Or, he was for the Tax Policy Center before he was against the Tax Policy Center, and how to assess think tank research.

That characterization in the title is from a Romney press release [0], earlier this year. But just yesterday, Governor Romney himself (as opposed to his campaign head [1]) presented a drastically revised assessment of the TPC’s work, in a Forbes Fortune interview (h/t The Hill):

… [The Tax Policy Center] made various assumptions about what they thought I would do which are not in fact accurate. They made an assumption that I would reduce the home mortgage-interest deduction. I will not do that for middle-income taxpayers, as I have already indicated. There’s an old expression in the computer world: garbage in, garbage out. They made garbage assumptions and they reached a garbage conclusion. My tax policy will continue to have a very clear direction. We are not going reduce the share of taxes paid by high-income individuals, and we’re certainly not going to increase the taxes paid by middle-income taxpayers.

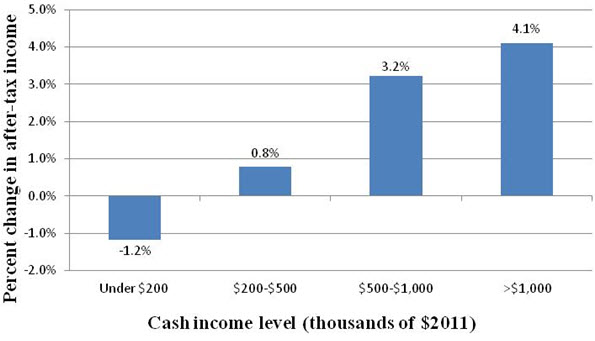

The TPC analysis is discussed in this post, with the report here. A key graph, depicting the implications for tax burdens:

Figure 3, Tax Plan Assuming Revenue Neutrality through Base Broadening, from TPC.

To my knowledge, nobody has really disputed the analysis, per se. Rather they have cast aspersions on the authors of the study, or on the center. For instance, Jennifer Rubin characterizes the TPC as “the very partisan Tax Policy Center”. It apparently matters not one whit that TPC is headed by Donald Marron, who served as a member on the CEA under G.W. Bush.

But this has all lead me to ponder whether these characterizations of think tanks as right or left leaning (or “very partisan” for that matter) are particularly useful. I think we should at the same time consider the methodological approaches undertaken at a given think tank, or say a center at a think tank. For instance, in describing the Heritage Foundation’s Center for Data Analysis, one might more profitably describe the approach imbedded in the simulation model (not characterized by standard employment-output relations, but incorporates high implied supply elasticities outside of the consensus) rather than merely “right leaning.” (In my discussion of the CDA model, [1], [2] , [3], I eschewed describing Heritage’s political leanings). Alternatively, one could characterize where a think tank stands by reference to linkage to mainstream economics (e.g., [4]).

I end off by returning to the point that without a clearer statement on what tax expenditures are to be eliminated, it is very hard to square the circle. That people should be able to agree upon. So, I appeal to the non-partisan Center for a Responsible Federal Budget (CRFB), which notes:

Among the many policies Governor Romney has proposed in his run for President are substantial reductions in tax rates for individuals, including a 20 percent across-the-board cut in marginal rates (for example, the top rate would fall from 35 percent to 28 percent). Governor Romney has called for making this plan revenue neutral, in part by offsetting the roughly $3.6 trillion of individual income tax cuts (through 2022) and $5.1 trillion of total tax cuts by reducing or eliminating tax preferences (especially for high-income earners).

To date, Governor Romney has yet to publicly discuss what cuts would need to be made to tax expenditures in order to finance his very specific tax cuts. However, we got a little preview last weekend when he was overheard talking about two possibilities for reducing tax expenditures at a private fundraiser — cutting the mortgage interest deduction for second homes and the state and local tax deduction.

How much of the $3.6 trillion in cuts would these changes pay for? In part, it depends on the details — particularly since it is unclear whether the cuts would apply to all taxpayers or higher earners. However, we do have enough information to make some estimates.…

Assuming Governor Romney takes the most aggressive possible action on the state and local deduction and the mortgage interest deduction for second homes, he will still only have offset about one-third of his individual income tax cuts. When looking at all of his tax cuts — including to the corporate code and estate tax — this base broadening would cover slightly less than one-quarter of the cost.

This means Governor Romney still has a long way to go to achieve his goal of of revenue neutrality. So where else must he look? The answer is probably everywhere. The rates he is proposing won’t require wiping out all tax expenditures, but it will require making some tough choices. Here are the top ten tax expenditures, as estimated by OMB on a static basis. Note that their value is not necessarily equal to the revenue raised from eliminating them and that their value also varies based on other aspects of the tax system (as we noted above).

The table in the post notes “Cost of Romney Tax Cuts = $2.2 trillion” over 2013-17, while total tax expenditures sum to $4.3 trillion.

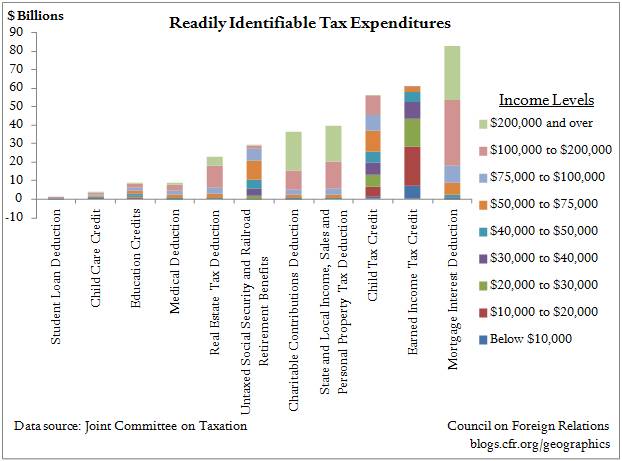

Benn Steil and Dinah Walker at CFR’s Center for Geoeconomics provides this illuminating graphic of annual cost of tax expenditures.

