In a previous post, I noted that Governor Romney’s budget plan was essentially unscorable (as he himself stated [0]) because he was so vague on the tax expenditures he was going to eliminate. That fog of obfuscation lifted slightly yesterday, with Governor Romney’s not-for-public attribution comments to donors. From Sara Murray, in the WSJ:

PALM BEACH, Fla.—Mitt Romney, speaking at a private fundraising event on Sunday, offered the first details of deductions he would eliminate or limit in order to offset the income tax cut he has proposed for all taxpayers.

Mr. Romney, the presumptive Republican nominee for president, said he would eliminate or limit for high-earners the mortgage interest deduction for second homes, and likely would do the same for the state income tax deduction and state property tax deduction.

As Matthew O’Brien notes in the Atlantic, the numbers still don’t add up:

Which brings us back to Romney’s recent run-in with a hot mic. During a more candid moment at a fundraising event, reporters overheard Romney lay out at least two loopholes he would consider closing: the mortgage interest deduction on second homes for high-earners and state income and property tax deductions. Let’s consider these in turn.

The mortgage-deduction on second homes is about the lowest of low-hanging fruit when it comes to tax reform. Everybody agrees that the mortgage deduction on first homes, let alone second homes, is bad policy. For one, it incentivizes people to take on more debt. For another, it’s doubly regressive. Not only do the rich get bigger deductions due to their higher brackets, but they also have bigger mortgages to deduct. Getting rid of this loophole is a potential cash cow that would go a long way towards making our tax code saner. Unfortunately, Romney only wants to close it for a small sliver of a small sliver of buyers. According to Loren Adler of the Bipartisan Policy Center, Romney’s proposal would only raise about $15 billion over 10 years. In other words, about a third of the revenue the Buffett Rule would generate in a world where the Bush tax cuts for high-earners expire.

There is real money, though, in Romney’s proposed end to state and local deductions. According to Chuck Marr of the left-leaning Center on Budget and Policy Priorities, axing this loophole would yield roughly $860 billion in new revenue over a decade. That deserves serious plaudits. Of course, there’s a problem. Romney’s tax cuts are so deep that this only fills about 20 percent of the fiscal hole he creates.

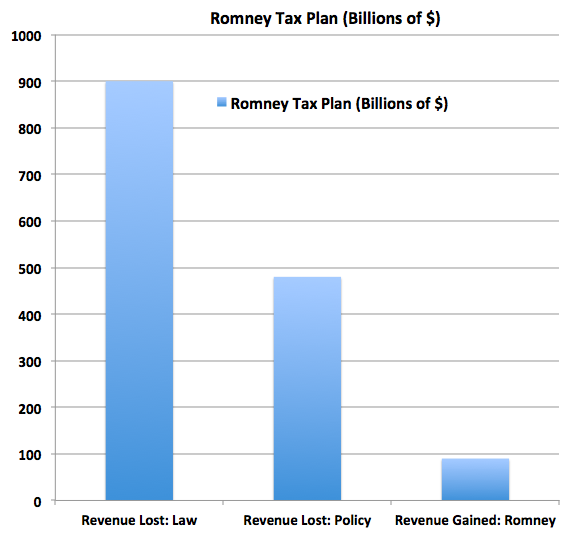

The below chart compares how much Mitt Romney’s tax cuts cost versus how much his loophole-closing saves, on an annual basis. (Note: “Revenue Lost: Law” shows how much Romney’s tax cuts costs if the Bush tax cuts expire; “Revenue Lost: Policy” shows how much Romney’s tax cuts costs if the Bush tax cuts do not expire; “Revenue Gained: Romney” shows how much new revenue he generates from closing loopholes).

Figure 1: Source: Matthew O’Brien, “Mitt Romney’s Tax Plan Is Still a Mathematical Failure,” Atlantic (April 16, 2012).

