Or lack thereof

Reports indicate that one of the reasons the “grand bargain” failed was the refusal of one party to accede to an increase in tax rates on households with AGI above $250,000. [1]. I can understand this reluctance, given that the share of total income going to the top 5% of households fell from 38.7% to 36.5%, going from 2007 to 2008 (just ignore the increase of 17.6 percentage points in the previous 30 years). Below is an updated graph from our forthcoming book Lost Decades by myself and Jeffry Frieden, illustrating the grievous harm that these households have endured.

Figure 1: Pretax income shares (including realized capital gains) accruing to top 5% of households (blue line) and to top 1% (red line). Source: updated version of Piketty and Saez (2007).

In 2008, the threshold income for the top 5% was $152,726. The top 1% of households (with a threshold income of $368,238) also suffered a decline in their income share, which fell from 23.5% to 21%. This was in contrast to previous experience. From Lost Decades:

Over the course of the Bush expansion, two-thirds of the country’s income growth went to the top 1 percent of the population. These very rich families … saw their incomes rise by more than 60 percent between 2002 and 2007, while the income of the rest of the nation’s families rose by 6 percent.

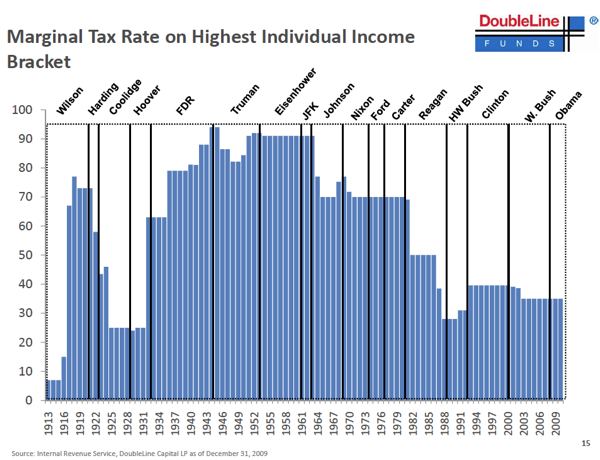

Hence, I can see why individuals in these households, failing to see continued growth in their income share, would want to maintain the low tax rates they have become accustomed to. The rates being levied at the top of the income distribution are illustrated below.

Figure 2 from Paul Kedrosky.

For those who are unable to detect sarcasm, please note the first paragraph was written tongue-in-cheek.

Update: 12:10pm Pacific Reader W.C. Varones demonstrates his inability to download a spreadsheet from the link I provided to the data. He writes:

The income share including capital gains is up largely due to Fed-blown bubbles. Easy money makes asset prices go up to a much greater degree than wages in a 10% unemployment environment.

For his benefit, I have provided Figure 3 below, which plots the data ex-realized capital gains.

Figure 2: Pretax income shares (excluding realized capital gains) accruing to top 5% of households (blue line) and to top 1% (red line). Source: updated version of Piketty and Saez (2007).

The pattern I identified remains.

Menzie this argument reminds me of the Bush early years. He campaigned and won on why should the government continue to over collect taxes? Remember the CBO surpluses as far as the eye could see? As soon as Bush proposed his first tax cuts the comments from the left/Dems focused on one tag line: “tax cuts for the rich.”

This is just a continuation of that tag line and the associated class warfare it embraced.

Many republicans (and a very few democrats) in this congress campaigned and won upon “cutting spending and balancing the budget.” Just like Bush they are following their campaign promises which were specific.

You seem to have a problem with politicians who follow their ideals and campaign promises?

Looking forward to read Lost Decades,hoping as well that you may not have to modify the cover graph.

In this cosmic life, two months may change the shape of a curve.

What always amazes me is that there is resistance to raising taxes on the “rich”. If you can get all these government benefits and stick someone else with the tab, that’s a pretty sweet deal, isn’t it? I don’t thnk most of the public is paying attention. This should be easy to do. C’mon, let’s shove some peas down those rich guys’ throats!

Since we are playing the class warfare game, I would be interested to see a corresponding time-series plot of the income tax share of the top 1% and top 5% respectively. Perhaps I can help you out. Since 1980 the income tax share of the top 1% has gone from 19.05% to ~38% today. For the top 5% the share has gone from 36.84% to ~59% today. Menzie, we do have some common ground on this issue: some people are not paying their fair share.

This is intellectually lazy, and driven by the sort of envy-politics that made 18th century political philosophers believe that Democracy was inevitably doomed to fail.

Yes, it’s true: during a period characterized by astonishing technological innovation and accompanied by the entry of ~2.5 billion people into the industrial labor force, the folks at the top reaped great gains and the folks at the bottom reaped less (as measured by pretax income + cap gains, which excludes very important forms of compensation like health insurance, etc).

As an “economist”, you might consider asking yourself the question: is it terrible that 1) returns on capital and 2) returns on innovation and general business ‘success’ are very high right now? As I see it, I would expect those two factors to lead to more investment, more risk taking, etc. All of which will, over time, help to take up some of the slack in the labor market created by the 2.5 billion folks jumping into the pool. At the end of the day, everyone will be much wealthier, and enjoy a higher standard of living.

Do I deny that rich folks could pay a little more? No, I suspect that a small increase in levies on their income probably wouldn’t have a large impact on economic activity, though I do think it would be more disruptive than, say, a VAT on high-value goods. Capital gains taxes are likely more disruptive than the income taxes, since they direct capital activity in unproductive ways at a time when capital productivity is at its most important (ie, we need the best capital allocation possible to create sustainable businesses and jobs for our people).

Let’s stop focusing on the irrelevant question of who has what, and instead focus on the more important question of “how do we raise standards of living broadly over time”. And by that latter metric, there’s almost no argument to be made that the US hasn’t succeeded over the past forty years. The vast majority of our citizens has access to virtually the entirety of human knowledge at the fingertips (the internet!); more entertainment; easier and relatively cheaper travel; more health; etc.

Interesting charts. Did you explore the correlation between tax rates and the share of income reported by the top percentile earners? I would suggest that when tax rates fall, the rich are more likely to report earnings. When rates are high, they have the tax attorneys and lobbyists to postpone income. I guarantee that higher rates will lead to lower reported income by the “rich”. That might make you feel better, but it does nothing to help the rest of society.

If higher taxes are such a moral imperative, why don’t you, Pelosi, Reid and Obama pay the higher rates and encourage all their donors to do the same. You could all get a bumper sticker showing your moral superiority. It would look good with the “Free Tibet” and “Hope” stickers already on your Prius.

Alternatively, why not just take the money from the rich? That’s alot easier than gaming the income tax system. If it’s moral to take more taxes, shouldn’t it also be moral to directly confiscate the assets earning that income? Start with members of congress (Pelosi is worth tens of millions) and work outward through the biggest donors on both sides of the isle. I think Romney is worth hundreds of millions.

Hmmm and GT4: Related to your queries, see this post on a CBO review of labor supply elasticities, as well as a discussion in the comment section of a CBO technical report regarding the tax receipts issue.

Menzie says:

“Hence, I can see why individuals in these households, failing to see continued growth in their income share, would want to maintain the low tax rates they have become accustomed to. The rates being levied at the top of the income distribution are illustrated below.”

What you forget Menzie is that these people actually WORKED for this income. It is their money, not the government’s. Yes, they should contribute to the provision of public goods, but what is not clear from your exposition is why exactly they should pay more. Yes, they are very rich, so? Are you somehow jealous, that the taxpayer in Wisconsin does not pay you a very rich salary at UW-Madison? Do these “very rich” people (“millionaires and billionaires” in Obama-language) somehow bother you?

One more thing: let me remind you that the money of these “very rich families”, these “millionaires and billionaires”, does not stay under their couches and sofas; that money is invested, in different ventures, and much of that investment creates wealth, which eventually pays taxes, including taxes that pay the salaries of tenured professors at public universities that apply sarcastic comments at “very rich families”.

T-Dub: Income taxes are not the only taxes; FICA is another big one. The top 5% and top 1% tax revenue shares are less prominent once one takes those into account; see this CBO document.

