I thought it of interest to see the evolution of Federal debt held by the public, and exactly what Administrations were the most spendthrift.

Figure 1 highlights the fact that debt-to-GDP began its startling rise in 2008Q2.

Figure 1: Publicly held Federal debt (end of quarter) divided by nominal GDP (SAAR) (blue). Figures are shares at 2001Q1, 2009Q1, and 2011Q1. Tan shaded area corresponds to Obama Administration (2009Q1-11Q1). Source: BEA, 2011Q1 3rd release, Treasury via FREDII, and author’s calculations.

Note that from 2001Q1 (the beginning of the G.W. Bush Administration) to 2009Q1 (the beginning of the Obama Administration), debt-to-GDP rose 17 percentage points. From 2009Q1 to 2011Q1, a period encompassing the worst recession in the post-War era, that figure rose 13 percentage points.

The accumulation of debt incorporates the effects of automatic stabilizers, such as the reduction of tax receipts as employment and wages and corporate profits decline, and the increase of transfers as unemployment rises. What about discretionary changes? The next figure is illuminating.

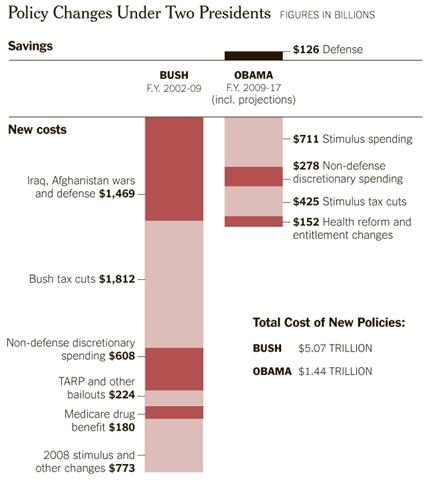

Figure from “How the Deficit Got This Big,” NYT (24 July 2011).

Neither of these points rebuts the challenge of rising debt-to-GDP, especially as entitlements costs accelerate their expansion starting after the next decade. But the breakdown in the second figure highlights the fact that Bush tax cuts of 2001 and 2003 are a not-inconsequential component of the trouble we are in now. (See the previous post on where tax revenues to GDP are right now.

“We won the election…this is our due…”

Dick Cheney

Or was it “Reagan proved deficits don’t matter.” Or my personal favorite Dick Cheney quote “Go $%#@ yourself.

So honestly I don’t see a way out of this mess. If you can have absolutely no new revenue, if defense is untouchable, if, as people like Michele Bachmann and Erick Erickson state Social Security and Medicare are untouchable, just wtf are we going to do?

What is the play here? For someone like me who has worked my entire life, saved and invested, I guess I buy Canadian bonds to help me plan for my retirement in a couple years? Not exactly the advice I have been given all my life…

Regards.

Does James Hamilton know you’re turning his blog into the diary of a political hack?

Get back to economics. Next you’ll be doing a post on how bad Gitmo is.

Referring to the Bush-era tax cuts as a “cost” is a misnomer. That nomenclature assumes the forgone tax receipts were somehow rightfully owned by the government in the first place and only because of Bush’s kindness the government instead gave that money to people to keep (or, equivalently, that the previous tax rates were divinely inspired). The money is the people’s money, not the government’s. The government is only entitled to the level of taxes the legislature authorizes through the tax code. Go ahead and refer to it as “forgone revenue” if you want, but it cost the government nothing—it’s not like the government opened up its wallet and gave us money. We just sent the IRS less in the first place. (Silly rebate checks aside.)

Ronaldo: Aside from ad hominem attacks, do you have any substantive comments to make, i.e., have you identified anything factually incorrect in what I have presented in the graphs? I know it might be temperamentally hard for you, but some of us would like to deal with facts and figures.

Brian: Wow, I’m dizzy after that screed. “The government is entitled to the level of taxes the legislature authorizes through the tax code.” Yes and if the Republican’ts and Bush had left the level of taxes alone rather than lowering them, the government would have $1.8 trillion more right now. You know, to offset the deficit and the debt that everyone keeps railing about. Deficits can be created by lowering the amount of revenue coming in as well, Bri-guy.

Menzie, since you wish to compare facts and figures, instead of comparing eight years to two years, why not compare the first two years of each administration?

“Referring to the Bush-era tax cuts as a “cost” is a misnomer.”

If you get paid $100 a day to work, not showing up for work costs you $100. Cutting taxes works the same way. Forgoing revenue is a cost.

Brian The money is the people’s money, not the government’s.

Strange comment. So you are saying that the government and the people are in no way related? It’s big, bad government versus the people? Better watch out for those black helicopters.

The government is only entitled to the level of taxes the legislature authorizes through the tax code.

Why not say that the government is only entitled to the level of spending that the legislature authorizes through the appropriations process? Afterall, wasn’t it Milton Friedman who said that to spend is to tax. If the legislature approved the spending, then the legislature also approved the tax.

