Here I offer some observations on what’s been holding back the recovery.

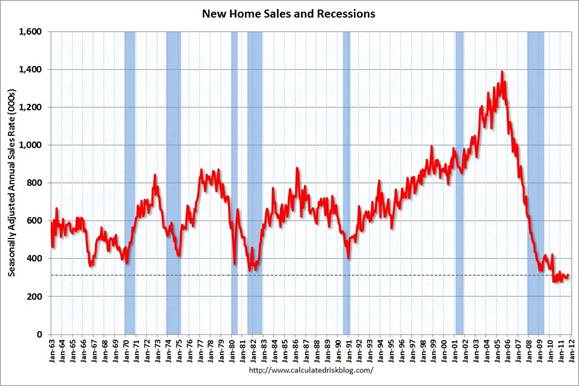

Two of the most important sectors in U.S. business cycle fluctuations are autos and housing. For example, in the 2007:Q4-2009:Q2 recession, real GDP fell on average at a 2.7% annual rate, with autos and housing accounting for about half of this decline all by themselves.

|

Although autos and housing make a very significant contribution to changes in GDP growth rates over the business cycle, they represent only a small part of the level of total GDP. Over 1947-2011, spending on motor vehicles and parts only amounted to 3.5% of total GDP on average, while housing was less than 4.7%. But the fluctuations in spending on new cars and homes are so volatile, these percentages change quite a bit over the cycle, rising well above average during expansions and falling in contractions. For 2011:Q3, motor vehicles and parts represented 2.4% of the level of GDP, while residential fixed investment was only 2.2%.

|

The fact that the levels remain so low today relative to their historical averages means that housing construction and automobile manufacturing have fallen well below what’s needed to keep up with growing population. That suggests the potential for a significant positive contribution from these two sectors if the recovery could ever get back on track.

But we’re not there yet. New home construction remains stuck at the lowest levels since the series began in 1963. Residential fixed investment contributed 0.03 percentage points to the 1.4% real GDP growth (annual rate) over the first three quarters of the year.

|

And autos subtracted 0.15 percentage points over that same period, though the October sales numbers released this week suggest a slight improvement. Sales of light vehicles manufactured in North America exhibited very little of the usual seasonal decline from September to October, and were up 11% year over year.

|

|

One factor holding back spending has been the debt overhang on which I commented last week. Another factor may have been the higher oil prices that accompanied the disruptions in Libya at the start of the year. Production there was reported by Gulf News to be back up to 370,000 barrels a day in October, though that’s still well below the 2 million barrels per day the country had been producing last year.

|

|

| San Diego Historical Gas Price Charts Provided by GasBuddy.com |

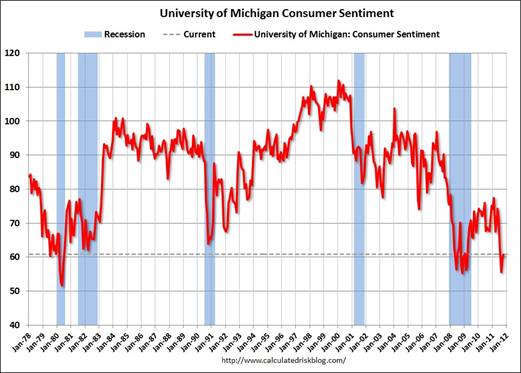

Continuing high gasoline prices in my opinion have been one factor depressing consumer sentiment.

