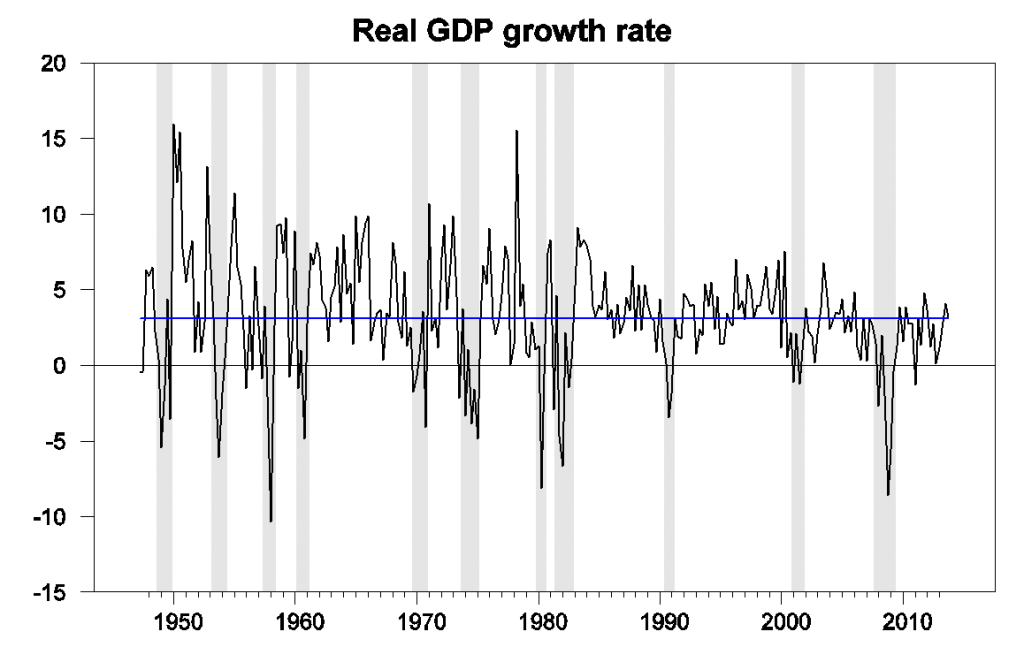

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 3.2% annual rate in the fourh quarter. That’s two quarters in a row now of above average growth. Given recent experience, that sounds pretty good.

|

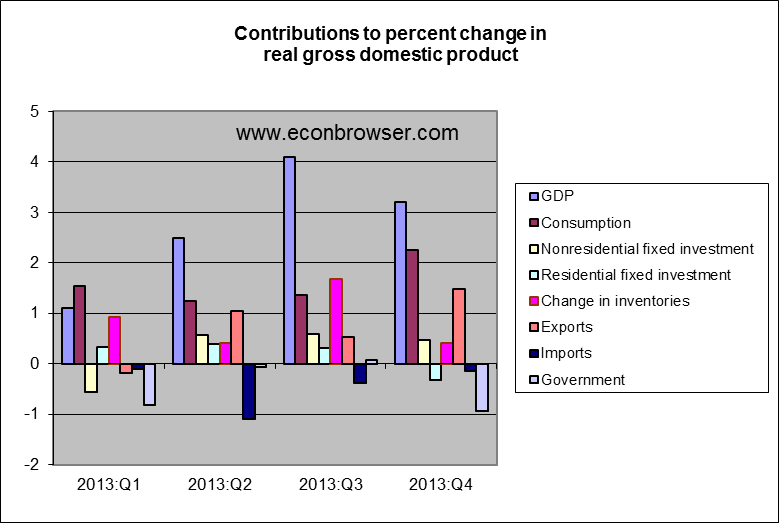

The brightest star was U.S. exports of goods and services, which contributed 1.5 percentage points to the 3.2% total. Nearly half of the export gains came from the foods, feeds, and beverages category, in which agricultural goods shipped to China figured prominently. Another important contribution came from exports of nondurable industrial materials. This includes exports of refined petroleum products, which are one byproduct of growing domestic production of crude oil.

