For some people this is a tough question; that’s because they’re using the wrong framework

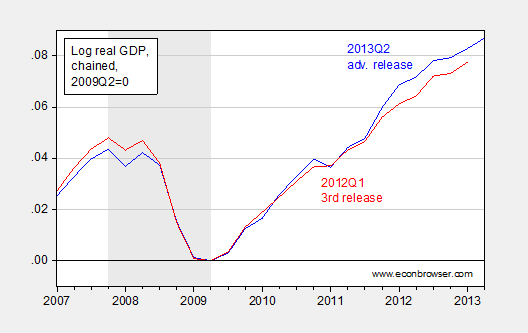

The GDP revisions boosted the level of output, and more interestingly, raised the measured pace of growth since the end of the recession.

Figure 1 shows the trajectory of real GDP, normalized to 2009Q2, the trough of the last recession.

Figure 1: Log GDP from 2013Q2 advance release (blue), from 2012Q1 3rd release (red), both normalized to 2009Q2=0.

NBER defined recession dates shaded gray. Source: BEA, NBER, author’s calculations.

While the measured pace of growth is faster than previously reported, what’s true is that output growth is still pretty tepid.

As Jim notes, in a mechanical sense had fiscal drag been less, growth would have been measurably faster.

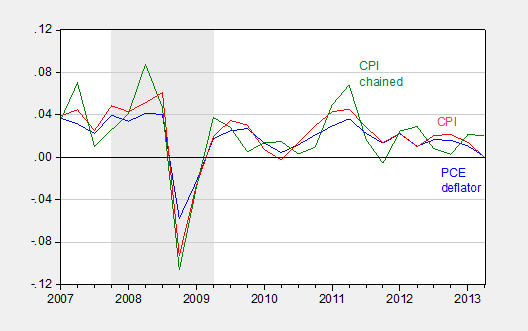

I think these observations link in with a puzzle often remarked upon — why is inflation so low and declining?

Figure 2: Quarter on quarter annualized inflation, measured by personal consumption expenditure deflator (blue), CPI (red), and chained CPI (green), measured as log differences.

Quarterly data is averages of monthly data. NBER defined recession dates, shaded gray. Sources: BEA, BLS, NBER, and author’s calculations.

I think this is only a puzzle for those who believe that potential GDP has shrunk considerably so that there is little slack in the system.

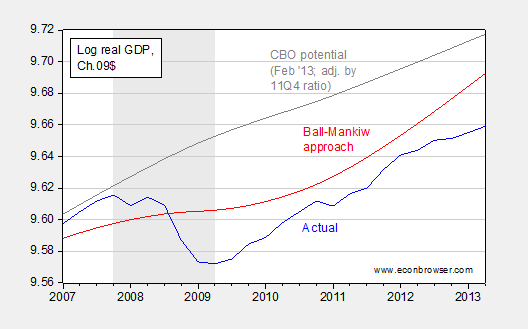

For the rest of us, it’s the large amount of slack that is the answer. In the past I’ve shown output gap relative to potential as measured by CBO; here I plot in addition potential output implied by an alternative approach, inferred from observed inflation.

Figure 3: Log GDP (blue), potential GDP as measured by CBO (gray), potential GDP implied by the Ball-Mankiw procedure (red). NBER defined recession dates shaded gray.

Source: BEA, CBO (February), author’s calculations.

The Ball-Mankiw procedure involves inverting a simple expectations-augment Phillips Curve (without supply shocks, but allowing for random shocks), assuming adaptive expectations (consistent with the accelerationist hypothesis).

πt = πet – a(Ut-U*t) + vt

Δ πt = a U*t – a Ut + vt

U*t + vt/a = Ut + Δ πt/a

Notice that NAIRU plus a random error is equal to actual unemployment plus the change in inflation divided by a.

This suggests that NAIRU can be estimated by filtering the object on the right side of the last equation.

I follow the same procedure, replacing NAIRU with potential GDP, and estimating the analogous a parameter over the 1967Q1-2006Q4 period, to obtain the estimates shown in Figure 3.

My estimate of a is 0.08. I use the default smoothing parameter for quarterly data suggested by Hodrick and Prescott.

