In a Guest Contribution today, John Kitchen (U.S. Treasury, formerly Chief Economist, Office of Management and Budget) addresses the issue of “Financing U.S. Debt: Is There Enough Money in the World — and at What Cost?”. The comments are based on a paper recently published in International Finance (Winter 2011), co-authored with Menzie Chinn. The views expressed are the author’s and do not represent the views of the U.S. Treasury.

From the abstract to the paper :

With the outlook for continued U.S. budget deficits and growing debt — and the uncertainties regarding their financing — we examine the role of foreign official holdings of U.S. Treasury securities in determining Treasury security interest rates, and the resulting implications for international portfolio allocations, net international income flows, and the U.S. net international debt position. … Although relationships suggest that the world portfolio could potentially accommodate financing requirements over the intermediate horizon, substantial uncertainty surrounds the likelihood of that accommodation and the associated effects on interest rates and adjustments in international portfolios. Notably, unprecedented levels and growth of foreign official holdings of U.S. Treasuries will be required to keep longer-term Treasury security interest rates from rising substantially above current consensus projections.

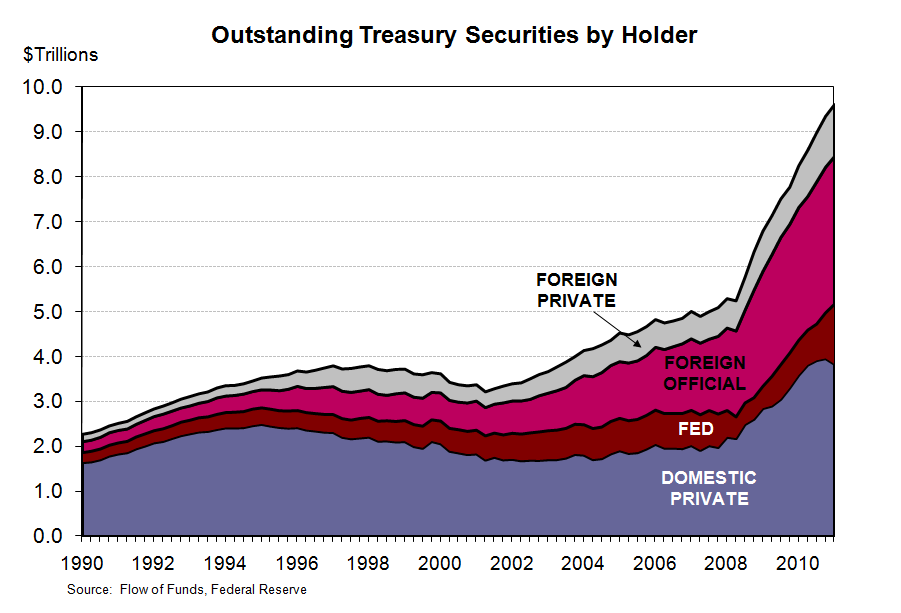

Although the United States has had little trouble financing its large budget deficits in recent years and at low interest rates, the results of the paper show the extent to which Federal Reserve policies (from expanding its holdings of Treasuries and government-backed securities) and the large purchases of Treasuries by foreign governments and central banks (foreign official assets) have contributed to keeping longer-term Treasury security yields low (and low relative to the low short-term interest rates from Federal Reserve policy). Once the U.S. and major developed world economies return to a more established economic expansion, however, the United States likely will face greater challenges in financing its debt — and at a higher cost with much higher interest rates.

