The Denver Post reported the opening on Saturday of stations offering compressed natural gas to drivers in Grand Junction and Rifle, towns along Interstate 70 in western Colorado, making it possible to drive a vehicle fueled by compressed natural gas from Denver to Los Angeles.

The Glenwood Springs Post Independent offered this account:

The use of CNG fuel on the Western Slope has long been stymied as a “chicken-and-egg” scenario. No one wanted to invest in CNG cars or trucks because there were no filling stations, but there were no filling stations because no one was driving CNG vehicles.

Kirk Swallow, owner of Swallow Oil and an investor in Rocky Mountain Alternative Fueling, has now changed that. Last year, Swallow won a $675,000 grant from the Governor’s Energy Office to develop the Rifle station. He and his partners in Rocky Mountain Alternative Fueling covered the difference for the Rifle station, which cost about $900,000….As part of the grant application, Swallow obtained commitments from local fleet operators to begin making vehicle conversions to CNG.

EnCana Oil & Gas (USA), Williams Production RMT and Bill Barrett Corp. all pledged to convert five to 10 vehicles a year to natural gas. Garfield County committed to converting a dozen vehicles. The city of Rifle and Colorado Mountain College are also running bi-fuel vehicles, which can run on CNG until that tank is empty, and the switch on the fly to burn gasoline.

Technological breakthroughs in drilling methods have turned natural gas into a resource that the United States has in abundance. But what is the appropriate role of government in promoting the transition to more use of this resource for transportation? The “chicken and egg” problem referred to in the Post Independent article is an example of what economists call a “network externality”, for which it makes a lot of sense for the government to be a first mover in helping encourage the infrastructure necessary to enable market forces to take over.

The days when significant numbers of people drive from Denver to Los Angeles in a CNG-powered vehicle may still be a distant vision.

But I am glad that some people have that vision and are doing what they can to make it a reality.

|

NG is an interesting resource because of its supply. In the industry there are several “elephant” fields in PA/TX that can and are being tapped. They are generally more expensive to tap than conventional supplies, where you effectively drill a hole in the ground, but the ability to quickly tap these reserves does provide a reliable cap on prices, even if demand should increase.

As an alternative vehicle fuel CNG should expand much faster than electricity. In simple cost comparisons CNG is a cheaper per vehicle conversion and provides better overall mileage. It allows for the use of the same engine technology with dual/tri-fuel usage.

As an interim technology it makes more sense than putting extensive efforts in untried and or long discarded technologies requiring huge scientific breakthroughs top be competitive.

Just my thoughts.

Our current problems with distribution are because the government “incentivized” the current transportation infrastructure. If the government does the same with CNG the price mechanism that directs investment to the most efficient and most desired alternatives will be distorted leading to a large waste of capital.

Hayek was very wise to point out that no one person or even a group of people can know everything these is to know about production and that includes energy. If the government becomes involved the decisions will be based on ignorance of the present and the future, but perpetuation of the past, and that totally ignores the political greed and abuse that is natural to all political systems.

That said CNG is the fuel of the future. If you want the government to do the best thing for CNG it should totally deregulate it then get out of the way. Then the price of CNG would make it the hottest (not pun intended) energy source in our country.

Here is an example.

The truth is that politicians know the oil companies are where the money is so any government involvement in CNG will be through the palm of the hand of a greedy politician.

Ricardo,

Your link doesn’t work, can you post the URL?

LNG will be important too, for big trucks, etc. They can run locomotives on LNG by adding tank cars, analogous to the coal tenders years past.

CoRev,

Yes, electric cars are ridiculous. Unless the electricity is coming from a renewable source, you are polluting more than even gasoline.

Most electricity is produced by burning coal and it loses 10% of its energy in transmission. When we get 25-50% of our electricity from renewable sources, and battery technology will have advanced by leaps and bounds, electric cars will be cheaper than gasoline models and will be a no-brainer.

From my experience, CNG should clearly have an impact on transport, but it is not a perfect substitution for liquid fuels, mostly because of range.

Coincidently, those stations featured in the story will help us on trips from Salt Lake City to western Colorado and Denver (ironically a natural gas rich stretch with almost no stations) to fuel our gasoline/CNG pickup that we bought to try out the technology and its economy and to have a backup.

