The Rise and Fall of the IMF’s Reputation

Today we are fortunate to have as a guest contributor Joseph Joyce, Professor of Economics at Wellesley College, and author of the new book, The IMF and Global Financial Crises: Phoenix Rising? (Cambridge University Press).

The latest twists and turns in the saga of the Greek debt crisis are signs that the brief honeymoon the Fund enjoyed in the wake of the “Great Recession” has ended. The wide-spread approval the IMF received for its “first wave” of lending in 2008-09 has been followed by debates over the size and effectiveness of its lending in the more recent “second wave.” The Greek government won narrow legislative approval for a new round of spending cuts and tax hikes, but its debt/GDP level is projected to rise to 190% by 2014, far ahead of the IMF’s recent predictions. The publication by the IMF of a range of fiscal policy multipliers higher than those used in past projections of the impact of fiscal consolidation in Europe displeased advocates of those policies while providing support to those who believe that the fiscal conditions attached to these programs were too strict.

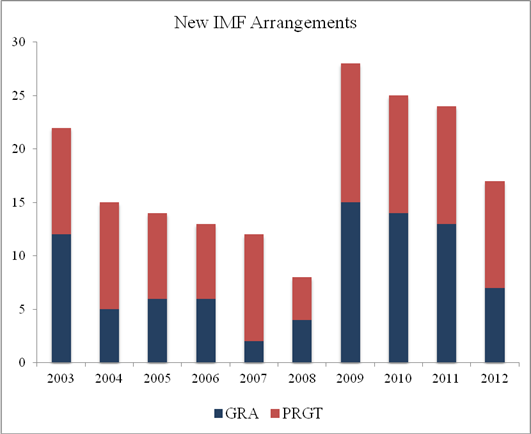

The IMF’s initial lending followed a period when the demand for its assistance had dwindled. During the early 2000s, there was a decline in the incidence of bank, currency and sovereign debt crises, and as a result the need for the IMF’s resources fell. In 2007, when there were ten new concessionary programs for low-income countries funded by the Poverty Reduction and Growth Trust (PRGT), only two new non-concessionary programs for middle- and upper-income nations financed through the IMF’s General Resources Account (GRA) were approved (see Figure 1).

Figure 1: Numbers of IMF Arrangements Approved in Financial Years ended April 30. Source: IMF Annual Reports.

But when the U.S. and European financial crisis turned into a global economic downturn in the fall of 2008, the IMF under Managing Director Dominique Strauss-Kahn took on the role of international lender of last resort. In the “first wave” of lending to 17 nations, it moved quickly to provide large amounts of credit to those members most affected by the disruption of trade and financial flows. The Ukraine, for example, received a Stand-By Arrangement (SBA) of $17.3 billion, which represented 802% of its quota. Iceland, the first upper-income country to enter a Fund program since the 1970s, received $2.2 billion, 1,190 % of its quota, after a spectacular collapse of its banking system. Pakistan received $11.3 billion, 700 % of its quota.

The policy conditions that accompanied these loans reflected an awareness of the nature of the global downturn (Ghosh et al. 2009, Ghosh et al. 2011). The contraction in global economic activity required an easing of domestic macroeconomic policies, including lower interest rates and some fiscal stimulus in countries with records of stable policies. Exchange rate devaluations could be useful, but their size depended on a country’s conditions, and the IMF warned of possible contractionary effects. Moreover, the IMF agreed that capital controls have a place in policymakers’ toolkits, a significant departure from its past policy stance.

The IMF also revised its programs in order to enhance their effectiveness. It established a new facility, the Flexible Credit Line (FCL), which allows countries with strong fundamentals to draw funds without conditions that can be repaid over a period of up to five years. The new facility was more acceptable than its predecessors, and Mexico, Poland, and Colombia signed up.

The members of the G20 group of nations, which replaced the G7 as the “premier forum” for international economic governance, showed their support for the Fund by endorsing an increase in its financial resources of $500 billion. The G20’s national leaders also pledged to establish a process for the mutual assessment of their economic policies, assisted by the IMF. They approved a shift in the quota positions of the IMF of at least 5% to the underrepresented countries, and endorsed a call for the selection of the next managing director of the IMF through a merit-based process rather than following the traditional practice of allowing the European governments to appoint one of their nationals to the position.

