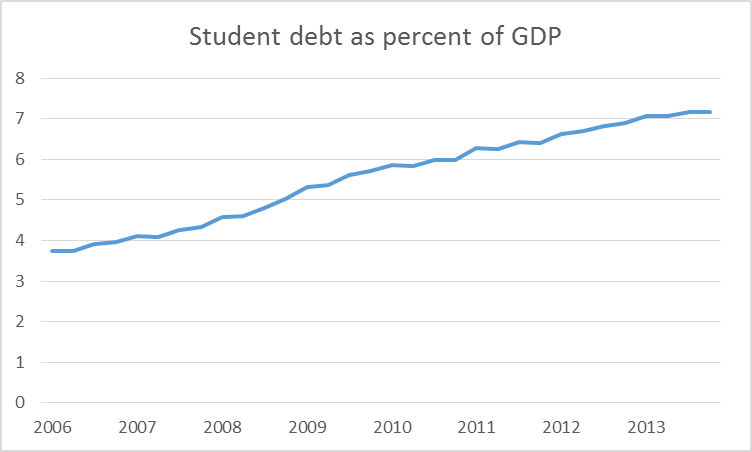

Mortgage and credit card debt today are lower than they were before the Great Recession. But the dollar value of outstanding student loans has surged, growing from 4% of GDP in 2007 to over 7% today.

Student debt (from Flow of Funds, Table L122) as a percent of U.S. GDP, 2006:Q2-2014:Q1.

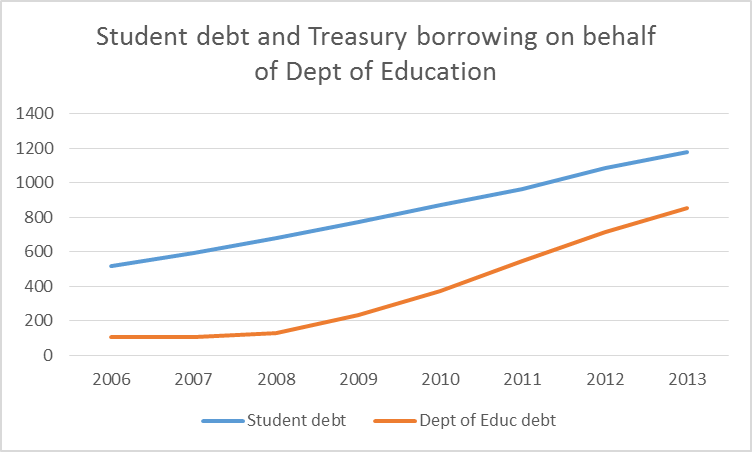

The facilitator has been the U.S. government. The U.S. Treasury earmarks part of its regular borrowing from the public for purposes of raising funds for the Department of Education, which in turn loans the funds to students. Growth in Treasury borrowing on behalf of the Education Department accounts for more than all of the increase in outstanding student debt.

Student debt (in blue, from Flow of Funds, Table L122) and borrowing by the Department of Education from the U.S. Treasury (tan), in billions of dollars as of the end of indicated fiscal year. Latter figures come from Hamilton (2013) with 2013 datum taken from Note 10 of Federal Student Aid 2013 Annual Report.

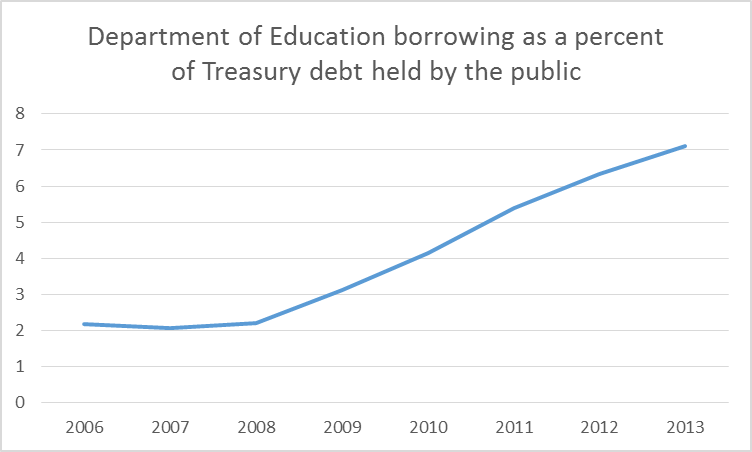

The outstanding balance borrowed by the Treasury on behalf of the Department of Education’s student loan programs comprises 7% of the $12 trillion in debt owed by the Treasury to the public as of the end of last fiscal year, and by itself accounts for 20% of the growth in Treasury debt during that fiscal year.

Department of Education borrowing as a percent of total Treasury debt held by the public as of the end of indicated fiscal year. Latter figures taken from Congressional Budget Office and December 2013 issue of Treasury Bulletin.