What is interesting is not the exact path of estimated potential GDP, but rather the fact that the output gap as of 2013Q2 is -3.3% (log terms), and widening (keeping in mind the end-point problems with HP-filtered data).

The gap using the CBO measure is -5.8%. (For other approaches to estimating potential GDP, see [1] [2] [3])

In addition, findings from cross-country studies would have also confirmed that fears of high inflation given the amount of slack were misplaced. That point should be remembered as long as the output gap remains very negative, and unemployment elevated.

I’ve never understood the argument highlighted in this line: “I think this is only a puzzle for those who believe that potential GDP has shrunk considerably so that there is little slack in the system.” That suggests a belief that productive capacity has shrunk which suggests growth is impossible because productive capacity would be right near what is capable and there is thus no slack which could be filled.

I think inflation is not low, but only seems low, because the cost of buying a retirement in the form of “stocks” is not included in CPI, but the price has gone up 80% across your time frame as measured by the S&P 500.

My main problem is adding in the bubble data to the GDP numbers. Since the bubble and crash were errors of great magnitude, then using, say peak employment during the bubble or the horrid trough is kind of weird. Seems like a much longer trend is desirable. Of course, by some thinking the bubble begain in 1996, the date of the coined irrational exuberance. Then there was (finally) a securities burst in 2000, and (really finally) a housing burst in 2007. Seems that pre 1996 benchmarks might be required.

Do you believe it makes sense to compare the Feb CBO estimates of potential GDP to the BEA’s revised calculation of GDP? Another way to say this: do you think that CBO will update its projections of potential GDP to coincide with the new way BEA calculates GDP?

jonathan There are many here on this board who believe just that. I don’t want to mention any names, but some of their initials include Ricardo and Steven Kopits. The latter has said many times that he does not believe GDP growth is weak because of weak aggregate demand, but is supply constrained because we don’t have enough oil. And then there’s Ricardo who can’t get past a world of 1979 style stagflation, which he blames on Komrade Bernanski and his fellow helicopter Kommissars at the Central Committee known as the FOMC. And of course more than a few on this board blame that atheist Islamic pinko gay married socialist in the White House taking away Medicare and cramming socialized medicine down the throats of uncertain business owners. But they have a couple things in common. First, they all share a belief in a single commodity that is the underlying source of “true” value. A kind of commodity fetish, as it were. This need for something of eternal value that can act as a kind of North Star to guide the economy lives deep in the reptilian core of the conservative brain. Keynesian economics with its fiat money is way too relativistic for the conservative brain. This leads to a second shared characteristic; viz., government is parasitic can never create true value. Government is always a parasite living off the surplus generated by the productive private sector. So if there is an output gap, then it must be because government is sucking the lifeblood from the private sector. Solution = less government. Finally, they don’t appreciate the significance of the zero lower bound. When you’re at the zero lower bound, it’s gonna be a long time before the economy fully recovers. Oh…one other thing. They all take the rantings over at ZeroHedge and CNBC as serious economic commentary.

Slack is just another way of describing the manifestation of malinvestment. When we are in an economic decline with broken mechanisms of credit transmission there simply can be no inflation. What Keynesians do not understand is that if the government picks up the “slack” of malinvestment through government spending and paying workers to be unemployed it does nothing to increase produciton. It only moves the waste of malinvestment into the government and makes the taxpayers ultimately pay for the waste.

During the Bush years I was very concerned about inflaiton and even at the start of the Obama administration because of the massive monetary expansion, but monetary expansion can only create inflation if it can get into the productive economy. In today’s depressed economy and over-leveraged asset debt loads monetary supply increases go into excess bank reserves and, as Steven points out, an inflated stock market.

WNY-WJ: That’s a good question. I believe they will produce a new measure of potential GDP that is consistent with the way BEA has estimated GDP. I followed an expedient of using the ratio of 2011Q4 GDP in Ch.2010$ to Ch.2005$ as an adjustment factor to the CBO series; hence, one should take the CBO series as merely indicative.

