Most of the discussion has focused on the domestic repercussions of going off the fiscal cliff (or as my former colleague Chad Stone calls it, the “fiscal slope”). I think it important to remember that, as the single largest economy, policy in the US has profound implications for economic developments overseas. This is particularly true with the eurozone still in a fragile state, and China growing (relatively) slowly.

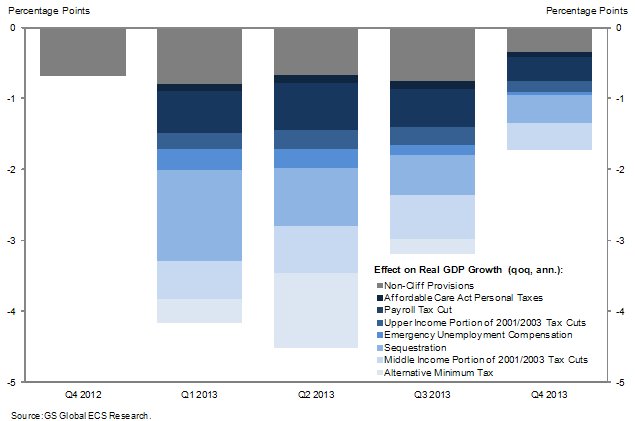

Jim’s post yesterday tabulated the numerical components of the fiscal cliff. Goldman Sachs has used its own tabulation to estimate the impact on GDP growth over 2013 (SAAR), shown in Figure 1.

Figure 1: Effect on real GDP. Source: Goldman Sachs, “US Daily : The Composition of the Fiscal Cliff (Alec Phillips),” October 19, 2012 [not online].

Note that one difference between the BofA and GS calculations involves the size of the Bush tax cuts. BofA indicates $180 bn, while GS indicates $192. The consequential piece of information is that $56 billion of the $192 bn is associated with high income tax cuts. Retaining the lower tax cuts for incomes less the $250K means the fiscal cliff would be reduced by $136 bn.

Nonetheless, with interest rates at zero, contractionary fiscal policy is likely to have large (negative) effects. (Obviously, I am ruling out “expansionary fiscal contraction”; strangely, I do not hear much discussion of this outcome being likely, this time around — where is the Republican JEC when you need cheering up?).

The IMF, using slightly different numbers, concludes:

The fiscal contraction built into the fiscal cliff is 4 percent of GDP (3 percent of GDP more than in the WEO baseline). A range of models is used to consider the short-term impact of the fiscal cliff, from simple calculations with tax and expenditure multipliers to fuller scenarios using various modeling approaches, each of which has its own assumptions regarding the permanence of the cliff and associated confidence effects (Fig. 14). The largest—not necessarily the most likely—hit to US growth comes from the G-35 model because it treats the cliff as temporary (i.e., private consumption does not rise to offset lower public demand), and since it builds in negative confidence effects (i.e., a 15 percent drop in stock prices, partially offset by lower long bond yields on account of the lower debt path). The spillovers from this model are also larger, and operate mainly via trade channels, which is why neighbors are most affected (Fig. 15). But China and several advanced countries would also suffer up to one quarter of the hit taken by US growth. Lower commodity prices—6–12 percent for energy and 3–6 percent for non-energy, depending on confidence effects and policy responses—also adversely affects net exporters of these goods. Were the assumed confidence effects more negative, so would be the spillovers. (page 10)

Exhibit 14 from the paper tabulates the various estimated impacts and assumptions.

Exhibit 14 from IMF (2012).

The estimated impacts are relative to WEO baseline (which includes a 1 ppt of GDP contraction), so they pertain to a 3 ppts of GDP contraction. Multipliers pertains to application of multipliers as in most of the calculations, e.g., GS. GIMF, GPM and G35 are Global Integrated Monetary and Fiscal model [1], Global Projection Model [2] and a panel unobserved components model of 35 economies (Vitek 2012) [3].

The (relative) impact on economies around the world is illustrated in Exhibit 15.

Exhibit 15 from IMF (2012).

Clearly, the impact is (relatively) largest for our neighbors, Canada and Mexico. But the impact on some other economies in a precarious state –- the UK, Germany, China, and Japan –- is also noticeable.

I would further note that expansionary monetary policy — such as implemented recently by the Fed in QE3 — cannot offset completely the contractionary impact of contractionary fiscal policy. In addition to the zero interest rate constraint, looser Fed policy tends to re-allocate economic activity toward the US.