The problem with taxes are how to assign someone their “fare share” of the burden. We have become so obsessed with avoiding paying taxes that we have a government that is at the brink of default. With some willing to default over the ideology that the wealthy shouldn’t pay more taxes.

Before we look at who to tax and how much to tax them we need to see what we really want out of government. I think the tea party is looking at this. However I think they may be a bit misguided in thinking that the private sector can do everything but defense.

If we truly want to raise the standard of living for everyone then everyone should be involved in that. We should note that many if not a majority of households have had a decline in the standard of living over the last 4 years due to the financial crisis. However the wealthy have a buffer against the financial crisis which many others do not. Hence if we raise taxes then it should be raised for everyone (not the same amount) and then we should make the government provide the services that raise the standard of living. Fill in the pot holes, make sure bridges will hold, provide a solid education, protect the food and water supplies, etc. We should also tax companies that utilize and profit from these services as well.

Fair taxes means everyone has a stake in them being used wisely because everyone pays them.

This is intellectually lazy, and driven by the sort of envy-politics that made 18th century political philosophers believe that Democracy was inevitably doomed to fail.

Yes, it’s true: during a period characterized by astonishing technological innovation and accompanied by the entry of ~2.5 billion people into the industrial labor force, the folks at the top reaped great gains and the folks at the bottom reaped less (as measured by pretax income + cap gains, which excludes very important forms of compensation like health insurance, etc).

As an “economist”, you might consider asking yourself the question: is it terrible that 1) returns on capital and 2) returns on innovation and general business ‘success’ are very high right now? As I see it, I would expect those two factors to lead to more investment, more risk taking, etc. All of which will, over time, help to take up some of the slack in the labor market created by the 2.5 billion folks jumping into the pool. At the end of the day, everyone will be much wealthier, and enjoy a higher standard of living.

Do I deny that rich folks could pay a little more? No, I suspect that a small increase in levies on their income probably wouldn’t have a large impact on economic activity, though I do think it would be more disruptive than, say, a VAT on high-value goods. Capital gains taxes are likely more disruptive than the income taxes, since they direct capital activity in unproductive ways at a time when capital productivity is at its most important (ie, we need the best capital allocation possible to create sustainable businesses and jobs for our people).

Let’s stop focusing on the irrelevant question of who has what, and instead focus on the more important question of “how do we raise standards of living broadly over time”. And by that latter metric, there’s almost no argument to be made that the US hasn’t succeeded over the past forty years. The vast majority of our citizens has access to virtually the entirety of human knowledge at the fingertips (the internet!); more entertainment; easier and relatively cheaper travel; more health; etc.

Menzie-

We hear this about FICA taxes all the time, but it’s wildly misleading. Unlike other forms of taxation, benefits are linked to taxes paid. The benefits from SS are based on the taxable earnings and the formula is strongly skewed to the lower paid. For example, a low paid worker may receive 50% or more of his final earnings as a SS benefit, while a worker who is just at the taxable wage base (currently around $107K) gets about 23% of his final earnnings.

One alternative excuse I have seen is that since the lower paid don’t live as long as the higher paid, they don’t get back enough. The difference in longevity appears to be 1-2 years, tops, which doesn’t do much to affect the much higher value of SS for the lower paid.

To resolve this problem of increasing inequality, the Fed could change their target from 2% inflation to 4% unemployment. The Fed has a dual mandate by law yet they act as if inflation is their only concern.

We had 4% to 5% inflation during the 90s which was the greatest economic expansion since WWII. Unemployment was 4% which resulted in pressure on employers and real wage gains for employees.

The Fed is making a deliberate choice to suppress wage gains by keeping inflation low and unemployment high. Yes, it is class warfare. It is being waged by the rich and the rich are winning.

@Manfred : Personally, I also belong to the top 5 %. And I would never say, that I have WORKED for my income. Just looked at the people in power and their real motives behind their doing, and I did the right thing at the stock exchange. Goldman Sachs. Easy, no work at all..

@Menzie : will buy your book, Amazon has already reduced its price from 26 to 17 bucks. Good sign. Shipment in September.

And speaking about your post : Yes, you are right, agree with you.

In the law there is an objection to a statement: “this assumes facts not in evidence”.

An excellent example is this:

The part in bold strikes me as assuming facts very much NOT in evidence given the course of the last 30 years.

It seems completely beyond everyone’s grasp that more investment might result in LESS income for the bottom half, since many of these investments are in labor replacing technology specifically designed to replace labor. Even a cursory examination of the trends in productivity and income growth would, however, question the assumption in the quote cited.

“Fill in the pot holes, make sure bridges will hold, provide a solid education, protect the food and water supplies, etc. We should also tax companies that utilize and profit from these services as well.”

I don’t think many folks deny that there are useful things to be paid for with tax dollars, and that we all benefit enormously from their continued existence as “public goods” (a functioning legal/law enforcement system is probably #1 here). It’s a straw man to suggest that Tea Partiers (and other limited-gov’t types) are against funding such programs at all.

As for your “We should note that many if not a majority of households have had a decline in the standard of living over the last 4 years due to the financial crisis… We should make the government provide the services that raise the standard of living.”: This is more shoddy first-order thinking.

First, long-run economic policy should almost certainly NOT be based on where we are in the current cycle. I think almost any human being would regret the troubles experienced by so many during the financial crisis; I think it would be a stretch though to suggest that it’s time for a wholesale change in economic policy based on the relatively short-term difficulties of the present.

Second, and I think this is a more important point, I would suggest to you that maximizing present standard of living by playing Robin Hood is a horrible and dangerous idea. You could have said the same thing at almost any point over the last century, but that choice would not have come without consequences. Take healthcare, for example. I think any intellectually honest conservative/libertarian should acknowledge that the government could save an enormous amount of money by exercising its monopsony power as a purchaser of products through medicare. But by dramatically shrinking the profit pool for all of the economic actors participating in providing new products to the elderly, what do you suppose will happen to innovation? Would a significant slowing of the rate of innovation in that space be justified by the savings? ie, is it a GOOD idea to trade in future benefit for present savings? I would suggest not, and challenge you to name when, precisely, we should have jumped off the carousel in the last hundred years if you disagree. Bear in mind, I recognize that the profit pool for elderly medicine would be much smaller were the government not to participate; it’s an interesting truth that certainly complicates my overall ‘hands-off’ preference re: government economic management.

More generally, I will admit to a growing concern that economists, having spent too much time alongside politicians, have stopped caring about the long term. Yes, Keynesian economic management can smooth out the cycle a bit, but is it good long-run economic policy? Isn’t a (real) recession good every once in a while, to clean out the mess in a capitalist economy? Is it really a good idea to redistribute wealth NOW, when that probably means less overall wealth LATER? At least acknowledge the choices your making: human progress vs. egalitarianism. And if you choose the latter, I would suggest that you do so on grounds of moral philosophy, rather than economics.

You always hear ther GOP types complaining about the roughly half of all taxpayers that don’t pay any federal income taxes. For starters, income taxes are not the only taes out there, and the poor and middle class pay a much higher percentage of their income in payroll taxes than do the rich or uper middle class. There claim that the poor/working class dont pay any taxes is the same as claiming that practicing Mormons don’t pay any taxes (if you only count excize taxes on Beer Booze and Butts).

It also effective means tha tthe GOP sees one of the principal economic problems we face in this country is that the after tax incomes of the porr are just too high.

@Fladem: “It seems completely beyond everyone’s grasp that more investment might result in LESS income for the bottom half, since many of these investments are in labor replacing technology specifically designed to replace labor. Even a cursory examination of the trends in productivity and income growth would, however, question the assumption in the quote cited.”

I have the wholeeee late 19th and 20th centuries as evidence. You want to talk about productivity? Labor savings? Howzabout “industrialization!” Miraculously, all the people displaced by machines or other productivity-driving devices did not end up unemployed and destitute; most moved on to other jobs. I would say the evidence for standards of living rising over time driven by technology and investment is so overwhelming as to be virtually incontrovertible.