Professor Chinn,

Would you consider expanding upon one of your prior posts to give your opinion concerning the difference between the 1980s inflation as related to money supply and the Fed’s activity today and the resultant low inflation rate? In addition to the GDP gap you describe, is the payment of interest on excess reserves a big reason that inflation has been muted, or are there other reasons? Apologies if you feel you have already explained my questions.

Funny, I have spent the last day thinking about the low inflation…

I will use this log graph of inflation, unit labor costs and labor share for this comment. (1970 to present)

http://research.stlouisfed.org/fredgraph.png?g=l7Q

So why low inflation? Inflation basically depends upon 1) enough money in the economy to support it, 2) enough wages or credit consumption in the hands of labor to support it, 3) expectations of inflation and 4) purchasing behavior.

As for #1, we see that lending is not getting enough money into the economy and into the hands of labor, the consumers. As for #2, we see that low wages and de-leveraging do not support more inflation. As for #3, the driving force behind consumption is labor, and labor does not have expectations of higher wages. They have expectations of lower wages. Then as for #4, prices are a reflection of the consumer’s fear to not spend more on items than they are accustomed to within their budget.

Labor share has fallen 5% since the crisis. Total labor hours are still the same as 15 years ago. The consumer has weak purchasing power on balance.

Here is a conceptual equation for inflation.

Inflation = (unit labor cost – labor share)/(utilization of labor and capital).

http://effectivedemand.typepad.com/ed/2013/05/the-price-spaces-of-the-effective-demand-model.html

According to this equation, increased utilization of labor and capital will tend to lower inflation. As you increase supply using more factors of production, prices decline, all else being equal. We now have a situation where real GDP growth is dependent upon increased labor hours and capital utilization because productivity has been flat for 3 years. So the equation above is holding true and inflation is tracking downward at the rate the equation would predict. Increased utilization of labor and capital is depressing inflation.

Normally unit labor costs rise in relation to labor share. It’s the normal result of labor market forces in an expanding economy. Inflation is nudged ever higher by those forces.

Inflation = unit labor cost/labor share

http://effectivedemand.typepad.com/ed/2013/05/labor-share-inflation-unit-labor-costs.html

Over the years though, unit labor costs have been growing more slowly. There was an abrupt slowdown during the Volcker recession. See log graph at start of comment.

The long-run suppression of wages and labor hours is reflected in lower unit labor costs, weakening the purchasing power of labor and this then feeds back to push down inflation. Lower wage power and lower inflation is a self-reinforcing dynamic over time. Easy credit hid this dynamic before the crisis, but not now.

Pete, but the bubble years didn’t have out-of-control inflation. The bubble prices weren’t inflationary because they weren’t sustainable. Although the housing and bond bubble did create jobs and demand.

If bubble years were pushing the economy past capacity and kicking up inflation they would have needed a Volcker to induce a recession to wring out the inflation.

Ricardo Since the short-term nominal interest rate is already at the zero lower bound, exactly how would a higher interest rate and less government spending redirect “malinvestment” toward more productive uses? Everything we know about interest rates tells us that higher rates only lead to evermore idle capital. Or are you saying that idle capital is evidence of good investment and employed capital is evidence of malinvestment? And of course you can divine good investment from “malinvenstment”?

During the Bush years I was very concerned about inflaiton and even at the start of the Obama administration because of the massive monetary expansion, but monetary expansion can only create inflation if it can get into the productive economy.

With this single sentence you have shown why your understanding of the Great Recession is completely wrongheaded. The conditional statement “…if [money] can get into the productive economy” tells us all we need to know. Apparently it took awhile for you to realize that the economy was in a recession and the nominal rate was at the ZLB. What? You thought that Bernanke just wanted to expand the money supply for the hell of it? The liquidity trap at the ZLB is at the heart of the problem, not just some little, perhaps inconsequential, piece of information that you forgot to take into account. You worried about inflation because your model was (and still is) completely wrong. Instead of going through all kinds of mental gymnastics to salvage what’s left of a half-baked Austrian theory of economics, why not admit that a Keynesian (even an Old School Keynesian) framework got it right?

Let’s face it…Hayek and von Mises is economics for sophomores engaging in dorm room BS sessions. I’m guessing that it’s been a long time since you were a sophomore. Time to move on.