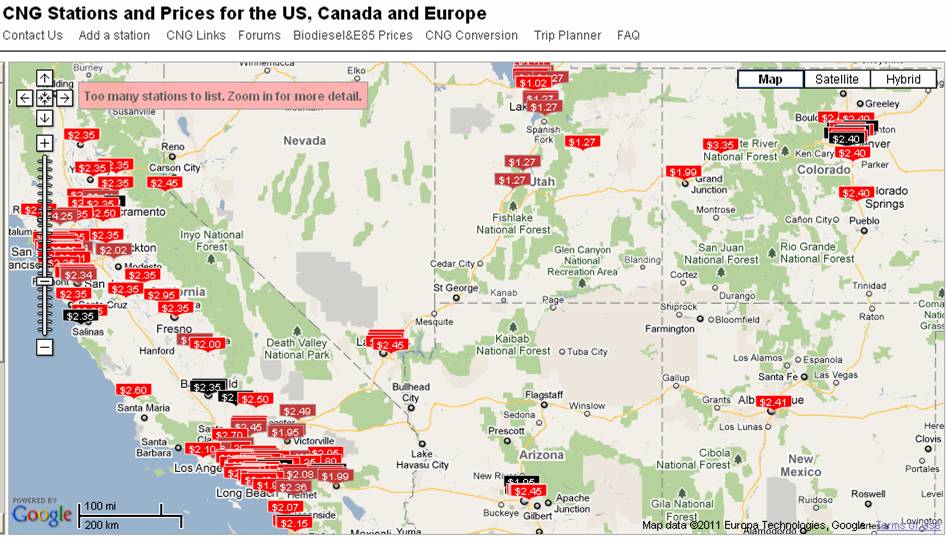

But range really matters. Our two large CNG tanks, which take up a lot of hauling space, perhaps a factor of three to four larger volume than the gasoline tank, can comfortably take us about 150 miles. We have been able to get to Grand Junction, but not Denver on CNG. This is about half the range of the gasoline tank, though a bargain at $1.27 per gallon of gasoline equivalent. (A CNG price map with more stations: http://www.altfuelprices.com/ )

The rough factor-of-two in range would seem to imply twice as many filling stations needed, a great opportunity for those firms manufacturing compressors. (Home-based compressors for overnight filling work, though.)

Retrofitting vehicles has been a regulatory jungle, with Utah battling the EPA for years now, and thousands of vehicles in Utah having a quasi-legal status. (And is seems like there are a number of potentially dangerous installations and un-inspected tanks out there.)

By the way, in reference to James Hamilton’s assertion, driving from Denver to Los Angeles will not work for the CNG vehicles that I know about using the I-70 route — the Grand Junction to Richfield leg, which encompasses one stretch of 110 miles without even any gasoline stations, will now have a 240 mile stretch without CNG through Utah. One would have to increase the Denver-LA drive by about 7 hours by going via Salt Lake. Range matters.

You must be psychic, Jim.

As I mentioned yesterday, I tesitified to the House Energy and Power Subcommittee on Monday, ostensibly on China’s oil and gas, but all the Congressmen had their own wish list: one from Kansas wanted a coal-fired power plant; one from California wanted a nuke; one from Massachusetts wanted a lot of wind turbines.

All of these would be closer to realization if natural gas moved into use as a transportation fuel. At present, nat gas costs about $4 / mmbtu; as a transportation fuel, it would currently be valued (at steady state consumption) at around $12 / mmbtu. Thus, nat gas would tend to migrate out of power gen and into transport, leaving behind it space for more coal, nukes, wind. Onshore wind, for example, is thought competitive around $8 / mmbtu, so it would be comfortably in the money. (Yes, this is pure Picken’s Plan. Don’t let the Oklahoma twang fool you: the man is a very solid analyst.)

To make this happen, we need a CNG tank which can be delivered at the showroom at a variable cost no more than $1000 (ie, a payback period of less than 2 years). The Indians can do this for $200; in the US, the differential is well over $10,000. I believe (but am not entirely sure) that the high US differential is the result of CNG tank regulation, which is geared for safety and environmental protection without consideration of market constraints. That’s enough to put CNG out of the money ($3,000+), and then low vehicle sales volumes and large allocated overheads do the rest. For example, Honda typically sold 1,000 CNG GX’s per year. If you had only $10 million of overhead associated with this effort (not a lot by auto industry standards), then you’d have to allocate $10,000 per car to break even.

So, that’s what we need: a $1,000 CNG tank. That’s it. Our research with Columbia University suggests that neither filling stations nor energy companies need to be subsidized. Nat gas vehicles must be priced in the showroom the same as their gasoline counterparts. If you have that, you’ll get market acceptance.

So, for me, CNG as a transport fuel is priority No. 3 for energy policy. Shouldn’t be that hard to do.

Bi-fuel cars and trucks would ease the transition. Bi-fuel vehicles have both a natural gas cylinder and a regular gas tank. Mercedes-Benz is starting to sell them in Europe. You can get factory approved bi-fuel conversions for Ford F-250 pickups in the US.