By the second half of 2009, the global crisis had moderated and there were signs of recovery. The IMF’s efforts were generally seen as timely and effective, and its reputation soared. But the advanced economies’ slow recovery from the global crisis had troublesome consequences for their fiscal positions. Increased government expenditures and declining tax revenues had resulted in budget deficits. Rising sovereign debt levels also reflected the absorption by governments of distressed assets on their banks’ balance sheets. The IMF’s response became part of a “second wave” of lending which eventually encompassed 13 countries.

The bond markets responded to the increases in European debt levels by demanding higher returns from sovereign borrowers. Greece, which had taken advantage of low borrowing rates for members of the Eurozone, was their first target. After its government announced that the fiscal deficit for 2009 would be twice as large as previously estimated, the return on Greek bond yields soared. In April 2010 the Greek government requested support from the other European governments and the IMF.

The IMF joined the European Commission and the ECB (the “troika”) in providing $145 billion in financing, with $40 billion from the IMF in the form of a three-year Stand-By Arrangement (SBA). The IMF’s commitment was equal to about 3,200% of Greece’s IMF quota at that time, a record amount. The IMF’s program with Greece included conditions that were similar to those the Fund had sought in the 1980s and 1990s. The program stipulated a reduction in the government deficit, which would be accomplished through spending reductions, increases in the collection of taxes, and the curtailment of entitlement programs.

Ireland became the next country to require a financial rescue by other European governments and the IMF in December 2010. The amount committed under the agreement totalled about $113 billion, which included a three-year Extended Fund Facility (EFF) from the IMF to provide $30 billion, worth about 2,322% of Ireland’s IMF then-quota. Since the source of Ireland’s debt problems was very different from the fiscal deficits in Greece, its program’s conditions had a different focus. They called for a restructuring and downsizing of the banking sector, although fiscal consolidation was also a component.

Portugal followed in May 2011. The IMF and the EU approved a financing package of $116 billion, including a three-year EFF for $39 billion, worth 2,306% of its quota. The policy conditions included a reduction in the government’s deficit, and the fiscal curtailments included cuts in public sector wages and staff positions.

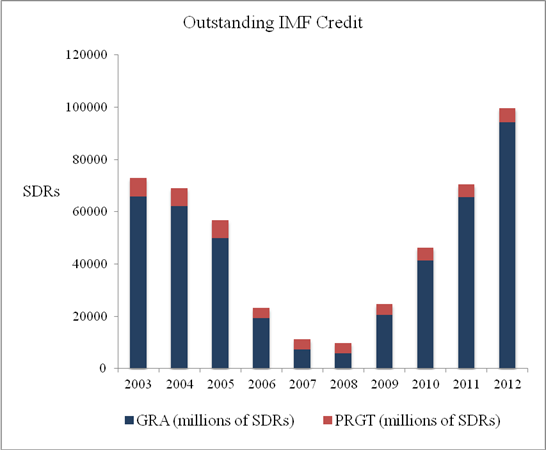

These European loans dwarfed the other country arrangements in the “second wave” of Fund lending. The amount of the IMF’s outstanding credit doubled from 41.2 billion SDRs in fiscal 2010 to 94.2 billion SDRs in 2012 (see Figure 2), and the IMF was obligated to borrow $438 billion from its members. The European loans were far above the conventional rules on access to Fund credit, which had been lifted to 200% of quota within one year and 600% over three. The IMF had issued criteria to govern exceptions to these rules in 2003, and one of these was a high probability that the country’s public debt is sustainable. In the staff report that accompanied the announcement of the Greek SBA, the IMF’s economists admitted that there were “significant uncertainties” over the sustainability of its debt in the medium-term, but claimed that the arrangement was justified because of the high risk of systemic spillover effects.

The measures designed for Greece proved to be inadequate. In 2012, a new financing package, linked to a substantial restructuring of Greece’s sovereign debt, was arranged. Bondholders agreed to a write-down of about 75% of the present value of their bonds, and the Greek government received a commitment for $170 billion in new financing from the official sector. The IMF’s share took the form of a four-year EFF of $36.7 billion, which replaced the cancelled program of 2010. The new program established a new fiscal target of a primary budget deficit in 2012. But a youth unemployment rate of 50% has raised doubts about the viability of these measures, and a similar situation in Spain shows that Greece is not alone. Several European countries faced the prospect of a new “lost decade.”

There are several significant differences between the two waves of IMF lending. First, the former followed a financial shock in the advanced countries, while the latter reflected domestic fiscal and regulatory policies that need correction. Consequently, there was relatively limited conditionality associated with the first group of programs, but more extensive measures in the European programs. There are contributing to the general European economic downturn.

