If the Bush tax cuts all lapsed?

Several weeks ago, Jim proposed breaking up the fiscal cliff into manageable pieces — which seemed like a reasonable approach. As we await counterproposals to the Administration’s proposal, it might be useful to consider what would happen if agreement proves elusive, and all the Bush tax cuts were to lapse (along with other tax reductions), reverting to the tax rates of the Clinton years. Because the Republicans feel so strongly about impending defense cuts, we can be pretty sure that the sequester will be held in abeyance (probably along with the AMT patch).

Clearly, this is not an optimal outcome. I much prefer the President’s proposal (described here), which includes letting the rates rise on the top bracket (as I outlined in this post). But EGTRRA and JGTRRA (aka the Bush tax cuts) have constrained our fiscal policy for a decade, and as Jeff Frieden and I discussed in Lost Decades, contributed to the financial crisis of 2008. With ever greater impact on tax revenues going forward, these provisions should end (although I would prefer to delay rate increases on middle incomes).

Were this scenario (all taxes revert, sequester held in abeyance) come to pass, GDP would be close to flat by end-2013, relative to end-2012, using the mid-point multiplier estimate from the CBO.

Figure 1: Log GDP (bn Ch.2005$, SSAR) (blue), CBO August forecast (red), no-sequester (green square) and no-sequester using high multipliers (purple triangle). NBER defined recession dates shaded gray. Source: BEA (2012Q3 2nd release), NBER, CBO, Budget and Economic Outlook: An Update (August 2012), CBO, Economic Effects of Policies Contributing to Fiscal Tightening in 2013, November 2012, and author’s calculations.

Given that monetary policy is likely to continue to be accommodative, I suspect that the multiplier would be at the higher end of range tabulated by the CBO. That outcome is shown as a purple triangle in the Figure.

Now, consider the fact that Republicans have asked for (unspecified) entitlement reform. This demand for reform before the new Congress comes into session seems unrealistic. Dealing with these issues in a sensible fashion requires careful analysis, and I don’t see that as being possible before January 1st.

In some sense, many conservatives should like this plan, insofar as it would reduce economic policy uncertainty — which some have pointed to as deterring investment and hiring — associated with tax policy. [1]

This is not my preferred outcome –- but it might be what we get.

See also this post on letting the tax cuts lapse; and my call for the end of EGTRRA and JGTRRA back in 2005.

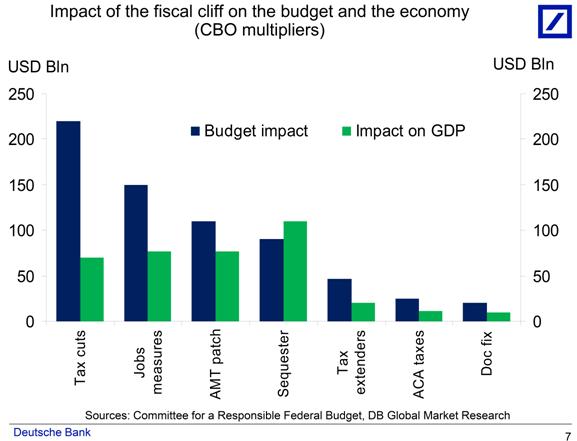

Update, 1:40PM Pacific: Deutsche Bank’s Torsten Slok provides this graph which summarizes CBO’s (midpoint) estimates of the impact of each component of the fiscal slope. Notice the impact on the budget from the tax component is relatively large, while that on the economy relatively small. The sequester exhibits the reverse pattern. This of course reflects the first round impact from spending on goods and services on GDP, as opposed to the effect via disposable income that follows from tax changes.

Source: Torsten Slok, The U.S. Fiscal Cliff (November 2012) [not online].

And no, merely restricting deductions won’t yield sufficient revenue Tax rates must rise.

I don’t see a deal coming unless the Democrats make a mistake. As I see it, the House GOP members rationally fear their next primary opponent will accuse them of raising taxes if they make a deal that bluntly raises taxes on some group. Thus the diddling about with deductions: it’s more a stalling tactic than a real gambit but one which is offered to see how stupid or desperate the other side is.

After the deadline, when all the tax cuts expire, then a vote is for a tax cut. That vote may not extend to all but you’re still voting to cut taxes and you can argue that was the best deal you could get especially since you voted to cut taxes for the vast majority of Americans and you most certainly voted to restore the cuts that affect your particular district.

