We had a couple of pretty scary economic developments last week, but as far as I can tell, we’re still standing.

|

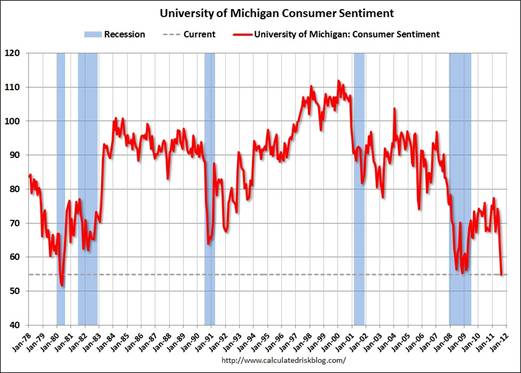

One very alarming indicator came from one of the lowest readings on record for the Reuters/Michigan index of consumer sentiment. Bill McBride, to whom I always turn when I’m unsure of myself (or, for that matter, better yet when I fancy myself to be in full understanding of what’s going on), attributes this primarily to heavy coverage of the debt ceiling debacle. Bill notes that sometimes these big negative swings recover when the news cycle moves on. In support of that view, he provides the following table, which may be very helpful to economic researchers studying this series.

| Event Driven Declines in Consumer Sentiment |

|---|

Event Date Bounce BackImpact on ConsumptionOther Factors1987 Market CrashOct-872 MonthsNoneNoneGulf WarAug-906 MonthsPCE declinedRecession, Oil Prices Doubled9/11Sep-014 monthsPCE declined 3 out of 4 monthsRecessionIraq InvasionMar-032 MonthsNoneOil Prices increased 10%+Hurricane KatrinaAug-053 MonthsPCE declined 2 monthsOil Prices increased 10%+Debt CeilingAug-11——European Crisis, Weak Recovery

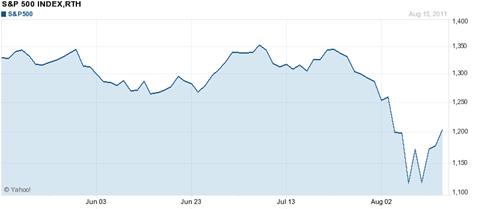

We also started out last week with stocks apparently in free fall, another indicator consistent with the view that a new recession could be about to crash down upon us, or at least consistent with the view that that many people were afraid that was happening. The subsequent violent seesaw in the market indexes was something to behold. But here we stand today, as if the whole week never happened. Perhaps it again is best seen as the market struggling to digest the implications of the U.S. credit downgrade, from which, after some dyspepsia, we may be prepared to move on.

|

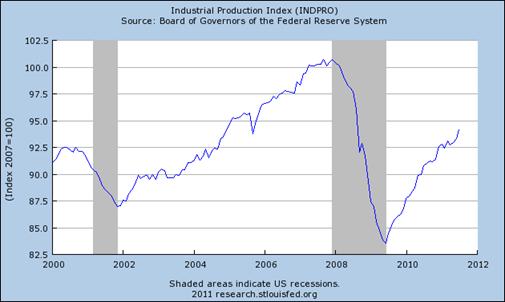

In any case, yesterday’s industrial production numbers were certainly positive, up 0.9% from the previous month and up 3.7% from July 2010.

|

There’s still plenty to worry about, and deep anxiety by consumers and investors can be both an indicator of bigger problems ahead as well as a cause of a downturn in its own right. But for the time being, the real economy seems to be continuing its recent pattern of unsteady growth.

Don’t forget the incompetent socialist commander in chief, stagnant housing markets and continued high unemployment. I know the MSM coverage tried to paint the Republicans as the bad guys, but enough people saw through this to the real problem – the fish rotting from the head down.

We might already be dead and your brain just doesn’t accept it yet.

George Soros :

“If a double-dip recession was in doubt a few weeks ago, it is less in doubt now, because financial markets have a very safe way of predicting the future. They cause it. And the markets have decided that America is going to see a recession.”

thats right amigo last weeks news

mich sentiment was polled right in the heart of default panic. want to bet the implied second half of the months later mich sentiment total is not up at least 4% pts?

from morgan stanley yest

Indeed, the University of Michigan survey reported that a record high 61% of respondents in the first part of August rated government economic policy as poor and a record low 6% as good.

The bonddad blog says that data mostly doesn’t show double-dip recession close at hand.

I think we have to wait and see. We are seeing a better week so far. And it’s also true, I think, that the economy would like to recover. For example, used cars prices in many cases are within a whisker of new car prices, which should presage strength in new cars sales.

But oil prices still exceed the comfort zone of the economy.

