The United States and Britain have apparently been discussing a joint release of strategic petroleum stockpiles.

The U.S. Strategic Petroleum Reserve was intended to be used in the event of a “severe energy supply interruption” whose legal definition is as follows:

a severe energy supply interruption shall be deemed to exist if the President determines that–

- an emergency situation exists and there is a significant reduction in supply which is of significant scope and duration;

- a severe increase in the price of petroleum products has resulted from such emergency situation; and

- such price increase is likely to cause a major adverse impact on the national economy.

Historical experience has shown that seemingly temporary supply disruptions can have very long-lasting consequences. Libyan oil production in November was still only about a third of what the country had been producing in January 2011 prior to last year’s disruptions. Iraqi production still has not returned to the average value seen in 1989 prior to the First Persian Gulf War. Iranian production has never returned to the average values achieved in 1977 prior to its revolution.

The U.S. SPR currently holds 696 million barrels of crude oil, of which 62% is sour and 38% sweet. If we relied on this stockpile to replace Iran’s current 4 million barrels of daily production, the SPR would be drained in less than half a year.

The SPR is likely to be most effective as a short-term device to help bridge a temporary supply shortfall until other sources can become available. Is there a conception of our current situation in which the primary challenges are short term in nature?

Europe has been trying to get by with less oil from Libya and has been drawing down its private stockpiles, and is looking for alternative suppliers to replace imports from Iran. This market tightness is the key factor in the current price of Brent.

|

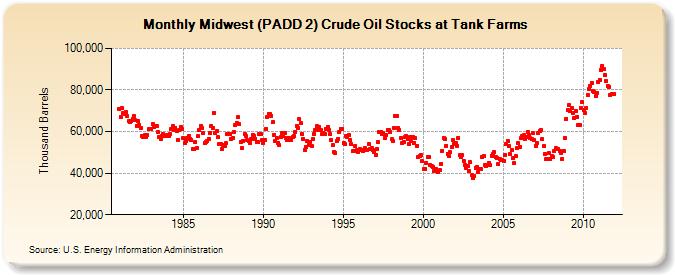

If one believed the Libyan problems will soon be resolved, an SPR release might make sense as a temporary assistance measure, though it is hard to find a basis for similar optimism for a near-term resolution of issues with Iran. Another development that could ease the situation in Europe will be completion by the end of the year of additional pipeline infrastructure to help transport crude from the central U.S. to the coast, which will relieve some of the competition with European refiners for buying international crude currently coming from U.S. refiners on the coast. However, some analysts worry that the added deliveries from the new pipelines will end up using some of the same limited distribution capacity required by an SPR release. And if the justification for the SPR release were just to buy time until more U.S. pipeline capacity can be added, surely the more sensible step would have been to speed up the regulatory review process.

I’m led to conclude that a more important rationale for another SPR release was expressed in the following report from Thursday’s Wall Street Journal:

A number of influential lawmakers, including Rep. Ed Markey (D., Mass.), have called on the president to tap the strategic reserve to deflate rising prices. “Releasing even a small fraction of that oil could once again have a significant impact on speculation in the marketplace and on prices,” Mr. Markey wrote last month in a letter to the president.

If that sounds familiar, it should. Here is what Representative Markey wrote in a letter to the President dated February 24, 2011:

Right now, the Strategic Petroleum Reserve holds 727 million barrels and is filled to capacity. Releasing even a small fraction of that oil could have a significant impact on speculation in the marketplace and on prices.

In fact we ran that exact experiment last year, which is the reason that Representative Markey would need to paste over “727” with “696” and cross out “is filled to capacity” if he wanted to re-issue the same letter this year as he did the previous year. Specifically, the IEA announced on June 23, 2011 that the OECD countries would release 60 million barrels from their joint stockpiles, half of which came from the U.S. Strategic Petroleum Reserve. There was an initial modest drop in the price of oil on the day of the announcement, though within two weeks the price was back up above where it had been before the announcement.