AS As a practical matter interest on reserves mainly affects a bank’s decision whether to hold “cash” in form of electrons or short-term Treasuries. You might find this Noah Smith post interesting:

http://noahpinionblog.blogspot.com/2013/07/is-interest-rate-on-reserves-holding.html

Menzie, I posted more thoughts with graphs at this link…

http://angrybearblog.com/2013/08/why-is-inflation-so-low-asks-menzie-chinn.html

Slug,

You make a common Keynesian mistake. You assume that deflation and inflation are simply inverse relationships. Perhaps a Socratic question will help you. If you deprive a living creature of oxygen and then it dies, will it come to life again if you bathe it is oxygen?

The problem with interest rates is not how high or low they are. The problem is when manipulation by government causes them to be higher or lower than the market demands. By using interest rates in an attempt to manage the economy one actualy harms the economy. I suggest you read Wicksell on nominal versus real interest rates.

Good investment is investment supported by the demands of the market. Malinvestment comes from distortions of market demand by government intervention usually through manipulations of the money supply. You are foolish if you believe malinvestment can be defined by the wise economic seers or by the commodity produced. Malinvestment comes from overproduction of products. This is often called a bubble in modern lingo. Bubbles are created by government fiscal mistakes (usually crony capitalism) and/or monetary mistakes (usually money supply expansion).

Finally, the ZLB can only exist in a Keynesian world where interest rates are manipulated. Yes, Keynesians do create liquidity traps. When the money supply is expanded to the point that malinvestment becomes manifest monetary expansion has no effect, Keynes liquidy trap is a trap that inflationists set for themselves.

The Keynesian expands the money supply and generates an artificial boom (malinvestment), but the boom cannot be sustained and so more monetary expansion is demanded (Krugman anyone!), more fuel for the fire. Finally, the truth of the artificial boom becomes manifest so that no amount of monetary expansion can sustain the malinvestment. Suddenly, the Keyneian discovers Keynes prediction of a liquidy trap has come true.

But the Keynesian is resourceful. He uses the power of the state to confiscate what little productive capacity is left in the economy and then uses it in an effort to “invest.” But the confiscated resources are used in an attempt to whitewash the malinvestment. Sadly, all this does is increase the destruction of productive capacity.

What you need to face is that Mises and Hayek have been proven right over and over. Let me just mention a few: the US rapid recovery from recession in 1921 after WWI, the US Republican supply side recover in 1947 after WWII, by Ludwig Erhard refusing the Keynesian advice of the US economic experts and leading Germany to spectaculat recovery after WWII, byTanzan Ishibashi rejecting the Keynesian solutions and leading Japan to an economic miracle after WWII, by Ronald Reagan leading the supply side revolution that turned around nearly every country in the workd from chronic and hyper inflation of the “we are all Keynesians now” 1970s. But who of the Keynesian results. Hoovers interventionist policies bringing us the Great Depression then Roosevelt sustaining it, Keynesian policies bringing the Great Inflation roaring into the 1970s, and now the Great Deflation of 2006 until who knows when.

Slug, The evidence is against you. I have asked Menzie a number of time to give me a period of great Keynesian economic success, but he has offered none; just empty words of a failed theory. The proof is obvious for those who have eyes to see.

Ricardo I have read Wicksell. Have you? Wicksell is not entirely consistent on many points and flat out wrong on others. But one thing he got right was the idea of a market clearing interest rate. And sometimes that market clearing rate can go negative. That can happen even without any government intervention. The ZLB is all about the Wicksellian market clearing rate being negative, but the conventions of arithmetic do not allow for a nominal interest rate less than zero.

As to your Socratic question, let me turn it around. Even if “malinvestment” causes a recession, how does good investment bring the economy back to life again? If the problem is too much supply relative to demand, why would more additional saving intended for more investment ameliorate the problem? It wouldn’t.

For someone who claims to be a believer in free markets you sure don’t have much faith in the market’s ability to find productive investments. Apparently any whiff of government intervention is enough to throw the whole enterprise off track and plunge us into recession.

As to the 1921 recession, I suggest you read some of Christine Romer’s papers. She’s something of an expert on that period. And she also uses the corrected GDP figures for that period.