Figure from Steil and Walker.

The graphic is not comprehensive; it omits the largest, which is the health insurance exclusion, at $190 billion in 2014, according to OMB.

I don’t think anybody sensible has ever characterized CRFB as left leaning. Methodology-wise, in regards to assessing revenue impacts, it tends to rely on JCT or OMB tabulations (so no macro-level dynamic scoring). In other cases, it relies upon CBO and TPC.

Of course, the circle can be squared if one assumes incredibly high factor supply elasticities (much higher than in the TPC report), a la CDA [5].

Update, 5:45PM, Pacific: Reader tj brings my attention to this WSJ article which purports to challenge the TPC study. It cites analysis by Matt Jensen, an economic researcher affiliated with AEI. I must confess I don’t understand the math. CRFB lists the 2013-17 costs of Romney’s tax cuts at $2.2 trn. The muni provision is tenth in the list of top ten, at $228 bn. The life insurance provision doesn’t make into CRFB’s top ten for 2008-12. JCT indicates $121.8 for 2001-04 (since this provision doesn’t make the top 10 in subsequent 4 year periods, the numbers aren’t listed). So I still don’t see how the circle is squared. But I confess to having limited imagination.

Update, 6:30PM Pacific: TPC has released a response to various critiques. See The Hill’s coverage.

I notice that the TPM piece provides no link to the supposed press release. Am I supposed to take their word for it? Apparently Menzie did.

He’s going to “restore” all the Medicare cuts.

He’s goint to sign wavers for Obamacare day 1.

He’s going to increase defense spending.

He’s not going to eliminate a loophole like the mortgage interest deduction.

I assume he won’t be eliminating the Charitable Contribution deduction, the State and Local Tax deduction. Or any other tax expenditure?

He’s going to cut the marginal taxe rates for everybody (!) by 20%.

So someone said I was a pretty funny comedian because I claimed budget hawks would be wiser voting for Obama than this budget arsonist. Prove me wrong.

Regards.

Radonwalker

Menzie

Exerpts from the Wall Street Journal-Mathematically Possible.

http://online.wsj.com/article/SB10000872396390443404004577581570978359112.html

The study’s biggest distortion is its raw assertion that Mr. Romney would refuse to close certain loopholes. In the appendix, the Tax Policy Center lists, among others, two giant tax deductions that it says would go untouched: the exclusion of interest on tax-exempt municipal bonds, and the exclusion of interest on life insurance savings. The study claims that Mr. Romney won’t close these because they are incentives for saving and investment. … Senior economic adviser Glenn Hubbard says these deductions are definitely “on the table.” And by the way, the municipal bond interest exclusion mainly serves to encourage states and cities to borrow and spend more.

Uh oh – redistribution coming, Menzie should like this:

AEI economic research associate Matt Jensen found that “Both of these exclusions largely benefit the wealthy, and, according to the Treasury Department, added together their repeal would net upwards of $90 billion that could be redistributed to lower-income individuals. That would go a long way towards balancing the supposed $86 billion windfall for the rich and tax hike on the middle class and poor, and it could make the impossible suddenly possible.”

One last excerpt:

This won’t stop the Obama campaign from making its false claims, but it ought to at least embarrass the media into questioning them. It should also embarrass the analysts at the Tax Policy Center who claim to be nonpartisan, above-the-fray economists but somehow always seem to provide analysis that serves those who want to raise tax rates.

tj If you had a teenage daughter that was as evasive and “too cute by half” in her non-explanations the way Romney is, would you trust her with the keys to the car on Saturday night? Sorry, but Romney’s endless evasions and shape shiftings are too much. Instead of having some removed spokesperson say that cutting the tax exempt bonds was “on the table,” why not just come out and tell us directly and exactly what kinds of tax expenditures and deductions he would eliminate or trim back? Why is that so hard? It’s not like the guy hasn’t had enough time to think things through. He likes to talk about his 59 point plan. Well let’s round it up to 60 points and give us a specific significant deduction or tax expenditure that he would eliminate. And telling us that he’ll cut Big Bird and Elmo doesn’t count.

tj: I don’t understand their math. CRFB lists the 2013-17 costs of Romney’s tax cuts at $2.2 trn. The muni provision is tenth in the list of top ten, at $228 bn. The life insurance provision doesn’t make into CRFB’s top ten. JCT indicates $121.8 for 2001-04 (since this provision doesn’t make the top 10 in subsequent 4 year periods, the numbers aren’t listed). So I don’t see how the circle is squared. But then again, I am not as imaginative Mr. Jensen (by the way, it’s a completely opaque analysis that’s being cited in the WSJ).

See updates to text

I’d like to know what Obama intends to do for the next four years. Why should I vote for him? I’ve heard all kinds of bad things about Romney and Ryan, but I really haven’t heard what Obama plans to do other than tax and vilify the rich. Is he going to repair our infrastructure? Is he going to fix the mediocre performance we’ve seen out of public schools the last 30-40 years?

“AEI economic research associate Matt Jensen found that “Both of these exclusions largely benefit the wealthy, and, according to the Treasury Department, added together their repeal would net upwards of $90 billion that could be redistributed to lower-income individuals.

Once again is is shown that if something comes out of the AEI, it is simply made up numbers. The municipal bond tax exemption is only $40 billion per year and the exemption on life insurance is just a couple of billion, nowhere near the $90 billion AEI hack Matt Jensen claims.

