Again.

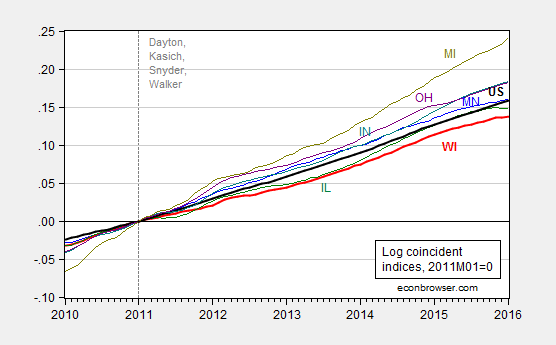

Figure 1: Log coincident indices for Minnesota (blue), Wisconsin (red), Illinois (green), Indiana (teal), Ohio (purple), Michigan (chartreuse), US (black), all normalized 2011M01=0. Source: Philadelphia Fed, January 2016 release.

(The set of states is defined as SBA Region V, used in this critique in Political Calculations. See also this post.)

The cumulative gap between Minnesota and Wisconsin as of December 2015 has widened from 2% to 2.2%, going from the December 2015 to January 2016 vintage.

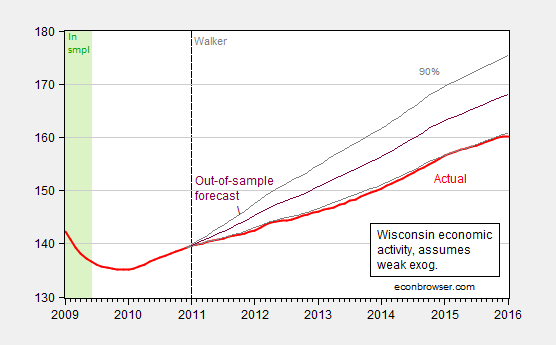

Note that Wisconsin continues to lag in performance relative to what correlations with the Nation would indicate. I estimate the long run relationship between Wisconsin and US economic activity from 1990M03 to 2009M06, and use that estimated model to dynamically simulate Wisconsin’s predicted level of activity (shown as the purple line in Figure 2 below).

Figure 2: Wisconsin coincident index (red), forecast from ECM (black), and 90% confidence band (gray). Green shaded area denotes in-sample period. See this post for description of forecasting model; assumes weak exogeneity of US index. Source: Philadelphia Fed January 2016 release, and author’s calculations.

Menzie,

What do you believe is causing Wisconsin to be left behind?

Mike: Contractionary fiscal policies — government employment in Wisconsin is down 10,000; in Minnesota, up 6,000 (12 month trailing moving average) relative to 2011M01 — and reduced spending relative to trend to match tax cuts; Wisconsin’s refusal to take Federal funds and expand Medicare; elevated policy uncertainty associated drastic policy changes (I am borrowing from Baker, Bloom and Davis for this point — I don’t have a Wisconsin policy uncertainty index to empirically validate).

Menzie,

How much less is Wisconsin spending versus Minnesota?

Government spending under Walker has gone up every year. The difference is he is taking money (and benefits) from middle class workers and throwing money at millionaires/billionaires who spend their gains out of state instead of investing in the state….because the people in the state don’t have more money to spend.

The dog (consumer spending) wags the tail (investment) by a 70/30 margin. Not the other way around.

The top 3 performers in your chart according to the philly fed index are Michigan, Ohio, and Indiana. Government spending in Michigan, Ohio, and Indiana have decreased more on a percentage basis than in Wisconsin and Minnesota according to BEA regional data real GDP.

From George Mason University: http://mercatus.org/statefiscalrankings

There are so many ways to look at the “health” of a state.

I look at California’s “Health” by driving down to Roseville to go shopping. Mercatus puts on Brown glasses to look at California. Then again California has been failing for my entire lifetime.

Still baking, are we?…

(P.S. Everybody knows.)

Ironman: See this post. You make me laugh, and laugh, and laugh. Thanks!

Why are Michigan, Ohio and Indiana doing so well?

How can US GDP for Q1 be trending towards zero with the kind of job creation we’ve been having? It makes no sense to me. Menzie?

THIS job creation is actually national cost cutting.