Raise the Minimum Wage!

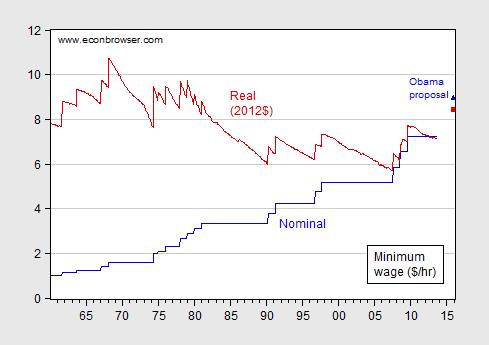

In the wake of New Jersey’s raise in the minimum wage,[0] it seems like a good time to re-assess the case for a nationwide increase. Back in the February State of the Union message, President Obama proposed an increase to $9.00 by the end of 2015. Figure 1 places in historical context the proposal.

Figure 1: Nominal minimum wage (blue) and real CPI-deflated minimum wage (red). Obama proposal for 2015M12 in nominal (blue triangle) and real terms (red square). CPI for 2015M12 calculated assuming forecasted inflation rates from WSJ October 2013 survey.

In other words, an increase to $9.00 would merely re-establish a real level of the minimum wage that held in 1981M07.

A partial equilibrium analysis, assuming full employment, an increase in the minimum wage (ignoring monopsony power, information asymmetries, etc., [1] i.e., a neoclassical world) would lead to lower employment and increased unemployment. In a world with economic slack, another outcome is plausible, even in the absence of these other market imperfections.

As I noted in this post, if the minimum wage increase enlarges the low-income wage bill, and this group has a higher marginal propensity to consume out of income, then the effect on the economy will be positive. Figure 2 illustrates this logic.

Figure 2: Low wage labor market, initial equilibrium and after imposition of minimum wage.

Initially, quantity labor supplied equals quantity demanded at N1. With the imposition of a minimum (real) wage, the wage rate rises from W1 to W2. In standard partial equilibrium analysis, there is excess labor supply Ns2 – Nd2. However, labor demand is derived; the income variable shifts out the labor demand curve (plausible if the marginal propensity to consume is high for low income households, and the wage bill increases).

Then, quantity of labor demanded rises to Nd3. While unemployment rises, employment also rises. Hence, the standard Econ 1 prediction that employment necessarily falls in response to the imposition of a (binding) minimum wage is a special case of a more general model.

Notice that the impact on the real wage bill, even when no spillover effect is present, is ambiguous. The original real wage bill is the orange shaded area, while the bill afterwards (once again ignoring spillover effects) is the lined area. Clearly, if demand is inelastic, then the wage bill will increase.

The larger the response of income to the low income wage bill, the larger the ultimate increase in the wage bill (to the dotted area).

The White House backgrounder on this proposal is here. Here are 2007 CBO calculations of the impact of a minimum wage increase, assuming net employment impact is zero. John Schmitt at CEPR.net reviews some recent literature, as well as the earlier.

Note that we first exceeded the current $7.25 value of the minimum wage in real inflation adjusted terms back in 1950 when the nominal wage was increased to $0.75/hr, or $7.28/hr in July 2013 dollars. Our society has a real gdp per capita 342% higher than in 1950.

http://www.fas.org/sgp/crs/misc/R42973.pdf

The minimum wage continued to rise in real terms until 1968 (10.77/hr in real terms). The current minimum is now just 2/3rds of that level, 45 years later, in a society where real gdp per capita is more than double that level (216% as of 2012). From 1938 to 1968, the minimum wage grew to 2.64x the original level in real terms, while gdp per capita grew to 2.74x the original level. Had the minimum wage increased at the same rate as gdp per capita after 1968, the minimum wage would now be $23.26/hr or 320% of the current level.

I’m not suggesting we raise the minimum wage immediately to >$20/hr. I do think it would be quite reasonable to raise it higher than $9/hr, perhaps by $1/hr each of the next 4 years, to end at $11.25, whereafter it would be indexed and ratcheted to either inflation or 50% of the average wage, whichever was high in a given year.

