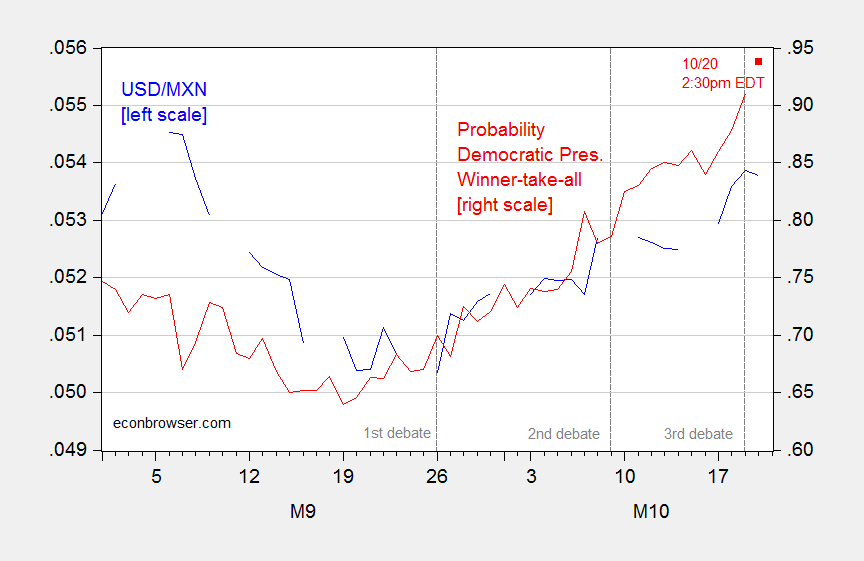

I was talking about prediction markets and asset prices (the Mexican peso and the Presidential election, and the pound and Brexit) in my classes this week. It struck me a good time to update this post on the peso’s movements as the odds for a Democratic win change.

Figure 1: USD/MXN exchange rate (blue), and odds of Democratic win in Presidential election, end of day (red). Observation for 10/20/2016 is as of 2:30PM Eastern time. Exchange rate defined so up is MXN appreciation. Source: FRED, Pacific Exchange Services, and Iowa Election Markets.

The adjusted R2 of a bivariate regression of first differences regression (exchange rate in logs) is 0.08, pretty good on a high frequency time series, in my book (t-stat with HAC robust errors is 2.06).

That chart puts a smile on my face. I can readily imagine more sensitive Mexican nationalists saying something nasty about Donald Trump’s mother while feeling vindicated.

In the background, oil prices have risen and somewhat stabilized. Higher oil prices could also be supporting the Mexican peso.