Substantial attention has been devoted to the disasterous effects of implementing a Donald Trump agenda of imposing 45% tariffs on imports of goods from China. To gain some perspective, consider the implications for prices of goods imported from China if such a tariff were imposed (and a large country assumption used, so that only half of the tariff increase manifested in increased prices).

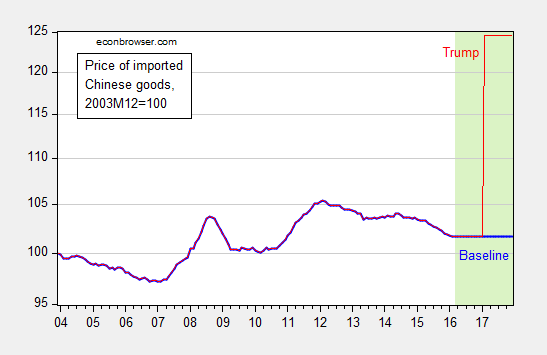

Figure 1: Price of Chinese commodity imports, 2003M12=100, with 2016M03 values at 2016M02 values (bold blue), and a 22.5% higher price level as of 2017M02 assuming the half of incidence falls on the US (red). Light green shaded area denotes projection period. Vertical axis is logarithmic. Source: BLS, and author’s calculations.

Obviously, drop the large country assumption, and the resulting price increase can be up to 45%.

From WaPo yesterday:

An economic model of Trump’s proposals, prepared by Moody’s Analytics at the request of The Washington Post, suggests Trump is half-right about his plans. They would, in fact, sock it to China and Mexico. Both would fall into recession, the model suggests, if Trump levied his proposed tariffs and those countries retaliated with tariffs of their own.

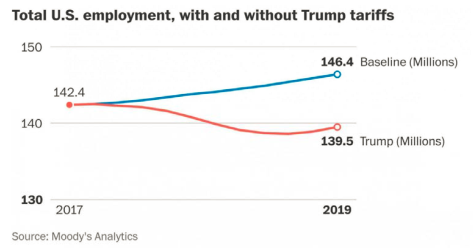

Unfortunately, the United States would fall into recession, too. Up to 4 million American workers would lose their jobs. Another 3 million jobs would not be created that otherwise would have been, had the country not fallen into a trade-induced downturn.

The job losses would be halved if China and Mexico chose not to retaliate to the tariffs of 45 percent and 35 percent, respectively. In which case U.S. growth would flatline, but the country would not fall into recession.

Here is the key graph from the article, depicting the baseline employment levels and the alternative under Trump:

I don’t know all the assumptions built into the simulation, and in particular I don’t know if the assumptions regarding imported goods price increases match those I’ve shown in Figure 1. But the trade flow impacts in the Moody’s simulation apparently match those in Peter Petri’s calculations, as recounted in this WSJ article.

Suffice to say, even the “no-retaliation” scenario (which in my personal, but limited, knowledge of Chinese characteristics, seems unlikely) is pretty unappealing.

That’s the Nuclear option. What is interesting is to consider what I call the Near nuclear option, which is implicit in the position statement on Senator Sanders’ website (Agenda Item 7).

We must end our disastrous trade policies (NAFTA, CAFTA, PNTR with China, etc.) which enable corporate America to shut down plants in this country and move to China and other low-wage countries.

Ending PNTR (I interpret the statement thus, as does Vox) with China sounds rather arcane, and even innocuous. After all, the acronym stands for “Permanent Normal Trading Relations”. It’s not clear what part of PNTR Senator Sanders wishes to do away with; if it’s the “P” in PNTR, then NTR will have to be renewed by Congress year after year, as it was from 1980 until 2000. How easy will that be in these times?

If NTR is not renewed, then what happens? Et voila, tariffs revert to levels applied before Most Favored Nation status was granted to China: to 44%. This figure is suspiciously close to the 45% value Donald Trump has cited.

So, what’s the difference between a Trump strike and a Sanders strike? Apparently, the only difference is that Donald Trump has promised to raise tariffs “on day one”, while Senator Sanders has not laid out a timeline. (An alternative interpretation is that Senator Sanders will only move to revoke PNTR if currency manipulation is proved, while Donald Trump won’t wait for a determination.)

