Today we are fortunate to present a guest contribution written by Ricardo T. Fernholz, Assistant Professor of Economics at Claremont McKenna College.

Recent trends in income and wealth inequality have drawn much attention from both academics and the general public. Atkinson, Piketty, and Saez (2011) and Saez and Zucman (2014), among others, document these trends for different countries around the world and have prompted a substantive debate about the underlying causes and the appropriate policy responses, if any.

A General Approach

In new research (Fernholz, 2015), I develop a general statistical model of wealth distribution to address these issues empirically. This approach overlaps both the empirical literature on income dynamics (Guvenen, 2009; Browning et al., 2010) and the broader literature on Pareto distributions for income, wealth, and other economic variables (Gabaix, 1999; Benhabib et al., 2011; Jones and Kim, 2014). A key difference between my approach and these literatures, however, is that I impose no parametric structure on the underlying processes of household wealth accumulation and do not model or estimate these processes directly.

Despite this minimal structure, I use new techniques to obtain a simple household-by-household characterization of the stable distribution of wealth. Using this characterization, I show how the model can replicate any empirical distribution and then construct such a match for the 2012 U.S. wealth distribution as described by the data of Saez and Zucman (2014).

The U.S. Wealth Distribution, Present and Future

The U.S. wealth shares data of Saez and Zucman (2014) have attracted attention recently by demonstrating an upward trend in top wealth shares starting in the 1980s, an observation that suggests that U.S. wealth is transitioning from one distribution to another. If this is the case, it is natural to wonder where the distribution is going.

My statistical approach to wealth distribution is able to provide estimates of the future U.S. stable distribution. These estimates depend only on the current rate of change of wealth shares in the economy, not on the causes of these changes. I consider four transitioning wealth shares scenarios:

- The 2012 U.S. wealth distribution is stable.

- The share of wealth held by the top 0.01% of households is increasing by 1% per year, while the share of wealth held by the bottom 90% of households is decreasing by 0.5% per year.

- The shares of wealth held by the top 0.01% and 0.01-0.1% of households are increasing by 1.5% and 0.5% per year, respectively, while the share of wealth held by the bottom 90% of households is decreasing by 1% per year.

- The shares of wealth held by the top 0.01% and 0.01-0.1% of households are increasing by 3% and 1% per year, respectively, while the share of wealth held by the bottom 90% of households is decreasing by 1.5% per year.

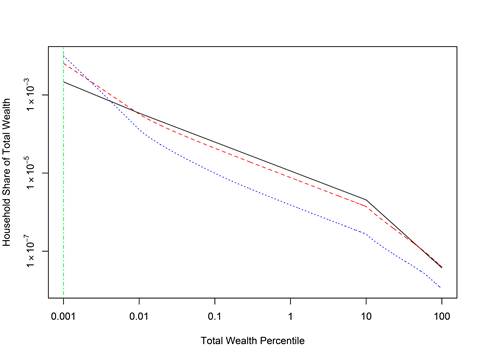

In Figure 1, I plot the future stable distributions of wealth for these four scenarios. The substantially different outcomes implied by these scenarios demonstrate how sensitive the future distribution is to upward trends in today’s top wealth shares. In the case of Scenario 4, top wealth shares are increasing so quickly that the distribution never stabilizes but instead separates into divergent subpopulations, with the top 0.01% of households eventually holding all wealth (represented by the vertical line in Figure 1). I emphasize that these hypothetical estimates are not intended as predictions but rather as descriptions of the trajectory of inequality in the absence of changes in the economic environment.

Figure 1: Household wealth shares under Scenarios 1 (solid black line), 2 (dashed red line), 3 (dotted blue line), and 4 (vertical dot-dashed green line).

Interestingly, it is difficult to reject a divergent trajectory as in Scenario 4 for the current U.S. wealth distribution. Indeed, according to the data of Saez and Zucman (2014), the share of wealth held by the top 0.01% of households in the U.S. has increased by an average of more than 3.5% per year since 2000 and more than 4% per year since 1980—faster than is assumed in Scenario 4. A cautious interpretation of this fact is that further increases in top wealth shares are likely in the near future.

