As noted in my last post, the collision of expansionary fiscal and counter-cyclical monetary policy will result in an appreciated dollar. How much more appreciated?

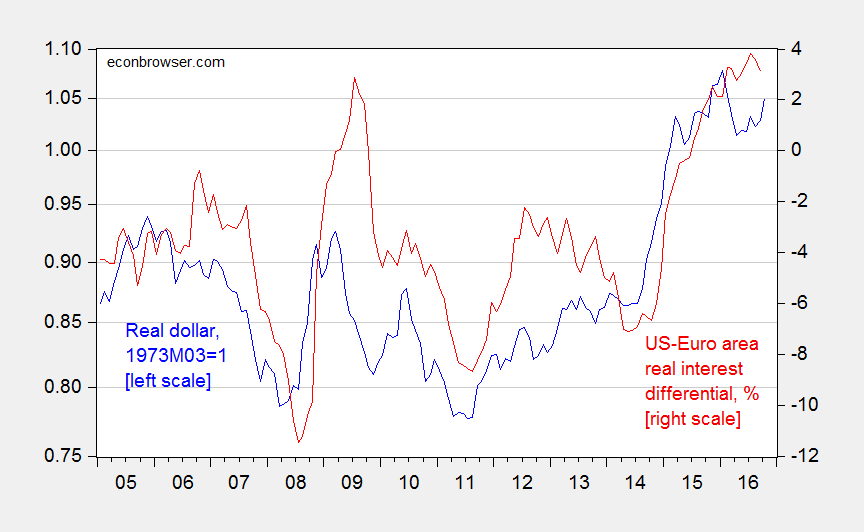

To get a first take on this question, first consider Figure 1 which shows the real value of the dollar against major currencies over the last 12 years, as well as the US-euro area real interest differential.

Figure 1: Real value of US dollar against major currencies (blue, left log scale), 1973M03=1, and nominal shadow Fed funds and ECB rates adjusted by lagged one year inflation rates for US and advanced economies ex-US, in %. Source: Federal Reserve Board, Wu-Xia, and BLS via FRED, and Dallas Fed.

There is an obvious correlation between real rates and the real dollar, as there should be according to certain theories. I estimate the long run relationship using the Johansen maximum likelihood method, assuming a dterministic trend in the data. This yields the following estimate of the cointegrating vector:

r = 5.94(i-i*) + 12.06(π–π*)

where i is the shadow Policy rate, and π is the inflation rate. The null of no cointegrating vectors is rejected at the 10% msl using the trace statistic. The coefficients are not inconsistent with a real interest differential/overshooting model of the exchange rate; a coefficient of 5 on the interest differential is consistent with a rate of price adjustment of 20%, and an interest semi-elasticity of money demand of about 7. See Chinn and Meese (1995) for discussion of a priori values for cointegrating relations).

If interest rates rise by 1.7 percentage points (see the reasoning in this post), then the dollar appreciates another 10 percent or so. If however the aggregate supply curve is nonlinear, or the fiscal stimulus is constructed in such a fashion that there is a substantial emission of new government debt per unit of fiscal stimulus such that more portfolio crowding out occurs than in a typical stimulus, then interest rates might rise more sharply — although a swing of 10.1 percentage points as in 1980M07-1981M01 is unlikely, a move greater than 1.7 percentage points is not implausible.

I might note that while uncertainty and risk is not included in the estimates, a surge in emerging market crises could very well exacerbate a dollar appreciation (consider the dollar in the wake of the 1990’s East Asian crises). And we know such crises tend to follow episodes of US monetary tightening (see discussion in Aizenman et al. 2015, 2016).

Hence, I do not anticipate a drastic shrinkage of the trade deficit (in the absence of a recession), nor do I expect a manufacturing renaissance despite the imposition of potentially punitive tariffs, given the development of extensive global value chains.

Trump may effectively prevent U.S. businesses from offshoring production through lower corporate taxes, less regulation, and pressuring CEOs. Also, he may attract foreign business by threatening tariffs, rewriting trade agreements, and jawboning domestically produced goods. So, there could be a significant shift from foreign to domestic production, along with a boost in U.S. small business.

Trump has already started:

http://mobile.reuters.com/article/idUSKBN13J1MR?feedType=RSS&feedName=topNews&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%253A+reuters%252FtopNews+%2528News+%252F+US+%252F+Top+News%2529

peak, such a scenario will inherently result in inflation here in the usa. are you accepting of such an outcome? i know in the past you have justified such outsourcing by the acquisition of cheap goods, which you claimed was beneficial for our country and produced a higher standard of living. are you going to change positions?

Baffling, it’ll result in stronger real growth. The country continues to underproduce by a large margin. And, exploiting foreign workers and other countries environments has benefited the U.S.. However, we have lots of low-skilled labor in the U.S. to absorb some of their work.

Nonetheless, I’d expect some inflation, particularly from low-wage employment. The migration of low-skilled Latin American workers, who work physically hard jobs at low wages, has slowed. There may already be a shortage of cheap labor. So, low-skilled wages will rise to attract out-of-the-workforce or unemployed American citizens.

Peaktrader: Thanks for the link.

So, is President-elect Trump adopting a ‘brow-beating’ industrial strategy? Will he actually promote domestic jobs by placing domestic companies in a pillory in the public square and throwing rotten tomatoes at them?

Erik, why not? I’m sure, many Americans would enjoy it. In particular, Bernie supporters and Elizabeth Warren types. The Rust Belt would favor it. I doubt more bad press will stop him. Trump can narrow tariffs enough to punish the American corporations not willing to cooperate. He should go after the big tech firms in California and Washington state producing in China. Then, next time, he may not lose California by about 4 million votes.

just the trump version of crony capitalism. you do me a favor and i feed you. you don’t do as i say, and i’ll publicly humiliate you. sure sign of a strong democracy.