The optimistic viewpoint is it is difficult to see how things could get much worse.

Not dead, dead. Just walking, rotting zombie corpse dead.

I really don’t think the debt ceiling debate is a big factor, the budget itself is the problem. The reason the debate side show happened is the obviously counterproductive spending based stimulus.

Thank goodness that the Auto Sector was already destroyed in a previous year so we don’t have to worry about a technical recession being declared.

To Nov. 2012 stimulus. Socialist policies are always needed when capitalism tries to commit suicide.

And 2012 will provide some stimulus. The Teapublicans will be tossed on to the dustheap of dead utopians.

aaron: Doesn’t it seem like the budget is the right time to debate budget problems? instead of a debt-ceiling debate?

maybe the patient is not dead, but in many respects one wishes it were. THEN we would actually get a code blue response from washington. right now it feels as though we are sitting watching the patient die and doing nothing…. and i bet 25 MM people would agree.

there was some confusion in the media last week as to how consumer sentiment could be at a 30 year low with retail sales up 5%…its a point ive made before; our bottom 90% of the population can go to hell, but the top 10%, controlling 93% of the wealth, will keep the gross aggregate numbers rising all by themselves…the rest of us are just economic baggage; we are no longer needed or wanted as consumers….nor as workers or voters, for that matter…

The PPI numbers out today show 4 percent inflation for past three years, or about 1.3 percent annual. The CPI numbers out show 2.62 percent inflation over last three years, or about 0.8 percent annual . Not core–these are headline numbers.

And some say (right-wingers) these overstate inflation.

The output gap is at what, 10-15 percent?

So why is not the Fed being more stimulative?

We are being Japanned.

The bilious knave Rick Perry has it exactly backwards: We should be angry with Bernanke-san for copying the dithering, feeble efforts of the Bank of Japan.

BTW I am not a Obama supporter. We could reduce federal outlays to 16 percent of GDP for all I care. Balance the budget (save perhaps for capital outlays).

But Fed policy is saying to investors, “Sayonara.”

Check out Japan’s real estate and equities markets of last 20 years. Down 80 percent.

Good luck, chumps.

anonymous: Yes.

Alexander Pope used to rail against the printing press making it easy for hacks to foist their wares on the public. The internet has made that fear real.

Hi All, Thanks Dr. Hamilton & Dr. Chinn, as well as all of the fantastic commenters here, for helping to educate those of us who never studied economics and are now scrambling to learn! I am a research scientist in biology, so my econ edu pretty much was very informal, except for “Economics of Medical Care,” and some remedial Macro. I do want to comment on one thing above, in which a respondent wrote, “Don’t forget the incompetent socialist commander in chief, stagnant housing markets and continued high unemployment. I know the MSM coverage tried to paint the Republicans as the bad guys, but enough people saw through this to the real problem – the fish rotting from the head down.” I have a pretty ok degree in biology, and rotting fish-whether anterogradely or retrogradely putrefying-lack an obvious correlation with the economy. Moving on to other things, why does this poster heap misplaced accolades on the very person s/he apparently seeks to denigrate?? IF the Pres HAD actually been a Social Democrat (ie., modern socialist), and had kept his campaign promises, we would NOT have high unemployment now. We would have work-sharing like Germany, or would have other solutions such as in other EU countries that keep the supply of labor and the demand for labor more precisely matched, so that both laborers and employers benefit enough that the well-being of the overall society is better served. That is what Socialism means; better standards of living and a more productive population through common, wide-based, support for your people and for the collective commons that are their & your right, regardless of the slings and arrows of outrageous fortune, or humble origins. This is a great aspiration, and I wish it were TRUE that Obama held this worldview- but he does not. He appears to hold the mainstream Republican view that we all need to get out there and fight with each other, tooth and nail, for the rancid rat meat left by the aristocrats. He is just like you. So, please think twice about applying a positive term like “Socialist,” to him, if your intent is to be honest. I think you should take hard look at ALL elected officials and ask, “Do they represent policies of equality for human beings, or do they represent only those with incomes in the million$ plus range?”

JDH showed some positive industrial production numbers, but just to show that there’s always a black cloud in every silver lining, a week ago the BLS reported a sharp drop in multifactor productivity in 2009:

Manufacturing sector multifactor productivity declined at a 5.7 percent annual rate in 2009, the U.S. Bureau of Labor Statistics reported today. (See chart 1.) This was the largest annual decline in multifactor productivity since the series started in 1987. (See table 1.) The multifactor productivity decline in 2009 reflected a 12.5 percent decrease in output and a 7.2 percent decrease in combined inputs.

http://www.bls.gov/news.release/pdf/prod5.pdf

Interestingly, Table A shows that energy inputs for manufacturing fell at an 11.4% annual rate, in contrast to capital services increasing at a 1.2% annual rate. Labor hours fell at a 12.6% rate.

