From Boston.com:

On a conference call with reporters, Romney advisers ripped the study — conducted by the Tax Policy Center, a joint venture of the Brookings Institution and the Urban Institute — as “biased” and “a joke.”

“The study doesn’t take into account important aspects of Governor Romney’s plan, which will have a positive, pro-growth impact on the economy,” senior adviser Eric Fehrnstrom said.

Kevin Hassett, an economic adviser, contended Romney’s plan to lower income tax rates for people at all income levels would boost the nation’s economic growth by about 1 percentage point per year.

The Tax Policy Center study is here, summary here. (To be correct, the Tax Policy Center is actually joint Brookings-Urban Institute operation, as opposed to joint Brookings-Tax Policy Center operation, as the Romney team incorrectly identified it.)

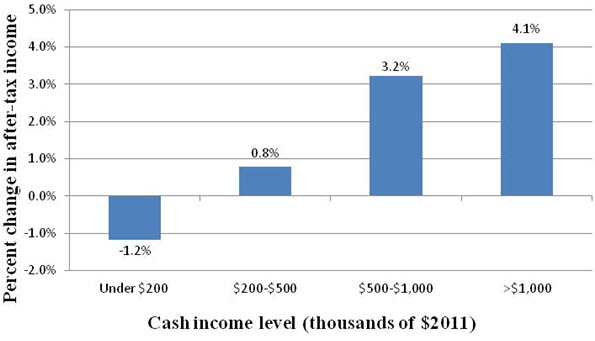

The distribution of benefits and burdens from the Romney plan, assessed by TPC, is summarized by this figure. [By the way, this graph is the best-case-scenario for the Romney plan, insofar as it assumes base broadening even though Governor Romney has refused to publicly specify which tax expenditures he would eliminate [0]]

Figure 3, Tax Plan Assuming Revenue Neutrality through Base Broadening, from TPC.

Readers can make their own judgments by reading the document. On the other hand, one can assess this specific critique by referring to Dr. Hassett’s earlier works, including (from 2000) Dow, 36,000. (As of 2pm Eastern time, Dr. Hassett was only 23,197 points off on his prediction.)

Strangely, the Tax Policy Center’s analyses were earlier lauded by Governor Romney. [1] So apparently, he was for TPC before he was against TPC.

For earlier analyses, from TPC and CFRB, see here, and from CBPP and Baseline Scenario here.

Actually, they did include some “dynamic scoring” in their study:

“If we assume, as in their model [referring to Greg Mankiw and Matt Weinzierl’s study on optimum tax rates], that 21.3 percent of capital income taxes and 13.5 percent of labor income taxes are offset by higher growth after five years this would imply a revenue offset of 14.7 percent. (Assuming the tax cuts are 85 percent labor and 15 percent capital, which is roughly the share of labor and capital income reported on individual tax returns).

According to this assumption, the tax cuts would result in revenue reductions of $307 billion

(instead of $360 billion).”

Tax analysis such as this is always suspect. For example, let’s assume that all citizens making less than $2 million per year were required to pay a tax of $1 per year while those making over $2 million per year were required to pay the balance of the governments commitments. If a law was passed that requires all taxpayers to increase their taxes by $1 it would be a huge percentage 100% increase for those making under $2 million per year while the increase on those making over $2 million per year would see their taxes increase at an amount less than 1,000th of 1%. Most would understand the absurdity of this kind of analysis but to politicians it is a powerful talking point.

Gov. Romney’s tax plan is actually pretty awful but not for reasons assumed by the Tax Policy Center. This analysis by Ed Breen is a much better analysis because it is at a more micro level. One specific and very significant difference is that where the Tax Policy Center does not look at Romney’s corporate tax proposal Ed Breen does.

But all of that said, without significant changes to the regulatory climate in conjunction with the tax code we will continue to see New Businesses and IPOs driven away from the US. For more on the decline in America’s entrepreneurial sector see this great analysis from the left-of-center New America Foundation by Barry Lynn and Lina Kahn.

Don’t forget Hassett’s work on housing during the bubble. He argued for continuing the Down Payment Assistance scam that has led to huge default rates and billions of dollars of losses for FHA and the taxpayer.

http://www.ideasinactiontv.com/tcs_daily/2004/05/down-payment-debate.html

mikev: Yes, you are right. To really change the conclusions, I suspect you need Ryan-esque types supply elasticities [1] [2].

“The study doesn’t take into account important aspects of Governor Romney’s plan, which will have a positive, pro-growth impact on the economy,” senior adviser Eric Fehrnstrom said.

Thus spake the Etch-a-Sketch adviser. Why is anyone taking this fool seriously?

