The Department of Revenue’s Wisconsin Economic Outlook, released last week, details a noticeable deterioration in forecasted economic performance, in just the past eight months.

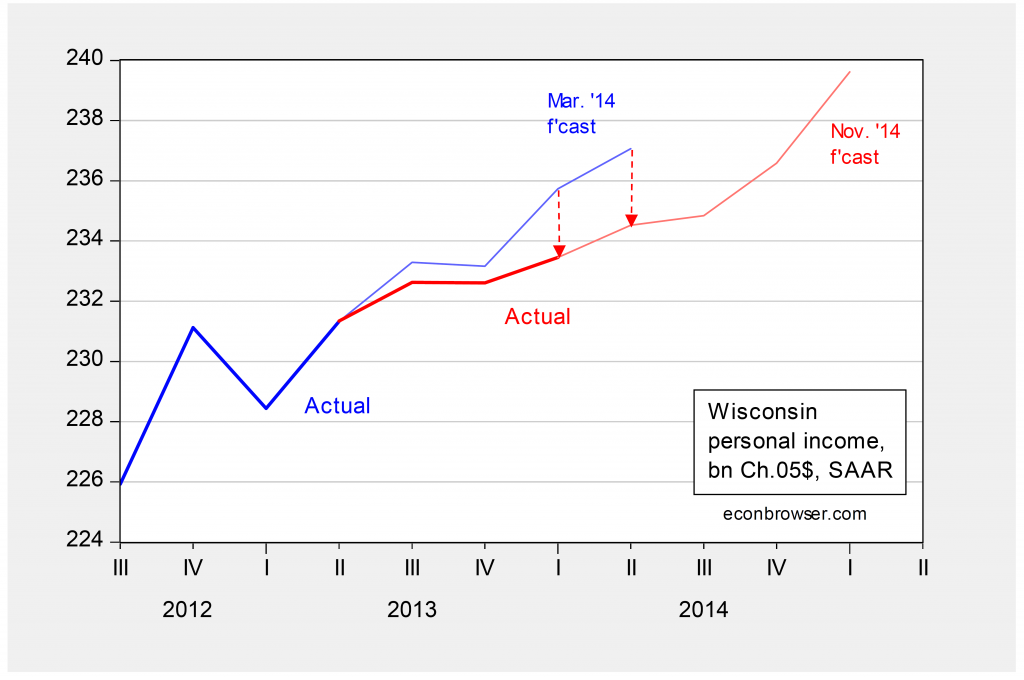

Figure 1: Real personal income (bn Ch.05$, SAAR) (thick blue, thick red), and forecast from March 2014 (Winter 2014 issue) (light blue), and November 2014 (Fall 2014 issue) (light red). Source: Wisconsin Economic Outlook, Winter 2014 and Fall 2014 issues.

2014Q1 personal income was 1% less (in log terms) than the March 2014 forecast. The forecast for 2014Q2 was revised downward by 1.1%. Interestingly, the report forecasts an acceleration to 5% SAAR growth in 2015Q1 (with nominal personal income forecast to growth 6.4%). About 44% of the increase in forecasted 2015Q1 nominal personal income growth is attributable to a nearly 17% growth rate (q/q annualized rate) in personal current transfer receipts. I do not know the basis for that forecast.

For a discussion of the employment outlook, see this post.

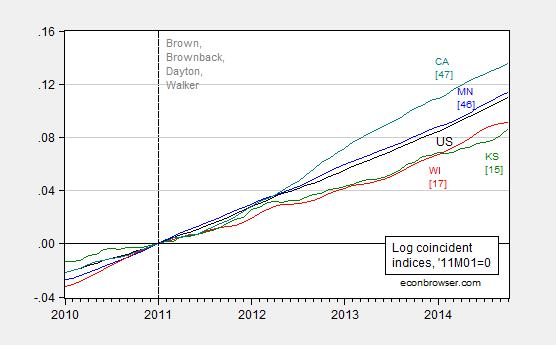

The mark down in prospects makes sense once one sees the trajectory of Wisconsin economic activity, as measured by the Philadelphia Fed’s coincident indices (October figures released today):

Figure 2: Log coincident indices for Minnesota (blue), Wisconsin (red), Kansas (green), California (teal), and United States (black), all seasonally adjusted, normalized to 2011M01=0. Numbers in [square brackets] are ALEC-Laffer rankings from Rich States, Poor States 2014. Vertical dashed line at beginning of Brown, Brownback, Dayton and Walker administrations. Source: Philadelphia Fed, ALEC RSPS2014, and author’s calculations.