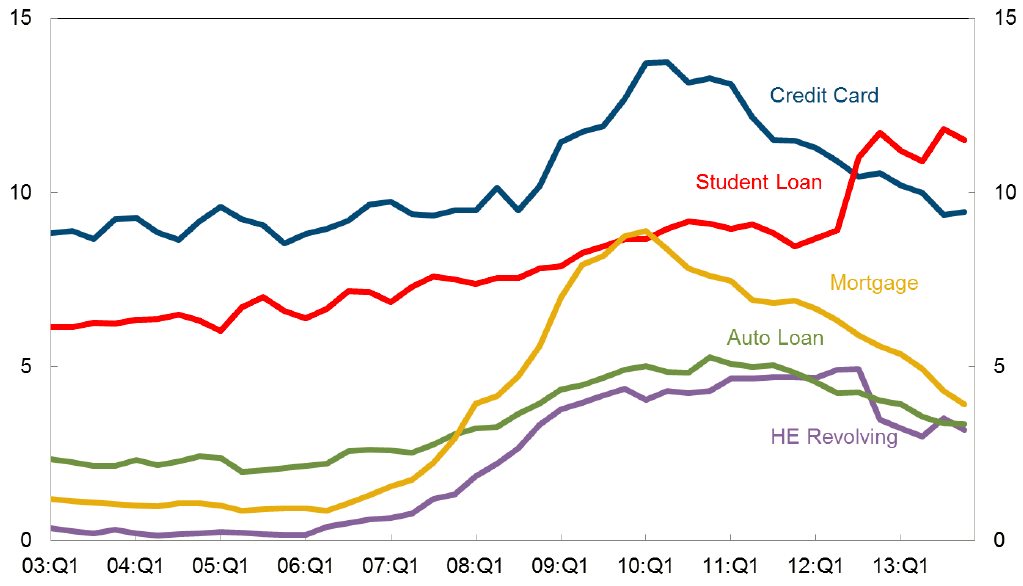

Student debt is also the fastest growing source of problem debt, with the highest delinquency rates of any form of household debt.

Percent of balance 90 or more days delinquent by loan type. Source: Federal Reserve Bank of New York.

Students were told that borrowing for their education was a way to get ahead, but now find themselves with high debt loads and no good job. Others have been using student loans as a way to get immediate cash with poor prospects for ever getting themselves out of debt. The core problem appears to come from for-profit colleges. These account for 13% of students in higher education but nearly a third of all student loans and half of all defaults.

The White House is finally beginning to address the problem. The Education Department announced on Friday a plan to deny federal loans to students at institutions for which the default rates exceed 30%. Sounds reasonable to me. But the Wall Street Journal reports this response to the proposal:

Steve Gunderson, head of the Association of Private Sector Colleges and Universities, the industry’s main trade group, called the latest approach plan an “ideological attack on the private sector’s role in preparing students in today’s workplace.” The group says many programs could be forced to close under the proposal because federal loans are their main source of funding. That, in turn, would cut off college access to many low-income and minority students, the schools contend. They add that many four-year public universities would fail the administration’s proposed standards if it applied to them.

Here’s the position of Education Secretary Arne Duncan:

Higher education should open up doors of opportunity, but students in these low-performing programs often end up worse off than before they enrolled: saddled by debt and with few– if any– options for a career. The proposed regulations address growing concerns about unaffordable levels of loan debt for students enrolled in these programs by targeting the lowest-performing programs, while shining a light on best practices and giving all programs an opportunity to improve.

I think the measures announced on Friday are long overdue.

This will be a very difficult problem because the ideology of the absolute supremacy of the private market has trouble understanding quasi-public markets like higher education. That is, like private prisons, which only at best appear to reduce costs – e.g., by taking only healthy prisoners and even returning ones who get sick – the private market is essentially an attachment to the public/non-profit market. It isn’t a real market but one in which private companies can extract as much as possible from the public. It is no surprise to me private colleges generate so much student debt because the business model depends on doing that and private companies are naturally going to be good at implementing their model.

This dialogue is woefully misinformed without the following:

http://www.studentloanjustice.org/defaults-making-money.html

Only when the perverted fiscal incentives driving the Department of Education are acknowledged and dealt with (returning standard bankruptcy protections is the obvious way to do this), will there be any hope of stabilizing the lending system, returning to rational pricing, and weeding out the bad schools as well as improving all schools, reducing indebtedness, and defaults.

Adam Smith himself is compelled to agree with this very obvious and simple proposition.

Jim –

The US private sector continues to deleverage. Do you have a view on when this will be completed, and also, what the impact of increased government debt may be on private sector attitudes towards deleveraging?

Thanks.

Partial reply to my own question:

http://soberlook.com/2014/03/whats-behind-sudden-improvement-in-us.html

Prof. Hamilton

Would you address the final point in the Gunderson from the WSJ; “They add that many four-year public universities would fail the administration’s proposed standards if it applied to them. ”

Is this true? And if so , why do you think it should not be applied to such, after all there is still another 50% of loans in default? And finally if so, does it still seem reasonable?

Ed

Some education rackets are more equal than others.

In my opinion, the major mistake we are making with higher eduction is Political Correctness run amok, i.e., the prevailing conventional wisdom that almost everyone should get at least a four year degree. Far too many students are taking on heavy student loans, only to never graduate, or if they do graduate, they frequently have degrees that are not of much use besides working at Starbucks.