I personally suspect that we may have seen the peak of the Top 1-5% income shares.

Keep in mind a two professional household will comfortably make it into the Top 5% on either coast. (So would, say, a two professor household in Wisconsin.) This constitutes the “rich” today in the US.

The very rich, at $368k, would include a VP at an investment bank (after bonuses), the partner at a small-to-medium sized law firm or Big 4 consultancy, or a senior executive (CFO, legal counsel, head of HR) at a reasonably sized firm. So these are the “Super Rich”, statistically speaking. Not exactly the Vanderbilts.

Investment banking in NY continues to struggle. I was recently speaking to a senior equity analyst at one of the big banks, and I asked about staff changes there, and he replied that they just can’t sustain their highest priced guys, so these are being let go and the juniors retained. So that’s a reality.

The Economist had an article on the decline of the legal profession. As a consequence, two sources of “Super Rich” are under significant pressure, at least on the east coast. The growth in the i-banking businesses is in Asia (with a recent FT article noting that 15% of the households of Singapore are millionaires). So the upper end is and will be under pressure from indigenous developments in Asia.

Meanwhile, a number of analysts feel that China as low cost exporter has nearly run its course. Thus, pressures on US labor are likely to ebb from the middle of this decade. Also, look who’s doing well domestically: oil patch, mining, farming–all typically rural and not high end.

And, of course, China will need a lot of cars and tractors and bulldozers–some may well be built in the US, or purchased from manufacturers which would otherwise supply the US market. This, too, should help US labor.

So I think larger economic cycles should tend to see catch-up for lower income groups for the next couple of decades.

But again, the underlying question is the share of govt spending in GDP. America’s relatively low spending levels (compared to Europe) have allowed its highly progressive taxation structure. That’s why 5% of taxpayers paid some 60% of fed income taxes. Raise spending, and in all likelihood, you’ll have to raise taxes on the bottom four quartiles, particularly as the Top 1-5% may have peaked in share of income.

Now let’s see a graph of economic value generated and total taxes paid by the top 5% of income earners. Those like Menzie who are focused on whether someone isn’t getting a big enough slice of pie tend to assume that bakers will just automatically keep serving bigger and bigger pies, without worrying about how or why they’re made.

Here’s my un-ironic statement: you’re a leech on the productive.

A.West: Thanks for the tightly reasoned argument, which is in line with your comment:

So why bother with any argument? By assumption you’d argue against any taxes above zero.

The income share including capital gains is up largely due to Fed-blown bubbles. Easy money makes asset prices go up to a much greater degree than wages in a 10% unemployment environment.

I don’t see how you can rail against the wealth gap or the income gap without mentioning the #1 cause of those gaps: the Dirty Fed.

Why not add more tax brackets? There is a very, very real difference between $250k a year, $750k a year, $1.5m a year, and $10m a year. It’s a matter of diminishing marginal utility and relative cost of living. On 250k, you still can’t afford to live in certain areas. On 750k, you can be comfortable in all but the most exclusive New York condos. 1.5m will set you up nicely anywhere, with a beach home in Nantucket. But the thing is that you can’t get any better than that — 10m just gets you a bigger house, or a second house, or a yacht, or a Bugatti.

The obvious conclusion, without going through unnecessary details, is that a tax cut for the 250k earner, who may still have a mortgage or car payments, will create much more useful demand than the 10m earner. And yet they’re both in the same tax bracket. I never understood the arbitrarily large top end.

@Johannes: Johannes, if you have so much money, without doing any or little work, good for you; maybe you can put in a good word for me. And also, if you agree with Menzie, then why don’t you just give, say, 65%, of that non-effort income to the Dept of the Treasury? I am sure Treasury will gladly take your money. And, if you feel so guilty of making too much, there are always lower paying jobs you can consider taking.

What Menzie refuses to answer is the question of, What is for him the optimal tax on high(er) income individuals? Is it 50%, 55%, 70% or maybe 99.5%? Does Menzie have a model that calculates the optimal tax? If yes, show me the paper and the calculations and the assumptions. In addition, he does not answer the question of, why should the tax code be progressive? Why? Is it a matter of “accepted fact” that it must be progressive? Says who? Some tenured prof in Wisconsin?

Dr. Chinn,

Does not Hauser’s Law (see link: http://randallparker.blogspot.com/2011/06/httponline.html ) trump a discussions of rates. Essentially taxes rate are not the question. The economy only gives back 20% of GDP; that’s it. A 96% top rate, 20% of GDP; 26% top rate, 20% of GDP. If the federal government wants more revenue, then pursue pro growth; 20% of a big GDP will fund a lot of social engineering.

Steven Kopits – I always enjoy your comments and I do agree. Peak Oil will eventually make it more profitable to build here than ship from China.

And by the way:

In today’s Wall Street Journal, Daniel Henninger comments on a Lecture given by Robert Lucas at the University of Washington. You should all look at the lecture slides.

http://www.econ.washington.edu/news/millimansl.pdf

Especially, slide 25 and slide 39.

But Menzie probably won’t, because I am not sure he is aware that there is this little University called “University of Chicago” southeast of Madison.

Manfred, what you are forgetting is that the money does not really belong to the person that owned it. It belongs to the federal government. Secondly, very many wealthy Americans are beneficiaries of government largesse. It’s not just the poor who are gaming the system. Lastly, the wealthy benefit disproportionately in societal improvement by government. How do the poor benefit? They barely make a wage that keeps up with inflation while the rich maintain margins in their businesses. For example, do the poor profit from roads? No, they use roads on a basic level, while businesses depend on roads for profit.

It could be argued that the rich are far more concerned about people from below rising up to displace them from their RELATIVE wealth position, than about increasing their ABSOLUTE wealth. Increasing your income from $250K/year to $260K/year isn’t going to make you eat better, after all. Whereas it would make sense for the rich to allow their income to drop in absolute terms, say from $250K to $240K, if that drop were accompanied by much greater immiseration of those in the lower echelons. The main thing is to ensure you don’t lose position, since absolute wealth just doesn’t matter at the top.

And that is what we are seeing. The pie would be bigger and everyone’s slice would be bigger in absolute terms if the economy were booming. Problem is, the slices of the poor would grow faster than those of the rich, and this is not in the interests of the rich.

Which vision of the rich seems more reasonable? My grim view of the rich taking smug satisfaction at how much better off they are than the unemployed. Or Hmmm’s vision of the rich virtuously spending their money (to economists, investment is spending, not trading cash for existing stocks, bonds, housing and other assets) in order to increase prosperity for all.

@Jolly Rancher:

You touch upon and confuse several things.

Money may be *printed* by the Feds; it is the *legal tender* in an economy (in the US economy it is the US dollar), but if I break my rear to earn $350K per year, this is MY money that *I* earned; this is not money of the government; sorry, but we do not live in the Soviet Union…yet.

Second, yes, government largess extends to rich farmers, rich bankers, etc. Take it away, sure, I have no problem. Eliminate farm subsidies, do not bail out Wall Street EVER again, and if you want, eliminate some tax deductions (but also eliminate the corporate income tax as well). So yeah, go ahead, eliminate all government largesse.

Lastly, you say: “the wealthy benefit disproportionately in societal improvement by government”, how do you know? Why is it disproportionately? Because “the very rich families” as Menzie calls them can buy 5 cars, while the poor buy only 1 car, and thus, the rich use the Interstate Highways 5 times more? Even if true, so what? Government is there to provide “public goods”, of which the definition is “a publicly provided positive externality”. People will benefit is different ways, so what?

People will benefit in different ways in MANY of the “positive externalities” provided by government, so what?

W.C. Varones: I’ve added a graph for your benefit.

David Penwell: Well, the scale of the graph obscures the fact that we have had total tax receipts in excess of 20% in the US. And many other developed countries have higher tax to GDP ratios, so I don’t view this as an ironclad law, any more than Okun’s law is.

Anonymous at 12:42 pm: Believe it or not, I know a bunch of people at UChicago. I think you have an outdated stereotype in mind.

