Economic conditions are deteriorating. Here’s how and when the Fed might intervene.

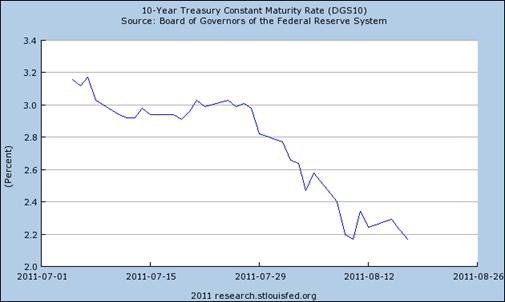

Bond yields on perceived safe assets have plunged as pessimism over global economic conditions takes hold. The 10-year U.S. Treasury rate has fallen 100 basis points since the start of July, signaling expectations of a profoundly weak economy and a very low inflation rate over the next decade.

|

The yield on Treasury Inflation Protected Securities, whose coupon and par value are guaranteed to go up with any increases in the headline consumer price index, fell by almost 80 basis points over the same period. That suggests to me that lower inflationary expectations have made only a minor contribution to falling nominal yields, with perceptions of a weaker economy the dominant factor.

|

And in response, the Fed should do what, exactly? A new phase of large-scale asset purchases (which doubtless would be referred to in the press as QE3) could sop up a few more percent of publicly-held Treasury debt. Conceivably that could put pressure on the nominal or TIPS yields to decline even further, and I suppose that one might hope that a 10-year real Treasury yield of -0.2% would be slightly more stimulative than the current real yield around zero.

I would suggest that the more important and achievable goal for the Fed should be to keep the long-run inflation rate from falling below 2%. The reason I say this is an important goal is that I believe the lesson from the U.S. in the 1930s and Japan in the 1990s is that exceptionally low or negative inflation rates can make economic problems like the ones we’re currently experiencing significantly worse. By announcing QE3, the Fed would be sending a clear signal that it’s not going to tolerate deflation, and I expect that would be the primary mechanism by which it could have an effect. Perhaps we’d see the effort framed as part of a broader strategy of price level targeting.

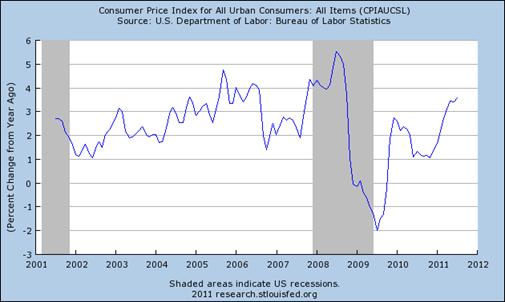

The graph below plots the annual percentage change of the headline CPI over the last decade. Defenders of the Fed could argue that QE1 helped kick the economy out of a dangerous deflation scare in 2008-2009 and that QE2 helped bump us out of the disinflationary environment in the fall of 2010.

|

The Fed’s critics, however, see something more insidious. Governor Rick Perry (R-TX) got a lot of attention last week with a criticism of the Federal Reserve that makes Rep. Ron Paul (R-TX) look like a moderate:

..If this guy [Fed Chairman Bernanke] prints more money between now and the election, I don’t know what y’all would do to him in Iowa, but we would treat him pretty ugly down in Texas. Printing more money to play politics at this particular time in American history is almost treacherous, or treasonous, in my opinion.

David Glasner

(hat tip: Economist’s View)

responds:

Well, let’s take a look at Mr. Bernanke’s record of currency debasement. The Bureau of Labor Statistics announced the latest reading (for July 2011) of the consumer price index (CPI); it stood at 225.922. Thirty-six months ago, in July 2008, the index stood at 219.133. So over that entire three-year period, the CPI rose by a whopping 3.1%. That is not an annual rate, that it the total increase over three years, so the average annual inflation rate over the whole period was less than 1%. The last time that the CPI rose by as little as 3% over any 36-month period was 1958-61.

Some may read the 12-month (as opposed to 36-month) rates in the graph above as suggesting we’ve left that episode behind and inflation is now headed higher. I believe it’s more likely instead that we’ll soon see the series moving back down with inflation rates well below 2%, and that in retrospect more observers will be inclined to view this episode from Glasner’s perspective of a prolonged, ongoing disinflation. I’d also guess that once the evidence of renewed deflationary forces becomes clearer, then the Fed would once again signal with some version of QE3 that it doesn’t intend to let such a situation continue.

Another related possibility is that the European sovereign debt concerns morph into a freezing of international credit markets, leading to some repeat of the ugly events of the fall of 2008. Here again there is little doubt that the Fed would need to intervene preemptively not with large-scale asset purchases but instead with the kind of emergency credit facilities that we saw 3 years ago.

And while I’m offering predictions, I might as well make it a triple. If events do take this turn and Bernanke does act again, he’ll be the subject of personal political attacks even more vicious than we’ve seen so far. But I expect the Fed chair to go ahead with the policy in those circumstances anyway, because he knows it’s the right thing to do. I could even imagine the Texas Governor delivering a rousing speech, praising in his appealing drawl those who have the courage to make a personal sacrifice for the larger good.