In contrast, in Switzerland only about 30% of high school students are on an academic track. The other 70% are on a vocational track; they graduate with basic job skills, and they can then of course go on to higher levels of training.

Jeffrey Brown is right on target. This is a graphic showing the distribution of undergraduate degrees from the University of Michigan in 2013.

http://www.law.umich.edu/prospectivestudents/admissions/PublishingImages/2013/majors_13.jpg

Perhaps it is time for both parents and students to take a long, hard look at for what money is being spent. It might serve the Education Department as well rather than setting arbitrary “standards” that have no basis in logic or reality.

bruce, blame should really be placed on the student and parents. they are making the wrong choices. the school is simply offering the market some choices of major. why should the government need to oversee their decision making? talk about a nanny state mentality!

The Government shouldn’t interfere with students choices about education, but equally students should not expect that ongoing public subsidy of their choices are an inalienable right. As a taxpayer i strongly object to handing out funds where the probability of obtaining a usable degree is less than 67%.

But I could go further – whenever we choose to subsidise a particular activity, with little price signalling mechanisms involved, we should also not be surprised that the public chooses to greatly increase its consumption of that activity. The answer of course is not to provide even greater public subsidy, but to include some forms of price signals in higher education.

This does not mean stopping the student loans program, but better targeting it, and yes reducing its overall size.

I have no problem with for-profit involvement in higher education – and many state programs can do with the competition – but the quality of the product supplied needs to be comparable. And we need to have a serious discussion about the overall size of the higher education market (i.e. to what extent is it a luxury good that people should choose to pay full cost for).

That graphic shows the “Distribution of Undergraduate Majors within the Student Body”, hosted from the Law School prospective students page. It’s not the UM undergraduates, it’s what UM Law Students studied in Undergrad, which one should assume, slants heavily to Political Science, Economics, etc.

Actually, in the words of the UM Law School website:

“From what schools does the University of Michigan Law School accept students?

We accept students from a wide variety of undergraduate schools, with more than 250 distinct institutions represented in the student body. While the strength of an undergraduate institution is certainly a factor we consider in the admissions process, our commitment to maintaining the excellence of our student body does not limit the wide range of educational institutions from which our students hail. There most assuredly is no accredited school whose graduates we would be simply unwilling to admit. (And for the record, contrary to popular belief / persistent and intractable rumor, students who attended the University of Michigan for their undergraduate studies are not at any disadvantage over students from other schools. Go Blue!)

Now, we’re all about visual aids, so below are a couple of fancy charts to illustrate our point that we admit people from lots of different institutions.

First, this chart shows the distribution of undergraduate institutions within the student body—in other words, each piece of the pie represents the number of schools from which a certain number of people in the student body as a whole have graduated. There are about 140 schools where only one person attended, and that works out to about 51% of the total number of schools represented by the student body. And so on.”

http://www.law.umich.edu/prospectivestudents/admissions/pages/faq.aspx

So, I’ll refer you back to my first comment and let you draw your new conclusions.

bruce, what is your point? it is not clear what you are trying to say.

jeffrey,

you are correct. currently we have private sector colleges who are taking advantage of this situation. that is why obama is setting out some new rules to make sure the government loans do not essentially pay the colleges to provide the equivalent of an “apprenticeship” formerly common in the working world. business should do this as an investment in their employees. right now the businesses have offloaded the cost of an apprenticeship to the employees and by default, the government, through for profit institutions. student loans were not designed to fund this type of education.

Much of the debt will be forgiven or defaulted and just tacked on to the national debt.

Obama has already created a debt forgiveness program for “public service” which conveniently includes all government workers, where they pay a nominal amount for 10 years and then have their entire balance wiped clean.

Many private sector workers who don’t get that sweet insider deal will simply default unless inflation devalues the debt enough to make it serviceable.

varones, it is very difficult to default and eliminate college loans. these are not treated the same as regular loans-the liability is greater. the repayment of government sector workers is related to the fact the government needs people to perform these tasks. since we underpay these workers, some incentive is required to keep the pipeline open for new workers. you either create an incentive through debt forgiveness, or pay raises. are you willing to accept higher salary for government workers?

baffling,

it is very difficult to default and eliminate college loans. these are not treated the same as regular loans-the liability is greater.

No argument there. But when loans start to exceed $100,000 for a major in Grievance Studies, the issue isn’t willingness to pay. It’s capacity to pay. Blood from a stone.

the repayment of government sector workers is related to the fact the government needs people to perform these tasks. since we underpay these workers, some incentive is required to keep the pipeline open for new workers.

We underpay government workers? Really? Please consider Average Encinitas government worker makes $92,000, plus $36,000 in benefits. The days when we underpaid government workers are a distant past.

varones,

yes lets go to california or florida, high cost of living areas, and use that as representative data for overpayment of government workers. there are thousands of small cities in the midwest, mountain west and deep south who do not have this overpriced government worker. what about those folks?

and the point is really targeted toward federal workers and teachers, folks with degrees of value in the private sector such as engineers, chemists, physicists, accountants, etc. the government has a need for these types of workers, and if you cannot reasonably compete with the private sector, you get no workers or even worse lousy workers. that is why incentive programs exist.