Further, less than 20% of the municipal bond exemption, about $8 billion actually goes to bond holders. Most of it is a subsidy to state and local governments. So if you eliminate the exemption, you simply increase state and local taxes. If that is what Jensen has in mind he should just say so — that he wants to cut taxes by raising taxes.

A real tax expenditure saving would be to subsidize municipal bonds directly, as in Build America bonds, thereby cutting out the $8 billion given to wealthy bond holders.

If it’s from the AEI, just assume it is made up.

The content of this “debate” astonishes me. Here’s why:

1. Guy announces “plan” with no details how it works.

2. Analysts make assumptions about how that “plan” might work and find it can’t.

3. Guy criticizes analysts, saying their assumptions are wrong.

What’s missing? Why isn’t the guy providing details that show what his “plan” is and thus why it works?

This is mind blowing. We have a guy who makes claims and rather than saying “prove your claims” we’re arguing about whether criticism of something which doesn’t even exist is valid. He refuse to prove that he even has a plan.

I doubt he does. Look at his daily Medicare waffling. I’ve seen clips of him saying his plan for Medicare is like Ryan’s. Today it isn’t. But what is his plan? He won’t say. His plan is that he has a plan but he won’t show that plan. Why? Maybe then we’d talk about his plan rather than about criticism of a plan that doesn’t even exist.

It’s bizarro world. It’s something of a Sholom Aleichem story. Here’s my plan: we have a shortage of sour cream so from now on water is sour cream and now we have an excess of sour cream. Mitt has a plan for tax cuts that are revenue neutral and maintain current distribution but he won’t show it to anyone and we’re arguing about criticisms of that? We should be demanding he show his plan.

Congress controls spending. Congress is a venal mess.

Presidents and would-be presidents posture and make mouth noises. The incumbent has proven more or less unable to carry out his last round of electoral promises. Romney’s don’t add up.

Question – why do supposedly intelligent people pay any attention to this drivel or to the driveling commentators?

A 12 ft Great White was spotted off the beach where we swim in Cape Cod. http://www.bostonherald.com/news/regional/view.bg?articleid=1061153475&srvc=rss

Readers may recall that I commented some time ago that I thought we would have problems with these Great Whites, which have come for the seals and stayed for the bathers. On the next beach up in Truro, a man was bitten a couple of weeks ago, requiring 47 stiches.

By next year, shark fears will be hurting the local tourist industry. (I understand there are no swimmers in the ocean just now.)

Then we start pulling out the sharks and culling the seals.

Congress controls spending. Congress is a venal mess.

Presidents and would-be presidents posture and make mouth noises. The incumbent has proven more or less unable to carry out his last round of electoral promises. Romney’s don’t add up.

Question – why do supposedly intelligent people pay any attention to this drivel or to the driveling commentators?

jonathan,

Right you are! All it sets up is another round of Romney Whack-A-Mole seeing how fast his supporters can get the Information Fog Machine going.

They were confronted with proof that the Romney Plan isn’t mathematically sound, so the AEI and WSJ begin their campaign of dis-information that 1) Hubbard says “everything is on the table” (so what? “everything” is always “on the table”, but was it actually addressed in anything the candidate ever said about the Plan) and 2) that taxing state and local bonds and the insider buildup in insurance values easily solve the problem. Sure, they easily solve the problem until you do the math and find out that $85-billion becomes $45-billion, but all the media writers are confused, their eyes have glazed over, and their conclusion becomes the headline: “Much Controversy Over Tax Study”. I wonder if Romney polled governors Perry, Walker, and Christie to gauge their reaction to a 380 basis point increase in their cost of funds for highway projects and prisons.

The point that jonathan makes is well worth repeating: what is in the Romney Plan? What tax expenditures are to be cut or eliminated, what are the impacts using the standard tax models available, and what is the predicted incidence of those policies? If the Romney Campaign claims all will be well, then Prove It.

I think this whole issue is much simpler. It comes down to spending, taxes and deficits. Here’s what I expect:

Obama Romney

Taxes Middling Higher

Spending Much higher To historical avg.

Deficit High Middling, declining

Steven, here’s what I expect:

If Obama wins, the deficit will go down over the next 4 years. How much depends on economic strength and too much of that depends on the mess in Europe to guess. Assuming the economy stays slow, then mild to moderate deficit reduction.

If Romney wins, they enact a tax cut plan. The deficit will go up, assuming the same economy as above. I suppose idiots will say tax cuts increase revenue but as a matter of actual fact they don’t and they certainly don’t when the marginal rate isn’t high. My guess is the actual tax plan will include a smaller marginal rate cut, a significant corporate tax rate cut and an attempt to zero out capital gains taxes. I’m guessing this because Congress won’t vote to eliminate the mortgage interest deduction and every state in the union with protest eliminating the tax exemption for municipal bonds – saying, “You can’t raise our cost of funding in a weak economy.”

People will argue they’ll make spending cuts. Eliminate education. Eliminate the EPA. Look up the total cost of running those agencies. Peanuts.

If anyone wants to make a bet against the dollar, do it when Romney wins because that tax plan is the best way to wreck it because no one outside the US believes that “freeing the markets” and all that quasi-religious ideological babble is real. The rest of the world will see a country that has compromised its ability to pay its bills. The world market will punish our hubris.

Jonathan –

You think spending will be lower under Obama? I think he’s targetting maybe 25% of GDP is his mind. But if he’s stated a lower target, I’d appreciate if you’d point it out.

Now, Obama will be unable to raise taxes with what is likely to be a Republican Congress and possibly Republican Senate. So an Obama victory to me promises a continuation of current policies.