I didn’t know Hoover was a Keynesian. I’m an old friend of Hoover’s biographer (George H. Nash) so I’ll have to ask him about that one. George told me many secrets about Hoover, but never that he was a closet Keynesian.

There are plenty of Keynesian success stories. How about 1933-1937? And even 1937 was a kind of success story because Keynesian policies were temporarily abandoned, with the predictable and predicted results. I don’t recall that Austrians were predicting economic recession in 1937. Weren’t they the ones arguing for exactly the contractionary policies that led to contraction?

I’m not sure how Reagan’s policies could be called “supply side” in any meaningful sense of the term. Private saving collapsed. Budget deficits skyrocketed. Yes, inflation fell, but that was due to Paul Volcker, not Ronald Reagan. Reagan’s fiscal policies were expansionary. In fact, if you add up the 8 budgets that Reagan submitted and compared them to the budgets proposed by the House Democrats, it turns out that Reagan’s budgets were slightly larger. The one really good thing that Reagan did was to accept Sen. Bill Bradley’s 1986 tax reform package. Now that was a supply side oriented tax bill because it reduced the kinds of tax distortions that Reagan’s 1981 tax bill created (e.g., crazy depreciation allowances, subsidies for office buildings, sales of tax credits, etc.).

hyper inflation of the “we are all Keynesians now” 1970s.

Like I’ve said before, you’re forever trapped in 1979. Move on.

2slugbaits:

The mistake you are making is you think that people like Ricardo base their opinions on evidence. He and his ilk read everything through the prism of conservative ideology. Their beliefs blinds them to evidence that Keynesian economics works. They view government spending in a recession as morally wrong. Government bad!

Slug wrote:

As to your Socratic question, let me turn it around. Even if “malinvestment” causes a recession, how does good investment bring the economy back to life again? If the problem is too much supply relative to demand, why would more additional saving intended for more investment ameliorate the problem? It wouldn’t.

Slug,

You are so brainwashed by Keynesian demand thinking that you are locked in a box. Government creates malinvestment by distorting the market and market signals causing the producers to starve sectors that consumers actually demand to produce in sectors supported by government largess.

You argue from an aggregate economic view. You have one hand in ice and the other in boiling water and can’t understan why you are in pain because in aggregate all is well.

Malinvestment is overproduction of commodities not demanded while starving demand in other sectors. Government largess causes cement to be used to build government buildings. Once that cement is malinvested it cannot be used to build factories. Malinvestment cannot be corrected by increasing malinvestment. The governemnt largess destroys factors of production. There is an oversupply of those factors that just rots away.

Slug wrote:

For someone who claims to be a believer in free markets you sure don’t have much faith in the market’s ability to find productive investments. Apparently any whiff of government intervention is enough to throw the whole enterprise off track and plunge us into recession.

Slug, I know it is hard for you to understand but government distortion of the market is not a free market. You tie down both hands of a fighter and then wonder why he lost the fight.

Anyone with a brain knows there were no “Keynesians” in 1929. Hoover applied Keynesian principles and created the Great Depression. The masters of the prosperity of the 1920s, Calvin Cooledge and Andrew Mellon, had absolutely no use for Hoovers engineering of the economy. Hoover was a proto-Keynesian in a long line of proto-Keynesians from the early days of the mercantilists. Keynesian theory is an ancient fallacy as Keynes himself admits in his General Theory.

Finally, the period 1933-37 was an artificial boom created by Roosevelts devaluations (remember FDR confiscation of gold. “Why, that’s just plain stealing, isn’t it Mr. President.” Dem. Sen. Thomas Gore)and malinvestments (massive government spending programs). The malinvestment bust came in 1937 as Roosevelt created a recession within the Depression. This period is always claimed by Keynesians as a success story but Roosevelt’s policies didn’t change in 1937. The entire Great Depression was a massive Keynesian failure world wide.

Robert Hurley,

Slug tried his hand at finding a period in history when Keynes theories worked and failed. Your turn.

Richardo: “Hoover was a proto-Keynesian in a long line of proto-Keynesians from the early days of the mercantilists.”