I think there are things we can broadly agree about Romney:

– He understands finance. He knows what revenues and expenses are and how to manage them.

– He understands the nature of restructuring, of prioritizing activities and making the most of resources

– Spending is likely to lower under Romney than Obama

– Energy policy is likely to be more aggressive under Romney than Obama

But beyond this, I think things are less clear:

– I think it fair to say Romney is more RINO than Tea Party

– I think it fair to say that the Tea Party is the dynamic force in the country; Romney will have to come to grips with the hardcore Tea Party constituent in his own party which has a markedly different view of the role of government in society from that of a Bloomberg, Schwartzenegger or Romney. Can he handle them? Hard to say.

– I think Romney will look first to fiscal order, rather than only low taxes, regardless of the rhetoric now.

The guy’s a legitimate candidate, much better operational credentials than Obama. Whether he has the character and conviction to lead is something only time will tell.

Given that we went down to 2 rates, 15% and 28% after the Tax Reform Act of 1986 and didn’t suffer a fall off in revenues, a 20% reduction seems quite feasible.

Berger–A 20% reduction is possible only if you tax capital gains and dividend income at ordinary rates–also a feature of the 1986 Tax Act. Romney has specifically rejected this.

The most interesting aspect of the Romney Team’s approach to tax policy lies in its response to the painfully non-partisan Tax Center’s analysis. Romney clearly states: 1) that he wants a 20% tax rate reduction, 2) that is to be revenue-neutral, and 3) that no changes will touch capital gains or dividends taxation. “Revenue-neutral” has a specific meaning in tax policy and having been a tax professional since 1975, growing up in a household of tax professionals, I can claim some small measure of authority here. To be revenue neutral means you can’t say that magic will solve the equation; that future growth will fill in for depleted revenues; or that confidence will make all the difference: it means that internal to the provisions of the bill affecting a particular chapter of the Tax Code there will a balance of reductions and increases that when modeled on current tax reports will result in a balance between cuts and increases. The Romney Team arithmetic does not meet this standard, and when it is pointed out to them, they engage in pre-pubescent mockery. That should tell you all you need to know. The Romney Team tax plan, if passed, will increase taxes on lower and middle income tax-payers for the benefit of high income tax payers.

Dr. M-

Thanks for your fact-free opinion.

Berger,

Please substantiate your claim.

I expect his definition of revenue neutral will only apply after we stop collecting any.

I get tired of the right claiming that the scoring of thier tax/spending/entitlement reform/fill-in-blank-plan is biased. Hire a freakin right-leaning version of Menzie to break down the ‘biased’ assumptions, provide evidence they are wrong, then produce an ‘unbiased’ result. The problem with Heritage and the like is that their analysts come across as undergraduate interns whose modeling is constrained to hardwired excel spreadsheet functions.

The entire discussion comes out of a false premise. Taxation is for the purpose of raising funds with which to pay for government activities and services. The secondary effects of collecting a portion of the GDP in order to pay for the activities and services of government are, and have always been, unpredictable. The more certain a proponent of one result or another may be the more likely it is that that person hasn’t a clue as to what they are talkliing about. Or he may be lying through his teeth.

The point is, again, that taxation is for the purpose of paying the cost of government. What ever the size and effectiveness of that government may be, its activities have associated costs and taxes must be collected in order to pay those costs. That is one reasonably clear point of agreement. Government has cost. You don’t like the nature of the costs or the amount of the costs? Argue those points in a seperate forum, but recognize that taxes have to be collected and that those taxes are only available from one source, the economic activity of the country. Some portion has to be tax receipts. Stop your whinning and pay your taxes. No, there is no acceptable bullshit excuse why one source of tax receipts should be “protected” more than some other.

This is the kind of thing I’ve been waiting for. We have a Presidential candidate who is unwilling to provide any details about his plans, while at the same time referring to his plans as being better than what Obama offers. It’s all “trust me”. I won’t disclose anything, not about my taxes, not about my plans but if you hate Obama vote for me. That’s pretty much the entire message. Hate the deficit, vote for me though I don’t have even the semblance of a plan to address it. Don’t believe what my plans mean, that the deficit will increase. Don’t believe what I say but somehow trust me.

It fascinates me, this human need to not hear what people say. Stephen Kopits, whose writing about oil is very interesting and informative, imposes his own view of what Romney must mean rather than take him at his word. It can’t be so therefore it must mean something I want it to mean. What if it means what he says? We’re in a campaign where a few ill-chosen words by Obama taken out of context have become the entire focus of GOP advertising. We’re supposed to take Obama not only at his word but at what he didn’t even mean but we’re not supposed to take Romney at his word?