The preferred equation in Kitchen and Chinn for estimating the effects of the various factors determining U.S. Treasury interest rates is given by:

i10YR-i3MO = 1.22 + 0.56(UNGAP) – 0.38(INFL) – 0.33(STRSURP+FOREIGN+FED)

where:

- i10YR is the constant-maturity yield on 10-year Treasury notes;

- i3MO is the secondary market interest rate on 3-month Treasury bills;

- UNGAP is the gap between the unemployment rate and the NAIRU;

- INFL is the deviation of consumer price inflation from the Fed’s target inflation rate;

- STRSURP is the Federal structural budget surplus as a percent of potential GDP;

- FOREIGN is foreign official holdings of U.S. Treasuries as a percent of potential GDP;

- FED is the change in the Federal Reserve’s holdings of long-term Treasury and government securities as a percent of potential GDP.The results in the equation generally conform to prior estimates in the literature for the effects of the budget deficit on long-term Treasury yields – and for the effect of the change in foreign official holdings, as well. The coefficient on the structural surplus variable is negative as an increase in the structural budget surplus (a fall in the deficit) would reduce the relative supply of Treasury securities and reduce risk and uncertainty for longer-term Treasury securities, leading to a lower long-term yield relative to short-term (short-run-policy-determined) rates. The estimated effect is 33 basis points on the 10-year yield relative to the short-term yield for each one percentage point of GDP for the structural budget deficit. The coefficients on the change in foreign official holdings of U.S. Treasuries, and for Federal Reserve holdings of long-term Treasuries, MBS and U.S. agency assets, are also negative; an increase in official/monetary holdings (foreign or domestic) is effectively an exogenous demand shift for Treasury securities (at that point in time) that would lower longer-term yields. And, the estimation results confirm that the constraint that the effects are the same — that the coefficients are identical — cannot be rejected. (Note that the paper also presents an Appendix with various estimates and discussion regarding the roles of deficits vs. debt — i.e, flows versus stocks; the preferred equation uses budget deficits.)

Given that the Federal Reserve is expected to draw down the size of its balance sheet over time as the economy returns to its potential growth path, the results of the paper indicate that the interest rate projections from public and private forecasters are effectively and implicitly based on an assumption (even though most probably don’t even know they are doing it) that foreign governments and central banks will continue to purchase a large share of U.S. Treasury securities. If the foreign purchases aren’t forthcoming at those large amounts, longer-term Treasury yields would be higher than forecasters project. Under such a scenario in the paper in which foreign official holdings of Treasuries are steady relative to U.S. GDP rather than continuing outsized growth, the 10-year Treasury yield would be 2-1/2 percentage points higher in 2020 at 7.9 percent compared to the 5.4 percent of the base case (CBO January 2011). To keep the 10-year Treasury yield down at 5.4 percent, the paper estimates that foreign official holdings of Treasuries would have to rise from 5 percent of world GDP to over 20 percent of world GDP by 2020. Given the large demands for funding governments worldwide, imagining such an increase for the U.S. alone seems challenging at the least.

But the challenges don’t stop there. As also discussed in an alternative forum (at a conference at the Baker Institute of Rice University on “Defusing the Debt Bomb”), the underlying required balancing relationships of international macroeconomics for financial flows and trade flows mean that exchange rates and the U.S. trade position will be affected by the extent to which foreign funding occurs. The high amount of foreign official funding flowing into Treasuries over the past decade has corresponded with China’s policy of keeping the exchange value of the renminbi (RMB) low relative to the dollar and with the U.S. running a large trade deficit, as well as other flows from other foreign central banks and sovereign wealth funds. In practice, then, it is unlikely that the United States — as it returns to a potential growth path — could simultaneously have relatively low long-term Treasury yields and a large improvement in its trade position. Yet that is what the “consensus” of private forecasters (as in the Blue Chip) shows. If foreign funding of U.S. Treasuries continues at a large pace and keeps interest rates lower than otherwise, then the United States will run a higher trade deficit, ceteris paribus. If, alternatively, foreign funding of U.S. Treasuries wanes, then the U.S. trade deficit will be lower, but interest rates higher, ceteris paribus.

The paper also considers another alternative for funding — partial monetization of the debt through increased purchase of Treasury securities by the Federal Reserve (i.e., the Fed keeps its balance sheet permanently higher relative to what would be consistent with the pre-financial crisis position). Under standard relationships, that would result in higher inflation, higher nominal interest rates, and a lower exchange value of the dollar. The higher inflation would erode the real value of existing bonds.