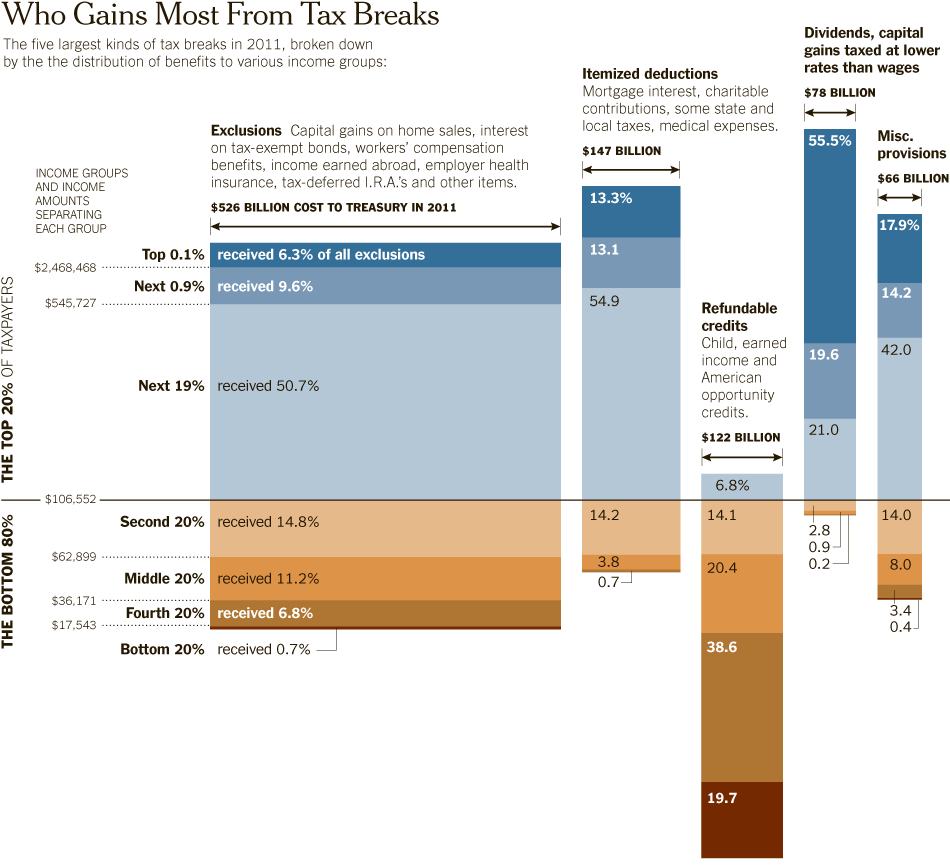

Just in case you were wondering who benefits from all the other deductions, exemptions and so forth in the current tax law, David Leonhardt in the NY Times provided the answer:

Source: D. Leonhardt, “Coming Soon: ‘Taxmageddon’,” NYTimes, 15 April 2012.

Still, if Governor Romney were to appeal to the Heritage Foundation, I’m confident he could get a “dynamic score” that would make everything add up; see the magic done on the Ryan plan here and here. (Where are you, Bill Beach?)

Update, 8am Pacific, 4/18: James Kwak at Baseline Scenario provides additional numbers demonstrating the failure of the Romney plan to “add up”, even with the release of these not-for-public consumption details.

Going after the mortgage deduction and state and local taxes is brilliant politics. Stick it to the Blue Staters, with their inflated home prices and outrageous state and local taxes.

The biggest tax expenditure, as we all know, is the exclusion of employer paid health insurance premiums from taxation. Like the mortgage interest deduction, it is a huge subsidy to “the rich”, and distorts markets.

If Romney can move towards phasing out this exclusion (say, by phasing it out for people over a certain income, maybe $200,000), he’d be doing us a great service.

Wow! Pseudo scoring based on eavesdropping. Are you sure you have his entire economic plan in there? I think this was intentional to offer some pieces that appeal to conservatives and some pieces that appeal to independents. That last thing I heard Romney say was that the details will have to be worked out in Congress. Unlike the Progressive in Chief, Romney will apparently not be ruling by edict.