The proto-Keynesian Hoover speaks “It cannot be borrowed without impairment of the credit of the National Government and thus destroy that confidence upon which our whole system depends. It is unthinkable that the Government of the United States should resort to the printing press and the issuance of fiat currency as provided in the bill which passed the House at the last session of Congress under the leadership of the Democratic vice presidential candidate. Such an act of moral bankruptcy would depreciate and might ultimately destroy the value of every dollar in the United States.”

Debt panic, fiat money, bond vigilantes, the confidence fairy, debasing the dollar — he’s got it all. In fact he sounds just like Richardo.

Slugs –

I hadn’t commented here.

However, I do believe that growth is limited by the binding constraint and that, in this case, oil is the binding constraint.

I read many things, including Zero Hedge. I don’t agree with everything said there (or here), but Tyler Durden’s tenacity, commitment and effort is simply breathtaking, and he has both broken a number of econ related stories and followed some important stories from my perspective (to wit, Cyprus) that others haven’t.

Ricardo,

You’re a joke. The German and Japanese miracles after World War II are examples of rejecting Keynesian policies? Um, no. Let’s see, Germany and Japan after the war had NO productive infrastructure. Especially in Europe, the Marshall Plan provided (gasp) government support through a massive ($13 billion or about 5% of total US GDP)stimulus program of which Germany received about 10% of expenditures. Once the US had convinced the Allies (France in particular) not to punish Germany by capping steel production, the German economy experienced its ‘miracle’. Sure, Erhard was responsible for lifting price controls, but that played only a minor role in Germany’s expansion compared to the above.

As for Japan after the war, give credit to US fiscal intervention. The US was concerned about communism encroaching in Japan and saw economics development as a way to fend off the Reds and democratize Japan. Then add in all of the money the US gave to Japan for procurement during the Korean War. Any Japanese policies were not born of Hayek and Mises. If anything Japanese policies were anti-free market. The development of keiretsu (what we might call Trusts or Cartels), shunto (unions) and lifetime employment aided Japan’s recovery, but you can NOT consider these developments as being free of government intervention.

As for Reagan, I have to agree with Slug. Hardly a supply sider when you look at the vast amount of fiscal expenditures that occurred under his administration. How many balanced budgets did he run?

In summation Ricardo, thanks as always for sharing your altered version of reality and for the laughs. You are the Joke of the Year. And not just any year, every year.

Steven Kopits: Re: jonathan’s comment, you are right that you didn’t comment on this post, but didn’t you elsewhere write:

It seems to me you have a primarily structuralist interpretation of the slump. But I may be reading what you wrote incorrectly.

Ricardo:

You just proved my point! Try reading a little economic history rather than ideological fiction.

That’s correct, Menzie.

I stated that you can’t stimulate your way out of a binding supply constraint. Thus, if you attempt to do that, then you’re left with the twin problems of high debt accompanied by low GDP growth.

It seems to me that’s what we’ve got.

Steven Kopits: But there is very little econometric evidence that most of the unemployment is structural in nature; most statistical estimates center on a percentage point or so. So how can you believe that we are constrained on the supply side (and are you thinking that aggregate supply is kinked so that it’s got a vertical slope at potential GDP? That is akin to saying the Phillips curve is vertical at NAIRU). Going back to the question posed in the title to the post, if we are constrained, why is inflation so low?

Slug and Ricardo: nice to see to intelligent people attempt to wrestle with difficult economic fundamentals (much as did Keynes and Hayak) in a (mostly)gentlemanly and respectful manner. (We can ignore the yahoos chirping from the sidelines). I live and teach economics in China which faces precisely the same dilemma but in a wildly exaggeated way. I suggest both of you delete the disparaging little swipes at the other, continue the (very important) debate in an adult fashion, and use China as an example.

Clearly the question should be’ why is inflation so high ? In other words why is Ball-Mankiw potenti al output so far below CBO potenti al output. I think the ansare is vero simple — your “Phillips curve” is a line not a curve. There is nothing special about inflation = 0. In the real world it is very hardware to get actual deflation (in his original scatter Phillips found it for one of two episodes of extremely pro longer extremely high unemployment. The Ball Mankiw potential output is far below true Nairobi output because many price and wage changes are at the zero lower bound (which is not impenetrable but which wasn’t breached by 10% unemployment.