I really don’t think it’s fair to look at this in a static framework. I don’t think it’s controversial at all to say that a minimum wage job shouldn’t be anyone’s long term career choice. By increasing the wage now you decrease the incentive to transition toward more productive employment in the future (whether programs we have to assist that transition are at all effective is a different issue on which I’m fairly sympathetic). You also increase the costs associated with a business that employs minimum wage labor. This has a larger effect in the future when fixed costs become part of the equation because they are no longer sunk.

More so, without the market power arguments, this is a pure subsidy to people with income below a certain level. If that’s the goal isn’t a pure transfer payment a more efficient way to do this? Why provide a subsidy to all minimum wage workers, when some may still be dependents in a household and not exactly the people we want to subsidize.

@ben: referencing to GDP is a good point.

@James: in my experience, the minimum wage workforce is different than it was when I was earning minimum wage. I was 16 & 20-21 when I earned minimum wage – first for McD’s, then for my University. Today, I see older workers in fast food, while I would imagine that the undergraduate graders are still young.

Part of getting people to transition to better jobs, is having more ‘better jobs’ available. This is Menzie’s point with ‘marginal propensity to consume’. Another way to do this would be to exempt the first 5k or 10k of earnings from SS taxes, and you could do this only on the employee side. A 6% increase in min-wage is almost a $0.50/hr increase.

Even if we are subsidizing families where a child is working a minimum wage job, is that bad? Are those families really not struggling? Wouldn’t the huge increases in tuition over the past 10-20 years overwhelm the small ‘subsidy’ by this minimum wage increase? I would agree that a better way to offset rising tuition costs is to directly subsidize (grants not loans) secondary education.

http://www.epi.org/publication/wage-workers-older-88-percent-workers-benefit/

http://www.bls.gov/cps/minwage2012.htm

Is the wage or the unemployment rate the problem?

“Almost 6 million young people are neither in school nor working, according to a study released Monday.

“That’s almost 15 percent of those aged 16 to 24 who have neither desk nor job, according to The Opportunity Nation coalition, which wrote the report.

“Other studies have shown that idle young adults are missing out on a window to build skills they will need later in life or use the knowledge they acquired in college. Without those experiences, they are less likely to command higher salaries and more likely to be an economic drain on their communities.

“”This is not a group that we can write off. They just need a chance,” said Mark Edwards, executive director of the coalition of businesses, advocacy groups, policy experts and nonprofit organizations dedicated to increasing economic mobility. “The tendency is to see them as lost souls and see them as unsavable. They are not.””

http://www.huffingtonpost.com/2013/10/21/youth-unemployment_n_4134358.html

“A stunning unemployment rate among Black 18- to- 29-year-olds continues to rattle experts at 20.9 percent. According to Generation Opportunity, a national, non-partisan youth advocacy organization that released its “Millennial Jobs Report for July 2013” on Friday, Black unemployment numbers are problematic.

““Both numbers are just way too high,” Terence Grado, policy director of Generation Opportunity, told NewsOne about the Black adult and youth unemployment rates. “It’s just way too high. They’ve been that way for many years now. We need to get serious about addressing these numbers. There is a real human impact behind them. There are young people graduating from college without real employment opportunities or their shot at the American Dream.””

http://newsone.com/2662081/black-unemployment-rate-2/

If you want more youth employment, get more oil.

HDLI: “Drop in teen driving tracks with teen unemployment”, http://www.iihs.org/iihs/news/desktopnews/drop-in-teen-driving-tracks-with-teen-unemployment-hldi-study-finds

The positive employment effect of a higher minimum wage seems to result mainly from the implied change in Fed policy that allows the higher ngdp. Is an increase in the minimim wage the best way to achieve the higher ngdp? Why not a deficit-financed EITC?

Now given that Congress is more likely to pass a higher minimum wage than a higher EITC, the President’s proposal may be a good idea, but not because of the employment effects of the minimum wage.

Well, since Obamacare is an incentive to get rid of full-time employees at businesses that pay minimum wage, another negative factor should have little additional effect on full-time employment at that level.

http://www.businessinsider.com/the-20-companies-with-the-most-low-wage-workers-2013-2

Menzie wrote:

“…if the minimum wage increase enlarges the low-income wage bill, and this group has a higher marginal propensity to consume out of income, then the effect on the economy will be positive.”