But I don’t expect the Governor to include in such a speech recognition of one person who deserves such praise.

Would it be wiser for the Fed, if it did wish to kick off another round of QE, to do reverse repos this time? Say a two year reverse repo? This would ensure the integrity of its balance sheet while also letting the public know that the QE will be absolutely reversed (and fends off criticism from politicians)?

Here, drink this poison. It’ll distract from the pain.

The fed needs a way to lend directly to people with bubble mortgage debt, to reduce interest cost, pay it down faster, and free up income for savings, investment, and new consumption. Reduce the uncertainty of debt and low income prospects.

The monetary base remains ~34% higher than it was 12 months ago. I would not be entirely sure QE2 ended.

Prof. Hamilton, your inordinate fear of any whiff of deflation implies that you do not really believe in the honest prices [those flowing from supply/demand] as the most efficient allocator of resources. Better to have the Bernanke do it?

Could it be that the severe deflation of the 1920-21 recession, which we have been discussing in the previous posts, was the key to the swift recovery?

QE might be politically hard, since many people view it as fueling a commodities-led burst of inflation (i am not agreeing with this, just observing).

I think that there is a fair bet the fed will try do something new- like lower Interest on reserves (when the fed pays .25% and treaaasuries are yielding .17%, theres a good argument to lower them maybe to -.25%)

is there any work on “trend” gdp vs actual gdp – analagous to “trend” (core, trimmed mean) inflation vs headline? i.e. work on gdp stripped of the more volatile components.

“Another related possibility is that the European sovereign debt concerns morph into a freezing of international credit markets, leading to some repeat of the ugly events of the fall of 2008. Here again there is little doubt that the Fed would need to intervene preemptively not with large-scale asset purchases but instead with the kind of emergency credit facilities that we saw 3 years ago.” See http://cuadernodearenacom.blogspot.com/2011/08/un-lehman.html

You’re digging yourself a very deep trench here, Jim. It’s obvious to almost everybody by now that QE has failed and history is going to judge it to have been a crucial mistake and Bernanke a great big failure.

Deflation would not be nearly as bad as this stimulating waste of resources during a recession driven largely by competition for constrained resources. Inflation below 2% is where it should be.

Even if one accepts your arguments about the benefits of QE, where is the marginal utility of QE3 at a time when 10-year rates are at 2%, and banks are so stuffed with liquidity some are charging interest to hold deposits?

It’s three years after Lehman now – far, far too late to still be arguing that without QE and fiscal stimulus the economy would be worse. Businesses need visibility. They need to know what demand will look like after stimulus is wound down. Until they get that visibility, the excess liquidity created by QE will remain within the banking system, and the excess consumption created by deficits will just be more accumulated cash by corporations.

Kudos to your bravery for taking such a big bet on a losing hand. Be ready to be playing short stacked for a very long time.

The lesson Bernanke should take from this is he had better follow through or he will have Perry as his next boss.

Dr. Rajan has an excellent post up this week on the prospective effectiveness of inflationary policy:

http://blogs.chicagobooth.edu/n/blogs/blog.aspx?nav=main&webtag=faultlines&entry=41

While this may be the academic view of economic conditions – I’d venture to say that the issue is more complex than simply inflation or deflation. The CPI fails to really show the vast increases in price of food, energy, healthcare, etc. as we’ve seen many of these offset by the deflation in housing and other areas of the economy.

Doesn’t QE3 just push up the cost of the very goods/services/assets that the average person depends on?

Overall, it seems as if this would just kick the can down the road by not allowing the bad debts to liquidate – if the foundation was sound to start with, maybe it would be a different story. I’d rather take the red pill and deal with the consequences rather than live through years of misery trying to pretend that we have a foundation to build sustainable growth.

The CPI is not a valid indicator of “debasement.”

Even putting aside quite legitimate quibbles with CPI calculation, the CPI remains contained because we are in a Depression and demand is anemic. This does not imply that the Fed is not debasing the dollar. It clearly is, as illustrated by M2, MZMN the Fed balance sheet, and gold.

Indeed, the demand Depression may present an opportunity for the Fed to devalue the debt by debasing the currency without causing equivalent inflation. I expect them to follow this path, though as noted before, it widens the wealth gap and benefits asset owners at the expense of food and energy consumers.

Cook,

As Jim has pointed out in the past and seems to be forgetting, short-term inflation (or deflation) is not the problem, it’s the relative price changes.

aaron – could you point to a particular reference?

I just don’t understand the logic with additional easing only providing short-term inflation. While demand has plummeted and there is certainly significant counteracting deflation, the two are working simultaneously and the Fed’s actions for the first few rounds clearly just boosted up asset prices to benefit some at the expense of others (hence the increase in income disparity).

I mean, how do you expect to correct balance sheets by burdening the average person with significantly higher costs of living (QE1/2/3?/4?). If there are no substantial results that actually help build sustainable growth, inflation will not be short-term if the same policy is continued over and over again.

Similarly, if housing is too expensive, why not let prices fall to market levels? If housing prices are artificially held up, these same people will have yet more difficulty owning capital assets.