According to this measure, the cumulative growth gap between Wisconsin and the US (and Minnesota) is again widening.

The ramifications of the downgrade in economic outlook are clear. From Jon Peacock/Wisconsin Budget Blog:

State officials confirmed today what we have feared for many months – that Wisconsin’s spending needs in the next biennium far exceed the projected revenue, and the state must also close a very substantial budget hole in the current fiscal year. As a result, lawmakers are likely to make cuts that have harmful consequences for Wisconsin children and families and for the investments needed to keep Wisconsin economically competitive.

Despite the assurances of Walker administration officials over the last couple of months that the state is in strong fiscal shape, the figures contained in a report released by the Department of Administration (DOA) today confirm that balancing the state budget in 2015-17 will require very deep spending cuts or significant tax increases. Specifically, the DOA document reveals the following:

- Tax revenue for the current fiscal year is now expected to be $82 million below the amount estimated in May (on top of a $281 million tax shortfall in the first half of the biennium), and net appropriations are estimated to be $43 million less.

- The state is on track to have a “net balance” of -$197 million at the end of this biennium, which means that significant cuts or transfers will have to be made to get the budget back into balance by June 2015 (and to preserve a required $65 million budget balance).

- The agency budget requests, which generally followed the Governor’s instructions for just maintaining existing programs, exceed the anticipated General Purpose Revenue (GPR) by $2.2 billion during the 2015-15 biennium (assuming the state does carry over a $65 million balance).

- The total gap between requested GPR spending and anticipated revenue is about $2.4 billion between now and June 2017, and that doesn’t account for various spending needs that are calculated later in the process (e.g., increases for debt service, state employee compensation and benefits, UW faculty pay adjustments, and a potential gap in funding for the Earned Income Tax Credit).

It is interesting to identify the sources of this shortfall. Most of it was not a failure in forecasting; rather it’s mostly due to the decision to cut taxes, and the refusal to take Federal funds associated with Medicare expansion.

I’ve seen similar charts, but I just can’t place where. Oh, yes, from the CBO: https://www.cbo.gov/sites/default/files/cbofiles/images/pubs-images/45xxx/45150-land-figure1.png

Of course, that’s not just limited to financial forecasts: http://www.drroyspencer.com/wp-content/uploads/CMIP5-90-models-global-Tsfc-vs-obs-thru-2013.png

So, that begs the questions: who is doing the forecasting, who is believing the forecasting, and why are we surprised when forecasts ≠ actual? Are more examples required?

Bruce Hall: For a person seemingly unable to grasp the concept of “fixed effects”, you pontificate with remarkable certitude on forecasting. As baffling notes, the downgrade in budget prospects is not in the main attributable to forecast errors in personal income, but rather to the policy actions of the legislature and the governor.

Once again, thank you for the content-free commentary. I look forward to a proper citation of unemployment rates in the context of fixed effects. I suspect I will be waiting a long time.

Interestingly, in 2013, Wisconsin was touting its high ranking using these statistics. http://inwisconsin.com/news/federal-reserve-july/

So, what happened? Or is this a case of parsing the same data differently to show different results? Or is it a case of “noise”? Or could it be that the metrics are prone to fluctuations? Not much happened in Wisconsin between 2013 and 2014 from policy changes that I’m aware of other than some withholding changes, so…? Or do you really believe that failure to take more money from taxpayers inhibits a healthy economy? If so, perhaps the answer is ever-increasing tax rates. After all, unlike the Federal government, state governments can’t run ever-increasing deficits to support ever-increasing spending.

bruce, as menzie noted, this is not an issue of failure in forecasting. it is simply an issue of the wrong policy and the ramifications of this policy. wisconsin not only did not meet the forecast (as you focus on), but the performance was also underachieving compared to the nation as a whole, and CA and MN in particular. however, performance was similar to KS. similar policies produced similar results…arguing about forecasts is simply a diversion away from the performance issue.

Baffling, just what economic policies overcomes 1] early 20th century manufacturing basis for the economy … http://www.jsonline.com/business/wisconsin-economy-stuck-in-old-growth-industries-b9934100z1-211923141.html and 2] relatively low college participation of high school graduates.

