Last week I puzzled over the response of financial markets to the U.S. election. Since the election, the S&P500 is now up 3%, the dollar is up 4.6% against the euro, and most remarkable of all, the 10-year Treasury rate has gone up 50 basis points. Here I offer some further thoughts on the last development.

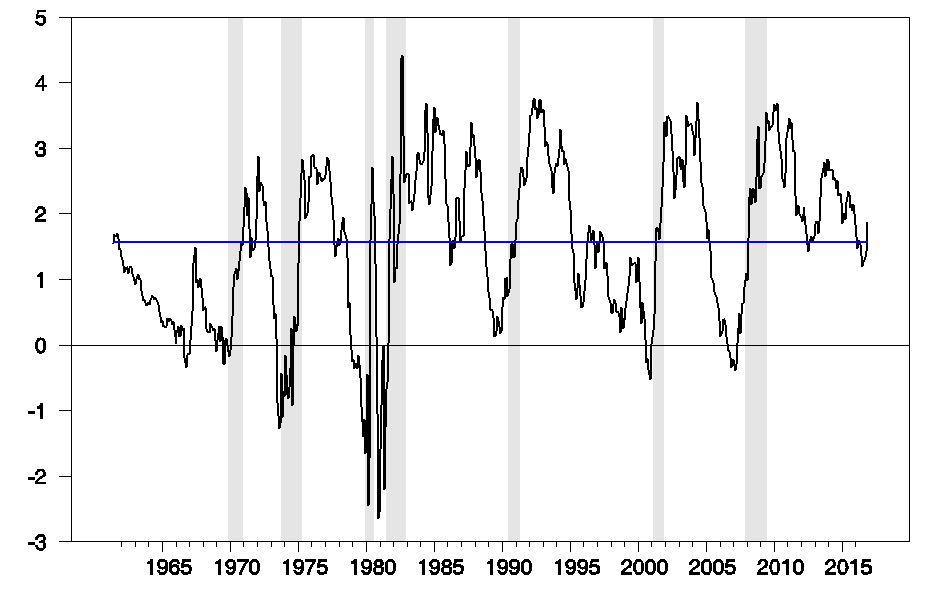

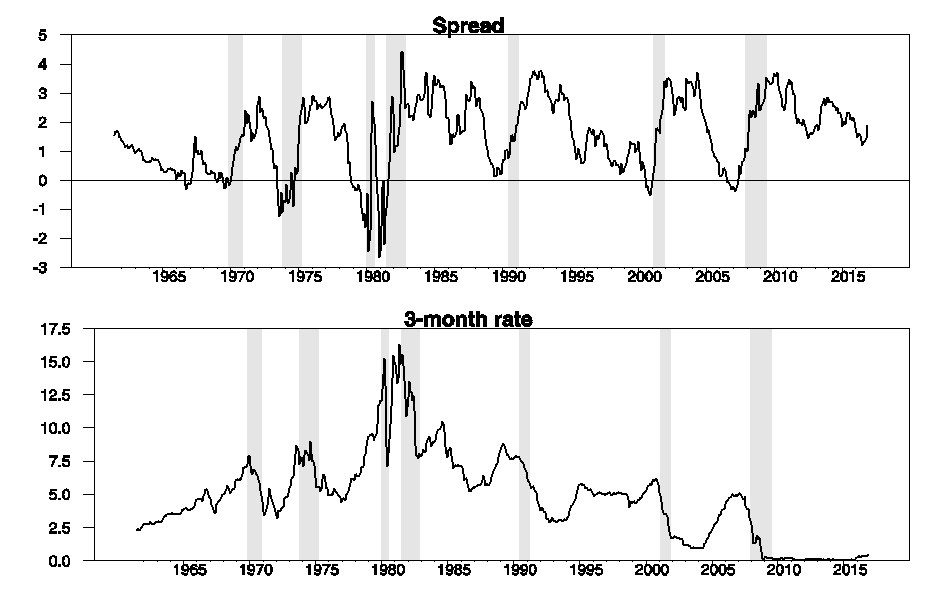

In normal times you would expect to earn a higher return from long-term bonds compared to short-term as an added compensation for being exposed to various risks. Over the last half century, the yield on 10-year Treasury bonds averaged 1.56 percentage points (or 156 basis points) higher than 3-month Treasury bills. But while the 10-year rate is up 50 basis points since the election, the 3-month rate has only risen 4 basis points. What we’ve seen is a rapid increase in the spread between long and short rates and a sharp steepening of the yield curve.