These are clearly unprecedented times, but I just don’t see how an orderly change in price levels or consistent easing will ever actually solve problems. I generally prefer to have the money supply follow nGDP as accurately as possible, yet there are many interesting things happening within the market that have been caused by gross imbalances over the years. While they were obviously avoidable, I don’t think Fed policy can solve the problem by pushing through with more easing.

Does anyone see the irony of the Fed? Govt is forever claimed to be the salvation of the poor. Yet here is this govt bureau the Fed, for the benefit of the most profligate banks (who with the Feds help made out like bandits for 25 years), screwing the honest people, the poor, & especially the elderly.

The powerful Bernanke can generate 3.9% inflation & CD rates of .4% (on which the poor seniors must pay tax). It is worse than that: the goods that seniors & the poor consume most are relatively more affected by inflation.

Unsophisticated people who have saved all their lives but don’t understand investment are being forced by the Bernanke to speculate or lose the value of their savings. Many have fled into bond funds, where they will be flayed when inflation accelerates & market interest rates eventually assert themelves.

Bryce You’ve been peddling this hyperinflation-is-right-around-the-corner story for a long time. When are you going to admit that you don’t have any idea what’s happening here? When are you going to put away the gold chains, bell bottoms and disco records and recognize that this is not 1979?

Inflation per se is neither good nor bad if it is predictable. What is bad is when we have accelerating inflation. The reason the Fed likes to set its inflation target at something like 2.5% is out of a concern that a higher target could lead to accelerating inflation. But the Fed has been undershooting its own target, and the concern is that we might slip into deflation; and deflation is a far more serious and intractable macroeconomic problem than inflation. We know how to fix inflation; we don’t know how to fix deflation. Deflation, coupled with an increasing interest rate (which is what some folks, and I suspect including you are advocating) is stupid-squared because the math leads you to a low output equilibrium at best or a permanently divergent path away from equilibrium at worst. We don’t want to go there, which is probably why “the Bernanke” lost the rest of his hair.

Your concern for elderly savers is touching, but somehow I don’t see equal concern for the next generation of workers whose future has been permanently scarred by this recession. We’re looking at a lost generation. And we don’t help the elderly on a fixed income if we condemn workers to low output. If you’re really worried about grandma’s future, then start worrying about how workers are going to support grandma if those workers can’t find jobs.

Finally, I get a kick out of your continuing reference to “honest prices” in relation to the 1920-21 recession. It’s funny because all of the arguments you’ve been relying upon were themselves based on GNP data for the period that was recreated in the early 1950s using incomplete Kuznets data and then spliced using 1982 relative prices. In short, it’s junk. The same BEA analyst who did the official Dept of Commerce numbers later (in 1961) went back and redid the analysis using complete Kuznets data and 1929 relative prices. That’s known as the Kendrick’s data set and is much better if you want to analyze price movements during the 1920-1921 recession. That data set will also lead to a very different conclusion than the one you have arrived at. But like I said, I find it ironic that you’re always going on about the importance of “honest prices” but then you hang one of your key arguments on a study that was based on patently dishonest prices.

Bottom 99% income is literally going nowhere at best, into the stiff winds of a globalized labor pool.

But sure, let’s make the income of the 99% buy less!…that’ll increase demand!

Jim – you cannot be stupid enough to buy that tripe, so I’ve got to assume you are selling it.

For the rest of you lurkers (I’m not going to try to sell Jim the Salesman himself) i’s not a “lack of demand” driving this….it’s the 99%’s “inability to consume” due to shrinking monthly purchasing power. But sure, Jim, give them another sound beating….I’m sure better morale is right around the corner.

JDH I hope you weren’t planning on attending any conferences in Texas anytime soon. Sounds to me like Gov. Goodhair might arrest you on the spot for treachery and treason.

Time for the band to strike up the Internationale as we all chant “Long Live QE3”:

http://www.youtube.com/watch?v=suVB3YGIUk0

Why will we better off if savers are deprived of all interest income and penalized by a devaluation of their capital through inflation. The US is mired in debt both governmental and personal. Inflation will write down that debt, but at the cost of our savings. It strikes me as perverse to succor debtors and punish savers. Down that path like only ruin.

2slugs: I’d appreciate your thought, ascercbis as they may be be about my reverse repo idia

Jim: Under the current economic circumstances, what mix of fiscal and monetary policy do you think would be desirable?

Anyone have any thoughts on the efficacy of NGDP targeting vs. price level targeting? Scott Summer, David Beckworth (and apparently Chinn but I am unable to read him any more) and others say that this would would address the fears of inflation /deflation hawks and the dual mandate of the FED.

“Some may read the 12-month (as opposed to 36-month) rates in the graph above as suggesting we’ve left that episode behind and inflation is now headed higher. I believe it’s more likely instead that we’ll soon see the series moving back down with inflation rates well below 2%…”

Rents have been going up quite a bit lately, due to foreclosures and people averse to buying. Owner’s equivalent rent is a large chunk in the CPI. I wonder what that graph would look like with OER stripped out? I wonder if it would show a much lower inflation rate. If the economy continues to go downhill, rents should stop rising as well at some point.