Second, while the IMF lent substantial amounts during the first wave of lending, the size of the European programs surpassed previous records. The emerging market governments are suspicious of IMF programs that appear to be more generous than those extended during earlier crisis periods. In addition, the relaxation of the criteria for exceptional access raises doubts (Schadler 2012) about the IMF’s ability to withhold credit in future debt crises.

Third, the Fund’s traditional “crisis manager” role in previous crises gave it control over the recovery programs and disbursements of credit. But in Europe it works in partnership with governments that also give assistance, particularly Germany, one of the IMF’s largest members. Chancellor Angela Merkel faces opposition from indignant taxpayers who do not want to pay the bills of profligate governments, while public officials differ over the degree of involvement of the private sector in any debt restructurings. The European Central Bank is also a major player in these negotiations and under President Mario Draghi takes independent positions. Consequently, the IMF is forced to reconcile the efforts of governments and organizations with different interests and goals. In addition, the IMF itself went through a change of leadership when Strauss-Kahn resigned and was replaced by Christine Lagarde, another French national. The IMF missed an opportunity to appoint a non-European and meet the G20’s call for a merit-based process free of regional influences.

The events in Europe pose challenges to the IMF. The Fund is caught in the crossfire among Eurozone governments and their citizenries over how to deal with members in financial distress. The IMF is rightly concerned that it will lose its newly-won credibility if it approves plans that are unrealistic. Meanwhile, the slow pace of implementation of quota reform perpetuates the image of the IMF as an organization under the control of the U.S. and European nations.

Figure 2: Outstanding IMF Credit in Financial Years ended April 30. Source: IMF Annual Reports.

References

- Ghosh, Atish R., Marcos Chamon, Christopher Crowe, Jun I. Kim, and Jonathan D. Ostry. 2009. Coping with the Crisis: Policy Options for Emerging Market Countries. IMF Staff Position Note No. 09/08. Washington, DC: International Monetary Fund.

- Ghosh, Atish R., Christopher Crowe, Jun Il Kim, Jonathan D. Ostry, and Marcos Chamon. 2011. “IMF Policy Advice to Emerging Market Economies During the 2008-09 Crisis: New Fund or New Fundamentals?” Journal of International Commerce, Economics and Policy 2 (1): 1-17.

- Schadler, Susan. 2012. Sovereign Debtors in Distress: Are Our Institutions Up to the Challenge? CIGI Paper no. 6.

This post written by Joseph Joyce.

and they told me the Gold Standard was dead!!!!!!

Good summary about conflicting interests.

Mr. Joyce, do you have an idea how this crises might develop in the near future ?

The narrative of the financial crisis are mundane and have been through time, papers, empirical data and history of financial crisis well retraced. It is better to prevent than cure, that is as well a function of the IMF and not only of the IMF. BIS was set as well for this purpose, and so many convivial governments buddies were ranked as the Atlas of knowledge and vestal of the economic soundness, among others Central Banks. Let us not forget that if gratified with a European nationality, a constitution comes with the birth certificate. With the constitution comes financial covenants. Let us not omit, when gratified with a say, one third of the European population, France and Spain citizens did not ratify the existence of this constitution. K Arrow theorem of impossibility was rewarded, the European constitution fell under the scrutiny of the Constitutional courts.

The specious argument, IMF fiscal multiplicators and monetary adjustments overshoot on the downside and overkill on the upside are an homage to economic sciences, as they reach the status of nano sciences. Markets have never existed, they did not prevent leverages and did not sanction indebt ness neither public nor private. Private debts corporate and household are never scrutinized until they filter through Banks accounts and through capillarity into Public accounts.

The Sophie’s choice of Europe, debase your public accounts, lose track of your productivity indulge yourself in more debts, or while you can be a better laborantin of the couple fiscal policy monetary adjustment.

Reference is made to the IMF statutory lending quotas and that is justice to bring them on topic. Since justice is not a one eyed incarnation, one may as well bring the subject of over money supply, macro public accounts that are over leveraged, tempering with foreign exchanges markets, manipulating all segments of the commodities and financial markets and the moral and fiduciary responsibilities of an international reserve currency status the US Dollar and its long run problem.

Hi Joe, Thanks for the summary and greetings from a fellow student/teaching fellow form BU days. Best, Giulio

Considering that the IMF is a junior player with respect to capital provided in the Euro countries, it is also a junior player in terms of policy setting now.

