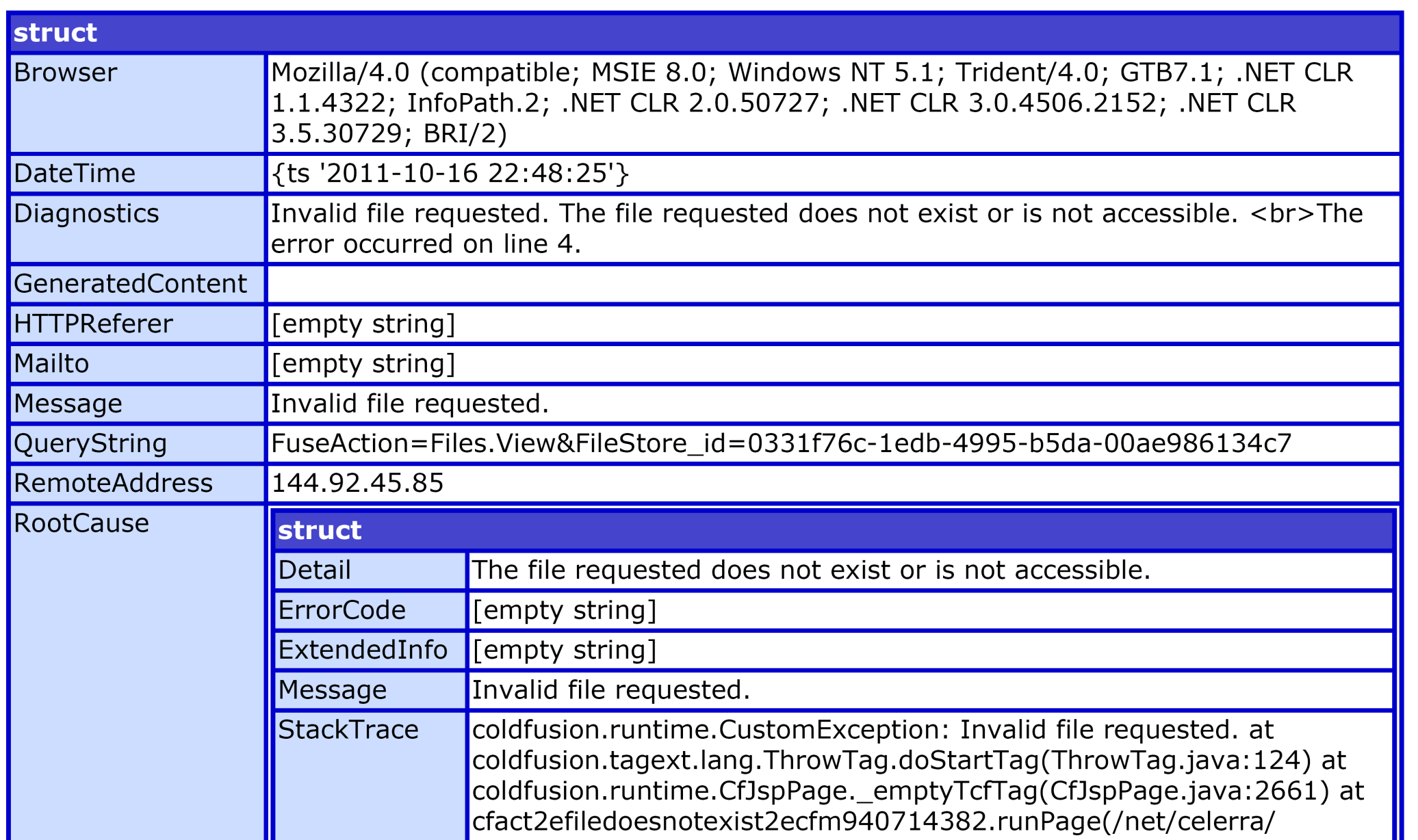

When I click on the link on the website for The Real American Jobs Act (officially, “Jobs Through Growth Act”), this is what I get:

Perhaps this is emblematic. Fortunately, the “bill” is also available directly on Sen. McCain’s website. Below is an annotated copy:

THE JOBS THROUGH GROWTH ACT The Republican Plan To Put Americans Back To Work SPENDING REFORM

Require a Balanced Budget Amendment to the Constitution – (S.J.Res.10, Sen. Hatch)

Limit the ability of Washington to raise taxes to pay for runaway spending and would enshrine firm tax and spending limitations in our Constitution. Job creators will have certainty that Washington will not continue to grow unchecked and consume more and more resources that would otherwise be available to fuel job creation.

Enact Enhanced Rescission Authority – (S.102, Sens. McCain & Carper)

This bipartisan proposal would give the President the statutory line-item veto authority to reduce wasteful spending. This is an important tool to ensure that tax dollars are spent wisely and efficiently. Congress would vote up-or-down on proposed spending cuts.

A constitutional amendment for a balanced budget sounds just fine for the campaign. If it were passed, it would have to be approved by a majority of states. How long would that take. I must say that incorporation of economic requirements into constitutions have not always worked out; Argentina’s convertibility law showed that it wasn’t a cure all for political gridlock.

TAX REFORM

Reduce and Reform Individual, Small Business and Corporate Taxation

A simplified tax system will keep more money in the hands of consumers, small businesses and job-creators. Reduce individual income tax rates to a maximum of 25 percent with two marginal rates. Within 90 days, the Senate Finance Committee will report back on recommended changes in credits and deductions to make this revenue neutral.