I would like to present here a New Monetary Policy, on the web site below.

https://sites.google.com/site/newmonetarypolicy/

And I would also like to remind the people that we are now in the balance sheet recession, which bust of bubble caused. So some kind of means is needed like above, to rescue the balance sheet of economic entity.

Slug,

The current 3.6% consumer price inflation hurts people. Inflation harms people in so many myriad ways that I wonder if you are a sentient human to be oblivious to them. As for predictability, what a joke. Economic events are not generally predictable, the timing & severity of inflation being no exception.

Having said that, in addition to the current CPI inflation & the gross distortion of relative prices, inflation is in our future. I say this because the monetary base has tripled since Fall’08, & because the Fed will be incapable of raising interest rates significantly because of the level of US debt. They will continue to monetize it for years till people have had enough.

If we are lucky, that will usher in an era of free market-produced money, so that we can have a market economy. Of course, some authoritarian outcome [a la Hitler] is also possible.

I think you’ll live to change your mind on how benign inflation is.

Slug,

As for concern about the next generation of workers, try understanding what caused the current situation.

As for information on the 1920-21 recession, Benjamin Anderson lived through it & wrote of it in the 1940s. Gene Smiley is a decent modern source concerning it.

But really when I’m talking about honest prices, all I mean is that they are market-established via supply & demand. As opposed to the continual distortions created by central banks, or Hoover telling employers not to reduce wages, FDR outlawing price reductions, or govt subsidies or price controls contrary to the will of market participants, et al.

The people I mentioned being hurt by the Fed are the tip of the iceberg, but it is particularly unfair to sacrifice this entirely innocent group for the benefit of banks that should have gone into bankruptcy if we were a free society.

The downside of what the FED is doing has been to give Congress an easy out. This is not a problem the FED can solve, but instead of admitting it, Bernanke persists in proposing one crazy QE scheme after another. All monetary policy can do at this point is to pop the stock market, and even that power appears to be waning. For Bernanke to admit that that he is powerless would be an act of courage. Pretending that QE will work is an act of deception, perhaps self-deception.

Sad to state, but I was actually moved to tears by your posting of the Internationale.

My father moved to this country when he thought it represented what was modern and the wave of the future. Now I can honestly say I am concerned that this is no longer the case.

I have no plans to leave my dear home at present. But I am deeply concerned for the future of my beloved country. And the people I fear most are the Tea Partiers.

And may I offer a Russian version, if only because it sounds so much better in a Slavic dialect than it does in in stupid French.

http://www.youtube.com/watch?v=gXZVhKvvMVU&feature=player_embedded#!

Sad days indeed.

Boy these comments are awful. Most so completely miss the point that they’re “not even wrong.”

And if this is how the relatively informed and literate readers of this excellent blog feel, then the rest of the country must be even more deluded. People need a villain, so why not the Fed?

We’re screwed.

Liquidity ,solvency,duplicity the perennial Trinity for the financial world.

Liquidities have been raising all the assets,in prices in volume since at least ten years.They still have to show their economic benefit (last Econbrowser posts are a proxy).

Liquidity expansion as applied to structural economic problems,debts,lower real incomes,inflation expectation have shown their tolls and further negative impacts on banks assets are to be expected.They may require Q3+n.

Banks lending capacity,has never ever been at such large potential capacity.Banks may have to work out their loans portfolio or debtors incomes to be raised.

Liquidity and solvency a perennial confusion,that everyone would wish to be lasting,in knowing that inflation has always hurt the financial system more than deflation ever did.

Ubiquity

Should Ciceron ” De Officiis”,”la Théorie des climats” Montesquieu,the Law system,Weimar not be written, implemented and lived on this side of the Atlantic,the theory of “your assets are our liabilities” would remain a subprime business and fund managers advises would be praised as they should have deserved.

Presumably Basle 4 should be written and the derivatives addressed more thoroughly.

Bloomberg

“Global Bank Capital Regime at Risk as Regulators Spar Over Rules”

Those who think QE3 is right around the corner are likely to be disappointed. If it comes at all, it’s probably 6-12 months away. The Fed demonstrated with their last announcement that they’re taking a gradualist approach. Next will likely be an announcement that they’ll maintain the current size of their balance sheet for two more years, followed a few months later by an announcement that they’re cutting interest paid to banks on reserves to 0%, followed a few months later by an announcement that as their bond portfolio matures they will be shifting its composition to longer dated bonds. Only when it becomes clear that these half measures have failed, will there be a serious consideration of additional bond purchases, AKA QE3. If another recession occurs before then, even a relatively mild one, then a lost decade becomes a near certainty.

It is interesting that the focus on curing our economic restructuring issues are so targeted on what the Fed should do next.

I’m sure Michelangelo could have made some interesting sculptures out of Play Doh, but they would have less value than starting with fine marble.

Tax, energy, labor, and regulatory policies have pulverized the marble of our system. The Fed simply cannot fix those issues.

Jim –

I think the policy that you’ve outlined is pretty sound in the circumstances. The Fed will do its best to respond.

But if we fall into another recession, and the odds look like we do, then the Fed will again have missed the turning point–not good for credibility.

