Today, we are fortunate to present a guest contribution written by Dae Woong Kang, Nick Ligthart, and Ashoka Mody, Charles and Marie Visiting Professor in International Economic Policy, Woodrow Wilson School, Princeton University.

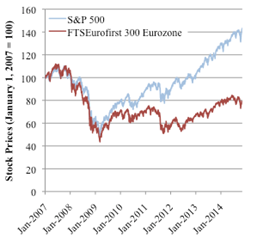

Although the Great Recession was viewed—especially in Europe—as mainly a U.S. problem, the eurozone was implicated from the start and felt virtually the same impact in the early stages (Figure 1). The U.S. economy, however recovered much faster. U.S. stock prices and GDP regained their pre-crisis levels by late-2011; the eurozone barely reached that stage in 2015.

Figure 1: Stock and GDP Price Movements.

The U.S. policy response was much more proactive. Fiscal stimulus was greater than in the euro area in 2008-9; the U.S. also returned to fiscal austerity later, in 2011, rather than in 2010 as the eurozone did (Mody 2015, p. 2). More important was the U.S. authorities’ active resolution of banking stress; eurozone banking problems were allowed to fester. And throughout, U.S. monetary policy was much more aggressive. In a recent paper, we used a narrative approach to identify the role of monetary policy during the Great Recession (Kang, Ligthart, and Mody, 2015).

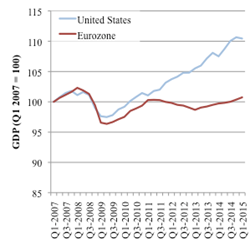

The U.S. Federal Reserve lowered its policy interest rate (the Fed Funds rate, the rate at which banks lend to each other) from 5¼ percent in September 2007 to 0-0.25 percent in December 2008 (Figure 2). At that point, the Fed also initiated “quantitative easing” and began “forward guidance,” making public its intention to keep interest rates low “for some time.” The ECB’s first reaction to the Great Recession was in July 2008, and it was to raise the policy rate (the main refinancing rate, the interest rate banks pay to borrow from the ECB). After the Lehman bankruptcy in September 2008, the ECB joined an internationally coordinated rate reduction on October 8. But then, the ECB slow pace of rate cuts was interrupted by two more hikes—in April and July 2011. The policy rate was brought to near-zero only in November 2013; modest quantitative easing began in September 2014 and was expanded in January 2015.

Figure 2: Policy Rates: the U.S. Federal Reserve and the European Central Bank.

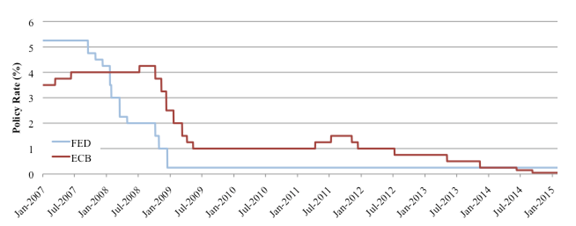

Our narrative tracks the stated policy intent, the stock market response following the announcement, and the immediate market commentary. To examine the stock market’s response to the announcement of interest rate cuts, we used an event-study methodology similar to that of Ait-Sahalia et al. (2012). First, the “abnormal difference” was computed for each day following the announcement. This is measured as the change in the stock price minus the average daily change over the twenty days before the announcement (the presumption is that absent the announcement, stock prices would have continued to change at the same pace over the next five days). Adding up the daily abnormal differences, the cumulative abnormal difference shows the post-announcement divergence in the stock price movement from the trend in the preceding twenty days. The results are summarized in Figure 3.

Figure 3: Stock Market Reactions to the Reduction of Interest Rates. Note: In computing the average “abnormal” reaction between 2007 and 2009, we do not include the market reaction on October 8, 2008 because of high volatility in the days following. The results remain unchanged.

The stock market responded positively to the Fed’s rate cuts. In contrast, the market’s reaction to the slower-moving ECB was, on average, negative between 2007 and 2009 and also between 2011 and 2014. Consistent with our findings around the announcements, U.S. stock indices moved ahead of those in the euro area, as seen in Figure 1. Moreover, as Figure 1 also shows, stock prices tracked relative differences in GDP performance, in line with the Akerlof-Shiller (2009) view that improved investor sentiment helps stem the fall and begin the recovery.

