In an EconoFact post from Saturday, Michael Klein and I noted that usually for the US, the trade deficit grows during times of robust economic growth.

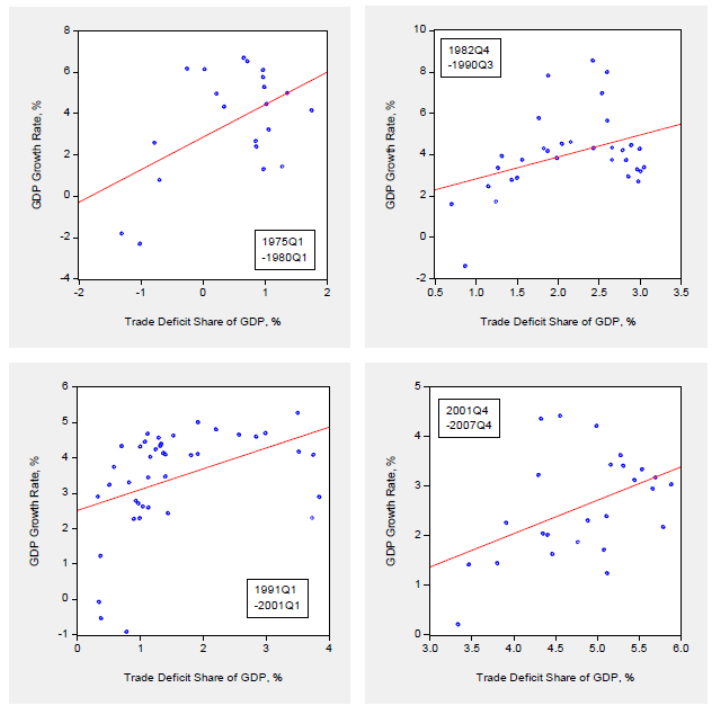

Here I provide an additional way of looking at the relationship between growth and trade deficits — namely scatterplots for the periods from recession trough to peak.

Figure 1: Annualized q/q real GDP growth, % against nominal trade deficit as share of nominal GDP, % for recession trough-to-peak samples. Source: GDP 2016Q3 3rd release, NBER, and author’s calculations.

Notice the clear correlation — as growth accelerates, trade deficits widen.

To understand how thinking in accounting terms can lead to misleading inferences, consider the statement in a Washington Post opinion piece, Peter Navarro and Wilbur Ross wrote:

Net exports are currently running at a negative $500 billion annually, a direct subtraction from growth.

While this is true in terms of accounting, it’s a misleading statement. Consider a firm with revenues of $3 million, and labor and materials costs of $1 million, and hence profits are $2 million. The $1 million in costs are a direct subtraction from $3 million in revenues, but if no labor and materials were purchased and costs $0 million, profits would not be $3 million, but zero.

not a huge fan of this factoid (even if it is true for US, and reflects fact that growth typically is a function of DD which raises imports as well as output)

it generally isn’t as true for more export driven economies than the US, so to a degree it reflects fact that US is a relatively closed (low trade to GDP) economy where exports (esp exports of manufactures) are low v GDP so mechanically exports rarely drive overall growth

Germany’s growth i think shows more correlation with exports

certainly in the years of super strong Chinese growth pre crisis (05-07), strong net exports resulted in exceptional rates of growth

certainly for the US there have been periods (07 for one) when growth would have been much lower but for nx, as domestic demand was weak

Brad Setser: Good point — this correlation applies to the US. I’ve changed the text to reflect that point. However, I think the main idea — that reducing imports invoking ceteris paribus is unrealistic in the context of prediction.

In the relatively short stretches you show above, your correlation holds. How about plotting a longer time line–say, growth rates vs. trade deficit from 1940 on. I think the correlation would probably run the other way over a longer period of time.

William Meyer: Well, yes, could do that – probably back to 1800 or so. Do you want to take those correlations into account when thinking about what is likely to happen in 2017-18?

I’m curious to know why you are quick to point out that thinking in accounting terms can be misleading and yet you have been arguing for years that an increase in G will boost Y.

Jeff: Well, I argue from a model, rather than from and identity. When I say higher G results in higher Y, I will caveat by saying assuming there is some slack in the economy so we are not on the vertical portion of the aggregate supply curve.

Turning to the trade, balance: In a model, say Mundell-Fleming, depending on the shocks, the trade balance can vary with or opposite from growth. My point is that saying:

Y ≡ C+I+G+X-M and just saying set M = 0 gets you commensurately bigger Y is wrong because you can’t invoke in the real world ceteris paribus.

Geez.

Menzie: So does this mean you support the the position that higher NX results in higher Y when there is slack? And why do you assume that the Navarro/Ross comment was not based on a model? As you point out, there are models consistent with the statement. You don’t clearly outline the model you have in mind when you say higher G leads to higher Y (with slack) but you expect everyone else to?

Despite President Obama’s best efforts to reduce U.S. conventional energy resources by closing off federal lands from more oil/natural gas exploration, the U.S. has benefitted greatly from the expanded drilling on state and private lands. President Trump’s approval of the two pipelines halted by President Obama signals an economic shift to come that goes beyond those pipelines: aggressive growth of the U.S. energy sector.

Why is that important? Possibly because it gives U.S. industries a significant cost advantage over Europe and Asia which offset, to some degree, the last decade’s push to increase labor costs which is an area the U.S. is less competitive. https://docs.google.com/viewer?url=http%3A%2F%2Fcep.lse.ac.uk%2Fpubs%2Fdownload%2Fdp1454.pdf

If the advantage in the energy sector widens, it is not unreasonable for industries to rethink their production strategies … and offers the possibility of increasing share of both domestic markets and export markets. Should this happen, perhaps the recent correlation between trade deficits and economic growth may be weakened.

Surely it is just as easy (easier maybe) to argue from the accounting identity. M is subtracted in total to remove it from its inherent inclusion in the other variables.

these lines don’t fit well, all curves look quadratic

jack: I could do a formal test, but really – the point is whether deficits rise or fall with GDP growth…not whether the second derivative is declining. If I really wanted to fit well, I’d do a LOESS regression….

“Net exports are currently running at a negative $500 billion annually, a direct subtraction from growth.”

Ergo, stopping all imports in excess of exports would increase growth by $500 billion annually.

Gee, that seems so logical I wonder why nobody has even proposed doing it?

In a gold-based monetary system mercantilism makes sense, but how does it make sense in our fiat money system where the dollar is the reserve currency of the world economy?

As Keynes said:

“Never in history was there a method devised of such efficacy for setting each country’s advantage at variance with its neighbours’ as the international gold standard. For it made domestic prosperity directly dependent on a competitive pursuit of markets and a competitive appetite for the precious metals. When by happy accident the new supplies of gold were comparatively abundant, the struggle might be somewhat abated. But with the growth of wealth and the diminishing marginal propensity to consume, it has tended to become increasingly internecine.” The General Theory, p. 349.