teachers, with masters degrees, and comparatively few private sector workers with such a degree. That alone will skew the graph (it’s the difference between an artificial credential vs. a degree that actually might make a person more productive, and thus better paid).

A better metric would compare similar or the same job between the public and private sectors, irrespective of educational achievement.

The conclusion that these states had fully funded pensions in 2007 might well be a function of the inflated asset prices that existed then as a result of the Greenspan/Bernanke Fed’s loose money policies.

In considering unfunded liabilities, it is important to separate cash-pay pension benefits from retiree healthcare.

As the Pew study makes clear, the states have set aside about $2.3 trillion to cover $2.8 trillion of cash-pay liabilities. But since retiree healthcare can, in theory, be canceled most states are on a “pay as you go” basis and have set *nothing* aside to cover retiree healthcare. That includes Wisconsin.

So, when the Pew study reports a trillion dollar gap they are actually talking about: (1) a 15-20% or so shortfall in cash-pay pensions; and (2) ignoring and setting aside nothing for retiree liabilities.

As a further complication, this discussion ignores the inherent controversy in deciding how much to discount future benefits that have already vested today. For example, there is an active argument in California over whether the actuarial 7.75% discount rate is appropriate or whether a lower rate – and hence higher required funding – is appropriate.

The private sector needs to be protesting on Wall Street the way the public sector is protesting in Wisconsin. Why should lazy financiers collect enormous fees for gutting private sector retirement funds?

This weekend WSJ had its usual “blame the investor” article (Retiring Boomers Find 401(k) Plans Fall Short): “In the stock-market collapses of 2000-2002 and 2007-2009, many people were over-invested in stocks.”

No mention of all the frauds from dot com to the current securitization scandal. No mention of the collapse in the RMBS/CDO bond market sector.

And what’s the solution? Giving Wall Street more money, taking bigger risks and relying on the god-like ability of her financial planner to ascertain the future:

“Then, to make ends meet, she plans to take bigger investment risks. Her financial adviser then will shift some of her savings out of an annuity and into high-yielding bonds and real-estate investment trusts, aiming to double the return on that money to 10% a year.”

Isn’t it more likely that the stock and bond markets, still mired in same fraudulent conduct that crashed the markets twice in the last decade will collapse once again?

Menzie,

Florida has been proactive in pension reform and so does not make the hit list. Apparently Wisconsin has been better than the rest of the country. But being better now should not give the citizens of Wisconsin a warm fuzzy. If you do not deal with the problems they will only get worse. We should not all wait until we are Illinois before we act.

Consider the heat the Republicans are getting for a paltry $60billion budget cut. If there were not more added to the national debt and congress were to cut $60billion every year it would take 236 years to pay off the debt. Also consider that $60billion is only about 1/3 of the interest payments that come due each year.

Our nation – federal, state, and local – is in more trouble than the politicians seem to realize, and the union leadership seems to not even care as long as they are allowed to scam the workers.

Sorry Menzie, I should have started out with a thank for the map and post. My rant was not targeted at you even though I addressed it to you, so let me set that impression straight right away.

Menzie, et al, I’m not sure that many realize the collective bargaining provisions are there mostly to help local governments. The state pays ~ 50% of its annual budget as transfers to localities. At that level the vast majority of the budget is tied up in salaries and benefits, including pensions.

Menzie’s referenced Pew Report says: “Locally run pension plans were excluded.” Which means that only WI state programs were studied in the report.

In many states, teachers’ retirements are funded partially or in whole from a state retirement system. I don”t know about WI, but it is common to find the localities fund the public safety and other local government employee pensions.

So it appears the real gap is at the local level where the bulk of public employment exists, and it explains why the local governments requested this “bargaining” relief.

Menzie,

First, I never characterized Governor Walker’s position on anything.

Second, in the next part of the Pew report is on unfunded healthcare liabilities. “Only two states had more than 50 percent of the assets needed to meet their liabilities for retiree health care or other non-pension benefits: Alaska and Arizona…”

So more than half of Wisconsin’s liability is unfunded.

Did you not get that far in the report?

This is from the Keefe report: “Retirement

benefits also account for a substantially greater share of public employee compensation costs: 8% compared with 4.6% in private sector organizations with more than 100 employees.”

And that report doesn’t mention retiree health care benefits at all.

And it comes from “Economic Policy Institute”, a very partisan organization and was clearly written as partisan response to the current political situation in Wisconsin. Their research should be looked at as skeptically as that of the Heritage Foundation, or AEP. They may make a valid point, but the point they make was probably decided before they began their research.