Wisconsin always has had a provincial-minded populace that is content to plod along. Where Walker was absolutely wrong was in expecting his economic policies to make a big, positive difference in the face of these structural issues. Culturally, geographically, and climate-wise, Wisconsin has little to offer the bright, young, technology entrepreneurs it needs to break out of its blue-collar morass. I know. I grew up there and left when I turned 21… 50 years ago. The friends and family who stayed are good people, but stuck in the 1950s.

Bruce Hall I know. I grew up there and left when I turned 21… 50 years ago.

Assuming all that’s true, wouldn’t those factors be absorbed in a fixed effects dummy? Just curious, but going back to middle school algebra, did you ever learn the difference between the intercept and the slope?

The friends and family who stayed are good people, but stuck in the 1950s.

I don’t have many friends or family in Wisconsin…well a cousin in Madison that I only see at funerals; but I do have a zillion cousins, second cousins, etc. in Kansas. Good people. Hard working…at least while they were able to work. When I was in high school I used to spend a lot of my summers loading and unloading their small fleet of trucks. But quite frankly they’re all dumb asses who don’t understand their class interests. They’ve been voting GOP since they arrived from Germany and settled in Kansas 125 years ago. Kansas has been a reliable red state since forever; certainly long enough that all those cultural factors have been absorbed into the data. What the log coincident indicator chart shows is that under Brownback and Walker things have broken from trend even relative to each state’s own peculiar history. That’s evidence of a regime change. It’s not the people, it’s the policies.

Finally, if you truly believe that Wisconsin’s problem is that it isn’t enough like Minnesota in terms of workforce demographics, then please explain to us how Gov. Walker’s war against teachers and academic institutions helps narrow the gap between those two states.

Perhaps one reason is that Minnesota has a policy of being adjacent to North Dakota. http://www.twincities.com/ci_23192483/minneapolis-fed-sees-wage-growth-rippling-from-north

Wisconsin may be lagging due to its policy of being next to states without shale oil/NG production… especially since Wisconsin has no shale plays available within the state. For some reason, Wisconsin’s paper industry is in decline: http://www.jsonline.com/business/wisconsins-paper-industry-braces-for-uncertainty-b99284187z1-262261441.html Must be Gov. Walker’s budget policies. Likewise, the motorcycle boom seems to have run its course [pun intended] which is not great news for the Harley fans in Milwaukee. Oh, that housing construction bust? Couldn’t have helped Kohler that much.

It looks as if Walker’s policies should be bringing in high tech companies, but that doesn’t happen overnight: http://urbanmilwaukee.com/2014/02/19/wisconsin-lags-in-building-a-high-tech-economy/

“Of the two generic business strategies–cost leadership and differentiation—Wisconsin’s current efforts at business development mostly fit the cost leadership mold. This approach depends on attracting companies through low tax rates and business-friendly regulations. In recent years this strategy has been heavily promoted by a number of well-funded organizations, in Wisconsin and nationally. A win for this approach is the recent decision by Amazon to create a distribution center in Kenosha, motivated in part by government subsidies and the prospect of serving the Chicago market without paying Illinois’ sales tax.

The other approach, a differentiation strategy, looks to differentiate oneself from competitors by offering a unique value to the customer, ideally something that’s hard for competitors to copy. On a state level, attempting to build a high-tech innovative economy is an example of a differentiation strategy that could have a major impact for Wisconsin. Two organizations that do research and publish studies about building a high-tech economy are the Information Technology & Innovation Foundation (ITIF) and Kansas City’s Kauffman Foundation. Although starting from somewhat different positions, their conclusions are remarkably consistent.”

But, 2slug, it all revolves around teachers’ pensions, right?

If Bruce wants to talk about bleed over from nearby states, he may want to mention that the two counties in Wisconsin that have the largest amounts of commuters to the Twin Cities for work (Pierce and St. Croix) are also the two counties with the lowest unemployment rates in Wisconsin, as shown by this week’s release by the state’s DWD.

http://dwd.wisconsin.gov/dwd/newsreleases/2014/unemployment/141126_october_local.pdf

And 3rd lowest? Those crazy hippies in Dane County. Funny how growing, progressive areas attract talent and jobs, isn’t it?

Bruce makes an excellent observation which brings some context to projections, financial and other.