The biggest drag came from the public sector, resulting in part from the federal shutdown in October. Lower government purchases of goods and services subtracted 0.9 percentage points from the fourth-quarter GDP growth rate. Bill McBride believes that public spending and private investment should make positive contributions in the current year:

[Residential investment] should make a positive contribution in 2014, the drag from the Federal Government should diminish, state and local governments should make a small positive contribution again this year, and investment in equipment and software and non-residential structures should also be positive in 2014.

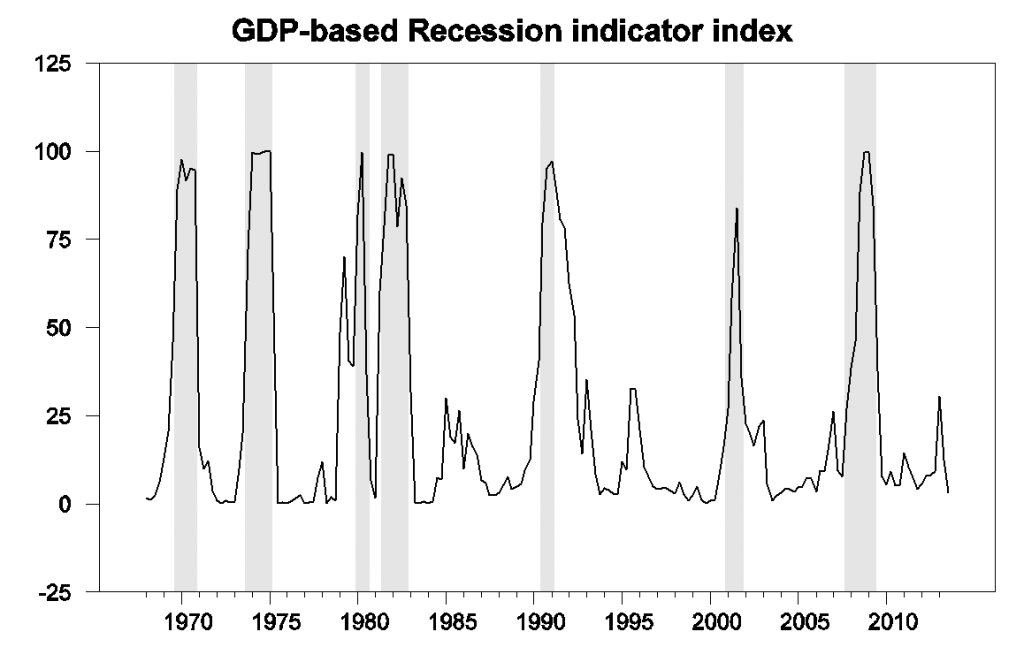

Two quarters of above-average GDP growth have brought our Econbrowser Recession Indicator Index down to 3.3%, which is a very favorable reading. Note that in calculating this index we allow one quarter for data revision and trend recognition. Thus the latest value, although it uses the GDP numbers released today, is actually an assessment of the state of the economy as of the end of 2013:Q3. However, our index is never revised, so that the numbers plotted in the graph below since 2005 are exactly the values as they were reported one quarter after each indicated historical date on Econbrowser.

To sum up: things are looking good, and are likely to get even better.

If government spending doesn’t change this year compared to 2013, why would the fiscal drag decline? It seems like year-over-year the drag will decline, but the overall effect of the drag would be the same in ’14 as in ’13 since the budget appears to be similar this year to what it was last year.

Just out of curiousity – I am not even sure the question makes sense…

You need to look at the change in the budget balance, rather than the level, to get at the impact on GDP growth. GDP growth is change, so inputs to growth are all in terms of change, too. If the change in the budget balance across all levels of government is a bigger rise, then you get an add to GDP growth. If the budget balance is steady, it does nothing to the pace of GDP growth.

We have had periods of decent growth earlier in the expansion. Persistence has been a problem. Why is this time going to be different?