This would ne much clearer if you used core inflation (why didn’t you ? I ask for information). The price of petrolem is not like most prices and depends on supplì and demand not a Phillips curve. It should be’ model ed separately. In any case the hypothesis that it, like other prices, fits a Phillips curve can be tested. I know you won’t do that, because you know your assumption is totally false.

Steven Kopits I stated that you can’t stimulate your way out of a binding supply constraint.

But you’re begging the question and assuming that the central economic problem is in fact a binding supply constraint. That’s why I keep saying that you and Ricardo are stuck in the late 70s when actual GDP was greater than CBO potential GDP and when the actual unemployment rate was running three-tenths of a percent lower than the NAIRU rate. Every metric today tells us that we’re running well below potential GDP and well above the NAIRU rate. And even the unemployment rate overstates the strength of the labor market. The employment-to-population ratio has barely budged over the last four years, and the most recent number was downright abysmal. The fact that the Fed is having a hell of a time trying to meet its 2 percent target is further evidence that there is no binding supply constraint.

My sense is that you actually agree that there is no labor constraint. And I suspect you would also agree that there is plenty of idle or underemployed capital. But I also suspect that none of that matters to you because you do see a binding constraint in oil, which you seem to view as the source of value-added in a modern economy. Ricardo has his gold, you have your black gold. To borrow a phrase from Marx, this is a case of a commodity fetish.

Ricardo Finally, the period 1933-37 was an artificial boom

Okay, so now you’re conceding that Roosevelt’s first term policies did at least stimulate economic growth. Now you’re just trying to distinguish between “artificial” growth and some other kind of (“natural”???) growth. Welcome to the world of metaphysics.

The malinvestment bust came in 1937 as Roosevelt created a recession within the Depression.

Check the OMB historical data. The 1937 recession was a direct consequence of higher tax receipts and a significant drop in government expenditures.

And if the 1937 recession was a result of malinvestment due to FDR’s first term policies, then wouldn’t it be fair to say that the 1929 Depression was due to malinvestment from the Harding/Coolidge era? Or were they closet Keynesians as well?

Robert Waldmann: I just followed the Ball-Mankiw procedure as I understood it; the oil shocks are represented by the v term. I am confident the results would differ using core. And I would be open to estimating a kinked Phillips curve, and then trying to recover NAIRU.

Inflation is “low” because it is a lagging indicator and global energy consumption is down. Inflation is as much a “global” indicator as a national one.

The US economy clearly is picking up speed. Government data lags are showing as the 2010-12 upward revisions in GDP is saying.

Malinvestment is a myth. All investment is malinvested then.

You’re a joke. The German and Japanese miracles after World War II are examples of rejecting Keynesian policies? Um, no. Let’s see, Germany and Japan after the war had NO productive infrastructure. Especially in Europe, the Marshall Plan provided (gasp) government support through a massive ($13 billion or about 5% of total US GDP)stimulus program of which Germany received about 10% of expenditures.

The Marshall Plan gave much less to Germany than it did to the UK and France. But Germany did better because Ludwig Erhard chose free markets over socialism. Many classical economists saw the Marshall Plan as an attempt to keep socialist countries from going bankrupt and argued that it substituted the ‘rob the local rich’ approach with a ‘rob the American taxpayer’. Erhard understood that and resisted the “call for collective security in the social sphere.” As a result Germany did much better than the allied countries that got far more aid but chose the more socialist path.

There is a lesson in the price control mechanisms that American central planners supported. At the end of World War II the planners were as rigid and totalitarian in economic policy as the Nazis. They supported the price control and weak currency policies that were preventing economic recovery and argued against their removal. Fortunately for Germans, Erhard ignored their advice and ended the tyrannical controls on the economy. That is why Germany did so much better than France and Britain.

If you were right the countries that got the most aid would have done best. But the opposite is true. That means that you need to check your premises.

Why Is Inflation So Low?

It isn’t. If we use the pre-1980 methodology inflation comes out to around 10%, which is hardly benign.