Estimating the Effects of Progressive Capital Taxes

Ever since Piketty (2014) proposed a progressive capital tax in response to increasing wealth inequality, much of the debate surrounding this policy has centered on how such taxes are likely to increase government revenues or distort economic outcomes, rather than how they might affect the distribution of wealth. My model can provide estimates of the distributional effects of progressive capital taxes on the U.S. economy. These purely empirical estimates do not rely on any assumptions about the underlying causes of inequality.

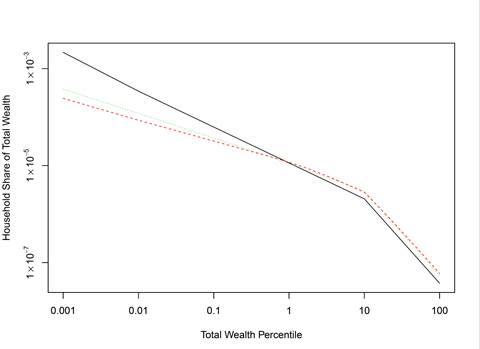

Because it is a useful baseline case to consider, the estimates I present here assume that a capital tax rate of 1% on some subset of households reduces the growth rate of wealth for those households by 1%. Although this leaves out incentive effects of the taxes, these effects can be incorporated into the model by adjusting the tax’s impact on the growth rates of household wealth. In Figure 2, I show the effects of a progressive capital tax similar to the policy proposed by Piketty (2014). In particular, this tax sets the capital tax rate for the top 0.5% of U.S. households equal to 2% and the rate for the top 0.5-1% of U.S. households equal to 1%, while the remaining 99% of households are assumed to neither pay nor receive any tax or subsidy.

Figure 2 displays the effects of this tax on the U.S. wealth distribution, assuming that the 2012 U.S. wealth distribution is stable (Scenario 1). As the figure shows, a progressive capital tax imposed on just 1% of households in the economy reshapes the distribution of wealth and reduces inequality. In fact, the after-tax stable distribution of wealth in this case is similar to the distribution observed in the U.S. in 1978 (the dotted green line in Figure 2), one of the most egalitarian in the U.S. in the last century.

Figure 2: Household wealth shares with (dashed red line) and without (solid black line) a 1-2% progressive capital tax on the top 1% of households under Scenario 1, and for the U.S. in 1978 (dotted green line).

I emphasize that this result is neither a statement about total welfare nor an endorsement of a progressive capital tax. My statistical approach only generates empirical estimates of the distributional effects of taxes and other policies, it does not measure the potentially large distortions or costs associated with such policies.

Interpretation

A measured interpretation of my results is important. Indeed, there remains uncertainty about the true state of U.S. wealth inequality today. While the quantitative results about the future U.S. wealth distribution and the effects of progressive capital taxes shown in Figures 1-2 are useful, a more important contribution is to introduce an empirical methodology that can address these questions without making assumptions about the causes or consequences of inequality. As more wealth shares data become available in the future, this methodology should yield even more information about the future of U.S. wealth inequality.

References

Atkinson, A. B., T. Piketty, and E. Saez (2011, March). Top incomes in the long run of history. Journal of Economic Literature 49(1), 3-71.

Benhabib, J., A. Bisin, and S. Zhu (2011, January). The distribution of wealth and fiscal policy in economies with infinitely lived agents. Econometrica 79(1), 123-157.

Browning, M., M. Ejrnæs, and J. Alvarez (2010, October). Modelling income processes with lots of heterogeneity. Review of Economic Studies 77(4), 1353-1381.

Fernholz, R. T. (2015, January). A Statistical Model of Inequality. mimeo, Claremont McKenna College.

Gabaix, X. (1999, August). Zipf’s law for cities: An explanation. Quarterly Journal of Economics 114(3), 739-767.

Guvenen, F. (2009, January). An empirical investigation of labor income processes. Review of Economic Dynamics 12(1), 58-79.

Jones, C. I. and J. Kim (2014, October). A Schumpeterian model of top income inequality. mimeo, Stanford GSB.

Piketty, T. (2014). Capital in the Twenty-First Century. Cambridge, MA: Harvard University Press.