|

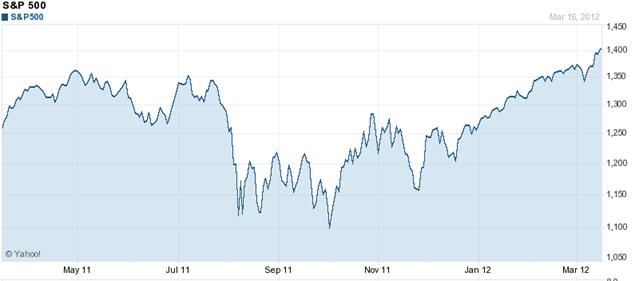

The price of oil did decline later in the summer, though surely this should be attributed to deteriorating news from Europe rather than the SPR release. For example, last summer’s drop in WTI was mirrored by a drop in other financial indicators such as the S&P500.

|

I see no evidence that last year’s SPR release accomplished anything, and would not expect the outcome of another release this year to be very different.

A far more sensible proposal would be to build the pipelines necessary to allow the oil currently in private stockpiles in the central U.S. to flow to refiners on the Gulf of Mexico.

|

I agree.

“Releasing even a small fraction of that oil could once again have a significant impact on speculation in the marketplace and on prices,”

Meh. If I were a rich man, la da de da dada, I’d be calling Bernanke’s bluff and stockpiling oil, oil futures and other assorted commodities with both hands using low interest, ZIRP loans provided by the thief coward himself. Bernanke’s policies have been geared toward increasing speculation, I’d dare him to tighten as oil and food prices conyinue to rise.

http://seekingalpha.com/article/262391-commodity-prices-show-strong-correlation-with-fed-treasury-purchases

The establishment seeks to pull yet another rabbit out of a hat.

Either the price increases (supply/demand) to to the point of visible rationing by price (diminished access to credit) or the price decreases b/c of collapsing credit.

It’s central banks v. geology and a hundred years of waste.

Funny thing is the 2008 spike had a speculative component as J. Aron (Goldman-Sachs) and Nymex traders executed a squeeze on Semgroup and added $20 to the price of WTI in the process: from $130- to $147 per barrel. Nobody thought of using the SPR then (or were bought off by Goldman).

For an interesting case that the release last year did move prices, read this http://streetwiseprofessor.com/?p=5243 post by Craig Pirrong.

Just because he thinks it really moved prices doesn’t mean he thinks it was a good idea. But he has some good arguments that it had an effect.

You say “pipelines”. Do you mean the Keystone south part that will be done in a year plus or other pipelines as well? Are other pipelines proposed? Up for permits? Permitted?

On a not-very-related issue, I’ve been reading that a reason for Keystone, meaning the entirety not just from OK down, is the ability to get oil to a trade zone so it can be exported at lower cost. Is this true? If it is, is there a sense of what part of that is the motivation?

… and they’re waiting a few months so it hits right before the election.

How convenient.

Banana republic.

How is this any different from reversing the 11% slide in oil production on Federal lands?

http://cnsnews.com/news/article/obama-s-claim-increasing-domestic-drilling-not-accurate-say-energy-analysts

It doesn’t change the long-term equation of buying oil abroad to fill the strategic reserve. It is short-term expediency to relieve political pressure from President Obama’s strategy of oil deprivation to support his greenie agenda. How is this any different from allowing more Canadian oil to flow to the U.S. to change the supply-demand equation?

http://hallofrecord.blogspot.com/2012/03/myth-of-us-oil-dependence.html

JDH I’m not following your argument. How is releasing oil from private stockpiles any different than releasing oil from the SPR? Building the pipeline connecting Cushing and the Gulf is not terribly controversial as a public policy issue, and it would no doubt rationalize refinery utilization, but how does it add more oil to the pipeline beyond what could be added by releasing from the SPR? If releasing from the SPR would have only a small and transient effect on crude prices, then wouldn’t releasing from private stocks have an equally small and transient effect on prices? Surely those privately held stocks are dwarfed by the size of the SPR, right?

Just to be clear, I am not advocating that the Administration release stocks from the SPR. And I am not arguing that completing the southern portion of the pipeline would be a bad thing. I just am not following how you got from saying we shouldn’t release from the SPR because it would be ineffective to saying that we should expedite building of the pipeline because that would release private stocks. If the pipeline were up and running today, more oil would be sold, but it would physically exist inside the pipeline rather than in the ground. I think you have to argue that there would be in increase in long run production sufficient to both fill up the pipeline and to increase the flow rate. That’s a tough argument to make.