Similarly, if the accepted wisdom comes to be that this recession is indeed an oil shock, then I would imagine the House E&C/E&P (Sub)committees would be looking to have Bernanke weigh in with the Fed’s perspective. Is oil an enabling commodity? If it is, wouldn’t then the Fed believe the best way forward is to provide more of such a commodity? Isn’t that the stimulus the economy really needs? You get the drift.

Is the Fed prepared to field such a discussion?

“The Fed’s critics [Rick “Good Hair” Perry and Ron Paul], however, see something more insidious [w/r/t QEs].” James Hamilton

Strawman! Strawman! Strawman!

What critics actually say is that while the Fed’s QE programs might encourage speculation in commodities which can lead to short term inflation, the Fed cannot create long term inflation or imbed any particular inflationary expectations in the thinking of economic agents.

And too, inflation in the costs of goods and services unaccompanied by wage inflation is no solution to the problem of reduced aggregate demand, And QE cannot generate wage inflation.

Rob at August 21, 2011 07:52 AM: The Fed would refer to an operation such as you have in mind as a repo rather than reverse repo. It historically would typically use repos when it wanted to temporarily increase the supply of reserves. Here the object is not the supply of reserves but instead the supply of assets such as Treasury securities.

Bryce at August 21, 2011 08:52 AM: I am not sure what you mean by honest prices. I am talking here about the purchasing power of a dollar. In what sense is there a natural value for this magnitude other than the one chosen by the institution responsible for controlling the supply of dollars in circulation? Why is 2% deflation more natural than 2% inflation?

Perhaps you’re implicitly thinking that the current low real rates are unnatural and caused by the Fed. However, as I note in the post, the 10-year real rate just fell 80 basis points for reasons that have nothing to do with the Fed. So whatever you thought had been the natural real rate, you should now think of it as substantially lower. Or perhaps you’re echoing Aaron’s point about relative prices. I have always agreed that once the Fed starts to see relative prices moving significantly in response to its actions, that’s a signal that it’s gone as far as it can.

Tom at August 21, 2011 09:18 AM: On what basis do you conclude that things could not have been worse?

Simon van Norden at August 21, 2011 04:35 PM: You ask an interesting hypothetical question, which I construe to be, if there were no constraints of political feasibility, what should the U.S. do? Although I think this question is worthy, I have trouble finding traction to analyze it. As far as monetary policy is concerned, the most fundamental ingredient is what the public expects to happen in the future– managing those expectations is the basic tool that the Fed could rely on in this situation. Given the way the Fed’s opponents have been reacting, I see no way the Fed could effectively approach this other than what I lay out above– namely, the Fed will have to wait for more convincing evidence of deflation or financial freeze-up before acting. But if you’ll let me wave a magic wand to dispense with that complication, the answer is easy– the Fed should credibly announce a 2.5% inflation target over the next 5 years.

As for fiscal policy, I’d give a similar answer. I see a dysfunctional political process and serious long-run debt management issues. I worry that the current actions of both the Fed and any fiscal stimulus could interact negatively with that for simple issues such as the logistics of weekly Treasury auctions and containing fears that are currently bouncing around Europe like a ping-pong ball. Again, if you give me a magic wand to dispense with all this, what I’d call for is a clear political consensus as to when and how the long-run debt problem is going to be controlled, and given that, I would favor a carefully targeted and explicitly temporary fiscal stimulus.

Given the lack of such wands, what I have instead proposed is that the President focus on the modest tools for job creation that are at his immediate disposal. Alas, this too seems too much to hope for.

Cook at August 21, 2011 12:28 PM, and many others: Who says the Fed has or can solve our problems? Certainly not I. What I instead have consistently said is that deflation would make our problems worse, and that the Fed can and should prevent that.

Jim M at August 21, 2011 06:18 PM: I have no problems with framing the above recommendations in terms of hoping to promote a particular growth rate for nominal GDP over the next two years, if that makes it more acceptable to you.

Bryce has, of course, begged the only really question in his argument. Hamilton’s fear is “inordinate” because Bryce doesn’t share it. Once you’ve decided the answer, the question doesn’t much matter, now does it? Good thing, too, because the argument he offers is pretty odd. Supply and demand DO set prices. There really isn’t much choice, unless we impose price controls, and even then, the market determined price tends to pop out in ways other than the single price at the point of exchange. What Bryce said about Hamilton’s “belief” in “honest” prices doesn’t make any sense, so doesn’t serve as a reasonable critique of Hamilton’s view.

“The fed needs a way to lend directly to people with bubble mortgage debt, to reduce interest cost, pay it down faster, and free up income for savings, investment, and new consumption. Reduce the uncertainty of debt and low income prospects.”

Lend those people their future social security benefits.

JDH wrote:

The yield on Treasury Inflation Protected Securities, whose coupon and par value are guaranteed to go up with any increases in the headline consumer price index, fell by almost 80 basis points over the same period. That suggests to me that lower inflationary expectations have made only a minor contribution to falling nominal yields, with perceptions of a weaker economy the dominant factor.

Professor,

When I read this I started getting excited about the thread, because I made a false assumption that you were breaking away from the 17th and 18th Century mercantilist Quantity Theory of Money. But my hopes were quickly dashed as you fell back on the old theory by encouraging “helicopter” Ben to reload and get back in the air.

