From Chapter 4 of the IMF’s World Economic Outlook, released today:

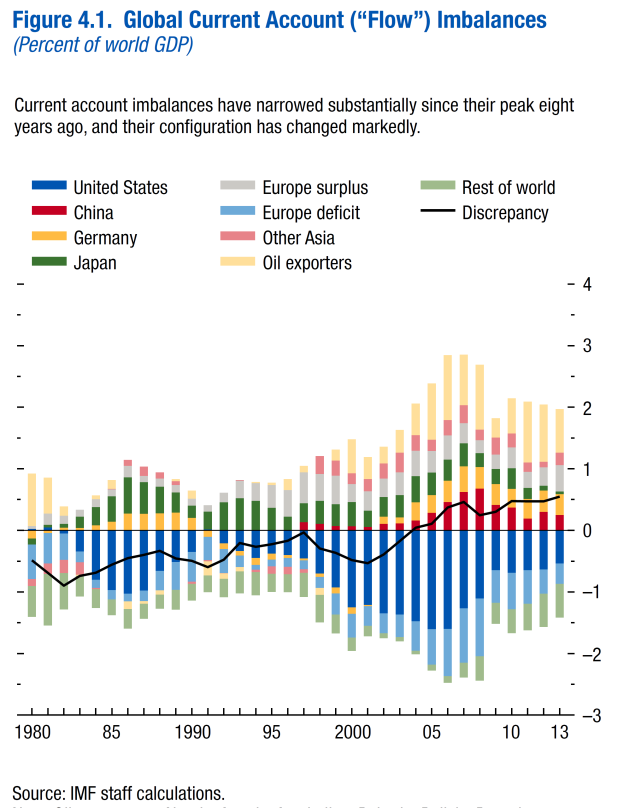

Global current account (“flow”) imbalances have narrowed significantly since their peak in 2006, and their configuration has changed markedly in the process. The imbalances that used to be the main concern—the large deficit in the United States and surpluses in China and Japan—have more than halved. But some surpluses, especially those in some European economies and oil exporters, remain large, and those in some advanced commodity exporters and major emerging market economies have since moved to deficit.

This chapter argues that the reduction of large flow imbalances has diminished systemic risks to the global economy. Nevertheless, two concerns remain. First, the nature of the flow adjustment—mostly driven by demand compression in deficit economies or growth differentials related to the faster recovery of emerging market economies and commodity exporters after the Great Recession—has meant that in many economies, narrower external imbalances have come at the cost of increased internal imbalances (high unemployment and large output gaps). The contraction in these external imbalances is expected to last as the decrease in output due to lowered demand has likely been matched by a decrease in potential output. However, there is some uncertainty about the latter, and there is the risk that flow imbalances will widen again. Second, since flow imbalances have shrunk but not reversed, net creditor and debtor positions (“stock imbalances”) have widened further. In addition, weak growth has contributed to increases in the ratio of net external liabilities to GDP in some debtor economies. These two factors make some of these economies more vulnerable to changes in market sentiment. To mitigate these risks, debtor economies will ultimately need to improve their current account balances

and strengthen growth performance. Stronger external demand and more expenditure switching (from foreign to domestic goods and services) would help on both accounts. Policy measures to achieve both stronger and more balanced growth in the major economies, including in surplus economies with available policy space, would also be beneficial.

The chapter was coauthored by Aqib Aslam, Samya Beidas-Strom, Marco Terrones (team leader), and Juan Yépez Albornoz, with support from Gavin Asdorian, Mitko Grigorov, and Hong Yang, and with contributions from Vladimir Klyuev and Joong Shik Kang.

For as assessment of global imbalances — causes and prospects — by me and Barry Eichengreen and Hiro Ito, see this post.

“narrower external imbalances have come at the cost of increased internal imbalances (high unemployment and large output gaps). The contraction in these external imbalances is expected to last as the decrease in output due to lowered demand has likely been matched by a decrease in potential output. ”

Are you kidding me? This is the supply-constrained oil thesis writ large. At the IAEE meeting, I was telling Jim that I felt that the current account was likely the disciplining lever on economic growth, ie, that much higher oil prices would have to be offset by either increased exports of other goods or services (or import substitution, as proved the case in the US), or decreased levels of economic activity. That’s how I read the passage above.

By the way, here’s my latest take on global oil markets: http://www.prienga.com/blog/2014/10/1/a-supply-constrained-view-of-the-production-surge

Ludwig von Mises HUMAN ACTION

In their blind zeal to please the governments and the powerful pressure groups of unionized labor and farming, they overstated tremendously the case of flexible parities. But the drawbacks of standard flexibility became manifest very soon. The enthusiasm for devaluation vanished quickly. In the years of the second World War, hardly more than a decade after the day when Great Britain had set the pattern for the flexible standard, even Lord Keynes and his adepts discovered that stability of foreign exchange rates has its merits. One of the avowed objectives of the International Monetary Fund is to stabilize foreign exchange rates.