It’s also not obvious to me that private owners of oil stocks would even want to sell additional oil even if the expanded Cushing to the Gulf pipeline capacity were in place today. As long as people think we’re on the uphill side of an oil bubble there’s very little incentive to want to sell as long as you have the physical storage capacity to hold oil. The one (admittedly unlikely) thing that releasing from the SPR might do is to help break any speculative bubble and thereby induce private owners of oil stocks to sell what they have in storage.

‘…more sensible proposal?’ In an election year with a liberal president up for re-election? Do pigs roost in trees?

jonathan: By “pipelines” I refer to reversal of the Seaway Pipeline, the Flanagan South Pipeline Project, and the Cushing-to-Texas portion of Keystone, as discussed here.

2slugbaits: Pipelines would not only release private central U.S. stockpiles, but more importantly would accommodate a greater ongoing flow rate, as well as assist with the logistics associated with delivering the SPR oil itself.

ThomasL: But as I point out, those temporary price declines were more than reversed within two weeks of Craig Pirrong’s statement, and look at what he himself wrote about it a week after the post you cite.

The discussion by policy makers regarding a release of oil from the SPR is a prime example of bad decision making, based on a false premise, to-wit, that we don’t have any fundamental oil supply problems.

I think that we are looking at cognitive dissonance on a global scale. The general tendency is to simply ignore the Net Export numbers, or if forced to confront them, the tendency is to assert that this is a temporary phenomenon, which will fade as soon as the appropriate policies are in place to allow American oil companies to fully exploit the near infinite oil supplies we have in the US.

The problem with Newt’s “Plan” for $2.50 gasoline is that we must not only offset the US decline in older oil fields, we have to offset the regional decline in net exports and the global decline in net exports.

The average 2004 to 2011 increase in US crude oil production was about 40,000 bpd per year; it did however increase to about 125,000 bpd per year, average over the past two years (which is a net increase of about 150 bpd per drilling rig, drilling for oil, per year, over the past two years).

However, from 2004 to 2010, combined net oil exports from major net oil exporters in the Americas and the Caribbean fell at an average rate of 240,000 bpd per year.

From 2005 to 2010, Global Net Exports of oil (GNE) fell at an average rate 600,000 bpd per year.

And ANE (GNE less Chindia’s net imports) fell at an average rate of 1.0 mbpd per year from 2005 to 2010. I estimate that this volumetric decline rate will accelerate to between 1.4 and 2.0 mbpd per year between 2010 and 2020.

But the real story is CNE (Cumulative Net Export) depletion. We are only maintaining relatively high net export volumes because of a sky high post-2005 CNE depletion rate. Perhaps 0.1% of the people in the world have a clue as to what I am talking about.

I’ve put it this way. Imagine the total volume of oil that will be (net) exported, after 2005, to importers other than China & India. And imagine all of that oil in one big tank. If we extrapolate current data, that oil tank could be half empty by the end of next year.

The primary trend we are seeing is that developed oil importing countries like the US are being gradually priced out of the global market for exported oil, as global crude oil prices doubled from 2005 to 2011, and as developing countries like the Chinda region consumed an increasing share of a declining volume of GNE.

Given the firestorm of Conucopian Disinformation out there, trying to counter it seems like an exercise in futility.

jonathan: As for the possibility that crude transported to the Gulf of Mexico would then be exported, the U.S. currently imports about 9 million barrels of crude oil every day. What would happen with better infrastructure is a reduction in the volume of those imports rather than the U.S. suddenly becoming an exporter of oil.

drilling will have no impact. lets delay the pipeline as long as possible. but: lets release the SPR. oh, the irony.

ultimately if the price of oil stays high people will use less of it and switch to cheaper natural gas (yes, even for cars: Honda is pushing NG cars and pushing dealers to install fill-in stations which right now are many fleet-oriented), more fuel efficient cars ad trucks, etc.

yes, virginia, the trade deficit (70% of which is oil) is self correcting.

the real issue is whether the Fed will over-react to the commodity price spikes (higher commodities prices are inevitable as demand picks up against inelastic short run supply).

Or, as it has in the past, paniced at the first sign of supply-side inflation.

Mark Thoma has a good post… Will the real Ben Bernanke (who said dont react to oil price spikes) please stand up??