One improvement is that fiscal policy won’t be a drag this year. However, the Q4 data show a pretty big potential for nventories in Q1 to be a drag. Trade was the glory of the Q4 report, but what are the odds that can be repeated? Real final sales to domestic purchasers rose at just a 1.4% annualized pace on the quarter. That’s the slowest pace in 3 quarters and below trend for the expansion so far. Real final sales serve as a sort of “core” function, showing what the underlying pace of growth is without the big swing categories. So, other than the widely understood easing of fiscal contraction, where’s the good news for future growth?

There’s a pretty good chance US domestic oil production will continue to grow.

Federal austerity was a drag on the economy in 4Q13 for the 11th of the last 13 quarters since late 2010, and was at the 2nd worst level over that period. Employment is still lower in absolute terms than in 2007. Inventories increased again on a seasonally adjusted basis. Fixed investment was third worst quarter since 2010.

Professor,

I have to challenge you on this comment.

The biggest drag came from the public sector, resulting in part from the federal shutdown in October.

This makes no sense. The government was never shutdown. There were not even 50% of government employees who were told to stay home and then all of them were paid their salaries plus whatever else they could get during the time they were off. Bill may have been delayed slightly but all were paid. Finally, if a short “shutdown” like happened in the fall creates a “biggest drag” on the public sector then the government is massively too big!

ricardo,

while government workers were able to recoup salary, that is not the complete input to the economy from the government during the shutdown. firms could not conduct business with the government while it was shut down. all that potential was lost. people and businesses contracted in their spending due to future uncertainty-this potential was also lost. businesses which service government workers-think of all of the restaurants in DC-were directly affected by shutdown activities. there was a real fiscal drag which occurred-it is disingenuous to say otherwise.

Exactly. Also, this isn’t widely known, but if you were a federal worker that did not have permanent career status, then you were screwed over the last couple of quarters. Those workers hired under 5 year temp status were released in 2013Q2. And the government didn’t do any summer student hires this year…not a lot of money, but bad news if you counted on that money to pay this year’s tuition. Workload at depots and arsenals was also cut to the bone, so that meant DoD cut orders from its suppliers for things like truck parts, tires, aircraft engine turbine blades, electronic components, etc.

Slug,

Please name one government contractor who was not paid because of the Democrat shutdown of the government in the fall fo 2013?

Ricardo,

Don’t be dense. No one said that contractors didn’t get paid as a result of the shutdown for work done prior to the shutdown. The point is that lots of big contractors (Boeing, Sikorsky, GDLS, BAE) and even more small suppliers saw their orders cut. And BTW, getting paid isn’t economic activity…it’s a reimbursement for already accomplished economic activity. The economic activity is in the actual production of goods and services, not in the payment. That’s why the NIPA tables include unsold inventories. That’s why it’s important to focus on lost work orders rather than on the irrelevant question of whether or not contractors were reimbursed for work already accomplished.

Where did you get this “plus whatever else they could get during the time they were off.” stuff? I realize that there were a lot of uninformed rumors floating around claiming that federal workers would be able to collect both unemployment insurance and their back salaries, but those stories were just urban myths. If you collected a dime of unemployment insurance, then you forfeited the back salary. Period. So those federal workers that were not in either the “exempt” status or the “excepted” status had to make a calculated risk. Those workers had no guarantee that they would get back pay, but many of them would be eligible for unemployment insurance. If you took the unemployment insurance, then you could not accept the back pay if it was offered. And if you declined the unemployment insurance, then you were betting that Congress would agree to give you the lost salary retroactively.

This is evidence that the US economy does not require stimulus to rebound from a recession. Austerity measures were implemented over the last year and the economy is still doing well. According to Keynesians the economy would have done poorer, not better.

I am assuming the argument against this is that the economy would be doing better if it weren’t for austerity, which may be true. However, people like Krugman make it sound like the governmnet can pull economies out of recession at will, and push them into recession at will. The new GDP data clearly shows that this theory is not the case.

You said:

“Austerity measures were implemented over the last year and the economy is still doing well. According to Keynesians the economy would have done poorer, not better.”

And then in the very first sentence of the very next paragraph you answered your own question:

“I am assuming the argument against this is that the economy would be doing better if it weren’t for austerity, which may be true.”

I don’t think there’s any “may be true” about it. It’s definitely true.