Is TJ’s comment meant to be a defense of the utter lack of substance in Mitt’s tax reform? The Buffet Rule may not pay out much, but I don’t think one could argue that the President is pushing ideas that are laughably inoperable.

The mortgage interest deduction is limited to $1M in debt. This means capping the deduction or even eliminating it will have minimal impact on any high income individual. That cap goes along with the existing cap on itemized deductions so it isn’t worth much except as a fig leaf.

There is no way to lower tax rates on the top earners without raising other taxes. Period. There is no way to keep their share of the tax revenue the same without taxing capital gains more, not less – and that won’t get the revenue all the way there. The GOP says they want a 0% tax on capital gains. Every other option means raising taxes on everyone but the top earners.

Jonathan, are deductions capped? Do you mean the AMT?

Have you seen this site?

It allows you to tweak the tax code and get real time feedback as to how it impacts the deficit.

The particular link is one I did, a 17% flat tax for most people, with 24% for those over $250k, no deductions or other tax expenditures (EITC). It was revenue neutral, more or less.

It is kind of shocking how low rates can be if there are no tax expenditures. And if rates are low, we can have dividends and capital gains taxed at the same rates as income, being economically efficient and fair at the same time.

Marv,

Maybe not operable, but they are constitutional 😉

Actually, if Romney follows Obama’s tactics, then he can bribe the fence sitters in Congress with $100 million federal outlays to get them to vote for entitlements that a majority of Americans say they don’t want.

It sounds like Romney, with the help of a Republican controlled congress, will make Federal departments and agencies more efficient, maybe even privatize some of their functions.

Buzzcut,

1. Revenue neutral overall means everyone who makes less pays more. You need to look deeper than you are. The tax code is progressive for a reason: it taxes people more who earn more. “Eliminating tax expenditures” means raising taxes on most people but the wealthiest and highest earners.

2. Itemized deductions are limited by income. A high income taxpayer may not be able to use much of the value of the mortgage interest deduction. The amount itself is capped at $1M of debt on 1st and 2nd houses.

A few folks here are missing the main point of Menzie’s post. The “holy sh*t is this guy stupid” issue isn’t just about the unfairness of Mittens’ tax plan, it’s that the guy hasn’t learned 4th grade arithmetic. His plan literally does not add up. Closing a few of the loopholes is all fine and dandy, but he’s offering them as a Trojan Horse because his tax cuts exceed the value of his revenue enhancing loophole closing. It’s the old Republican shell game all over again.

Almost as bad is the fact that Romney seems to believe that a “revenue neutral” tax plan is good enough. Wrong. At some point we will have to run a primary surplus for a very, very long time. Revenue neutral doesn’t get you there.

We are faced with “dum and dummer.” Romney’s tax plan is essentally “pie in the sky,” pulling ideas out of the air. But that is not the real issue in November. The real issue is will “pie in the sky” be worse than no pie at all?

What issue is President Obama running on? I only know of one, higher taxes. Is that really a better issue than what Romney is proposing?

You think 2008 was bad, wait until the tax increases kick in in 2013-14!

Eliminating tax expenditures” means raising taxes on most people but the wealthiest and highest earners.

Considering that most people on the low end do not itemize, this is not necessarily true. Tax expenditures like the mortgage interest deduction benefit higher income taxpayers much more than lower income ones, simply because of who itemizes and progressive tax rates.

Romney has said he’s going to bring spending down around 20% of GDP, and I believe he will do that. I also believe that he will increase taxes, probably more broadly based than just the top 1%. But of course, no one really wants to hear that. The kidney needs to be removed, but no one wants to be reminded of the operation.

Interestingly, I think Romney will be to the left of a Republican-majority Congress. Congress will focus on reducing spending more. I don’t think Romney will accept that. Rather, I think there will be a gradual consolidation of the budget, essentially driven by Romney’s understanding of finance, on the one hand, and competent management skills, on the other.