If one looks at devaluation not with the eyes of an apologist of government and union policies, but with the eyes of an economist, one must first of all stress the point that all its alleged blessings are temporary only. Moreover, they depend on the condition that only one country devalues while the other countries abstain from devaluing their own currencies. If the other countries devalue in the same proportion, no changes in foreign trade appear. If they devalue to a greater extent, all these transitory blessings, whatever they may be, favor them exclusively. A general acceptance of the principles of the flexible standard must therefore result in a race between the nations to outbid one another. At the end of this competition is the complete destruction of all nations’ monetary systems.

The much talked about advantages which devaluation secures in foreign trade and tourism, are entirely due to the fact that the adjustment of domestic prices and wage rates to the state of affairs created by devaluation requires some time. As long as this adjustment process is not yet completed, exporting is encouraged and importing is discouraged. However, this merely means that in this interval the citizens of the devaluating country are getting less for what they are selling abroad and paying more for what they are buying abroad; concomitantly they must restrict their consumption. This effect may appear as a boon in the opinion of those for whom the balance of trade is the yardstick of a nation’s welfare. In plain language it is to be described in this way: The British citizen must export more British goods in order to buy that quantity of tea which he received before the devaluation for a smaller quantity of exported British goods.

In the late 1980s and early 1990s he used the price of gold to determine the quantity of the dollar and kept the price of gold the most stable it had been since Bretton Woods, but in the mid-1990s he ignored the signal that gold was sending that the economy was moving into deflation. The price of gold fell almost 50% from when he took over at the FED. He has decided the “Greenspan” standard was better than the “gold” standard. This was a signifcant reason for the 2000 recession.

Alan Greenspan in Foreign Affairs once again becomes the friend of gold but even in the quote below Greenspan does not understand the gold standard.

“…gold has special properties that no other currency, with the possible exception of silver, can claim. For more than two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II was drawing to a close. Today, the acceptance of fiat money — currency not backed by an asset of intrinsic value — rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold.”

@Steven Kopits, How do you feel about OPEC under the present scenario? Their targets have remained unchanged since 2012. You think they would announce production cuts at their forthcoming meeting?

I am not an expert on OPEC. However, the Saudis claim to have cut 400 kbpd in August; I would anticipate some modest additionally cutting, looking to get Brent back into the $100 range.

Oil is less of a constraint on growth than some people believe.

When oil prices rise, supply, technology, efficiency, and conservation increase, to lower oil prices.

Also, U.S. production has become lighter, e.g. through more services and high tech.

The energy savings on the production side was shifted to the consumption side, e.g. bigger houses and autos.

Dead wrong, Peak.

By the way, in 2014, the US is on pace for the most jobs added since 1998.

Beat McBride by 6 minutes.

Steven Kopits, reality contradicts your conclusion about oil.

The global economy has been expanding and oil prices haven’t been rising.

If we had a V-shaped recovery, oil prices would rise and then fall.

Peak –

Take a look at my latest oil markets review, here: http://www.prienga.com/blog/2014/10/1/a-supply-constrained-view-of-the-production-surge

It’s a nice overview of the current state of play using a supply-constrained approach.

Prices are depressed because of astounding NA supply growth, coupled with the effects of Russia on Europe, and a waivering China that’s about to enter either a period of significant repression or a huge step forward towards a more sophisticated level of governance. (I am more optimistic about China now than at any time in the last year–I am scheduled to be presenting there in November.) By the way, if you’re tracking European numbers, expect some upside surprises. German consumers, Ireland and Estonia–all looking good. Never underestimate the idiocy of the Russians, but if oil prices stay low, you’ll see some horsepower from across the pond, too. (And keep in mind, the US consumer is likely to become more interested in importing stuff from Europe; that’s where we’ll squander our improving current account balances.)

Meanwhile, the oil majors are in real trouble. Statoil just announced another 500 layoffs yesterday. On graph 3, you can clearly see the impact of a peaking conventional supply: oil prices go up, cash flow goes up, oil prices reach the carrying capacity levels, E&P costs continue to go up, and oil majors free cash flow goes straight to hell. It illustrates the supply-constrained dynamic: once you’re at carrying capacity, marginal costs have to come to price, not vice versa.

In any event, read the piece, and then comment.

Initial unemployment claims are about the best we’ve seen since 2000.

Got oil. Got GDP.

Fuel economy is down sharply: Sivak.

http://www.umich.edu/~umtriswt/EDI_sales-weighted-mpg.html