|

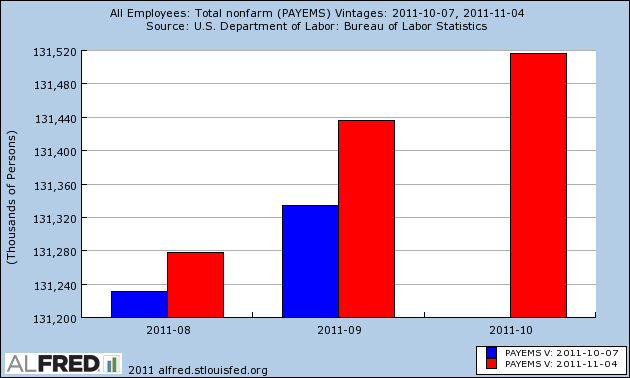

The most important monthly economic indicator is total employment, which continues to send the same signal– we’re seeing some growth, but well below what’s needed to make any progress for the millions still without jobs. The Bureau of Labor Statistics reported on Friday that employment at U.S. establishments rose by 80,000 workers on a seasonally adjusted basis in October. A little more encouragingly, BLS revised up the estimates previously reported for September and August, and is now reporting an average gain over the last 3 months of 114,000 jobs per month. Actual good news is suggested by the separate but less reliable household survey, which has civilian employment increasing by 335,000 per month over the last 3 months.

|

In other words, I think things stand pretty much as they have been– sluggish growth continues. The potential is there to do better, and there are some indications of modest improvement. Meanwhile, across the pond, Europe looks headed for recession. And if events there lead to significant financial instability and disruptions in lending, America is unlikely to emerge unscathed.

Don’t worry about auto sales that much. You can have a much better life without cars: http://andreasmoser.wordpress.com/2010/10/02/car-free-by-choice/ – If more people are cycling, that’s fine.

Meanwhile, across the pond, Europe looks headed for recession.

We don’t have to look across the pond for worrisome news…just look across the Great Lakes. Canada’s GDP fell 0.4% (annualized rate) in the 2nd qtr. And this was after a fairly robust 1st qtr growth rate. The reason for the negative growth was a drop in exports.

http://www.statcan.gc.ca/daily-quotidien/110831/dq110831a-eng.htm

My concern is that except for Germany, all of OECD countries are on the same business cycle, so we cannot count on a “beggar thy neighbor” policy to pull us out of recession through export growth. So as long as consumers are saddled with debt, and as long as businesses aren’t soaking up excess savings, and if we can’t count on increases to net exports, and as long as the GOP frustrates fiscal spending, and as long as the Fed sits on the sidelines, just how are we supposed to stimulate aggregate demand?

“WASHINGTON – The jobs crisis has left so many people out of work for so long that most of America’s unemployed are no longer receiving unemployment benefits.

Early last year, 75 percent were receiving checks. The figure is now 48 percent — a shift that points to a growing crisis of long-term unemployment. Nearly one-third of America’s 14 million unemployed have had no job for a year or more.”

Read more: http://www.foxnews.com/politics/2011/11/05/most-us-unemployed-no-longer-receive-benefits/?intcmp=trending#ixzz1cwXhPmH3

It’s obvious that everyone needs to spend more one automobiles and housing so that jobs will be generated so that people can spend more on automobiles and housing. Well….

It’s fairly easy to dismantle and economic structure, but replacing it is a bit more problematic. If hundreds of billions or trillions of dollars can’t move the needle, one might ask if there is some other giant anchor holding the economy back.

Just saying… one might ask.

We Ignore Keynes, So Results Are Predictable

“I should support at the same time all sorts of policies for increasing the propensity to consume. For it is unlikely that full employment can be maintained, whatever we may do about investment, with the existing propensity to consume.” The General Theory, p.325.

Clearly, the government has done nothing to stimulate housing demand and has done next to nothing for auto demand (Cash-4-Clunkers excepted). The reasons for this neglect are obvious, but at some point the government must change its approach. Until it does, we are doomed to the Great Recession.

What’s been holding back the real economy? Central banks et al doing everything they can to prevent actually price discovery from occurring. Free markets don’t exist because of central planning intended to keep the status quo in place.

Nothimg to stimulate housing demand? Really?

4% mortgages, homebuyer tax credit, 95% of the loan market supported by the gov., mortgage interest deductions, capital gains deductions, carry back losses for home builders,…. Yeah I guess the feds have done nothing to stimulate housing.

NOTHING to Stimulate Housing Sales

TIGHTER lending standards, tighter appraisal standards, 1st Time Home Buyers’ Tax Credit expired with NOTHING to replace it.

The Fed Gov could do a lot more to stimulate housing sales, but it REFUSES to do so because it would be criticized for creating a new “bubble”.