Menzie says:

Anonymous at 12:42 pm: Believe it or not, I know a bunch of people at UChicago. I think you have an outdated stereotype in mind.

But you keep avoiding the more important issue: how do you know what the optimal income tax rate is? Do you have a model? If yes, provide it, with your assumptions. Otherwise, your post is only class warfare written in sophisticated form.

And the other thing you are avoiding is the following: in the 1950s and 1960s, when marginal tax rates were very high, what was the output lost because of disincentives to work? Were they small or large? Did you run a “counterfactual” of which you are so fond of, to see how output would have changed if taxes had been lower? I am sure you did run such a counterfactual; it would be one measure of the “opportunity cost” of income taxation.

CoRev Remember the CBO surpluses as far as the eye could see?

That’s how you might remember things, but that’s not actually what CBO and GAO were saying. The CBO in 2000 was that there would be surpluses over the next 10 years, not “as far as the eye could see.” But as GAO pointed out in 2000, the longer run forecast was very grim.

http://www.gao.gov/new.items/d01385t.pdf

And many others made the same point. For example:

http://www.econdataus.com/pro2001.html

And these projections were assuming that there would be no more recessions and productivity would forever escalate at late Clinton era rates. If you bought the “surpluses as far as the eye can see argument,” then you were likely stupid enough to have voted for Bush…maybe even stupid enough to have voted for Bush twice.

Rich Berger We hear this about FICA taxes all the time, but it’s wildly misleading.

So are you suggesting that FICA taxes don’t count and the poor don’t pay income taxes? It’s obvious you have no formal economic training, but I was just wondering if you are aware of the difference between a tax impact and a tax incidence? It’s pretty basic stuff in public finance classes. You might want to look it up, check Menzie’s post on labor supply elasticities and then ask yourself if you don’t want to retract your post. No need to thank me, just trying to help out

Menzie isn’t an economist, he’s a full time class warfare guy. But what else can you expect from a guy who has sucked at the taxpayer trough most of his life.

It is amazing how liberals like Menzie preach class warfare perched at a university where he teaches what? one undergraduate class a year! Talk about lazy slackards who contribute virtually nothing to society ..

Steve Kopits America’s relatively low spending levels (compared to Europe) have allowed its highly progressive taxation structure. That’s why 5% of taxpayers paid some 60% of fed income taxes.

That is a very bizarre notion of tax progressivity. I believe this is the first time that I have ever heard it explained as the percent of total income taxes paid relative to the percent of the population. The usual interpretation is the percent of income taxes paid relative to income, not percent of population. A typical measure of income inequality would be something like the Gini index. By the Gini coefficient the US is significantly inegalitarian…about on a par with Egypt, El Salvador and many banana republics, or about twice as bad as other advanced countries like Sweden, Great Britain or France.

Anonymous The Lucas slides are further evidence that the man’s mind has slipped badly. I hope his son was around this time to pull him off the stage before he further embarrassed himself. His presentation is a complete muddle. Did you notice that now all of a sudden he has abandoned his old “unit root” argument of long term growth being due to persistent stochastic productivity shocks, and now he’s talking about mean reversion? How does he explain that little change?

And I’m sorry, but if I hear that Smoot-Hawley and labor union argument one more time I might barf on my keyboard. Smoot-Hawley was bad policy for a lot of reasons, but it definitely did not worsen unemployment in the US.

But at the end of the day Lucas is as clueless as ever. He talks about deviations from long term growth, and has even come around to the mean reversion argument (albeit only growth from below trend and never deviating above trend), but he still sees things in terms of one and only one curve…the supply curve. What Lucas doesn’t get is that deviations from long run growth are generally due to aggregate demand shocks and that it takes aggregate demand management policies to correct things in a timely fashion. He asks who remembers previous recessions as though they were no big deal. Well, no big deal to a well-heeled public intellectual. But studies have shown beyond any serious doubt that those entering the labor force during a recession will suffer a permanent reduction in lifetime earnings. So those folks remember the recessions of 74-75, 81-82, 90-91, 01 and now 08-??.

Finally, he confuses countercyclical demand management policies with long term structural relationships between labor policies, government involvement in the normal economy, etc. Even if he’s right about some of Europe’s social engineering policies hurting long run growth (and he’s not, but let’s assume it anyway), what does that have to do with Keynesian countercyclical policies to soak up excess saving? The fraud that he’s perpetuating is the old lie that Keynesian economics = Pinko socialism.

Manfred if I break my rear to earn $350K per year, this is MY money that *I* earned

Except that you didn’t “earn” most of your income regardless of how hard you did or did not work. Two people can put in equal labor efforts with very different income results. Most of what you earn is due to nothing that you accomplished on your own. You are not responsible for who your parents are. You did not choose to have a high IQ or a low IQ. You did not choose your skin color. You did not choose which country and region to be born into. You did not choose when to be born. Most of life’s results are pure Chauncy Gardner events…just being at the right place at the right time. So quit flattering yourself by thinking you’re such a wonderful and productive person, so by gosh golly the government better give you what’s yours. You might as well ask if people who win Lotto “earned” it. By and large the wealthy got their money the old fashioned way…they inherited it.

Yes, Robert you are a class warfare guy as well. Worshipping the plutocracy and their constitutes.

Higher tax rates are not about paying more taxes, but giving government legal powers to force higher wages or higher employment creating more demand.

You want a break, higher more people. Stop hoarding money and suffocatinng everyone else to death. While the wealthy saved more and more in the early 30’s. The poor workers went into debt more and more as the great contraction surged on causing the banks to collapse and they lost their jobs.

I found it funny how the great contraction wound down after Hoover gave up in 1932 and jacked up the top marginal tax rate to 90% from 24%. By the end of 1933 the economy was surging again and didn’t stop to end of the war in 1945(outside FDR’s stupidity in 37-38). This was before the “New Deal” programs even got rolling fully yet.

According to “some” intellectuals on this site, the economy should have completely collapsed with the stifling taxes put on individuals. But instead, it got the wealthy off their butt and investing,hiring and actually, you know, doing stuff again.

If anything, the high marginal tax rates eventually helped lead toward the stagflation era as the economy had so much excess demand from the Boomer’s growth surge, business thought labor costs would rise forever(as would 4% growth). The Kennedy-Johnson tax cut is credited with the 60’s economic boom, but that is all wrong. The economy was already in boom state when the cut was enacted. If anything, the cut wasn’t deep enough to slow it down. Going from 90% to 70% wasn’t much. Going to 50% would have done the trick.

High marginal tax rates are the opposite of what you think. When they are low, they are contractionary and disinflationary. When they are high, they are expansionary and inflationary.

We need to raise taxes to get more growth. It won’t be a complete pancea, but a nice part of it.

>In addition, he does not answer the question of, why should the tax code be progressive? Why? Is it a matter of “accepted fact” that it must be progressive? Says who? Some tenured prof in Wisconsin?

Unless you are a member of the uber-rich, it should be clear that it is strongly in your interest to set up a tax system that prevents the emergency of an hereditary aristocracy of wealth. Madison’s famous saying was that “ambition will check ambition”. That is, the billionaires will fight among one another to prevent the emergence of a tyrant. But there is nothing that says the billionaires can’t collude among themselves to create an oligarchy. And that is exactly where we are heading. Maybe the oligarchs will be benign in the short-run. But everything I know about human nature tells me they will soon degenerate and create an oppressive neo-feudal system, sort of like what you see in the Arab countries.

As I posted on another thread here, the top 1% of US households by income and wealth receive income that is equivalent to nearly the GDP of Germany, exceeding every nation’s GDP save for the US, China, Japan, and Germany.

Moreover, the top 1% hold financial wealth that exceeds by a significant degree the GDP of the EU.

The top 1% of US households could lose 90% of their financial wealth and still collectively hold more financial wealth than all of the world’s individual nations’ GDPs, save for the top eight countries: US, China, Japan, Germany, France, UK, Brazil, and Italy.