Active Stimulus

The anticipation of the announcements was not the primary influence on stock prices. In the U.S., the one unexpected announcement did trigger a strong response; but even the anticipated rate cuts were viewed favorably, especially if they were 50 basis points (0.5 percent) or larger. Researchers at the Chicago Fed find that anticipated policy actions have positive stimulative effects if they signal deviation from historical policy (D’Amico and King 2015, p. 2-3). Thus, while formal “forward guidance” came only on December 16, 2008, the actions up until then established a presumption that the Fed was pursuing a risk management approach and creating a safety net. In Woodford’s (2012) terminology, the Fed was not just responding to news but was changing policy. Specifically, the larger rate cuts and accompanying statements signaled that the Fed was trying to “forestall” financial turmoil from spiraling out of control.

In contrast, even the larger ECBs rate cuts were seen as “too little, too late.” The ECB was reacting to news—building its shelter amidst a raging storm. ECB statements also mused endlessly about rising inflation and hence almost never promised more forthcoming action. The Bank of England was also late, but made up with quicker and much larger rate cuts, followed by quantitative easing.

It is true that the Fed has a clear dual mandate to support employment and maintain price stability. However, the central banks’ differing mandates were not the reason why they acted differently in the Great Recession. The ECB—despite its primary focus on price stability—had previously responded as if it had a dual mandate. Indeed, as Lars Svensson has pointed out, the ECB’s goal of “medium-term” price stability (over a two-year horizon) implied that it would not seek to bring inflation down instantly since attempting to do so would cause an unreasonable drop in output (Svensson 1999, p. 83, 96, and 107). The result, Svensson argues, is that ECB’s stated objective is indistinguishable from that of central banks with dual mandates, as studies have confirmed (Taylor 2010 and Nechio 2011).

Rather, as Alan Blinder pithily states, the Fed operated during the Great Recession on the “dark” view that a huge loss of wealth could tip the economy into a free fall (Blinder 2013, p. 94). The priority was to prevent or manage that risk. Between 2007 and 2009, the Fed made the judgement that inflation risk was low and the main task was to prevent a downward output spiral. Later, the Fed used the same risk management approach to fend off the risk of price deflation.

By contrast, the ECB concluded that a temporary scare had caused banks to hoard cash and restrict lending to other banks (Blinder 2013, p. 94, Stark 2008). Thus, the ECB provided ample liquidity to banks, although no more so than the Fed. As the Fed understood, such passive provision of funds to banks was insufficient to induce banks to lend more and stimulate economic growth (Hetzel 2012). The loss of confidence and severe demand contraction required active monetary stimulus. The ECB insisted that foreign demand would “support ongoing growth” in the eurozone (e.g. Trichet and Papademos 2008).

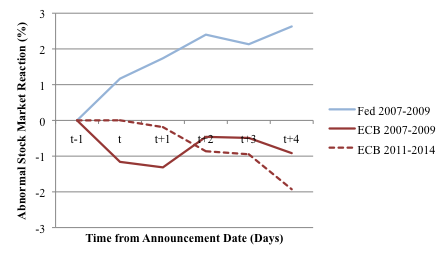

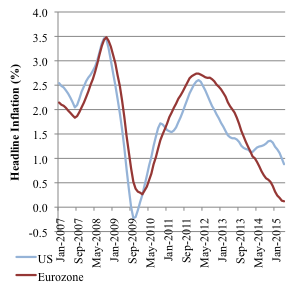

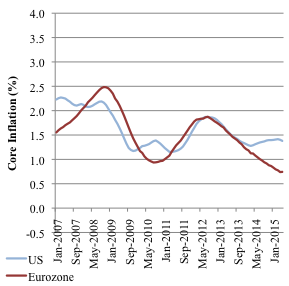

The essential difference between the Fed and the ECB, therefore, boiled down to how each institution viewed the evolution of the economy. Even though inflation rates in the U.S. and the euro area were nearly identical (Figure 4), the ECB’s overemphasized the risk of a commodity price-wage spiral and underestimated the financial and economic risks (Hetzel 2014). Market commentary repeatedly sent this message, as we document in our paper.

Figure 4: Headline and Core inflation for the US and Eurozone. Note: 12-month moving average of year-on-year inflation.