So housing sales continue to collapse. New home construction is at 1963 levels and THERE IS NO END IN SIGHT!

Oh yeah, the government has really been stimulating housing alright. Get a clue.

On autos most eventually reach a state where they are worn out and or in need of constant repair. I think I read that the fleet is now older than ever before, so folks are stretching the life of the vehicle. However sooner or later a big item will go and a newer vehicle will be required. With the average age of vehicles now being 9.4 years major systems become likely to fail.

John Pretty much all those things you mentioned have been baked in the cake for a long time, and therefore they do not have much, if any, new stimulus power. Stimulus has to come from some new policy differential. In any event, I’m not a big fan of re-inflating old bubbles. I think it makes more sense for the government to adopt stimulus policies that can be more broadly applied. For example, skills and capital needed for residential construction could be easily shifted to home repair that complements “green” initiatives (e.g., white roofing, new windows, insulation, etc.), or fixing bridges, or repairing sewer & water lines, or planting shade trees, or upgrades to the electricity grids, etc. These are easily substitutable skill sets, so it’s not like we’re asking accountants to become plumbers.

Paul,

You’re not considering the conditions under which they relationships hold. Housing prices are down because of loosened leading standards and then constraint. And cash for clunkers way a mistake; it simply shifted demand forward, at a cost to taxpayers (because of the subsidy), and also made inequality worse by taking cars out of the used car market.

One thing that I am surprised is not being done is an increase in SKILLED, LEGAL immigration.

This is even more odd given how many powerful factions would support this :

1) Seniors, as immigrants pay into SS.

2) The Tech Industry, which routinely lobbies for this.

3) Democrats, who want votes.

4) Republicans, who want free market skilled labor (even if it does not vote for the GOP).

5) The state of CA, which attracts a large portion of these immigrants, who pay taxes and buy houses.

So 5 powerful groups want more SKILLED, LEGAL immigrants. Yet someone, a correction of the ludicrously tedious immigration policy is not happening.

No one seems to be asking the question whether it is wise to stimulate growth with more debt when both personal and private debt are so high relative to any historical norms other than during world or civil wars.

I think we should give up the cult of GDP and substitute a new measure of risk-adjusted GDP based on debt to GDP ratios. The risk-adjusted GDP of today might look better than that of 2007 before the crash.

One of the two recent Nobelists won for demonstrating that economic agents counter the effect of policies intended to goose the economy by planning for the future. So if government decides to run up huge debts to stimulate short term demand people start planning for a future when the lenders get skittish.

Right now borrowers are paying down their debts. As they do so, money is destroyed. Banks, required to increase capital, are also deleveraging and therefore destroying money by restricting new loans. They are choosing this rather than going to the stock market, which would dilute existing shareholders and which might create massive selling of their shares.

So therefore we find ourselves in a slow-growth economy, as consumers and banks lower their debt ratios. But perhaps this form of growth is better than debt-stimulated growth.

colonelmoore There is nothing inherently wrong or bad about debt-stimulated growth. We don’t think it a bad thing when corporations go into debt to expand factory capacity in order to meet consumer demand. We don’t think it a bad thing when municipalities borrow to build a new school. Borrowing is just the flip side of saving. If no one borrowed, then no one could save.

If government borrows, then this will create the financial assets needed to support consumer demand for safe financial assets. And if the government borrows to build stuff, this will create demand for real goods and services. Once aggregate demand gets going again it will be self-sustaining. Yes, there will be a cost and public debt will increase; but once the economy gets upright it will be time to increase taxes and dramatically cut spending. There’s a time for deficit spending and a time for deficit cutting. For some reason voters and politicians always want to do the wrong thing at the wrong time.

Excellent post Dr. Hamilton. The housing contribution to GDP stuff reminds me of Andrew Leamer’s work. Karl Smith thinks we will have an “echo” boom in housing:

http://modeledbehavior.com/2011/07/19/there-is-a-boom-out-there-somewhere/

Bill McBride is optimistic about car sales:

http://www.calculatedriskblog.com/2011/09/vehicle-sales-fleet-turnover-ratio.html

Fingers crossed. I feel like things would do fine if not for the risk of European contagion.