Romney has stated a desire to reduce spending to 20% of GDP; the Congressional Republicans will want to do at least that much. So I think we’ll see definite movement in that direction.

The tax side is more problematic. Romney will push for a higher tax rate (probably a lapse of either the SS holiday or the Bush cuts.) Remember, he’s a restructuring guy, good with math, good with understanding sustainable performance. Will the Congressional Republicans go along with this? That’s open to question.

So, under Romney you’ll see lower spending and stable to lower taxes. Under Obama you’ll see unchanged spending and probably unchanged taxes. As such, I think Romney is more likely to close the deficit, with the primary difference being on the spending side.

Steven, Romney just increased the deficit by $700B by flip-flopping on his commitment to Ryan’s plan for Medicare. Remember, that was the same plan he endorsed a few days ago. Mitt runs from confrontation with all the integrity of loose jello.

The Ryan plan assumed essentially the same $700B in reductions to Medicare growth as ObamaCare – and both keep the growth in the program to within the same GDP growth range. So now that’s gone. Ryan used the $700B to finance tax cuts for the top taxpayers, but never mind that. How’s Romney going to come up with $700B to reduce the deficit?

The “conspracy theory” guess is that the GOP intends to enact the tax cuts and use the shortfall in revenue to force through a voucher system for Medicare. That voucher system shifts future cost “control” to people rather to hospitals, but never mind that. The next level of the “conspiracy theroy” guess is that the GOP will do this, that the Tea Party forces who insist on lower taxes will win in the short-term but that the party will be faced with a hard choice: raise taxes or destroy the party as the nation revolts against the hard realities of vouchers and the like. I think the ideologues – and their idiot attendees – think the people will actually go along, but then they’re proved wrong every time they even start to raise the issue.

So we have the GOP now running on a series of enormous lies with vast implications: can’t touch Medicare but Obama doesn’t have the guts to touch entitlements as ads run “cut the debt” and Romney runs away from that except in the empty suit contex of “I have a plan.”

Vote for that kind of idiocy and you deserve the consequences.

Steven Kopits You think spending will be lower under Obama? I think he’s targetting maybe 25% of GDP is his mind. But if he’s stated a lower target, I’d appreciate if you’d point it out.

CBO says that Obamacare will reduce healthcare costs. I know that’s not the kind of news that Republicans like to hear, but CBO has crunched the numbers and that’s the bottom line. Obama also wants to cut DoD spending. Romney (inexplicably) wants to increase it or at least hold it steady. You should also check out “White House Burning” by James Kwak and Simon Johnson. They do a nice job of summarizing spending trajectories under various scenarios. If you think Romney’s budget reduces the deficit, then you’re living in la-la-land.

Obama will be unable to raise taxes with what is likely to be a Republican Congress

This is exactly backwards. If we end up with a Republican Congress, then Obama will have no option other than the “fiscal cliff” option. That means taxes will be raised and spending will be cut dramatically. It also means a nasty recession in 2013. The only chance of a budget deal is if Obama wins. And we know that a few of the less radical Republicans have been working on a post-election deal that would accept the fiscal cliff scenario on 1 January, but then rush through a compromise on 2 January before the new Congress is seated.

If the GOP wins everything, then the first order of business in the new Senate will be to abolish the filibuster (and in order to do that it must be exactly the first order of business). That will free the nutjobs and allow them to push through all of those crazy Romney/Ryan ideas. A lot of the hardcore Tea Party types do not care about getting re-elected in 2014. All they want to do is have one big chance at strangling the welfare state. I suspect most of them know that this is probably the last election cycle in which the GOP has any chance at all of winning the Presidency. Demographics and the mortality of the GOP base are not the GOP’s friend.

As such, I think Romney is more likely to close the deficit, with the primary difference being on the spending side.

I have no idea how you came to this conclusion. I think you’re seeing in Romney what we want to see in a candidate and not what is actually there. As Richard Armey (the guy who funded the Tea Party) said:

Balancing the budget in my mind is the attention-getting device that enables me to reduce the size of government….If you’re anxious about the deficit, then let me use your anxiety to cut the size of the government.

And as Grover Norquist said:

Anyone who says we have deficit problem is either a Democrat who wants to raise taxes or a Republican who’s dimwitted and doesn’t understand what he’s talking about.

All Grover and his allies in the Tea Party want is a warm body without a spine that will sign anything put in front him. And in that regard Romney is a perfect fit.

tj has been asking Menzie for months about the Obama plan. I would like to open that up. Can anyone tell me where I can find a comprehensive Obama plan?

tj and Ricardo: I believe what you are looking for is the called the budget proposal.

Ricardo That’s easy. If you want to know about the Obama plan for national security, go read the Future Year Defense Plan (FYDP). If you want to know about Obama’s proposed fiscal plan, go read the OMB submissions to Congress. If you want to know about Obama’s plan for healthcare and Medicare, go read the Affordable Care Act, especially Title III. Obama’s plan is, to a large extent, already a matter of public law, so if you really wanted to know all you would have to do is check it out. But I suspect that your question was really intended as a kind of snarky rhetorical shot and that you (along with everyone else) pretty much know what Obama’s plan is.

If you would like to read CBO’s perspective on the FY2013 FYDP see this:

http://www.cbo.gov/publication/43428

Note: The FY2014 FYDP will be published in September and is being revised according to the Presidential Budget Estimate Submission (BES), which is from last February.

Menzie, wasn’t it the budget proposal that got zero votes in the democratically controlled Senate?

Ah, the budget does in fact tell us about the President’s thinking:

Spending is set at 22.5% of GDP at steady state. Thus, the size of the government will be 1/8th bigger under Obama than under Romney.