Hence, the stakes for a successful resolution of the fiscal cliff are high, not just for the US, but for the world economy.

More on this from the CBO report released today.

Menzie,

I am surprised you think the efficacy of monetary policy is constrained by the zero bound. Unconventional monetary policy can pack a punch as shown by FDR in 1933. To the extent the fiscal cliff affects the economy via a drop in aggregate demand, then a monetary policy aimed at stabilizing NGDP, if credible, should offset much of the fiscal drag.

So let’s see if I read this right. GS numbers show the fiscal cliff would reduce 2013 GDP by about 3%, with the effect largely dissipating by Q1 2014.

To avoid the cliff, we will be borrowing something like 7% of GDP in 2013, with no end in sight without the fiscal cliff.

So the payback period on the fiscal cliff is six months? If that’s the case, bring it on. Indeed, if that’s the case, we were fools not to take the hit straight up in 2011, because we’d be back to growth with manageable deficit now.

Steven Kopits To avoid the cliff, we will be borrowing something like 7% of GDP

Once again you’re thinking like a private household or business. Borrowing 7% of GDP is not anything like losing 7% of GDP. You seem to see government borrowing as some kind of black hole. Government borrowing creates a government liability; but it also creates a financial asset for someone. That financial asset represents a claim against the future income stream generated by those borrowed resources. If the government borrows 7% of GDP to rebuild infrastructure (e.g., think the Jersey shoreline), that infrastructure will generate a flow of benefits. As long as the benefit flow is greater than the interest rate it makes sense to borrow.

On the other hand, a 3% loss of GDP is a pure loss and can never be recovered. It’s a dead loss.

The problem is that you continue to see government borrowing as only a cost to you without any corresponding benefit going to you. You pay more taxes in the future and get no benefit. That’s a purely household view. It has a certain kind of intuitive appeal, but it’s bad macroeconomics and even worse public policy.

I am looking forward to Professor Chinn’s log graphs showing us how things are now as bad as they seem, over Mendax I’s second term.

Not really, because I am going to suffer, along with the rest of the nation.

Who are you, Anon?

I well understand that the loss of production for a period is lost for good. There is plenty of slack now, too. So you want to borrow another trillion to mop that up? Do you think that will jump start the economy? Or will it be another blip like cash for clunkers, the first time homebuyers’ credit, or census hiring?

In any event, if I understand GS correctly, then a year from now, we could be in a position where the deficit is 3% or so and GDP is beginning to grow again. In other words, we would be out of this no-man’s land we’ve been in for the last three years.

Is that worth a year of pain? From my perspective, yes.

Oh, and by the way, this chart:http://research.stlouisfed.org/fred2/series/RECPROUSM156N

You’ll note the probability of recession has never exceeded 20%–where it is now–without going all the way to full recession. Can you imagine? A trillion dollar deficit. Monetary pumping without bounds. And still, a recession.

The point of government borrowing is for the household to reduce its deficit, but if both are reducing its deficit, then neither “really” are. This is what happened when Hoover tried to control the deficit in the 29-30 period.

When Creditanstalt collapsed, Hoover finally got off his duff, though Democrats blocked him only allowing modest fiscal spending and pushed through big tax increases………by 1932 the contraction finally began to ebb with a monster output gap. It was to late for Herb.

The outline is, the Bush tax cuts can go mostly. Keep parts of them for right now, but get rid of the worst. Put those savings plus DoD cuts into infrastructure and don’t let the structural deficit go below 1 trillion. If it looks like it is, spend some more to keep up the flow.

If Europe has another Creditanstalt, the government better be ready or face riots and death in the US of A.

“I am surprised you think the efficacy of monetary policy is constrained by the zero bound. Unconventional monetary policy can pack a punch as shown by FDR in 1933. To the extent the fiscal cliff affects the economy via a drop in aggregate demand, then a monetary policy aimed at stabilizing NGDP, if credible, should offset much of the fiscal drag”

Yeah, but that “unconventional” monetary policy was just going off the gold stantard. There was also the Thomas Amendment that allowed FDR to essentially use the FED for interest free money to spend on his new deal programs, but that wasn’t autocratic workmanship like NGDP targetters want to do.

I would like to see a similar figure showing the effects of Chair Bernanke’s monetary policy, which led to substantial dollar depreciation. Since many Asian currencies remained pegged to the dollar, the effect on them would presumably be quite small (or perhaps even positive). But the resultant overvaluation of the euro (by something like 15% to 20%) surely hit their economies hard. The euro at close to $1.60 was very bad, but the recent value of $1.30 is also a powerful drag on their faltering economies.