Releveraging through credit expansion, non-govt debt levels are still at record historical high. The economy has rebounded from this recession? I wouldn’t be so sure about that.

anonymous,

“Austerity measures were implemented over the last year and the economy is still doing well. According to Keynesians the economy would have done poorer, not better. I am assuming the argument against this is that the economy would be doing better if it weren’t for austerity, which may be true. ”

you should have stopped right there. you state the answer correctly, and then go off on a tangent oblivious to your insight!

I have a question that I mean with all sincerity.

How will the increases in health insurance premiums in 2014 for the people not eligible for subsidies (“Middle Class” and were paying less for the premiums prior to Obamacare) impact overall Consumption Expenditures? I assume it is just moving it from one part of the measure to another BUT will it not adversely affect the purchase of MANY durable and non-durable goods OUTSIDE of the health care sector? In other words, more money is going to premiums that are not directly purchasing “stuff” and less going to purchase, well, stuff that the rest of the economy produces. Seems like no free lunch with total Cons Expenditures and every other part of the economy is going to get less.

Again, just looking for a reasonable explanation. Thanks!!

Hope this makes sense.

Gene,

Why do you assume that in the aggregate health insurance premiums will be increasing more than they would have without Obamacare? Yes, some folks will see a rise in their rates. But more folks will see a drop in rates. Most of the aspects of Obamacare that tended to put upward pressure on health insurance premiums (e.g., allowing coverage for your kids until age 26, elimination of lifetime benefit caps, no pre-existing condition exclusions, etc.) were already priced into the market long before the mandate went into effect. The mandate was the part that put downward pressure on prices. The effect of the mandate was to increase the number of subscribers, which spread the existing costs (which Obamacare effectively fixed) over a larger pool of subscribers. For some of us that already had health insurance the effect of the mandate was to reduce our share of the burden.

And if you’re one of those folks who thinks the “uncertainty” surrounding Obamacare was a drag on the economy, then the emerging reality that Obamacare is here to stay should reduce that uncertainty.

So, I had warned of developments in Alaska and catastrophic developments at Shell. Well, here’s both in one announcement.

Shell received an unfavorable court ruling against the government regarding Alaskan Outer Continental Shelf, and announced that it would not be drilling there in 2014. I would say there’s a better than 50% chance that Alaska will now exit the oil business. The decision represents is a devastating, scorched-earth policy for Alaska.

Further, Shell CEO Ben van Beurden said he had to makes tough choices, and is reducing Shell’s capex by $9 bn, or 20%. That is major league capex compression, and we should have every expectation that it will spread rapidly throughout the industry. Weatherford independently announced lay offs of 7,000 employees. Such headcount reductions will spread rapidly now as well, I think.

I called this a long way off, but it’s terrible to see.

Here are the Upstream article (Jeffrey also has a link from previous blog post):

Shell has scrapped plans to contine drilling efforts off the US state of Alaska in 2014 after an unfavourable court ruling and amid a global slimdown of its exploration profile.

The Anglo-Dutch supermajor’s boss said the company is changing tack and promised more asset sales as fourth-quarter profit slumped 48%.

Chief executive Ben van Beurden said Shell would be “making hard choices in (its) world-wide portfolio” and would slash capital spending by $9 billion.

“This is a disappointing outcome, but the lack of a clear path forward means that I am not prepared to commit further resources for drilling in Alaska in 2014,” van Beurden said in a presentation of the company’s results.

Shell investors reacted positively, with shares closing up 2.35% in London and trading up 1.25% in New York at midday local time.

But the company stock had already taken a hit earlier this month after van Beurden broke with company tradition to issue a hefty profit warning ahead of Thursday’s fourth-quarter and full-year result presentation.

Shell has spent over $5 billion in its efforts to explore the Alaskan Arctic, an effort that has been tied up in court challenges.

After regulatory hurdles were conquered, the supermajor kicked off a blunder-filled 2012 drilling campaign that only got as far as top-hole drilling.

That programme was capped by the embarassing grounding of the conical Kulluk drilling rig, which ran aground on an Alaskan island after slipping its moorings during a tow.