If we moved a fraction the corn ethanol subsidy to a subsidy of bi-fuel vehicles and loan guarantees for filling stations, we would probably make a fast transition.

Before we launch a massive CNG/LNG program, it might be wise to consider some of Art Berman’s work. A link to a 2010 interview follows. Note that Art’s research indicates that only about 10% of Barnett Shale wells have paid out so far.

http://scienceblogs.com/casaubonsbook/2010/07/aspo-usa_interview_with_art_be.php

And following is a link to some of my recent thoughts about maintaining and replacing our energy & transportation infrastructure in a Post-Peak Oil world–especially in the context of the ferocious rate of increase in Chindia’s combined net oil imports, as a percentage of global net oil exports.

http://www.energybulletin.net/stories/2011-04-04/commentary-will-we-be-able-maintain-replace-our-energy-transportation-infrastruct

I switched my wife’s Subaru (20 mpg in her usual city driving) to gas 1 month ago.50% savings (price of gasoline is 8 usd/gallon here), installation costs 1100 usd. Filling stations abundant. Should have done it earlier,still a good investment looking to 200 usd Brent next year and beyond in 2013 and 2014.

I forgot to mention i converted the Subaru Outback to LNG, so range is the same.

“The city of Rifle and Colorado Mountain College are also running bi-fuel vehicles, which can run on CNG until that tank is empty, and the switch on the fly to burn gasoline.”

This is old, old technology. When I was in high school in the 1960’s the local Thermogas dealer had a V8 Olds that was set up like this. He could switch it back and forth while driving down the highway and you couldn’t tell the difference.

Bob,

Here is another hyperlink that should work, but below is the link just in case.

http://www.cngnow.com/en-us/newsandevents/pages/oklahoma-lawmakers-target-fuel-conversion-plan.aspx

I just came across this at EIA:

“Shale gas is a global phenomenon”

http://www.eia.doe.gov/todayinenergy/detail.cfm?id=811

Steve Kopits wrote:

So, that’s what we need: a $1,000 CNG tank. That’s it. Our research with Columbia University suggests that neither filling stations nor energy companies need to be subsidized. Nat gas vehicles must be priced in the showroom the same as their gasoline counterparts. If you have that, you’ll get market acceptance.

Steve, thanks for this. If the government got out of the way there would be no need for government subsidies. Sadly, what the government will probably do is keep the regulations then subsidize the sellers sucking more capital out of the public sector that could be used to create other capital.

One thing, I am not so sure that making CNG viable for transportation will actually favor the other fuels you discussed. If CNG replaces gasoline as a transport fuel, then excess oil supplies will drive the cost of other oil products down. Oil products will be more competitive for electricity, etc. While the mix of fuels might change the fuel BTUs will not. Oil is still a very efficient fuel.

NG is sold by the million BTUs (~1.055GJ). Oil is sold by the barrel, and is not a uniform commodity. But, a barrel of oil ~= 6 million BTU. Right now, NG at Henry Hub is under $4.20. Oil is $108/bbl at Cushing, but $120 at Brent, so it around 4 or 5 times as expensive as NG per BTU.

Not only that, but NG is not taxed as a motor vehicle fuel. A gallon of gasoline has about 125,000 BTUs, so a million BTUs equals about eight gallons of gasoline. Gasoline carries a tax in the US of about $0.50/gal. A comparable burden would double the price of NG.

If the use of NG as a motor vehicle fuel is to be promoted, it will have to be taxed.

The real problem with NG as a motor vehicle fuel, is that it is low density. So it must be compressed or liquefied. In either compressed or liquid form it is hard to handle. CNG carries a risk of explosion that could make otherwise survivable accidents spectacularly fatal.

The good news is that NG is not hard to convert into liquid hydrocarbons that can be used in existing vehicles and with the existing fueling infrastructure. If the shale gas phenomenon is for real and it is long term, and the hydrocarbon business is allowed to do it, they will have every economic incentive to do exactly that.

The bad news is that between the existing rent seekers (e.g. ethanol) and the “visionary” politicians who think an industrial economy can be run on unicorn farts and bottled rainbows, there is little likelihood of this happening.

What about the Gas-to-liquids (GTL) process? Natural gas can be converted into diesel fuel, for example. Doesn’t that seem more logical than completely converting over your transportation fuel system to deliver CNG?

Especially when you consider that a good deal of the premium in the price of diesel fuel is due to a mismatch in US refining between gasoline and diesel fuel. We make too much gasoline and not enough diesel, and it is not trivial to address that mismatch (completely rebuild US refineries, basically).