…and if frogs had wings they wouldn’t bump their butts.

Progressives are so cruel and thoughtless. If a minimum wage of $9.00/hr is good, why not $100/hr?

The idea that without putting people on starvation salary is absurd. People at the button of the scale always have an ambition to get more.

Can someone give me a mechanism whereby McDonalds would fire people if they had to pay them $2 more? If people on the lower part of the income scale have more money they will eat more fast food so the amount of work will increase. How is the company going to do more work with fever employees? And while you are at it also point me to the data documenting that something like that actually happened in the previous rounds of minimum wage hikes. Yes they may have to raise the price, but so will all their competitors so they will not lose market share.

Prelim Q3 GDP growth numbers are out (from CR):

2.8% on an annualized basis

1.6% over the last year (Q3 2012 to Q3 2013)

Oil consumption is up 1.1% Q3 to Q3.

Thus, efficiency gains are 0.5-1.7%, depending on the GDP measure you use. Jim had estimated this at 2.5%; I had thought 3.0% possible. Clearly efficiency gains are well below that. Indeed, the US is able to add consumption at average $110 Brent, when I calculate the carrying capacity at $103.

If you don’t think exploding shale oil production has something to do with this, think again.

Proposition 1: “Sustained tax and spending policies that boost consumption in ways that reduce the saving rate are likely to lower long-run living standards.” A panel of 38 economic experts (Auerbach, Eichengreen, Fair, Hall, Kashyap, etc.) unanimously agreed, but for those uncertain or with no opinion. None disagreed.

Proposition 2: “Raising the federal minimum wage to $9 per hour would make it noticeably harder for low-skilled workers to find employment. The same panel was split on this – 13 agreed and 12 disagreed.”

Implicit in the MPC assumption in the post, the saving rate falls. Implicitly, the second proposition is short-term. Whereas, both short and long-run are subsumed in the first proposition. And the evident sense of the first proposition is that anything that reduces the saving rate lowers long-run living standards.

This is quite in line with Keynes’s classic having been titled The General Theory instead of more properly having been called A Special Theory of The Short-Run , which is what it really was. Where on the above static graphic does the crucial element of time enter in any meaningful sense?

James,

Raising the minimum wage protects businesses that are productive and efficient against businesses that aren’t. Thus productivity is increased by raising the minimum wage.

Businesses that are inefficient pay low wages and bring down the value of workers even at businesses that are productive enough to pay more.

It is not that workers should be paid less, but rather inefficient businesses make it seem like the workers should be paid less.

McDonalds Hires 7,000 Touch-Screen cashiers..

http://news.cnet.com/mcdonalds-hires-7000-touch-screen-cashiers/8301-17938_105-20063732-1.html

DeDude –

Menzie argues that a higher minimum wage could help the economy because min wage people have a higher propensity to consume. Menzie would appear to be arguing that McDonald’s customers are big savers, and hence their money would be better given to McDonald’s employees.

Of course, the counter is that social welfare would fall. If I used to like to eat at McDonalds for lunch, then I have to eat either less or elsewhere. In either case, the consumer’s utility falls.

So does the employee’s. While the employed burger flipper sees higher wages, the now unemployed one has no wages. Since income faces a very steep decline in marginal utility around zero income, the employee who lost his job is worse off that the employee making another $1/hour is better off.

The case for employment levels is similar. As Ricardo points out, there is clearly some point at which an increasing wage cost will lead to lower employment. I think we all agree that $100 / hr would cause McDonald’s to fire employees.

So, the general case is that increased wage costs lead to lower employment. But what is that number? $9/hr, $12, $22? To argue that an increased minimum wage does not lead to lower employment, you’d have to argue there’s a kink in the curve which allows a higher minimum wage. The onus is on the proponent of this view to explain the exception and quantify the optimal value. That’s the crux of Ricardo’s point.

As for McDonald’s, if their wage costs go up, their selling price will also go up, and they’ll have an incentive to swap out labor for capital. If they put up their prices, then demand for burgers may or may not be elastic. The Dollar Menu notion suggests that it’s quite elastic.