More evidence that the Lesser Depression is a lot worse than we originally thought. If we’re still alive today it’s a miracle because we sure didn’t see any heroic efforts from Dr. Bernanke, Dr. Obama or Dr. Congress, not to mention the best efforts of Dr. Teabag to kill the economy for raw political purposes.

lol aaron. What “fiscal stimulus”? That thing was so small and drug out over a decade. Compared to the output gap plus tax cuts/transfer part of it, it was made for a recession like 90-91 in today’s dollars. At some point, “Lazy Fares” and “libertines” need to admit as much or face redicule over and over again. It is just like the myth of the “inflating” FED. They try and use it for political gain, but reality will not agree with their fantasies and needs.

Lets be clear, stop overblowing the contraction. It wasn’t any bigger in real GDP than the early 80’s one was in whole. The financial system pretty much imploded but the transfer payment crisis was adverted. There are alot of contraints:

1.Because the financial system threw up guts and blood, confidence won’t be back for awhile. While Chindia and Brazil both made bad decisions to overheat their economies in the post-08 timeframe, that constrained resources and has overvalued commodity indexes globally took real GDP from the west.

2.Major government jobs programs are for DEPRESSIONS. What this is not. This is a major recession. If the government goes into a hiring binge for a short term fix, it will drop unemployment far to low in the short term and hurt business confidence with higher labor costs to quickly.

3.The FEDERAL RESERVE cannot PRINT MONEY!!! The only thing they can do is swap assets around the liquidity curve to try and boost investment. People that confuse this with “printing” need to be jailed. Their obvious obsession with inflation and pro-creditor policies is sickening. The only time the FED has ever printed directly from US Treasury was when semi-dictator FDR was in charge. He nationalized the FED, took it from private banking and used it to fund his New Deal and War efforts, which were incredibly inflationary. It wasn’t to the 1950’s the FED regained independence. Heck, you could argue the “FED” didn’t even exist from 1933-51. It is the reason the bankers were out to get FDR, but he was a dictator however, not easy to get. Money creation like the “excessive” printing in 2001-2006 was by private banking as it always is.

I suspect by 2013 things will begin to normalize. RE will regain some momentum and begin building again(at lesser numbers than the post-war era considering the secular recession will last a alot longer) enough consumer stress will pass and consumer spending will increase more persistantly(once again, lower than the post-war era due to secular recession) Global disinlation will lead toward lower real commodity prices and help loosen up more capital. Finally and most importantly, business investment will move markedly higher. We already saw the foundations of this last summer, but the it ran out quickly(even faster than I thought, half-year faster than I thought actually, but it will make for a better 2nd half).

We are in a secular recession. The unemployment isn’t going persistantly below 6% for awhile. Maybe not to the 2020’s. Problems in the banking sector will always worry for a run. Can F/D use FDIC procedure to unwind BofA for example, without causing a bankrun? Can Europe not implode. Can Chindia and Brazil control themselves and disinflate? Secular recessions always hold these problems, but set the stage for the next boom as long as their is no trigger to complete global meltdown happens. Then be scared.

It does seem kind of like a car driving down a mountain highway, careening and skidding, barely keeping all four tires on the road, averting the cliff. I have been saving money for a major purchase for 2 years now, and just… when… I get ready to pull the trigger and spend the money, everything goes sour. That happened in the middle of last year, and then AGAIN this summer. I blame Europe for keeping me from durable purchases! The post title “Not Dead Yet” is an interesting song by The Bad Examples. Those lyrics kind of fit the situation too…

Subtracting the real yield of the two year inflation linked maturity curve from the yield of the two year nominal treasury maturity results in an implied inflation rate of 0.95% as of the closing today. This is down from 2.58% the day before the FOMC announced there would be no more QE2 (4/26/2011).

http://www.bloomberg.com/apps/quote?ticker=USGGBE02:IND

Such a rapid decline in inflation expectations is usually associated with very bad future economic news. As for myself, I can only say that my seatbelts are securely fastened.

Don’t worry.

The Chairman says he’s got everything under control.

The chart is missing an important event…the financial crisis in the fall of 2008. Casual empiricism suggests that these event-driven movements in sentiment are sharper (both up and down) than typical cycical movements in sentiment.

The Fed has declared that the US will have zero interest rates for two years, “guaranteed.”

Do you need better proof that nominal GDP will remain stagnant for a while?