You completely miss my basic observation about the clear difference between the retiree benefits of the AVERAGE private sector worker and the average public sector worker.

As I’ve shown, 87% of private jobs come without a defined benefit pension.

When it comes time to meet that unfunded health care liability, whether it’s the 50% in Wisconsin or 100% in Massachusetts, you are going to be asking tax payers who have nothing comparable to come up with the money. It’s not going to happen.

It’s not a simplistic case of right or wrong. The average person does not identify with a public sector employee. You all are losing the battle and you have no idea why.

Next, we can discuss the survivability of tenure in the modern labor market…. 😉

Good luck to you.

What, exactly, is your understanding of the tenure system in academia, Bob_in_MA? Do you think it’s about “job security”? Because if you do, that would be incorrect. Teachers with tenure can be laid off and/or fired and are.

Also the average person, in fact, DOES realize that the trade-off for a public job is lower pay while employed and a retirement plan. That’s the balance. Most blue-collar, middle class people know that a starting salary of 38K for a PhD is LOW by any measure, and the benefits are the equalizing factor. And isn’t it funny that in WI, cops and firemen were exempted huh? So much for treating all public sector employees the same. Why teaching staff isn’t viewed as essential also I have no idea. But I suppose if you’re of the class that you don’t send your kids to public school you don’t care about the quality of the education your taxes will now buy.

Again, you are bending data or offering unsubstantiated or anecdotal “proof” to back up your political view. I’d rather let the data dictate the conclusion. And the conclusion is different than you are suggesting.

Bob_in_MA: You are right; you did not make any references to Governor Walker, and you only argued generally for cutting public sector benefits. I apologize for that error, and have edited the post accordingly.

Regarding retiree health care, please refer to this website. You will see that in Wisconsin, although the proportion of unfunded liabilities is fairly large, the total dollar amount of retiree health liability is relatively small, on the order of one-24th that of pension liability.

Finally, regarding the source of the study: I understand think tank studies come with biases. But as long as I understand the methodology, and the problems with the approach (which Dave Backus @ NYU highlighted and I elaborated upon, in the comments), then it is still useful. If you can quantify the extent of the bias, or provide better (i.e., more econometrically defensible) estimates, then I’ll modify my views; but for now, I’ll use the EPI estimates for the want of better estimates.

I wish you the best as well.

I truly find it fascinating that we have been so effectively propagandized by Capital that for a significant number of people, the fact that 87% of private sector jobs do not have a pension leads to the conclusion that public sector jobs shouldn’t have them either. Or that, despite all the gains in productivity over the last 30-40 years, we somehow cannot afford such luxeries in the “modern labor market”.

1. Public employees usually don’t pay into social security. They don’t in states like Wisconsin, Illinois & Massachusetts. In some 15 states, including MA, if they work in the private sector and thus accrue social security, they lose retirement benefits if they receive a government pension. In MA, the average loss – per the government source – is about $3600 a year, a substantial amount for a retiree.

2. So if you think we should eliminate public pensions, then you need to understand they get nothing at all. Nothing. That would be evil.

3. A 401(k) is not a substitute for a guaranteed benefit. Social Security is a guaranteed benefit, so all the people whose pensions are lost would still need to receive that amount. In one sense, state plans are more like how the GOP under GWBush wanted to privatize social security – taking control out of Washington – and that is why many state employees have favored this system.

4. Consider funding. For a replacement 401(k) system to work, it would also need to be funded for all the years that all the existing employees have worked or you’ve just impoverished them. I don’t think anyone has done numbers on how much this would cost to enact; many states, like Illinois, would still face a huge funding gap.

5. Consider then the funding gap between the actual pensions and Social Security: take Illinois where the average teacher pension is about $15k over Social Security. Teachers pay into this system so they partially fund it, at somewhat more than Social Security rates – in MA, the mandatory contribution is 11% for teachers and in Illinois, they pay 9.4% (and the average is 8.5%), all much more than Social Security rates. In blunt terms, when people look at pensions, they look at the entire number and fail to understand that employees fund much of it and you can’t just take that away. In Illinois, rather than failing to fund a massive pension – as portrayed – they’ve actually failed to fund a relatively small average pension over Social Security, despite the employees paying more than we all do into Social Security.

5. Legality. If you’ve paid into a system and have accrued benefits, the legality of taking those away is questionable.

The article by Novy-Marx and Rauh in the Jnl of Econ Perspectives, Fall 2009, “The Liabilities and Risks of State Pension Plans,” does not show Wisconsin to be nearly as well off as the Pew Report claims, either absolutely or relative to other states. They make the important point that state plans tend to use discount rates for liabilities that are too low.