@JDH: “potential for a significant positive contribution from these two sectors if the recovery could ever get back on track”

Another possibility is that autos will *never* get back to their old level. I wouldn’t be sad. America has spent way too much of its time and energy building cars and houses. With smaller houses and smaller and fewer cars, we might have better lives. In an energy-constrained future, it might happen…

Referring to line 31 instead of line 33 of Table B.100 referenced by Professor Hamilton (Home Affordable Refinance Program), total liabilities as a percent of the GDP are about 92% of the GDP as of Q2 2011. This compares to about 40% as of Q1 1960 and 51% as of Q1 1985. http://www.federalreserve.gov/releases/z1/Current/z1r-5.pdf . How does this debt get paid-down in any reasonable period of time? Seems like massive inflation is the only way out for debtors.

2sb,

I think you’re are right for a more cyclical recession, but in debt crisis like this borrowing for consumption is very bad. If the government was investing in creating excess capacity to reduce cost an make travel and business cheaper, and if they were using their cheap debt to refi and/or write-down bubble debt accross the board, that’d help. But we see very little (essentially nothing) like that.

Given the contition we’re in, I don’t think those contractors are going to be doing a whole lot with the money they get. The small group of people getting most of this money don’t really need it, they know most people’s positions continue to deteriorate (partially fueled by low interest rates distorting prices) so they can wait for prices to fall for non-consumer goods they want, they know securities prices are inflated by low interest rates.

I’m sort of in an intellectual quandary about this piece. I support the use of government debt to kick-start the economy when the business cycle is low and, frankly, don’t even understand why this is controversial. But I think there is something else going on by looking at these data, especially comparing the last couple of recessions to older ones. There is a distinct pattern of elongated recovery. Lots of ideas why, and they sort of all beg the question “is the government spending on the wrong things and just propping up industries trying to die?” That seems to me to be the legitimate question. Also a legitimate question is, did credit itself cause this problem by pulling forward so much that everyone got over-indebted over the last 30 years and what we’re seeing is the result of that. If that’s true, it means no amount of stimulus will help here.

I think there are certainly a couple of things going on…one is the effect of technology and the opening of the employment market on a global basis, and the other is the expansion of credit. We seem to have this backward looking idea that manufacturing is a key when we know that, even if I built a factory here in the US, I’d automate as much as possible and minimize humans. So the “hollowing out” of the middle class just means that, as more and more of these jobs disappear because of technology (because it is technology that makes it possible) what else replaces jobs at these wages? The answer, truly, is nothing we’re stumbled on yet. So jobs move further up the scale and those without the skill move further down. And there seems to be “learn a trade” people. When construction is in the tank as it is now, wither these jobs? How many welders can we reasonably employ? Enough to make a dent in 10% unemployment now? When will these jobs come back without government infrastructure spending? When everyone from people to local and state governments is not spending, who creates these jobs? When will consumers buy houses again? When their debt is low and lending standards loosen? When houses decrease in value enough to make them affordable to people now working service-sector jobs instead of making twice as much at factory work?

Hard thoughts.

Today, 1,6 trillion USD of US Treasuries is owned by FED. About 11% of total USA debt.

I have a question to all the clever guys and girls here:

What happens ( some day in future) if the USA treasury defaults only (for a starter) on the treasuries it owes the FED?

As I understand, FED balance sheet will shrink, so will the USA debt.

Will such an “internal” default affect USD value against other currencies?

Thank You in advance.

Ivars

lvars: I discussed that here.

Excellent post. Great overview of where we are now.

OT:

I had an interesting conversation with a DC lobbyist last week who was referred to me (by an energy staffer) as “the godfather of energy staffers on the Hill.”

The lobbyist drew an interesting contrast between the Clinton and Obama administrations:

He said that, with the Clinton guys, the meetings would take a predictable pattern. The Clinton team would give their spiel; then he would give his (pro-energy) spiel, and then the Clinton folks they would ask him what he needed, they’d negotiate, and business would get done.

It’s different now, he claimed. “With the Obama team, they give their ideological spiel and then they kick you out,” he said.