More on the trade positions of both candidates here, and the likelihood each one can make a case that the Chinese currency is undervalued, here.

The trade deficit is necessary to fund US debt……….privately. Without it, short term rates would spike, inverting the yield curve, destroying the US economy. Protectionism and capitalism do not go together and never have. It is why paleo-cons are deluded morons(a name David Rockefeller told them to use). Only socialism and its tribalism can make that work. In many respects, the US doesn’t run a real trade deficit, as all of it recycles back into the country to finance consumption.

Capitalists will won’t and will not have a nation that has all its production and high living standards together. Simply no. They would be more profitable to shut down production and allow deflation to build up their assets.

Trade deficits fund US debt that is used to fund the trade deficit. It is a circular motion and if you eliminate this circle, nothing bad will really happen. Persistent large trade deficits are the main reason for the secular trend for a slowing economic growth in the US.

The U.S. consumes more than it produces in the global economy through trade deficits. And, U.S. gains-in-trade tend to be larger than our trading partners.

Milton Friedman: “The worst case scenario” of the currency never returning to the country of origin was actually the best possible outcome: the country actually purchased its goods by exchanging them for pieces of cheaply-made paper. As Friedman put it, this would be the same result as if the exporting country burned the dollars it earned, never returning it to market circulation.”

“And, U.S. gains-in-trade tend to be larger than our trading partners.” Given US has been running trade deficits for more than 30 years, this statement cannot be true. If I buy from you more than what I sell to you, and we are the only two economic entities in the universe, there are two inevitable consequences: I underutilize my productive resources, and I owe you money, a lot of it.

An example of gains-in-trade is China selling its goods too cheaply to spur or maintain employment. So, U.S. consumers benefit more than Chinese producers (U.S. producers also benefit from cheap imports).

The U.S. exchanges worth less dollars for valuable Chinese goods. So, the U.S. consumes more than it produces in the global economy and in the long run.

Moreover, the U.S. benefits from the dollar being the predominant world’s reserve currency:

“A reserve currency is money that’s held by many countries as their foreign exchange reserves. It’s also the currency that’s typically used to price commodities, such as oil and gold, that are traded between countries.

A country whose currency is the predominant reserve currency benefits tremendously. In the case of the dollar, the U.S. benefits from the increased demand for the dollar that the reserve currency status creates.

Other countries give the U.S. valuable goods in exchange for dollars issued by the Federal Reserve. They also lend the dollars they’ve accumulated back to the U.S. at low interest rates. Most significantly, the U.S. benefits from importing these goods and exporting its inflation to other countries in the form of depreciating dollars.”

I would differ with the line that protectionism and capitalism don’t go together. They went together quite well in the period 1865-1914 in the US. The republican party at the time was the party of protectionism. Lincoln was a strong proponent of protection for example. There was a $25 a ton tariff on British Rails during the period for example. (this was close to a 100% tariff on the rails). At the same time we had the pure capitalism boom with the relatively richest group of individuals in our history (Rockefeller, Carnegie and Ford to name a few). In one sense Trump is taking the republican party back to its historical position on protection. My thesis is that the worlds leading country is ok with free trade until serious competitors arise. The one complete case is the UK where by 1906 Joseph Chamberlin was pushing for imperial preference instead of plain free trade. By 1906 the UK had two serious economic competitors the US and Germany.

Since the 1970s, the U.S. had a low-skilled immigration boom, while we offshored jobs (e.g. to Mexico, China, India, etc.) that low-skilled workers can do.

I think, severely limiting low-skilled immigration to the U.S., since the 1970s, while moving forward in globalization (I.e. open markets, free trade, and unrestricted capital flows) would’ve resulted in higher low-skilled wages and less income inequality.

Also, if there were millions or tens of millions fewer low-skilled immigrants and their children, environmental stresses, particularly in the Western U.S., would’ve been much less.

That graph is hilarious.

The education in trade policy is greatly appreciated, but it is doubtful that there is much danger from Mr. Trump if the current betting odds mean anything related to who will become president. Great summary odds website: http://www.oddschecker.com/politics/us-politics/us-presidential-election-2016/winner

Why even post about Trump is he can’t be elected?

