“…the Risks from Nonbank Intermediation in China,” by Nigel Chalk in IMFDirect.

Many China-watchers looked on in awe in 2009 as the government’s response to the global financial crisis unfolded, causing bank lending as a share of the economy to expand by close to 20 percentage points in less than a year. …

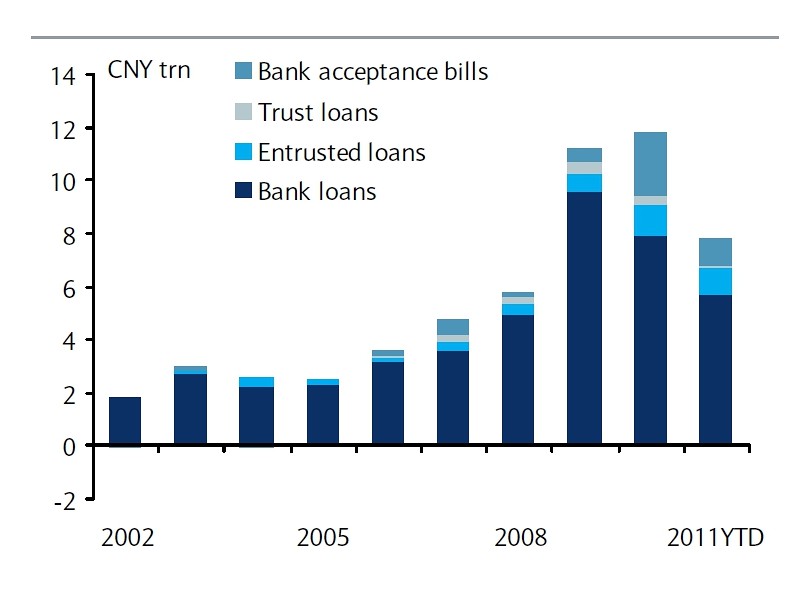

[A]t the same time…Various types of nonbank financial intermediaries—some new, some old—were gearing up to provide a conduit through which China’s high savings would be tapped to finance the corporate sector. The available data on this is terrible—the central bank’s numbers on social financing are the only credible and comprehensive public source, but even that gives only a partial picture.

Talking to people in China, and looking at what numbers are available, one cannot help but have an uneasy feeling that more credit is now finding its way into the economy outside of the banking system than is actually flowing through the banks.

The means by which such “lending” is being provided is wide-ranging and dynamically evolving.

Certainly many are aware of the high volumes of bankers’ acceptances—off-balance sheet short-term credit—being used of late. Over the past couple of years, trusts and entrusted lending vehicles (China’s own particular form of asset securitization) have also taken off. Then there is the world of informal lending: loan sharks charging high interest rates to those poor souls that are rationed out of regular channels of intermediation. The recent narrative from Wenzhou has certainly excited many.

But the shadows stretch even beyond these tales.

In the 12 months to June, over RMB 600 billion poured into China from short-term lending by nonresidents to Chinese corporations. Financial leasing companies have expanded, providing services that look a lot like credit by another name. The corporate bond market has blossomed, perhaps reaching RMB 1 trillion in new issuance for this year. There is an unknown volume of inter-corporate lending passing from one large company to another. And finally, some nonbank institutions have entrepreneurially moved into the lending space, providing loans to large corporations as a way to boost their profitability.

Dragonomics’ Arthur Kroeber also provides some thoughts on the shadow banking system — with an interesting graph of estimated total lending on page 16 of this presentation. But, as both Chalk and Kroeber observe, this “shadow banking system” is not primarily based on derivatives, but rather more conventional lending.

Estimates lower than Dragonomics’ (if I’m doing my math right) come from Barclays, as cited in this WSJ RTE article:

Figure from M. Gongloff, “China’s Shadow Banking System: The Next Subprime?” WSJ RTE (Sept. 25, 2011).

The cybernetic of the Asian financial flows may have changed in amounts but they do not seem to depart much from days when the Rmb had two exchanges rates domestic and HK international Rmb. The days when shadows swaps were a tripartite agreement between those who had and generate surplus Rmb cash flows and those in need of Rmbs and the deal medium in guaranty and risk providing foreign currencies.When singled out those participants were suffering silently from any economic downturn.It is naive art to faint to believe that in a larger macro frame the large groups financing arms were immune of the same downturn,banks may easily go back to their books to check the reality.In economics terms what Granger caused the financial crisis,the risk or the liquidities.

An expected stream of dividends that would never cover the total amount funds of borrowed, overvalued non listed participations,thinning cash flows etc.

The strength of the herd is in its compactness,in a good scramble no one should know who is holding the ball.

The Wall street Asian journal published a decade ago a list by order of happiness within the Asian nation,the income per capita was the discriminant,the Philippines ranked at the top.