Today, we are fortunate to have Jay C. Shambaugh of the McDonough School of Business at Georgetown University as a guest contributor.

There has been considerable debate lately about why the U.S. economy continues to struggle. Some — notably economists on the right and some Federal Reserve Bank Presidents — have argued that concerns about future taxes and regulation are preventing American businesses from investing and hiring. Other economists have argued that we have inadequate aggregate demand in the economy and that explains slow GDP and employment growth — not fear of future government policy.

The case that inadequate aggregate demand is holding back the economy and job creation has received ample support in the blogosphere, some of that argued or linked to on this site over the last 12 months. Additional evidence comes from something Menzie posted about last week: the strong performance of U.S. exports. One way to sort out the competing explanations is to see what happens when there is substantial demand for U.S. products. In foreign markets where economies are growing quickly, U.S. exports are rising fast. American businesses do not seem to be held back by fear of taxes or regulation; they are hiring and increasing production for sale where there are customers.

Export surge:

U.S. exports have surged since the end of the recession. Real exports are up 23% in the 9 quarters since the recession ended (a better performance following a recession than any of the last 3 recessions including the strong early 1980s recovery). Nominal exports are up even more as the price exporters can get on world markets has been rising.

Figure 1. Source: BEA data, and author’s calculations.

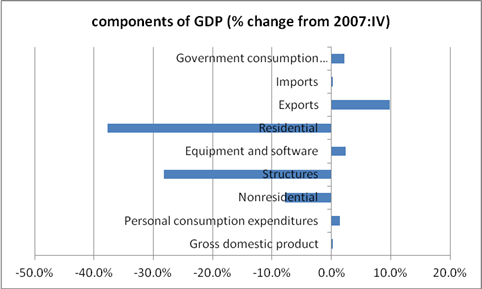

During the recession, exports fell sharply — even faster than GDP – but they have rebounded as the world economy recovered. The recent growth, though, is not simply bouncing back from the crash. Real exports are also 10% above where they were before the recession started — better than any other major component of GDP. The overall economy just surpassed its pre-crisis peak in the 3rd quarter of 2011, but exports bounced out of the recession faster and have continued to grow. Consumption is just 1% above its pre-recession level, and even though investment in equipment and software has grown rapidly recently, it fell more than exports during the recession and thus is now just over 2% above its pre-recession level.

Figure 2. Source: BEA data, and author’s calculations.

If the problems in the U.S. economy came on the supply side – fear of regulation, inadequate workers, etc. – there would be no reason to expect production for exports to grow any more rapidly than any other component of GDP. But, exports have outperformed the economy – the key difference being demand for U.S. products abroad.

Demand Abroad:

U.S. exports have always been largely driven by world growth and relative prices of U.S. versus foreign goods (see Chinn 2010 and IMF 2007). Numerous posts on this site and many papers by Menzie have made this clear.

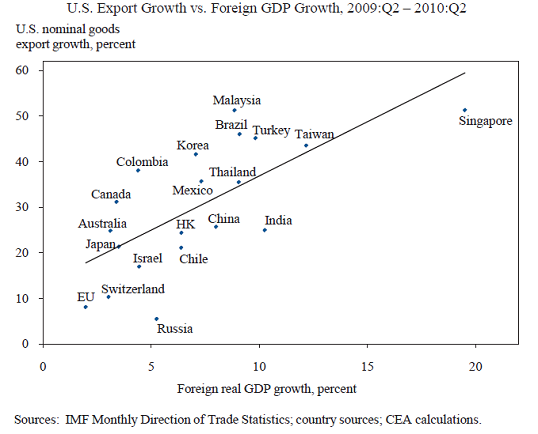

We can learn more looking at where across the globe the exports are going. Quite simply, U.S. exports are going where the demand is. China’s economy has been growing rapidly, and U.S. nominal exports to China have soared 49% since the recession ended (only nominal export data are available for individual countries, data through 2011:Q2). The euro area’s economy has grown slowly, and U.S. exports are up only 17%. Exports to Mexico are up 53% while exports to the more sluggish Japanese economy are up 29%.