What you seem to miss is that the Bush TARP, the Obama stimulus, and the FED QE1, and QE2, massive injections of cash unprecedented in US history and perhaps world history, did not make more than a blip on inflation. All the QTM theorists can do is call for more of what hasn’t worked.

Your analysis is spot on. The perceptions of a weaker economy – and dare I say more than perception, reality – show that all of the transmission mechanisms that QTM theorists rely on are broken. The result is a dollar that is falling relative to the major world currencies (the $US just hit a low against the Yen) and is absolutely crashing relative to gold. But because the QTM theorists define inflation as rising prices rather than a weakening quality of the monetary unit, they do not see inflation.

So what is holding down prices? Consider massive loss of wealth in the real estate crash that is continuing because of government efforts to prevent the deleveraging. And then consider the massive unemployment created by government taking from the productive economy and giving to idle workers in the form of unemployment insurance.

But where is the money going? Consider that excess bank reserves are greater than $1.5 trillion as of end of July 2011 and growing toward $2 trillion. And that does not include the huge dollar reserves being held overseas.

Now consider the foolishness of QE3. In August 2011 the debt ceiling was raised with essentially no limit. The Treasury will now roll over debt at low interest rates. The FED bought 80% of Treasury debt in 2009 so we can be assured that it will buy about the same or greater with a QE3.

So what is the bottom line of this transaction? In 2010 we spent $413 billion on interest alone. In 2011 we maxed out the approved debt ceiling so the amount of interest will increase significantly by year end. But then in August 2011 the debt ceiling was essentially removed so the amount of interest owed by year end 2011 will be amazing. But where is that money going? As we have seen primarily into excess bank reserves. So we are borrowing, sending our interest payments through the roof, and why? To park dollars in bank reserves. We are destroying our credit rating for absolutely no return, then see it as acceptable because the CPI is not increasing.

Insane!

Odds of a Recession:

Here’s a piece from the NYT on the Philly Mfg Survey. http://www.nytimes.com/imagepages/2011/08/19/business/20110820_CHARTS_graphic.html?ref=business

Note the troughs on the graph. Every time the Philly survey fell to current levels, there was a recession. Seven for seven times. No false positives, no false negatives. That is a crystal clear pattern.

Does that mean there will be a recession now? No, the economy may be different in some respect–but then you’re really forced to establish what that difference might be. How has the economy changed that the drivers are different from the last seven times? And note that these recession correlations also hold for oil prices (100%) and the stock market (at least 50%). So the simple models are really shouting “recession”.

And yet, over at CR, we have a number of quotes–some from the Fed–looking at 2-3% growth going forward.

Not everyone can be right.

It appears that allowing or forcing higher inflation is new path for Federal Reserve actions.

However, just on March 2 of this year, at Congressional hearing, Bernanke said:

“… we are going to be looking very carefully at inflation expectations and making sure that people remain confident that inflation will stay low and we will address that. Again, I want to reassure you that central bankers have learned the lessons of the 1970s. We will not allow inflation to get above low and stable levels.”

Professor,

What lessons of the 1970 have the central bankers learned? Hopefully, it is not that stagflation is impossible, and that any inflation must be transitory due to presence of weak economic conditions?

Here are the official inflation numbers:

CPI-U for July 2011 is 0.5% for 1 month!

CPI-U for 12m is 3.6%.

CPI-W for 12m is 4.1%.

Michigan Inflation Expectations is 3.4 as of Aug 12, 2011.

All these inflation numbers are way above 2% or 2.5% inflation target.

The government is always right, by definition.

Hopeless! The FED’s most important job was to control credit expansion, so that goods production would be sufficient to service debt… At that, it was a colossal failure – conning itself first into the illusion that GDP represented value rather than the tradable goods that the economy could produce. Next, that more pump priming and liquidity generation would allow the economy to grow faster than the leverage to which it became increasingly bound. Finally, it graduated to criminality, buying non-performing assets from financial institutions far above market prices, rewarding fraud and political corruption…

From my perspective, policies of deflation and inflation end up in the same place with America’s huge debt burden (+$50-Trillion in total credit market debt)… Credit collapse, allows deflationary forces to quickly reduce costs (price levels) sufficient for America to balance its foreign trade …. Conversely, continued credit and money expansion will inflate the currency, slowly increasing tradable price levels until the devalued currency has reduced imports and domestic costs sufficient for America to balance its foreign trade.

Policy makers in the Federal Government, The FED, and the BIS, rightly believe that slow policy change and counter-cyclical spending will protect the most people from the ravages of a banking and credit collapse… What they don’t acknowledge is that their failure to prosecute fraud and corruption and their failure to properly regulate financial markets simultaneous with preventing market corrections has produced an insidious cancer in society. The new money is supporting the same corrupt institutions and agents responsible for the present crisis! Public support is quickly evaporating, and the environment is perfect for the next great populist… ready for a military adventure into Abyssinia, Poland, Iraq, or Lybia to occupy the public’s attention.

JDH:

By honest prices, I mean those established by supply & demand. In the case of that most central price, the interest rate, it should be the supply of savings & the demand to borrow those savings. Instead the Fed lends ungodly amounts created with a mouse click, never saved. This is multiplied by the banks, who are obtaining funds for virtually nothing.