In short, the analysis and scenarios illustrate that there is “no free lunch” for funding U.S. government debt, with some combination of “costs” from higher interest rates and debt servicing costs, an adverse trade balance effect, or negative effects on the real valuation of existing bonds.

As we conclude in the paper, the escape hatch from these challenges and costs is to implement a “responsible” fiscal policy rather than the current policy outlook for the U.S. in which public debt rises to nearly 100 percent of GDP by 2020 (and higher and higher in the years beyond):Ultimately, measures that reduce the deficit by changing the trajectory of tax revenues and spending, particularly in the latter years of the horizon we consider and beyond, would mitigate concerns about the financing of the U.S. budget and current account deficits. In the absence of such actions, it is unlikely that the rest of the world would finance our needs at the terms that are currently being projected, and American policymakers will become less and less the masters of our own economic fortunes.

This guest contribution written by John Kitchen.

As long as China et al are running a large trade surplus with us, they will be accumulating dollars. They either hold those dollars in the form of Treasuries, or they buy some other dollar-denominated asset … in which case the seller of that asset now has a pile of dollars to hold as Treasuries.

Or, China et al stop running a large trade surplus with us. That sounds like a fine thing to me. American households, in aggregate, want to save right now (their balance sheets got wrecked in the housing crash; their income is still insecure due to the lousy labor market). More exports/income, less imports/spending, some of that desire to save gets met. The federal govt is still refusing to run a deficit sufficiently large to accommodate that desire to save (hence, the required dis-savings manifests as involuntary unemployment); any help from the foreign sector would be welcome.

You focus on foreign owned debt, but the big rise after the crisis has been in private US ownership. I know how that breaks down but most people don’t and they don’t know how that can be unwound.

Also, when people say “responsible” fiscal policy those words are mush, even mealy mouthed. Many people will argue we need tax cuts – magic growth – and spending cuts and that’s “responsible”. Others will argue we need tax increases and spending cuts. Others will argue we need tax increases and no spending cuts because spending cuts – as even Romney has said – hurts growth in the short-term and lower growth means lower tax revenue, etc. Others will argue we need tax increases and spending increases, that otherwise we won’t escape this trap for many years. Others will argue we need to change entitlements to put the risk on the person while others will argue this will so change personal spending that the change will hurt the economy.

It isn’t a recommendation to say words with no real meaning. You need to have the courage to say what the words mean.

Why are Fed holdings of Treasury debt relevant to anything?

The Fed is the United States government, the same organization which borrowed the money in the first place. When the Fed buys a bond from a private holder or foreign government, it is paying back the money that the Treasury had borrowed. The Treasury doesn’t have to pay the Fed when those bonds reach their maturity.

If the Fed and the US Treasury like to account for these things as if the Fed and the Treasury are not the federal government, well all that does is confuse people, even experts such as Dr. Kitchen.

Treasury securities held by the Fed have nothing to do with the ability of the federal government to pay its debts. If the Fed has the bond, then the federal government has already paid back the money it borrowed when it sold the bond.

In any case, the federal government, which issues the currency that it later borrows, can always pay back any money it has borrowed. It cannot run out of US dollars. Why does Dr. Kitchen believe that the US government might run out of dollars or otherwise have trouble paying its bills or meeting its commitments?

I don’t understand your preferred equation. On the LHS you have the difference between 10-year and 3-month rates, which should be and indicator of inflation expectations. Then on the right you have various measures of U.S. Treasury demand. Are you trying to say that an change in U.S. Treasury demand is going to influence inflation expectations?

Left Coast Bernard,

Your comments are good as far as they go but you do miss the most important aspect of the FED buying Treasury securities and that is the expansion of the money supply. When the FED buys Treasuries the money goes into excess reserves, or into the rotating economy, or, which is more likely, is used to buy more Treasury securities and the Treasury uses it to pay for government largess. Large holdings of Treasury debt by the FED on one side of the ledger means money out the door on the other.