That looks like cherrypicked data. It appears to include a lot of managers and engineers, as well as emergency worker overtime.

The dept of Ed is proposing to apply quantitative standards such as a debt-to-earnings ratio and a cohort default rate to determine if the student loans are really worth it. If the programs fail to get the students meaningfully better jobs relative to the debt they took on, then the loans may be denied to the students of those programs going forward. However, the rules seem to be aimed at for profit colleges and community college training programs. Why wouldn’t you apply the same rules to all colleges–both public and private universities? Why would they be exempt? Student’s who majored in English, or Classics, or Anthropology can graduate with a very large debt and no real job skills. Many students can get a degree in economics and then be working at the local coffee bar with a large debt. Why shouldn’t the rules apply in these cases too?

The student loans are a symptom of the real problem, which is that post-secondary education is much too expensive. Denying these loans to all colleges that don’t deliver value for the money would limit their ability to charge too much.

stryker,

the outcomes at these for profit institutions is far worse than the outcomes of public and private non-profit institutions. you should not really look at the “major” versus outcome, but the institution versus outcome. a large percentage of students at the for profit schools fail to achieve good outcomes-this is an institutional problem. finding a major within an institution which performs poorly is not the best way to evaluate the institution outcome. criticizing an English, Anthropology or Economics major is different from a culinary institute, or a technology institute. those latter programs are explicit in that the training in the program should directly lead to a successful career in that field. liberal arts degrees-such as english and the classics-do not make that claim. while i am not a fan of liberal arts education, there is long term value in those degrees compared to culinary degrees.

you also need to understand not all colleges and their students are equal. how do you compare outcomes for an undergraduate state college which primarily educates first generation inner city students with a research intensive private school? of course the small state school will fail the metrics in its comparison, but it also has students with much higher barriers to entry. if you are not careful, all you will do is make schools ignore high risk students-and this leads very easily to a rise in inequality between the haves and have nots.

Rick Stryker On the other hand, my guess is that students who majored in English, the Classics or Anthropology probably would have known that Charles the Simple and Hugh the Great were Frankish, not English.

Baffling is right. It’s the for profit “schools” that are responsible for suckering students into high debt. And which political party has resisted reforming these for profit schools? Go on, take a guess.

JDH I’m assuming that the NCCA bracket contest will be posted very soon?

2slugbaits: I’ll have it up tomorrow.

Rick, I agree. But, at the same time, it’s probably good to start small and then expand as we see what problems arise and tweak the program.

“post-secondary education is much too expensive”

Yes. It is. That is part of the problem.

The other part of the problem is a horrible labor market. If the labor market was better these companies looking down their nose at economics majors would suddenly notice the value in such students.

Obvious answer: tackle the cost of education, tackle the lack of good jobs (or the lack of all jobs for that matter).

Should most of the jobs exist due to the effects of accelerating automation of service sector employment, which is not altogether certain, 80%+ of future employment will not require a ridiculously overpriced four-year credential (“education”). Secondary schools should be “educating” and training the bottom 80-90% to be “job ready” for most of the employment of the remainder of the 21st century, which will most likely require (already does require) gov’t subsidy for medical insurance, housing, and food stamps.

Capitalism, as we know it, no longer creates net new full-time private sector subsistence employment after inflation, taxes, debt service, and “health care” costs for the bottom 90%. “Higher education” is now a net cost to this condition for the American working class.

“Capitalism” does not work for the bottom 90%, and increasingly in the future for the next 9% below the top 1%.

Might this be like any other bubble in which people begin to speculate on asset values continuing to rise? Perhaps some people have valued their education to highly.

While I have met many parents who argue that we should be sending more children to vocational schools, of those, I have not met a single one who has sent their own children to vocational school. It seems they only mean other people’s children.

It might be interesting to take a poll of the views of parents–who have fully or partially funded the educations for their adult children–and who now have adult children living at home again, after graduating from college.

http://online.wsj.com/news/articles/SB10001424052702304617404579304913308674896

Can’t Find Skilled Workers? Start an Apprentice Program

In Switzerland, 70% of young people age 15-19 are training for hundreds of occupations. Among German youth: 65%.

Sounds like a good rule to me, but it should be an even lower percentage,. 30% default is still way too high. I work in public higher education, at a school which has many poorer students , so take this either as self-serving or having actual knowledge on the topic. At most places like mine, the tuition is very low, and many live at home. So there simply cannot be much debt to default on, as there are limits on how much can be borrowed. This level of national debt can only be possible at private school, where tuition is much much higher. There should be a much tighter leash…

baffling

“why should the government need to oversee their decision making? talk about a nanny state mentality!”

For once we agree. The govt should stop guaranteeing loans and get out of education financing all together.

anonymous,

our agreement only goes so far. government has a role in funding higher education. students (and parents) should be more responsible for their education and performance. simply providing metrics on post graduate performance should be enough to allow students to make informed market decisions. pulling federal funding for higher education simply leaves us a future with less education and more inequality.