As I see it, this is classic economics: the self-interest of the individual versus the collective interest of the community as filtered through specific time periods that change incentives. The game might be different if the GOP House were substantially in neutral – or Democrat leaning districts – but they aren’t. If you’re a House member from Georgia, you know your opposition will come from the right and that means accusations of big government taxation.

So what is “objectively” right or wrong subordinates to what is “objectively” right or wrong for the individual. A classic framing issue.

There is uncertainty because business people don’t understand the dynamics of the economy. The natural rate of unemployment has risen by approximately 3%. Most can’t conceptualize that yet.

and as for labor income, even Warren Buffet predicted in 2000 that it would start back up. The whole marginal product of labor stability thing. Well, he was totally wrong.

Business people really don’t understand the economy.

My equation… (UT is non-negative)

UT = unemployment – capacity utilization + labor share + a calibration

has another form…

UT = unemployment + unused capacity – capital share of income + a calibration

Rearrange…

Capital income (max)= unemployment + unused capacity

Thus, the maximum that capital share of income can reach is constrained by unemployment and unused capacity.

Now that the natural rate of unemployment has risen and capacity utilization is constrained by low labor income share, the maximum that capital income can reach has been raised by at least 5%.

We are developing the economic dynamics of a third world country.

As I said, the consensus for the fiscal cliff is growing.

Don’t know about the whole abeyance issue; but you may be right about the role of defence in determining Republican behavior. On the other hand, if I were a Republican, I’d take the cuts whole to prove my small government bona fides.

But if you can live with the cliff, and so can Howard Dean and Charles Krauthammer, what are the odds of a deal being passed? Not great, I would think.

One side comment about uncertainty. The GOP is endlessly tiresome in its continual hand-wringing over the indignities suffered by businesses faced with uncertainty, and, further, suggests that the way to limit this frightful uncertainty and calm the savaged nerves of the job creationists is to gut the social safety net. How is inducing great uncertainty among the vulnerable in order to deliver certainty to affluent justifiable? Is there some conservation of uncertainty principle that I missed in my graduate education? Is there some great Spirit of Uncertainty that blesses the transfer of uncertainty and is satiated when the not-so-well-off suffer instead of the new nobility? It is a profound source of puzzlement to me that all that is required according to the GOP to awaken to the Dreamtime of Prosperity is that Uncertainty be concentrated among those least able to bear it.

Edward, correct, the US has become an overstretched, militarist-imperialist, one-party corporate-state in which the top 1-10% own 40-85% of financial wealth and receive 21-46% of income.

The issue of the fiscal cliff is much larger than what is perceived as partisan brinkmanship. Total local, state, and federal gov’t spending as a share of private GDP reached 66% during the last recession; and it is well above the peak of WW II where it has been since the ’80s.

Since the early ’80s, the US has added $45 trillion in total debt, which is equivalent to more than $140,000 per capita, $325,000 per employed American, and EIGHT TIMES private wages.

The total compounding interest claims to US total credit market debt owed to term is now an equivalent of more than private GDP in perpetuity.

Total gov’t spending is now an equivalent of 100% of private wages and 54% of private GDP.

It gets worse. Total local, state, and federal debt is now 140% of private GDP, having reached a differential cumulative order of magnitude increase from the early ’80s, i.e., Jubilee threshold.

The primary inference is that debt can no longer grow as a share of private GDP. In a debt-based economy, if debt cannot grow, real GDP per capita will not grow, thus neither will private investment, production, employment, incomes, and gov’t receipts.

The real story “at the bottom of” the fiscal cliff, so to speak, is that debt can no longer grow without claims reducing further private sector activity, which in turn will reduce gov’t receipts and constrain gov’t spending hereafter (and cause an ongoing contraction per capita).

We are the “USPIIGS”, only we don’t yet realize it.

jonathan If you’re a House member from Georgia, you know your opposition will come from the right and that means accusations of big government taxation.

The GOP establishment will have a strong incentive to resist far right Tea Party challenges in a 2014 primary because their current safety margin is only 17 seats in the House. That margin should be safe in 2014 (especially given the gerrymandering by GOP statehouses), but if they nominate extreme right wingers they could lose that 17 seat margin. And I think Grover Norquist also understands that primary fights could tip the House to the Democrats. In fact, that’s probably the only scenario in which the Democrats would be able to recapture the House in 2014. Besides, I believe the Tea Party thing is starting to fade. Given the Tea Party demographics quite a few of them will be pushing up daisies by 2014.