Figure 3 shows the relationship between nominal goods export growth and foreign real GDP growth across major trading partners of the United States in the year following the recession, (borrowed from the 2011 Economic Report of the President). Where there is demand for U.S products, the U.S. typically is able to sell more.

Figure 3. Source: CEA (2011).

Some might argue that exports are up to certain destinations simply because the dollar has weakened against those currencies. But, the patterns noted above do not match where the dollar has moved. Since the recent dollar peak in March of 2009 until the end of the third quarter, the dollar weakened 7% against China’s currency, but 10% against the euro. It slid less than 20% against Mexico’s peso but 27% against the yen.

The ability of U.S. firms to increase production and sell to markets where demand is growing is just more evidence that the U.S. economy is not fundamentally flawed or broken. Firms can find workers and increase output where they have customers. Yet while exports to growing foreign markets have been soaring, at home, residential construction has collapsed, structures investment by firms has collapsed, and state and local government spending has declined. All of these are a serious brake on demand. Compounding all this is the fact that real Federal Government consumption expenditures and gross investment in the third quarter was 2% below that of a year ago. This acts as a further brake on growth in output and employment.

Some businesses may complain about fear of regulation (though in surveys their number one complaint is lack of customers) and some commentators may worry about structural unemployment and a lack of appropriate skills amongst the U.S. work force. There is plenty of reason to always make sure that supply side policies are sensible and worker training and education is adequate. But these do not seem to be the problems of today. Based on exports, the evidence shows that where there is demand for their products, American firms are more than ready to produce and to sell.

Exports cannot solve all the economy’s woes, though. The U.S. economy is huge, and exports only a relatively small part. World demand alone cannot lift us out of a slow recovery. Furthermore, persistent slow growth in Europe –- with a possible recession looming or underway –- and slowing growth in other regions suggest that export growth could slow in the near term. If it does, it will simply be one more piece of evidence that when the economy is drastically below its potential, demand is a major determinant of output.

This post written by Jay Shambaugh.

The more I look at US debt crash correction and future gold/silver charts, the more I feel that defaults of USA treasury to FED will happen in discrete way starting from November 2012,then FED buys more, then Treasury defaults again etc. It will be kind of a new “permanent” way of handling country debt and monetary issues combined.

I just wander what other consequences it will bring to USD value ( vs.commodities, other currencies), will it become fashionable way to handle part of debt in every country (except Europe where partial debt corrections happens country by country as there are no local central banks). Than of course every countries currency will devaluate in a similar manner to the USD except that USD will still be sitting on bank balance sheets even if they will receive a default in JPY ( e.g. Japan). So despite US correcting its debt to FED , USD still will have the longest (one of the longest ) lifetimes among currencies. The currencies that can outdo USD will be those where total government debt and other debt in the economy is small relative to GDP.

Also, does it MEAN Ron Paul can make it to president? Or his idea will be stolen by Obama?

Congressmen and Presidential hopeful Ron Paul, who chairs the House sub-committee on monetary affairs says the Fed should not be holding this “ficitious” debt any longer against US tax payers.

More evidence against the supply-side rhetoric. This is really starting to become embarrassing for conservative economists. I wonder if they even looked at any data before coming out and ranting about regulatory or tax policy impediments. Probably not. I haven’t heard one coherent argument from that side (with supporting data) showing that regulations or fear of higher taxes is hurting job creation.

Fictitious debt?

Riiiiiiight

Ron Paul has no clue about money. He is stuck in a commodity money world

The increase in exports are an indication that the US economy is in worse shape than most imagine. Of course good will flow where there is demand and we see that demand in the rest of the world. The fact that our exports to China are so great proves the lie that Chinese currency manipulation is causing problems in the US economy. China’s growth is driving Chinese imports of US goods. All of the foolishness in the Senate over China’s monetary policy was stupid at best and a dangerous threat to international trade at its worst.

If you do not understand that production and consumption are simply two sides of the same coin you cannot understand that that “concerns about future taxes and regulation” are not incompatable with “inadequate aggregate demand.” There is no demand in the US because people are out of work because there is weak production in the US. The US is facing a situation much like China has faced where domestic markets are restricted in favor of foreign markets. In the US we drive production out of the country, create jobs in other countries and that in turn creates demand in those countries. More and more the US economy moves towar third world status. We export but can’t feed our people.