Thus, an increased minimum wage may or may not have an effect on employment, depending on whether it is a binding constraint (ie, above market rates), consumer price sensitivity, economic growth, substitutability of labor by capital, and substitutability of lower productivity labor by high productivity labor, among other factors.

Pure free market and no bleeding heart: The 70 million (half) of our workforce who take 88% of overall income are not about to say to the 70 million who get 12% — that they wont need what they produce anymore should 4% of overall income slide in their direction.

Obama’s median wage — right in the middle of the 140 million — is in the neighborhood of $15/hr (you get different figures).

The 4% represents raising the minimum wage to $15/hr: 70 million X $8,000/yr average raise (half way between $15,000/yr and $30,000/yr) = $560 billion = 3.6% of our $15.8 trillion economy.

* * * * * *

My minimum wage worksheet — the easily could-have-been minimum wage dbl indexed for inflation and per capita income growth:

yr..per capita…real…nominal…dbl-index…%-of

68…15,473….10.74..(1.60)……10.74……100%

69-70-71-72-73

74…18,284…..9.43…(2.00)……12.61

75…18,313…..9.08…(2.10)……12.61

76…18,945…..9.40…(2.30)……13.04……..72%

77

78…20,422…..9.45…(2.65)……14.11

79…20,696…..9.29…(2.90)……14.32

80…20,236…..8.75…(3.10)……14.00

81…20,112…..8.57…(3.35)……13.89……..62%

82-83-84-85-86-87-88-89

90…24,000…..6.76…(3.80)……16.56

91…23,540…..7.26…(4.25)……16.24……..44%

92-93-94-95

96…25,887…..7.04…(4.75)……17.85

97…26,884…..7.46…(5.15)……19.02……..39%

98-99-00-01-02-03-04-05-06

07…29,075…..6.56…(5.85)……20.09

08…28,166…..7.07…(6.55)……19.45

09…27,819…..7.86…(7.25)……19.42……..40%

10-11-12

13…29,209…..7.25…(7.25)……20.20?……36%?

I have been reading Richard Reeve’s President Kennedy: Profile of Power this week (Time magazine: best non-fiction of year, 1993). JFK had not much faith in the progress of the civil rights movement because he was afraid opposition attitudes were too deep and too long ingrained.

He did not seem to grasp that things never would change if somebody did not finally dig in hard and fight. I’ve read elsewhere that he said supporting civil rights would gain him 5% and lose him 10% of the vote. To his credit he voiced willingness to take on civil rights after his reelection.

In comparison to Kennedy’s dog pile of disincentives to take on civil rights, what in the world is holding back Obama on the $15 an hour minimum wage (and re-unionizing America — legally mandated, sector wide labor agreements the only way to go as far as I can see)?

The great majority of the public supports a raise in the minimum wage (and half already support unionization) – even if the question is not presented to them in terms $15 an hour. Even if he could not sell $15 an hour (having said that, the arguments on the simple logical and eighth grade math level seem blow-away-the-opposition compelling), he would not burn up any political capital trying.

Some of the minority who pose minimum wage increases could actually be swung over to a lesser increase – no votes lost there. A minority of the great majority who might not want to go all the way to $15 would not by any stretch of the imagination become disenchanted Obama voters and switch to the Republicans.

All noble (desperate!) cause and all political plums: whoever peoples the planet that Obama is living on?

Trickling down the trickle down — US and California’s very minimal minimum wage increases

If Obama gets his (not very fervent) wish to raise he federal minimum wage by $2 an hour over two years that will shift all of ONE-THIRD OF ONE PERCENT of overall income in this country from the top 80 percentile who get about 95% of all income to the bottom 20% …

… as per capita income grows TWO PERCENT, P-E-R Y-E-A-R*. Talk about-trickling the down the trickle-down.

*http://money.cnn.com/2013/08/29/news/economy/gdp-report/

Which is exactly what California’s raise from $8 an hour to $10 an hour over two years has achieved. (California income number only 5% higher than national averages so comparisons should hold.)

http://www.cpec.ca.gov/FiscalData/50StateEconGraph.asp?Type=MedIncomeAverage&Gender=Total

********************

ASSUMPTIONS:

$9 an hour is about 15 percentile wage. 5% of work force at minimum wage. 20% of national workforce gets a raise to $9 an hour.