The budget calls for tax revenues to increase by $1 trillion per year by 2015. So the average tax take is set to rise by $8,800 per household per year by 2015.

Debt held by the public rises from 68% in 2011 to 78% in 2014. The budget deficit falls to 3% in 2017. (Table S-1. p. 205)

Moving on to Table S-4, p. 208

From 2012 to 2022,

– Social Security increases from $773 bn to $1,361 bn, a compound annual growth rate (CAGR) of 5.8%

– Medicare doubles from $478 bn to 967 bn, a CAGR of 7.3%

– Medicaid more than doubles from $255 bn to $589 bn, a CAGR of 8.7%

– Individual income taxes increase from $1.2 trn to $2.4 trn, a CAGR of 7.2%

– Corporate income taxes go from $237 bn to $520 bn, a CAGR of 8.2%

– Medicare payroll taxes go from $203 bn to $355 bn, a CAGR of 5.7%

Quite a budget, this.

And I might add that nominal GDP rises at a 4.8% CAGR in the budget from 2012 to 2022.

And I might add that nominal GDP rises at a 4.8% CAGR in the budget from 2012 to 2022.

@2slugbaits: You wrote: “As Richard Armey (the guy who funded the Tea Party) said:…”

IIRC Richard Armey isn’t the guy who funded the Tea Party. He’s a beltway insider living large on the right-wing welfare circuit, and the funding (including a generous salary plus very generous benefits for Mr. Armey) comes from the Koch brothers.

Menzie,

I was actually looking for your analysis of the Obama plan. We all know Obama submitted a budget that even his own party would not touch. How do you feel about his budget?

Thank you Steven Kopits. The analysis the Democrats run from and apparently so does Menzie. He would rather pick at the nits of Romney-Ryan. Menzie strains at the mote in his own eye but does not notice the Obama beam in his own eye.

Steven Kopits

If you think steady state spending over the next 10 years is going to be anything less than 22.5% of GDP, then you probably shouldn’t be driving under the influence of whatever you’re smoking. The 20% number that some conservatives like to talk about is based on pre-baby boomer retirement numbers.

The budget calls for tax revenues to increase by $1 trillion per year by 2015.

I don’t know where you’re getting this. I see tax revenues from $2.469T to $3.450. That is not $1T per year. And we would expect tax revenues to rise for two reasons. First, the budget assumes the Bush tax cuts expire. Second, the budget assumes the economy has recovered by 2015 and more people are working. Did you expect tax receipts to go down???

As to the data on table S-4. First, if you’ll look at the historical tables you will see that a doubling of tax receipts over a 10 year period is not unusual. We did it during the 90s and somehow managed to come through okay. And some of the increase in dollars is simply inflation. We’re talking nominal dollars here.

The rise in Social Security costs in real inflation adjusted terms increases because more people will be retiring. The growth in the program is not because it will suddenly become more generous. Those same people will be retiring regardless of who is President, so Social Security’s expenditures will grow at the same rate. Unless Romney intends to renege on promised benefits, your point here is irrelevant. And if Romney does intend to renege, don’t you think that’s something the voters might want to know about? Pretty much the same story with Medicare. It’s a function of demographics, not which party controls the White House. Even Ryan has said “no change” for the next 10 years. And most (~two-thirds) of the Medicaid increases are because more seniors will have to enter nursing homes. Again, do you have an alternative plan that doesn’t involve pushing grandma off a cliff?

Increasing medical costs as a percent of GDP are a fact of life. The country is getting older and that means higher medical bills. The country is also getting wealthier over time, and that means increased demand for healthcare, which is a “normal” good. People are living longer, which means we have to find a way to equitably balance healthcare costs across generations. I’m not saying that today’s way of balancing those costs is the best, but the Romney/Ryan approach surely has to be one of the worst ways imaginable. At least the Obama plan tries to shift some of the necessary cost reductions onto the service providers,who by the way have already agreed with the proposed cuts conditioned upon the mandatory participation part of Obamacare remaining. If Obamacare is abolished along with the individual mandate, then hospitals have promised that they will consider themselves released from their commitment to reduce their per insured patient visit rates. The Romney/Ryan plan is all about shifting the costs onto seniors. Note…no actual reduction in total costs, just cost shifting. If you think the Romney/Ryan approach that relies upon greater competition among insurance companies will work, then I suggest you read a very old (1963) and very famous paper by Kenneth Arrow in the American Economic Review. It was recently selected as being one of the all-time top 20 most important AER papers ever.

Corporate income taxes go from $237 bn to $520 bn, a CAGR of 8.2%

Since the President’s plan doesn’t call for an increase in the corporate tax rate, it sounds like corporate profits will be doing just fine under Obama.

As regards the nominal GDP forecast, it looks within reasonable limits.

Real GDP growth from 1998 to 2008, thus including one shallow recession and the smaller part of a deeper recession, was at 2.5%. TIPS inflation expectations are 2.3%, which is 4.8% for ngdp–so right on target for nominal GDP in the budget.

Please remember, I don’t think it’s possible to persuade anyone. I’m merely interested in understanding how people think.

My take is that you, meaning Steven because you’re a rational person, intend to vote GOP no matter what. Doesn’t matter that Romney/Ryan’s plans are significantly worse for the deficit and the debt. You prefer to believe that somehow, in some way, they’re better.

Maybe that’s because you don’t like the idea of health insurance for more people. Or because you don’t like Medicaid – and think the government shouldn’t be assisting the poor old and poor children who are its beneficiaries. Those are philosophical differences, maybe even religious ones because I can’t square rejecting those – especially as affronts to liberty – in any form of Judeo-Christian belief. But if those are your beliefs, they are your beliefs.