Steven Kopits

March 16, 2014 at 12:46 pm

Jim –

The US private sector continues to deleverage.

WUT?

http://research.stlouisfed.org/fred2/series/TOTALSL/

http://research.stlouisfed.org/fred2/series/TCMDO

Sorry, Anon. My bad.

I thought Jim’s charts above were totals, when in fact it’s only delinquent accounts.

baffling,

baffling

March 16, 2014 at 4:40 pm

jeffrey,

you are correct. currently we have private sector colleges who are taking advantage of this situation

It’s not just private sector colleges taking advantage of this situation. Public schools are wildly overpriced as well. It’s just that the type of kid that attends public university is much more likely to succeed than the type who gets duped into attending UPhoenix online. Don’t let public schools off the hook just because they wind up with brighter students.

anonymous,

“Public schools are wildly overpriced as well. ”

can you justify this statement?

tuition at public schools has risen in response to states cutting back significantly on higher education funding. there is a price to pay to keep top level phd’s employed at a university-particularly a research university. these folks don’t work for free. and they produce enormous benefits to their society. not only in the direct outcome of their research through spinoff companies and advanced technology. but they are training the next generation of scientists, engineers and thinkers. you think that is cheap? if it is so cheap, why has private enterprise essentially abdicated the responsibility of training its employees for the future? it’s expensive and hard to justify on yearly ledgers-but it is required long term.

“tuition at public schools has risen in response to states cutting back significantly on higher education funding.”

Can you justify this statement? I have heard it a lot, but would love to know how the numbers work out exactly, what with my state school alma mater building all kinds of upscale facilities on their campus.

My father is a veterinarian. He says that currently, there are something like 100,000 veterinarians in the country, yet there is only demand for about 85,000 (he mentioned this was in a professional publication, so the actual numbers might be off, but the general idea is the same). Even in the face of this reality, veterinary schools are INCREASING enrollment. Talking with a friend of mine who is a research professor at the local university, she indicates that the vet college is currently having ethical discussions about admitting so many students, when the professors KNOW that most of these students will amass staggering amounts of debt and not be able to attain a job in the profession. The large amount of graduates increases competition and reduces compensation for the lucky ones that do land jobs.

One person’s nanny state is another person’s predatory lendor, that in my opinion are lending vast sums of money to what amounts to 18 year old women (not trying to be sexist, just that most veterinary students nowadays are women) who are simply following their life long dream of becoming an animal doctor who works primarily with horses. This is exactly what happened in the housing bubble . . . there are no underwriting standards being imposed on student loans.

river,

you can google the topic and find a hundred sources showing the decline in higher education funding:

http://www.usatoday.com/story/money/personalfinance/2013/09/02/state-funding-declines-raise-tuition/2707837/

operating costs do not drop just because state funding is pulled back. the other direct source of revenue is tuition. hence the rise at a rate above inflation. previously tuition at state schools was subsidized. now people are paying the increased unsubsidized rate plus inflation. you want cuts in state taxes, fine. but if you have kids in college you will pay the price there.

How about this link: http://centerforcollegeaffordability.org/research/studies/who-subsidizes-whom

You are looking at one small piece of the funding puzzle, and saying that since the state is dropping their funding, the student must pay more. Yet, the overall actual cost to provide the education is going up faster than inflation (at least that is my understanding), and I believe that colleges are using the no taxes crowd to basically cover their tracks.

Finally, your government funding per student figures don’t take into account what happens to government funding when the number of students go up . . . the state funding may actually stay the same on a nominal amount.

river,

here is a graph that shows both appropriations per student and total. They have both dropped while enrollment has risen. Thus schools have had mores students to teach with less funds each year, total and per student. Not too much ambiguity in the data.

“You are looking at one small piece of the funding puzzle, and saying that since the state is dropping their funding, the student must pay more.”

This is patently false. Tuition and state support at a state university are significant pieces of the funding puzzle. I don’t think you fully understand the mission of a public university, especially a research university. Research is critical to the mission, and this does cost money. A university which does not have a research component is stagnant and lagging, meaning it does not contribute to the creation of new knowledge. This is what separates a high school education from a college education.

link to graph mentioned above

http://trends.collegeboard.org/college-pricing/figures-tables/total-and-fte-student-state-appropriations-and-public-enrollment-over-time

XO

March 16, 2014 at 9:46 pm

Sounds like a good rule to me, but it should be an even lower percentage,. 30% default is still way too high.

CR and 180

I didn’t note who wrote this post before I read it, but as soon as I saw “govt is facilitating this” I knew it was a Hamilton post. Menzie would never speak ill of our benevolent Govt.

Bill Black needs to write another book about how to rob from the government – start a private college or prison.

The CFPB is getting in on the action as well. Their recent complaint against ITT tech makes for a surprisingly compelling read:

http://www.consumerfinance.gov/newsroom/cfpb-sues-for-profit-college-chain-itt-for-predatory-lending/

Many thanks for these interesting graphs. I am asking myself two very basic questions:

– Why are student loans increasing? Are there more students or is education simply more expensive?