Forestalling Deflation

The Fed transitioned to worrying about deflation risk as early as June 2010, even though inflation was rising in tandem with the European inflation rate (Figure 4) (Federal Reserve System 2010). The Fed’s main tools now were quantitative easing and forward guidance. As is well-known, in this inglorious interlude, the ECB twice raised interest rates. But even past that point, the ECB continued to reject a risk-management approach and followed rather than anticipated the deceleration in inflation. Because it had delayed stimulus during 2007-9, the ECB needed more aggressive action, rather than continued wait-and-see approach. At a November, 2013 press conference, a journalist described the ECB as a “pea-shooter dealing with an approaching deflationary tank” (Draghi 2013). ECB President Mario Draghi responded that the ECB was waiting for more data, and would do more, “if needed.” Thus, the ECB acted asymmetrically: rising commodity prices were expected to feed persistent inflation but falling commodity prices were expected to reverse course. Once again, markets and analysts reacted impatiently. Interest rate cuts were not enough. The question was why more aggressive “non-standard” actions were not being taken.

Policy Credibility

We conclude also that the Fed gained credibility even though it appeared to temporarily suspend its commitment to price stability. Michael Bordo and Finn Kydland (1995) have argued that setting aside a policy rule to deal with extraordinary contingency is consistent with commitment to long-term goals. The Fed made clear its objective of preventing a meltdown and, as Blinder (2012) has emphasized, credibility principally requires that words be matched with deeds.

In the eurozone, words were often a substitute for deeds. Markets and investors reacted to the tight monetary policy, which added to the economic drag and deflationary tendencies due to fiscal austerity and lingering banking problems. By mid-2009, euro area output had fallen behind that of the U.S., and it never caught up. Delays in stimulating economic recovery have permanent consequences, as recent analysis reaffirms (Fatas and Summers 2015). For all its rear-guard action, the ECB misread the crisis and will be associated with the legacy of a weak recovery and more entrenched deflationary tendencies. If, as is entirely possible, the euro area’s core inflation rate remains below 1 percent a year, the ECB’s credibility will be twice hurt. Not only would it have failed to provide stimulus when needed, but it would have allowed the euro area to slip into a low inflation trap, well below its stated target of 2 percent a year.

References

Aït-Sahalia, Yacine, Jochen Andritzky, Andreas Jobst, Sylwia Nowak, and Natalia Tamirisa, 2012, “Market Response to Policy Initiatives during the Global Financial Crisis,” Journal of International Economics 87(1): 162-177.

Akerlof, George and Robert Shiller, 2009, “Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism,” Princeton: Princeton University Press.

Blinder, Alan, 2012, “Central Bank Independence and Credibility During and After a Crisis,” Griswold Center for Economic Policy Studies Working Paper No. 229, September.

Blinder, Alan, 2013, “After the Music Stopped: the Financial Crisis, the Response, and the Work Ahead,” New York: Penguin Press.

Bordo, Michael and Finn Kydland, 1995, “The Gold Standard as a Rule: an Essay in Exploration,” 32: 423-64.

D’Amico, Stefania and Thomas King, 2015, “What Does Anticipated Monetary Policy Do?” Federal Reserve Bank of Chicago, Working Paper 2015-10, November.

Draghi, Mario, 2013, “Introductory statement with Q&A,” European Central Bank, November 7.

Fatas, Antonio and Lawrence Summers, 2015, “The Permanent Effects of Fiscal Consolidations,” Centre for Economic Policy Research Discussion Paper No. 10902, October 2015.

Federal Reserve System, 2010, “Minutes of the Federal Open Market Committee,” June 22-23.

Hetzel, Robert, 2012, “The Great Recession: Market Failure or Policy Failure,” Cambridge: Cambridge University Press.

Hetzel, Robert, 2014, “Contractionary Monetary Policy Caused the Great Recession in the Eurozone: A New Keynesian Perspective” The Federal Reserve Bank of Richmond Working Paper Series, August 22.

Kang, Dae Woong, Nick Ligthart, and Ashoka Mody, 2015, “The European Central Bank: Building a Shelter in a Storm,” Griswold Center for Economic Policy Studies Working Paper No. 248, Princeton University, December.

Mody, Ashoka, 2015, “Living dangerously without a Fiscal Union,” Bruegel Working Paper 2015/03.

Nechio, Fernanda, 2011, “Monetary Policy When One Size Does Not Fit All,” Federal Reserve Bank of San Francisco Economic Letter, June 13.