The top 10% of US households receive nearly half of all US income (an amount larger than Japan’s GDP and twice Germany’s GDP), and they hold 85% of financial wealth.

The top 10% of US households hold financial wealth equivalent to ~60% of world GDP and an equivalent amount larger than the top 10-11 nations’ GDPs combined.

Someone above mentioned the US being like a banana republic in this regard; it’s worse than that: we don’t even have the bananas!!!

I suspect that at least a plurality of the top 1% do not realize how concentrated wealth and income is among their caste. (They don’t need to know or care.)

It would require taxing half of the income of the top 1% for 10 years or more in order to eliminate the annual deficits that are likely due to the structural effects of the ongoing slow-motion debt-deflationary depression.

But what would prevent the US gov’t from taking the revenues and running deficits in any case? And what would happen to net private investment from a 50% tax on the 1%?

US gov’t receipts now equal personal transfer payments.

Irrespective of one’s political persuasion, the inescapable fact is that the US gov’t is on track for interest on the public debt to reach 20-25% of US gov’t receipts by no later than the ’16-’19 period, and another recession will likely mean we get there sooner.

At the trend rates of gov’t spending, nominal GDP, and deficits/GDP, the debt held by the public will reach 100% of GDP by no later than ’15-’16 and 200% sometime in the early to mid-’20s.

The inescapable reality is that gov’t spending at all levels must be cut (not just spending growth reduced), transfer programs means tested, elder Boomers forced to pay more out of pocket for sick care, imperial overstretch ended, gov’t programs and agencies ended, and gov’t benefits reduced outright.

But no politician can be selected or reselected by proposing contraction of gov’t and ending imperial wars.

Therefore, one can only conclude that a fiscal train wreck must first occur to force a systemic crisis that leaves no alternative but to impose slashing of spending across the board.

Otherwise, we face hyperinflation and the utter destruction of the purchasing power of the currency, wages/salaries, business sales, etc., as well as the likelihood of the eventual irretrievable loss of legitimacy of the central bank, banking system, Wall St., CEOs, and gov’t in general.

Another potential outcome is that the top 1% take their $2.8 trillion in income and $20 trillion in financial assets (or what is left of it by then) and leave the country with the blessings of the bottom 99%.

In the meantime, we could default on the Treasury obligations, take what’s left of the remaining $30 trillion in assets and 75-80% of remaining income and get on with it without the rentier caste.

@2slugbaits: I keep re-reading your comment characterizing the US as “inegalitarian”. Certainly, any capitalist society will have an income distribution that is unequal. The part that I am struggling with is that the top 5% take home 38% of the income share, but shoulder 59% of the income tax burden. If you truly want to be “egalitarian” shouldn’t the top 5%’s share of income tax be reduced to 38%? As an aside, you might just look at what the top 5%’s share of the tax burden represents in both Sweden and France (it is considerably lower).

If you want to shrink the income gap in a more effective way, then stop the Fed and Treasury from pumping money into the banks (steep yield curve, etc) so that the bankers continue earning record bonuses. Note that BofA, Goldman, and JPM had trading losses on only one single day in Q1. Geez those guys are smart (at lobbying).

I think the chart would have more visual impact if you added the labels ‘Great Depression’, ‘Great Recession’ and ‘Happy Days’ in the appropriate places.

Speaking of Moral Imperatives, I believe the Republicans think they have a Moral Imperative to destroy the working and middle classes in the United States. They believe it is the Right thing to do.

They won’t say it, but their every act implies it. Once they have destroyed the working and middle class, they will have effectively destroyed the tax base of the government. The government will effectively cease to exist, most of its functions (and assets) will have become privatized, and they will have entered their Libertarian paradise.

I think that’s the plan. It is one of those things that is (almost) too big to be believed. But I’m coming around to believing it.

2slugbaits,

you are factually wrong in what you say to Manfred. The Millionaire Next Door documents that very little of the wealth of the wealthy in the US is inherited.

More importantly, prosperous people do choose their attitudes, which is THE ingredient that is critical to success. It is more important than any of the ingredients you mention. It is the make or break ingredient.

In general, prosperous people work harder, longer, smarter, are more entrepreneurial, & CHOOSE to delay gratification. They CHOOSE to save a lot too [I know you are fuzzy on that concept but it doesn’t all come from the Fed].

W.C. Varones:

I think you have it backwards. Clearly, the Fed has had a tight money policy since 1979. Easy money leads to rising wages; it’s tight money that leads to low inflation, a strong dollar, and higher asset prices.

It might be helpful to consider inflation as a form of taxation on wealth. While the top is paying a larger portion of the taxes currently being collected, we also have less monetary inflation, which in effect has been another tax cut for the wealthy. So it’s not clear that overall they are really contributing more.

Joseph above might be correct that we could resolve this problem if the Fed were to change their target from 2% inflation to 4% unemployment. But I’m thinking it might be enough for them to simply change it from 2% inflation to 4% inflation.

As for those who are arguing that these policies are good for investment, where is the evidence? Nonresidential fixed investment has clearly been on the downtrend as well. The following graph might be instructive:

http://research.stlouisfed.org/fredgraph.png?g=17W

Ultimately, why do we care if some people are doing much better than others? Only because this has been bad for overall economic growth. Capitalist economies tend to stagnate when they don’t have enough redistribution.

But, maybe progressive income taxes aren’t the best way to do this. And maybe inflation isn’t either. How about a financial asset tax? With $150T in financial assets in the economy, per the Fed, even a 3/4 percent annual tax would be enough to replace all income and estate taxes. Would that be unfair?

I think the chart showing highest marginal tax rates is good. The real world proposal (not the imagined bullshit of some commenters) is to return to the rates under Clinton, which are still pretty low by historical standards. That would be a big help in addressing the federal fiscal imbalance. Obama offered that in combination with $4 trillion in spending cuts. So I think we are talking about $4 of spending cuts for every $1 of tax increases. That seems like a pretty reasonable bargain to me. Unfortunately, doesn’t look like the whaco Republicans are going to accept it. Oh well, we get what we vote for.

BTW, I think we should return to the Clinton-era rates for everyone. Not just the rich. We all need to pitch in to help solve the mess we are in.

Menzie,

Thanks for the updated graph, but that doesn’t absolve the Dirty Fed.

It’s not just “capital gains.” Income that is categorized as “ordinary income” for CEOs, other highly compensated employees, and certainly Wall Street hotshots is highly correlated with asset bubbles.

P.S. I would think how the Fed enriches the wealthy and impoverishes the working class would be a very deep and rewarding field of study for someone with your macroeconomic skills and progressive worldview.

Should you choose to take it up and write a book, I will buy it and promote it widely!

+1,000 on the first paragraph sarcasm. Mid-’80s Letterman couldn’t have done better. The golf gallery applauds after shooting Dr. Pepper through the nose cackling.

acerimusdux,

If you look at a 40-year chart of the price of anything with more commodities than technology — houses, cars, food, oil, gas, gold — you’d have a hard time arguing we haven’t had easy money.

Nonetheless, your premise that easy money would cause wage inflation in excess of cost of living inflation is unsupported, and in fact has been empirically false for quite some time. If you print money with 10% unemployment and a weak economy, you’re going to get food and energy inflation far in excess of any wage inflation. I warned Bernanke about that more than a year ago, but of course he didn’t listen.

“how do you know what the optimal income tax rate is? Do you have a model? If yes, provide it, with your assumptions. Otherwise, your post is only class warfare written in sophisticated form.”

And do you have a model that class warfare is bad? Don’t? Didn’t think so.

Must disagree on this, because a family making 250K on the coastal states is probably working 100 hours a week between the husband and wife. When you tax 250K earned from long hours, that is not taxing the “rich” it is tacking the hard workers. I know lots of woman doctors who work part time precisely because the trade-off between income and family is tilted away from working at their professional job by the tax code. It is quite inefficient to do this.

Slugs –

If you have party with a hundred people and five guys pick up 60% of the tab, by some measure, they are carrying their fair share. You can argue that, well, they could have afforded to pay 80% of the tab, and that’s another view. These are, as you suggest, fundamentally different views of property rights.