I am always baffled by the spending on infrastructure thing. Where we need infrastructure, we can’t get it approved. And the cost of union labor is so high, it just doesn’t make sense in many cases. The third train tunnel from NJ to NY is a case in point.

However, I do see an area where it could be well spent: Demolition. In places like Baltimore, Newark and Detriot, there are essentially abandoned, run-down neighborhoods. (See last week’s New York Times Magazine.) Bulldozing these would reduce urban blight, deprive criminals of safe havens, and make everyone feel safer. They’ve already started doing this by the tracks in Newark, tearing down industrial buildings abandoned decades ago. It’s making the place look better.

We’re not worried here in Michigan. The unions own the automobile manufacturers and Obama won’t let anything happen to the unions. And like the young woman who was in line at Cobo Arena… we’ll just get some of that Obama stash.

http://www.youtube.com/watch?v=_Ojd13kZlCA

Don’t you just love connected and informed voters.

The ball is in Obama’s court. He’ll save us… with HIS stash… and maybe some free cell phones.

When you do what you did… you’ll get what you got. Just keep pumping the cash and well get that 2009 summer of recovery over and over and over.

Reading carefully « Misguided Fiscal cliff »

The federal budget is expected to shrink dramatically between 2012 and 2013 if the laws governing revenues and spending remain largely unchanged. With no action from policymakers, that sharp reduction in the deficit would slow the economy dramatically, likely creating a mild recession in 2013…

And may read as well the numbers as set in table 1 outlining a total deficit reduction in 2013 of $560 billion under current law.

Few economists would wish to see « Play it again Sam » a good movie but a little pathetic isn’t?

In my opinion, lots of discussion of the symptoms, but not much discussion of the problem–constrained global net exports of oil.

The GNE/CNI ratio* versus total global public debt, 2002 to 2011:

http://i1095.photobucket.com/albums/i475/westexas/GNE-CNI_total-debt_PS1.png

In my opinion, most oil importing OECD countries have been going increasingly into debt, in an attempt to keep their “Wants” based economies going, in the face of a doubling in global annual crude oil prices, from $55 in 2005 to about $111 in 2011/2012, as the Chindia region consumed an increasing share of a declining post-2005 volume of Global Net Exports of oil.

*GNE = Net exports from 2005 top 33 net exporters, BP + Minor EIA data, total petroleum liquids. CNI = Chindia’s Net Imports

I’ve been using my own “Cliff” metaphor for a couple of years:

The OECD “Thelma & Louise” Race to the Edge of the Cliff

Let’s go over the cliff. Sounds like a great natural experiment. The Dems get their tax increases, the Republicans get their spending cuts. Isn’t that the grand compromise everyone wants?

This economic fantasy that is out there that suggests we should delay any pain until the economy is “strong” because then the economy could handle cuts/tax hikes without consequnce is absurd.

PRO TIP: WE ARE NEVER GOING TO HAVE A STRONG ECONOMY EVER AGAIN. WE ARE JAPAN. ENJOY THE DECLINE.

Rich –

I don’t know if you’re being serious or sarcastic. But taking the fiscal cliff implies that we’d be back to positive GDP growth by Q4 next year. That doesn’t seem so bad to get out of deficit hell.

And consider Jeffrey’s point: the economy is supply-constrained for oil, which I have said as well many times. Jeffrey makes the point that current consumption levels in the OECD countries are inherently unsustainable, and therefore should be cut. I am inclined to agree; thus, the fiscal cliff is nothing more than adjusting to this reality. Failure to do so simply extends the period of heavy borrowing. Eventually, you’ll get to the same place, with the difference that we’ll owe a ton of money in the end if we drag out the adjustment process.

Jeffrey and I disagree on whether oil consumption should be encouraged (I think). First of all, US oil consumption is pretty much in free fall, down 1.6% in October compared to the same period a year ago. I don’t know how fast Jeffrey wants to cut consumption, but to me, the current pace is pretty fast. I would add that US consumption is currently at 1977 levels, hardly some lofty state of mega-consumption.

Now, if we tax oil more, then oil consumption will fall even faster. And if we believe the economy is oil-constrained, then the economy will perform even worse.

But as for aggregate consumption, I am all with Jeffrey. Our oil consumption possibilities continue to decline, and with it, our total consumption outlook. Taking on debt is not bridging the past and the future–as Anonymous above would have it–but rather delaying a necessary reckoning.