Steven Kopits Thirty years ago Charles Krauthammer was worth reading. I didn’t always agree with him, but his columns in The New Republic were original and he oftentimes made interesting points. But that Charles Krauthammer is long gone. He’s a clown show who is in way over his head. He used to make some good arguments when given the time to think things through. But in his Fox News instapundit incarnation he basically just phones stuff in. I have no idea why you would listen to him. Come to think of it, I could say similar things about some of those former other conservative New Republic writers who drifted over to Fox News (e.g., Fred Barnes and Morton Kondracke). It’s literally been decades since they’ve written or said anything worth reading or listening to.

My problem with the Obama plan is that he promises to make the middle class tax cuts permanent. I think that’s a mistake. I’m all for immediately raising the top rate and temporarily keeping the Bush tax rates for those making less than $250K, but eventually the middle class will have to see its taxes go up as well. Maybe an ad valorem tax of 2% as well.

As an individual, the so-called fiscal cliff means nothing to me at this point. The ‘fixes’ that tax money away from me [higher taxes on incomes or dividends or capital gains] will certainly mean something negative although they mean something positive to the government. The fixes that cut spending mean little to me unless I am a recipient of government largesse. Cutting military spending means little to me unless I am a corporation in the defense sector or a worker therein.

The fiscal cliff fixes of cutting spending and raising taxes are not going to affect ‘Americans’, they are going to affect individuals and businesses in America quite differently.

The arguing over which is the better ‘fix’ presumes that I care if the market is down for a few months or unemployment rises for a few months or taxes on the wealthy affect me. The 51%-ers will be upset if the ‘fixes’ affects their pocketbook by higher taxes and lower benefits. Same for the 49%-ers.

If nothing gets ‘fixed’, then the same thing regarding automatic cuts.

We have winners and losers under all scenarios. What matters is which we are. Right? The ‘country’ is such a vague and fluid concept. What could be ‘right’ for the country? We’ll just have different winners and losers.

As Valarie Jarrett said before the election: “After we win this election, it’s our turn. Payback time. Everyone not with us is against us and they better be ready because we don’t forget. The ones who helped us will be rewarded, the ones who opposed us will get what they deserve. There is going to be hell to pay. Congress won’t be a problem for us this time. No election to worry about after this is over and we have two judges ready to go.”

Yup, winners and losers.

Raise your hand if you think Harry Reid will let a bill on the Senate floor in the next 4 years that cuts entitlement spending if Obama gets his way with the tax increase before Jan 1.

Why would Reid do that?

Here is the game right now – Obama needs his tax increase on the rich to quell his base and quench his thirst for redistribution. (Never mind that it is nothing more than a few cents on the ‘true’ deficit dollar.)

The Obama proposal makes little/no mention of entitlement cuts.

However, he has placed the ball in the right’s court. If the right puts a comprehensive plan forward with entitlement reform, then the left will create a false narrative that the right wants to throw granny off the cliff, etc.

Given the false narrative that an acommodating press will push on the public, the left has the fallback position of voting nay on any bill before Jan 1 and blaming the right for cutting entitlements and/or not increasing the tax rate on the rich.

However, the left’s preferred outcome is that the right votes nay based on not entitlement reform and/or to much tax on the rich.

Either way, we are going over the cliff. The only way we don’t go over the cliff is if both sides veer off at the last moment and pass a 6 mo, 1 yr etc extension with minimal strings attached.

If we go off the cliff, then the left gets the tax rates they want, while claiming they really didn’t want to raise taxes on the middle class. The media will make sure that the right gets blamed a middle class tax increase.

Once the Bush tax cuts expire, there is no way Reid will let a middle class tax cut on the floor of the senate.

2slugs

…but eventually the middle class will have to see its taxes go up as well. Maybe an ad valorem tax of 2% as well.

2slugs is correct. This is what will happen if the left gets their tax increases without spending cuts.