But on budget issues, the only restraint to Medicare is in ObamaCare. Or why would the GOP now be running ads about how it “cuts” $700B from Medicare? Remember, the same growth is projected in the Ryan plan. The now rejected by Romney plan. So there’s $700B not coming out of Medicare.

The Romney approach to taxes isn’t a plan at all. You can point to the tax increase of 3% – for some, not all and then at the margin not for all income and then of course only for taxable not gross income so we’re talking for people making $300k gross or more. But how do you defend a plan that isn’t a plan? If we take Romney at his word, you won’t be seeing a tax cut; you’ll be seeing a reallocation of your taxes as they cut away your tax deductions. How does that plan do anything other than increase the deficit?

So is your objection really based on the fact that you intend to vote for the GOP and you find whatever you don’t like about Obama to be persuasive? I’m curious. My reason for asking is that I’m a genuine independent: I vote GOP or Democrat depending on the candidate and the issues. For example, if not for Sarah Palin, I was leaning toward voting for McCain, who has a substantial record in government, over the silver-tongued guy with no experience.

Maybe my lens is outdated: I’m a traditional moderate who isn’t driven by social issues, much like what Mitt Romney said he was when he ran for governor and as I remember his father growing up. Maybe what I’m seeing is a lot of justification for positions that actually are generated by something else. I see a lot of people who are literally unable to hear what either side is saying: they hear their own party’s words in a favorable fantasy light and the other party’s words as if spoken by the devil.

Procopius the funding (including a generous salary plus very generous benefits for Mr. Armey) comes from the Koch brothers.

I think that’s called a distinction without a difference. None of them are actually concerned about the deficit. And the Koch brothers least of all, since both of them already have one foot in the grave and the other on a banana peel. Deficit talk is just a Trojan Horse to pull people in. The real objective is lower taxes on the wealthy. That’s always been the goal.

johnathan I agree that Steven Kopits is a rational conservative. There aren’t too many of them around anymore. But I suspect that very reasonableness is what’s getting him into trouble. A lot of moderate and rational Republicans simply cannot believe that Romney is as crazy as he sounds. They are betting that the real Romney will emerge a much more practical and moderate guy than the one they hear on the campaign stump. And they also believe he will grow a pair. If Steven Kopits truly believed that Romney wasn’t just cynically whipping up the base, then I don’t think he would vote for him. And this is a real problem for the GOP. What’s left of the moderate wing of the party things Romney is just posturing for the base and isn’t sincere about what he says. So they give themselves permission to vote for him. The extreme wing of the party also doesn’t believe Romney, but they think that if Romney wins, then he will almost certainly carry along with him a very conservative Congress and that it won’t really matter what Romney believes. For example, the oftentimes very sensible Miles Kimball supports Romney, but worries that a GOP Congress is likely to force him into some very bad policy choices. If Steven Kopits wants to vote for Romney, then he better be pretty sure that the Democrats are able to hold onto the Senate, because an all GOP government really will be as crazy as Romney/Ryan sound on the stump.

I haven’t analyzed the Romney plan. Do I have to do that, too?

But remember, the role of the politicians is not to inform us or to have a proper debate. Rather, it’s to win the election. Personally, I think it’s a referendum of Obama’s policies. It’s not about plans, but tangible achievements. (The Romney camp, in choosing Ryan, doesn’t quite seem to agree with me.)

I stand by my analysis regarding likely outcomes. If Obama wins, with a Republican House or Senate, the current stalemate is likely to persist. I do not see Obama climbing down on spending plans; I do not see Republicans conceding tax increases. True, Obama can allow all of Bush or the SS holiday to lapse. The Republicans would be only too happy to pin it on him. Otherwise, I see discipline arising only from market forces–some sort of debt crisis.

If Romney wins, notwithstanding Slugs’ views on the inevitability of 22.5%, the Republicans are going to carve down this number. That’s fairly clear. But as I said above, taxes are harder to judge, for some of the issues that Slugs raised above. Low taxes versus fiscal balance: where do the Congressional Republicans really come out? Not sure, but again, I would bet Romney works for somewhat higher taxes.

The point of my original post above, was that the nonpartisan analysis essentially assumed some loopholes will not be closed, so their analysis is biased. I didn’t look at the data, but I recall Jensen, or the article author stating that the number are quite variable. Perhaps the numbers for tax breaks cited above in replies to my post are using low-end numbers. Perhaps not.

Even if Obama has a budget plan, scoring it, and Romney’s is pointless. There are not enough details and even if there were, the plan would no go through Congress unchanged.

The philosophical choice is clear:

With Obama – higher taxes, higher spending, more regulation from the executive branch and more centralization of power.

With Romney – a slower growth rate in spending, fewer executive branch regulatory mandates, less centralization of power. Changes to the tax system, regardless of what happens to various rates, will hopefully lead to higher tax revenue. That last piece is going to be the key to Romney’s ability to close the deficit.

Jonothan I generally appreciate your thoughts, but you are wrong when you state – Those are philosophical differences, maybe even religious ones because I can’t square rejecting those – especially as affronts to liberty – in any form of Judeo-Christian belief.

Nowhere does Judeo-Christian belief state that citizens should support redistibution by force of government. Rather, the redistribution from wealthy to poor can only fit the Judeo-Christian belief system when it is performed voluntarily at the discretion of the individual. You may vote to raise taxes on others to fullfill your desire to ‘spread the wealth around’, but then you are forcing others to proivde the charity you refuse to provide. Marx and Mao both would choose to force redistribution, and be very efficient at it. In their eyes, there was no room for a Judeo-Christian belief system or religion in general. We can applaud the good works of the government, but it can never be used to justify taking from one person by force or threat of punishment, to give to another. Maybe that is your belief system, charity through coercion.