Brian:

The government is YOU and every other citizen of the United States. We all vote for the elected representatives who make fiscal policy choices that result in deficits or surpluses.

Here is the simple deficit formula: D=R-E. If we are trying to find out what contributed to the deficit, you can see from the formula that smaller R and/or larger E will impact the deficit. Lower tax rates will generally lead to smaller R, so they are definitely a contributor to the deficit.

Our problem is that we do not hold our elected representatives accountable for reducing R without also reducing E. I suppose we can say that is the government’s problem. But we are the ones who vote for the government. So it is our problem as well.

are my eyes bad ? looking at that chart I see Carter paying down the debt in terms of GDP ? what’s this world coming too !

Menzie, on chart 2, where are the Obama continuation of the Bush tax cuts, and the 2% FICA holiday? Both are policy changes.

CoRev asks: where are the Obama continuation of the Bush tax cuts, and the 2% FICA holiday?

I think the chart labels these as “Stimulus Tax Cuts,” estimated to add $425 billion to the deficit over the period 2009-2017. Obama has argued for letting the Bush tax cuts on wealthier Americans expire, returning to the slightly higher rates in effect under Clinton. It would be nice to see an addition to the chart showing the deficit impact for permanently extending Bush tax cuts for less wealthy, as Obama advocates.

Interesting that I see a higher correlation of increase debt to GDP when the democrats controlled both houses of Congress than I do to Presidential terms. But than again, since the President is only president, not dictator, and can not create spending except as authorize by law, I guess it is the Congresses that should be more closely observed.

Menzie,

Do you have any numbers for Obama’s wars with Libya, Pakistan, and Yemen? Oh, I guess we should add Iraq and Afghanistan since it has been two years since Bush left that mess.

Have you all been brainwashed? Or are you simply ignoring a glaring error in Brian’s thinking? Bush sold the tax cut on the faulty premise that the taxpayer is entitled to the annual surplus of federal revenue over expenditures. However, that’s only true if there is no debt. The surplus should have been used to reduce the existing debt. At the same time, don’t place all the blame on Bush for the current debt problem. It took both houses of congress to craft and pass an annual budget. I don’t post much here anymore because the blog has become like the movie Grondhog Day, same old rehash over and over.

“Groundhog” in last post. Continually trying to blame one party for all of our fiscal/economic problems is nonsense. Good day!

On a Sunday show I can’t remember, a commentator said, “States borrow to invest, Federal borrows to spend” (sic) which struck me as summing up a dramatic change since Reagan in public debt.

If we consider war to be a public investment as the Continental Congress did (implicitly), the US has borrowed to fund the Civil War, WWI, WWII, but not so much Korea or Vietnam. And the Revolutionary War was funded by debt and charity because the Continental Congress had no power to tax because Rhode Island vetoed all proposals to tax.

Looking at the debt for Federal, State, and local governments, the local debt exceeded the total of Federal and State debt other than war investment. (Using Commerce Dept data via usgovernmentspending.org) WWI ran up Federal debt, but over the next decade, that debt was paid down while local debt increased building auto roads. The reaction to the depression was a big boost in public works funded by local debt, but that quickly exceeded their ability to service the debt. Hoover and the new Democratic Congress began borrowing to lend to private firms to invest, and make grants to State and local for investment in public works.

It is at this point where Federal accounting breaks down relative to private firms and State and local government: FDR attacks Hoover for not balancing the budget. Hoover reversed the decade of Republican tax cuts, imposes harsh works rules on labor to drive down construction costs, refuses to pay the Bonus early, all to balance the budget, and gets attacked by FDR who broke with Hoover over Hoover not spending enough government money as Commerce Sec on the Mississippi flood relief. While States and local government divided spending from investment so investment could be funded with debt, the Federal government did not.

When FDR was elected president, he took the same positions as Hoover, but because of his popular support could impose greater austerity: FDR cut pay to government workers and military as his first bill through Congress, and he opposed Congress on restoring that pay. FDR vetoed the early Bonus payments. FDR opposed relief which Hoover had supported, taking the position that relief was degrading, and instead sought to make the unemployed work to get government money.

For FDR, I think he had an internal accounting of the debt increase in the 30s that was shared by both Republicans and Democrats: debt to pay for public investment where something concrete and visible was fiscally responsible. FDR invested in lots of data collectors, giving a big boost to both artists and economists. Artists were hired by FDR to record the great public works funded by debt, but the artists focused as much or more on the greater needs unmet. Economists began the great era of econometrics who became the central planners behind the war which pitted US against German, Japanese, and Russian central planners.

The failing or failure, as I see it was in not creating the same division of operating spending from investment. Under FDR, he was the ultimate pragmatist willing to tolerate waste and inefficiency that Hoover wasn’t, so he spread Federal investment around to get political buy in on wasteful and corrupt public works, partly to win public support and votes in Congress, and as sort of trickle down, just to get money flowing into every community faster. Hoover’s failing is he didn’t tolerate waste and corruption.