Obviously, the optimal answer would be market-produced money (which will tend to be money backed by something–wouldn’t most people prefer money that is backed by something rather than nothing?).

Relative prices are the prime concern well before any CPI inflation. It is impossible to triple the monetary base in less than 3 years & not distort the market’s view of the supply of savings. Relative prices are distorted all through the economy, emanating from this Fed-generated lie about the supply of savings. Thereby, savers & entrepreneurs confront misleading incentives, just like they did during the housing bubble.

Permit me to add the observation that the levels of indebtedness worldwide would never have reached these levels without the facilitating arm of fiat money greasing the skids. What a wonderfully devious invention.

Okay, who actually feels that their dollar buys only 3% less than it did three years ago? Because pretty everything I buy on a regular basis is much more expensive. I just don’t see these immense purchasing power my dollar is supposed to have. (and general technology improvements are supposed to be ignored for purposes of determining whether there’s “deflation” … hence the lack of CB concern for computer deflation).

Note: do not answer my question unless you actually pay the bills in your household.

I’m a little irked by how all this supposed deflation disappears the moment you try to run a household budget, you know?

OT but I have a question for someone who understands muni finance and credit. My city is going to float $120 million in bonds to finance a water upgrade. They plan to offer the bonds to the market in 2 or 3 years. In the meantime the city council just voted to authorize $37 million in preliminary spending towards this project using commercial paper.

This vote was done without discussion or debate. I had never heard of commercial paper being used in this way. My instinct is that this could be dangerous, like a bankruptcy inducing event. Is this sound?

JDH: Thanks for your answer!

Steve Kopits: That manufacturing survey certainly is striking. Several other indicators are less gloomy. The consensus seems to be that the odds of a recession are under 25%.

1) Survey of Professional Forecasters: The last quarterly survey (also run by the FRB Philadelphia) had an August 2nd cutoff date. Forecasters were asked for the probability of real GDP growth JDH last updated the Hamilton-Chauvet index back on July 29th; they put the recession odds at 14.4% (but that was for 2011Q1.)

Bryce So you’re infatuated with Walras’ Auctioneer. Imagine for moment such a leviathan sprang to life. What do you think the “honest price” market clearing interest rate would be? Hint: The answer could be less than zero.

As to world indebtedness, you might as well talk about world creditedness. For every dollar of debt there is a dollar owed to a creditor. The global problem today is not too much borrowing, it’s too much desired saving for the level of income.

Finally, all the Fed has done is credit excess reserves. Those reserves are just sitting there earning 0.25%. That is not an increase in the money supply in any meaningful sense.

The main problem is that the definition of a recession is itself obsolete.

A recession is deemed to have ended just when the line starts to turn upwards. NOT when the previous high-water mark is reached. That is problem #1 – we should not consider the 2008 recession to have ever ended, since we are still 5 million jobs from the peak (let alone accounting for pop. growth).

So the next few months should certainly count as a recession, even if the technical definition is not precisely met.

Thanks, James, for being pro-QE3. Not enough people realize how important it is to prevent inflation from going below 2%. Nor do they realize how MUCH printing would be needed to keep it above 2%.

Even a $3T easing would not make inflation rise to 4%.

Silas Barta,

People focus on just selective items when judging ‘inflation’.

Have you seen how much cheaper electronics have gotten in 3 years due to Moore’s Law?

Have you seen that 25% of the homes in the US are in negative equity? They DESPERATELY need inflation.

People have a huge cognitive dissonance about complaining about rising food prices, while also whining that their home equity is zero or negative. Cognitive dissonance.

I want a big QE3, that is not afraid to push inflation up to 3%.

“I want a big QE3, that is not afraid to push inflation up to 3%.” GK

GK,

Can you describe the QE3 you want (what the Fed’s actions would be) and via what transmission mechanisms those Fed actions would push inflation up?

Is the mechanism solely psychological — that is, altering the expectations of economic agents? Do foreigners bailout of treasuries leading to a dollar devaluation and an increase in import prices?

I’m puzzled.

GK:

According to cpi, during the past two years, the cost of food at home increased by about 6.1%. Nevertheless, my own grocery bill just about doubled during the same time period, for about the same grocery list at the exact same store.

There is a cognitive dissonance here, and it is between my overall grocery bill increase during the past two years and what is reported by cpi.

Thank you for saying this in such clear terms. As bad as things may be, adding deflation to the mix would be worse.

Unfortunately with a large number of dissenters, I expect the Fed to be divided and potentially behind the curve should deflation intensify.

> Have you seen that 25% of the homes in the US are in negative equity?

> They DESPERATELY need inflation.

Riiiiiiiiight…..because declining purchasing power coupled with widespread unemployment and underemployment will allow them to….oooops….still lose their home, despite reflating it’s price back beyond the ability of anyone else to buy it (as a multiple of income).

> I want a big QE3, that is not afraid to push inflation up to 3%.

Yeah, that should asphyxiate the economy right quick….and settle once and for all that QE will not repair the economy at all….let’s do it! Don’t be shy!