I’ve voted for the GOP for about half of my adult life. This kind of campaigning is nonsense. Romney isn’t trustworthy: why isn’t he willing to release his tax returns? What am I supposed to trust? I admit my experience with him lying to me when he became Governor colors my view. He bluntly lied to me. He said he was a “social moderate” and an “economic conservative” and within days of being elected he jettisoned that to appeal to the ideological GOP right. So I’m supposed to trust that he doesn’t mean a nonsensical plan?

Let’s not forget that Hassett also suggested that it might be necessary for the U.S. to bomb France and Switzerland in order to prevent them from turning on the Large Hadron Collider and destroying the earth. Really!

I think it is fair to say that history indicates that critical analysis is not Hassett’s strength.

Steven Kopits – He understands finance. He knows what revenues and expenses are and how to manage them.

What evidence do you have for this claim? Romney’s company demured on the opportunity to takeover GM and Chrysler because Bain thought both companies were beyond hope. And the Obama Administration practically begged Bain to jump in. And when it came to restructuring failing companies Bain Capital also had a higher “bust” rate than the Administration…even if you include Solyndra!

Romney’s real talent, and what made Bain successful, was his incredible ability to break agreements and lie to potential investors. A few months ago Krugman referred to some stories by investment bankers about how Romney’s untrustworthiness (even by the standards of Wall St. sharks!) was so legendary that Bain was beginning to have difficulties finding investment banking partners, and his 1999 departure was fortuitous for Bain. In other words, investment partners didn’t just have a problem dealing with Bain’s reputation, investment bankers had problems dealing with Romney specifically because he was trust impaired. At least Richard Nixon gave the appearance of feeling guilty when he lied and told us he wasn’ a crook…I don’t get that same sense when I listen to Romney.

Romney will have to come to grips with the hardcore Tea Party constituent in his own party

How would that happen? Is there a new medical procedure to regain one’s manhood after having been castrated? As Grover Norquist said, the Tea Party doesn’t care what Mitt Romney actually believes (if anything). All Team Norquist cares about is that the guy has ten working digits that will allow him to sign whatever nonsense the Tea Party shoves under his nose. And his tax plan is proof that he’ll just parrot whatever his handlers write for him. Do you honestly believe that he could both be a sharp finance guy and at the same time claim to have critically understood his own plan??? Give us a break. The TPC’s autopsy of Romney’s plan unmasks the lie that this guy has even the vaguest clue about economics…or even arithmetic. His plan literally does not add up. How can someone be both a finanical whiz (as you seem to believe) and yet put out a plan that demonstrates his innumeracy.

– He understands the nature of restructuring, of prioritizing activities and making the most of resources

Romney’s business experience is irrelevant to his understanding of macroeconomics. A dentist and a heart surgeon are both doctors, but that doesn’t mean a dentist can perform heart surgery. Business involves money and a kind of economics, but it doesn’t translate into understanding public policy economics.

I used to think that Romney’s executive experience in the private sector might be at least one positive; but the last few weeks have shown that he really doesn’t have any executive skills either. His unpreparedness in everyone of his foreign visits was shocking. And the guy can’t even run a campaign effectively.

– Energy policy is likely to be more aggressive under Romney than Obama

Did you hear his tin-eared statements about Iran? I agree, he might be more aggressive, but that kind of aggression won’t help the price and supply of oil.

From the viewpoint of the private sector, I think the optimum tax rate is 0%. But where will the roads and police come from? If we had a government that provided those services that are not easily provided privately, it would be much smaller than the current leviathan. There would of course be arguments over the size of the military, but so what? There is a tremendous amount of waste in government at all levels. Before I agree to have my taxes increased, I would like to see the government put on a diet. Let’s start with getting rid of a few agencies. I don’t think we would miss the Departments of Labor, Energy and Education. Let’s start there.

I like the Romney tax proposals, the more I hear people complain about them.

Rich Berger There is a tremendous amount of waste in government at all levels.

I work for the government, so I suspect I am more keenly aware of waste in government than you are. But worrying about waste is something you do when the economy is near full employment and waste subtracts from private sector productivity. In the current ZIRP low output environment “waste” is probably a net positive because it’s more economically useful than letting money leak from the system while sitting in a vault earning a negative real return. At least wasteful projects earn a small but positive return.

Let’s start with getting rid of a few agencies

How about starting with the Immigration & Naturalization Service? Their entire mission is to make the economy less productive. Would you support a government agency that blocked the importation of capital equipment? How is that different from blocking the importation of the workers needed to make that capital equipment productive? And if you’re really serious about cutting waste, fraud and abuse, let’s eliminate those dinosaurs called state governments. Let’s return to Madison’s and (especially) Hamilton’s vision of neutered state governments. Could there be anything more wasteful than 50 corrupt and incompetent governments duplicating services that are already performed better at the federal level? I say we cut out the middleman. One political scientist made a pretty good case for reconfiguring the 50 states into 10 administrative districts. That’s what the private sector does, so why should government allow 50 little empires squabble over a race to the bottom? Our national goal should not be to create a country that looks like Mississippi.