Reduce the top corporate tax rate to no more than 25%. Within 90 days, the Senate Finance Committee will report changes in credits, deductions and subsidies, with priority given to eliminating all industry-specific provisions and revenue neutrality.

Repatriation and Territorial Reform

Our current corporate tax code is outdated and is a major reason why there is up to $1.4 trillion in foreign earnings trapped overseas in countries where U.S.-based multinational companies do business. Under a reformed territorial system of corporate taxation, this plan would create a permanent incentive for companies repatriating foreign earnings to the U.S. economy.

Withholding Tax Relief Act – (S. 164, Sens. Scott Brown, Olympia Snowe, David Vitter)

Removes the undue burden on businesses of all sizes by repealing the provision in the tax code requiring federal, state and local governmental entities to withhold 3% of payments due to private vendors who supply their goods and services.

In Lost Decades, Jeffry Frieden and I argue for tax reform that includes elimination of many tax expenditures. It is unclear to me whether there is any reason to believe that the rates indicated would raise sufficient revenue, given that the bill does not specify which tax expenditures would be eliminated (see this post for amounts). Moreover, I find it remarkable in an era of increasing income inequality, this proposal seeks to increase the regressivity of the tax system.

The decrease in the corporate tax rate should, in some models, decrease the user cost of capital, and hence raise investment. Presumably, this would increase employment — although the answer surely depends in part upon whether capital and labor (and what types of labor) are complements or substitutes.

Now, there seems to be some belief that the effective corporate tax rate in the United States is much higher than in the rest-of-OECD. This view is cast in doubt by this CBO study. I also wonder at the time frame in which a reduced corporate tax rate would induce either more rapid employment growth (which is not guaranteed, if one thinks about relative after-tax costs of labor versus capital) or income (think about the time horizon in these supply side models examined by the Bush Treasury)[0].

The most reprehensible of proposals is the holiday on tax repatriations. As I noted in this post regarding the effects of the 2005 experiment, a repeat of this policy is highly unlikely to spur lots more R&D spending, or capital investment. We can expect lots more dividend payouts (to the wealthier households who hold the bulk of shares directly). So if we want to boost the higher income households’ after tax income, then this is a way to proceed. But don’t look for a big immediate boost in employment. For more detail, see the forthcoming Journal of Finance paper on the topic, by Dharmapala, Foley and Forbes:

Repatriations did not lead to an increase in domestic investment, employment or R&D—even for the firms that lobbied for the tax holiday stating these intentions and for firms that appeared to be financially constrained. Instead, a $1 increase in repatriations was associated with an increase of almost $1 in payouts to shareholders. These results suggest that the domestic operations of U.S. multinationals were not financially constrained and that these firms were reasonably well-governed.

Returning to the bill:

REGULATION REFORM

Repeal the Job-Killing Health Care Law Act – (S.192, Sen. DeMint)

Repealing and replacing Obamacare will remove over $550 billion in new taxes, over $300 billion in higher health care costs, and $2,100 in increased family insurance premiums from employers and workers. The job-destroying policies of Obamacare are estimated to cost the economy at least 800,000 jobs and hit small businesses especially hard. Studies have demonstrated Obamacare – not yet fully implemented – is a huge driver of unemployment. Economists have referred to the passage of Obamacare as a “structural break in job growth,” an economic term describing the correlation between a single event and resulting job-loss. Obamacare ruined our 2010 recovery slowing private sector hiring to one-tenth of its previous clip, down to just 6,500 jobs per month. In addition, nearly 80 percent of small businesses and 70 percent of all businesses may be forced to drop their current health care plans.

Wow — talk about the correlation is not causality rule being discarded. I wondered what economist was being quoted. It was The Heritage Foundation’s James Sherk. Literally, the proof is a graph with two lines drawn through employment data. I could eyeball a break that was before the passage of PPACA. Here’s the graph:

Figure 1 from Sherk (2011).

Well, it’s always scary to see regressions (either statistical or “ocular”) from the Heritage Foundation, and this time is no different. I estimate over the same sample starting in 2009M01 the regression of net change of private payroll employment on a constant (which is appropriate since the series appears to be difference stationary). I find a Chow test does reject the no break at 2010M05. It also does at 2010M04, and 2010M03 and 2009M05 and … I also plot formal structural break tests, CUSUM and one step-ahead recursive residuals.

Figure 1: CUSUM test for regression of first difference of private employment on constant, 2009M01-2011M09. Source: Author’s calculations based on BLS data (September release).

Figure 2: One step ahead recursive residuals test for regression of first difference of private employment on constant, 2009M01-2011M09. Source: Author’s calculations based on BLS data (September release).

So, one can find a lot of evidence for different break points; and in any case…correlation is not causation.

(And of course, we must remember it was Heritage which brought us the hysterically funny “analysis” of the Ryan plan, discussed before [1] [2] [3] [4]. I miss Bill Beach!)

Is uncertainty important? I think so, but I think it is not so clear cut that the measures the Republicans propose would address it (see Greg Ip). In fact, I would argue a much better case is for macroeconomic policy uncertainty to be important; see Baker, Bloom and Davis (2011) attempt to measure the impact. Overarching this is the fact that surveys of small businesses indicate that deficient demand, rather than regulatory burdens, are cited as the most important negative factor facing such firms.