I just heard the president indicating that we need a balanced approach – seems like the cliff is perfect in this respect – taxes go up on everybody, spending cuts are spread around. Let’s get this over now.

I am scheduled to be on NPR’s Marketplace tonight.

And now I see , on Fox News, that Paul Krugman agrees with me. That should put me in good with the left wing.

Steven Kopits But taking the fiscal cliff implies that we’d be back to positive GDP growth by Q4 next year. That doesn’t seem so bad to get out of deficit hell.

No, No, No, No, No!!! You are badly misunderstanding what the CBO report implies. Returning to positive GDP growth does not mean we would return to where we are now. GDP growth throughout most of the 1930s was technically positive. GDP growth fell four consecutive quarters (3Q2008 thru 2Q2009) before returning positive; however, it was not until 4Q2011 that we were back where we were before the recession started. The Great Recession lost about 4.7 percentage points (in log differences) from peak to trough. What CBO is saying is that the fiscal cliff would be roughly two-thirds as bad as what we just went through. No thanks.

You’re also ignoring the hysteresis effects of another mini-Great Recession. We already have a lot of workers unemployed over 26 weeks. A 3% GDP loss would add to that number and make a huge number of workers essentially unemployable for the remainder of their lives. Remember, we would be looking at a large number of folks being continuously unemployed for several years. If you’re worried about the impact of future debt, then you really ought to be worrying more about how hysteresis effects impact long run potential GDP. That absolutely swamps any concerns about interest payments on future debt. It’s not even a close call.

Failure to do so simply extends the period of heavy borrowing. Eventually, you’ll get to the same place, with the difference that we’ll owe a ton of money in the end if we drag out the adjustment process.

Once again, you’re falling into the trap of applying “household economic” thinking to a macroeconomic problem. Borrowing might increase the future taxes that you personally owe, but it is just as likely that it will increase your personal future wealth because a dollar of borrowing also creates a new financial asset worth one dollar. And since we’re at the zero bound that new financial asset not only does not crowd out private sector investment, it actually “crowds in” investment because it keeps that dollar within the GDP flow cycle.

You’re also making the same mistake that European austerity types are making. Implicit in your argument is the assumption that cutting spending will reduce the deficit. It won’t. Austerity policies in the midst of a zero bound recession increase the deficit. So any thoughts that a fiscal cliff will somehow right the ship are completely out of touch with reality, economic theory and historical experience.

Finally, the main theme of Menzie’s post is the effect of the fiscal cliff on the rest of the world. How exactly would a fiscal cliff help US exports when it would adversely affect our chief trading partners (Canada and Mexico). So much for an export driven growth stategy.

Well Paul Krugman is at it again. He called for a housing bubble and he got his wish, and we got the disaster. Now he is calling for President Obama to push us over the fiscal cliff.

Krugman is the Dr. Kavorkian of the economic world. He would lead us all to the nirvana of assisted suicide if we would only do it his way.

The voters stepped up to the fiscal cliff in November 2008. They chose to go over it on November 7. Deal with it, slugboy.

You may talk a lot of nonsense, but sometimes you are amusing, as in:

“Borrowing might increase the future taxes that you personally owe, but it is just as likely that it will increase your personal future wealth because a dollar of borrowing also creates a new financial asset worth one dollar.”

Gee, I have a faltering automaker, bankrupt alternative energy companies and $900BN down on the drain in a failed stimulus. I feel wealthier already!

These are not investments. An investment is an expenditure now in hopes of a greater return in the future. There was no such thinking in any of Obama’s actions. They were designed to be payoffs to Democratic interest groups.

Rich Berger Your understanding of macroeconomics is as shallow as your understanding of political reality. You don’t seem to have any talent as a private sector investment analyst either. In case you didn’t know, GM and Chrysler are doing pretty well. Ask the voters in Ohio. And most of the stimulus investments have paid off…in fact, Obama’s track record of successful investments exceeds Bain Capital’s track record of 80%. Check the data. As I’ve said before, my main gripe with Obama’s alternative energy investments is that the DoE was too risk averse. Unlike a private sector venture, a government project should be risk neutral. You could take the time to read the technical literature on public finance, but I seriously doubt you have the math skills to follow the arguments. And even McCain’s chief economnic adviser agrees that the spending portion of the stimulus paid for itself. It was only the tax cut portion supported by the GOP that had a multiplier less than 1.00.

Now go back to blaming Nate Silver.