The Economist has had a few publications on this topic. While I have not studied the merits of either side’s case I offer up just what is supposedly passing for analysis these days. Of course, I tune in here for erudite and cogent analysis as well.

“…Economists still debate exactly what impact public-sector unions have on pay. Evidence from the American Bureau of Labour Statistics support the conservative argument that they have used their power to extract a wage premium: public-sector workers earn, on average, a third more than their private-sector counterparts. Left-leaning economists reply that public-sector workers are, on average, better educated. Whatever the merits of this argument, three things seem clear. Unions have suppressed wage differentials in the public sector. They have extracted excellent benefits for their members. And they have protected underperforming workers from being sacked…”

http://www.economist.com/node/17849199

This article from the same Economist points out some of the ways States get around the accounting (amongst other things).

David Crane, an adviser to Arnold Schwarzenegger, the governor of California, describes the treatment of state pension funds as “Alice-in-Wonderland accounting”. Suppose, he says, that a state had to pay a bondholder $30,000 a year for 25 years and to pay a pensioner the same sum for the same period. The bond obligation would have a present value of $425,000 in its accounts but the pension liability, with the same cashflows, would be valued at just $320,000.

http://www.economist.com/node/17248984?story_id=17248984

Finally, many people read articles like this, which simplistically points out a few “facts”.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/02/07/BAD91HJ22F.DTL

MC: I think you’re overconfident in assuming that the NPV of public sector retiree health liability is low, given that medical technology is advancing rapidly and beneficiaries sue to increase benefits. See http://www.jsonline.com/news/milwaukee/100108249.html for MIlwaukee Public Schools’ experience with Viagra.

“MPS first agreed to cover drugs that treat erectile dysfunction in 2002. By 2004, there were 1,002 claims for such drugs from MPS employees. During negotiations with the union for its 2003-2005 contract, MPS tried to stop coverage of the drugs, citing rising costs. An arbitrator sided with the district in 2005.

In 2008, the teachers’ union filed a charge with the state’s Equal Rights Division, complaining that not offering the drug violated the Wisconsin Fair Employment Act… Some, including at least one state lawmaker, have criticized the union for asking the district to cover Viagra instead of using money to save teacher jobs.”

“…New York…”

Putting NY on this list destroys this claim’s credibility — and shows what “funded” means as to govt liabilities.

The new govt accounting rules allow previously uncounted liabilities to be put on the books incrementally over a couple decades. Mayor Bloomberg to his credit had the city calculate its number all at once as of today and showed the NYC’s balance sheet net to be already at negative tens of billions of dollars, with the wave of big liability accruals going up an up.

New governor Cuomo – a lifetime NY liberal, son of famous same, and head of the state Dem party that is famously owned by the govt unions as few others – *after* he got elected started running TV ads saying the state is broke, taxes are far too high, and massive spending cuts out of govt programs and personnel are mandatory.

So if Wisconsin’s liabilities are “funded” like NY’s, yeah, good luck with that.

Looking at the Methodology section in Attachment A to the Pew study, I think two things should be noted.

Firstly, local-level pensions are not necessarily included (some municipalities participate in statewide plans for certain of their workers, and those are included). The authors claim this doesn’t affect their analysis (I think they’re focused on state comparability), but I think it would be more likely for local plans to be underfunded.

Secondly it looks as if there is a dearth of information on the health-care liabilities due to data-collection/reporting problems at the state level.

Additionally, this section (pg. 55 – last section in Appendix A) on their grading of health-care liabilities seems problematic:

“Health care and other non-pension benefits grade. Pew’s criteria for grading states’ retiree health care and other non-pension benefit obligations were much simpler and more lenient than those used for the pension assessment. This is because most states have only recently begun to recognize these liabilities and many still have not put aside any assets to pay for these bills coming due. On average, states have only put aside 7.1 percent of the assets needed to adequately fund their retiree health liabilities.

Because most states have only recently begun to account for and address these liabilities, Pew’s grades measure the progress they are making toward pre-funding. As a result, a “serious concerns” grade was not included. Pew rated as solid performers those states that had set aside more than 7.1 percent of funds to cover the bill coming due. All states that had set aside less than that amount were identified as needing improvement. This allowed Pew researchers to highlight and give credit to states that have begun to fund their retiree health care and other benefits while acknowledging that it is still too soon to expect states to have made meaningful progress.