On 23 January Shell suffered another blow when a US appeals court found the government had not properly assessed environmental risks when it issued drilling leases in Arctic waters.

Environmental watchdog Greenpeace, which has campaigned heavily against Shell’s Arctic drilling plans, was quick to seize on van Beurden’s comments.

“Shell’s decision to gamble on the Arctic was a mistake of epic proportions,” Charlie Kronick, an oil campaigner for the nonprofit, said in a statement that also called for the company to likewise cancel all future drilling efforts.

“The company has spent huge amounts of time and money on a project that has delivered nothing apart from bad publicity and a reputation for incompetence.”

The decision may also impact suppliers of the supermajor, which had already contracted two rigs on three-year contracts starting in 2014.

Upstream reported in December that Shell re-signed the Noble Discoverer drillship to a three-year gig after the unit completed repairs from its last Alaska stint at a Korean shipyard.

Shell is paying $160,000 while the rig remains in the yard but is due to increase to $363,000 in February and so remain through December 2016.

The supermajor also hired Transocean’s semi-submersible Polar Pioneer through 2016 to remain on standby for a relief well.

That unit is booked on a dayrate of $620,000 during the July-October summer period and $589,000 during the off-season for the three years, according to a Transocean fleet status report.

Investment bank Investec said that, while van Beurden’s comments on a “change of emphasis” and improved returns were admirable, they “strike us (as) a holding statement”.

“The 2012-2015 cash flow and capex targets have been dropped, but the disposals target has not increased,” it said in a note.

“Organic capex in 2014 is $35 billion, as guided, plus $2 billion of acquisitions (which didn’t complete in 2013). The chief executive reiterated the asset disposals target ($15 billion for 2014-2015) but we think investors expected more.

On Wednesday, Shell said it has agreed to sell a 23% stake in the Parque das Conchas field off Brazil to Qatar Petroleum International for $1 billion, just a matter of weeks after buying the stake from state-owned Petrobras for the same price.

Earlier this week it was reported that Shell is shopping a stake in an oil pipeline from Houston to Houma, Louisiana, partly to raise funds to invest in drilling.

Investec retained its “Hold” recommendation on Shell’s stock.

Steven,

Perhaps that capital will be better invested elsewhere. The oil industry enjoys enormous subsidies (direct and indirect), and that causes enormous over investment in the industry.

Nick,

The oil business most certainly does not receive great subsidies. For example, in Alaska’s, 62% of revenues historically have gone to the various governments. Last year, the oil business contributed about $10 bn to Alaska state coffers, about $50,000 per family of four. Why do you think I am apoplectic about the ruling against government’s leases? It’s going to destroy that economy.

Now, if you think oil is being subsidized (leaving aside climate–we can debate that separately), then those subsidies have to relate primarily to providing security in the Persian Gulf. As the US gains energy independence, the rationale for maintaining a strong military presence in the Gulf diminishes. And we have guys like you–Democrats and Republicans alike–you are going to argue that the US should not pay for providing security to thankless Arabs selling oil the rival Chinese. All well and good.

But now do you think the US will cede its military primacy in the Gulf to the Chinese? Or do you think the US will want to have its cake and eat it, too, that is, maintain discretionary supremacy (we intervene when we want to) but with a highly limited appetite for military outlays? So if I’m China or Saudi Arabia, how do I think about these issues?

And meanwhile, the Chinese now have one aircraft carrier in operation, one under construction, and two on order. And there’s a boatload of tension in the South China Sea. So where exactly will those Chinese carriers be used? And how will a potential attempt by China in the 2018-2020 time frame to protect its critical imports from the Gulf be viewed through the US lens? Will China be characterized as an aggressor or a policeman? A meddler or a savior? How is the media tending to portray China today? How do the Chinese perceive their treatment in the US press? How are the Chinese managing their public relations? These all become important questions.

