That’s the topic of a conference sponsored and hosted by the Swiss National Bank and co-sponsored with the Bank for International Settlements (BIS), the Dallas Fed, the Centre for Economic Policy Research (CEPR), and the Journal of International Money and Finance.

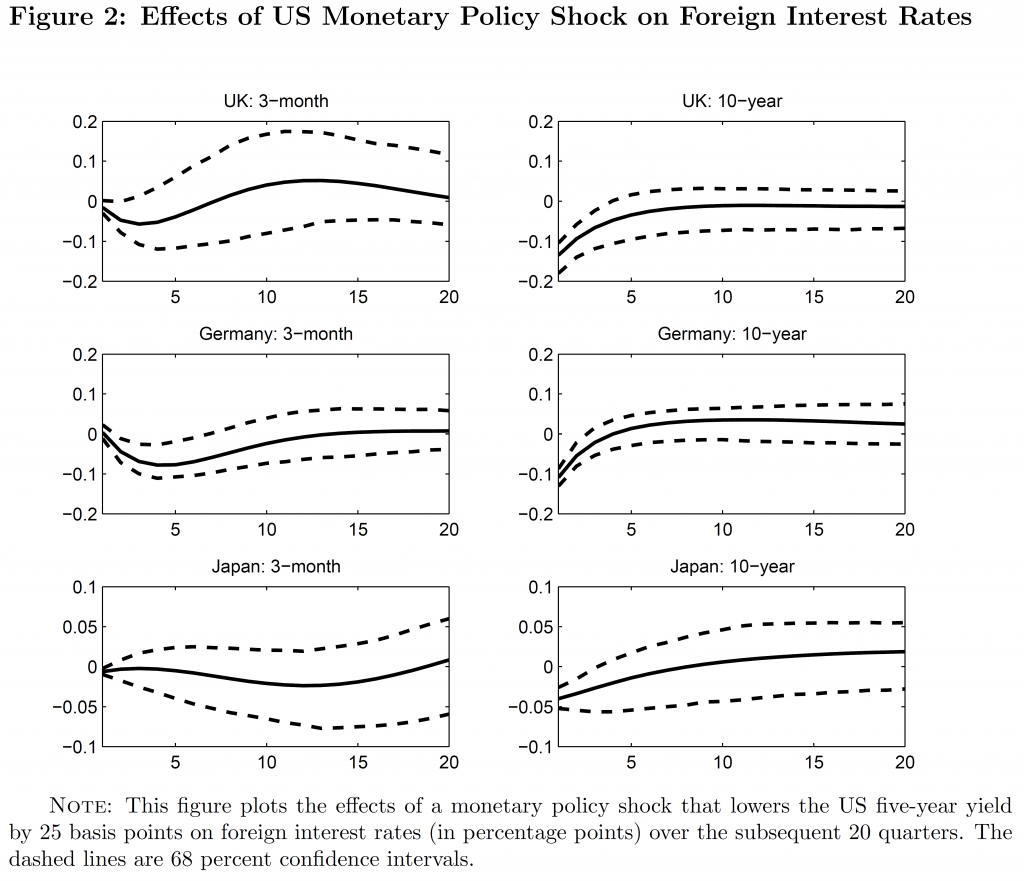

Figure 2: Impulse response function for 25 bp reduction in the 5 year rate. From Rogers, Scotti and Wright (2015).

The links to the papers are here.

Opening remarks: Thomas Jordan

Chairman of the Governing Board, Swiss National BankSession I

“Monetary Policy Spillovers and the Trilemma in the New Normal: Periphery Country Sensitivity to Core Country Conditions”

Authors: Joshua Aizenman (USC), Menzie D. Chinn (Wisconsin), and Hiro Ito (PSU)

Discussant: Atish Rex Ghosh (International Monetary Fund)Session II

“Short-Term Pain for Long-Term Gain: Market Deregulation and Monetary Policy in Small Open Economies”

Authors: Matteo Cacciatore (HEC Montréal), Romain Duval (IMF), Fabio Ghironi (University of Washington and CEPR), and Giuseppe Fiori (North Carolina State University)

Discussant: Giancarlo Corsetti (Cambridge University)“Self-Oriented Monetary Policy, Global Financial Markets and Excess Volatility of International Capital Flows”

Authors: Michael B. Devereux (UBC and CEPR) and Giovanni Lombardo (BIS)

Discussant: Aitor Erce (European Stability Mechanism)Session III

“What drives the funding currency mix of banks?”

Authors: Signe Krogstrup (Swiss National Bank) and Cédric Tille (Graduate Institute and CEPR)

Discussant: Adrian van Rixtel (Bank for International Settlements)“The impact of international swap lines on stock returns of banks in emerging markets”

Authors: Alin Andries (Alexandru Ioan Cuza University of Iasi), Andreas Fischer (Swiss National Bank and CEPR), and Pɪnar Yeşin (Swiss National

Bank)

Discussant: Andreas Schrimpf (Bank for International Settlements)Keynote address: Claudio Borio (Bank for International Settlements)

Session IV

“Unconventional Monetary Policy and International Risk Premia”

Authors: John Rogers (Federal Reserve Board), Chiara Scotti (Federal Reserve Board), and Jonathan Wright (Johns Hopkins University)

Discussant: Julieta Yung (Dallas Fed)“If the Fed sneezes, who gets a cold?”

Authors: Luca Dedola (ECB and CEPR), Giulia Rivolta (University of Brescia), and Livio Stracca (ECB)

Discussant: Mark Wynne (Dallas Fed)Session V

“Trilemma, not Dilemma: Financial Globalisation and Monetary Policy Effectiveness”

Authors: Georgios Georgiadis (ECB) and Arnaud Mehl (ECB)

Discussant: Sandra Eickmeier (Bundesbank)Organization committee: Raphael Auer, Menzie Chinn, Giancarlo Corsetti, Andrew Filardo, Andreas Fischer, Mark Wynne.

One message I took away from the conference is that US monetary policy retains potency, with respect to international and foreign financial markets, and also with respect to foreign economies. The issue is that the magnitude and nature of those effects, particularly during the era of unconventional monetary policies, are not well understood. To the extent that some of those unconventional policies will remain in the policymakers’ toolkit, we need to focus our efforts on furthering our understanding.

Paul Krugman’s knowledge of economics regresses backwards from 1998 to 2015. His views on minimum wage economics have moved away from fact.

Hat tip : Prof. Mark J. Perry