Svensson, Lars, 1999, “Monetary Policy Issues for the Eurosystem,” Carnegie-Rochester Conference Series on Public Policy 51: 79-136.

Taylor, John, 2010, “Globalization and Monetary Policy: Mission Impossible,” In International Dimensions of Monetary Policy, University of Chicago Press: 609-624.

Trichet, Jean-Claude and Lucas Papademos, 2008b, “Introductory statement with Q&A,” European Central Bank, February 7.

This post written by Dae Woong Kang, Nick Ligthart, and Ashoka Mody.

interesting comparison. there are many, even here on this blog, who argue the US response has been a failure. but actually, when compared to a real natural experiment, it appears the US response and recovery has been rather successful. in particular, compared to a response which focused on austerity and balanced budgets in europe, the us recovery has been rather good. it is nice to be able to compare the recovery to another real event. it has been easy for some to argue the recovery in the us has been poor, because of comparison to some fictitious “normal” recovery. reality seems to draw somewhat different conclusions for the actual events which occurred.

The US also does not suffer from the geographic imbalance between a highly productive, low employment export region and a low productivity, high unemployment import region the way that Europe does.

While the geography of “the lower 48” is far from an optimal currency zone, it’s a much better fit than the patchwork crazy-quilt of Europe. Our labor mobility is much higher than Europe’s and we have the benefit of a single language (majority, anyway) zone to accompany our currency zone . . . . . . .

That decision by the ECB to raise rates in early 2011 was just the most bewildering thing.

It should be noted, the E.U. continues to lag the U.S. badly in emerging industries and U.S. population growth is four times faster.

It’s a U.S.- centric world and the E.U. Is part of the “train wreck.”

US population growth (driven primarily by mass immigration from Mexico and Central America) under the constraints of Peak Oil, overshoot, resource depletion per capita, unprecedented debt to GDP, peak-demographic drag effects, climate change, a record low for labor share, decelerating productivity, and obscene wealth and income inequality is NOT a positive. The EZ is finding this out as they mistakenly accept waves of desperate refugees escaping the effects of the last-man-standing competition for the remaining scarce resources of a finite planet between the West and Russia-China.

The mass immigration to the US, Canada, Australia, and the EZ will reduce productivity and growth and increase the cost per capita to same in the short AND long run.

The greater flow of low-skilled immigrants from dirt poor countries, who are desperate for work and have little wealth, helped keep wages depressed and prices low. In the high-skilled economy, wages, prices, and wealth increased. So, there’s greater income and wealth inequality.

“That decision by the ECB to raise rates in early 2011 was just the most bewildering thing.”

This is only surpassed by the bewildering decision of the U.S. Fed to raise rates in 2015.

Dumb and Dumber.

The authors ignore that the euro area has been hit in 2012 by a second and more severe sovereign crisis. At least they should acknowledge that this is an important element in explaining the divergence in performances – perhaps more important than differences in monetary policies.

The authors ignore that the euro area was hit by a second, more severe sovereign debt crisis in 2012. At least they should acknowledge that this was also an important element in explaining the difference in economic performance relative to the US.

the current euro zone rules probably ensure they have a sovereign debt crisis every couple of years into the foreseeable future. a one size fits germany monetary policy is bound to have repercussions on other members of the euro zone without a fiscal transfer system. this flaw needs to be addressed.

your “fiscal transfer” is crime against me

actually, it is not a crime if you want to have a euro zone. once again, the eurozone cannot be made up of a one size fits germany policy. if you do not want shared sacrifice, then leave the euro. but it will not work without shared monetary and fiscal systems in place. selfishness is what will ultimately bring down the euro zone in the long run. too many people in europe are not ready for a truly integrated europe.

The obscure FT index is a propaganda tool.

Please compare to way more objective IMF data :

http://de.slideshare.net/genauer/gd-pper-capita-in-ppp-us-versus-euroarea-germany

I had previously posted a comment, detailing on Mr. Modi and his criminal proposals, which was censored.

I kindly enquire, why ?

genauer: I deleted because your last two points were ad hominem attacks on the author, with unsubstantiated allegatioins. You can repost the comment without the personal attacks and I will assess.