Medical Malpractice Reform – (S. 197 – The Medical Care Access Protection Act)

Medical malpractice abuse in the US health care system is out of control. Junk lawsuits drive up the cost of health care and the system must be reformed. Reform Medical Malpractice law based on Texas “stacked caps” to improve patient access to health care and provide improved medical care by reducing the excessive burden the liability system places on the health care delivery system.

Financial Takeover Repeal – (S.712, Sen. DeMint)

We need to lift the burdens the Dodd-Frank bill placed on community banks and the small businesses that depend on them for financing, from oppressive new regulations to the resulting uncertainty that prevents growth. Repealing Dodd-Frank will also significantly reduce financing costs for consumers and businesses, as well as reduce costs to manufacturers in hedging their risks in the financial markets. Research compiled by the Financial Services Roundtable indicates that the cumulative weight of new financial rules, from Dodd-Frank to similar efforts abroad, could cost the U.S. economy 4.6 million jobs by 2015.

Regulations from the Executive In Need of Scrutiny (REINS Act) – (S.299, Sen. Paul)

The REINS Act would require Congressional approval by joint resolution of any federal rule that would cost the economy $100 million or more.

Regulation Moratorium and Jobs Preservation Act – (S.1438, Sen. Ron Johnson)

Prohibits any federal agency from issuing new regulations until the unemployment rate is equal to or less than 7.7 percent (the unemployment rate in January 2009).

Freedom from Restrictive Excess Executive Demands and Onerous Mandates Act – (S.1030, Sens. Snowe and Coburn)

Streamlines and strengthens the Regulatory Flexibility Act by requiring regulators to include “indirect” economic impacts in small-business analyses, requiring periodic review and sunset of existing rules, and expanding small business review panels as a requirement for all federal agencies, instead of just the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA).

Unfunded Mandates Accountability Act – (S. 1189, Sen. Portman)

Requires agencies specifically to assess the potential effect of new regulations on job creation and to consider market-based and non-governmental alternatives to regulation; broadens the scope of Unfunded Mandate Reform Act to include rules issued by independent agencies and rules that impose direct or indirect economic costs of $100 million or more; requires agencies to adopt the least burdensome regulatory option that achieves the goal of the statute authorizing the rule; creates a meaningful right to judicial review of an agency’s compliance with the law.

The Government Litigation Savings Act – (S.1061, Sen. Barrasso)

Reforms the Equal Access to Justice Act (EAJA) by disallowing the reimbursement of attorney’s fees and costs to well-funded special interest groups who repeatedly sue the federal government. The bill retains federal reimbursements for individuals, small businesses, veterans and others who must fight in court against a wrongful government action. By eliminating taxpayer-funded reimbursement of attorney’s fees for wealthy special interest groups, the legislation helps eliminate repeated, procedural lawsuits that delay permitting, exploration and land management.

Employment Protection Act of 2011 – (S.1292, Sen. Toomey)

Requires the EPA to analyze the impact on employment levels and economic activity before issuing any regulation, policy statement, guidance document, endangerment finding, or denying any permit. Each analysis is required to include a description of estimated job losses and decreased economic activity due to the denial of a permit, including any permit denied under the Federal Water Pollution Control Act.

Farm Dust Regulation Prevention Act – (S.1528, Sen. Johanns)

Prevents the EPA from regulating dust in rural America, while still maintaining protections to public health under the Clean Air Act. The EPA is currently considering a dust standard that would, by the agency’s own admission, double the number of counties that are in nonattainment status and put activities like tilling soil, harvesting crops and driving down unpaved roads under the purview of federal regulations. Under this bill, the EPA would still be allowed to regulate dust, but only after demonstrating scientific evidence of substantial adverse health effects of farm dust.

National Labor Relations Board Reform – (S.1523, Sen. Graham)

From back-door card-check, to threatening jobs in South Carolina, the out-of-control National Labor Relations Board (NLRB) is paying back union officials at the expense of worker rights and jobs. To create more jobs, legislation prohibiting the NLRB from stopping new plants and legislation to prevent coercive, quick-snap union elections should be passed.

Government Neutrality in Contracting Act – (S.119, Sen. Vitter)

Repeals the President’s order requiring government-funded construction projects to only use union labor. This would reduce costs of federal jobs projects by as much as 18 percent.

Financial Regulatory Responsibility Act – (S. 1615, Sen. Shelby)

Requires financial regulators to conduct consistent economic analysis on every new rule they propose, provide clear justification for the rules, and determine the economic impacts of proposed rulemakings, including their effects on growth and net job creation.

Regulatory Responsibility for our Economy Act – (S. 358, Sen. Roberts)

Codifies and strengthens President Obama’s January 18th Executive Order that directs agencies within to review, modify, streamline, expand, or repeal those significant regulatory actions, that are duplicative, unnecessary, overly burdensome or would have significant economic impacts on Americans. It directs meaningful review and possible revocation of regulations counter to our nation’s economic growth.

Reducing Regulatory Burdens Act – (H.R. 872, Rep. Bob Gibbs)

Eliminates a new duplicate EPA regulation that will cost millions of dollars to implement without providing additional environmental protection. The current rules for pesticides, which have been in place for decades, will remain in force.

Certainly, regulations can in certain cases reduce economic activity. Sometimes dead weight losses are incurred. Of course, in markets with monopoly power, or asymmetric information, one can over- production of certain goods and services. So, perhaps in order to maximize GDP, more mountaintop removal mining of coal would be optimal. That doesn’t necessarily mean welfare would increase. But the real question for purposes of this post is: Over what horizon one expects elimination of all farm dust regulations to noticeably affect employment, if ever?