So, yes, I understand your point only too well, and there’s a huge amount of risk gathering due to a US…how should I put this…careless arrogance. Or maybe unfunded condescension is a better phrase. In any event, either we manage the hand-off with China, we deter China with appropriate defense spending (harder and harder to do over time), or we have a military face-off with China over completely pointless strategic goals, with the only outcome to determine who is top dog. Right now, we are on track with the latter option.

kopits,

your points are valid, but they exist in a world which continues to focus on oil and not develop alternatives. all of your issues become less so when alternative sources of energy, ie wind and solar, begin to replace the current oil based system. this is why many folks are pushing for these other sources of energy. long term, oil simply becomes a high cost item, either through production from extreme environments (your Alaska example) or international friction with overseas sources and competitors. oil is not renewable, so with a finite resource you will need to find alternatives sometime in the future. if that move is to be made, I would rather do it today than continue to incur the problems of oil into the future and then make the inevitable change anyway. let china try to protect its oil supply lines with one aircraft carrier. it will be costly for them to do so, and take a valuable asset away from more strategic activities.

I understand you have a vested interest in oil-it pays your bills. but keeping oil integral to our economy and defense is not an intelligent path to follow, and we should be researching alternatives to the greatest degree possible. let other countries be vulnerable to those supply lines.

Baffs –

I have written at least two articles and sponsored a workshop at Columbia University on alternative fuels. So there’s no need to lecture me. But the question remains: Are the alternatives better or cheaper? Right now, natural gas could be cheaper if we had a cost effective fuel tank. Remember, your margin is only $1-2 / gallon for CNG, which translates into $500-1000 per year, or a payback threshold of $1500-3000. So a CNG vehicle, to be “cheaper” can only cost, say, $2,000 more than a gasoline-powered alternative. We don’t have such a vehicle offering in the US today. There was an ARPA study on the matter two years ago. I’ve heard nothing of it since. Ask Pres. Obama what the result was.

As for electric cars, the capital costs are higher. Therefore, for EVs to be cost effective, they must achieve higher utilization rates, which can be attained with self-driving technology. I have written about this in Foreign Policy.

So, when we are talking about alternatives, let’s keep in mind that these are subject to strict cost/benefit tests that can be objectively applied. When you go to buy a car, you do actually consider the value proposition–and that proposition can be broadly quantified. Our CNG workshop occurred in 2010, which gives you a feel for how far behind the curve I think we are. This issue may revive. To appearances, oil production at the majors is going to fall off a cliff–as a result, CNG as a transportation fuel may yet have its day. (Remember, if you use a supply-constrained model, then CNG is not a threat to gasoline prices. But the oil majors don’t use supply-constrained modeling, so they haven’t seen it that way, as I understand it.)

As for EVs, I believe the government should be more aggressive on self-driving technology. If I were Obama, that’s the picture I’d be painting. On the other hand, the vehicle manufacturers are racing ahead, and full self-drive will be on the market by 2020, I expect. This should prove a transformative technology. (And you can thank Steve Jobs for that.)

But even if I allow these, it takes a long time to swap out the vehicle fleet–and keep in mind we’ve already made a lot of changes. Home heating oil use is down by nearly half since 2005. On the other hand, China is a very large country, and on paper, they add a US worth of oil consumption between now and 2020. Thus, the transition to alternatives is not occurring in a static environment, but one in which huge incremental demands on the oil supply are likely at the same time. Therefore, we will continue to have pressure on the oil supply, and oil will remain the fuel of choice, if it’s available.

If you’ve enjoyed the recent recession, then by all means, we can do without oil. If you didn’t, you’d be a fool not to develop Alaska.

Kopits,

if we had taken $1 trillion of the money poured into Iraq and Afghanistan, and instead spent it on alternative energy sources and distribution, we would probably not need oil today. there needs to be a big picture effort to change the landscape. incremental changes will not work, because it keeps oil in the equation. oil does NOT need to be in the future energy equation. but it will take somebody with bold vision and guts to make this happen, because there is a significant vested interest in the business world today to keep oil in the equation for the foreseeable future. but the change is inevitable because oil is a finite resource.

The oil business most certainly does not receive great subsidies.

I didn’t say the “oil business”, I said the “oil industry”. And, in fact, the industry receives *enormous* direct subsidies, though not mostly in the US: look, for instance, at the enormous expenses in India to subsidize below market prices. Below market prices represent several $100 billions of dollars of subsidies, around the world.