20% of the national workforce = 28 million people. Average pay raise $1 an hour. Assume 2000 hour work year. 28 million X $2,000 = $56 billion out of a $15.8 trillion dollar economy = .0033734 = one-third of one percent price rise or shift of income from top to bottom.

Just an FYI, the final two CEPR hyperlinks both go to the same blog post.

Eric M.: Thanks for pointing that out; link fixed now.

Can someone please explain to Denis that there is not a big pile of income out there that he can arbitrarily shift from the group that got lucky and has too much to the group that has been oppressed and received too little. These Keynesians kill me. Just because you can add up income and produce some national figure does not automatically imply that you can control who gets how much of some make believe static pie.

We’ll just conveniently forget about those deemed not part of the labor force when the minimum wage is increased and just focus on how much better the lives of minimum wage employees will be with a pay raise. Oh, and we can pretend there is a multiplier effect from their propensity to spend every dollar they earn.

“Can someone give me a mechanism whereby McDonalds would fire people if they had to pay them $2 more?”

Think of a restaurant as a machine, like a automobile. If tires get more expensive, do people start driving around on three wheels? No, because the car won’t run at all below a certain number of wheels.

Can you imagine a McDs functioning at lunch hour with one cashier and one cook? I would bet that MacDonalds is currently operating at the minimum possible staffing levels, with hours and skill levels tweaked to reduce payroll as much as possible consistent with business stability. You think they wouldn’t cut the payroll “fat” if they thought they had any?

No, I think most sectors that depend on minimum wage jobs have reduced staff to a bare minimum, and raising their pay won’t change that. At least, not till capable AI staff become available at a price less than that of a basic model self-maintaining and replicating human being.

Noni

Menzie: I spent longer than I care to admit on trying to find the theoretical basis for assuming labor demand is a function of income. I suppose this is just another example of “assume a wrench”?

Steven, just a note that 0.8% of the 2.8% reported real GDP was attributed to inventories.

Real final sales per capita yoy are decelerating below 1% (historical recession threshold), although sales were reported to have accelerated above 1% in Q3 since Q1 and Q2.

http://research.stlouisfed.org/fredgraph.png?g=o90

http://research.stlouisfed.org/fredgraph.png?g=o92

See above. Real private non-residential investment to real depreciation and to private employment is again contracting yoy, which historically leads (or coincides with) production, private employment, and real final sales per capita into recession. The predictable result is a recession-induced acceleration in labor productivity, i.e., fewer workers at the same capitalization at less production.

Regressing the variables implies a contraction of real final sales of 2.5-3% and loss of private employment of ~3-4%.

Under these conditions, in order for the U rate not to rise, 5-6 million workers must leave the labor force (or be forced off when unemployment benefits expire) over the next 12-24 months, and the participation rate needs to fall further from 63% to 59-60% (Japan is ~58% today).

Speaking of which, had 5 million or more Americans not left the labor force since ’07, the U rate would still be 10-11% (U-6 near 20%) with the participation rate at 66%, all else equal.

https://app.box.com/s/urkg7lqju0xz348shf2p

https://app.box.com/s/5dqe1l2j8r2gg9g99mot

The US labor underutlization and lack of real GDP per capita growth since ’07-’08 is a not-so-subtle cost of oil above $40-$45 (2013US$) that does not permit growth of real GDP per capita, whereas a sustained price above $75-$80 causes a net contraction 4- to 5-year change rate.

Finally, a recession and 2.5-3% contraction in real final sales per capita suggests US oil extraction falling back to 5-6MMbbl/day and the price of oil at or below the $50s.

Of course we need a NATIONAL minimum wage because the labor market in rural Mississippi is just like that in NYC.

Labor will typically run 30% of revenues for a fast food restaurant.

If the minimum wage is $7.25 (and assuming all employees are paid that), then an increase of $2 would raise the wage to $9.25 / hour, an increase of about 28%.