But let us ignore that inconvenient fact and look at the inflation argument. Inflation is defined as an increase in the supply of money and credit. Nobody can deny we have seen an explosion on that front. The confusion lies in expectations. The Keynesians believe that the increase in money and credit has to manifest itself as increasing prices for consumer goods. But this is not true. When you have great increases in productivity we expect prices to actually fall as they have for items like TVs, i-Pods, or Personal Computers. Just like the late 1920s, the great inflation in the supply of money and credit is preventing such price declines and keeping the prices of many goods much higher than they should be.

But it gets worse than that. The great increase in money and credit has made its way into other parts of the economy. In the bond market we now have the greatest bubble in history. Housing has also seen the creation of another bubble as institutions with access to cheap borrowing have purchased properties that would be pooled to create rental units that can create a pool of income that can be securitized and sold to unsuspecting investors reaching for yield in a ZIRP environment. Equities have risen to record high levels even though earnings are growing weaker and companies are having a huge problem with revenue growth. That makes three bubbles and we have yet to look at prices for health care, insurance, education, and other services.

Sorry Menzie but you are missing the inflation.

Vangel: I love the blithe assertion without backing. Please, please provide some supporting documentation re: inflation. For instance, are you using Shadowstats? If so, you might wish to consult Jim’s deconstruction of that data source.

Slug wrote:

And if the 1937 recession was a result of malinvestment due to FDR’s first term policies, then wouldn’t it be fair to say that the 1929 Depression was due to malinvestment from the Harding/Coolidge era? Or were they closet Keynesians as well?

Slug,

You don’t know how funny this is because you only know demand side Keynesian economics. You are taking exactly the position that Murrary Rothbard took in MAN, ECONOMY, AND STATE. In case you don’t know Murrary Rothbard is considered the dean of “modern” Austrian economics.

But that is not the amusing part. The amusing part is that I disagree with Rothbard where you agree.

Hoover and FDR took a relatively mild economic correction and turned it into the Great Depression. Had the government policies followed the solution of 1921 the downturn would have been short and the recovery strong because the infrastructure was in place for recovery. It took Hoover almost 4 years to destroy most of the asset values and then Roosevelt stomped on what remained. We can get into the details of why I disagree with you and your friend Rothbard if you want to.

Robert Hurley,

Another duck and run hiding to avoid debating the truth. At least Slug trys.

Joseph,

Concerning Hoover actions speak louder than words. Never forget that FDR got elected by promising not to confiscate gold. Many classical economists like Benjamin Anderson supported FDR strongly because of his words. Once they saw his actions they were horrified. Mellon was so disgusted with Hoover that as his Treasury Secretary he refused to present Hoover’s budgets to congress. Ogden Mills was essentially Hoover’s Treasury Secretary while Mellon was in office under Hoover. That speaks volumns about Hoover’s policies.

If you want to really understand Hoover read Slug’s favorite economist Murrary Rothbard. He is a good economic historian, not such a good economist.

Gridlock,

You seem to be knowledgable about Germany and Japan after WWII. Can you tell us about the tax policies of each country up to about 1960? (Think

Ronald Reagan and supply side economics)

Gridlock wrote:

As for Reagan, I have to agree with Slug. Hardly a supply sider when you look at the vast amount of fiscal expenditures that occurred under his administration. How many balanced budgets did he run?

Gridlock,

Your statement simply proves you do not understand supply side econoics. Supply side is not opposed to fiscal expenditures. Supply side is opposed to Keynesian crony capitalism, expenditures for expenditures sake.

Supply side is also not opposed to budget deficits. Once again it is the why of budget deficits not the fact. Budget deficits created by supply side tax cuts are no problem, for example, because the increased production by the productive economy will create prosperity.

Supply side does oppose Keynesian budget deficits that fund crony capitalism under the guise of stimulating the economy. The empty spending that Keynes recommends to stimulate the economy through the magic of money supply expansion is totally opposed in supply side economics. Spending has to be purposeful.

Low nominal spending growth (due partly to fiscal drag)

Enough slack to accommodate that (which doesn’t have to be much, and by the way, slack isn’t uniform or on-off, it’s variable by place, goods and professions)

Plus global commodity cycle turning related mainly to China.

To be more precise, I should say: Enough slack and technological productivity progress to accommodate that.