I don’t know, it just seems more logical to me to invest a small (or large!) amount of capital in a relatively small number of US refineries to be able to make GTL diesel. Utilize the infrastructure you already have.

As a bonus, GTL diesel is completely sulfur free. This would allow you to do less hydrotreating of the conventional diesel produced by US refineries, which itself would boost diesel capacity somewhat (and actually use a little less natural gas, the hydrogen for hydrotreating is often created from natural gas).

I thought CNG was taxed. Which is it?

Gas to liquids is only about 60% efficient. You give up 40% of the energy in the natural gas before you even put it in a car. This makes it much worse than gasoline for net carbon emissions.

“The American love affair with the automobile is best compared to the Stockholm Syndrome.” (Source of quote is unknown)

Instead of increasingly desperate efforts to maintain our auto centric suburban lifestyles, the more rational approach (see post up the thread) would be to gradually abandon suburban and exurban areas–which is almost certainly what we will ultimately be forced to do anyway.

Already, many government entities can’t even fully maintain their existing road networks.

Shell is in the process of commissioning its Pearl GTL plant in Qatar.

Capacity is 140 kbpd diesel and 120 kbpd NGL’s.

It is quite a monster. Take a look: http://www.shell.com/home/content/aboutshell/our_strategy/major_projects_2/pearl/overview/

For proforma analyses, the conversion of nat gas to diesel is estimated at about $20/barrel, or $3-4 / mmbtu. This works if nat gas remains cheap or oil dear; but if either changes radically, then you have a very expensive plant with nowhere to go. Still, right now it looks that Shell made the right bet. Their all-in cost of production (back-of-the-envelope) looks to be around $25-35/barrel. At the current price differential, the payback on the plant could be as little as three years. (They must have been using a Douglas-Westwood forecast!)

The more I learn about Shell, the more intriguing they become. These guys are involved in all the interesting frontier areas: GTL, Arctic, FLNG. Quite remarkable, actually.

“Instead of increasingly desperate efforts to maintain our auto centric suburban lifestyles, the more rational approach”

I prefer not to.

Walter,

If we can maintain an infinite rate of increase in our consumption of finite fossil fuel resources, the ‘burbs should be in good shape.

Mr. Brown: I cannot begin to determine what an “infinite rate of increase” is, nor what mathematical function might represent such a thing. I do know that Malthusianism has consistently failed, and suggest that you read Julian Simon’s “Ultimate Resource” to understand why.

Professor Hamilton: Here is some excellent reporting on the continuing impact of the Tohoku earthquake and tsunami on the automobile industry:

http://www.thetruthaboutcars.com/2011/04/parts-paralysis-daily-digest-april-7/

It seems to me that this will be a continuing drag on output, and will result in price increases for new automobiles.

I think oil will start to go down soon, with money moving into PM. That means, peak for correction in silver and Gold will coincide with next LOW in oil. Which is early MAY, 2011.

So , one more month for silver rally.

Here are oil price prediction for 2011-2012, has predicted 2 peaks correctly already:

http://www.saposjoint.net/Forum/viewtopic.php?f=14&t=2626&p=31662#p31662

See the dip in MAY? And here is corresponding ( independently derived) peak in Silver ( it has to be in early MAY 2011, the March 13th graph shows maximum little too early. The value at peak can be close to 45 USD, may be 48 USD):

http://www.saposjoint.net/Forum/download/file.php?id=2673

Then, FED will bailout JPM shorts, and silver will drop by 40% afterwards, as it happened in 2008 when FED bailed out Bear Sterns via JPM.

http://www.saposjoint.net/Forum/download/file.php?id=2609

http://www.saposjoint.net/Forum/viewtopic.php?f=14&t=2626&start=0#p30486

After that, oil will continue to go up, while silver will take a 1 year breather.

Walter,

It’s ironic that while the cornucopians talk about virtually infinite sources of energy, back here in the real world, many once paved roads are already being turned back to gravel roads, because many governments can’t afford increasingly expensive asphalt.

But it’s always nice to have visitors from Fantasy Island.

18 cities where the suburbs are rapidly turning into slums:

http://www.businessinsider.com/american-slums-2011-4

Time to throw the BS flag on JJ Brown. He claims: “…many once paved roads are already being turned back to gravel roads, because many governments can’t afford increasingly expensive asphalt.”

Turned back to gravel? Think that one through. Tearing up older hard surface roads and replacing them with with gravel is cheaper than just patching or even resurfacing with asphalt. I dun thin so :-))

CoRev: Turned back to gravel? Think that one through. Tearing up older hard surface roads and replacing them with with gravel is cheaper than just patching or even resurfacing with asphalt. I dun thin so :-))

Think again. As documented in the Wall Street Journal, of all places.