[deleted text – mdc]

but here goes the rest:

As discussed here previously,

1. The plot of absolute GDP is misleading, with the arbitrary starting point 4Q2007 is grossly missleading, given

a) the different population growth in the Euro and the US

b) the delayed onset of the housing crisis in Europe

A fair and neutral comparison shows that the US and Euro development is not significant different, and “ordo-liberal” Germany perforrming systematically better

http://de.slideshare.net/genauer/gd-pper-capita-in-ppp-us-versus-euroarea-germany

2. the FTSE Eurofirst is a strange index, given that there seems to be no ETF available which represents it, nor a long term ticker symbol in total contrast to the S&P500, maybe this is a justa specially chosen comparison ? I am happy with my Euro investments

3. The US had the advantage of a much lower public debt at the begin of the crisis, that the very most Euro countries. This enabled a much larger deficit spending before running into the financial crisis 2008

http://de.slideshare.net/genauer/sampler-of-gdp-and-other-data-emphasis-on-russia , page 3

Mody personifies was is wrong with american academic economics, togehter with Krugman

This post falls far short of telling the true story. Europe was weaker than the US going in. The paper makes no mention of this. Weakness was because of the eurozone’s top-heavy, insolvent banking system. Also because the euro currency is a vise-like constraint on euro periphery growth. Note the banking problems in Portugal now breaking out, those in Italy as well, and the phenomenal surge in Deutsche Bank CDS spreads now underway.

Even more glaring, there’s no mention of the unintended consequences of QE. QE did help the US grow somewhat faster than the eurozone this past 7 years. But half of the economic energy of the QEs went abroad to China and the EMs via the carry trade, and another quarter created bubbles in US home prices and stocks. The gargantuan carry trade flow is now reversing. Like a scorpion’s tail, it is whipping back around about to sting. The Fed’s foolish, flagitious liquidity injection via ZIRP and the QEs has in this way set the stage for the recession about to begin. Recession cannot now be avoided given the forces emanating out of China and the EMs that were fed by US and eurozone QEs. Oil is merely a symptom, a transmission device.

The far larger question is: Will the coming financial crisis be mild or will it rival the last one? Global debt-to-GDP is at an historic record, far beyond that ahead of the 2008 crisis. This time there are no country locomotives to pull the globe out of recession. Last time there were two. As well, the US fracking locomotive is completely derailed. Around the globe, fiscal and monetary policy have little if any ammo left to reverse the coming decline. Only gullible academics hermetically sealed off from the real world would believe the stuff of this post. It lacks any semblance of being comprehensive about its subject matter.

How can you blame the Fed for doing what it had to do, i.e. QEs?

It’ll likely tighten the money supply very slowly – much slower than normal – from a highly accommodative stance.

Here’s what Bob Brinker said about the Fed (Dec 2012):

“It’s only because the Federal Reserve has been active that we have any growth at all in the economy….The Federal Reserve is the only operation in Washington doing its job.

The only person that would criticize Ben Bernanke would be a person who is so clueless about monetary policy and (the) role of the Federal Reserve as to have nothing better than the lowest possible education on the subject of economics….Anybody going after Ben Bernanke is a certified, documented fool….”

PeakTrader … So you get your economics off the radio, eh? Well, well … that explains a lot.

JBH, I have degrees in economics. I think, Brinker has an economics degree. You can praise the Fed later.

PeakTrader Look, Peak. Degrees are a dime a dozen. I wrote my doctoral dissertation under one of the most brilliant economists of the 20th century. In 12 weeks. With the core of the dissertation published in a top economics journal. But I did not truly understand real world macro in those days. Rather, I simply got my foot on the necessary first rung. One of the many gaping holes in my understanding was credit, debt, and the financial sector. Over the course of many years I shed much academic baggage piece by painful piece, and with great difficulty replaced it with what worked. The test of a theory is its predictive ability. My forte is prediction, and I am good at it. The heart of Keynesian economics is wrong. Savings is crucial, and Keynesian economics is upside down on this. Ergo the miserable track record of nearly all forecasters.