DOMESTIC ENERGY JOB PROMOTION

The Domestic Jobs, Domestic Energy, and Deficit Reduction Act – (S.706, Sen. Vitter)

Will require the Interior Department to move forward with offshore energy exploration, and create a timeframe for environmental and judicial review.

The Jobs and Energy Permitting Act – (S.1226, Sen. Murkowski)

Eliminates confusion and uncertainty surrounding the EPA’s decision-making process for air permits, which is delaying energy exploration in the Alaskan Outer-Continental Shelf (OCS). It will create over 50,000 jobs and produce one million barrels of oil a day.

The American Energy and Western Jobs Act – (S.1027, Sen. Barrasso)

This bill streamlines the preleasing, leasing and developmental process for drilling on public land and requires this Administration to create goals for American oil and gas production.

Mining Jobs Protection Act – (S.468, Sens. McConnell, Inhofe, Paul)

Requires the EPA to “use or lose” their 404 permitting review authority. Under this bill the EPA will have 60 days to voice concerns about a permit application, or the permit moves forward. Any concerns voiced by the EPA would need to be published in the Federal Register within 30 days.

Energy Tax Prevention Act – (S.482, Sen. Inhofe)

Prohibits the EPA from using the Clean Air Act to regulate greenhouse gases. It is estimated that greenhouse gas regulation could result in a loss to the economy of as much as $75 billion and 1.4 million jobs by 2014.

Repeal Restrictions on Government Use of Domestic Alternative Fuels

Repeal Section 526 of the Energy Independence and Security Act of 2007, which prohibits federal agencies from contracting for alternative fuels, such as coal-to-liquid fuel. This provision stifles the coal industry and puts our national security at risk by limiting the Pentagon’s ability to get its fuels from domestic sources.

Public Lands Job Creation Act – (Sen. Heller)

Eliminates a burdensome and unnecessary delay in approval of projects on federal lands by allowing the permitting process to move forward unless the Department of the Interior objects within 45 days. This will streamline the permitting process for domestic energy and mineral production on BLM lands without compromising environmental analysis.

The increases in jobs that are cited (I’ll take their word on the count) would occur years from now. While non-negligible, they pale in comparison to the 140 million currently employed.

EXPORT PROMOTION

Renew Trade Promotion Authority – (S. Amdt. 626, Sen. McConnell)

Provide the President with fast-track authority to negotiate trade agreements that will eliminate foreign trade barriers and open new markets for American goods.

I’m for free trade. If free trade agreements do in fact liberalize trade (and yield greater trade creation than trade diversion — see a trade textbook for explanation), then this would be a good thing, when coupled with policies to help those dislocated by trade. But even estimates of 70,000 jobs created by the S.Korea-US FTA are for the long run, years in the future, and are small relative to the labor force.

Really, it is macroeconomic policies that are essential for increasing employment in a noticeable fashion. And to the extent that uncertainty is a drag on the economy, the Republicans can help by avoiding further intransigence when it comes issues like the debt ceiling debate.

Update, 9:42Pacific: From Politico:

At a press conference with 11 GOP senators on Thursday, Republicans cited the conservative Heritage Foundation to claim that the plan would create 1.6 million private sector jobs. They said they did not yet have an official cost estimate.

I could not find any reference on the Heritage website to this estimate.

Ironic considering he is from Nebraska, a state who had just a little bit of a problem with their topsoil during the dustbowl. He must have missed that month in high school history class.

Haven’t read all of it. Agree mostly.

One quible, regulatory burden is not as big a factor to existing small businesses, it likely is for potential new ones, which are the real growth generators. Of course, low demand is a problem for them too, which will only be fixed by some type of jubilee.

Right now, employment is probably 4-6 million jobs below where it would be for any other recession since WWII. The economy, unlike any other recession since 1948, has not materially recovered employment levels. (See Calculated Risk’s chart: http://cr4re.com/charts/charts.html#category=Employment&chart=PercentJobAlignedSept2011.jpg) What exactly is the Preident doing other than riding around in a bus?

I see all the initiative coming out of the Republican camp. What does Obama have other than either i) new deficit spending for jobs, or ii) taxes increases for more spending on jobs?

Too damn much to read all the way through before I finish my second cup of coffee, however, the line item veto caught my eye..

Maybe someone with knowledge and experience with states that have a line item veto could fill us in on the line item wars between governors and legislatures. I could see someone programming a computer game after this idea.

I’m all for focusing on energy jobs, but the jobs are already there. There’s just no one qualified to take them.

We’ve produced far too many Marxist academics (if #OWS is any indication) and not enough piping designers. I can’t hire a new piping designer at any price, and certainly hope that the increase in piping designer salaries will bring more of them into the field. But I guess our resident Marxist academic economist 😉 is probably correct, that is going to take years.

You know, I’d just like the US to create economic and regulatory conditions where I don’t need to reinvent my engineering career every 4 years. I started out in energy, which was booming in Asia in the mid-90’s. That crashed, and I switched to natural gas fired generating facilities, which everybody thought was the future in the early ’00s, before that crashed. Then it was on to diesel engine emission controls, when it looked like the Detroit 3 were going to go big into light duty diesel. Then that crashed, and now I’m back into booming energy. I’ve only been out of school for 15 years!

It’s kind of ridiculous, don’t you think?