A lower oil price would help here in the U.S. and I wonder why the Saudi’s couldn’t help us out a bit.

Could it be that the Saudi’s probably have no interest in lowering the price because that would help China more than it would help us. What do you think?

Capital intensive technology has been great for large corporation and those with access to cheap money but its killing the consumer market as jobs disappear under the heading of productivity gains. Computer intelligence and software apps is now attacking the knowledge labor market an expensive area and therefore ripe for greater automation. Automation trends are redefining what we have called work and its impact on employment yet it gets little attention from our corporate driven academic economic thinkers.

1. You overstated the line about car sales not keeping pace with population. This is a topic within the car industry, but a better statement is that people are keeping their cars longer. We have an abundance of cars to people. The industry relies on people turning over cars. There is a weird dynamic at play in the large fleet market: high used car prices tend to offset the desire to lengthen the hold time. I’d say there’s a good chance they are a real factor in the industry’s relatively good health, but I haven’t paid attention to fleet sales issues for a while.

2. You should look at household formation rates. They fell through the floor. Much of this is due to unemployment, not housing issues on their own. So for example, rates in “growth” areas are very low despite low house prices because jobs are few and pay little.

It’s different now, he claimed. “With the Obama team, they give their ideological spiel and then they kick you out,” he said.

Well, that’s progress, although they could save even more time by refusing to see the lobbyists at all.

aaron I think you’re are right for a more cyclical recession, but in debt crisis like this borrowing for consumption is very bad.

I would tend argue exactly the opposite. In a normal, garden variety cyclical recession you would want to use monetary policy to prop up aggregate demand. Fiscal policy is a very blunt instrument and it should never be a policymaker’s first choice. But in a liquidity trap financial recession, with no real risk of fiscal stimulus mistiming, and with a “flat LM curve,” so to speak, fiscal policy is about the only option left on the table. Deficit spending on infrastructure projects would put money in people’s wallets, and it would draw down supply inventories, and it would provide an adequte supply of safe financial assets as households repair balance sheets. And of course it would also leave us wealthier with a larger capital stock. Deficit spending operates on the real goods & services side of the economy, so you’re not relying on the good graces of the confidence fairy. Demand for cement will cause cement suppliers to increase production of cement. Demand for machinery operators will put operators to work. Nothing magical about it. The alternative being pushed by the GOP is to just do nothing and hope that eventually the economy will endogenously return to a “good” equilibrium position. I think that’s a vain hope.

One factor rarely discussed concerning new vehicle market size is the change in leasing versus purchasing. In the early 1990s, one in every 12 or 13 new vehicle transactions were leases. By 2000, that ratio became 1 in 4… and greatly inflated the new vehicle market size as these vehicles were cycled every 2 or 3 years. There has been a gradual reversal of that trend [along with the economy-related shrinkage of the overall vehicle market] leading to vehicles being held longer and reinforcing the smaller size of the annual new vehicle market. While leasing may be a popular approach for many consumers, manufacturers were burned too often by vehicles with low residuals and have limited their lease offerings.

Rick –

If I believe the EIA data, the Saudis have been helping out. Saudi September 2011 output was listed as 10 mpbd, the highest since at least 2004.

JDH, thanks!

Ok, I think this Paul’s proposal is coming in late 2013-early 2014 as first option to avoid full scale default-US debt correction by 15-25%:

I have been mentioning the full USA default in end of 2015-beginning of 2016 here:

http://www.tfmetalsreport.com/comment/78029#comment-78029

However, in initial post about this issue, I was speaking about US debt correction, that is distributed haircut of around 3 trillion USD in 2013-2014:

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626&st=0&sk=t&sd=a&start=100#p31678

Here is the chart that supports that initial view. Its a fit of certain pre-crash behaviour model. How it is produced, is explained here:

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626&p=34998#p34998

So its earlier than I was saying lately. Lately I was talking of a full scale default, but it looks like it will be gradual, and the first one will happen very soon. To be honest, I forgot about my first idea-but usually they are the most accurate. So some assumptions following it will have to be reworked.