This would increase wage expense by 8% as function of revenues.

Were this to be translated into prices, the price of a Big Mac Meal would rise from $5.69 to about $6.16, a jump of nearly 50 cents.

Whether such a wage increase leads to lower employment levels is a function of a number of factors. For example, if the number of meals ordered remains the same but the value of each order drops (ie, a hard budget constraint per meal), then the difference would be absorbed from profits, as the need for labor would remain the same. Over time, the number of McDonalds restaurants would fall.

If the number of meals drops instead, then the need for variable labor (assuming you had at least one in the kitchen and one at the counter) would drop. Indeed, the drop in labor could be greater than the increased wages would seem to warrant, as fixed costs would have to be spread over a smaller revenue base.

Finally, customers could simply accept the price increase and move on, leading to a reduction in their welfare due to cost inflation.

The impetus to increase productivity through process and technology innovation would be significant. We’ve already seen that many fast food places now let the customer fill their own drink (Chipotle, for example). Order taking and payment, as Anonymous notes above, could be automated via kiosks, just as they are doing in Europe.

Polls this year indicate 80% of Americans support raising the minimum wage to $10.10 and indexing for inflation, including 81% of Southerners, 75% of white Southerners, 62% of Republicans, and 67% of small business owners.

Menzie assumed the economy was at full employment, so in that case the first order effect of a hike in the minimum wage would be to increase the labor force as the higher wage would match the reservation wage of those previously not included in the labor force. The unemployment rate would likely go up; but total employment would also go up. That’s why there would be an increase in aggregate demand at the macro level that translates into a shift in the labor demand curve. Menzie also assumed no monopsony powers. Enter the real world for minimum wage jobs and employers enjoy significant monopsony powers, so an increase in the wage would not reduce employment. Raising wages is very effective if employers enjoy monopsony powers. The classic examples are teachers and nurses.

Raising the minimum wage when the economy is not at full employment is ambiguous. It is certainly possible that raising the minimum wage would increase total output and total employment if interest rates are at the zero lower bound and deflationary pressures are strong enough that the aggregate demand curve is locally downward sloping.

One social benefit of a higher minimum wage in an economy with slack labor demand would be lower teenage employment. Most employers would rather hire an adult at the minimum wage than a teenager. Raise the minimum wage and teenage unemployment increases. Some of us think that would be a good thing. Less time flipping burgers and more time studying at the library.

Steven Kopits I believe the standard labor cost for the restaurant and fast food industry is around 22%. Food costs are typically in the 28%-33% range.

Also, the minimum wage does not apply to “tip workers.” Not a big issue if you work at a high end restaurant during high volume dinner shifts. It’s a very big issue if you work the graveyard shift at a North Dakota truckstop.

oops. aggregate demand curve locally UPWARD sloping.

The studies I’ve read that look at real world natural experiments say there is no negative effect on employment from raising the minimum wage, though the wage rate is lower across the immediate border. They’ve been able to study, for example, counties in NJ versus counties in PA.

Here are the real wage and salary earnings of the bottom 90% (2007 = 100), which are at the same level as the late 1960s (when the post-Bretton Woods fiat debt-money regime began):

http://research.stlouisfed.org/fredgraph.png?g=o9m

But CPI is a rather questionable metric (too conveniently politically malleable) for determining purchasing power of working-class wages and salaries after price changes.

Here are working-class wages adjusted for M2 plus institutional money funds and large time deposits (the closest to broad money supply M3 as the Fed data permit), which tracks closely GDP, or the total value-added in terms of prices the economy produces (down by two-thirds since 1973):

http://research.stlouisfed.org/fredgraph.png?g=o9n

Working-class wages to GDP (down an order of exponential magnitude since 1970):

http://research.stlouisfed.org/fredgraph.png?g=o9p

Thus, deindustrialization, financialization, “globalization”, and the resulting unprecedented increase in public and private debt to GDP has resulted in a 63-65% decline in the purchasing power of working-class labor time in terms of debt-money supply and reported value-added output of the the US economy, about 50% equivalent of which is today household debt service, public and private health care spending, and local, state, and federal gov’t spending (less public health care spending already counted).