– Has education become better?

JDH,

I thought about this a bit more and although I think these measures make sense as you do, I’m concerned about the manner in which they are being applied.

The problem I have with this is that the Administration is legislating by executive fiat rather than going to Congress as they should, and therefore, not unsurprisingly, the rules are being applied unfairly. The proposed standards apply only to for-profit “proprietary” programs and not to non-profit public and private degree granting schools. The Administration is going farther than just denying loans to schools that have a default rate greater than 30%. They are also setting up credit ratios for lending to students, but only if the students attend proprietary programs. These ratios are student debt-to-income limits of 20% of disposable income and 8% of total income. Thus, proprietary programs will have to project and measure income of graduates and report ratios to the government. In addition, the proprietary programs have new reporting requirements to the Secretary of Education on how well their programs perform. Non-profit public and private schools will not have any of these requirements.

Non-profit public and private colleges and Universities are an important constituency of the Democratic party. This proposed executive order protects them from competition from existing proprietary programs. But more importantly, it protects them from the many entrepreneurs who are busy trying to figure out how to deliver high quality college eduction much more cheaply.

The executive branch should not be using executive orders to legislate on behalf of their political constituencies. Yes, student loans should be reformed but Congress should do it. Allowing the executive branch to legislate by executive order sets a very bad precedent if we want to live under a rule of law rather than of men.

rick,

you are more concerned with finding ways to complain about the obama administration than actually solving the problem.

“This proposed executive order protects them from competition from existing proprietary programs. But more importantly, it protects them from the many entrepreneurs who are busy trying to figure out how to deliver high quality college eduction much more cheaply.”

these new rules are not meant to protect nonprofit schools from competition. they are meant to protect taxpayer backed student loans from going directly into the profit of the for profit schools. the schools are required to meet performance metrics so that for profit schools cannot simply line their pockets with tuition paid for by government backed loans, and pass that profit on to the shareholders and/or owners.

i think you need to educate yourself on exactly how noble these “entrepeneurs” are that you believe are looking to deliver high quality college education. many of them are trading dollars for credit hours-nothing more nothing less. that is not a high quality college education. i would think somebody like yourself would certainly be against the use of taxpayer backed loans to support such an operation.

‘Students were told that borrowing for their education was a way to get ahead, but now find themselves with high debt loads and no good job. ‘

Finally, someone comes up with a legitimate example of predatory lending.

baffling,

as one example of the countless, if you think attending UC Berkeley Law school and paying $300K for the privledge, you sir, are mentally ill.

Also, while I have a masters degree that is relevant to my job, I could do my job without my degree. Most higher education does not provide the value it costs.

anonymous,

in response to your snide remark i can say i am not at all interested in paying for a law degree. but i must say your statement is very strange.

So you agree or disagree that a Law degree from the public university Berkeley is over priced?

it is disingenuous to try to make me state one way or the other. A berkeley law degree is very prestigious, and it also comes with an extremely competent and quality educational experience. i am sure most graduates feel the price was worth the result. i have no need or desire for a law degree, so even if you offered it for free i would not spend the time to obtain one. for somebody else with the dream of a career in law, i would think they would feel differently. so both of us seem to agree we do not want a law degree. that perspective does not mean berkeley is overpriced, it simply means we are not interested in that product at any price. but compare that with a graduate from a culinary institute, or from an online university. can you say they received an extremely competent and quality educational experience? at this time there really is no comparison between the quality of these online for profit programs and the vast majority of accredited nonprofit schools.

Might be a good idea to look at some facts here. The linked article in the post refers to denying loans to for-profit schools with a default rate greater than 30%. But the administration is actually saying that they will do that if the default rate is above 30% for 3 years. How many such schools are there? How many students would be affected? What kind of schools are they? Of course this policy is designed to look like the Administration is tackling a major problem, but how many for-profit schools have default rates greater than 30% for 2009, 2010, and 2011, the years for which there is data? Zero. That’s right, zero.

Below, I’ve reproduced the data for 2011. As you can see, we are talking about mostly beauty and barber schools plus a few others thrown in plus a small number of students potentially affected. Sorry for the formatting, but I’ve listed the number of borrowers, the number of defaulters, and the default rate. No school yet satisfies the criteria of 3 consecutive years of default rates greater than 30%.

Again, what the Administration is actually doing by executive fiat is proposing to attach credit scores to student borrowers, but only if they attend a for profit school. If you look at the data, you can find plenty of public and private non-profit schools with relatively high default rates, but these schools will not be regulated. This policy is not about protecting the tax payer or the students.