The approximate visual fit with Sornette Johansen log-periodic process with critical time tc = September 30 2013-January 1st, 2014:

http://farm7.static.flickr.com/6100/6322611889_f67e5664fe_o.png

QUESTIONS:

1) The distribution of haircuts of such partial US default (who will forgive 3-4-5 trillion USA debt in few months?)

2) consequences for USD rate to currencies

3) consequences for USD rate to commodities

4) consequences for USD rate to gold, silver ( i will dig into my charts on this)

The issue of lobbyists is an interesting one deserving greater attention. I think the topic would make a fascinating book.

I am under the impression that policy analysis for Congress has been largely outsourced. Partly I think this is due to a rise of partisanship, and hence a decline in what we were taught in school as a more neutral “policy analysis”.

However, I think specialization is even more important a factor. A good industry specialist–for example, in energy or power–can run hundreds of thousands of dollars per year. Clearly, this is unaffordable to Congress. Like major corporations, Congress relies on consultants (albeit often either paid by industry or participating on a pro bono basis) for expert views. (If politicians were paid incentive bonuses, Congress would hire its own experts more frequently.)

The lobbbyists I have met–mostly in energy–are generally highly intelligent, very well-meaning individuals who are passionate about governance and politics. Of course, everyone has a client, but often clients are pretty sophisticated themselves. So if I were a decision-maker, I would want to solicit the views of such lobbyists, even if I ultimately decided to go another route.

In short, I would caution against blanket cyncism and the facile view that a $4 trillion budget can be better managed by term-limited amateurs than by experienced professionals.

Autos and housing are lagging, and both are over priced. Homes because of excessive non safety zoning regulations, and autos because CAFE is forcing auto makers to use ever more exotic (expensive) materials.

Oil is also highly priced, slowing things more. It just takes too many hours on the job to buy things, so people buy less. The central bank makes things worse by removing additional purchasing power from wages/pensions.

Lower prices are the key to recovery.

This weekend I listened to a podcast on Schumpeter and one on Ludwig Von Mises The Theory of Money and Credit. They made me sensitive to economic theory and especially the business cycle. Professor, it appears that using the logic of oil prices driving the economy but the economy driving oil prices and all costs as components of the GDP then using GDP to determine the business cycle is circular reasoning.

From what I have seen most Keynesians attribute the business cycle to “Animal Spirits” which means that they actually do not have a theory of business cycles. It is just assumed that when people decide to change the cycle they just change the cycle and it is all psychological.

What is your concept of the business cycle?

On the Canada import/export issue. Has there been a change in the balance of trade with Canada? I have noticed that lately most trains a heading to Canada loaded, but unlike before the trains coming from Canada are almost empty. Also of interest, the oil boom in the Dakotas. I want to thank Barak Obama for shutting down the oil industry on Governemt owned/controlled land. This has led to a huge boom in oil exploration on private land, where the beauracracy cannot prevent it. Ohio/Pennsylvania are also about to boom in the energy business. I noticed coal is also up, not sure why, though, probably the greater use of electrical. We are in a massive transitional period, economically speaking, so…. it is time for the American entrepeneurial spirit to lead. As previously posted 2013-2014 the debt digout begins to show traction, by 2017-2018 massive boomtime, greater than anything in the last 150 years. You heard it first, right here on roller derby.

OT,

Is the fed doing some covert easing?

Why did gas prices just spike up here in MI?

Oh yeah, we probably just switched to the winter mix.

Hi, I’m James Hamilton, and [my usual cynical comment about “who cares about cars?” and “so what if we can’t get this or that metric back to what it was in the Golden Age of ’05-’07?”, plus mocking remarks about “buy buy buy, consume consume consume consume].

There is something here I don’t quite understand. You write that:

“Continuing high gasoline prices in my opinion have been one factor depressing consumer sentiment.”

Why should gasoline prices matter more to consumer sentiment than any other prices? And if it is higher consumer prices that really matter for consumer confidence, why not talk about CPI rather than only about oil prices? In other words, why should the consumer be more happy if oil prices were to fall while other prices rose to keep his total expenditures constant, than if no prices changed at all? In total, he would be paying exactly the same amount for the exactly the same basket of consumption goods in both scenarios.