Jonathan –

On rationality: I think it unlikely that I am more rational than anyone else. However, I do believe that in politics we have three objective functions. These translate as values and determine our political priorities. Thus, rationality can only be judged against a given objective function.

My objective function is first and foremost classically liberal. Thus, I see the role of government as primarily to create sustainable economic growth, and I believe excessive spending will reduce this growth rate over the long run. I also value individual freedom (property rights) highly, and want to minimize the government’s infringement of these.

By contrast, Slugs–as I understand it–makes a socially conservative case. He feels we have no choice but to cover medical costs for the elderly. I believe he is arguing this is our social obligation, rather than on the basis of equality (since seniors are receiving preferred treatment here). He is alluding to our duty, to the primacy of agency. That’s also a legitimate perspective and is one with which I have a good deal of sympathy. (On the other hand, it’s the very essence of Eurosclerosis.)

If you’re egalitarian, then typically you’re more interested in allocation of resources now and are relatively tolerant of lower growth rates, with costs being foisted on someone else. An example ad absurdum is Cuba, where there’s plenty of egalitarianism and people are poor. But that is also not irrational, if you have a high discount rate and value equality more than prosperity. It’s not my taste.

So rationality is a function of your political ideology. You’re only irrational if you are acting contrary to your own goals. But people can hold conflicting ideologies, with each being rational within its own set of preferences and priorities.

tj: Well, if Mr. Jensen had actually put the requisite numbers into the analysis (do you see them?), we could assess the plausibility of it all working out. But he didn’t. (I’m sure Heritage CDA could provide numbers that would, but then we’d know what the numbers are, and how to assess their plausbility.) Hence, my conclusion is that nobody has seriously sat down, and provided the numbers for how the circle can be squared.

No disrespect to Mr. Jensen, but I think it telling no high profile economist/budget analyst has sat down and laid out the numbers.

tj The point of my original post above, was that the nonpartisan analysis essentially assumed some loopholes will not be closed, so their analysis is biased.

That is not correct unless you mean “biased” towards the most favorable outcome possible for Romney. The analysis took Romney at his word. If Romney said that certain loopholes would not be closed, then the analysis assumed they would not be closed. For example, Romney said that tax breaks that encouraged saving would not be effected. The TPC analysis assumed that the treatment of local & municipal bonds as well as life insurance savings were things that Romney had in mind. Now Glenn Hubbard has since said that those things were “on the table,” but that would suggest Team Romney does not regard the current treatment of state & local bonds as well as life insurance savings as things that encourage savings. I believe most people would be surprised by that.

After excluding those loopholes that Romney had indicated would not be effected, the TPC analysis then proceeded to close the revenue gap by excluding the most progressive tax loopholes. It’s in that respect that the TPC analysis gave Romney’s plan the most favorable interpretation possible. The TPC analysis could have easily made the Romney plan look even worse from the perpective of middle class voters, but they didn’t.

Steven Kopits

Slugs–as I understand it–makes a socially conservative case. He feels we have no choice but to cover medical costs for the elderly.

Actually, I come at this from a Rawlsian perspective. Behind the Rawlsian “veil of ignorance” people would follow a maximin principle. The point of Medicare is to spread risk across generations. I certainly do not believe we “have no choice but to cover medical costs for the elderly.” I do not believe the taxpayer is under any obligation to pay for heroic efforts at the end of life that simply keep a terminal patient in a coma for another few weeks. Death is inevitable. I also don’t think expensive healthcare for the elderly should come at the expense of healthcare for children, which is something that happens all too often today. I also do not believe the Ryan plan even comes close to making sense for the extreme elderly. Recently retired folk (e.g., those in their late 60s through their 70s) might do okay or at least tolerably well under the Ryan plan. But there is no way that folks in their 80s ad 90s will be able to navigate through the menu of healthcare choices that they would face under the Ryan plan. And even if they could wade through the literature and understand it, there is no way that they would be able to buy any insurance plan with such a pitifully small voucher. Remember, under the Ryan plan the older you are less you get.

Correct, they view the interest loophole on state and local bonds as something that encourages state and local spending. It is clearly on the table.

Regarding Medicare – With Obamacare the government will decide which procedures are covered and how much the government will pay.

With Romney – The individual will decide how to spend their medicare dollars.

I suspect many of the perceived ‘best’ or popular pieces of Obamacare will show up in Romney’s Medicare.

People 55 and over won’t be affected. People under 55 can choose traditional medicare of the ‘voucher’ system.

The reason the lower income brackets will like the voucher system is that it puts cash in their pocket instead of forcing them to spend on the Obama mandated policy. With the voucher you will get to keep what you don’t spend.

I think catastrophic illness and insurance is something that needs more thought in the Romney plan.

tj: “They view the interest loophole on state and local bonds as something that encourages state and local spending. It is clearly on the table.”

When you say “they” are you talking about the voices in your head, because neither Romney nor Ryan have said they are interested in eliminating the bond interest deduction.

In fact yesterday, Fox News’ Britt Hume directly asked Ryan if the municipal bond deduction was on the table and Ryan refused to answer.

I am very interested in this phenomena in which conservatives claim to be able to read the candidates’ minds when candidates adamantly refuse to state what is on their minds.

tj Regarding Medicare – With Obamacare the government will decide which procedures are covered and how much the government will pay.

Exactly. And that’s how it should be. The government should only pay for procedures with proven effectiveness. If patients want to receive ineffective treatments, then they should pay for those treatments out of their own pocket or find an insurance company willing to do so.

With Romney – The individual will decide how to spend their medicare dollars.