Entitlement spending is going to cost trillions more per year in expenditures. We have a spending problem. Obama is talking about raising $1-$2 Trillion per decade in tax revenue. We need 3 or 4 times that amount per YEAR! Tax the rich if you like, but that revenue isn’t even a drop in the bucket. IT’S A SPENDING PROBLEM!

tj,

We do not have a SPENDING problem, we have a TAXING problem. Everyone knows that Ronald Reagan reduced income taxes (more than one half for the wealthy); what is less commonly understood is that he extensively offset this by raising payroll taxes(more than double for most self-employed). Today, most American families pay more in payroll taxes than they do in income taxes. Between 1946 and 1981, income taxes averaged 12%(+/-1%) of normalized GDP. Reagan reduced income taxes to near 9%. Clinton increased them back to 12%; and Bush/Obama reduced them again to 9 %(and below). However, on budget expenses have remained 12%(+/-1%) of normalized GDP throughout. The deficit in income taxes has been financed by borrowing, largely from the Social Security trust fund. When Clinton raised income taxes back to 12%, this eliminated the on budget deficit. The CBO projected that this, plus the Social Security and Medicare surpluses, was enough to pay off the entire US debt before the Social Security/Medicare trust funds would have to be amortized for beneficiary payments, all without having to raise taxes to pay for the amortization of those trust funds. Like Reagan before him, Bush took those excess payroll tax receipts and gave them “back” as income tax reductions, heavily weighted to the wealthy–who didn’t create those surpluses in the first place. By doing this, Bush guaranteed that income taxes would have to be raised in order to amortize the trust funds. The failure to do so simply permits the 1% to steal the money contributed by workers for their retirement. Everything about not raising taxes or limiting expenses, is about stealing the 99%’s money. The national debt has been caused primarily by income taxes which were reduced far below their historic 12%(+/-1%), not by on budget expenses, which have remained at their historic 12%(+/-1%) throughout. These taxing games have transferred $ trillions from the 99%’s payroll taxes to subsidize income taxes.

tj Calm down. Simply returning to the Clinton era tax cuts for everyone wipes out most of the problem. Most people did pretty well back in the Clinton years, so I imagine it’s something we could handle if phased-in after the economy fully recovers. As to entitlement spending, you really need to be specific. Under current law Social Security does not contribute to the debt and should not be part of the debt negotiations. It is true that longer term (~25 years out) there will come a day when the Trust Fund bonds are exhausted and Social Security benefits will have to be reduced by roughly 25% of promised benefits. But let’s remember that promised benefits are still significantly greater than current benefits. There is a case for relooking Social Security and making it more sustainable over a 75 year horizon, but that argument should not be part of the debt deal. It’s also a relatively simple problem to fix.

Now Medicare and Medicaid are a different story. Some parts of Medicare are in trouble and will be driving outyear budgets. But that’s because healthcare costs in general are growing (at least until recently) faster than the rest of the economy. There is no way to fix Medicare and Medicaid without also fixing healthcare in general. Cutting Medicare or Medicaid without fixing healthcare costs in the larger economy simply shifts the costs around. And all that cost shifting would only increase deadweight costs. Everyone would be worse off. If you want to fix healthcare, then Obamacare is a good place to start. CBO says it will lower costs overall. Allowing Medicare to negotiate for prices the way the VA does would help control costs. Some patent reform would help control costs. Federal subsidies to streamline administrative procedures in hospitals and doctors offices would pay off. Taxing “Cadillac” health insurance plans would help. Cutting into doctors’ economic “rents” would make a big difference. That’s how you get entitlement reform; but those are also the kinds of things that you cannot do over the course of a few weeks or months. Raising taxes is something you can do quickly and easily. The political fights over controlling healthcare costs are not likely to come from Democrats because the things that are primarily driving up healthcare costs are things that are near-and-dear to the hearts of the GOP’s base. The A.M.A. is not in the habit of endorsing Democratic candidates. The reason healthcare entitlements are a problem is because those same programs represent a revenue stream for a powerful constituency within the GOP.

2slug, I’m not exactly sure what you think happen but to clarify I say don’t confuse general with specific interest.

1. Specific interest: if you’re a House member, you worry most about your district and your re-election chances. Many are in conservative districts, so the threat is from the right. And the GOP primary process dramatically favors the far right.