Steven:

Perhaps I’m being a simple minded Keynesian but what other options are there besides deficit spending to create new jobs? Most everything I’m aware of (excluding monetary policy) is included in the silly bill above.

As for tax increases, doesn’t it make sense to raise taxes on those who spend the least of their income? Raising taxes in this way would preserve aggregate demand the most…

Maybe I’m just wrong, please enlighten me.

I’m a fiscal hawk, but I’ve never understood the rationale behind a balanced budget amendment. Government spending has a countercyclical component due to unemployment insurance payments, welfare, and other programs, yet government revenues are procyclical. Ergo, the government will naturally run a deficit during a recession. (Whether we could trust the government to run a surplus during growth periods so the surpluses and deficits average out to zero is another question.) If we had a balanced budget amendment, wouldn’t that require the government to reduce spending when it makes the least amount of sense? It’s not even a Keynesian-versus-some other economic theory debate; it comes down to a question of whether or not someone understands the natural impacts of recessions on government finances.

Brian, yes. And certain infrastructure improvements should be planned in advance and kick in in severe recessions, as these projects interfere with economic activity and do the least damage when growth is low.

But it doesn’t have to always be more spending, we can run a deficit by reducing revenue and produce more sustainable benefit.

Just wait, Engineer, for what’s coming!

We just prepared a forecast engineering services for offshore and subsea, and there’s a lot of growth on the horizon. Do we have the engineers to support that growth? Not clear that we do. It’s going to be a great time to be an engineer.

Oh, and I’m not even speaking of Alaska. To tie in the Chukchi, it’s 100 miles of pipe offshore and 300 more back to Prudhoe Bay. I keep telling my friends at Shell that the US goverment is going to ask them to accelerate the Alaska program. They don’t believe me (yet), but the oil supply and demand outlook suggests that’s entirely possible.

I think that to make possible a new Dust Bowl is not a good way to create jobs.

Because the reason there is a Dust Farm Regulation is exactly that: to make dificult to have a new Dust Bowl.

Dave –

I would argue that the numbers suggest we’re (oil) supply-constrained, not demand- constrained. (That might be an implication of Engineer’s comment, I’d note.) So it’s questionable whether stimulus will work. It’s hasn’t so far (other than the necessary stabilizing of the banks), and we have spent a truly vast sum.

Second, I have to admit mental fatigue with chronic budget deficits. It’s constantly hanging out there, and it prevents us from moving on. We’re trying to preserve some previous level of consumption that’s no longer sustainable. The sooner we deal with that, the sooner we can turn towards the future.

As for taxes: I am well aware that I am one of those the government is looking to tax. But what is being asked? If it’s to bring revenues back in line with historical Fed spending norms (ie, max 20% of GDP), then OK, let’s do it. Let’s drop the payroll tax holiday, let the Bush tax cuts expire on everyone, and if you really want, get rid of the deduction for health insurance. That will close the gap on the revenue side. Those making more will pay more.

But my support for any tax increase is contingent on an iron-clad program to bring Fed spending to 20% of GDP. Not in 2020 or 2050. But 2014/2015 with immediate and material spending cuts pari passu with tax increases.

So let’s do what we need to do, and let’s do it now.

Franklin D. Roosevelt was born into wealth. However, when he was elected president he was hailed as the champion of the working man. But, he was also American capitalism’s greatest champion. He knew, by the time he was inaugurated in 1933, that his ultimate opponent would be the Communist Party not the Republican party. His task was to reform capitalism or lose capitalism. And reform capitalism he did; laws were passed, and regulatory agencies created, all with the objective of eliminating the excesses of capitalism which caused the Great Depression. Where the free markets could effectively protect the public interest, they were permitted to operate mostly unfettered. However, where competitive markets neither existed nor were strong enough to protect the public interest, the federal government would. And the next 40 years was to see the greatest increase in prosperity for the American middle class ever; but it also saw increased prosperity for all Americans, as well as the enrichment and strengthening of American capitalism itself.

However, the malefactors of great wealth had been required to yield majority of their wealth to serve the public. And they resented the burdens the federal government had placed on them, notwithstanding that they too had prospered. Their enemy was the federal government; and they possessed sufficient funds that they were ultimately able to convince the majority of the electorate that the federal government was their enemy too. Hence, the last 30 years have seen a wholesale attack on the laws and regulations which protected the public from corporate excess, the decimation of the middle class, and over 90% of the increase in national wealth accruing to the top 1%.

Taxes: Just about every Republican politician alleges that: “we do not have a taxing problem, we have a spending problem;” but this is a lie. Everyone knows that Ronald Reagan reduced income taxes (more than one half for the wealthy); what is less commonly understood is that he offset this by raising payroll taxes(more than double for most self-employed). Today, most American families pay more in payroll taxes than they do in income taxes. Prior to 1981, income taxes averaged 12%(+/-1%) of normalized GDP. Reagan reduced income taxes to near 9%. Clinton increase them back to 12%; and Bush/Obama reduced them again to 9 %(and below). However, on budget expenses(which excludes Medicare and Social Security) have remained 12%(+/-1%) of normalized GDP throughout. The deficit in income taxes has been financed by borrowing, largely from the Social Security trust fund. When Clinton raised income taxes back to 12%, this eliminated the on budget deficit. The CBO projected that this, plus the Social Security and Medicare surpluses, were enough to pay off the entire US debt by the time that the Social Security/Medicare trust funds would have to be amortized for beneficiary payments, all without having to raise taxes to pay for the amortization of those trust funds. Like Reagan before him, Bush took those excess payroll tax receipts and gave them “back” as income tax reductions, heavily weighted to the wealthy–who didn’t create those surpluses in the first place. By doing this, Bush guaranteed that income taxes would have to be raised in order to amortize the trust funds. The failure to do so simply permits the 1% to steal the money contributed by workers for their retirement. Everything about not raising taxes or limiting expenses, is about stealing the 99%’s money. The national debt has been caused primarily by income taxes which were reduced far below their historic 12%(+/-1%), not by on budget expenses, which have remained at their historic 12%(+/-1%) throughout. These taxing games have transferred billions of dollars from the 99%’s payroll taxes to subsidize the wealthy’s income taxes.