We have reached the limit at which gov’t deficit spending and debt-money supply to wages and GDP can increase real GDP per capita. Wages to debt and debt service and GDP MUST rise hereafter or there will be no growth or real GDP per capita; rather, it will contract.

Returns to capital’s share at this particular point in the Long Wave Downwave/Trough must by definition decline as a share of GDP, and labor’s share must rise. Increasing supply of cheaper debt-money (Say’s Law) will not create its own demand with unprecedented levels of debt to wages, GDP, and gov’t receipts, and with the real, after-tax wages of the bottom 90%+ stagnant or contracting.

There is too much public and private debt (and thus wildly overvalued assets by extension); an obscene share of wealth and income is concentrated to the top 0.1-1% to 10% who are hoarding 85% of financial wealth at zero velocity; there is too much gov’t to wages and GDP, benefiting primarily the top 1-10%; and there is too little return to the bottom 90% for their labor time after taxes (such that they can afford to pay and still subsist).

The bottom 90% of US households can now purchase after taxes and price changes just half of what they could purchase in 1980 in terms of US value-added output, 30% less than in 1990, and 17% less than in 2000.

The top 10-20% receive 45-60% of all US income and account for no less than 33-45% of reported GDP. Can the US sustain a modern, affluent, high-tech economy and a civil society when half of all value-added output is dependent upon increasing concentration of wealth and income to the top 1-10%?

@Edward Lambert

You say that like it’s a fact. If there are inefficient firms employing minimum wage labor why doesn’t an efficient firm enter the market, pay slightly above the minimum wage and earn excess profit (where the excess profit comes from efficiency)?

I’m not saying that’s not the case. I honestly don’t know. But what’s rationale for starting the argument by supposing market failure without specifying the reason?

The chart Menzie cites above has a cherry picked start date. Here is a longer record –

http://oregonstate.edu/instruct/anth484/minwage.html

Some of us think that would be a good thing. Less time flipping burgers and more time studying at the library.

2slugs I think that tradeoff only exists in Leave it to Beaver reruns. I doubt that the opportunity cost of working for most teens is time spent studying at the library. There are so many positive benefits to working as a teen. Lack of work for teens is one of the reasons for the social problems in Detroit, Chicago, etc.

Higher minimum wage: I am for it. This will decrease low skilled immigration. I’m happy to see liberals champion this cause.

Also, higher minimum wage will increase investments in automating restaurants and some other industries that use low minimum wage workers. No need for cashiers any more. The move to online buying will be accelerated. Fewer store clerks needed. More robots at work around farms, factories, warehouses. The investments will increase the demand for embedded software developers and machine learning specialists. Happy days for many friends.

Of course higher minimum wage will accelerate the already quite pronounced trend of lower employment for lower IQ folks. I am guessing either Democrats are okay with that or deny that IQ exists. Not sure which. Curious though.

Much of the argument against the minimum wage seems to imply that this will impose a higher wage bill on enterprises incapable of supporting it, and that they will increase labor productivity faster to avoid that wage bill, throwing workers out of work.

This ignores that, in the case of inaction, profit and productivity are rising, while the minimum wage is sinking in real terms. The extent of this is clear from the fact that we are 342% richer (GDP per capita) than in 1950, and yet folks argue (as if in good faith) that we cannot afford to pay a higher minimum wage than we paid then. Failing to act shifts the wage bill downward and improves profits at the expense of the lowest paid workers among us. The assumption that all increased wage costs will be borne by either workers or consumers is unsupported and unlikely to be correct given the present state of profits, ages, aggregate demand, and prices. When profits are high and aggregate demand is low, it seems likely wage increases are likely to come largely from profits, at least in industries with some elasticity of demand.

It is clear that raising the minimum wage benefits workers who keep jobs, since even if their hours are reduced commensurately so that their pay is identical (extremely unlikely), they gain in time.

Thus the argument against a higher minimum wage boils down to the idea that it will throw many workers out of work, the validity of which is apparent from the fact that those with the most to gain from a weak labor market are the same putting forward this argument. The validity of such protests can be seen from the reaction of those forces to the reduced employment we have seen over the past half-decade. Cut public employees, cut public spending, cut unemployment insurance, cut SNAP, cut Social Security, cut taxes for those with the least propensity to consume, etc.