On a slightly different topic, from CNBC:

The preliminary reading for the consumer sentiment index dropped to 63.8 in July from 71.5 the month before, falling far short of expectations of an increase to 72.5, according to a Reuters poll of economists.

The survey’s barometer of current economic conditions fell to 76.3, the lowest since November 2009, from 82.0. The gauge of consumer expectations was also at its lowest since March 2009, tumbling to 55.8 from 64.8.

“Whenever the Expectations Index has been this low in the past, the economy has been in recession,” survey director Richard Curtin said in a statement. “Nonetheless, one month’s data is insufficient to signal a renewed downturn, particularly if a last-minute agreement on the debt ceiling results in a partial restoration of confidence.”

This quote is consistent with our views of the impact of oil prices on the economy.

W.C. :

There are already plenty of comprehensive measures of inflation, such as the CPI or the PCE less food and energy. These are the measures the Fed actually uses, and what they target. To use anything else is simply redefining the word “inflation” to mean something else, in a way which makes it less useful.

Aside from food (which hasn’t increased much over the last 30 years, about a 2.9% rate) and energy, the items you are talking about which have gone up, like gold and houses, are things which are held as stores of value. These are alternatives to investment. They soak up savings that doesn’t go to investment. They go up alongside a strong dollar.

And, I never said wages rose more than inflation, but if you wanted to check that, the measure to use would be real wages, which have in fact been rising, and which did so to a greater degree when inflation was higher (such as prior to 1980).

link

Also, your theory seems to be contrary to actually used measures of money as well. Look at M1, and it is quite apparent that money was relatively tight leading up to the financial crises:

link

In addition, it doesn’t square with the trade balance. Loose money would debase the currency, and a higher supply of currency would lower the exchange rate, making US good more attractive. So loose money should be associated with trade surpluses, not record trade deficits.

When I looked at Saez’s charts it looked to me as though it is only the top 0.1% or .005% of earners that ran away from the rest of us. The top fraction of one percent seesm to skew the interpretation of the top 1.0% of earners.

maynardGkeynes,

What was so bad about the Clinton tax code? We ran budget surpluses with that one in place and had rapid economic growth as well (note to Hmmm as well, who claims to be interested in raising all the boats).

What’s the moral imperative for taxing higher income citizens at higher rates? Other than the mob view – because there are more of us and we can. The higher earners probably use less government services.

“Menzie, we do have some common ground on this issue: some people are not paying their fair share.” – T-Dub

Interesting concept… fair share. Mark Perry, economist at UM-Flint, pondered whether grades should be distributed on a “fair share” basis. How about MDs? How about luxury cars? How about mansions?

What is your definition of fair? How about a flat tax where everyone pays the same percentage of their gross income. That would be a fair incentive to get off your butt and earn more. But let’s be progressive and allow everyone a $25K exemption to accommodate the unable or unwilling. Would that not be fair[er]? Let’s try 17 or 18% and put the issue to rest.

The apparent assumption of fairness in your comment is that since you really didn’t earn your fortune, you really shouldn’t keep it.

Henry Ford really didn’t earn his fortune, so he shouldn’t have been allowed to keep it. Bill Gates really didn’t earn his fortune, so he shouldn’t have been allowed to keep it. Warren Buffett really didn’t earn his fortune, so he shouldn’t have been allowed to keep it. After all, Joe Slobnik doesn’t have a fortune, so he should get the benefit of theirs.

Well, Joe has gotten the benefit of theirs in a vastly improved standard of living. He can run his low-priced PC and watch his low-priced HDTV and have low-priced fresh meat shipped in on Burlington rails. But, gee, Henry and Bill and Warren are thieves who need to have their earnings taken away… because it is really fair.

Bryce More importantly, prosperous people do choose their attitudes, which is THE ingredient that is critical to success. It is more important than any of the ingredients you mention. It is the make or break ingredient.

I think you are confusing necessary and sufficient conditions. If you’re starting from scratch, a “go get’em” attitude is no doubt a necessary ingredient for success; but it is not a sufficient condition. My point was that people are always eager to flatter themselves and so they imagine that their good fortune isn’t due to fortune at all, but to their just being so downright great and wonderful. It’s a lie. There is very little about a person’s economic condition that is not due to mere serendipidity. Even if you’ve got real drive and ambition, you still have to be in the right place at the right time. For example, graduating from college in the last three years will absolutely put you at a huge disadvantage relative to someone who was born a few months earlier. I don’t think the average college graduating class of 2009 had less ambition than the college graduating class of 2007, but yet their economic prospects are very different and will remain different throughout their lives. That is a statistical certainty. The rest of your comments are just warmed over Puritan ethic nonsense straight out of Max Weber.

And noone making minimum wage works 100 hours per week? Likewise, noone with income of 250K works 5 hourse per week? You wouldn’t be cherrypicking data now would you?

T-Dub If you truly want to be “egalitarian” shouldn’t the top 5%’s share of income tax be reduced to 38%?

My comment about inequality in the US was in regard to income distibution, not shares of federal income taxes. A lot of people in this country do not pay income taxes because they are just too damn poor. The top 5 percent might be paying a larger share of total tax revenues, but it’s also true that they are paying a larger share of a smaller pie. Income taxes as a percent of GDP have been shrinking and are at a 60 year low. So in absolute terms the top 5 percent are carrying a very light burden relative to the last 3 generations of taxpayers.

And like a lot of folks here, you don’t quite seem to get the difference between the impact of a tax and the incidence of the tax. What counts in welfare economics is the tax incidence, and given labor supply elasticities the poor are taking it in the shorts. It’s just a general law of economics that those with the least elastic curves must absorb most of the shock. As a public finance prof once told me, that’s why the rich are always wanting to change the tax codes.

Manfred You asked: how do you know what the optimal income tax rate is? Do you have a model?

It so happens that Saez does have a model. He calculates the optimal revenue maximizing tax rate under non-Rawlsian and Rawlsian assumptions. The Laffer curve nonsense is shown to be just that…nonsense. We are nowhere near the revenue maximizing point.

You also asked: when marginal tax rates were very high, what was the output lost because of disincentives to work? Were they small or large?

Turns out that Saez’ model also addresses that point because part of the analysis is driven by the relative income elasticities and substitution elasticities. He modeled his work after Mirrlees paper from the early 70s.

The top 0.1-1% pay taxes to buy the services of politicians just as they do for services rendered from house staff, nannies, drivers, tax and estate attorneys, private banksters, and private jet pilots and yacht captains.

The US does not have taxation without representation; rather, we have full representation with taxation for the top 1-10%, as the top 10% pay 70%+ of federal income taxes.

Many of the top 0.1-1% would agree that the US has the best gov’t lots of money can buy.

Put another way, for the bottom 90%+ of households, we have no representation without taxation.

But this is the way a feudal-like, militarist-imperialist, rentier-financier oligarchy is supposed to function.

Therefore, what’s not to like about the arrangement?

W.C.,

I called it Oct 08.

Come on, Menzie,

After your “spreadsheet” ad hominem, no substantive response to the correlation between the income gap and Fed easy money?

So quit flattering yourself by thinking you’re such a wonderful and productive person, so by gosh golly the government better give you what’s yours.

And there you have it: a portrait of a true state socialist.

At what point then is the approach of danger to be expected? I answer, if it ever reach us, it cannot and it will not come from abroad. If danger ever reach us, it must spring up from amongst us. – Abraham Lincoln

“The economy only gives back 20% of GDP”

Revenue has been between 30%-34% of GDP for the past 30 years.

(Federal Government Current Receipts + State & Local Government: Current Receipts)/GDP

W.C. Varones If you print money with 10% unemployment and a weak economy, you’re going to get food and energy inflation far in excess of any wage inflation. I warned Bernanke about that more than a year ago, but of course he didn’t listen.