b) Healthcare: Healthcare has been the primary mechanism for redistributing income and wealth upwards. But for increasing health care costs, over the last three decades median US real wage increases would have more than doubled. US healthcare costs are twice, or more, than those of virtually every other industrialized country; and consistently, the incomes of physicians in the US are over twice theirs. Because our competitors’ healthcare costs are so much lower than ours, our manufacturers and workers suffer huge competitive disadvantages. Our healthcare system transfers an almost unbelievable $1 trillion per year from the the middle class to the wealthy. Hence, the single most important way that we can reverse the upward redistribution of income is to adopt a fully socialized healthcare system (similar to those of our competitors, and the Veterans Administration–which is this country’s highest rated healthcare system). This is also the primary reason that the 1% and their Congressional allies so strenuously resist attempts to reform healthcare.

Any senator or congress critter who thinks farm dust is innocuous should spend a little more time down on the farm and less time at the farm lobby trough. Farm dust is not good clean dirt in the air. The best way to think of farm dust is to imagine it as airborne northern New Jersey chemical dust. Farm land is largely some binder material called “soil” that is used to retain pesticides, herbicides and fertilizers. And we don’t even want to talk about farm dust blown up from hog confinement lots. Today’s farm is not your grandfather’s farm.

What’s striking about the GOP wish list of things to grow the economy is that almost all of the items are things that (if they actually worked!) would operate on the AS curve. Earth to GOP: Today’s problem is on the AD curve, not the AS curve.

Farm dust could be bad this year since weather patterns suggest drought in the south.

I grew up in the rural midwest. Imagine thousands and thousands of square miles of farmland dotted with a small community here and there. In the spring, much of the ground is bare in preparation for spring planting. It takes weeks for crops to grow to the point where the soil is protected. Any dry spell will produce some dust on windy days, but it’s not really that noticeable. This EPA over-reach produces mental images of dust storms, but like I said, you barely notice the dust in the air on the windiest of days, unless you are sitting on a tractor without a cab.

I know plenty of old timers who sat unprotected on their old tractors, covered in dust. You know what? They didn’t drop dead from dust exposure. In fact, Iowa, the Dakotas and Nebraska are all in the top 10 for the highest proportion of people over the age of 85! http://www.statemaster.com/graph/peo_per_of_peo_who_are_85_yea_and_ove-percent-who-85-years-over

A majority of midwest farm to market roads are gravel and produce dust every time you drive on one. Harvesting crops produces lots of dust but modern farm practices, like no-till farming have greatly reduced the amount of bare ground exposed to the wind. Farmers are not stupid, they do not want their topsoil blowing away. They use the best practices available to reduce that possibility.

Regulating dust is nonsensical, but is a great example of the progressive push for uber regulation. We live in crazy times when non-elected appointees can create and impose federal restrictions on the amount of dust that a farmer is allowed to produce.

tj: I grew up in rural eastern Washington state — so there! Bet I saw more flying dust than you did. But seriously, if we took off every ag regulation as you seem to want to do, what would be the employment effect?

The “Obamacare effect on private employment” graph deserves a page of its own in the book “How to Lie With Statistics.” What the graph really shows is that the private sector stopped shedding jobs and started adding jobs in March 2010.

Total Nonfarm Private Payroll Employment (NPPTTL)

Jan 2010: 106793

Feb 2010: 106772

March 2010: 106916

April 2010: 107145

That dust storm talk is exaggerated.

Oh, wait a minute.

http://www.miamiherald.com/2011/10/18/2460679/massive-dust-storm-envelopes-lubbock.html

Regulations may be pesky but, where are the figures and studies to back up all of the “job killing” rhetoric? I’m torn between calling the language Orwellian or the product of some old Soviet 5 Year Plan. One wonders what the Republican staffers have been reading in order to be able to perfect such a style.

Menzie,

I am all for air quality reg’s when it comes to hog confinements 🙂 The biggest ag reg that needs to go is not an ag reg at all, it is the ethanol mandate.

The Engineer: “I’m all for focusing on energy jobs, but … [t]here’s just no one qualified to take them.

“I can’t hire a new piping designer at any price…”

Why do you think this might be?

The Engineer tells us himself, a paragraph later:-

“I started out in energy … That crashed, and I switched to… generating facilities … [T]hat crashed. Then it was on to diesel engine emission controls … Then that crashed … I’ve only been out of school for 15 years!”

If you want to raise a family, are you going to want to work in a field with this kind of volatility? The problem is not the money you get when you have a job. It’s the insecurity.

Until engineering companies reinstate the social contract, i.e. commit to keeping their staff on the payroll during down times, they’re going to have trouble getting staff.

That, in fact, is what #OWS is about.

I remember breathing some of that yummy dust in the fall in Fresburg CA. There is a spike in something called Valley Fever after one of those dusty days. Some with compromised immune systems die from that bug.