It may be ad hoc, but the empirical case of previous increases does not support the avowal of disasterous employment consequences. In actual fact, most employers would benefit from a higher minimum wage due to reduced competition from abusive employers, reduced indirect costs (turnover foremost), increased aggregate demand, etc.

The above is with reference to the limited and timid raises which are all we have undertaken for over 30 years. However, assuming a smooth pace of increase rather than a shock (such as raising the minimum wage overnight to $100/hr), the consequence of raising the minimum wage a little too high, and a little too often would be increased inflation, as the wage share of producer costs rose and consumer prices were raised to compensate. At the present time, such a consequence is not the worst thing I can imagine, given that it would allow greater scope for monetary policy…

Oh, and for tj, I agree, I strongly support teenage work as busboys, etc for the scions of the upper crust. Our social problems have much to do with the lack of understanding of the real world among such twits.

MERRY Christmas:

Although the number of long term (>6 mos) unemployed remains very high (~4M), the EUC expires between Christmas and New Year’s. Although Congress has chopped this benefit down so that only 34% of the long-term unemployed who are actively seeking work are still receiving benefits(and of course none of those who need work but have given up on finding it for the mean time), all of the 1.3M who are still receiving benefits will be cut off near the end of the year, and it’ll rise to about 2M over the following 3 months. That’s right, nobody will get extended unemployment unless House Republicans vote for it, despite employment to population levels flirting with 1953 levels.

Now admittedly, I would have reformed this system 4-5 years ago to incorporate work-sharing and workfare programs, but unless Congress acts, we’ll see another few tens of billions in austerity targeted on the weakest among us. People whose payroll taxes were paid into the program will be denied benefits at the moment they need them most.

Also, if I remember correctly, FUTA tax cut-off levels aren’t indexed and haven’t been raised in over 30 years. Back then they were at roughly the same cutoff level as FICA.

As a brazilian, I’ll say this with firsthand knowledge:

Shortsighted welfare policies don’t work.

Policies like food stamps, without the proper restraints and without being combined with structural reforms, do more harm than good.

Don’t know why, but there’s a refusal to recognize that investment in the education of the poorest is the only way. I don’t follow this blog since its beggining, but I’ve never seen this discussion brought up here.

Can we get a graph of the cost to employ a minimum wage worker full time over the same time period? If so, I think we’ll find out why our unemployment rate is stuck. Thanks!

It is apparently beyone the ability of anyone in this thread to remember that firms in competitive markets are price takers. It is very ptobable the price would not change at all or mininally, and that the effect would be a decline in profits, since the difference between the value add of labor and the cost of labor would narrow.

Jeff: I am not responsible for your intellectual shortcomings. If you do not understand how higher wage income induces higher consumption when some agents are liquidity constrained (or rule-of-thumb to use Mankiw’s language), and that higher consumption requires higher production, that in turn requires higher labor input, then I feel sorry for you.

Two things to note:

1. Not all countries find it necessary to have a minimum wage. Germany does, but e.g. the Scandinavian countries don’t. In fact most countries don’t. Why is that? (could be because labor has more leverage?).

2. What worked in the 50ies here in the US doesn’t necessarily work today (e.g. a decent minimum wage). 60 years ago, the US was one of the few countries with an intact industry in a world needing industrial products.

3. in the last 10 – 15 years we’ve tripled the labor force with the addition of China and India, but we haven’t tripled the worlds demand for industrial products of the kind that the US and EU built their wealth on (cars, computers etc.).

In this new world you are better off producing commodities like food, minerals etc. than if you produce cars.

I think this explains a lot of the erosion of salaries, which b.t.w. is hitting everybody, not just minimum wage earners. 1995 I was paid $65/hour as an engineer in Silicon valley – that is more than the going wage now. The reason is that today it’s possible to outsource the work to India and China.

We buy more from them than they buy from us. It affects everything, from inflation to interest rates to trade deficits and minimum wage.

The Supremes should have ruled a long time ago, that the governmental units have no “business” in entering negotiations between two parties..