Finally, using government to stimulate demand is foolish because the government does not produce. The government takes resources from the domestic economy and wastes them on in efficient and unnecessary expenditures and ultimately creating a debt crisis.

Wait just a minute! Where is the counterfactual analysis of how many additional jobs and goods the export sector would have created if we did not have some supply side issues?

Does this count as exports?

http://www.washingtonpost.com/world/national-security/us-cyber-espionage-report-names-china-and-russia-as-main-culprits/2011/11/02/gIQAF5fRiM_story_1.html

I don’t understand the logic behind your assertion that high export growth proves that domestic demand is inadequate. Consider exploration for oil and gas. The feds do not allow exploration and production in many areas, such as offshore Virginia. That restricts output and employment in the U.S. We export drilling services to countries that allow drilling. And you interpret this as inadequate domestic demand?

Short version: When times are good you complain about taxes/regulations and when times are bad you complain about lack of income i.e. customers. Also in bad times you complain about the non-producers dragging you down. Everything else is just blah blah blah.

I’m not saying regulatory uncertainty is the problem, but simply pointing out that exports have grown more than domestic production is absolutely NOT an argument against the hypothesis.

Export Surge:

Do you think this could be due to a lack of demand in the domestic market? Is it possible that firms were only trying to unload the excess supply? Do you think this could be a trend or temporary surge due to current domestic consumption?

Ricardo, the next time I drive on an Interstate highway or land at an Airport or use the internet, I will remember this statement:

“Finally, using government to stimulate demand is foolish because the government does not produce. The government takes resources from the domestic economy and wastes them on in efficient and unnecessary expenditures and ultimately creating a debt crisis.”

Also, I will think of the genius of the private market as I drive by half empty malls and foreclosed homes dotting my free market paradise.

@Jeff

You’re right, but taken together with this (http://www.treasury.gov/connect/blog/Pages/Is-Regulatory-Uncertainty-a-Major-Impediment-to-Job-Growth.aspx), any reasonably logical person could surmise that demand is the overriding factor driving job growth in the U.S. right now.

Net exports tell a different story.

The trade deficit with China is nearing or surpassing record highs.

The US has a trade surplus with Canada largely because of US depreciation.

If exports increase 25% (from a small base) and imports rise 50% (from a huge base) the country is worse off. Period.

As a piece of data, the small business survey shows concerns about taxes and regulations are at the same level as always while sales worries are much higher. Sales worry was up 3x – to about 1/3 of all respondents – and is still over 2x normal.

Some businesses do ok even in a depression, let alone in a big recession. Some businesses worry about taxes and regulation in any economy, perhaps because that affects some businesses more than others, perhaps because there will always be a certain number of people who see that as their obstacle in a country where there’s a lot of native hostility to regulation. I can imagine dry cleaners, for example, worrying about regulation because many of them sit in locations contaminated by their use of now-banned chemicals and they rightly worry about liability. It may even be worse if the current tenant is clean but the old one wasn’t because you may have bought a dirty business. (Be very careful buying a shopping center which has had a dry cleaner or which is near one because that stuff migrates through the water table.)

I don’t get why commenters can’t understand Menzie’s point about exports. It merely means suppliers are willing to produce – that they have the necessary “confidence” – for markets where there is demand. Given the persistent output gap and low inflation, the rise in exports says the problem isn’t adequacy of supply or anything like that but a lack of domestic demand. It’s not like there is competition for productive capacity with the winner being exports. It’s that the demand for capacity is coming from overseas markets.

Commodity prices are moving so slowly that cash hoarding is becoming the preferred status-and will lead to recession soon:

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626&p=35012#p35012

If firms are not hiring because they are concerned about taxes and regulation I wonder what it was during the Bush administration since employment growth is actually stronger now than it was at this point in the Bush administration.

The post is misleading, I think. The contribution of the trade balance has been negative since 2009. In 2010 the U.S. trade balance moved seriously towards deficit and the deficit has continued to grow so far in 2011. It is true that the trade deficit has not reached its level in 2007, but we were running a huge and clearly unsustainable deficit then.