I also remember breathing some of that yummy black soot from the orchard heaters that were used to prevent crop freezing in SoCal.

Get rid of all those anti-farmer regulations!!! Farmers want to be free. Freedom To Farm!!!!!

How can farmers get anything done when they have one of their hands out all the time?

Steven:

It seems that you’re saying there is no way the government could create jobs in the short term? What about an infrastructure bank for oil development, or building extra refining capacity? I suppose this question is more philosophical then practical.

As for the stimulus, didn’t total government spending decrease after the first year of the stimulus? My worry is stagnation similar to Japan, we try stimulus, take it away, try a little again… Where it may have actually worked if we just bit the bullet and spent everything up front.

I think folks are missing the point with the dust regulation. Yes it’s protection of air quality but more to the point it’s protection of top soil. No top soil equals no food. Thus the birth of soil conservation in the 1930’s. Farmers covers in field dust is not romantic, it’s a sign of not so great farming practices. Also Important to note soil erosion through either air or water begets other problems such as water quality, flooding etc. It’s all linked in the end.

Which further illustrates my point that most politicians don’t know enough to make informed choices. More than likely they are just the mouth piece of private interests. In this case scale large scale agribusiness.

Hey Menzie,

I just got your book today on Amazon, wait for it Post Mail. I just wanna let you know I got many ECON/FIN books on the crisis and in general but I felt since your blog provides so many graphs and useful data you should be “rewarded” with some people buying your book so you had something tangible (and not just being a good guy in the American society) for your providing free info to people on the net.

What I have skimmed on your book online it SEEMS your book doesn’t have as many awesome graphs as your blog does. I hope I am wrong. If I am correct, next time put some of your awesome graphs in an Appendix for your next book.

YOU AND YOUR BLOG AND GRAPHS ROCK MENZIE!!!!!!

Take care

Greg vP, is it the engineering companies responsible for the volatility, or is it something else?

I made the move from building gas fired “peaker” plants to diesel emissions controls after 2 years of not getting a raise. They were the two worst years in that particular company’s 100 year history (following a couple booming years). I certainly would not blame the company for that, it was the market they were in, a market created and then destroyed by the government (I personally don’t think that peaker plants make any sense whatsoever, but they are a product of electrical utility and clean air regulations). So many utilities switched over to gas (for clean air reasons) that the market for natural gas went through the roof, making the plants uneconomic (until shale gas came along).

I think the government could create and maintain a very nice domestic energy industry if they allowed more drilling and went easier on the clean air regs. I don’t think we need to go back to the days before the EPA, but how about rolling them back to, say, 2003 or so?

When people like me complain about regulations, it’s generally the latest regulations that we’re complaining about (because those are the ones that take additional effort to comply with). Thus, on the topic of ag-dust, I’m no expert, but I’m guessing that there are recently enforced regulations that people are talking about in this thread? Are these additional regs really necessary? Where’s the cost/ benefit analysis.

One thing to mention, when discusssing small businesses as jobs creators, many people are referring to new studies that show that it’s newly established small businesses, in their first year, that create new jobs, not small businesses in any other year of existence. While partially correct, most of the studies include only establishments, not businesses because of the nature of survey data. So if a restaurant opens a second location, it is counted as a ‘new’ small business.

GregvP,

“Until engineering companies reinstate the social contract, i.e. commit to keeping their staff on the payroll during down times, they’re going to have trouble getting staff.

That, in fact, is what #OWS is about.”

When The Trojan Rubber Works (TRW) went from 16K to 8K employees in the late 60’s I knew it was time to get out of Dodge. Not TRW’s fault that the gov decided to end the moon program, but the effect was the same.

Dave –

You ask: Is there “is no way the government could create jobs in the short term?”

Of course it can. The question is whether that’s a good idea and good use of funds. If you believe the economy is weak due to coordinative failures (demand-constrained), then priming the pump makes sense. If you believe it’s supply constrained–as I do–then pretty much you have to adjust. I think the evidence more strongly favors a supply-constrained global economy.

“What about an infrastructure bank for oil development, or building extra refining capacity?”

Now we’re discussing peak oil theory. Our oil consumption and refining capacity is declining and will continue to decline. We don’t need more refineries on a net basis.

There is a strong theoretical case for the support of the upstream (exploration and production) oil industry in a cyclical downturn. We looked at our offshore engineering forecast both on a no-cycle and business-cycle basis. Our rough estimate suggests that the business cycle will reduce potential output by about 1/6th over the five year horizon. If you believe oil demand will outstrip supply, then you might argue that the government should support the upstream industry in a downturn. If we’re short on oil, we should do everything to try to maintain a high level of supply growth.

There are policy tools. For example, you might want to refill the SPR during such a downturn as a way to support prices. You might want to guarantee certain assets (an Alaskan pipeline?) to maintain or speed up development. You could ease permitting.

There are caveats. Such policy decisions should be made well in advance. They’re usually not. They should be made by disinterested policy-makers. Usually they are not.

Further, if you place a subsidy trough in front of the oil industry, they will gorge themselves no less than the solar business. As an industry, oil is not big on rent seeking (because it actually makes money!), but we’re not immune to temptation either.

Finally, Engineer is cautioning us that demand growth may not be the constraining factor in oil consumption. The business may simply become supply constrained, and engineering is one of the critical areas. Upstream projects–deepwater, oil sands, LNG and others–are very high value and highly complex. You don’t just plop these on the desk of a junior engineer. So getting these projects on line is going to be a big challenge.