The IMF was important, initially, for their experience in turning around countries, the plans, how to work with the usual screw ups, etc.

After being politicized with Madame Lagarde, and the repeatedly outrageous nonsense of Olivier Blanchard, the IMF has lost all credibility.

They have no fresh money, the voting rights do not represent the capital paid into (more Chinese, BRIC). It represents a colonial order (US, UK, FR) gone by.

The IMF has failed its role of “final”.

Up the capital to be paid in by another trillion, and adjust the voting rights accordingly.

We are living in a difficult time. It is obvious. Europe is the clearest example of what can happen when there is not sufficient control of the finance spending and banking sector. It has been four years since the crisis started. And we don´t have any solution. IMF does nothing. EU does nothing. What is left are the national states, principally Germany and France (How to Fight Economic Crisis). The rest just joins one or the other. Great Britain will probably leave the EU. This is something very serious for the future development of the united Europe. You can´t let GB leave and replace it with Turkey or Ukraine.

The IMF was not a “phoenix,” in 2008. It simply was able to sell itself more than what it was worth, thanks to its former managing director Dominique Strauss-Kahn (DSK) caught on May 14, 2011 in a scandal with a hotel chambermaid in New York who accused him of sexual harassment.

Four internal employees accused the IMF to be responsible for the 2008 crisis:

1) The Brazilian Executive Director Paulo Noguiera Batista sent an inside newsletter throughout the institution holding the I.M.F responsible for the crisis;

2) Peter Doyle resigned from the IMF on June 18, 2012 because of “incompetence,” “failings” and “disastrous” appointments for the IMF’s managing director, stretching back 10 years. He pointed out that “the Fund’s delay in warning about the urgency of the global financial crisis was according to him a failure of the “first order;”

3) an assistant in her book “The Department of Infernal Affairs—The Exposed Underbelly of the I.M.F” wrote that “when the IMF can foresee a disaster, it prefers to ignore it by burying its head in the sand.” She added “The IMF, unable to healthily manage itself, nonetheless gives off an aura of inescapable power. It gets paid to detect and analyze the slightest economic fluctuations and rejoice over upturns. Its economists explain faits accomplis, but are unable to forecast what has already happened, and they have the nerve to claim they can teach good governance. Perhaps the IMF needs to sift through tons of muck before finding the elixir of life, that drop of gold that could save us from the catastrophic situation we are in now. Then the organization would have a raison d’être;” and

4) The IMF internal audit held the IMF responsible for the 2008 crisis.

CONCLUSION: The IMF, like many other international organizations, cares only for itself. It has no empathy for the turmoil of its external surroundings.

Black Elk GoM Explosion (Upstream online)

A shallow-water oil and gas platform in the US Gulf of Mexico was on fire after an explosion, with reports saying at least two people were missing with another four injured.

Initial reports said two people had died, but that has not been confirmed. CNBC reported that the fire had been contained around 10:30 am local time.

The four injured were airlifted to the West Jefferson Medical Centre in Louisiana, local reports said, citing the US Coast Guard. Three of them are said to be in critical condition. The agency was not immediately available for confirmation when contacted by Upstream.

Coast Guard Captain Peter Gautier told WWLTV news that there was believed to be 28 people on the platform when the explosion occurred.

CBS News reported that the two missing people jumped overboard after the incident.

The platform is located south of Grand Isle in West Delta Block 32, where Houston-based Black Elk Energy is the operator.

Black Elk chief executive John Hoffman confirmed the fire to the Houston Business Journal, saying that a construction crew was finishing work on a water skimmer when, apparently, the wrong line was cut, causing the explosion. The company was not immediately available for comment.

Gautier said the platform was not actively producing oil at the time, lessening the chance that there would be a major environmental disaster. No oil has been reported spilt.

The incident comes just a day after BP was charged a record fine and faces criminal charges for the 2010 Macondo disaster in the Gulf of Mexico.

The Coast Guard has reportedly set up a command centre to investigate the incident. An update was expected around noon Houston time.

Privately-held Black Elk holds stakes in more than 854 wells on 155 platforms off the coasts of Louisiana and Texas, in water depths ranging from about 10 feet to more than 6000 feet,

I may have missed something, but it seems that in all of the criticism here that one important consideration has been left out: For there to be any significant changes in IMF policy… the US must include its 17% voting share to reach the 85% requirement to ratify any efforts to make the IMF anything more than a puppet organization.