School # Defaulted # Borrowers Default Rate

Henri’s School of Hair Design 17 39 44%

Florida Barber Academy 154 362 43%

Appalachian Beauty School 1 3 33%

Southeastern Beauty Schools 19 49 39%

Borner’s Barber College 9 17 53%

Pennsylvania School Of Business 178 476 37%

L T International Beauty School 27 73 37%

Mims Classic Beauty College 1 3 33%

American Commercial College 159 437 36%

Valley Beauty School 14 39 36%

Profile Institute of Barber-Styling 9 24 38%

Pace Institute 63 177 36%

New Age Training 2 3 67%

Cosmetology School of Arts and Sciences 12 34 35%

Northwest Health Careers 67 190 35%

Scott College of Cosmetology 13 38 34%

RWM Fiber Optics 10 30 33%

Total Image Beauty Academy 4 12 33%

CC’s Cosmetology College 49 147 33%

Memphis Institute of Barbering 35 105 33%

Mai-trix Beauty College 1 3 33%

Centura College 20 60 33%

New Life Business Institute 60 181 33%

Teterboro School of Aeronautics 26 79 33%

Career College of San Diego 54 165 33%

Cut Beauty School (The) 19 58 33%

Academy of Healing Arts, Massage & Facial Skin Care 33 103 32%

American Commercial College 58 183 32%

Louisiana Academy of Beauty 12 38 32%

Health and Style Institute 10 28 36%

Paul Mitchell The School Huntsville 10 32 31%

Travel Institute of the Pacific 18 58 31%

Tint School of Makeup & Cosmetology 25 81 31%

Lawton Career Institute 20 65 31%

Arizona Automotive Institute 367 1197 31%

Palladium Technical Academy 34 112 30%

Southwest School of Business & Technical Careers 142 468 30%

Virgil’s Beauty College 2 4 50%

rick,

are you for or against wasting government backed educational loans? i for one am not interested in having educational loans spent on beauty school. this is an apprentice program, not a college education. you should be happy steps are being taken to reduce this kind of waste. within a couple of years those programs will no longer be wasting college loan funds. or would you rather we keep sending money to those institutions? you complain too much!

http://online.wsj.com/news/articles/SB10001424052702304585004579415022664472930

Student Loans Entice Borrowers More for Cash Than a Degree

Low-Cost Debt Proves a Draw for Some Caught Up in Weak Job Market

Excerpt:

Re: WSJ article on using student loans for living expenses, I just realized that the WSJ link is posted in the article.

This dialogue is woefully misinformed without the following:

http://www.studentloanjustice.org/defaults-making-money.html

Only when the perverted fiscal incentives driving the Department of Education are acknowledged and dealt with (returning standard bankruptcy protections is the obvious way to do this), will there be any hope of stabilizing the lending system, returning to rational pricing, and weeding out the bad schools as well as improving all schools, reducing indebtedness, and defaults.

Adam Smith himself is compelled to agree with this very obvious and simple proposition.

I think a good cost benefit analysis should consider a few elements not explicitly brought out above. First, the cost from defaulting students is not the only taxpayer cost of higher education, and is not even the full cost to the federal government: the full cost to taxpayers includes state payments to the public schools and the tax revenue foregone on charitable contributions to public and not-for-profit schools. Secondly, the student loan program has increased demand and so allowed all post-high school educators to increase prices, similar to the effect of Medicare on the price of healthcare. The effect on cost for a degree from a public or non-profit institutions would be greater without competition from for-profits. Finally, for-profits may be cutting into the AMA monopoly on the supply of medical doctors, in my view one of the sorriest examples of taxpayer ripoff, as it increases the cost of Medicare and Medicaid programs.

I’d be curious to see evidence that increasing the numbers of physicians reduces billings. From what I’ve seen, an increase in physicians (and dentists) above the level of “need” just increases the level of “imaginative” billing for services that are of marginal value (e.g., cosmetic procedures).

Well, I suppose there are two separate effects – remuneration per doctor and total remuneration. But I would favor expanding medical services by expanding supply, rather than by increasing government subsidies in order to increase the demand.

I wonder if there’s good research on whether the US needs more doctors. My observation is that most doctors are over treating a lot of things: too many prescriptions, too many surgeries, etc. If they had more real patients, they wouldn’t have to over treat the ones they have in order to bill enough to afford the lifestyle to which they’ve become accustomed.

Personally, I’d like to see an enormous expansion of medical research, to give doctors better tools to work with. Right now the National Institutes of Health are funding only 17% of research grant applications: they don’t have nearly enough money. It’s a tragedy.

don,

“Well, I suppose there are two separate effects – remuneration per doctor and total remuneration. ”

the problem is you patently state a problem and a solution. then you honestly state that you really don’t know what the problem is-hence your fix is unsubstantiated except by your gut feeling you “favor” one solution over the other. we need to get out of the habit of just “knowing” what the problem and answer is, because usually this is directly related to our own personal and political ideology. let’s simply do some good research and get an answer to the question-then propose the solution. we too often already have a preferred “solution” and simply look for a “problem” to apply it to.

This post links to a Department of Education release that claims that most of the problem in student loans is with for profit colleges. Of course, it’s not true. In fact, the majority of the for profit institutions that have 2011 default rates between 15 and 30 percent (I listed the schools above 30% in 2011 in my comment above) are just trade schools for people who are trying to get marketable job skills without having to attend college: they are beauty and cosmetology schools, auto and aviation mechanics schools, schools for administrative assistants, schools for medical billing assistants, etc.