No, the individual will get to decide which insurance company will decide how much to spend on their medical care. The voucher is only worth a few thousand dollars for one year…or basically half a day in the hospital assuming you don’t go by ambulance, in which case you will have less than 6 hours of hospital coverage.

People 55 and over won’t be affected

False. Romney elminates the donut hole correction, which will cost seniors a lot of money. That change is immediate and applies to current retirees. Romney/Ryan also immediately slashes Medicaid, two-thirds of which goes to pay for seniors in nursing homes.

The reason the lower income brackets will like the voucher system is that it puts cash in their pocket instead of forcing them to spend on the Obama mandated policy.

It does no such thing. They ONLY get the voucher if they buy insurance. And every insurance policy will require that they pay for the difference out of their own pocket because the voucher is trivially small.

the interest loophole on state and local bonds as something that encourages state and local spending.

So does the home interest deduction because it boosts property values and property taxes. Is Romney going to abolish that? And the ability to deduct state and local taxes on your federal tax return also encourages state spending. Is Romney going to abolish that? And if abolishing all of those tax loopholes will throttle spending at the state and local governments, then doesn’t it follow that the additional revenue accruing to the federal government would likewise increase federal spending? You seem to want less state spending and more federal spending.

Slugs –

By “no choice”, I meant a more practical issue. A personal example: A month ago my mother fell down and broke her hip. A day later, she had a new hip, and she’s now back on her feet. Now realistically, how does the healthcare system deny a woman like her care? Do you say, “Well, Mrs. Smith, you lack insurance, so you will have to lie in bed until in acute pain until you die of septicemia or pneumonia.” Of course, you could treat her and come after her assets ex-post. And if she doesn’t have any? So it’s very difficult to deny care for certain types of events.

And that care is extended not out of egalitarianism or intergenerational insurance, but because it would be simply inhuman to do so otherwise. It would be a breech of social obligation to our fellows, not because they are our equals nor because it might benefit us later, but because it is simply our duty.

There are some strong points about Ayn Rand, but I find her writing in many ways cold and stilted. We do not always speak our mind and we don’t always do what we want (particularly if you’re married!). We cannot always deny people our assistance. This is not to refute the need to take responsibility for our own actions. But in the real world, sometimes you have to carry the water, without thanks or credit, because that’s what being an adult is about. It’s your duty.

And, of course, the notion of duty is deeply and profoundly socially conservative.

2slugs

I am not sure where you are getting your info, but it is completely at odds with the legislation that is being written behind the scenes. Once Romney is elected, he will ignore the economy as Obama did, and push his social engineering through Congress by shrieking that it has to be passed NOW! Oh and the bribes, don’t forget the bribes.

The fact of the matter is that none of us know what kind of tripe the left or the right will try to shove down our throats. The only thing we know with near certainty is that Obama wants to consolidate power in the executive branch, reduce the fraction of the population that pays federal income tax, increase the regulatory burden on the business sector, and essentially follow the progressive game plan that has brought California, Illinois, Chicago, Detriot, et. al. to their fiscal knees.

tj You forgot the part about the black helicopters and minting a new coin with Obama’s image on one side and the Roman fasces on the other.

tj’s comments about Judeo-Christianity are interesting because they reflect the peculiarly American view that these beliefs are rooted in economic “liberty” as well as a determined ignorance of what 2000 years of Christian thought and many more years of Jewish thought say. This approach to the meaning of belief is relatively recent. Sure, the “thinkers” can find all sorts of justifications in old words but the system of thought dates to the latter 19thC and only became a major force in the last 50 years. For example, it would have been unthinkable not long ago for Catholics to be against healthcare on the grounds of liberty. This is a byproduct of Roe v. Wade.

For example, I was reading recently Maimonides on social compulsion. It’s strikingly close to the Christian positions – meaning over 1000 years of Christian thought from Jesus on. The word “compulsion” fits exactly. There was no real conception of liberty in action the way Americans see religion and moral obligation today. That we convince ourselves our versions of truth are eternal is the typical hubris of any society.

Jonathan,

Catholics are not against Obamacare on the grounds that it vioates economic liberty. It violates religous liberty.

A feature of the Catholic mission is to serve the less fortunate, so Catholics create hospitals, charities, food banks, shelters for the homeless, etc. All are welcome, regardless of faith. The problem arises when Catholics need to staff the various operations and the government forces them to violate their religous beliefs.

The original point remains. Forced “charity” through government mandate is not charity.

The Catholic church favors universal health care and would even accept a tradeoff that reduces economic liberty in order to get it. That’s why many supported Obama. However, they will not accept a tradeoff of universal healthcare for a decrease in religous liberty.

The WSJ article that Randomworker references stakes its analysis on an AEI report as most of you have pointed out.

FYI: AEI is a right-wing think-tank and is funded by the Koch Brother and other wealthy people. Follow the money Randomworking fool!

And punch this into your calculator:

Randomworker est AGI: $60,000 * .20 = $12,000 tax

$12,000 * 0.2 = $2,400 annual savings (i.e. $200 bucks a month…WOW, you can increase your smartphone plan, buy a V8 again, and add HBO, SHOWTIME, and the NFL Sunday Ticket to your cable package)

Now think about how much 0.20 * the Koch Brothers income tax bill would save them. It’s easily tens of millions if not a hundred million a year…a billion over 5 to 10 years (1/60th their net worth)!

Now Randomworker, look at yourself in the mirror and say…”I want to vote for the Romney-Ryan plan so I can save the Koch Brothers and people like them hundreds of million over the next four to ten years…for the low, low, price of $2,400 a year in my wallet…and a larger deficit to boot!”