From Reuters:

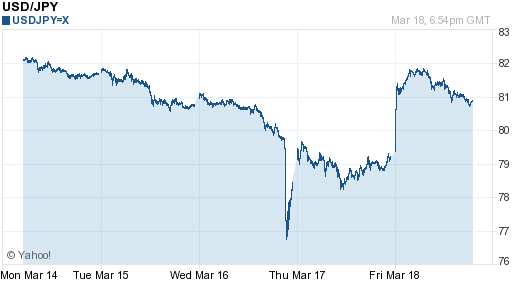

A coordinated move by central banks of rich nations to stabilize the yen’s value appeared to be having a decisive effect on Friday, after a sharp rise in the yen after Japan’s devastating earthquake and nuclear crisis raised fears about the global economy.

The action by the Group of Seven, in which they poured billions of dollars into markets, was the first joint intervention in currency markets since the G7 came to the aid of the newly launched euro in 2000.

The U.S. dollar surged two full yen to as much as 81.98 yen in response, up from a record low of 76.25 hit on Thursday. Traders estimated the Bank of Japan alone bought more than $25 billion, paying with yen to effectively weaken the currency’s value by boosting the supply.

…

The impact on the USD/JPY exchange rate is shown in Figure 1 (down is an appreciation of the Yen against the dollar).

Figure 1: JPY per USD, past five days. Source: Yahoo finance.

Previous posts on the efficacy of forex intervention: [1] [2] [3].

it works mainly if it unsterilized.

it works real well if it supported by even easier money in the currency to be weakened, “super-unsterilized”

What are the “investing” implications? I see this as on topic.

From Mr. Forsyth @ Barrons

“…The risk of the so-called yen-carry trade has been neutralized. This gambit consists of borrowing yen at zero percent interest to buy higher-yielding assets, from gold to Australian bonds to the Standard & Poor’s 500. Borrowing yen means an effective short sale of the currency. A dollar-based investor has to guard against a jump in yen, which boosts the cost of that borrowing

The G7 just removed that risk. In the wake of the earthquake, any leveraged speculators such as an hedge funds can fund their positions by borrowing yen with impunity.

As appalling a notion as it might be, Japan’s tragedy may end up being positive for asset values, including stocks.”

http://online.barrons.com/article/SB50001424052970203322004576208220803440798.html?mod=BOL_hps_highlight_bottom

If he’s accurate, are we just blowing another bubble on top of a bubble (I don’t think, e.g. by Shiller’s estimates that US equities are “cheap”)

It’s a pity that it seems to be standard on Yahoo and elsewhere to label charts of yen per dollar as “USD/JPY”.

Short term it works , long term unless boj intervened like Pboc on daily basis , in the range of few % gdp or few hundred billion usd ; it wont work

All concerted intervention from central banks work,worked,will work,in prices,in rates,in volume.

Foreign exchange

Public debts

equities markets

Properties markets

When did they lift up IS/LM ?

May be an available comprehensive macro stabilization program could be of assistance.

Menzie wrote:

…efficacy of forex intervention…

Menzie,

This is an oxymoron. Certainly central banks can change the exchange value of relative currencies. Anyone who would deny this would not be a very good monetary economist.

But the real question is will this intervention solve any problems? Will weakening of the value of the yen allow the Japanese to buy greater quantities of building supplies to rebuild their nation? If 76.25 yen could buy $1 worth of building supplies yesterday, but today it takes 81.98 yen to buy those same supplies has Japan’s recover actually been helped?

It seems foolish in a country where half a million people have lost their homes and all their worldly goods and savings to now strap them with the added burden of a falling currency. Markets actually do work and they actually do price properly. Government interventions only harm the functioning of the market – rearranging the deck chairs on the Titanic (with some thrown overboard).

Concerted intervention is agreed upon by central bankers around the world. Why? Because the sudden appreciation of Yen to $76 is speculative – hedge funds anticipate Japan, the second largest creditor country in the world, will need to sell their foreign assets and repatriate their money to pay for insurance claims and rebuilding costs. So they bought Yen in order to sell it at a much higher rate to the Japanese. This is robbing the victim and the central bankers intervened to counter it.