Here is some context about historical coincidence indicators for Minnesota and Wisconsin. It is possible to look at the last 3 decades, (1) Oct.1984 to Oct. 1994. (2) Oct. 1994 to Oct. 2004, and (3) Oct. 2004 to Oct.2014.

Change by Decade Period by State

Minn. (1) 34.20 ( 2) 32.73 (3) 23.34

Wisc. (1) 35.61 (2) 25.64 (3) 12.63

It should be noted that the improvement of the coincidence indicator of Minnesota above Wisc. is not just a phenomenon since 2011, but has been pronounced for more than 20 years. This indicates to me that there is a significant difference in the mix of industry between the states. A characterization could be that Minn. has more modern, more quickly adapting industry than Wisc. which could be characterize as older and less adaptive.

Admittedly, this characterization seems to be based on limited data. So consider, a second measure of state industry. Consider the change of coincidence indicators around recessions. The last four recessions are group as: (1) the double recession 1980 though 1983, (2) the slight recession 1990 and ’91, (3) recession of 2001, (4) the great recession of 2007, ’08, and ’09.

Peak to trough change of the coincidence indicator around recessions fro Minn. and Wisc.

Minn (1) -3.27 (2) no trough (3) -11.46 (4) -7.9

Wisc (1) -7.43 (2) – 0.64 (3) -2.63 (4) -11.73

Please note, the Minn. mix of industry is less affected by recession than is the mix in Wisc.

My conclusion, while Menzie’s use of data and charts and graphs are accurate, he continues to give an incomplete picture due to lack of context. While true that Minnesota has been doing better than Wisconsin since 2011, it is also true that Minnesota has been doing better than Wisconsin for at least 20 years. Minnesota has also shown better resistance than Wisconsin during every one of the last four recessions. I submit that the coincidence indicator is effected by the particulars and mix of the state’s economy than by the current political direction of the states.

Again I would like to thank Bruce for bringing some context to projections.

Ed

Please note that part of the increase in earlier personal income levels in Wisconsin has its origins in farm support payment policy. In fact a careful dissection of the reports should have drawn your attention to the 30% of the increase that was entirety ag support related. The Bureau noted these concerns (they were multi-state) in a side document. Once the ag component of personal income settled back to its baseline, Wisconsin’s overall growth lagged as well.

Looking at the recent downgraded tax revenue projections from the DoR, I have to express some concerns. Part of the decrease is being blamed on the decline in withholding amounts. This will be true to some extent, but it will depend upon the number of individuals who received withholding advice from their tax preparer. There is a practice rule among preparers that biases withholding so that a refund is most often the result. The reason for this is simple: many taxpayers (indeed most) judge the performance of their tax preparer on the receipt of a “big refund” (this despite the fact that you are merely receiving your own money back). If you hit too many clients with the fact that they will need to pay in, you will find that you begin to lose clients. Strange but true.

So if tax preparers went overboard with their withholding recommendations to their clients so that the big refund checks continue (remember tax rates were NOT cut–only the withholding tables were changed) then the personal tax shortfall of over 10% is actually a catastrophe, but we’ll need to wait until Feb-Mar to determine if that is true.

Doc- I’m betting the average Wisconsinite didn’t change their withholding preferences, which means their tax refunds will be a lot less than they’re used to in Feb and March. The fiscal problem is that sales taxes are the only revenues staying within projections- that might not happen if people don’t get the refund “bonus”.

As others note, Wisconsin’s revenue shortfall us directly related to blowing a projected surplus on tax cuts in the name of electoral pandering. And now we’re seeing the fallout from that short-term thinking. Very BUSHHH-like, isn’t it?

You are probably right (and kudos on your recent coverage of the ever-increasing Wisconsin budget deficit in your blog. I think you have been the only observer who has predicted the continual upward spiral of the deficit–with frightening accuracy). But I have to tell you that, as someone who has been there, you lose clients–even big and apparently sophisticated clients–when you don’t give them a big refund to brag about to their friends. It is something I’ve scratched my head about for 40 years. Look at the refund totals reports from the DoR beginning in February. If the refunds are at the same level as for tax year 2013, then there is even more revenue trouble that will hit right in the legislative session.

ed

“I submit that the coincidence indicator is effected by the particulars and mix of the state’s economy than by the current political direction of the states.”

then why fight so hard to reinforce the walker administration’s policy, if it has little influence? instead, why not follow the data, which indicates a policy such as that in MN appears to produce better results, at least on the margin if there is truth to your statement? data seems to show wisconsin (and kansas) are producing the lower bound performance. why continue down that path, when other paths have shown better performance? baffling.