Thanks PPCM & Marguerite for your comments. “Western” international financial institutions frequently engage in a shell game to loot both existing and future wealth creation (goods & services) through securitization and subordination . Basil III is a figleaf that fails to cover the gross over-leverage of the banking sector, while the regulation of the derivatives market is still moving at a glacial pace. SEE:

http://blogs.cfainstitute.org/investor/2012/11/14/dodd-frank-extra-territoriality-pervasive-regulatory-changes-for-otc-derivatives-in-asia-europe-beyond/

The real problem is that multinational corporations arbitrage regulations and tax regimes on a world-wide basis. (For instance, financial regulations in New York resulted in expanded brokering in London)… Because nation-states have limited international jurisdictional and enforcement powers, correction and regulation has to be implemented ad hoc through weak international institutions like the G20, IMF or the BIS. Such efforts rely on treaties and “harmonized” domestic legislation that can take many years for implementation…. Simply stated, international corporate interests can run rings around individual nation states. If you want a functional global economy you need effective global regulation. Forgive me if I don’t hold my breath for such a magic world government to occur.

Here is Fulcrum’s paper on why the recovery is stronger in the US than the UK.

http://www.fulcrumasset.com/datasource/frp201211.pdf

They attribute 0.5% of GDP difference to the UK’s declining oil sector. They have not looked at the US, as I understand it.

I, however, did prepare an estimate for the US, which suggests that US shale oil and gas and UK oil and gas declines account for 41% of the non-fiscal difference between the US and Great Britain since the start of the Great Recession.

That’s a big number, if it holds up.

Here’s a nice story about how unions destroy companies.

When a union employee can find alternative employment at market wages, he has no incentive to accept market wages from his unionized employer.

Therefore, there’s a willingness to go to the wall and drive the company into bankruptcy, because there is relatively little downside. But it also means that those who would have accepted lower wages (and maybe had something of a pension involved), also see their employer sent into bankuptcy.

We see that clearly illustrated in the case of Hostess.

http://money.cnn.com/2012/11/16/news/companies/hostess-workers/index.html?iid=Lead

Some excerpts:

Tracy Fea, the wife of a Teamster working at Hostess, said she’s particularly mad at the Bakers’ union for the strike.

“While they [Teamsters at Hostess] were not at all happy about the additional concessions, they did not want to lose their jobs,” she said. “My husband and I feel that if these employees [Bakers] were so unhappy … then they should have quit so the company could continue on and the remaining employees that want to work could.”

But Joe Lannan, a Teamster based in Kentucky, said [the]…split among Teamsters was between more senior workers and the newer drivers, such as himself. He’s been at Hostess about a year.

“There were a lot of nervous guys, mostly with more senior drivers. I’ve seen a lot of teary eyes,” he said.

But he’s hopeful that a lot of the drivers will be able to find jobs due to the demand for truck drivers overall.

“The company has been in decline for years. There was no way it was going to get fixed,” he said. “Everybody I worked with was looking for other jobs anyway.”

Because of his commercial driver’s license, Lannan was lucky enough to quickly find a new job, getting a call with a job offer as a fuel truck driver Friday afternoon.

We see clearly that Lannan had other opportunities, and from his point of view, the bankruptcy of Hostess was acceptable, if not optimal.

In a non-unionized shop, Lannan would have had no reason to quit and would have valued his job. However, if he had not, he simply would have left without taking the company under. But enough of the employees felt that killing the company was preferable to taking market wages.

That’s what unions do for you.

Steven,

I drive trucks, but I’ve never been in the Teamsters; I have though been in 2 trade unions. And so, I have enough applicable experience to know that your comment is so far short of weighing all of the factors that it is bordering on ridiculous.

To begin with wages alone do not provide a comprehensive evaluation of how one driving job compares to another. I worked for one employer for example who paid “market wages” but he always scheduled more drivers per shift than he had trucks for. Roughly 24 drivers would be required to report for duty every shift but 3 or 4 drivers would routinely be sent home without any compensation for their trouble. Then, those drivers who were given work, as if it were a gift of sorts, they were very willing to haul loads that were over the weight limits, and to take shortcuts over roads and bridges where restrictions applied, and in trucks that were dubious in regards to safety issues. And drivers learn very quickly not to complain about anything, and to do minor repairs without compensation for parts or labor, and to pay for the inevitable citations, and to avoid potential citations via dubious machinations, all to keep from being one of those drivers sent home. At one of the companies where I worked we were expected to haul 100,000# loads over a bridge that was rated at 56k; and this could be 2 or 3 times a day times 10 or so trucks. The ticket, if we were cited, cost the driver $2,300 and the company would ‘help out’ by giving the unlucky drivers extra hours with runs that allowed for an occasional nap while on the clock and etc. (bookoo overtime). And these policies are fairly common in the trucking industry.