That’s my mid-line expectation.

See update at 8am, 4/18, link to Baseline Scenario on this topic.

Everyone discussing the trees but missing the forest. What’s the democratic alternative?

Ricardo gets it with Obama running on tax increases. Strangely i agree with 2slugs that the way out is to run a primary budget surplus, and he has, as always, supported no attempt to get there.

Menzie, instead of kibitzing, what is your or any democratic plan? Simpson/Bowles? How much more farcical does it need to get before voters finally revolt against the DC elitists?

CoRev Ricardo gets it with Obama running on tax increases. Strangely i agree with 2slugs that the way out is to run a primary budget surplus, and he has, as always, supported no attempt to get there.

Notice any contradiction in your claim. First you start out saying that Obama wants to run on tax increases, then in the very next breath you say that Obama does not support any attempt to get to a primary surplus. Huh? Ummmm, the last time I checked raising taxes will increase revenues, and ceteris paribus that will lower the deficit. And I seem to recall that Obama offered a “grand bargain” that Team Tea Party choked on even though it was predominantly spending cuts. If you had merely said that Obama’s plan gets us closer to a primary surplus than Romney’s but still falls short of the mark, then I would agree. But if you’re trying to suggest that there is some sort of equivalence in terms of some kind of fiscal irresponsibility index, then you’re wrong. And oh by the way…Obamacare reduces the deficit according to CBO.

Steve Kopits I think you’re fantasizing about Romney being left of the GOP in Congress. Romney could be Attila the Hun and still be left of today’s GOP. If Obama were running against George Romney, then I would agree with you. Hey, I might even vote for George Romney over Obama; but Willard Mitt is not George. Today’s Romney changes his views as often as Microsoft changes operating systems…and each version of Romney is just as buggy as the last one. A President Romney alongside majority leader McConnell and Speaker Boehner would be a disaster for this country. Four years of Tea Party 2.0 and more tax cuts would dig a deficit whole that would make Greece look responsible. And where do you get this spending as 20% of GDP? Do you know that what’s driving outyear spending is demographics. Do you have a plan to reverse demographics? The laws of arithmetic make a 20% target a knee-slapper.

I can’t believe I’m having a conversation, but: tax expenditures doesn’t just mean the mortgage interest deduction, though that happens to affect more than high income taxpayers because a relative increase in taxes if you make $50k is as meaningful as a larger dollar, smaller percentage increase if you make $200k. If you go to a flat tax, you need to reduce or eliminate things like the earned income credit. That lifts some 6 million above the poverty line. You can see that easily on the splitwise site: removing the EIC can be a substantial reduction in income.

The splitwise site is scaled so large the effects are misleading. Eliminating mortgage interest deductions makes the curve change a bit but that change is $120B by their numbers. Eliminating AMT moves the line a bit but that is actually $130B. Those are huge numbers whose size is hidden by the scale.

As for who claims, only in rural WVA and a piece of rural Texas do fewer than 10% of filers not use the mortgage interest deduction. One can argue about how much it means to different groups but the typical percentage of claimers across the country is between 20 and 40% of all filers. It’s higher in some places and lower in the plains. That’s a lot of people.

Slug wrote:

Ummmm, the last time I checked raising taxes will increase revenues, and ceteris paribus that will lower the deficit.

Slug,

Check again in the real world. If you live in the static world of econometric sudoku perhaps, but the real world actually reacts to incentives.

Steven Kopits,

Menzie seems to think your opinion is wrong. I really, really hope that your opinion is wrong. I believe your assessment of Romney is accurate, but my hope is that those in the House who actually have policies that will return us to economic growth and prosperity will win the policy battle.

If Romney’s vision wins we will once again find ourselves back in the GW Bush era debating who we want to manage our decline, demand theory liberals or demand theory conservatives. Liberty and freedom will be pushed to the back burner, if they are allowed at all.