2. General interest: the best way to forestall a right wing challenge is by not feeding them red meat in the form of votes to raise taxes.

jonathan I probably didn’t explain myself well enough. What I mean is that Tea Party challengers aren’t just lone wolfs; they require some kind of financial backing and support structure to launch a primary challenge. I think much of that Tea Party structure has fallen on hard times recently. For example, Grover Norquist might not think twice about supporting a far right wing primary challenger if the general election was likely to return a Republican to office regardless of how far right that candidate was. But there are enough marginal districts (as I said, the GOP safety margin is only 17 seats) that in some cases the Norquist types would have an incentive to follow what Karl Rove used to call a “catch and release” policy with respect to Republican House members in swing or marginal districts. So you might see a Tea Party challenge in a strongly Republican district in Georgia or Mississippi, but not necessarily in a Republican district in Minnesota or New Jersey. And I think Karl Rove learned the lesson that he will have to fund moderate Republican incumbents who face Tea Party challenges in moderate districts.

bmz says: “We do not have a SPENDING problem, we have a TAXING problem.”

@bmz, the underlying intractable problem is unsustainable perpetual growth of population and resource consumption and waste disposal per capita on a finite planet. Every challenge and solution in response creates successive challenges at larger scale and higher costs per capita that are the result of too many human apes on Spaceship Earth with expectations of living like westerners (thanks to cheap fossil fuels since the 19th century, US supranational corporations expansion abroad, and mass-media advertising and entertainment).

Reagan cut taxes from the lofty levels because interest rates were at 15%, allowing for an unprecedented reflationary boom from falling interest rates and increasing financial returns to assets and expansion of debt at falling nominal interest rates; that phase of the Long Wave is over, and now the world, not just the US, is faced with imputed compounding interest to term on the total US credit market debt owed equivalent to 100% of private GDP in perpetuity; that is, all US private uneconomic activity hereafter forever is pledged to the service of total US debt owed to the owners of the public and private debt of the US. Growth of private uneconomic activity per capita is no longer possible. Period.

We have reached the Jubilee point of cumulative public and private debt growth to wages and GDP, and debt must now contract 50% per capita for as long as it takes for wages, production, and GDP to catch up to sustainable debt levels (or debt to “catch down” to wages and production).

We want to believe that our predicament can be resolved with tweaking spending, tax rates, and revenues/GDP, but we cannot tax, cut, borrow, spend, kick the can, or postpone the debt Jubilee and fiscal cliff anymore than can the EU or Japan, and soon Canada, Australia, and China.

Simply put, there is too much debt and perpetual claims to wages, profits, and gov’t receipts in perpetuity than labor product, resource services throughput, returns to physical and financial capital, and gov’t spending can service. Debt (and asset values and imputed financialized returns in perpetuity therefrom) must be, and will be, deflated to levels that are supported by wages, profits, and gov’t receipts.

These eras occur but once in a lifetime, or every ~55-70 years historically (or longer now than lifespans in the West are 78-81 years).

How the top 0.1% and their hired banksters, politicians, CEOs, and intellectual elites in academe and mass media deal with this once-in-a-lifetime event will determine whether the US survives intact and viable for the bottom 90% working-class majority population or descends into post-imperial collapse and anarchy.

Ultimately, what becomes of the US is not the choice of the bottom 99-99.9%.

@Carman : “Ultimately, what becomes of the US is not the choice of the bottom 99-99.9%.”

No, that’s wrong, tells us history : e.g. the “let them eat cake” 0,1 % was really punished by the bottom 99,9 %. The bottom 99,9 % has a word to say, one way or the other.

But in general I agree with your other statement, in essence you are right.

The questions below are not rhetorical, I would like to know the answers.

*How do the trust fund IOU’s work? Do the IOU’s have a maturity? Or, does the federal government have to borrow to pay off enough IOU’s each year to cover the annual difference between outflows and inflows? The implication is that as outflows exceed inflows, the entire difference must come from annual federal borrowing.

*How is the cost of Obamacare impacted by states who opt not to operate an exchange and shift the operation to the federal government?

——————-

Regarding CBO budget projections – It looks like they made several assumptions that turned out not to be correct causing their projections to underestimate the-fiscal problem.

See page10-http://www.gao.gov/assets/590/589835.pdf

Also the conclusion to the actuary’s report highlights the entitlement problem as COST CONTAINMENT PROBLEM.

http://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/2012TRAlternativeScenario.pdf

While the substantial improvements in Medicare’s financial outlook under the Affordable Care Act are welcome and encouraging, expectations must be tempered by awareness of the difficult challenges that lie ahead in improving the quality of care and making health care far more cost efficient. The sizable differences in projected Medicare cost levels between current law and the illustrative alternative scenarios highlight the critical importance of finding ways to bring Medicare costs—and health care costs in the U.S. generally—more in line with society’s ability to afford them.