I in fact recently applied for a job driving for a private contractor who hauls mail, and this company uses a ploy that is even more common. This job pays more than “market wages”, but… the driver only gets paid for 3 hours on the way out, and for 3 hours on the way in, but with 4 hours in the middle that are not only without pay, but that leave the driver in a day-cab in a parking lot behind a post office in a variety of small towns. A job then that takes about 13 hours to perform, once loading and unloading is considered, times 6 days per week,ultimately pays less than ‘market wages’ because there is no overtime pay. This though is just one version of scheme that is rife throughout the industry.

I once waited in Twin Falls, ID., in the dead of winter, for 26 days without pay, while repairs were being made on a truck that I was responsible for. In the meantime, I stayed in a run-down motel that my employer paid for, but I paid for my food and anything else required, and these realities are what make the union jobs worth fighting for.

To add a little perspective to the off-topic subject of the demise of the Hostess company:

(italics are mine)

“In an interview with CNBC, the CEO laid the lion’s share of the blame at the feet of the striking union. However, he acknowledged that management missteps, particularly ones that saddled the company with debt when it last emerged from bankruptcy after more than four years of restructuring in 2009, also contributed to the company’s current situation.

Despite the company’s tough talk, though, Hostess still needs to get permission to liquidate from Judge Robert Drain, who is overseeing its Chapter 11 restructuring. An interim hearing is scheduled for Monday afternoon and a final hearing is scheduled for Nov. 29.

Hostess has broached the prospect — or threat, from its unions’ perspective — of liquidation before without following through. But today, Rayburn said that even if the union relented and agreed to accept the 8 percent percent pay cut and nearly 20 percent hike in benefit costs, “[It’s] too late. We’re done.”

Management missteps… such a delicate euphemism for screwing up a company that had an iconic brand.

Now, if it is too late, why wasn’t too late a few weeks ago? It certainly sounds like a case of management knowing that the union would balk, and therefore trying to shift blame onto the latter. The captain and officers trying to get the responsibility for the ship sinking on the crew…

Back to the topic – I think JB succinctly stated the overall problem.

The saddest part of it all is that the leaders of the EU were warned, knew better, and chose to do little or nothing before the crisis blew up on them – another case of management misstep…?

Claims of management incompetence are rife when union shops go down. But a hallmark of competent management is the ability to maintain productivity or costs in line with industry requirements.

Thus, if by competent management we mean “management that was able to get union demands down to market levels”, then you’re right, very few unionized companies have competent management. By definition.

Ray –

Most jobs I have worked in have requirements in excess of those stated nominally. As both an employer and employee, I have both taken and made such demands.

Having said that, if you are in any profession, you become aware of the pitfalls of that profession. I would imagine truck driving is no different. You either accept these or find something else to do.

But that’s not how it played out at Hostess. The unionized members killed the company–they took others’ jobs with them. And the sober truth is that they did this because they had other potential sources of employment. So destroying the company was cost free–except to the older guys with pensions at stake. But this was not a consideration for the younger guys, as the story tells us.

Finally, a comment about culture versus market.

I think there are certain cultural norms that are viewed as valuable and to an extent, sacred. These include holidays like Christmas and Thanksgiving.

Pushing too hard on these norms can truly offend people in a non-monetary way. Not everything is measured in dollars and sense, and I think these sorts of phenomena are not well-enough understood in either economic theory or business practice.

ADS shows second recession is coming to the USA. No one worried? ( of course, small war with about 2 trillion/year expenditure from the printing press FED-> USG can fix it- until the USG defaults).

For a few years more?

Have no doubt USG will default on FED- or rather, FED will cross out step by step, gradually 2 opposing lines in its balance sheet- USG treasuries on asset side, excess bank reserves on liability side.

There is no way USG will default by inflating debt away. Think like bankers. Exit number one will be decided by them, during Obama or straight after (2016-2017), when the first signs of serious CPI inflation of order of 10% will finally start to show up in the USA after finishing its loops over the rest of the world.