Perhaps the FDR debt wasn’t put on a business accounting ledger offset by the assets funded because it would show the bridges to nowhere and Big Dig and the huge debt behind them and the inability of those projects to directly service the debt. The Big Dig is definitely worth the investment because it benefits the Northeast, and a big part of the cost was a consequence of not doing it in the 50s and 60s to “save money”.

The problem is finding out the value of the built public assets, which are the major contributors to public debt from 1900 to 1980 (my hypothesis cut off). The value of the roads and highways was estimated during the Clinton years, and I’ve tried to use that as a proxy for public investment funded by debt. As a boomer kid, I remember the debate over debt to fund schools to house all the kids that followed my – my cohorts were crammed in the existing schools for the most part, but I also remember the debate over debt for water and sewer and for roads.

So, using the estimate from 1995 on road value from 1920 to 2000 with some SWAG, the assets to public debt (Federal, State, local) started at 20% road value to total debt (war investment debt high) and rose to over 30% during the 20s and stayed above 30% until WWII when road investment fell and WWII investment debt exploded driving it down to 10%. From 1945, roads to debt rose from 10% to 50% in 1975, and it stayed above 40% until 1982, and from that point on, the road value to public debt fell steadily to under 20%.

So, the question isn’t “who” is responsible for public debt, but what is responsible.

Before Reagan, public works like roads, water treatment, public electric, schools, court houses, libraries, jails, dams, were funded with debt, and the debt was paid for with taxes and fees that allocated the debt service as best as possible to those who benefit. Jail building debt is serviced out of general taxes, roads out of road use fees and gas taxes, water debt out of water use fees and fire hydrant fees on property owners, and so on.

Before Reagan, to avoid debt, and leakage, trust funds were setup to hold taxes and fees. Many States have constitutional provisions that limit road use fees to roads with trust funds to hold the money. The same is true for pension funds. Many budget hawks, conservative and liberal, protected the trust funds from spending leakage.

Since Reagan, the balancing of investment with public debt, and protection of trust funds from spending leakage as faded and disappeared.

Reagan personally, I would argue had FDR’s values more than most people think – he hiked road taxes and fees to rebuild the highway trust to rebuild the roads, and he protected Social Security instead of just incrementalism. As Governor, he hiked taxes – Jerry Brown cut spending and the budget immediately after Gov Reagan.

But Reagan didn’t see debt as a problem, while FDR did.

But Reagan was much more fiscally responsible than the current elected Republicans – Reagan responsible Republicans can not get past the nomination process.

I will concede Republicans talked a lot about debt and deficits and wise investments before Reagan, while Democrats were like “all investment is good, and the way to get great investment is by lots of investment” which is somewhere between the NASDAQ boom in the 90s to the Wall Street investment enthusiasm in general since the beginning of general retail Wall Street investing. In the 60s, the WSJ articles were focused on ROIC and the emerging retail investor was told to look for value in solid records of earnings and profits and dividends.

So, one could say Democrats were and have been public money investors with the common sense of the investors in the NASDAQ in the 90s. But Republicans were like Warren Buffett until the 80s, always looking for the revenue and debt service and profit. Building a road paid for with gas taxes with the profit of economic growth along the road, or building the water treatment plant with debt serviced by water fees to bring in the factory that used lots of water, were wise use of debt.

But today, conservatives are all about attacking the trust funds for pensions and roads and libraries and selling off jails and public buildings and parking spaces and roads, all to cut taxes. But to the public, they didn’t bargain for less government service, so they rebel against still paying gas taxes, but now paying higher tolls and fees to use roads and parking spaces to a for-profit. Or paying high fees to house people in private prisons, or seeing libraries closed. And the decaying roads and bridges are hardly a sign of wise investment.

Before Reagan, government was held accountable like a business was on Wall Street: is it a value investment. After Reagan, government has been that stock that is being shorted, with the short sellers doing everything they can to drive down the worth of government so it goes bankrupt. Why should the US have steel makers so let’s short them and drive them into bankruptcy. So what if we import our steel from China. Why should government build roads, so let’s short government, force it into bankruptcy. So what if we buy our roads and parking spaces from European and Asian firms.

But when you don’t own the assets, you must pay the capitalist to use them, and you don’t save any money, so the tax cuts made on the basis that spending on capital investment is wasteful spending that isn’t needed result in debt to pay for operating expenses. This is the case for both Federal and State budgets.

The why of debt:

Before Reagan: to fund investment in physical things

After Reagan: shifting from funding investment to funding operating costs to pay for privatized investments

Please use graphs that compare the federal debt to the federal income, or the interest payment to the federal income. It is quite meaningless to compare federal debt to national income over the time spans shown.