After we get rid of the states, let’s get rid of that Soviet inspired monstrosity called Homeland Security?

I’m sure you would like to eliminate BLS. Afterall, their main job is to provide hard data. And most of what the Dept of Energy does is manage nuclear material, so you might want to rethink its abolition. And obviously we should get rid of the Dept of Education because Mississippi, Arkansas and Alabama are doing such a wonderful job of educating their citizens. Again, why have one department do the work that fifty could do? Smart thinking.

Rich Berger: Yes, never thought those nukes needed safeguarding. Let the magic of the marketplace solve that problem! (I am, of course, being sarcastic here, just in case some reader thinks I am being serious.)

Slug says ‘”waste” is probably a net positive’.

So I’ve wasted time discussing economics with someone who has no notion that it is about efficient allocation of resources.

Bryce No, economics is about the product of allocative efficiency and technical efficiency. A solution that is allocatively efficient but is further from the frontier may be less efficient overall. For example, a few months ago I presented a stochastic frontier analysis paper at some symposium where we found Army garrison-based repair facilities were all were approximately equal in terms of allocative efficiency of inputs, but there were significant differences in terms of technical efficiency. This resulted in very different overall efficiency scores.

But you seem to have missed the larger point, which is that there is nothing particularly efficient about putting money in a vault so that it can earn a negative return. There are plenty of public infrastructure projects out there that could earn a positive rate of return. All “waste” is not created equal. Wasting human capital seems like a serious economic problem to me, but apparently you just see long term unemployment as some autonomous shock to the labor/leisure trade-off and any attempt by government to increase employment would disrupt this finely balanced decision by workers to choose more leisure. Sorry, but you have a very strange view of waste.

I hear these lame arguments all the time – if you eliminate such and such how will we do such and such. Funny you should mention the DoE and nukes – they don’t seem to be doing such a great job.

I think we had nukes well before the DoE and somehow they were managed.

Like most conservatives, Rich prefers his opinions fact free. It saves getting confused by reality.

Rich Berger: Yeah, we had the AEC and the DoD. Well, let me just say for a lot of stuff, waste is in the eye of the beholder. Let’s consider that $1 trillion (by FY13) or so expenditure involving Iraq. I think waste (or even negative value added). I suspect you think otherwise.

I leave you with this.

Have a nice summer.

Rich Berger: Thanks for killing a few more of my brain cells by putting the link up! I like this line in particular:

Only in the fevered imagination of Jennifer Rubin is TPC “very partisan”. I’m sure by her metrics Attila the Hun is a moderate.

Hope you have a good summer too!

I consider the TPC, a creature of Brookings/Urban Institute, to be on the left. For comparison, I consider the Cato Institute and the Heritage Foundation to be on the right.

Rubin had a number of specific criticisms of the TPC analysis. I read the TPC paper and they make assumptions which may bias their results as cited in Rubin’s piece. One of their criticisms is that his proposal cannot be revenue neutral. I checked Romney’s website and he does not claim that his proposal is revenue neutral:

“Reducing and stabilizing federal spending is essential, but breathing life into the present anemic recovery will also require fixing the nation’s tax code to focus on jobs and growth. To repair the nation’s tax code, marginal rates must be brought down to stimulate entrepreneurship, job creation, and investment, while still raising the revenue needed to fund a smaller, smarter, simpler government. The principle of fairness must be preserved in federal tax and spending policy.”

I read “smaller, smarter, simpler government”.. as one requiring less revenue.

You cannot directly examine the TPC model which was used to produce these results. It is based on a file from the IRS. From the FAQs on the model:

“The TPC microsimulation model’s primary data source is the 1999 public-use file (PUF) produced by the Internal Revenue Service (IRS). The PUF is a microdata file that contains 132,108 records with detailed information from federal individual income tax returns filed in the 1999 calendar year.”

I wasn’t so thrilled with Romney at first, but the more I hear and read about him, the more I like him. I welcome a debate on taxes. I think he will eviscerate Obama in a debate.

Rich Berger: No commitment to revenue neutrality? OK, will dispense with this. Maybe the ever triangulating Mr. Romney has made previous remarks “no longer operational” (Ziegler fans will remember!).

Rich Berger the more I hear and read about him, the more I like him.

Since Romney has at one point or another taken just about every possible position on every issue I’m sure I could also find things to like in some of Romney’s statements.