Slug wrote:

Obamacare reduces the deficit according to CBO.

Once again you are behind the times. CBO has rescored Obamacare and with its current configuration, subject to change at the whims of the Secretary of HHS and the president, it will increase the deficit. Are you perhaps factoring in projected savings from all the seniors that Obamacare will kill off?

Steven Kopits,

I misattributed comments to Menzie that were actually from Slug. Sorry!

Ricardo wrote:

“Slug,

Check again in the real world.”

Here’s how things work in the real world:

In 1993 President Clinton raised taxes(if you’re old enough you may remember that conservative hysterics called it “the biggest tax increase in history”.) Here’s what happened to federal receipts in 1993 and the 2 years after:

FY ending-

1993-09-30 1154335 (millions of $)

1994-09-30 1258566

1995-09-30 1351790

Sure looks like an “increase [in] revenues” to me.

In 2001 G.W. Bush cut taxes.Here’s what happened to federal receipts in 2001 and the 2 years after:

2001-09-30 1991082 (millions of $)

2002-09-30 1853136

2003-09-30 1782314

Are you seeing any kind of pattern here, Ricardo?The pattern I see is that conservatives are always wrong about everything

(BTW, these are real numbers from FRED, and they reflect “the real world”.)You must be living in Fox news Fantasyland!

Ricardo

You’re right, CBO did rescore the Obamacare numbers. And the savings came in slightly higher than the original estimate. But Fox News viewers wouldn’t know that because they were led to believe that Obamacare increased costs because Fox News doesn’t think it’s important to note the change the starting point. I suggest you reread the latest CBO report. As to the “dynamic scoring” fantasy, no one seriously believes that tax cuts reduce the deficit. Under some conditions revenues may go up, but they cannot and do not increase faster than deficit. Even diehard believers in dynamic scoring don’t believe you recover (at most) 20% of the tax revenues. But then again you believe in Austrian voodoo too, so I dunno.

Menzie –

You linked back the macroecon site–which appears to be a great resource, by the way.

On it, you have a link to Econmagic. What’s your view of that site? How up-to-date, reliable and useable in the information there?

Steven Kopits: By the macroecon site, do you mean St. Louis Fed FRED?

Econmagic is useful, but since FRED has expanded its coverage, I tend to go there first. I know for sure what the series is, there, given the documentation.

C is a C-

The real world is trying to get in contact with you. First, the increase in revenues from Clinton’s tax increase was relatively small in constant dollars (around 3%). The deficits stayed high until the Republicans took control of Congress. Also, Clinton came into office well after the recession was over whereas Bush walked in right after the stock market tanked and a mild recession started. Then came 9/11. The real supply side cuts started in 2003 and the revenues poured in. Take a look at the historical tables from any source (White House, for example).

Ricardo was correct.

Rich-

Obviously, you are a True Believer, so it’s pointless for me to try to disprove your religious beliefs, but here goes anyway:

You said, “Ricardo was correct.”

Correct about what? Ricardo said (implicitly) that raising taxes won’t increase revenue. I presented evidence that this is false. In the 2 years after Clinton raised taxes, Federal receipts rose 17%. I also presented evidence that cutting taxes doesn’t increase revenue; in the 2 years after Bush cut taxes, Federal receipts fell sharply.

You: “First, the increase in revenues from Clinton’s tax increase was relatively small in constant dollars…”

So….are you saying Clinton should have had a bigger tax hike?

“The deficits stayed high until the Republicans took control of Congress.”

Well, except for the FACT that the deficit fell by 15% in FY93 and another 20% in FY94 when the Dems controlled Congress: Federal surplus/deficit; FY ending; millions of $

1992-09-30 -290321

1993-09-30 -255051

1994-09-30 -203186

“….Bush walked in right after the stock market tanked and a mild recession started. Then came 9/11.”