Wow.

This is consistent with typical fundamental (ie, accounting) analyses in different sectors–the futures curve and fundamental analysis do not square.

Thus, it would seem to support the notion that the futures curve is an extrapolation, not a forecast, and should be treated with concomitant caution.

Menzie,

How would you incorporate any potential reduction in private debt – specifically mortgage – elasticity with respect to the term spread?

The continuing trend of Asian countries to buy dollar reserves is troubling. In the last half of 2011, Japan bought over $180 billion. What other purpose besides exporting unemployment can such purchases have? Why do Taiwan and Korea have more foreign reserves than the United States? Why are such policies tolerated, whereas we have entire bureaucracies (the WTO) to combat the much less important trade distortions caused by tariffs or quotas?

There is such a thing as path dependency. The longer we wait to counteract these policies, the bigger the damage to our present and future economies.

Ricardo,

Thank you for your thoughts.

You miss the point that when the Treasury sells bonds, people buy them with US dollars that the Treasury had previously issued when Uncle Sam bought some roads, computers, or military equipment or paid his soldiers or civil servants. The money that the Treasury borrows was already in circulation and in reserves. When the Treasury borrows, it reduces reserves and currency held by the public. When the Fed pays off the Treasury’s borrowing, it increases reserves and currency held by the public. But the Treasury and the Fed are merely Uncle Sam’s right and left pockets. It only confuses matters to pay attention only to the Fed’s activity or only to the Treasury Department’s activity.

Uncle Sam, one entity, issues US dollars by spending them. Uncle Sam has an infinite supply of US dollars. There is not some fixed pile of Benjamins in the basement of the Treasury Department or down the street in the Fed. Unlike you or me, or Apple, or Goldman-Sachs, or the government of California, Uncle Sam cannot run out of US dollars, and he can always meet any US dollar denominated commitments.

The Tea Party’s plan, however, is to stiff Uncle Sam’s creditors. This is the often used method of tyrants and absolute monarchs of the past. Uncle Sam can always pay his bills, if he wants to.

Here is another thought. Suppose that in the absence of foreign official purchases we expect that the term spread will be determined by the expected path of the funds rate plus some constant risk spread.

Then there is a foreign official purchase. Assuming to change in Funds path or risk spread the foreign purchase will be contractionary as it drives down net exports but does not drive up investment.

In response, the Fed would then cut rates.

So, an investor seeing an unexpected increase in foreign official purchases should expect to revise her estimate of the Funds rate path downward.

Likewise an investor seeing an unexpected decrease in foreign official purchases should revise her estimate of the Funds path upward.

This might suggest that expected and unexpected changes in foreign purchases have different effects on the term spread.

One issue this may help to address is that the fitted path did not quite explain the depth of the “conundrum” despite the fact that we suspected the foreign official purchases to be at its root.

However, if that period showed a surprisingly large increase in foreign purchases then that may explain a larger impact on the term spread.

First, apologies for the delay in response (I was working — yes, and NOT watching March Madness … 🙂 )

Thanks for the comments …

Left Coast Bernard: That the Fed affects interest rates by its purchases of Treasury securities is well established — short-term interest rate policy is conducted through open market operations; in the recent experience the Fed’s quantitative easing and operation twist policies have been directed at longer-term rates.

Jeff, re the preferred equation specification, specifically the LHS: The long- to short-term rate spread is comprised of various components, one of which is the inflation expectation. However, it also includes risk premia and is affected in short-run periods by the position of the economy. For that latter effect, when the economy is well below potential, for example, the Fed will drive short-term interest rates down relative to long-term yields (widening the spread) and largely independent of the inflation expectation effect. That is the role of the ungap term …

Steven Kopits: yes, the futures are not very reliable …

Karl Smith: Private debt does not directly enter into the relationship — it is for Treasury rates/yields. The Fed has increased its holdings of agency backed MBS and those are included in the Fed variable — effectively they represent obligations of the US government.