Except of course that we aren’t seeing any inflation. Good thing Bernanke didn’t waste his time reading your blog. Now I wish we were seeing some inflation…a 4 percent core inflation rate would look pretty good right now. Alas, no such luck. The Fed’s principle objective seems quite modest; viz., avoid deflation. And so far they’ve managed to at least do that much, although I wish they worried more about unemployment.

It’s interesting that whenever I bring up a wealth tax everyone shies away. It’s interesting because we already have one, the property tax. The only wealth tax we exercise is on wealth that composes the largest share of accumulated middle-class wealth. (and they are paying tax on wealth that very often don’t even have, the principle that the bank owns)

To make my point Bill Gates owns the most expensive house in America at $500 million. This represents 1/120th of his wealth, 0.8%. Now figure out what percentage of your wealth your paying property tax on.

This concentration on just the income tax plays into the conservative’s hands. Taxes are fungible as federal taxes are largely fed back to state and local government which are mostly regressive. Decreased fed taxes requires increasing state and local taxes.Tax arguments should be based on the overall tax load.

The sarcasm was duly noted in the first sentence. If the purpose of tax rates is to punish those that are deemed too successful, then your post is a very good one in pointing out that the ‘rich’ haven’t been wacked down as far as many would like.

If the purpose of tax rates is to generate revenue for legislators to spend the way they see fit, then a 100% rate over a certain livable income makes perfect sense. Since this will not make even a small dent in the deficit and continuing debt levels of the country, I was just wondering why you think flushing another trillion dollars down the drain is really a good idea.

I understand the multiplier effect. The democratic party interest groups have had their joy multiplied many times recently. The effect on the economy is exactly what I would expect from shoveling money down the toilet. Zilch. Perhaps we should start breaking windows so the money will be spent fixing them instead of funding community agitation.

I know someone making over 250K per year. He is my employer. Most of that money is used to grow the business. A little thing we like to call investing. It works differently than the definition you are probably accustomed to. One invests to keep up with technology, stay a viable and going business concern, or expand the business. The overall point is to generate more money and hire more people and enlarge GDP. The term is often used by bureaucrats to describe flushing money down the toilet because if they used accurate terminology, they would lose their jobs and be replaced by people more willing to lie to the public.

One question for you. When tax rates of 100% are achieved on these filthy stinking rich people and revenues to the government decline, what will you suggest then? Remember, rich people do not need an income by definition. They already have enough.

A quick few comments, some on the comments themselves. Quite aside from a matter of fairness and severe income disparity is inefficient. It concentrates monopoloy power of wealth so it brings an oligopoly type phenomenon to demand. Additionally, tax cuts or income growth don’t translate into the same kind of quantitative or qualitative demand as would be for a less skewed income distribution.

Societies in general have become more prosperous when economic growth has been broadly shared but when held to too few, the growth is slow.

Hitchhiker: I know someone making over 250K per year. He is my employer. Most of that money is used to grow the business.

One does not invest $250,000 in the business and pay income tax on the same $250,000. Money that is invested in the business is tax deductible and incurs no income tax. I suggest you learn more about the tax system before complaining about it.

>I know someone making over 250K per year. He is my employer. Most of that money is used to grow the business. A little thing we like to call investing.

Investment spending is tax-deductible. So if your employer is truly reinvesting profits, he is probably not paying much tax.

Try again.

Hitchiker:

“Most of that money is used to grow the business. A little thing we like to call investing.”

graph

The red line on the above graph shows non-residential fixed investment relative to personal consumption. The blue line is the 1-year treasury bond interest rate. Clearly the kind of jobs creating investment you are talking about is more likely to occur when interest rates and inflation are high; this is when the economy is most competitive.

W.C. Varones: If you print money with 10% unemployment and a weak economy, you’re going to get food and energy inflation far in excess of any wage inflation.

energy inflation is often far far in excess of food and wage inflation. Predicting that energy inflation is going to be in excess of wage inflation is like predicting rain some time between now and 2013. Food inflation was 3.7% and wage inflation was 1.6% this past year. Food inflation was hardly “far in excess” of wages.

oil, food and wage inflation

food and wage inflation

Bruce Hall wtote: Mark Perry, economist at UM-Flint, pondered whether grades should be distributed on a “fair share” basis.

Fair grading as opposed to biased grading? Definitely prefer fair grading.

Bruce Hall wrote: How about a flat tax where everyone pays the same percentage of their gross income.

The top 400 paid an average effective tax rate of 18.11% in 2008 and 16.82% in 2007. A flat tax would never make it through the house since it would result in a significant tax hike for the wealthy. Someone making 33K a year pays an effective tax rate of 24%.

At the Helmsley Building, the Little People Pay the Taxes

The point is that the price changes caused by easing will be bad regardless of whether or not there is inflation. In fact, the increased demand for savings and decrease in ability to save will slow money, neutralizing stimulus and potentially even leading to deflation.

joe Revenue has been between 30%-34% of GDP for the past 30 years.

You’re double-counting. A lot of state and local receipts involve the same dollar being handed from one level of government to another. You’re misusing the NIPA tables.

I continue to find it funny that leftists who want to return to Clinton-era taxes don’t want to return to Clinton era-spending.

I would gladly return to those tax rates if it guarantees those spending levels (i.e. a 50% cut from where we are now).

Any takers?

crickets chirping from ashamed leftist silence.

The only fair ways to tax people are :

1) A consumption tax, OR

2) A flat tax.

A progressive bracket of income taxes is not fair, nor effective. Wealthy people can simply move their income to corporations and trusts, and corporate tax rates are much more sensitive to global competition.

MarkOhio,

BTW, I think we should return to the Clinton-era rates for everyone. Not just the rich. We all need to pitch in to help solve the mess we are in.

I fully agree, IF we also return to Clinton-era spending rates (which would be a 50% cut from what spending currently is).

This condition is usually what shuts leftists up. They want Clinton-era taxes but Obama-era spending. Modern leftism cannot be financed by Clinton-era spending, and leftists know it.

Also, the 3.8% Obamacare surtax did not exist in Clinton’s time, so that would also have to go if we return to Clinton-era taxes (which again, is what I want, as per the above).

Question for tax experts :

If someone is a daytrader/hedge funder, and is earning, say, $5M a year in Short-term capital gains, and plowing all gains back into trading.

…Can he avoid taxes because he is reinvesting the profits? Would he have to be a C-Corp?

Or does he not get to do that, because this is an investment company?

I’ll pay real money to someone who is a real expert on this subject.

The truth is, wage income tax is not really sensitive to global competition.

But both corporate tax rates and capital gains tax rates are.

China, India, and Russia all have 0% LT and 10% ST capital gains tax rates.

14 o 30 OECD countries have no LT capgains tax rates, and 28 of 30 have lower corporate tax rates than America.

Thus, Capital Gains and Corporate Tax rates in the US will be forced lower, whether anyone likes it or not. Global pressure guarantees it. Wage income tax, not so much.

Obama is already talking about lowering the Corporate tax rate from 35% to 26%. Even he knows this is inevitable.

I think about 100% of the commenters on this thread are male.

About 70-80% of all government spending is a transfer from men to women. Think about it.

1) They live longer so use much more of SS and Medicare than men do, even if men are the ones paying most of the taxes into it.

2) Most government jobs are held by women, particularly those jobs that are utterly useless.

3) Women have more to lose than men if police budgets get cut, prisoners are released, etc.

70-80% is a transfer from men to women. If you think male-female interaction were different in 1950 vs. now, this is what changed.

Barkley Rosser,

What was so bad about the Clinton tax code? We ran budget surpluses with that one in place and had rapid economic growth as well

I agree. That means we have to make both taxes AND spending the same as they were in Clinton’s time.

That means spending would be cut by 50%.

I am amazed how people can delude themselves into only seeing the tax side of the ‘Clinton miracle’ and not the spending side.

The reality is, leftism as we know it today would end if we returned to Clinton-era spending levels (again, a 50% reduction).

Any takers? Or is selective memory going to continue to be the leftist mission statement?

Joe,

Thank you for proving my point.