Markey’s reasoning isn’t sound, but maybe it’s not supposed to be. Drawing on the reserve makes sense if we’re planning a military action.

2sb, the purpose and size are important. SRP is for emergency needs, particularly military and disaster relief.

I doubt strongly SRP release is election strategy related. It’s easily seen through and people know what to expect after.

Most likely, it is done to coincide with a short, intense military action. Or to signal intent and preparedness.

2sb, pipeline is a long term fix. the SRP release will cause a negative supply shock afterward.

Pipelines also dont just release current private stock, they stop the backlog that leads to these buildups, this allows new production to come online.

As I understand it, the reserves will not save us if the Strait of Hormuz are closed.

Something like 17 mpbd of oil move through the Strait; the SPR is designed to mobilize 4 mbpd, although many question whether even that is feasible. http://www.msnbc.msn.com/id/46761734/ns/business-oil_and_energy/

Should the Strait be materially closed for an extended period of time, don’t expect the SPR or the concerted action of global SPRs to save the day. More likely than not, a closing of the Strait would take down the global economy within one month.

Steven,

I have thought for a while that possible military action against Iran was beginning to look like a variation of “Waiting for Godot,” i.e., endless waiting for an event that never comes to pass.

However, given the public statements by Israeli officials, it now seems unlikely to me that Israel will be willing to unilaterally back down.

@JDH

You are quite right. I recall that second post you referenced as well.

When you said in this article that it did not “accomplish anything” I misread that as saying it had no effect at all (against which I referenced Pirrong’s post).

Reading it again, I see that you meant that it didn’t accomplish anything of any lasting importance.

On that I think we are in perfect agreement.

it is the more permanent fix that stops speculation. supply constraint and inefficint logistics are what drive speculation. short term manipulation only benefits speculators.

I’m curious as to why no one has commented on the elephant in the room. It seems to me that a release from the SPR would contravene the law as quoted by JDH.

The United States is a net exporter of petroleum products. Its own production of crude and condensate is high (by recent standards) and rising. Oil is freely available for import – at the market price.

By what reasoning can an emergency be said to exist? Remember, according to the definition, high prices must be the *result* of an emergency, not the emergency itself.

We need to keep in mind that no one is stopping the construction of the southern leg of the Keystone pipeline. In fact, the Administration welcomes it:

The White House said in a statement today that Mr. Obama welcomes the construction of the Gulf Coast section of the pipeline. “We support the company’s interest in proceeding with this project, which will help address the bottleneck of oil in Cushing that has resulted in large part from increased domestic oil production, currently at an eight year high,” White House Press Secretary Jay Carney said in a statement. “Moving oil from the Midwest to the world-class, state-of-the-art refineries on the Gulf Coast will modernize our infrastructure, create jobs, and encourage American energy production.”

http://www.cbsnews.com/8301-503544_162-57386002-503544/first-leg-of-keystone-pipeline-slated-for-construction-as-standalone-project/

That said, looking at the refinery operable utilization rates I find it a little hard to see how increasing the flow to PADD2 or PADD3 (going in either direction) will do much of anything to ease gasoline prices…especially gas prices on the east and west coasts. Refineries at PADD2 and PADD3 are running over 90%. The problem children are on the two coasts, with east coast operating in the 55% range.

aaron I’m not recommending a release of stocks from the SPR. Just looking at the refinery utilization rate data it seems to me that a better and more natural explanation for high gas prices might be because PADD2 and PADD3 refineries are operating a few percentage points above their historical norms and PADD1 is operating about 20 percentage points below its historical norm. Releasing from the SPR won’t fix that problem…and neither would a pipeline connecting Cushing to the Gulf. Doing something about refinery capacity on the east coast would help.

Steven Kopits I don’t lose a lot of sleep over the Iranians trying to close the Straits.

Want to tamp down speculation? The US gov’t shouldn’t release oil from SPR. Instead, it should flood the market with futures contracts. After the bubble deflates, buy back the deeply discounted contracts.

2sb, I think you’re mostly right regarding the SPR release to have little effect on US gas prices. I doubt that is the intent. It is more likely for military purposes and foreign policy matters. Europe could use our petroleum products and–hopefully Jeff can fill us in–it also matters the size of the refinery capacity of padd2 and 3. That few percent probably means more than it does at cushing.