Maybe it should be even bigger! We wouldn’t want Kruggles to claim the stimulus just wasn’t big enough…yet again….

Sometimes, the bandaid of stupidity can only be ripped off….

I bet you guys would throw a third bucket of water on a kitchen grease fire too, because, of course, the first two buckets must not have been big enough.

@GK: Technology improvements are supposed to be ignored for purposes of determining monetary policy’s impact on price levels, remember? That’s why central bankers are unconvinced of the goodness of deflation when people point to falling computer prices?

So no you don’t get to (selectively) claim low inflation by (selectively) invoking tech-based price drops. I elaborate here.

Again, isn’t it funny how the disinflation disappears the moment you try to predicate a household budget on it?

Btw, I’m not complaining about my house losing value or my negative equity position. I was one of those morons that didn’t get suckered into the bubble. My complaint is that homeowners won’t let go of houses are their supposed new “low” prices!

Inflation and deflation are monetary phenomena. The Fed is a powerful entity but in the end money is created when banks lend and destroyed when banks fail to lend (either out of fear or lack of customers) or loans go bad.

If deflation sets in due to less money creation than destruction, then people can make money simply by putting cash under the mattress. The more people do that, the more money they can make doing it, which one could think of as a cash bubble but for the fact that there could be no end to it. Then the central bank is required by its mandate to do everything in its power, criticized or not, to entice people take that money out of their mattresses and find something else to do with it.

If they put it into speculation that is of course a symptom of the fact that they don’t see business being profitable. But as the Professor said, the Fed’s job is not to heal all things but merely in this instance to keep people from hiding cash under the mattress, or its abstract equivalents.

I think economics needs innovation. We have a lot innovation in our lifes like new technology in telecom -Ipad, new electric cars, new alternative energies and new financial innovation.

For economic policies, the economists must think out of the box. QE is one of policy innovations to tackle the deflation if we are at zero rate.

I think the quasi-fiscal polciy may be the major drivers for the US umemployment back to normal level. I think Federal Reserve should inject one time 5 trn funding facilities to tackle all problems in US in many ways. First, US face mortgage problems. People are struggle to pay their debts. Fed should se up funds to refinance the American’s debts at 0% rate at maybe for the first 200,000 USD for every borrowers. This will help the finanical burden of people.

For employment, Fed should give 0% rate funding for government and state governments to expand investments and employment especially infrastructure projects.

For private sectors, Fed should set up the special credit facility at cheaper cost to all SMEs and people to do businesses.

I think 9% unemployment and >15% real umployment rates must solve quickly and quasi-fiscal policies that we have seen in developing worlds may be useful for developed world. US, Europe, UK must use these policies innovations to solve the umployment as quickly as possible to solve not only economics problems but also social problems.

As several have said above in one form or another, does the inflation Ben creates do any good, or does it merely lower real wages?

I can see little real effect of QE other than to devalue the dollar and export some of our deficient AD problem. But that policy may prove short sighted. The euro ‘belongs’ at about $1.25. At over $1.44, it is having a serious adverse effect on the member economies. The chances of a euro sovereign debt crisis, which would surely have much worse effects than Lehman’s collapse, are not independent of Ben’s policies. Is the notion to go ahead with more QE, and then deal with the consequences?

Those decrying Fed policies may be proven right, although I’m not sure they would be very unhappy about it.

> If deflation sets in due to less money creation

> than destruction, then people can make money

> simply by putting cash under the mattress.

“People” (the bottom 80%-99%) don’t have cash to stuff in their mattress. That’s the whole point — they are broke and fighting to stay employed, and

their one major retirement “investment” (speculation in easy-money-driven-overpriced housing) has cleaned their balance sheet clock. Their income

could never support reflation, so once the housing

prices finally topped out, the housing speculation party ended for another 80-year generation.

To the degree “People” manage to scrape together some cash they can save, they’re desperately trying to save a bit because their retirement plans are completely blown and a good portion are saving up first and last months rent for the day they get foreclosed/evicted.

MEANWHILE….

The Banks have cash. It’s piling up. Nobody viable to lend to. So maybe you mispoke when you said “People” — did you really mean to point out that Banks can make money by just sitting on the cash and letting deflation rip? I’d buy that argument. In fact, that’s exactly what’s happening and will continue. Banks have balance sheet problems and a friendly yield curve, so they just recycle the cash without it ever touching the real economy.

But how is making “People” poorer going to force “Banks” to NOT sit on the cash the Fed throws at them? The Bank cash from stimulus is going to go absolutely nowhere, for a long time. And worse, the dollar devaluation is going to keep the “People” (you know, the ones who participate in the real economy) from ever repairing their own balance sheets.

Good money after bad…

Nevertheless, my own grocery bill just about doubled during the same time period, for about the same grocery list at the exact same store.

Clearly you are eating too much (as are most Americans).

Actually, processed food is not only junk, but is market up 4X to 5X from the cost of whole foods from the farmer’s market. Cereal costs $4/box for 20 cents of grain, for example.

> Clearly you are eating too much (as are most Americans).

Maybe his weekly bill went from $40 to $80.

Clearly you are not good at logic (as are most

stereotypes….ironic self reference intended).