An additional concern in grading state retiree health care and other benefit liabilities was the variation in the generosity of benefits offered. States vary much more in the level of non-pension benefits they provide than they vary with pension benefits. Moreover, for states with minimal (or implicit) benefits, it may be less of a financial necessity to pre-fund, and such states potentially could sustain a pay-as-you-go approach. However, it is still good financial practice to pre-fund, future liabilities. Additionally, in requiring that states assess their obligations for retiree health care benefits, GASB made no distinction in the size of retiree health benefits. We decided to follow that approach in deciding which benefits to include in our analysis.”

Hi Menzie, I think the link to Keefe (2010) is leading to Keefe (2011).

Jonathan,

You make a valid point about public employees being outside Social Security, but your contribution comparisons are rendered meaningless by the difference in terms.

Using your data, the employee in Illinois receives a pension about $15k over Social Security, after a 9.4% contribution. So they contribute an extra couple percent, about 30+%, and receive an increase of over 50% of the maximum SS benefit.

BUT, in my cohort, we can’t receive full SS until were 67. What is the minimum retirement age of a teacher in Illinois? I just checked, 55. If you use a retirement savings calculator you will be amazed to see he difference in savings required to start a retirement at 55 rather than 67.

BUT there’s more! The teacher from Illinois receives health care coverage at 55! That’s worth another $10,000+ a year…

Realistically, that 9.4% contribution would probably need to be 15-20% and comparing the benefits to Social Security is really nonsense.

Orin Kramer on the fuzzy accounting of gov’t pensions:

“Consider, for the sake of comparison, how private corporations, in measuring the value of the assets in their pension systems, are required to use real portfolio market prices. Government accounting standards, in contrast, allow public pension systems to measure their assets based on average values looking back over a period of years. In most instances those average values add up to a figure that is much higher than the amount of money the pension plan actually has.

“Public pension funds are also allowed to make assumptions about future investment returns that many of us would regard as overly optimistic. And since those assumed returns are incorporated into measurements of the fund’s status, as if they had already been realized, states that come up with the most rosy market forecasts look, on paper, to be better financed….

“To make matters worse for state budgets, hidden underfunding of public employees’ health retirement costs is even greater than that of their pensions….

“Accounting is inevitably an artificial language that can distort some economic truths. But at the least, government accounting should aim for greater transparency and consistency, allowing outsiders to compare one jurisdiction against another. At the same time, the social contracts that exist today in many places among taxpayers, beneficiaries of public services and public employees need to be renegotiated before a crisis arrives.”

— Orin Kramer, “How to Cheat a Retirement Fund,” The New York Times (Sept. 10, 2010, op-ed)

Do wildcat strikes violate the collective bargaining agreement in place?

It isn’t nonsense to point out that public employee pensions include their replacement for social security. Take that money out of the picture and the problem is much different. So yes, they can in many cases get pensions earlier. And yes, they get some more money. I’m adding actual facts to the story not making political arguments.

Consider the argument that private company pensions are smaller and then remember the private company only needs to worry about an excess over social security.

Also note that if you switch to defined contribution, there is a cost – and experience in doing this in private companies. As of now, benefits are paid out of a pool but defined contribution is individual accounts that are funded and vested for each person. Existing accrued benefits are legally required – in almost all cases – to be paid so there is a liability for all those benefits into the future. That will amount to some large number. Then accounts have to be set up that have in them actual contributions plus earnings – meaning a lot of accounting and then likely another big sum to fund the accounts if the state is like Illinois and has fallen down on the job.

As for how large a public pension is overall, if you take away incentives for public service then you have to pay them more currently. Since educated public employees are paid less than private sector workers, that means you either hire worse people who work cheaper or you raise pay as you cut benefits. I’m not sure which path actually costs less when you take all the factors into consideration.

The saying Pew Report notes that Wisconsin is only 23% funded for retiree medical care. Regardless, having state employees pay into their medical plan at the rate that the private sector does (roughly 25%) should not be considered onerous.

Michael: Thanks, you are right. Typo corrected now.

I see comments about a battle-as in the battle to take over 99% of the country’s wealth and pass it to the top .01% of the population? As in the battle to sell off every public works program-waterworks, bridges, highways, street lights, parks, sidewalks and public buildings-to investors overseas? As in the battle to spread the concept of Mafia style public services ( Hey Bud, Ya Ain’t paid yer dues so we’s gonna let yer house burn to the ground)? As in the battle to make certain that all discussion about this topic is injected with fear and hatred?

Can’t we use the market test for whether state employees are overcompensated? If demand for those jobs is robust people think its a good deal. If there is a shortage its a shitty deal.

Generally, it seems there is sufficient demand for state jobs, and many people consider themselves lucky if they land a government job. The only place I’ve seen a labor shortage is when the state tries to hire high end specialists. Teaching seems to have a robust bid from labor.