Are you arguing that higher taxes would have led to higher personal income and a higher employment rate? what’s the transmission mechanism?

Josh Dannett: See this post. A little algebra and calculus is helpful in understanding the logic.

Josh

Just a note, while it is nice that another post is referenced, notice that Menzie would not give a simple Yes or No answer.

Ed

Ed Hanson: I guess your comment conclusively proves you either (1) can’t read, or (2) can’t follow algebra. The answer is Yes, as laid out in the referenced post, with the indicated assumptions. Thanks for confirming my impressions.

Menzie’

your mind reading ability is slipping, perhaps you need to get out your dictionary again. Your second post has within it, the clearer answer you should have provided Josh in your reply:

“The answer is Yes, as laid out in the referenced post, with the indicated assumptions.”

Not just:

“Josh Dannett: See this post. A little algebra and calculus is helpful in understanding the logic.”

I assume you see the difference, and that is all I was commenting about.

Ed

I would caution strongly against feeding the trolls.

Seruko: You are probably right, but when I see stupidity in need of correction, it is hard to resist. And Mr. Hanson provides so much material…

Josh- Higher taxes often = higher quality of life = attracts more TALENT. Therefore, a better economy. It’s not that hard to figure out.

Heck, even the “miraculous” growth in Tex-ass is limited to a handful of big cities, while many of the rural areas are bleeding population.

Revenues follow the economy.

People follow the economy as well, which explains why Minnesota’s population is growing twice as fast as Wisconsin’s, and Wisconsin’s growth has greatly slowed over the last 3 years.

It doesn’t happen in a vacuum, folks

I think the biggest reason for the budget shortfall in WI is that state policymakers repeated a mistake that they have made many times over the last several decades — making commitments to use a projected surplus (for tax cuts or more spending) without planning for the possibility that the revenue growth wouldn’t materialize. As soon as it appeared that there would be a surplus at the end of the 2013-15 biennium, WI lawmakers committed to large tax cuts and suspended a statute requiring half of the revenue growth to be placed in a rainy day fund.

WI currently requires that lawmakers budget for a balance of $65 million at the end of each fiscal year. That amounts to just 0.4% of state General Fund spending. A statute that would require a 2% budget cushion was enacted about 20 years ago, if I recall correctly, but every budget bill postpones the requirement (which was delayed by Walker’s last budget bill until FY 2018).

Legislators and the Governor knew that the tax cuts enacted early this year were creating a structural deficit, but they said that didn’t matter because the state would grow its way out of that. Unfortunately, we can now see that won’t be the case. I think many other states have also made overly optimistic revenue forecasts, but most of them do a better job of setting aside funding and preparing for revenue shortfalls.

I noticed that Brownback is charging up from below. Just you wait, the Kansas growth explosion will happen soon.

George H.W. Bush was correct when he labeled the panacea of tax cuts as ‘voodoo economics’. Thanks to Governors Walker and Brownback there might be more people now who believe in actual voodoo than believe that cuts produce revenue. It is fiscally and socially reckless, and it turned a state that was in the top third for job growth in the year before Governor Walker took office, to bottom third is jobs and income growth since Walker took office. Walker’s policies have not delivered on his promises.

That said, a Walker-Brownback team for 2016 will make America great again.

At least Wisconsin will benefit from being near liberal paradise (and hence economic dynamo) Illinois. Our tax rate went up 67%, so our economic boom is certain to follow, right?

What are the other implications of all this ? Does it mean more and accelerated Muni defaults to be expected in Wisconsin and Kansas ? How does this play out in contiguous states ? Surely spill over effects are both positive and negative.

Sometimes someone’s meat is another poison. Will this lead to intense beggar thy neighbor policies from nearby states and will that dynamic in turn make the situation more fragile ?

Unintended consequences of policy (left or right) always have long lasting impacts.

While Wisconsin is dealing with a projected $2.2 billion state budget deficit, it is worth noting that Minnesota is dealing with a projected $1 billion state surplus (to go along with a 3.9% unemployment rate).

http://www.startribune.com/politics/statelocal/284649071.html