Saez, E. and G. Zucman (2014, October). Wealth inequality in the united states since 1913: Evidence from capitalized income tax data. NBER Working Paper 20265.

This post written by Ricardo Fernholz.

I’m having a bit of trouble understanding the shares implication. Is the absolute wealth of the nation remaining static and the income being redistributed from the bottom to the top? Or is the absolute wealth of the nation decreasing and despite share shifts all income is decreasing? Or is the absolute wealth of the nation increasing and all segments are increasing in wealth, but the top tier increasing faster? Or is it some other scenario?

Now, if it is the first scenario, that is troubling indeed. If it is the second scenario, that is even more troubling. If it is the third scenario, then the system is working just fine, the top producers are being rewarded, and the problem is one of envy. (BTW the makeup of who is in which tier is constantly changing) If it is some other scenario, then we should be examining all of the stimulus programs that have been going on for the past five years in various forms because they would appear to be failing. Or is the author arguing for more income redistribution beyond welfare, earned income tax credits, federally supported health care, and many other support systems?

As I said, I’m having trouble understanding the shares implication.

Think of a mountain as the metaphor for capitalism. Some will climb to the top, many will find varying heights, and some will never venture up the sides.

Think of socialism (Venezuelan style) in terms of another metaphor: a crater. Some will loiter around the edges and may actually be raised somewhat above the surroundings. The rest will find themselves on the slippery slope to a flat bottom that is devoid of anything beneficial… and they will have an immense struggle to escape it.

“I emphasize that this result is neither a statement about total welfare nor an endorsement of a progressive capital tax. My statistical approach only generates empirical estimates of the distributional effects of taxes and other policies, it does not measure the potentially large distortions or costs associated with such policies.”

What’s being proposed?

Think of the game of Jenga (http://www.jenga.com/ ) as a metaphor for late capitalism, that stage of capitalism where it is more profitable for the wealthy to manipulate and divert demand to themselves, eg through creative finance, than to create and increase the supply of goods and services, by investing in the real economy. The very wealthy, at the top, augment their wealth by taking it from the people beneath them. The stability of the tower decreases, until sudden collapse.

Yes, I understand the concept of crony capitalism. It has accelerated in recent years. What’s the proposal?

It should be noted, unlike Europe, the U.S. led the rest of the world combined in the Information Revolution, which created many very wealthy Americans, along with creating more wealth for the top 10 or 20 percent.

At the same time, tens of millions of low skilled immigrants and their children, with little wealth, became part of the U.S. population.

It is good that Paul Krugman agrees that monetary policy should be part of the 2016 election. Most on the left are deathly afraid of discussing monetary policy seriously. Of course Krugman’s article does lead one to believe that he is not really serious about having a real dialogue on monetary policy. Krugman would rather build a soap box from which to shout invectives (quote: “So it matters that the emerging G.O.P. consensus on money is crazy — full-on conspiracy-theory crazy.” Not exactly the best way to engage in dialogue!)

But better than Krugman is the Friday, February 27, 2015 meeting between Janet Yellen with 21 classical policy economists. It is an historic event to have a FED Chair listen to an alternative to the Keynesian demand theories of the left. The meeting was held at the same time as the CPAC meeting so it was over-shadowed. While the meeting was reported by AP and picked up by most major news, there was no detail, so an average person would not know the uniqueness of the meeting. Ralph Benko writes about the meeting here. I encourage you to read the papers presented (linked in the article.) If classical policies were implemented wealth would be distributed by the market rather than by crony socialists (Keynesians) and wealth would actually be allocated to wealth creation rather than wealth consumption. That would go a long way to correcting the unequal distribution of wealth created by crony politicians.

As an aside: One great announcement is that APIA has scheduled its own Jackson Hole Symposium featuring <a href="http://www.nysun.com/national/as-congress-eyes-the-fed-greenspan-is-telling/89063/"Alan Greenspan.