The notion that an increase in oil prices necessarily leads to an increase in the deficit is wrong. Some countries with large trade surpluses have no domestic oil production at all and must import all of their oil.

I ask the same question I asked in an earlier post on this topic – why look only at exports? It gives an incomplete and often very misleading picture of the effect of trade on the economy.

Trade deficits measure whether a country is getting richer or poorer relative to its trading partners. Not a perfect measure, but better than any other.

If we want to address unemployment or stagnant/ declining real wages in this country, we can’t do that selling things to our own overindebted selves. We have to sell them to foreigners who have something of value to trade for them.

Ideally, we would trade our labor at a high cost for other people’s materials at a lower cost. That’s the prescription for high US standards of living. If we can’t do that, we would be better off pursuing autarky. Isolation and the attendant privations is better than bleeding out through engagement.

sherparick,

When you drive on the interstate highway consider that this government project probably cost 10 times or more than if it had been done by private business.

A current case in point. I worked for 18 years at Walt Disney World. Last week I was at an event in one of the Disney hotels where central Florida communter rail came up as a discussion point. The state and federal government are in the process of creating a communter rail project 61 miles long at a cost of $18 million per mile ($1.1 billion in total). I asked would Disney do any kind of rail or transportation project that cost $18 million per mile. If you have been to Disney World you will know that they have a transportation system that puts any transportation system in any city in the world to shame. But I was involved in the decisions of how much to spend and I promise you they would never come close to paying even $1 million per mile.

Government expenditures are made based on socialist principles. Get yourself a good book on the inability of socialist economic calculation to understand what governments simply cannot produce efficiently.

Then when you drive by those empty malls consider that they would be full if only the government would get out of the way and allow the market to satisfy consumer demands rather than picking winners and losers. Politicians make viable businesses pay their crony capitalist friends as they engage in legalied theft to support failed businesses. The politicians are destroying businesses that actually serve people while protecting their donors “investment.”

With everything that has been in the news lately I don’t think I need to give an example. Take your pick.

Ricardo,

Disney World may be able to build a nice transportation system, but is it 61 miles? Infrastructure projects grow more complicated in proportion to their size (much like IT projects). Decreasing Economies of Scale can be a major factor.

The reason why Private companies do not generally engage in large infrastructure projects is because these projects are very capital intensive. Governments have the necessary capital to help give private companies incentive to take on these large projects (grants, guaranteed loans, etc…).

The government may be inefficient at carrying out these projects, but where would this country be without all the government funded infrastructure?

most big U.S. infrastructure projects have been horribly inefficient. Example, building super highways to allow whites to flee the inner city after Brown v. Board of Education….silly idea. More highways, more suburbs, more driving, more wars…do the math.

Second, Rachel Maddow’s fave is the horrible damming of the Colorado river. Used data from the wettest decade in a long time to estimate the flow. Did not account for silt….horrible idea. Please no more of this.

Army corp and levees in New Orleans anyone???

Big government=big inefficiency at best, horrible scarring and unintended consequences up the ying yang.

Please stop.

…they are hiring and increasing production for sale where there are customers.

I see where you’re going, but I have two issues:

* Your claims rest on the unsupported assertion that the firms that are increasing exports are also increasing total production on net.

* With that asserted production increase in mind, your claims further rest on the also-unsupported assertion that firms are making new hires in step with their increased exports.

Indeed, productivity increases and whatnot aside, if it were that case that production was rising without appropriately large gains in hires, that would seem to lend some credence to the uncertainty hypothesis.

If you have some additional data on the matter I would love to know.

This is simply a “straw man” argument from a left wing economist. Of course a businesses’ main concern is ALWAYS customers. The question is customers at what price! The argument is not that businesses don’t expand because of a fear of regulation but that the cost of regulation (among other things) makes US production uncompetitive or less competitive than it could be. The same is true of taxes, employment rules, etc. Any business can have all the customers it wants if it can just lower its prices, but it can only lower prices if it can lower its costs….reducing regulations and taxes does this across the board. The reason exports are a bright spot is simply because much of the developing world is not experiencing a recession and we are; this sheds no light on the cause of our deep recession.