Commenting on what has been termed “Francogeddon” and a “tsunami” as well as consequent mayhem, Joe Weisenthal at Bloomberg/Business Week writes:

“Today the Swiss National Bank shocked the world when it announced it would remove the cap it had in place to prevent the Swiss franc from rising too high against the euro.”

The SNB’s statement is here; see additional discussion here. The jump in the CHF’s value is shown below:

Source: Bloomberg 15 January 2015. Down is an appreciation of the CHF against the EUR.

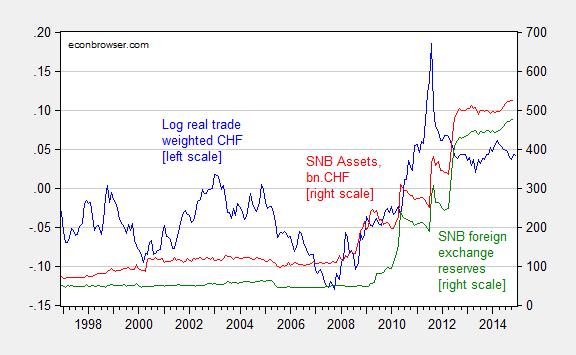

The expansion in the SNB’s balance sheet as a consequence of foreign exchange intervention is shown in Figure 1. Also shown is the stabilization of the real trade weighted CHF as a consequence of the foreign exchange (euro) intervention.

Figure 1: Log real trade weighted value of the Swiss Franc, 2010=0 (blue, left scale, up is a real appreciation of the CHF), and asset side of the SNB balance sheet (red, right scale), and foreign exchange reserves (green, right scale), in billions of CHF. Source: BIS and SNB.

Weisenthal reports speculation that the SNB will focus more on the trade weighted SNB, and perhaps shift intervention to the USD/CHF pair, especially as the path for the ECB’s quantitative/credit easing program is cleared.[1]

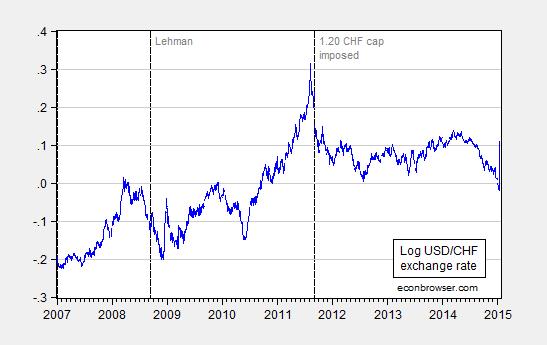

Update, 5:50PM Pacific: The appreciation today restores the USD/CHF bilateral exchange rate to that obtaining on 7/14/2014.

Figure 2: Log USD/CHF exchange rate. Source: FRED and Pacific Exchange Rate Services.

The CHF is about 4% stronger against the USD than it was on 9/7/2011 (the day after the imposition of the cap), while the US CPI has risen about 5% relative to the Swiss CPI since 2011M09. Hence, the real US-Swiss bilateral rate is about the same as it was when the cap was imposed.

Buckle up, it’s going to be a bumpy ride:

Bloomberg on volatility; expect Europe EM balance sheet problems associated with external CHF liabilities.

Update, 1/16 9:15AM Pacific: A review of market commentary from Hilsenrath/WSJ RTE. Krugman discusses credibility issues here; Krugman reviewing events here.

Their -.75% rate is awfully attractive!

More fall-out from:

– the US zero interest rate policy (ZIRP) and highly stimulative monetary policy stances world wide

– the effectiveness of Russian sanctions which is what….. fall-out from NATO’s aggressive push into the former Soviet Union based on …. access for subsidized US grain for NATO membership?

Funny to think that despite historically effective Swiss armed neutrality, it cannot stop overzealous monetary policy from invading its shores in the 21st century.

Anyhow, that attempt at clever humour aside, I feel kinda stupid because I do not know how to financially exploit this situation though I am certain that the well informed and nimble will make a lot of money.

If western monetary policy authorities wanted to shroud market prices in mystery, they have succeeded. Congratulations! Well done I say.

In the FT today: http://www.ft.com/intl/cms/s/0/16717380-9c8e-11e4-a730-00144feabdc0.html#axzz3OxK817gD)

Some stunning consumer sentiment developments.

http://www.prienga.com/blog/

A friend did a great analysis on this that says that this is a preemptive move by the Swiss in anticipation of the ECB engaging in another round of QE. They realize that the euro is on its way down big time. While the US is engaging in more sound monetary policy the Europeans are crashing their economies under a flood of liquidity. The ECB does have an impact on the US. Thankfully congress is in the hands of the Republicans so the chances of the US making a dumb move are lessened. We may be able to weather the storm but it will be a bumpy ride.

As an aside: how about the US once again leading from behind and finally days after the rest of the world marches in solidarity, John Kerry goes to France to give them a big “hug.” Oh, I’m going to be sick! It would have been better if they had just left it alone after they admitted they messed up. The US looks more like a laughing stock than before.

My friend nailed it in an email he sent me.

Its, ‘Money on the Run!’ Fiat ‘Money’ is becoming homeless; Rubles are sleeping in the street; Euros are fleeing France faster than French Jews! They are all singing, ‘Gimmie Shelter’!..”Yeah, a storm is threat’ning / My very life today / If I don’t get some shelter, / Lord I’m gonna fade away…” Fleein the cots of the Salvation Army…CHF, Gold, U.S. Treasuries…not much more the CBs can do. The patient is learning that QE is merely a placebo.

The ECB will have to takeover from the Fed to print multiple trillions of euros to prevent EZ (and combined EZ and US) M3 and nominal GDP from contracting in the years ahead, resulting in debt, asset, price, and wage deflation. The size of Swiss savings, current account, reserves, equity market cap, and M3 to GDP and total EZ share requires that the SNB leave the peg to maintain “independence” or be sucked into the euro reserve printing black hole and resulting obligations of citizens to make whole the Anglo-American and European banking syndicate’s owners’ losses.

The Fed will not raise the funds rate and will eventually resume QE for the same reasons once the bubbles in shale debt, bank C&I loans to the energy sector, housing echo, subprime auto loan, and student loan burst, which has likely begun.

We face another Lehman- and AIG-like episode as in 2008, only this time Goldman intends to use its ownership of the US gov’t and control of the US Treasury to take down rival JP Morgan, and perhaps Citi, Barclays in the UK, and HSBC in Asia.

But the Swiss cannot escape the black hole, only postpone it by zigging and zagging around the event horizon.

But recall that the Anglo-American and European int’l banking syndicate’s owners need the euro to “fail” as a rationalization for the successive step in the the larger objective of merging the US$, loonie, pound, and euro as part of the long-term goal of a “Trans-Atlantic Federation”, including a single currency, customs union, unified military command, regulatory and taxing authority, “bail-ins” and seizure of deposits, the eventual dismantling of the social-welfare-state and associated income supports for the bottom 90%+, and the imposition of a kind of police- and security-state apparatus to secure “domestic tranquility” and defend “national security” against Radical Islam, Russia, Iran, and China in the Pacific, Middle East, Africa, and the western hemisphere.