The administration wants us to think of the for profit colleges like the University of Phoenix in their misleading Dept of Education report.. Here’s what the Dept of Education does not explain. The University of Phoenix, which offers undergraduate and graduate programs, had a student loan default rate of 14.3% in 2011. But Youngstown State University, which also offers undergraduate and graduate degrees and is a public university in Ohio, had a student loan default rate of 14.1% in 2011. Why regulate the for profit college and not the public college?

More to the point, why is the Administration planning to regulate schools which mostly provide trade school training but not schools that provide college degrees?

So let’s say I’m a guy that didn’t like high school and doesn’t want to go to college. But I want a better job than the minimum wage job the Administration and Menzie thinks I’ll be happy with (if I’m lucky enough not to be one of the people fired as a result of the Administration’s minimum wage policy.) I could go to trade school and become an auto mechanic. Or I could learn welding or become an electrician or plumber. Or I could go to barber or hairdressing school. Or I could get into medical billing.

Now, these programs might cost between 15 – 30K total. If I want to get a student loan, the Administration is going to put a credit score requirement on me and the training school will have to demonstrate that I’ll make enough money to pay back the student loan after graduation or I can’t get the loan. The training school will also have to report to the Dept of Education on how its programs add value. But if I decide to attend a completely non-selective public or private college and major in anthropology, there will be no credit score placed on me if I want a student loan. And the college will have no reporting requirements.

Does this really make sense?

This is more bad, discriminatory regulation. It reminds me of the military draft policy before 1971 that would allow a person to defer going to Vietnam if he was attending a college or University. If you were an auto mechanic or other blue collar worker back then you had to go fight and maybe be maimed or killed but if you were in college you could be deferred. Now, if you want to be an auto mechanic or a hair stylist you need to prove to the Ivy League graduates in the Administration you will make enough to justify the student loan but if you are going to college you don’t need to prove anything.

stryker,

your example is a perfect illustration why the rules are different. so you know anything about youngstown state and the surrounding communities? this school serves an economically deteriorated community. conditions for jobs, secondary education and housing are terrible in the youngstown area. the university serves a purpose of providing higher educational opportunities to a community of people who do not have much otherwise. these are high risk people, and i think it goes without saying they are going to have a higher than normal rate of default on loans.

“More to the point, why is the Administration planning to regulate schools which mostly provide trade school training but not schools that provide college degrees?”

because trade schools are not higher education. if this is what you advocate, then create a separate program whose purpose is to fund the trade schools. they are different institutions with different missions-they should not be lumped together. but don’t use the excuse of trade schools to try and defund higher education. you complain too much instead of providing solutions!

Seems I can’t post anymore. Blackballed?

We also need to clearly differentiate the student loan default issue from the problem of growing student indebtedness. Student loan indebtedness is largely a reflection of the large college cost inflation rate. The data shows that tuition and fees at public universities has been growing at about a 4% annual rate after correcting for inflation since 1983, for example. Total cost (including room and board) growth rate after inflation for public universities has actually accelerated from 2.3% in the 80s to 3.2% in the last decade.

A college education simply costs too much and the administration student loan policy is doing nothing to address this. Instead, they are making it more difficult for blue collar workers to get training.

JDH,

As a side note, the captcha comment system fails intermittently. I’m sure others are having this problem. Occasionally, I have posted “captcha iterate” in another post to iterate the comment system numbers so that I can get a captcha that works. I just posted “captcha iterate” in Crimes and Punishments.

RS: “Total cost (including room and board) growth rate after inflation for public universities has actually accelerated from 2.3% in the 80s to 3.2% in the last decade.”

My guess – this change is directly related to federal student loans programs that serve to increase the demand for education. Part of the effect is wasted on rents to educators, but I am egalitarian enough to think that the student loan program nevertheless is a good idea – probably more efficient than guaranteed college to qualified students, which has some of the efficiency disadvantages of gifts in kind.

During times of high involuntary unemployment, the opportunity cost of time spent investing in future productivity is low. If expectations for future employment are mistakenly based on past experience (much like the stupid forecasters using post-war data to forecast future economic performance, failing to realize the fundamental change in underlying conditions), there could be a lot of waste in the program. The taxpayer costs of defaults on student loans are only a part of the complete picture. For example, the program would still be better than a Keynesian program of digging holes and refilling them to spur aggregate demand and it reduces the psychic costs of unemployment. On the other hand, if the investment does not prove worthwhile, the investor may find herself saddled with a large unpayable debt, which would have its own psychic costs, so it might be a good idea to see if it is possible to develop some debt forgiveness standards that prevent this latter cost without creating too much moral hazard. (I know – sounds impossible on its face. But recall how census takers were able to get data on illegal behavior by cleverly fashioning a procedure that allowed respondents to provide data on the behavior without admitting to any illegal activity?) Finally, there might be non-pecuniary benefits to higher education (expanded horizons, benefits to society that cannot be internalized by the student), whereas an education in a defunct skill may leave little to be salvaged. This might give grounds for greater subsidies to formal higher education than to trade schools.