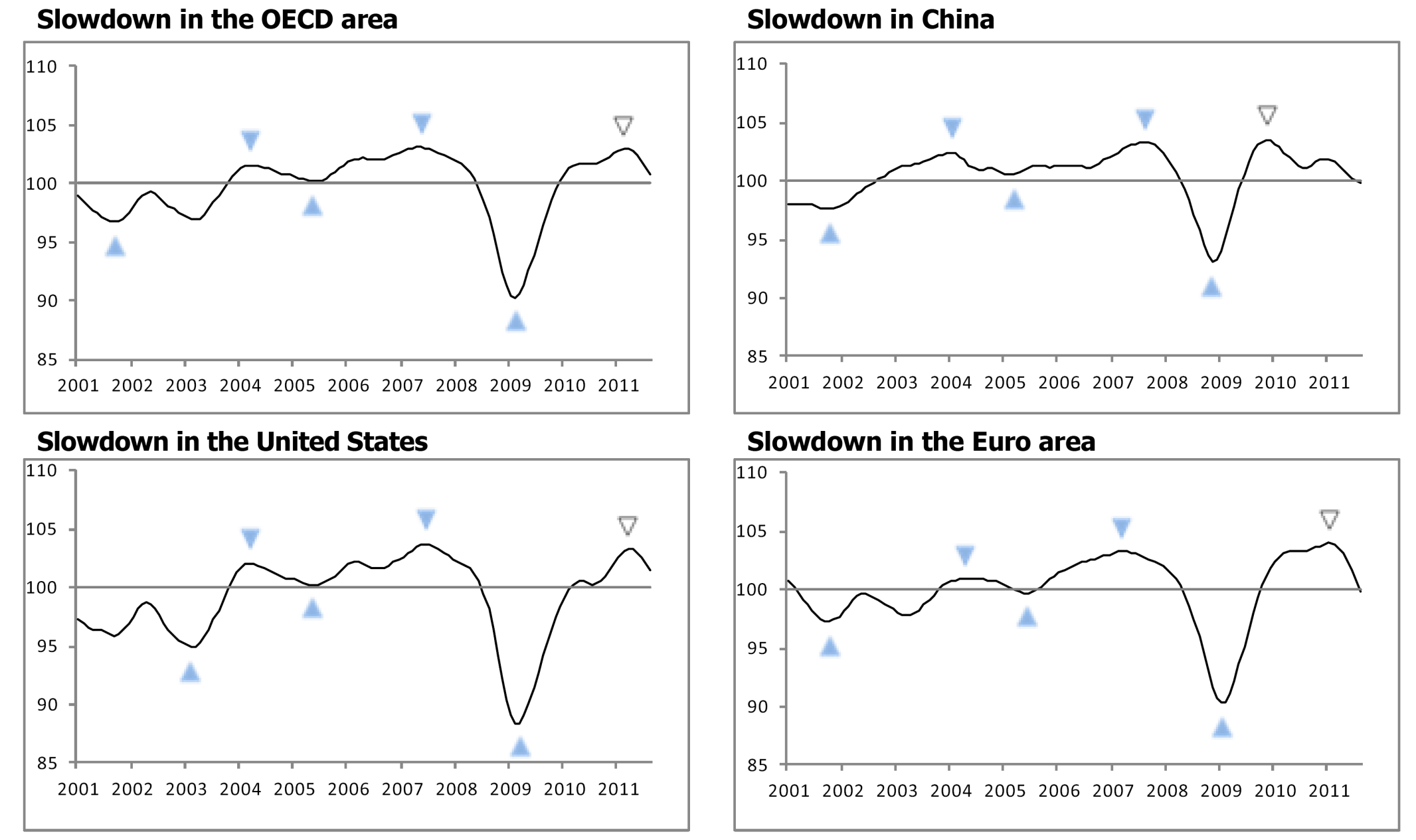

Or at least OECD plus China *, on the basis of the OECD’s Composite Leading Indicators for August 2011:

Figure 1: from OECD.

These series are scaled so that 100 is the long run trend. The euro area and China are at 100, and so those economies are no longer expanding relative to long run trend. The US remains above, but the gradient is negative. The latest readings on monthly GDP are mixed.

Figure 2: GDP (blue bars), monthly GDP from e-forecasting (red line), and from Macroeconomic Advisers (green line), all SAAR, in billions of Ch.2005$. NBER defined recession dates shaded gray. Source: BEA, 2011Q2 3rd release, e-forecasting, Macroeconomic Advisers, and NBER.

These indicators merely confirm the need for additional stimulus. Moves to eliminate regulations, reduce the corporate tax rate, and pass free trade agreements [1] might provide growth at some time in the future, but are unlikely to provide succor to the economy in the short term. (Allowing the payroll tax reductions to lapse is contractionary, and current opponents at some time in the recent past were supporters of this tax reduction.) That leaves measures that have been outlined here.

* [4:13am Pacific 10/11/11] On reflection, it seems to me “slowdown” is a better characterization for China’s likely performance. Given the steep trendline in Chinese economic activity, going below 100 is still rapid growth.

Well more stimulus is hardly likely given that the GOP has said it doesn’t work. And in addition it might improve Obama’s reelection chances and that won’t be allowed.

I disagree. If that were true, Greece would be improving and Ireland sinking. It’s just the opposite.

I suggest re-running those numbers using Liebig’s Law of the Minimum assuming you need a fixed ratio of oil to GDP (1:24). Without additional oil, stimulus will borrow consumption from other countries, but be unable to lift output permanently, by definition. Then start to relax the constraint and see how far that has to go to get a decent multiplier on a stimulus.

Menzie,

Why can’t we just swallow hard, and accept some below trend growth for a few years while households adjust to huge negative shocks to their home equity, their retirement account and their tolerance for risk?

The Keynesian answer is a larger stimulus package.

Admittedly, ‘x’ more years of temprorary stimulus packages will keep some workers on payrolls. The tradeoff is that in a low-growth world, many countries will end up in a situation in which debt grows faster than tax revenue for several years. Is more debt really the best long run solution? Look at the problems that high debt countries are experiencing now.

Bernanke is doing his best to increase equity prices and home prices. Payroll tax holidays, extended unemployment benefits, etc certainly don’t hurt. However, monetary and fiscal stimulus create their own problems and will not solve the slow-growth problem. That’s the point, there is no easy short-run solution to this problem. It’s a long run problem driven by huge negative shocks to household wealth. We need long run soltutions.

If you’re going to make a convincing argument for fiscal stimulus, you’ll need to do more than just cut and paste a chart of multiplies from the CBO.

It would seem also that any reduction of the US trade defecit, or a reduction of enough to create a meaningful number of jobs, would worsen the Triffen Dilema factor? That dynamic would then leave a paradox regarding US exports as the ROW would have increasingly fewer dollars to trade for US exports. This then should cause a rise in the dollar which would be the result of a global economy with a decreasing volume of dollars, a paradox.

ray

TJ–just tightening your proverbial belt and toughing it out doesn’t work any more. We’ve been transformed from a nation of citizens to a nation of consumers. That’s our job now. It doesn’t matter if we’re overindebted, overweight, and living in an oversized house with oversized closets already stuffed full of more crap than we know what to do with. Now is not the time to be thinking about saving money or paying down debts. Pile on some more credit card charges! Come on, upgrade that kitchen! It’s your patriotic duty!

Agree with Steven Kopits. Without more oil the world economy is going to stagnate or grow slowly.

What I’d like to know: If world oil supply just stays flat for a while can the economy grow slowly as more parts of it move away from oil?

To put it another way: can the ratio of oil to GDP decline? If so, how rapidly?