The question is, will Japan be a net lender in the immediate future? If it needs capital to rebuild, the yen will strengthen. Currency intervention can work, only if it prevents the net capital inflow. I wonder if this is a productive goal?

What remains mysterious is why the disaster should have pushed the value of the yen up in the first place. This happened after the Kobe earthquake as well, but has not happened to other countries after such natural disasters. Many of the implications of the disaster do not seem to push in this direction, such as a possible lower savings rate or lower productivity in Japan.

Near as I can tell the only two identifiable forces pushing in this direction are the Japanese repatriating capital from abroad to pay for cleaning up the mess and an unwinding of short positions in the yen carry trade, apparently due to a fear of global growth slowdown, although I confess to being a bit mystified by this last one, even if some say it is the most important reason for this.

There is now solution emerging for the USA:

From now on, USA military actions are sold for the USD, Arabs with oil fields are paying.

This is what Obama calls Doubled export increase-

-first inflation export,

-now military protection is being sold to fight the consequences of the first export.

In the end, we all pay with higher oil prices again.

So it goes. A vicious circle America and the West is being drawn into, but of their own making. Overleveraged companies can not sustain external shocks. Nor can overeleveraged countries weakened by Keynesian irrationality in action. External shocks seem to be in abundance. So recession in q1 2012 is another step closer ( in fact, its unavoidable, but interesting to see what events which lead to Peak oil will ultimately achieve the implementation of the USA recession).

See my old Feb 6th graph, which will be followed nicely again with this spike in oil prices and consequent dip in DJIA. Libyan war is just another episode in spiking the oil.

http://saposjoint.net/Forum/download/file.php?id=2609

http://saposjoint.net/Forum/download/file.php?id=2608

I am also waiting for spike in coming days and weeks in silver (up to 45 USD) and gold prices with heavy correction ( 40-50%) very soon ( sales by gold in big amounts by someone or redirecting resources to oil and military preparation?Japan?)

http://saposjoint.net/Forum/download/file.php?id=2673

SI wrote:

Concerted intervention is agreed upon by central bankers around the world. Why? Because the sudden appreciation of Yen to $76 is speculative – hedge funds anticipate Japan, the second largest creditor country in the world, will need to sell their foreign assets and repatriate their money to pay for insurance claims and rebuilding costs. So they bought Yen in order to sell it at a much higher rate to the Japanese. This is robbing the victim and the central bankers intervened to counter it.

SI,

I do not say that you are right but I have something for you to ponder. Could speculators create such distortions in FOREX rates if the world were on a gold standard?

if Japan deflation continue to persist while pretty much all the rest of world-US, EU, CHINA, EMK inflating away like last 10 years,

no matter how much MOF intervene, it wont stop the rise of nominal YEN

but with 250% public debt/GDP and 1% JGB,and aging populations and pensiton crisis, is Inflation what Japanese need and want ??

I believe the only main reason why G7 agreed to jointly intervene in weakening the Yen is because Japan’s recovery is crucial for the global economy. Imagine companies around the world having to buy critical industrial materials from the Japanese at 76Yen/USD as opposed to 90Yen/USD. This would derail global economic recovery, especially the US and EU.

Sterilized foreign-exchange intervention does affect exchange rates from time to time, but its successe more generally is rather hit or miss. By my count, roughly 60% of all U.S. interventions are associated with an appreciation or depreciation or with a modified movement from the previous day. This is roughly what one would anticipate given the random nature of exchange rate movements. This overall conclusion does not necessarily hold across subperiods, currencies, and success criteria. In any event, U.S. monetary authorities seem to have concluded that intervention–even sterilized intervention–is not conducive to maintaining monetary policy credibility.

The effectiveness of FX intervention depends on the circumstances in which it is used.

Asking whether intervention works or not — unconditionally — is a bt like asking if antibiotics work. They work in some circumstances and don’t help in others.

The yen appreciated after the earthquake because markets anticipated higher investment, lower savings and higher interest rates. It is a standard FX reaction to a positive growth surprise.