John Kitchen:

Yes, but

1) Foreign Official purchases of Agencies were quite substantial. Presumably had the stock of Agency debt not expanded these flows would have gone into Treasuries.

2) The stock of Agencies expanded in large part because the low term spread contributed to a housing bubble.

Thus, it seems logical to conclude that official purchases of both Agencies and Treasuries contributed to an increase in the supply of Agencies which in turn decreased flows into Treasuries.

So there was a dampening effect because of the elasticity of private debt with respect to the volume of foreign official purchases.

Suppose this is now gone. Then smaller purchases may be necessary to induce the same reduction in term spread.

Looking at the crowd at the conference at the Baker Institute of Rice University “Defusing the Debt Bomb” , it may not be too hasty to think that the Crazy Horse Saloon in Paris, may receive more parishioners.

Where are the national debts perimeters, are the actual numbers including all debts components (too long to expand but relevant since the financial crisis)

In an interesting paper BIS “The real effects of debts” by Stephen G Cecchetti, M S Mohanty and Fabrizio Zampolli,have tested the path of pain in the debts loads private and public.

“When does debt go from good to bad? We address this question using a new

dataset that includes the level of government, non-financial corporate and household debt in

18 OECD countries from 1980 to 2010. Our results support the view that, beyond a certain

level, debt is a drag on growth. For government debt, the threshold is around 85% of GDP.

The immediate implication is that countries with high debt must act quickly and decisively to

address their fiscal problems. The longer-term lesson is that, to build the fiscal buffer

required to address extraordinary events, governments should keep debt well below the

estimated thresholds. Our examination of other types of debt yields similar conclusions.

When corporate debt goes beyond 90% of GDP, it becomes a drag on growth. And for

household debt, we report a threshold around 85% of GDP, although the impact is very

imprecisely estimated.”

Scientifically modest in their conclusion ,the quantitative results do not depart much from the exhaustive sample under review “This time is different”.

The key issues economists still believe in the invisible hand and still believe that an output gap has to be filled and no matter what Cobb Douglas take care.

Note that once again, the trajectories of interest rates are not included in the variables, the unidimensional world of debts and debts only is prevailing.

In table 3 P16 the correlation of GDP volatility and Debts is evidencing the public debts as the predominant factor of GDP volatility after the aggregated non financial debts.

Worth noticing the uncertainties surrounding the capital stocks and the associated incomes (Econbrowser More on Potential GDP and the Output Gap)

“Before turning to the results, two additional points are worth emphasising. First, given the

difficulty of measuring the physical capital stock and the link that should exist between capital

and income, one can also interpret the log of real per capita GDP on the right-hand side of

(1) as a proxy for physical capital.

From a practical standpoint the threshold of corporate debts pain is much,much lower than BIS estimates,and money illusion as provided during these lost decades.

John –

I should have added that I thought it was a great paper. It is, I think, a very valuable contribution to our understanding of just how constrained our long term policy options may be.

So in the Long Run, We Will Have a Problem?

I believe Keynes had something to say about this type of thinking several decades ago, i.e., it is BS.

John: I agree with what you said but I’m still having trouble interpreting your equation. Are you saying that the demand effects should be influencing the risk premia and not inflation expectations? How do you explain away the no arbitrage finance models of asset prices? If demand for long-term treasuries issues drives rates up, then why won’t people shift out short-term treasuries (or any other asset) into long-term treasuries?

The continuing trend of Asian countries to buy dollar reserves is troubling. In the last half of 2011, Japan bought over $180 billion. What other purpose besides exporting unemployment can such purchases have? Why do Taiwan and Korea have more foreign reserves than the United States? Why are such policies tolerated, whereas we have entire bureaucracies (the WTO) to combat the much less important trade distortions caused by tariffs or quotas?

Free trade is supposed to be about reducing economic distortion. I’ve come to wonder lately if the primary effect is that it makes it as cheap as possible for nations indifferent to the neoliberal vision to introduce deliberate distortions into the market as they see fit.