Lessee, we have an article that says some locales are so strapped for cash they have stopped road maintenance. Years of little to no maintenance leads to roads so deteriorated that complete repair/reaurfacing is needed. Some locales are just letting the road degrade to a gravel or “Outside this speck of a town, pop. 78, a 10-mile stretch of road had deteriorated to the point that residents reported seeing ducks floating in potholes, Mr. Zimmerman said. As the road wore out, the cost of repaving became too great. Last year, the county spent $400,000 on an RM300 Caterpillar rotary mixer to grind the road up, making it look more like the old homesteader trail it once was.”

It’s not the price of asphalt as JJ Brown would have us believe, but the cost of nearly any maintenance for which voters are failing to vote tax increases. Wonder what we would find if we took a deeper look at the pension/benefit/salary costs of their budgets.

Poor decision making in years past on road maintenance has cost impacts today. For some locales minimal cost for repairs is the only affordable solution because of revenue shortfalls.

You see, CoRev, this is why no one can have a rational conversation with you. Someone makes a statement about roads. You flame them for making that statement. Then someone else provides evidence that backs up the original statement, from the Wall Street Journal, no less, and you still deny its existence. Whether it is global warming, tax cuts that pay for themselves, or the shape of the earth, you will always invent your own reality. Facts are irrelevant and discussion is pointless.

Corev is right, it’s not oil that is the price driver for road maintenance cost. The article doesn’t say what you think it says.

In Michigan, portions of roads were done to test new low-cost maintenance gravel/dirt road construction techniques.

And revenue shortfall seems to be the cause of neglect.

Given that the utility companies own the distribution gas lines it would make sense for them to build filling stations. This is where the government could play a role. Utilities are state regulated. The state could work out a surcharge on the filling station gas meter to repay the utilities. The utility would make money from the increase in metered gas consumption.

And higher fuel prices are adversely affecting government budgets? In any case, higher asphalt prices have been a factor for a while. Here is an article from 2008:

http://www.nytimes.com/2008/06/29/nyregion/nyregionspecial2/29Rasphalt.html

NYT: Cost of Asphalt Rises, Affecting Repaving

Excerpt:

“Westchester is moving forward with repaving almost 12 miles of road at a cost of almost $9 million, or nearly $90 a ton of asphalt, up from $72 last year, Mr. Butler said.

But Bergen County, N.J., will repave only 23 miles of road, not the 32 that were scheduled, because of the cost of asphalt, said Mabel Aragon, a county spokeswoman.”

But the real story globally is the steady decline in Available Net Oil Exports (Global Net Exports not consumed by Chindia). Here are the recent numbers for Available Net Exports:

http://i1095.photobucket.com/albums/i475/westexas/Slide3-1.jpg

2005: 40.8 mbpd

2006: 40.5

2007: 39.1

2008: 38.6

2009: 35.5

Our work suggests that the US is well on its way to “freedom” from out dependence on foreign sources of oil, just not in the way that most people anticipated.

From the 2010 WSJ article:

“Rebuilding an asphalt road today is particularly expensive because the price of asphalt cement, a petroleum-based material mixed with rocks to make asphalt, has more than doubled over the past 10 years. Gravel becomes a cheaper option once an asphalt road has been neglected for so long that major rehabilitation is necessary.”

In any case, my original point was that “Happy Talk” from energy cornucopians is particularly ironic when one considers what is going on in the real world.

The hard, cold reality here in the US is that we need to be thinking hard about what areas to abandon.

Should read: “And higher fuel prices aren’t adversely affecting government budgets?”

Any thoughts on natural gas to liquids plants of the kind South African-based Sasol and Canadian explorer Talisman Energy might build in northern Alberta? From memory, SASOL claims that 10,000 cubic feet of natural gas can be converted to the equivalent of one barrel of oil.

Jeffrey Brown,

I am struck by how much we need to shift energy sources.

We need to shift transportation to natural gas in order to save oil for roads and chemicals for assorted materials, plastics most notable.

But in order to switch natural gas to transportation we need to shift electric power generation away from natural gas and toward nukes, wind, solar, and coal (ignoring the ice caps).

I’d prefer switching transportation to electric power. But the batteries aren’t getting cheap enough fast enough.

Steven Kopits,

I love your observation about how the cost of compressed gas tanks on cars is a key problem. We need a very timely solution. The IMF just adjusted downward expected US economic growth for 2011 to 2.8%. Peak Oil is going to put a ceiling on US economic growth and then the ceiling is going to start moving downwards.