Alan Greenspan

Indeed, now as Europe is getting flooded with immigrants, the system that seemed to work well for 40 years or so for them is becoming a burden. Clearly in the US the dotcommers have generated substantial wealth by providing us with neat toys and electronic equiptment. Many dotcom employees were paid with options and shares which led to many newly rich. Since global output is zooming due to globalization, and incomes are rising everywhere, it seems that these red herrings about inequality are simply that. I suspect that as in the 1920s, when we had similar inequality after the industrial revolution, things will get redistributed over time. 1968 was peak inequality, before the Great Society and unfettered monetary policy took off. We do need to pay attention to crony capitalism which is of course nonpartisan. The simplest way is to demand less government rather than more.

Pete. Can you point to any studies that support your assertions that less government leads to less inequality?

Bruce Hall Contrary to what you said, there is very little economic mobility in the US. We rank below Britain, which isn’t exactly known for its egalitarian ways.

As to top producers earning their just marginal product, that’s a hoot. The top income gains have been concentrated in fields that positively reek of rent seeking; e.g., copyrights, finance, sports & Hollywood, etc.

We need to worry about slipping into plutocracy. The US is not exceptional, so we shouldn’t think that it couldn’t happen here. For example, the IMF worries that the US has already reached certain inequality thresholds that (so far) have always ended badly. And by “badly” the IMF means a man-on-a-white-horse outcome. Eventually plutocrats start to eat each other. It’s been true for thousands of years. It was true in ancient Greece. It was true in the Roman Republic (think Crassus, Pompey and Caesar). It was true in medieval Venice. It was true in 1920s Chicago. And today we see the same dynamic in Putin’s Russia. Plutocracies always become gangster governments, with prominent politicians getting gunned down right in front of the Kremlin or wherever. It’s the way of all plutocracies, true for all times and in all places.

2slugs,

What do you propose be done? It seems like the folks you worry about are in the top 0.1% or 0.01%. My concern is that politicians will use the guise of going after the top 0.1% or .01%, find there is not enough tax money there and proceed to significantly increase taxes on the folks in the $100,000 to $500,000 AGI group.

AS Fair question. The gist of my comment was more about the likelihood of plutocracy leading to political instability and not so much about economic issues per se. While I strongly suspect that extreme wealth inequalities are also likely to slow economic growth, I would concede that the jury is still out on that one. But with respect to the political question, the jury gave its verdict long ago; plutocracies are politically unstable and always come to a bad end.

What would I recommend? Well, let’s start with a pretty stiff estate tax. Such a tax would generate revenue, but more importantly it would go a long way towards taming wealth concentration across generations. The main justification for an estate tax is political rather than economic, but there are good economic reasons as well. For example, there’s a fair amount of evidence that people exit the labor force sooner than originally planned when they inherit more than expected. Any negative incentives that an estate tax might have for the ambitious entrepreneur while he or she is still alive are more than offset by the disincentive effects on the heirs. A significant estate tax would encourage people to stay in the workforce rather than allow them to become rentiers. Another potential benefit would be that it might lessen concerns about dynamic inefficiency. A generation ago dynamic inefficiency (basically an over-accumulation of capital) was more of a theoretical concern than an actual concern. Today…I’m not so sure.

What else? How about a more muscular wage & hour enforcement division over at the Dept of Labor? Or adopt more union friendly policies? I would also change policies and laws that encourage unhealthy levels of rent seeking, such as ridiculously long copyright and patent protections. How about a Tobin tax as well?

As to increasing taxes on the $100K-$500K crowd…maybe. Long run government expenditures are going to be in the 23%-24% of GDP range. That’s just a fact. We need to set revenues to match expenditures over the long run. If that means raising taxes or cutting deductions, then so be it. There’s a strong Rawlsian streak in me, so I’m fine with income & wealth inequalities as long as those inequalities also serve the interests of those at the bottom of the economic ladder…or at least do the poor no harm. Ultimately the optimal tax rate for those at the upper end of the income scale is an empirical problem. Saez tells us that we can be pretty sure that the optimal top marginal rate is well north of 60%.

Yes, I agree. More taxes.

http://ctj.org/ctjreports/2014/04/the_us_is_one_of_the_least_taxed_of_the_developed_countries.php#.VPzHLtLF-So

No, I disagree. Less taxes.

http://taxfoundation.org/article/2014-international-tax-competitiveness-index