Alaska state coffers, about $50,000 per family of four…It’s going to destroy that economy.

Yes, oil exporters are going to be hurt by the decline of oil. It’s sad, but why should others subsidize them?

leaving aside climate–we can debate that separately

No, we really can’t. Do you agree that it’s a large cost, and real?

subsidies have to relate primarily to providing security in the Persian Gulf

So, we’re agreed that a large portion of the 100’s of billions we spend on Middle East related security could reasonably be allocated to oil? If we take $275B per year, and allocate that to the roughly 275B gallons of oil consumed by the US annually, that’s about $1 per gallon.

there’s a boatload of tension in the South China Sea…China…to protect its critical imports from the Gulf

And here we begin to see the very large external costs of oil to China. If China is smart, it will eliminate price controls and direct subsidies, and begin to internalize these costs with fuel taxes.

natural gas could be cheaper if we had a cost effective fuel tank.

You seem to be focusing on personal travel. I’d say that’s not the optimal place to start. The best place to start is commercial haulers, who have much larger vehicles, much higher utilization, and much simpler infrastructure requirements. Big shippers, like UPS, are working very hard on such programs – they’re feasible right now, and in operation.

for EVs to be cost effective, they must achieve higher utilization rates, which can be attained with self-driving technology.

This is highly unrealistic.The idea the self-driving tech is a requirement is a red herring, like fuel cells. We have all the tech we need, in the form of hybrids, PHEVs, EVs, etc.

alternatives…are subject to strict cost/benefit tests that can be objectively applied.

Of course. Have you ever looked at Edmund’s 5 year cost schedule, or Consumer Reports cost analyses? These are available, and not rocket science. You’ll see that hybrid-electrics are the cheapest of all, in most categories.

Tesla, of course, tops the ratings chart for luxury vehicles, with peformance that tops much more expensive vehicles, while it’s operating cost is far lower.

it takes a long time to swap out the vehicle fleet

Not that long – 50% of vehicle miles travelled comes from vehicles less than 6 years old.

Therefore, we will continue to have pressure on the oil supply

Not if China gets smarter. The ruling party is dominated by engineers, and they’re not beholden to the oil industry. There’s a reason why Chinese e-bikes sell in larger volumes than ICE vehicles.

If you’ve enjoyed the recent recession, then by all means, we can do without oil. If you didn’t, you’d be a fool not to develop Alaska.

That’s exactly reversed: if you don’t like oil-induced recession, then the obvious solution is to phase out oil with better and cheaper replacements.

Steve, the weather in the Alaskan arctic in recent decades may have been unusually good. Perhaps Nick is right for the wrong reasons.

Shell drilled the Alaskan OCS in the 1980s and 1990s. That’s why they paid such a premium for the leases. Drilling up there is not new; it goes back to the late 1960s.

Northern Alaska is a hard place to work. By the way, the work season onshore is the winter. because that’s when you can use ice roads. Offshore, obviously the drilling season is short. It’s made shorter by the need to allow for relief wells, which knocks maybe a month of the available time.

In any event, I don’t think unusual warmth has affected the option to drill for oil in the Alaskan OCS. Here’s a nice picture of operations near Sakhalin Island, east Russia. Operators like Shell are capable of working under such conditions. http://www.stxeurope.com/sites/Finland/Products/Pages/Multipurpose%20Icebreakers%20and%20Supply%20vessels/Fesco-Sakhalin.aspx

Rather, the issue is logistics, delays and costs. I think Shell received some criticism for downplaying some of the practical difficulties of working in the Arctic. On the other, the operators are so paranoid about environmentalists and the left in general, that they feel compelled to give a don’t-worry-be-happy view of working in these challenging locations. I personally would not have chosen that communications strategy (and in fact Shell is aware of my views). But it’s tough to stand up and say, “Look, this is going to be hard, but we think it’s worth doing.” They want to avoid giving openings for attack. This risk, however, is that your credibility can be hurt, which is what happened with the Kulluk grounding and the underwhelming performance of the containment system–hence my view that it’s better to fully disclose and fight your corner rather than trying to minimize issues which are likely to haunt you later. But you have to like confrontation for that approach.