The reaction of the financial markets was not an accident. It was the result of monetary mismanagement (again).

Of course, some of us crazy types think that developed countries are being gradually priced out of the global market for exported oil.

My sketch showing my “Peak, What Peak?” graph of GNE (Global Net Exports) and ANE (Available Net Exports, i.e, GNE less Chindia’s net imports) versus annual US oil prices follows:

http://i1095.photobucket.com/albums/i475/westexas/GNEANE.jpg

Data source: BP + Minor EIA input for top 33 net oil exporters in 2005 (99%+ of global net exports)

An interesting article about US Airlines’ wish that the US government impose stability on global oil prices follows. They want “Stable fuel prices.” And I want to weigh less, look better and have a bank account like Warren Buffet.

http://www.star-telegram.com/2011/08/17/3297440/airlines-push-to-curb-oil-speculation.html

Airlines push to curb oil speculation by traders

Excerpt:

“Given how much trading there is today in commodities, it warrants as much attention and scrutiny as the stock market gets, and deserves some checks on the power of any individual player so as not to unduly influence” pricing in oil markets, said John Heimlich, the Air Transport Association’s chief economist.

Airlines argue that huge investment inflows from pension fund investors and Wall Street firms into the oil markets are driving volatility in world oil prices and distorting the price of crude oil and jet fuel. “We don’t want to be in a scenario where we have to ‘right-size’ the airline for fuel prices. We want stable fuel prices so we can go and run our business, grow and be a normal business,” Jacobson said. “When we have to react with capacity reductions, all of this stuff is important.”

Capacity reduction means that Delta and its competitors have to ground airplanes when oil prices get too high, cramming more passengers onto fewer flights.

It is an ugly day for centrally planned economies on both sides of the Atlantic.

Got gold?

Oh, boy, ugly out there on the capital markets this morning.

JDH wrote:

But for the time being, the real economy seems to be continuing its recent pattern of unsteady growth.

How do you spell Japan….?

The economy has been weak for two reasons:

1. the impact of higher inflation on real incomes and spending.

2. the Japanese supply chain disruptions.

The higher industrial production last month was largely a bounce back for the Japanese disruptions,

so it is not a sign of sustained higher growth.

The latest CPI report was surprisingly high so that real wages continued to fall.

With wages and incomes so weak the economy can not sustain higher inflation. Higher inflation currently leads to a weak economy, not an inflationary spiral.

This is actually a response to the last thing that Menzie Chinn wrote because the political situation is deeply intertwined with the economic one at this point.

Although some predict horrible things if the GOP wins another round and takes total control, I look at the issue of regulatory certainty. Right now the battle over regulation is creating a lot of hesitation. Is the EPA going to punish carbon emitters? What will be the cost and outcome of the healthcare law? If one party takes control of all parts of the government, then businesses can adapt and maybe investment for the long term will pick up. Countering that is the possibility that it will adopt bad fiscal policies at precisely the wrong time and tip us further into recession.

Spencer –

From my perspective, this downturn is an oil shock, nothing more, nothing less. It fits all the requirements:

– global in scope (Germany, France, US, even China)

– timing fits: oil price shock + 30 to 180 days

– surge of business in the oil patch (not a recession, which is what we would expect if the source were financial)

– high oil prices (again, not consistent with a financial crisis)

– primarily affecting oil importers, not exporters

– oil price exceeds 4% of US GDP recession threshold by a margin (even today!)

– no other real compelling cause (debt ceiling drama could account for US, but not for Germany or France Q2).

– consistent with historical record (prior to this, oil price increases associated with 10 of 11 recessions, as I recall, per Jim)

If you’re looking for an H1 2011 event that could cause a recession globally, there’s really not much other than oil to definitively blame it on.

However, it is not a double dip recession if we allow that it is an oil shock. (Maybe I’ll write a piece on this making the case.) If you graph it, you can see clearly that it’s the next oil shock, not the continuation of the previous one. This recession (which looks ever more likely) would be properly characterized as the second peak oil recession, in my opinion.

I would not argue with you about it being an oil shock.

But it also is a food shock and core inflation is starting to rise significantly.

the Japanese supply disruption is definitely secondary. but it was significant for this months industrial production gain.

Oil shock?

With steady supply and a weak global economy, what on earth could be making prices go up?

Zimbabwe Ben has absolutely no idea.

Well, welcome Claudia. First time I recall seeing you post here. Nice to have a Fed economist among us.

I agree about event-driven responses, but I think that is often linked to asset bubbles, no? Where everyone is playing musical chairs, and waiting to see when they have to jump for a seat.

