The employment release (see also [Duy/Economists View]) provided some interesting insights into how manufacturing has fared, in the wake of the appreciation of the dollar (and the slowdown in the world economy).

In particular, manufacturing employment growth registered at the high end of the range experienced over the past year, as noted by Furman/CEA.

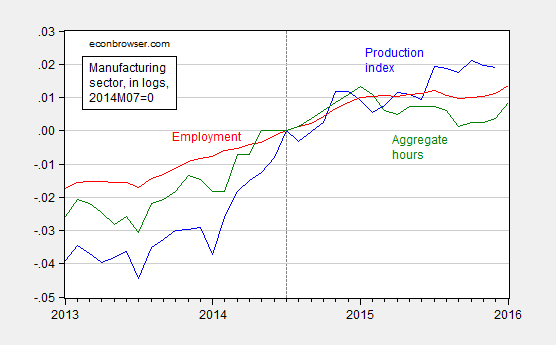

Figure 1: Log industrial production in manufacturing (blue), employment (red) and aggregate hours (green), all normalized to 2014M07=0. Source: FRB and BLS via FRED, and author’s calculations.

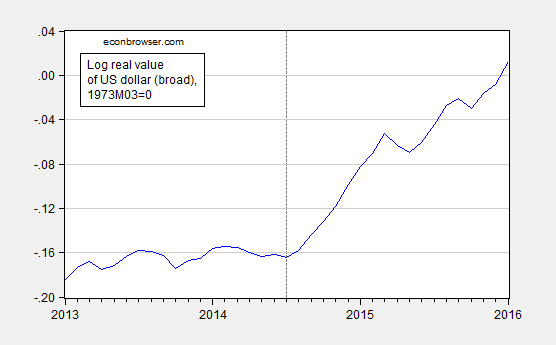

Note that while employment is above the most recent peak, aggregate hours is not. Furthermore, the dollar has appreciated on a broad basis by 17.7% (log terms) since 2014M07, and the lagged effects are yet to fully appear.

Figure 2: Log trade weighted value of USD, broad basket of currencies, 1973M03=0. Source. FRB, author’s calculations.

Hence, the question in my mind is how long this seeming resilience (keeping in mind all recent data entries will be revised) will persist; the ISM PMI continues to signal manufacturing contraction [1]. Maybe a Plaza Accord II, if effective, wouldn’t be such a bad idea. Absent that, further deferral of monetary tightening makes (a lot of) sense.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=3n6R

https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-updated-multiple-jobholders-boost-full-time-employment

https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-fresh-data-cheap-labor

The net of job growth since 2012-13 is for those will less than a high school diploma and for multiple jobholders in low-paying jobs in retail, restaurants, and bars.

Full-time, private employment for age 25 to 54 per capita is at the level of the late 1980s to mid-1990s.

Capital formation to GDP is at the levels of the early to mid-1990s.

Labor share remains at, or near, a record low to GDP going back to the 1930s and 1890s.

Private non-residential investment to employee is contracting YoY again.

Gov’t, “health” care, “education”, and financial net flows cumulatively are equivalent to well over 50% of GDP.

Debt to wages and GDP is at unprecedented levels.

Wealth and income inequality rivals the Gilded Age.

Taxes on earned income, including payroll taxes and a meager EITC, are highly regressive vs. favorable tax treatment of speculative, non-productive rentier activity.

Yet, the vast majority of eCONomists continue to scratch their heads about why labor productivity is weak and barely growing, if at all.

Economists understand productivity is mostly influenced by the labor and capital inputs, along with technological improvements.

“In the survey, 94% of economists said weak capital spending had a “large” or “modest” impact. Workers need the innovative equipment and modern supply chains to increase their output per hour, but the capital spending dearth means that isn’t happening. “The drop in capital investment has reduced the growth of [the] capital-to-labor ratio.”

Increased government regulation was cited by 64% of economists as having a large or modest impact. “Tax and regulatory policies have restrained investment and innovation.”

Also, I may add, raising the minimum wage will make capital relatively cheaper than labor. Capital spending will increase and employment will decrease (or shift, e.g. to production of capital equipment). However, to insure employment, tax and regulatory burdens should be reduced.