Thanks.

kopits,

you say shell should stand up and say

“Look, this is going to be hard, but we think it’s worth doing.”

the problem is most people do not think it is worth doing, that is why you will have a pr mess. and the people are probably right. why would we continue to invest in a resource that has shown scarcity and created political and military confrontations? history will show oil paved the way for energy use which was very transportable. but history will also show we have access to better forms of energy without the political and military baggage-and we are best to shift our efforts into those arenas.

Professor Hamilton,

As you are an expert econometrician, I am interested to know if you publish your GDP forecasts. As a hobbyist, I notice that a model using the relationship of d(gdp^.25) c ma(1) ma(2) with monthly data from 1947 forecasted a 3.1% SAAR GPD for 4th quarter 2013 and 2.9% for 1st quarter 2014.

Inventories. Drawdown and decelerating q-q and yoy real final sales per capita ahead.

Exports are not sustainable due to slowing of EMs.

Growth of shale extraction and exports has peaked. Global demand destruction ahead.

Money supply/deposits are contracting yoy after bank cash assets: Deflationary.

China’s largest credit and fixed investment bubble as a share of GDP in world history (excepting the Great Wall and Egyptian pyramids?) is deflating, not unlike the UK in the 1820s and the US in the 1930s.

Debt, asset, wage, and price deflation ahead.

Contracting real final sales per capita.

Demand destruction leading to falling oil/shale/kerogen extraction and price.

Growth of the global mass-consumer economy is over. Business-to-business sales of the Fortune 25-300 with sales/employee of $450,000-$1 million will outperform firms selling to the bottom 90-99% of households. Small businesses (employers of 80% of the workforce) cannot compete with $450,000-$1 million in revenues/employee. But the concentration of business-to-business sales of the Fortune 25-100 will mean mass-consolidation of capacity worldwide and accelerating automation of services employment (80% of US workforce) and the resulting loss of tens of millions of jobs and associated purchasing power.

Think Elysium.

Look out below.

Return “of” one’s money trumps return “on” one’s money. It’s 2008. Get liquid. Hunker down. Be safe.

Ongoing disinvestment out of liberalism debt trade investments, and currency carry trade investments in Transportation Stocks, XTN, as well as Global Industrial Producers, FXR, such as Boeing, BA, will be active factors of economic deflation, turning down the metrics of economic reports ,such as those reported by Scott Grannis in Truck tonnage rose 8% last year, and in the one you present here.

Much can be said of the Consumer Discretionary, XLY, with its loss leader Retail Stocks, XRT, as well — ongoing disinvestment out of these stocks will be active factors in economic deflation.

Said another way, the Tail Risk of Ben Bernanke’s money manager capitalism, is going to be a deflationary bust, the likes of which the world has never seen.

If you believe there is a bright future ahead, you are dreaming; please wake up, as you are dreaming, and fail to recognize the new normal, that being Jesus Christ has introduced the paradigm and age of authoritarianism, replacing that of liberalism.

Please consider reading As The Tide Of Liquidity From The World Central Banks Recede, We Will Soon See All Have Been Swimming Naked …. All Those In Euroland Will Be Given Swimsuits Of Diktat Money, That Is Garments Of Diktat Policies Of Regional Governance Which Are Woven In Schemes Of Totalitarian Collectivism.

http://tinyurl.com/lqr8um6

If the economy is gaining momentum (a good thing), why is the stock market not believing it? They employ smart economists, don’t they? They see the same data as Econbrowser does, they may even *read* this blog, too.

Hmmm. I think we need to work on semantics some. While a component such as government spending may add or subtract from GDP, that doesn’t really say whether it is a “drag” or “lift”. Government spending will add to GDP, but in many circumstances be a drag on other growth.

aaron,

True. Under some circumstances growth in government spending can be a drag on economic growth. But not when the economy is operating at the ZLB, when inflation is running well below the Fed’s target, when there’s a small army of unemployed and discouraged workers, and when the economy is operating with lots of slack and well below optimal output levels.