Greg, what matters is the size of oil imports to petroleum product exports.

2sb, on Iran, I very much agree. Shutting down the strait would be temporary. It would be a pause in economy as resources are directed to reopening it.

padd1 is probably down because of refinery shutdown. with production coming online in ohio and penn, putting in pipelines along some passenger rail routes could help.

The west coast is trickier, that would take moving oil around mountains.

Slugs –

I find the whole SPR situation a bit odd. If you look, both Jim and I have published in the past in support of SPR withdrawals. We’re both opposed now. So is Yergin. In fact, I don’t think I’ve found a technical professional in support of a drawdown right now.

But there’s a widespread call from Democrats to do so. Why? The election is still months away. Do they know something we don’t? They might. Maybe they have better information about the odds of a strike on Iran than we have.

And if so, what will the Iranians do? What are the Saudis doing? They’re arming the Syrian rebels, according to news reports. So the whole situation is looking more and more like a showdown. And if so, how will Iran respond?

The Iranians don’t need to sink a thing to close the Strait. They just need to create an environment where the tankers’ insurance is voided. Not that hard to do, at least for a while.

Jim, I speculated on this as well. I argued the market had priced in the SPR release last year.

http://jerrykhachoyan.com/could-a-strategic-petroleum-reserve-release-drop-oil/

Steven Kopits Why couldn’t governments become the insurers of last resort? If Lloyds of London doesn’t have faith in the US Navy, then shouldn’t the US govt have enough confidence in its own Navy to be ready and willing to accept an insurace premium in exchange for safe passage?

The IEA report and forecast March 2012 (P2) left a provision for a shortfall in oil supply but not that significant,and not signifying any trouble but the politic of the uncertainty.The world of oil seems to be balanced, even with Iran forced savings of its mineral resources, supply and demand are trending towards equilibrium.The swinging OPEC producers expecting to meet with supply shortfalls, please see tables P14 the delta growth in demand is not that impressive and neither is the economic growth.As for the OECD reserves P14, they seem to be managed within regular sinusoids of the same amplitude.

P25 Tables depict a balanced world be it on production or consumption.

Since the key subject is the drawing on the physical inventory, it may fall within the usual sinusoidal pattern and at its lowest point.The main question being left to the accountants is it Last in First out or First in First out when dealing with pricing and profit and loss records?

A look at the Nymex crude oil future may reveal that the wall of oil worry started as of the year 2012 since volume and prices were built up within this time frame,a fat finger glued on a key board?

Rather than drawing on the reserves it would tempting to explore the resistance of the futures.

Noted that supply to consumers is not constrained and prices bottlenecks would meet with the definition of “severe energy supply interruption” so it is price.

Or you could just trade in your gas hog now for a Volt and entirely stop using gasoline for much of your daily commute and weekend errands. That would free up crude for lower prices for actual important social uses such as to supplement biodiesel in interstate shipping.

It does seem difficult to describe the current situation as an “emergency,” when the US is exporting sizable quantities of refined petroleum products.

As I noted up the thread, the primary trend we are seeing is that developed oil importing countries like the US are being gradually priced out of the global market for exported oil, as global crude oil prices doubled from 2005 to 2011, and as developing countries like the Chinda region consumed an increasing share of a declining volume of Global Net Exports of oil.

I recently read this piece on oil & gas prices on the east coast. I’ve reduced it in size:

To recap the problem, two of the nine East Coast refineries with a capacity of 363,000 barrels a day (b/d) have recently been closed down. Sunoco which owns a large Philadelphia area refinery (with a capacity of 335,000 b/d) is seeking a buyer and says it will close the refinery in July unless one can be found. These three refineries comprised 50 percent of the East Coast refining capacity as of last summer. Interestingly, the Sunoco’s Philadelphia is the oldest continuously operating refinery in the world having been established in the 1860s. The company says the price of imported crude which costs refiners roughly the going rate in London, plus about $2 a barrel for shipping, simply makes refining along the East Coast unprofitable.

There is some good news in the situation, however, as a refinery in Delaware recently reopened after a two year shutdown adding another 182,000 b/d to regional refining capacity; the bad news is that a big refinery in the Virgin Islands recently closed, halting the 200,000 b/d of refined products it was sending to the East Coast so the region is currently down about 380,000 b/d.

