Today we are fortunate to have a guest post written by Eric Fischer, PhD candidate at the University of California, Santa Cruz.

On December 16, 2015 the Federal Reserve Open Market Committee will decide on whether to raise the short term nominal interest rate. What effect will this announcement have on global investors? Will it affect emerging market debt flows? Are hard currency debt flows more sensitive to this announcement than local currency debt flows? Are some emerging market debt investors and some regions more sensitive to this announcement than others?

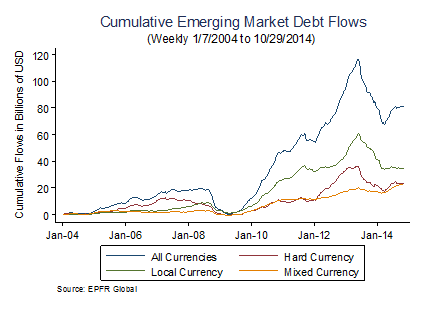

Volatility in foreign investor debt flows have caused financial crises in emerging markets during the 1990s and 2000s when they had fixed exchange rates and issued hard currency debt in dollars. When U.S. interest rates rose, countries like Mexico and Indonesia had to break their pegs, making their dollar debt unsustainable and thus leading to defaults. As a result, the International Monetary Fund and the U.S. Department of the Treasury encouraged emerging economies to develop domestic financial markets and issue local currency debt. Local currency debt now accounts for the majority of emerging market debt issuances. Since the global financial crisis, interest rates in the United States have been zero, and foreign capital flows have moved to hard currency, local currency, and mixed currency debt in emerging markets.

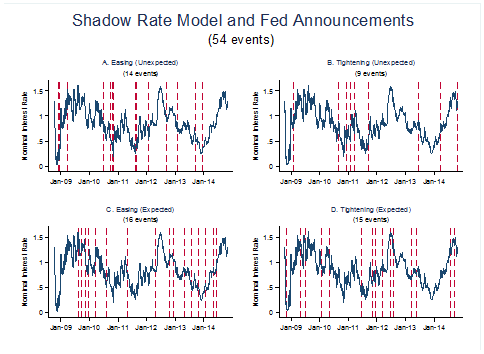

My paper “U.S. Monetary Expectations and Emerging Market Debt Flows” examines the effect of 54 Federal Reserve announcements on emerging market debt flows since the Global Financial Crisis (GFC). I do this analysis in two parts. First, I take all the Federal Reserve announcements since the GFC and categorize them as easing (unexpected), tightening (unexpected), easing (expected), and tightening (expected) using two year expectations of the short term nominal interest derived from federal fund futures and a shadow rate term structure model of expectations. For the purpose of categorizing announcements during this time period, I find that the shadow rate term structure model is a better measure than federal fund futures.

Second, I use the announcements categorized by the shadow rate term structure model to examine the effect on debt flows by currency (all currencies, hard currency, local currency, mixed currency), investor (all investors, active investors, passive investors), and regions (all, Asia excluding Japan, Latin America, EMEA, and Global EM). I use an event study approach to examine daily debt flows seven days before and after Federal Reserve announcements. I find that the 1) tightening (unexpected) announcements lead to outflows by emerging market debt investors, 2) local currency debt flows are less sensitive to announcements than hard currency debt flows, 3) passive investors are more responsive than active investors, and 4) in comparison to other regions, debt flows to Latin America are the most sensitive to Federal Reserve announcements.

What will happen to emerging market debt flows on December 16? It appears that most market participants expect the Federal Reserve to raise rates at the next meeting. However, what is not certain is where markets expect the short term interest rate to be in two years. This measure could change at the December meeting. According to my paper, if the change in expectations is tightening (unexpected) then this will have a significant effect on emerging market debt flows. It will be interesting to see how things play out.

Relevant Links:

Eric Fischer. “U.S. Monetary Expectations and Emerging Market Debt Flows” 2015.

Aizenman, Joshua and Mahir Binici, Michael M. Hutchison. “The Transmission of Federal Reserve Tapering News to Emerging Financial Markets” NBER Working Paper 19980, 2014.

Christensen, Jens H.E. and Glenn D. Rudebusch. “Estimating Shadow-Rate Term Structure models with Near-Zero Yields” Journal of Financial Econometrics Vol. 0, No. 0, 1-34, 2014.

Eichengreen, Barry and Ricardo Hausmann. “Exchange Rates and Financial Fragility” Federal Reserve Bank of Kansas City Symposium, Jackson Hole, Wyoming, 1999.

Fratzscher, Marcel and Marco Lo Duca, Roland Straub. “On the International Spillovers of US Quantiative Easing” ECB Working Paper 1557, 2013.

Gürkaynak, Refet S. and Brian Sack, Jonathan Wright. “Market-Based Measures of Monetary Policy Expectations” Journal of Business Economic Statistics, Vol. 25, No. 2: 201-212, 2007.

Miyajima, Ken and M.S. Mohanty, Tracy Chan. “Emerging Market Local Bonds: Diversification and Stability” BIS Working Paper 391, 2012.

Puy, Damien. “Mutual funds flows and the geography of contagion.” Journal of International Money and finance Vol 60, 73-93, 2016.

Tett, Gillian. Emerging markets repent of ‘original sin’. April 18, 2014. Financial Times.

This post written by Eric Fischer.

Discount rate, reserves, etc.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2V51

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2V55

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2Kr8

https://app.box.com/s/earfgyknu6xx8woigktnnny6dn7devt2

Monetary base to GDP:

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2V6Y

We’ve been here before, “the market” has been tightening for a long time, the Fed “policy error” occurred years ago, and the damage is only beginning for the cycle.

http://www.hussmanfunds.com/wmc/wmc151214.htm

http://schrts.co/MZM559

http://schrts.co/T4lXuH

http://schrts.co/lBGBhY

http://schrts.co/jJSnYf

http://schrts.co/oLPI9N

http://schrts.co/dtCHW8

http://tinyurl.com/pljj7gq

It’s deja vu 2008 and 2001, only this time the overleveraging is global and unprecedented in world history as a share of GDP and bank capital. We are witnessing the end of a once-in-a-lifetime global debt cycle going back to after WW II and the reflationary phase that began in the early 1980s.

Cash/liquidity for households and firms will become increasingly dear. Liquidity preference and risk aversion will be the dominant mindset. QEternity will resume by the Fed along with a return to ZIRP and the likelihood of NIRP in some form.

Mass consolidation across industries will occur, including asset sales, spinning off lines of business, reduction of capacity, mass firings, early retirement without replacement, restructuring debt, mergers, large firms merging and going private, etc.

The post-2007 trend of nominal GDP will decelerate to below 2% and the post-2007 trend for real GDP per capita will persist around 0%.

Global deflation, a liquidity trap, and secular stagnation will be the normative global condition for 70-75% of world GDP.

Interesting! An update will be required soon! Thanks for posting…

This work looks very valuable.

The December Fed hike helped create stability investing in emerging markets, because;

1. An unexpected tightening is less likely when the Fed is ahead of the curve.

2. Fewer tightenings are needed when the Fed stays ahead of the curve.

3. The market is expecting a Fed Funds Rate of 1.25% to 1.50% by the end of 2016, which seems too high given current and expected economic conditions.