To substantiate this. Made in late-Jan or early-Feb (after the initial BEA estimate for the final quarter of the prior year was out), my 4th Q to 4th Q year-ahead real GDP growth forecasts this past four years had absolute errors of: 0.2, 1.0, 0.2, 0.4. I warned of the potential for a systemic risk crisis in a comprehensive piece I wrote in July 2007. That November I predicted recession in 2008 in no uncertain terms. At the time only 5% of forecasters were. Accurate and early recession calls at the peak of the cycle are the most difficult, worth their weight in gold relative to forecasts at other times. From January on during 2014, my 10-year yield forecasts for yearend 2014 were below those of all consensus forecasters in 9 of the 12 months, with only one forecaster below mine in two of those months and two below mine in the other month. I’m on record on this site in late-July this past year saying the Dow had entered a bear market. That has yet to be proven correct, but soon will be. Bear is minimum down 20%. In December when the Fed hiked, I said there would be no more hikes in 2016. This was raw fodder for my prediction that the 10-year yield would trend lower over the course of 2016. The January consensus predicted the 10-year would be 2.8% this coming December. Only two of 70 forecasters had yields falling, one to below 2%, which was what I forecast. I made this claim on Dec 18th, two days after the Fed’s hike! In the face of all their rising dots‼ At the time the 10-year was 2.19%. It proceeded to rise to 2.32%, and you know where it is today. Of course the year has 11 more months to go, but they won’t be pretty.

The last recession was unlike any in our lifetime. Few got it right in advance. You had to be creative, think outside the box, and be deeply knowledgeable about economic history to do so. Similarly, for the coming recession. Again it will be unlike any in our lifetime in terms of causation. On Jan 14th I claimed unequivocally that we were not in recession yet, but – overruling trusty, proven indicators – that this next recession would get underway sometime between Apr and Aug. At the time not one forecaster in the consensus was calling for recession. The core reason for this is that mainstream theory most economists rely on is utterly (though not wholly) wrong.

The above is laced with factual statements and at least three specific forecasts of the future that are time dated and hence verifiable as those dates roll around. The second two QEs and the pegging of the funds rate to zero all this time have been a travesty on the American public. The policies of Greenspan, Bernanke, and Yellen have all been travesties. You cannot see this because of your belief system. I judge that like most you are myopically focused mostly on the recent past and present, with no real comprehension about how policy actions today affect the economy far into the future. At present moment, a vast stock of poor policy consequences from policy actions going way back is charged like a capacitor and about to discharge. The Greenspan put, dating from Oct 1987 and enacted again and again since, is a good placeholder for what I am talking about. The QEs were nothing other than an extreme morphed version of that put. Through either stupidity or malice the Federal Reserve has driven the US economy into a box canyon. Mainstream economists have blindly cheered the economy’s progress this recovery – look how well the US economy has done this past seven years relative to the eurozone, they say. Not for a moment understanding that if the US economy is ever to get back on the track of healthy sustainable growth, we all will have to turn back! That is, undergo a couple decades of far, far below healthy growth to purge the consequences of the recent decades of manifestly bad policy that have accumulated. The actual official growth rate since even before 2000, low as it has been, has all along been partially illusory built as it was on excessive credit and debt. It’s cheated the future in that from now on growth will be far below what it could have been. Not easy to see unless you stand very, very high so as to know exactly where to burrow deep. A la Richard Feynman.

Take no offense by these remarks. I read most of your comments and you certainly do get some things right. But there are a lot more light bulbs that will have to illume, dimly at first and then brighter over time, before you get most things right. Since the future is inherently uncertain, most is the best that can be expected of us humans. Reinhart and Rogoff, Steve Keen, Michael Pettis, Lacy Hunt with Hoisington Investment, Robert Gordon, Mark Skousen, hedge fund managers like Jeffrey Grundlach, Kyle Bass, and Ray Dalio, and the website Zero Hedge are there for anyone wanting to understand the myriad different aspects of the real world. The problem highly trained professionals have is breaking out of the belief structure of the pale imitation academic stuff they and public have been brainwashed with. Because of peer review pressure, this is not easy to do when you are on a tenure track. And by tenure it is too late since it is well-nigh impossible for one to see – let alone repudiate – what is wrong with one’s life work. John Hicks comes to mind as someone who was able to do so.

“How can you blame the Fed for doing what it had to do, i.e. QEs?”

peak and i rarely agree, but this statement is true. it is fascinating how people immediately line up for/against the bed and bernanke. how can you fault the fed for taking action to defend the economy against utter collapse. some people live in a fantasy land, where all would be well if only the fed had stepped back and let the chaos occur. truly baffling. the fed could be conducting more traditional monetary policy today if the congress would have allowed the needed fiscal support during the crisis. but congress chose to provide back door support through the fed, so that they did not have to step up and explain the situation to their constituents. this was a very inefficient approach to the crisis.