But what’s the event here? Are there any asset bubbles out there other than government debt and gold? Equities and real estate weren’t horribly over-priced before the crash. Perhaps the deteriorating Greece situation. Yes, but that’s chronic and no one has defaulted. The protracted debt negotiations in the US? Possibly. But wouldn’t we expect the equity slide during the negotiations, not after they were successfully resolved? Or do people think the US will default? As Greenspan points out, the US would very likely print money before defaulting.

So what’s the event?

ECRI was calling for a global slowdown as early as May and advising people to buy bonds in summer. I partially took their advice and sold my bonds early 🙁

Professor, do you know of a clear instance of a confidence-led recession in either the US or overseas where a central bank hasn’t tightened monetary policy and where fiscal policy was broadly unchanged? Thanks very much

Re: W.C. Varones

As noted in my post up the thread, the global supply of net oil exports available to importers other than China & India has been dropping at an average rate of one million barrels per day per year for the past five years, from about 40 mbpd in 2005 to 35 mbpd in 2010.

“We had some pretty scary experiences with that iceberg an hour ago, but as far as I can tell, we’re still standing.” — Captain of the Titanic

there truly has not been a recovery…..a weak dollar has boosted corporate revenues …..47 million on food stamps…….80 million baby boomers ready to retire…….banks cannot take back the homes because they do not want to take the losses……its a tough game out there,,,,but there is great volatility for trading.

CNBC headline this morning, at about 7:00 A.M. Central Time, “Oil prices fall again.”

Not really. At around 7:00 A.M., WTI was down about 80¢ (around $81), but Brent, a far better indicator of global oil prices, was up about 80¢ (around $107).

The WTI/Brent spread was zero in July, 2010, it was $20 in July, 2011, and it is currently between $26 and $27, even as Cushing inventories are way down from their high, and well below year ago levels.

A more accurate headline would be, “WTI crack spread increases again, as global oil prices rise, while the WTI oil price falls.” As Undertow has documented, the WTI crack spread has increased from single digits a year ago to over $35 per barrel currently. The WTI price has no virtually no real relationship to what consumers pay at the pump (refiners are simply retaining the growing spread between the WTI price and the Brent price), and the Brent price is a far better indication of global supply & demand factors.

Average spot prices through July, for 2011 (EIA):

WTI: $98

Brent: $112

So, currently WTI is down about 17% from seven month average, while Brent is down about 4% from seven month average.

Regarding the bizarre, and growing, spread between WTI and Brent crude oil prices, a related article by Jeff Rubin, from a Canadian point of view:

http://www.theglobeandmail.com/report-on-business/commentary/jeff-rubins-smaller-world/time-for-canada-to-find-new-trading-partners/article2132282/

Time for Canada to find new trading partners

It occurs to me that the Mid-continent refiners are playing with fire. If their short term drive for profits ultimately causes Canada to redirect most, or virtually all, of their oil exports to their West Coast, Mid-continent refiners–and US consumers–will pay a huge long term price.

As a citizen in the Far North allow me to comment on the Amurican tendency to characterize Obama

as a “socialist”. Lest you forget, Obama inherited the economic dung of the Bush II 8 years. How do you ever shovel it up and rid yourself of the expansion of debt during Bush II in less than the present term of this president? America, ideological differences will be the eventual downfall of the republic lest a collective vision and will is born to repudiate the “know nothings”.

Until the housing market problems have been solved, the American middle class is at least brought back to stable condition from the current critical, near death condition and the criminals who have destroyed the American dream are brought to justice and serve very long terms in prison, there will be no recovery. I will stick with what I’ve said for the last 36 months. 2012 will be the end of the tyranny. 2013 will be the beginning of a return to what makes us a proud, great nation, 2017 will see the re-birth of housing and 2021 will be a very good year for the American middle class. In the interim, we will continue to reduce our debt and hide the hard earned fruit of our labor, until it is once again “morning in America!”.

“. . . do you know of a clear instance of a confidence-led recession in either the US or overseas where a central bank hasn’t tightened monetary policy and where fiscal policy was broadly unchanged? Thanks very much”

The recessions and bear markets occurring during the Long-Wave, debt-deflationary depressions of the 1830s-40s, 1890s, late 1930s and 1940s, and in Japan in the ’90s to date were not caused by rising central bank reserve or discount rates; rather, they coincided with demographic drags effects, financial system shocks, including successive rounds of bank failures and runs and currency crises, as well as periodic disruptions to trade and resource flows, labor unrest, and discontinuities to production associated with wars.

Consequently, an inverted yield curve does not precede recessions and bear markets during debt-deflationary depressions, which is what we are likely to experience throughout the decade and perhaps into the early ’20s.