John D. Shatto, FSA Director, Medicare and Medicaid Cost Estimates Group.

M. Kent Clemens, FSA Actuary

tj SS Trust Fund bonds have a maturity of 1 to 15 years.

http://www.ssa.gov/oact/progdata/specialissues.html

Under current law Social Security is not a big driver of the debt. Now you could reasonably argue that it is unlikely that seniors 25 years down the road will accept cuts to promised benefits, which are implied under current law. But the current debt and deficit discussions are about what happens over the next 10 years, and all of Social Security’s problems are almost a full generation beyond today’s budget horizon. Besides, fixing Social Security’s long run imbalance is not a difficult problem. When people talk about including Social Security under the 10 year budget deficit knife what they really mean is that they are looking for a way to effectively default on those accumulated Trust Fund bonds.

States that do not set up their own exchanges will have to accept whatever rules the Secretary of Health and Human Services decides. Deciding not to participate in the exchanges does not mean the states get to dump healthcare onto the federal government; it means the states must accept whatever exchange arrangement the federal government imposes. So Republican governors that dragged their feet on implementing the exchanges in the hope that either the SCOTUS would overturn Obamacare or that Romney would win have really done their constituents a disservice. The irony is that the state governments most opposed to a single payer system are the ones most responsible for driving towards that outcome. This is called cutting off your nose to spite your face.

As to the Actuary’s comments, those also apply to private health insurance every bit as much as they apply to Medicare. In fact, the growth in Medicare costs has been slightly lower than the growth in private health insurance costs. An equivalent way of looking at things is that every dollar saved in healthcare costs represents a dollar of less income for someone in the healthcare sector. The first place we should look for savings is in areas that generate economic rents. But the actors who live off of economic rents in healthcare are also big donors to GOP candidates.

Again, 2lsugs, puts his political bias in front of his logic. He was doing fine in his comment until he said this: ” But the actors who live off of economic rents in healthcare are also big donors to GOP candidates.” If he had just admitted that the “actors — big donors” donated to both parties’ members. They also played a big role in writing the DEMOCRATIC health care bill.

Some times one must suspend logic to read 2slugs comments. He never seems to miss an opportunity to slam conservatives, while ignoring the obvious liberal/democratic involvement.

No further comment

needed.

Thanks 2slugs.

Defaulting on the IOU’s is simply a recognition that the “trust fund” existed in name only.

You prefer to blame the GOP and their special interests for everything, but I think the larger point of the actuary is that many of the “savings” identified in Obamacare are impractical so projections are of the savings are too low. I think the executive branch has already reduced their “savings” claim from $700+ B to $300+ B.

I, for one, will be happy to see the end of era of blaming the Bush Tax cuts for everything. Over the next several years we will be blaming the Obama Tax Hikes for everything 😉

Recall the recession of the late 1930’s when the federal government cut spending and established a minimum wage. At the same time, unions were granted the power to bargain for higher wages. The U.S. also turned a blind eye to the threat that Hitler posed.

One thing that differs is monetary policy, but at this point, the impact of contractionary fiscal policy will dominate any amount of accommodation by the FED.

I am not suggesting the minimum wage or bargaining rights are bad things. However, the comparisons are striking. Today we have Obamacare imposing tax increases on firms and forcing an increase in health care costs on firms.

We have Obama’s promise to raise net tax revenue collected from corporations and small business, while at the same time imposing a tax on carbon dioxide emissions.

Over the next few years his energy policy will impose a regressive energy tax on U.S. households through by increasing the cost of energy from coal.

Iran threatens to wipe Israel and the U.S. off the map, while Iranian sympathizers grow in power throughout the Middle East.

To top it all off, he wants to shift the power to raise the debt ceiling from Congress to the President. If only we could get Obama and Harry Reid to pass a budget in the Senate, then we wouldn’t have this problem because the debt ceiling would be part of the budget negotiations.

Geesh!

Many similarities to the late 1930’s.

Rich, nice link.