Yield on 10-year Treasury bonds minus that on 3-month Treasury bills, monthly June 1961 to Nov 2016. Blue line corresponds to average historical spread of 156 basis points.

In some historical episodes, short-term securities have a higher yield than long-term and the yield curve becomes inverted. These brief episodes of a negative spread usually come near the end of an episode of tightening short-term rates. If investors anticipate falling interest rates, an anticipated capital gain on a long-term bond can help compensate for the fact that its current yield is less than that on a 3-month T-bill.

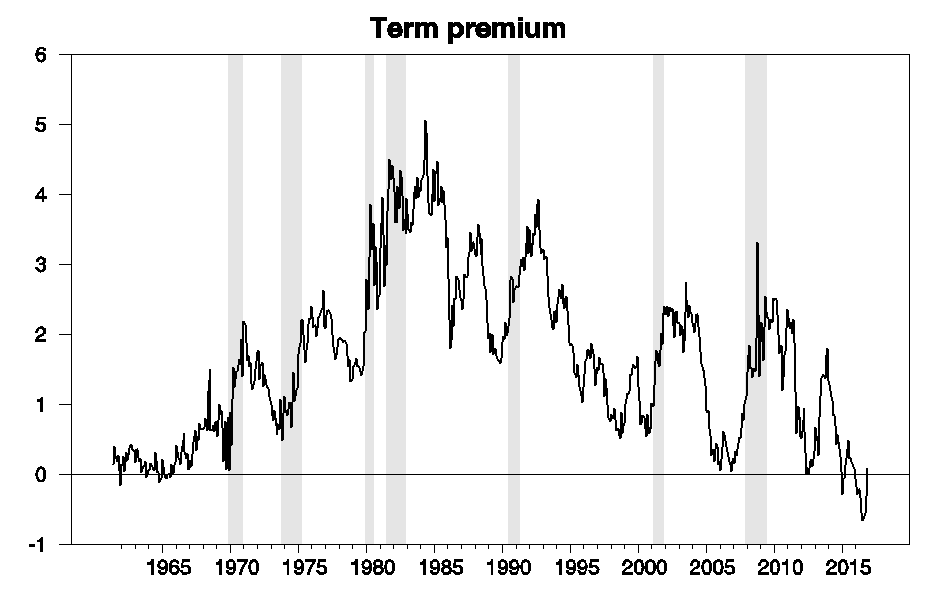

In principle it should be possible to calculate how much of the movement in the spread represents a changing assessment of future short-term rates and how much is a change in the premium earned for holding long-term bonds. If we have a model for forecasting short-term rates, we could calculate how much the spread should change due to the first factor, and attribute the difference between the actual spread and the predicted spread to changes in the term premium. Of course, the answer one arrives at can be quite sensitive to the model used for forecasting. Below is a graph of one popular estimate of the term premium.

Estimate of term premium on 10-year Treasury bonds based on the Adrian, Crump, and Moench model.

This series suggests that we have just emerged from an unusually long episode in which the term premium was actually negative, that is, an episode in which investors could anticipate higher returns from T-bills compared to Treasury bonds. Meager as the T-bill yield was, it was a better deal than taking a capital loss on long-term bonds, which would be the likely outcome once interest rates returned to something more in the normal historical range.

What could account for such a negative term premium? One big risk weighing on some investors recently has been the possibility that the U.S. might be about to enter a Japanese-style prolonged deflationary slump, with real interest rates near zero or even negative for the foreseeable future. Even if that is not the most likely outcome, it was a possibility against which investors might want some insurance. Long-term bonds are the one asset that would do well if that dismal scenario should unfold, which could have been one reason investors were willing to accept a lower expected yield for holding long-term bonds– the one state of the world in which they do well is the state in which you really want to have some extra money.

If this interpretation is correct, it means that the market views a protracted deflationary slump as significantly less likely than it had seemed three weeks ago. There has been some favorable economic news over this period. Positive reports for retail sales and housing starts have helped lift the Federal Reserve Bank of New York’s estimate of 2016:Q4 GDP growth rate from 1.6% on November 4 to 2.5% today, while the Federal Reserve Bank of Atlanta’s estimate has gone from 3.1% to 3.6%.

But the biggest news would seem to be the election outcome, which raised the prospects of significant fiscal stimulus. I think we’re likely to see both tax cuts and spending increases passed relatively quickly by the new Congress and signed into law by the new President. While that could raise some other concerns, a prolonged deflationary slump isn’t one of them.