Reducing tax and regulatory burdens should have a positive effect on business start-ups and expansions. And, it’s possible, ptoductivity gains went to taxes and regulations rather than to (higher) wages or (lower) prices.

Raising the minimum wage should reduce employment, reduce other production costs (e.g. turnover), raise consumption (workers with high marginal propensities to consume), attract idle labor, raise capital spending & employment, raise productivity, and raise prices (although, real income of low-wage workers rise and real income of high-wage workers fall).

Moreover, I may add, small businesses aren’t thriving, like in the past, to become big businesses. More progressive middle class taxes and more regulations, along with greater legal burdens, may be major factors why business start-ups are in decline and more businesses are being destroyed than created. However, big businesses can more easily absorb taxes, regulations, and legal burdens. Many U.S. multinationals have less competition and more market power to thrive, particularly many high-tech firms, which have huge profit margins, little or no debt, and lots of cash.

Profits Without Production

Paul Krugman

June 20, 2013

“Economies do change over time, and sometimes in fundamental ways.

“…the growing importance of monopoly rents: profits that don’t represent returns on investment, but instead reflect the value of market dominance.

…consider the differences between the iconic companies of two different eras: General Motors in the 1950s and 1960s, and Apple today.

G.M. in its heyday had a lot of market power. Nonetheless, the company’s value came largely from its productive capacity: it owned hundreds of factories and employed around 1 percent of the total nonfarm work force.

Apple, by contrast…employs less than 0.05 percent of our workers. To some extent, that’s because it has outsourced almost all its production overseas. But the truth is that the Chinese aren’t making that much money from Apple sales either. To a large extent, the price you pay for an iWhatever is disconnected from the cost of producing the gadget. Apple simply charges what the traffic will bear, and given the strength of its market position, the traffic will bear a lot.

…the economy is affected…when profits increasingly reflect market power rather than production.

Since around 2000, the big story has been one of a sharp shift in the distribution of income away from wages in general, and toward profits. But here’s the puzzle: Since profits are high while borrowing costs are low, why aren’t we seeing a boom in business investment?

Well, there’s no puzzle here if rising profits reflect rents, not returns on investment. A monopolist can, after all, be highly profitable yet see no good reason to expand its productive capacity.

And Apple again provides a case in point: It is hugely profitable, yet it’s sitting on a giant pile of cash, which it evidently sees no need to reinvest in its business.

Or to put it differently, rising monopoly rents can and arguably have had the effect of simultaneously depressing both wages and the perceived return on investment.

If household income and hence household spending is held down because labor gets an ever-smaller share of national income, while corporations, despite soaring profits, have little incentive to invest, you have a recipe for persistently depressed demand. I don’t think this is the only reason our recovery has been so weak — but it’s probably a contributory factor.”

But numbers are pretty weak for construction of non-residential structures, which is usually a leading indicator.

I personally found this a heartening report. It fits with the narrative of a supply-driven collapse in oil prices.

At first, oil-related investments falls, slowing the economy. However, low oil and commodity prices allow other sectors to flourish, and after a while these pick up the slack. (I would also note that $2 trillion in oil capex from 2005 to 2014 was close to a deadweight loss.)

True, the dollar is strong, but in my view, readily explained by the effect of improved US terms of trade. US manufacturers may be facing relatively higher labor and real estate costs due to a strong dollar, but the country is enjoying very cheap energy and commodity prices. So, we’ll see, but this last report was quite heartening, I thought.

On a more provincial note, I was shopping last night at Trader Joe’s and it was absolutely packed, far more than any other time I have been there, including Christmas time. Of course, today is the Super Bowl (no hype this year, it seems) and Chinese New Year starts at noon, but even so, I was astounded at the traffic there. My son reported a 1’45” wait at On the Border, a Mexican restaurant also here in Princeton. I don’t know, but the anecdotal evidence suggests an economy gathering steam, not foundering, at least here in Princeton.

Rock solid JOLTS report.

Note quits and hires.

http://www.calculatedriskblog.com/2016/02/bls-jobs-openings-increased-in-december.html