If you don’t think food inflation running at more than double the rate of wage inflation (to say nothing of even hotter energy inflation) is a problem for the poor, then you may have a bright future as a Fed economist.

Total Govt spending %GDP about 35%, 1995. Granted it went down a couple % before Bush ramped it up with the War of Terror, etc. So about the same %GDP as 2007, before the Bush Train Wreck.

http://www.usgovernmentspending.com/downchart_gs.php?year=1950_2010&chart=F0-total&units=p

Total Govt taxes %GDP about 34%, 1995. Went up a couple of % before the Bush Tax Cuts. Total taxes 2007 still about 36%, but more of that was due to increases in state and local taxes, as Federal revenue was still down. The revenue collapse in 2008-2009 was mostly state.

http://www.usgovernmentrevenue.com/downchart_gr.php?year=1950_2010&chart=F0-total&units=p

I apologize if I posted this twice.

Interesting how the share of income ex cap gains jumped about 5% around 1988. That would be the time top marginal individual tax rates dropped below the corporate tax rate. MeThinks income shares did not jump 5%, but that “rich” business owners shuffled around how they paid themselves.

There are lies, damn lies, and statistics.

graph

Looking at spending and revenues as a percentage of potential GDP, both need a correction. At least some of the recent spending increase was temporary, first from war, then from stimulus.

The sharp drop in revenue since 2000 though really likely needs some government action to correct. At the very least, congress ought to be able to come together and agree to allow temporary tax cuts to expire.

GK:

Like any reasonable person, I want to fix the fiscal imbalance. And that will most certainly require dramatic reductions in spending. I think 80% spending cuts with 20% revenue increase seems like a reasonable way forward. Not sure if that gets us back to Clinton-era spending, but who gives a shit. The president’s proposal seems like a damn good start. For the life of me, I can’t understand why the Republicans won’t take it.

GK I agree. That means we have to make both taxes AND spending the same as they were in Clinton’s time.

A lot of the revenue and spending numbers you are quoting (after correcting for double-counting) are due to income transfers…specifically, Social Security. The population is getting older, with retirees making up an increasingly larger share of the population and necessarily putting an increasingly larger demand on government revenues and expenditures. Unless you are advocating a plan to “off the geezers” you’re just going to have to live with the demographic realities. When we think about the economic burden of government spending we usually think in terms of the percent of GDP that goes towards government purchases of goods and services. If you set aside the countercyclcial stimulus spending, which should not be part of the long run debt problem, there really isn’t a lot of discretionary federal govt spending that is beyond what we saw in the Clinton years. Federal government employment is actually down.

The short-run problem is to get the economy back on its feet. That ought to be job #1. This BS about the long-run debt is dishonest. There is a long-run problem, but it is long-run and not the immediate problem. Actually, I don’t really believe most Tea Party types really mean it anyway since way most of them will be rotting in their graves long before debt issues hit home. What the GOP base is really concerned about is the here-and-now. They want to keep their tax cuts and don’t want any cuts to Medicare, Medicaid or Social Security that will impact them. It all gets pushed off to future generations. If you’re really worried about the long-run debt, then you ignore the short-run deficit, which can be financed at less than 3% nominal interest rates, and worry about getting the economy set right. Then after a couple of years you start looking at ways to reduce Medicare spending, cuts in DoD and tax increases. The real reason Tea Party types don’t care about unemployment is because a whopping share of the movement’s members are retirees. Unemployment is not a problem if you don’t have to work.

If you want to see ideology clouding thinking, just look at this from 2slugs: “The real reason Tea Party types don’t care about unemployment is because a whopping share of the movement’s members are retirees. Unemployment is not a problem if you don’t have to work.” But a quick search finds:

Gallup: TEA Party demographics represent mainstream America

Look closely at the demographics chart included in the article. From here: http://radioviceonline.com/gallup-tea-party-demographics-represent-mainstream-america/

MarkOhio,

I think 80% spending cuts with 20% revenue increase seems like a reasonable way forward.

I am fine with that.

80% spending cuts. Done.

20% revenue increase. Yes, I agree.

_______________________

Now the question becomes, does revenue increase from tax increases on the rich, on the middle/poor, or by lowering taxes across the board? Or by lowering corporate taxes so that more profits are passed to shareholders?

Centuries of data from Europe, India, and China seem to indicate that a flat tax in the low 20s (21-24%) delivers peak revenue. Anything outside this range reduces revenue.

China also taxed in a way that mandated female productivity. In America today, while women certainly pay income tax, they are much greater recipients of government spending than men.

2slugbaits,

Unless you are advocating a plan to “off the geezers” you’re just going to have to live with the demographic realities.

That makes the notion that we can return to a ‘Clinton Miracle’ by having the same conditions (tax PLUS spending) as existed from 1996-2000 sort of unrealistic, doesn’t it.

The real way to offset the aging baby boomers is to give greencards to 10 million SKILLED, LEGAL immigrants. They buy up the houses, and start paying into SS, even though their parents in China, India, etc. are not collectors of any US entitlement.

SKILLED + LEGAL is the key. Right now, we do the opposite (unskilled + illegal), who are net tax consumers rather than contributors.

CoRev And as you should know, the Gallup poll got a lot of attention because it was seen as something of an outlier. Turns out that it got weird results because they used a rather unconventional definition of Tea Party identification. In a rolling together of several surveys it was found that 46% of Tea Party supporters are over age 55. And 70% are over age 45. That’s a lot of gray hair and Depends. Tea Party activists are also largely ignorant of basic macroeconomics; a full 56% believe that cutting govt spending will increase job growth.

http://winstongroup.net/2010/04/01/behind-the-headlines-whats-driving-the-tea-party-movement/

GK That makes the notion that we can return to a ‘Clinton Miracle’ by having the same conditions (tax PLUS spending) as existed from 1996-2000 sort of unrealistic, doesn’t it.

No. It’s an economics thing…you wouldn’t understand.

The real way to offset the aging baby boomers is to give greencards to 10 million SKILLED, LEGAL immigrants.

Over the long run I’d give lots of green cards to skilled and unskilled alike. Doesn’t really matter. And we could solve the illegal immigrant problem with a stroke of the pen by making them legal. But today’s problem is not a constrained aggregate supply curve. We need aggregate demand.

Dontcallmybluff:

I realize the top 5%’ers share of individual tax revenue has increased from a 19% share to a 59% share over the last thirty years but your use of percentages obscures the real numbers. Once accounting for inflation it appears that personal income tax revenue is mostly flat since 1980, which makes sense considering the shift to deficit spending over the same time-frame.

It took only a few minutes perusing tax data to see that inflation adjusted personal incomes for the top 5% of income earners has risen about 1000% and their overall tax burden has increased about 30% over 1980 numbers; or about 3% of their total income increase. Hardly the shocking and overbearing yoke that your use of percentages w/o context appears to make it out to be.

Of the bottom 95%? Inflation adjusted tax revenue has dropped considerably and income has nearly tripled. However, those income improvements drop steeply beyond the top 10% of wage earners.

2slugbaits

One of your postings appeared to indicate that increasing the top tax rates would spur economic growth and offered historical support. I am curious to know if those assumptions are affected by the considerably more service orientated nature of the US economy.

So…with the top 5% paying 59% of the income tax burden, I have a question: how much of the tax burden *should* be paid by the top 5%? If you are talking tax burden it is bounded at 100% of the share.

@ T-Dub: It is pretty clear to me that the constituency that benefits most from economic growth should shoulder increases in the burden of acceptable governance. The key is how acceptable is defined.

Again, the use of percentages without context has no business in a reasoned discussion. 5%’ers pay 59% of personal income tax revenue, not total revenue. When considering the whole of federal outlays 5%’ers account for only 24% of total federal expenditures. For the 95%’ers it is 17%. Those are the scary figures to me as it speaks to how much we are actually borrowing.

IMHO posters such as yourself who appear to be concerned with the fairness of progressive tax rates should focus on the relative value of WHAT the money is being spent on. A topic outside the scope of this discussion and frankly one that has already been covered by earlier posters with varying opinion.