Here’s another article dispelling the notion that the Bush tax cuts helped caused deficits:

http://news.investors.com/ibd-editorials-perspective/113012-635352-bush-tax-cuts-did-not-cause-deficits.htm

CoRev Just last week the AMA House of Delegates voted to recommend transitioning Medicare from a defined benefits program to a defined contribution program along the lines of what Rep. Paul Ryan proposed. The AMA did not do so because they believed a defined contribution plan would reduce physicians’ incomes. They also recommended that the payment advisory board be abolished.

http://www.ama-assn.org/resources/doc/cms/i12-cms-report5.pdf

The AMA is not interested in lowering costs; they are interested in schemes that increase fees…particularly cash fees for service as opposed to outcome based payments.

And while Big Pharma did contribute to both Democrats and Republicans (in fact, they donated slightly more to Obama than Romney), when you look at key House and Senate races (especially Orrin Hatch!) Big Pharma spent a lot more on Republican candidates:

http://www.opensecrets.org/industries/indus.php?ind=H04

Most of the opposition to controlling healthcare costs will not be coming from people who stand to lose benefiits; they are simply not politically powerful. The political opposition is going to come from those big healthcare industries that stand to lose the revenue stream; and those lobbyists get a disproportionately sympathetic ear from Republican congress critters.

I’m not an economist, meaning that I am more honest than people like Glenn Hubbard. However, I know that US Federal Debt fell in the year 2000 and began climbing in 2001. Debt increased every year of W. Bush’s presidency, picking up speed as he went along. In his last year, 2008, it grew by 15.9% while it grew by 15.1% in Obama’s first year and less thereafter, however the absolute numbers are big indeed.

Overall, national debt grew by 89% during Bush’s 8 years and 189% in Reagan’s 8 years. Don’t tell me that IBD has proved anything because they haven’t. The Bush tax cuts were part of his debt accumulation, the unfunded wars, Medicare part D, etc. Bush was great for the top 0.1% who made out like bandits.

I agree with Bruce Carman that debt will be deflated one way or another, but I’m not certain that the top 0.1% will remain in control. Oligarchies tend to overplay their hand and bring down the nations that they control.

I’m not a great Obama fan. If you object to the term oligarchy, consider how businesses have consistently extorted tax breaks and other concessions from local and state gov’ts, reviewed in the ongoing New York Times story. Like the Bush deficits, that trend is accelerating.

Menzie,

I see your numbers for GDP. Could you give us your projection of what will happen to federal tax revenue in 2013?

There is little doubt that the Bush tax cuts will expire and sequestration will be law (whether it is actually followed is another question. Congress doen’t have a very good record of following the law.) There is also little doubt that those wealthy individuals who can reduce their taxable income have already shifted their assets to lower their 2013 tax bill. My friends who are lawyers and accountants are going crazy with all of their clients making changes to their investment portfolios.

Anytime I see obfuscation about the causes of the financial meltdown I post about it.

The financial meltdown was caused the collapse of a speculative bubble.

The speculative bubble was created by government interference in the mortgage beginning with the Community Reinvestment Act and its update.

The speculative bubble was put on steroids by the decision of the Republican Congress and Democrat President, Bill Clinton, to omit shield profits from home sales from capital gains taxation.

If you look at any graph of home prices the graph explodes upward after this exemption.

Then you have Alan Greenspan practicing dollar devaluation throughout the 1990’s.

You have Freddie Mac and Fannie Mae consistently buying all the mortgages the private sector could afford to write so those banks could write more.

Then you have to complete and predictable regulatory failure to check fraud and malfeasance at the height of the bubble.

The bubble doesn’t change with or without the Bush Tax Cuts.

The Bush policy that could have changed the outcome, treating Fannie and Freddie like banks, was defeated by the four horseman of the apocalypse Chuck Schumer, Chris Dodd, Maxine Waters, and Barney Frank.

The history books written in 75 years will not be kind to people that ignore the real causes of the financial meltdown.

I think there is a rush to get the remainder of the Obama Tax Hikes passed before the economy picks up steam and revenues recover all by themselves. At that point it will be clear that a reasonable reduction in the growth rate of entitlement spending will solve the problem.

2slugs, your national political view is interesting. You said: “Most of the opposition to controlling healthcare costs will not be coming from people who stand to lose benefiits; they are simply not politically powerful.” I see you’ve forgotten the Tea Party already?

Dave Thomas: The fact that you tag the crisis as caused by the Community Reinvestment Act tells us volumes about the triumph of ideology over empirics. You might wish to read further, e.g., here.

Menzie,

You forgot to change the wording in this post!! It’s Fiscal SLOPE not fiscal cliff!!! Quick edit this or you’ll be exposed as a propagandist of the left!!!