1. Generally, from and economic and human culture perspective, having more people from different places lead to a more humane, liberal, creative country. Blaming the stagnation of wages over the last 40 years on the immigration of low skill workers ignores the geographic fact and broad skill levels of that stagnation. http://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2016/01/22/fewer-manufacturing-jobs-housing-bust-haunt-many-us-counties

2. The mass migration of Hispanic Americans from Mexico, Central America, and Northern South America from 1970 – 2005 (the animus against these people is what is driving anti-immigrant sentiment – the large immigration from Asia (and in the 1970s and 80s from then poorer and more oppressed parts of Europe such as Poland and Ireland) does not seem to be the motivating emotional engine of the Steve King’s and Jeff Sessions of the world – has been what as created anti-immigration movement – hence the obsession with “building a wall” with Mexico) was primarily the result of a population boom that occurred during a demographic transition in those ares from 1960 – 1980. That boom has turn into a bust and immigration from those areas (except for the areas of instability and violence like Chiappas, Mexico, or Honduras, and Guatemala) is declining.

3. The areas most affected by globalization, financialization (essentially financial institutions using financial and tax avoidance techniques to extract rents, wealth, and income from the other stakeholders in a firm (investors, workers, and customers) – http://economix.blogs.nytimes.com/2013/06/11/financialization-as-a-cause-of-economic-malaise/?_r=0). Rust Belt (from up-State New York to Wisconsin and Missouri in the Midwest), Appalachia, and South have not seen a large influx illegal immigrants that depressed the cost of labor. Rather, industries such as steel, machinery, apparel, furniture, etc. were encouraged by private equity and investment bankers to shift production to China and other low cost Asian producers from the late nineties to at least 2007-9 recession. (The financing of that shift of investment, and the re-circulation of the the Chinese Current Account surplus back to the U.S. as a Capital Account Surplus was another way financialization extracted rents from their “middleman” position.”)

4. Capitalism’s secret for creating wealth these last 300 years has been a combination of technological progress, spread often by “stealing” the ideas and technological inventions of others and improving on them, and internal and external migration of “unskilled” labor from subsistence labor into industry which would magnified their productivity by factors of ten. (Patent trolling and other forms of rent seeking with patents and copyrights (and the extension of copyrights and patents in time) should be researched, along with growing monopolization and concentration of business, for the effect that this is having on the slowing of technological growth and productivity since 1970 – and yes, I tend to blame Nixon as the source of all the bad trends in U.S. life since 1970).

5. Tribalism is also a old human survival mechanism and one tribe will always like to think that membership therein makes them special, superior humans. Very self-flattering if nothing else. There may be good arguments about resisting immigration to preserve the “Anglo-Saxon” culture of America, except of course that such common culture is a myth (as in many ways New England, California, and the South are all separate “countries” themselves with barely language in common). It also underestimates the persistence of five great folkways of America and their attraction to newcomers who usually completely assimilate within 2-3 generations of the ancestor’s arrival. (For those interested, I refer David Hackett-Fisher’s “Albion Seed.”)

6. If anyone has a complaint about “illegal” and “uncontrolled” immigration, it would be First Americans (and it is an irony that predominate ancestors of most Mexicans and Central Americans are “First Americans” tribes).

7. The environmental carrying cost of human beings does not stop at borders, since atmosphere and the ocean currents don’t seem to have much respect for them. Higher living standards and sustained economic security appear to political prerequisites to environmental and conservation values and programs getting political support. The biggest environmental problem in the U.S. right now is that a substantial part of the U.S. elite has actually adopted values and beliefs that contain an animus to the environment, conservation, and public health as demonstrated by the policies being proposed in the U.S. Congress and enacted the States such as North Carolina, Kansas, Louisiana, Wisconsin, etc.

This comment is a bit late, but grist for future posts.

Hillary Clinton has joined the Trump-Sanders anti-trade bandwagon after being trumped by Sanders in Wisconsin. https://www.yahoo.com/news/clinton-tells-workers-shell-stand-cheating-china-221257929.html?nhp=1