Wonder why anyone waste time to consider what will happen in between. Consider what will happen when FED will announce and remove excess reserve cash say at the rate 500 billion/month or more.

And the ensuing worldwide depression.

Exit number two will be already much more dangerous enterprise.

Before that (FED balance sheet adjustment) , the role of USD as reserve currency has to be reinforced by utilizing military supremacy built over years from printing of reserve currency, financed by foreigners.

Short term, that means Middle East/Central Asia concentrating on Iran and other oil/gas states.

Steven Kopits once again recites his mindless conservative talking points.

The unions didn’t kill Hostess. Debt killed Hostess. The private equity owners, Bain-style, performed capital destruction using leverage to loot the company. The debt service loaded on the company amounted to many times the concessions they were seeking from the unions.

The company went into bankruptcy in the first time in 2004, also the first time the unions made huge wage and benefit concessions. The company came out of bankruptcy in 2009 with almost a billion dollars in debt, more than when they entered bankruptcy. The owners used this new debt to pay special dividends to themselves, recovering their small investment plus generous profits. The PE guys were golden and the company was stuck with debt they had no hope of surviving.

There were few drops of blood left in the corpse. The brands were worth cash if only they could persuade the bankruptcy judge to allow liquidation. Liquidation was their goal all along and the unions were just the excuse. How do we know this?

1. A year ago the owners installed a liquidation specialist as the new CEO. Gee, I wonder why they would do that?

2. The first thing the new management did was convert millions of dollars of tax-deferred compensation for executives to immediately payable salary. Now why would executives give up sweet tax-advantaged deferred compensation for immediately taxable compensation? Perhaps they didn’t expect to the company to be around very long.

3. When the bankruptcy judge uncovered this blatant looting, the executives offered to work the rest of the year for a one dollar salary. No stock options, no equity, just a dollar. When Iaccoca and Jobs took a dollar salary they did it in exchange for stock options, anticipating their options would be very valuable. These guys didn’t want any equity. I wonder why?

4. Why would anyone offer to work essentially for free? Well, in a liquidation of this size, the executives who hang around to assist the liquidation are given millions of dollars by the bankruptcy judge for their services. Conveniently, liquidation managers are at the head of the line for payouts, even ahead of bond holders and stockholders.

So it is pretty obvious that liquidation was the plan all along. The only problem was getting the unions to cooperate by not cooperating so that liquidation could proceed. The method was to offer the unions a “deal” that was really a poison pill. What was in the offered deal?

1. The unions had to agree to the closure of 12 factories. So thousands of people were destined to be fired regardless of anything the unions decided. That’s a real deal sweetener.

2. The unions would be given a 25% stake in the company in exchange for taking on $100 million in debt in addition to wage and benefit cuts. A lot of this debt was money owed to the pension fund so the union was being offered the privilege of working at reduced salary to pay back the money looted from their own pension fund by the PE guys.

3. By taking an equity position in the company, the unions would be giving up pension insurance provided by the PBGC. Considering the debt load the company would be saddled with, there was the almost certain risk that they would lose most or all of their pensions. Many likely decided that they were better off taking a certain insured pension rather than a share of a debt crippled company.

This is an old story, repeated many times by private equity. Leverage, looting and scooting. It would make Mitt Romney smile. Meanwhile Steven Kopits continues in his poor imitation of Sean Hannity.

Ivars, at the current trend rates of post-’00 and -’07 nominal GDP, deficits/GDP, public debt, and net interest as a share of total federal receipts after Social Security (SS) and Medicare (MC) receipts, the US gov’t will be faced with the Jubilee and PIIGS-like threshold by no later than ’16-’17, at which point net interest to receipts less SS and MC will reach or exceed 25%, requiring massive gov’t spending cuts and the risk of a moratorium on interest payments to foreigners.

A recession that is increasingly probable, including profits after tax falling $900 billion, will result in federal deficits approaching, if not exceeding, federal receipts. This is the “fiscal black hole” that those who are fully informed fear the most and the scenario that is now becoming more likely than not.

Of course, the problem is that raising taxes and cutting spending at this point will only, at best, reduce gov’t borrowing, whereas there will be no net private sector “stimulus”; and a recession with tax increases and spending cuts will be even deeper than otherwise would have been the case.

The “fiscal cliff” is not a choice but an inevitability, and stock prices and business investment and private employment decisions will soon reflect this reality.