“Well Paul Krugman is at it again. He called for a housing bubble and he got his wish, and we got the disaster.”

Krugman never called for a housing bubble. He was ahead of everyone in pointing out the danger that Alan Greenspan would do exactly that in an attempt to recover from the tech bubble. Too bad no one listened.

Sluggo-

Got a cite for those successful Obama investments? Here’s an article that begs to differ with you regarding the “success” of the auto bailout (that is if you define success as making a profit).

Furthermore, the idea that Obama saved the auto industry is pure BS. They would have gone into bankruptcy and renegotiated the union contracts. What Obama did is stiff the creditors and bail out the unions. That’s investing, Chicago-style.

Sluggo

You claimed:

“And most of the stimulus investments have paid off…in fact, Obama’s track record of successful investments exceeds Bain Capital’s track record of 80%. Check the data.”

I would be happy to check the data; just tell me where it is.

Paul Krugman wrote in 2002:

“The basic point is that the recession of 2001 wasn’t a typical postwar slump, brought on when an inflation-fighting Fed raises interest rates and easily ended by a snapback in housing and consumer spending when the Fed brings rates back down again. This was a prewar-style recession, a morning after brought on by irrational exuberance. To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

So who you gonna’ believe, your lying eyes?!!

Now Krugman has a track record of economic disaster. Back in 1995 Jude Wanniski pointed out that Krugman did a tour of Southeast Asia and his advice brought down Thailand as the first domino to fall in the Asian crash (flu) at that time. And since then Krugman has only gotten worse.

Now he is calling for us to rush headlong over the fiscal cliff. When the NYTimes take such a man seriously we are all in trouble. I have never called for the firing of Ben Bernanke because of my fear that Obama might actually replace him with Krugman. Yes, things actually could get worse.

Rich Berger You might want to re-read your WaPo/Bloomberg link. After you get past the headline paragraph, the actual narrative makes a pretty strong case for the success of the bailout. The fact that it didn’t save 100% of all of the automobile related jobs does not mean it wasn’t a success. The bailout saved a lot more jobs than liquidation, which is effectively what Romney was proposing.

As to successful stimulus green projects, here’s what the CNN fact checker says:

“Most of the large projects that benefited from the Department of Energy loan program remain in operation — contrary to Romney’s assertion that “almost half” of them had closed.

http://www.cnn.com/2012/10/04/politics/fact-check-green-energy/index.html

And here are some specific examples:

http://www.epa.gov/recovery/success.html

And here’s an Atlantic article on some Dept of Energy success:

http://www.theatlantic.com/technology/archive/2012/09/the-silent-green-revolution-underway-at-the-department-of-energy/261905/

And this report takes a broader look at subsidizing green projects overall:

http://www.brookings.edu/~/media/Research/Files/Papers/2012/4/18%20clean%20investments%20muro/0418_clean_investments_final%20paper_PDF.PDF

The difference between those projects that you cite and Bain Capital’s investments is that Bain’s were required to make a profit and be self sufficient. The projects you cite are simply aspirational and have no real metrics for success. Sink holes for our tax dollars – a metaphor for the Obama administration. No measure, no problem!

I assume that you did read the WaPo article and noted that at current prices, the government’s investment is way under water. These analyses ordinarily ignore the waiving of taxes on GM (another lawless Obama move) which increases the effective loss more.

Well, maybe all of these projects are losers, but hey, we will make it up on volume!

Long time reader, infrequent commenter. I don’t have a heavy macro background (I’m a business guy) but 2slugs’s point about borrowing at the zero lower bound seems pretty intuitive and I’m having trouble following why so many of you resist it. We might (only might!) have to pay higher taxes in the medium term to fund borrowing today, but letting our accumulated capital rust away due to inactivity is guaranteed to reduce our standard of living today, and the value destroyed by forgone growth compounds with every passing year.

Same as Rodrigo, no economics background: I do not understand why we do not have further stimulus such that unemployment can be brought down? why not borrow another trillion at 2% for ten years? Why not inflate wages, since 80% of the people have no spending power due to falling wages and debt. Why should the 1% wealth owners be able to control the levers so much that inflation is being avoided at all cost? We have a fiat currency why not deflate value of USD to make exports more competitive and discourage imports and outsourcing? Or is it just a tactics used by oppostion party to obstruct economic recovery and blame it all on the ruling party?

http://www.bloomberg.com/news/2012-11-09/when-republicans-deliberately-sowed-a-financial-crisis.html