Supply is another issue. Some of the compression of the term premium probably reflects scarcity coming from, first, Fed QE removal of duration from the market, and, subsequently, similar bond purchases in Europe and Japan reducing supply of risk free paper in those markets and increasing demand for US Treasuries. Markets perceive, rightly, that the coming US federal government tax cuts will increase budget deficits and hence Treasury supply dramatically. The uncertainty about the timing and exact magnitude of this supply probably implies that the increase in term premium and rise in yields has been only partial so far. Additionally, note that the continuing loss of FX reserves by emerging market central banks, namely China’s, also implies additional increasing supply for markets.

Given that even monetary policy will remain extremely easy even after a 25bps increase in the Fed Funds rate in December and that the 3m/10yr curve should be steeper than average during periods of very easy monetary policy, the rebuilding of term premia has probably only just begun.

It will be interesting to watch a tax cut into a growing economy. Wonder if the stimulus will be somewhat like a Trump promise to contribute to a charity. Or a Trump promise to disclose his tax returns. All hat and no cattle.

Curious that deficits only seem to matter if a Democrat is president. Now that we have a Republican, it seems that Republicans are Keynesians. Paygo, out the window. Thanks for screwing middle Americans for the last eight years.

Solid work again from you James, thank you very much. Trump would say great.

Many things may happen during Trump’s term, but two are for sure :

1) He will run his presidency with the same mindset as his business empire. Wilbur Ross is the key here.

2) He will team up with Putin and will show no interest in an active foreign policy, some kind of isolationism.

Wilbur Ross is the key. You know, It was with the assistance and assurance of Ross, then senior managing director of Rothschild Inc., that Trump was allowed to keep the casinos and rebuild his businesses in the eighties.

What do you think about Ross ?

It seems, a substantial fiscal expansion by the Trump Administration will be constrained by the $20 trillion national debt, $600 billion annual budget deficits (last year and projected this year), and the most fiscally conservative GOP House since the 1920s. There may instead be a restructuring of taxing and spending with a small net fiscal expansion to achieve stronger growth. That will take some time. However, in the meantime, there will be much more optimism in the economy to boost growth.

Hmmm. Hearing a lot of noise here. We have uncertainty; uncertainty doesn’t seem to be bothering the markets. We will have spending cuts; we won’t have spending cuts. We will have tax cuts; debt precludes more tax cuts. Trump’s advisers are military adventurers; Trump will be an isolationist.

Also, http://www.nytimes.com/interactive/2016/upshot/presidential-polls-forecast.html?_r=0

+1

Dr. Hamilton, IIRC, you projected that the Fed could continue to operate at a profit through about mid 2017 shortly after either QE1 or QE2. Since then we’ve had QE3. But the Fed also received a massive windfall from TARP. How likely is the Fed to keep interest rates low though the next couple of years, and what would rising interest rates do to the budget?

The Trumpster is a Neo-Fisherite….. or is that Neo-Fisherian?

The master of the zero-sum deal and stealing from contractors is a big fan of obfuscation. Maybe he will start a campaign to get the Fed inflation target up to 3 or 4%?

If honourable, esteemed and most prestigious liberal economists have been preaching real price confusion for so many years, why would the Trumpster not be in favour?

Back to the future err autarky => structural changes that encourage higher rates of inflation => American economic happiness!

I think we’re likely to see both tax cuts and spending increases passed relatively quickly by the new Congress and signed into law by the new President. While that could raise some other concerns, a prolonged deflationary slump isn’t one of them.

Great. Just when it starts looking like the economy was starting to get some mild inflation and growth traction on its own, now along comes Trump with a big tax cut giveaway to the 0.1%. Wonderful. Why didn’t the GOP Tea Party types support fiscal stimulus back when it would have done a lot more good? The only good that’s likely to come of the Trump plan is an increase in the nominal interest rate well above the ZLB. That’s not nuthin’, but we’re going to end up paying a hell of a price for a small benefit that could have been purchased for much less. But then again, Trump never was much of a businessman.

its very clear. Republicans, and many of those cranks here on this site, were very comfortable with the idea of damaging the obama response to the economy by withholding support for a stronger fiscal stimulus over the past several years. they were willing to sacrifice many hard working americans lives, in order to make a stronger run at the election cycle. as we also learned, it is ok to lie in order to achieve your means. unfortunately, the democratic side will either need to behave the same way in order to win, or become irrelevant in future elections. politics operates off of the lowest common denominator. we may have gotten to this point eventually, but the trump election cycle shaved decades off of that path of destruction.