Yes, it’s unfortunate that Bush and Cheney weren’t up to the job. But it was small stuff compared to the multiple disasters they left behind them for President Obama to clean up.

“The real supply side cuts started in 2003….”

Cutting the top marginal tax rate (in 2001) from 39.6% to 35% wasn’t a real supply side cut? Good to know. Is raising the top rate back to 39.6% a real increase?

“….the revenues poured in. Take a look at the historical tables….”

Well, here’s a historical table: Gross Federal Debt; FY ending; millions of $

2001-09-30 5769.9

2002-09-30 6198.4

2003-09-30 6760.0

2004-09-30 7354.7

2005-09-30 7905.3

2006-09-30 8451.4

2007-09-30 8950.7

2008-09-30 9986.1

2009-09-30 11875.9

The national debt rose by 500 Billion or more every year following the 2003 tax cuts. Hard for me to discern that revenue pouring in. Maybe Bush/Cheney and Congress (Republican-controlled until 2007-01-20) were pouring it right back out again?

Rich Berger Take a look at the historical tables from any source (White House, for example).

Good idea. Let’s do that.

Year….Income Tax %GDP

1981….9.4%

1982….9.2%

1983….8.4%

1984….7.8%

1985….8.1%

1986….7.9%

1987….8.4%

1988….8.0%

1989….8.3%

1990….8.1%

1991….7.9%

1992….7.6%

1993….7.7%

1994….7.8%

1995….8.0%

1996….8.5%

1997….9.0%

1998….9.6%

1999….9.6%

2000…10.2%

2001….9.7%

2002….8.1%

2003….7.2%

2004….6.9%

2005….7.5%

2006….7.9%

2007….8.4%

2008….8.0%

2009….6.6%

2010….6.3%

2011….7.3%

All years are fiscal years.

Souce: OMB Historical Tables

The facts are not Rich Berger’s friend.

You can clearly discern business cycle influences as income tax receipts fall with employment. You can also clearly discern tax policy changes as income tax receipts fall in the wake of the 1981, 2001, 2003 and 2009 tax cuts. You can also see the effect of Clinton’s tax hike in 1993 and

Reagan’s tax hike in 1986 (effective in FY1987).

I don’t see any surge in income tax receipts following the 2003 tax cut, do you?

You guys try a bait and switch but it is a massive fail. You lose.

Rich Berger You lose.

Right. Just like you and Charlie Sheen are “winning.” This isn’t a contest, it’s a simple matter of fact checking. You and Ricardo made a specific claim about the effect of income tax cuts on income tax revenues. You suggested the White House OMB tables as evidence to support your claim. Those tables are reproduced above and do not support your claim. The appropriate response from you would have been to thank us for taking the time to correct your error. No need for the “tiger blood” attitude.

You might want to ask yourself under what conditions would it be theoretically possible for tax cuts to pay for themselves? The basic math tells you that it cannot happen on the AD side of things. If you don’t believe me, just try taking the most basic fiscal multiplier possibe found in any high school textbook and try to construct a situation in which a tax cut will increase revenues more than it increases the deficit. You can’t because it is mathematically impossible on the AD side. So what about on the supply side? The only way this happens is if the tax rate gets so high that people decide an extra hour of leisure is worth more than an extra hour of work. Or if the cost of hiding money is less than the cost of the marginal tax. This is the so called Laffer Curve, although he really stole it from James Mirrlees. And that can happen, but it’s an empirical question. Fortunately we have some studies on this and all of them tell us that the tipping point is roughly double today’s top marginal rate. You could make a plausible case that the top rate under Carter (70%) may have been slightly beyond the revenue maximizing point, but claiming that cutting today’s rates would increase revenues more than it increses the deficit is just laughable on the face of it.

None of this means that there aren’t oftentimes good reasons for cutting taxes, only that you shouldn’t believe tooth fairy tales that claim cutting taxes will somehow increase revenues so much that the tax cuts pay for themselves.