The EIA says the refinery situation, which will be greatly exacerbated if the third one shuts down in July, will leave us with two kinds of problems. The first will be to where find additional barrels of gasoline and low sulfur diesel and how to transport them to the region and the second will be distributing these products to those areas that have been completely dependent on the Philadelphia area refineries.

The most serious problems are likely to develop in Pennsylvania and Western New York State where oil products are delivered by pipeline from the refineries in question. There seems to be no quick fix for moving oil products into Pennsylvania and Western NY as the product pipelines originate at the refineries and reworking the piers, pipelines and storage terminals to adapt them to handle finished products rather than crude brought in by ship will take time and be expensive.

Ultra Low Sulphur Diesel (ULSD), which is now the standard fuel for trucks, trains, heavy equipment etc. will be the most difficult to find and distribute and would likely be the first to develop shortages. While there are adequate sources of ULSD along the U.S. Gulf coast, getting them to the Northeast may be a problem. The pipelines are fully utilized and the Jones Act requires that shipping between U.S. ports be in US flagged ships. There are very few available tankers meeting the requirements available and cost of using them is three or four times as much as foreign flagged ships.

Another problem is that most of New England, starting with NY State this summer, is scheduled to switch to ultra low sulphur heating oil which was to have been refined in the Philadelphia refineries. This will increase the consumption of ULSD by 70,000 b/d in the winter. Even with the relaxation of the Jones Act and the environmental regulations, there seems to be a potential for problems in the near term.

The Pennsylvanians in Congress are very concerned about the situation. The House has scheduled hearings for March 19 and the Senate is planning to hold them also. Some have suggested that the Federal Government intervene in order to keep the Sunoco refinery operating, but this seems difficult to do in that it is losing considerable amounts of money and the owner wants to get out of the business. Finding a buyer in the next few months also seems unlikely given the large number of refineries that have come on to the market recently. Profitable refining seems to be one of the casualties of high oil prices.

Given enough time, the markets and the infrastructure will rebalance, but for now it looks as if the Northeast may be in for some abnormally high gasoline and diesel prices in comparison to the rest of the country.

(source: Tom Whipple on oilprice.com)

…been discussing a joint release of strategic petroleum stockpiles.

No. It means : Obama needs a war.

Nov 2012 coming soon.

Hopefully this crazy guy in Teheran gets his atomic weapon right in time for a little chance of self-defence.

Jonathan, thanks for posting that snippet, it was very educational.

BP is also trying to sell two refineries, one at Texas City, Texas (their largest) and one in Long Beach, California. One wonders if they will be shut if a buyer can’t be found.

Product pipelines from the Midwest need to be extended to the East Coast.

“And if the justification for the SPR release were just to buy time until more U.S. pipeline capacity can be added, surely the more sensible step would have been to speed up the regulatory review process.”

The opportunity to speed up the regulatory process to have an effect on oil supply now was gone long ago. Releasing oil from the SPR is still a solution that can be tried. It may not be the right one, but it’s available now. As you point out, SPR release is only a short-term measure. Regulatory review is irrelevant for short-term issues.

Do we ever have to refill the SPR? It seems from Rep. Markey’s point of view the SPR has tapped into a source of enless supply.

Slug,

Just for the record you may not be losing sleep over the closing of the Strait of Hormus but you probably will if it is closed…then again maybe you won’t. Maybe you like high gasoline prices.

Tomorrow Obama will go to Cushing, OK to announce that the Administration intends to fast track approval of the southern leg of the pipeline. Just sayin’.

Ricardo I don’t lose sleep over the Iranians closing the Straits because I have more faith in the US Navy than you do. If the Iranians were really, really lucky they might be able to bottle up the Straits for a few days. The mullahs and ayatollahs know that blocking the Straits would all but guarantee a sea launched cruise missile strike decapitating the Iranian leadership. We know where they live. And I think the Iranians are smart, rational actors and understand this perfectly well. As to high gas prices, while I do think gas prices should be higher, I only support higher gas prices through a Pigovian tax that could be rebated or reapplied towards mass transit. Higher gas prices due to misallocation of resources is not a good thing.