The President could help by i) acknowledging that we’re oil (transportation fuel) constrained, and ii) being absolutely clear that we have to get more and get it faster, and iii) that while he is committed to the climate, right now, if we can’t get the economy re-started, we won’t have the resources to fund expensive alternative energy.

Behind the scenes, insiders tell us that the Administration has become more involved and helpful in coordinating exploration permits–and that’s good. But the President should shelve his ambivalence, come out directly and strongly for an enhanced transporation fuel supply (oil and gas), and get us to 20/20 on the budget within four years. With that, he could be free of the Republican menace by New Year’s.

tj modern farm practices, like no-till farming have greatly reduced the amount of bare ground exposed to the wind. Farmers are not stupid, they do not want their topsoil blowing away. They use the best practices available to reduce that possibility.

That used to be true a few years ago, but not today. No-till farming was a reality because of powerful herbicides developed in the 1970s. Those herbicides were highly effective only 2 or 3 years ago. Then came the superweed, which is resistant to 1970s Round-up style herbicides. Today no-till farm is long gone. Some farmers are able to get by with low-till farming, but a lot have reverted back to the 1960s approach. John Deere is once again selling tillers and rippers in big numbers.

But if you’re worried about farm land erosion, the big problem is increased rainfall in the upper midwest. Up until the 1990s the odds of a large rainfall event (defined as 4 or more inches of rain falling within a 24 hour period) was less than once every 10 years. Today those odds are not slightly more than once every year. The Iowa DNR estimates that soil erosion, which up until recently was sustainable for over 100 years, is now running at more than 10 times the sustainable rate and within a generation all black topsoil will be gone in the upper midwest.

What can the government do besides the necessary and wise deficit spending on public goods at this time of slack demand and low interest rates?

1)Increase private physical investment spending — now is an excellent time to mandate cash/credit rich industries to do the things they are avoiding investing in. Things like emissions controls upgrades on large point sources like power plants and refineries and chemical plants. Things like positive train control, signal modernization, and grade crossing upgrades, and LNG-fired locomotives. Things like cold-ironing for ports, and ship to rail facilities. Things like conversion of gas fired compressors to electric or addition of ORC waste-heat turbines to improve energy efficiency of gas compressors. Things like methane digesters for all CAFO’s of size. Things like VFD’s on every well/booster pump over a certain size. Things like a full, detailed energy audit for every industrial/commercial premise using more than 200kW of power, or its equivalent in other energy sources. Things like lining irrigation ditches, and upgrading irrigation systems to reduce water use. Things like aerodynamic retrofits for all OTR trucks.

2)Create investment/consumption spending by consumers. Start by capping interest rates on all existing mortgages at 2 percent over cost of funds. Require anyone who has a mortgage and requests an energy efficiency loan up to 3 times their total energy payments for the previous year for a term based on the useful life of improvements, be granted a loan on the same terms as their mortgage balance as long as the installer warrants energy usage reduction offsetting at least the amount of the payments. Require a home energy audit for any house being sold by a bank with results to be provided to any potential purchaser.

There’s a lot we could do, if we wanted to.

2slugs,

Then came the superweed, which is resistant to 1970s Round-up style herbicides.

Obama should like this 😉 Ever hear of ‘walking beans’? It’s a nice way for a kid to make a buck.

It sounds like you are throwing your full support behind the farm lobby and want a return to the days when government paid farmers to take land out of production.

Imagine the result, many grains are already in short supply due to a misguided ethanol policy. Reducing supply and increasing crop prices in today’s market will increase world hunger.

This is one of those problems where short term needs trump long term sanity. Try telling a mother who can’t afford to feed her child that you want to take crop land out of production, while at the same time, you are promoting the conversion of food crop production to fuel crop production.

By the way, the EWG loses some credibility with a big “DONATE” link at the top of its webpage. We need to hear from them, but keep in mind that they represent one side of the arguement and are not trying to produce policy reports that weigh the full costs and benefits of their policy recommendations.

http://www.ewg.org/about

tj I think you may have misunderstood my intent. I do not support set aside acres and I hardly support the farm lobby. I was simply pointing out that soil erosion has, over the last few years, become a much bigger problem than it was in the 90s and early 00s. Thanks to some prudent farm management practices soil erosion was well contained and farmers were on a sustainable path. But over the last few years that has changed dramatically. First because of the need to do tilling because of superweeds and second because of the increased occurence of large rainfall events in the upper midwest. I am only pointing out that erosion is now a very serious problem…as though we didn’t have enough problems on our plate already! I have no bright solutions. I suppose one thing that might help would be less direct and indirect government support for a certain kind of farming that promotes endless rows of corn and soybeans, much of which is not used for food. So less ethanol and less fructose sugar would be a good start. Anything that helps ADM cannot be a good ag policy.

The idea that you would tie spending to %GDP is wrongheaded, particularly so given Baumol’s equation. This is an argument for massive spending cuts. Of course, advocates of this don’t want to say what they would cut.

Why 20%? Why not 22%? Or 18%.

Here is the simple truth: Baumol’s equation predicts that in order to keep the same level of service the % of GDP going to Education and Health Care is going to go up. Add to this the demographic change that will occur over the next 20 years, and it becomes quickly apparent that holding to 20% GDP would require massive service cuts.

But then the advocates know this: they just don’t want to say how they would do it.