President Trump is upset that the media missed this economic event:

“The media has not reported that the National Debt in my first month went down by $12 billion vs a $200 billion increase in Obama first mo”

I do not have the stats for Inauguration + 1 month data, but here is end-of-month data through January 2017 for total Federal debt.

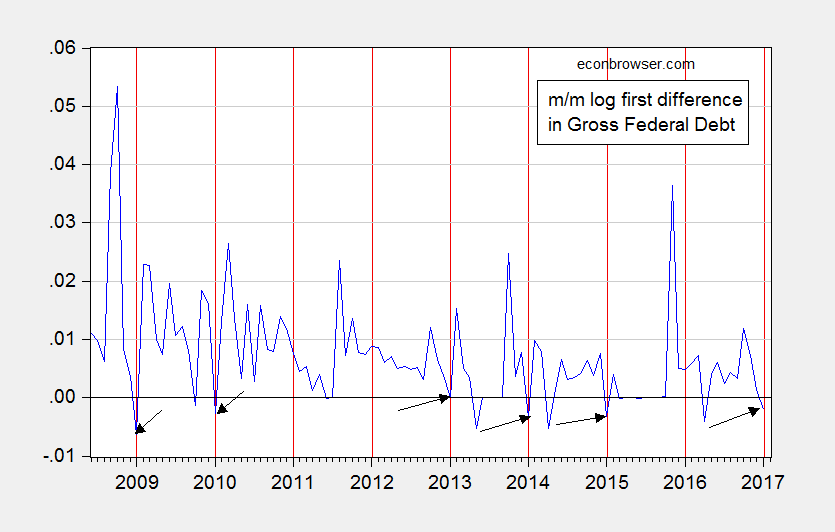

Figure 1: Log first difference of monthly total Federal debt (blue), and red lines at January. Arrows at non-positive January entries. Source: Dallas Fed, and author’s calculations.

Notice that a reduction in debt in January happens more often than not. A regression of this series on a constant and a January dummy over the period 1947M01-2017M01 yields a January coefficient of -0.0036, t-stat of 5.6 (HAC robust standard errors). In words, gross Federal debt drops on average 4.3% (annualized) in January relative to average growth. Of course, total Federal debt includes intra-government holdings. What is more relevant is privately held Federal debt (which includes debt held by the Fed).

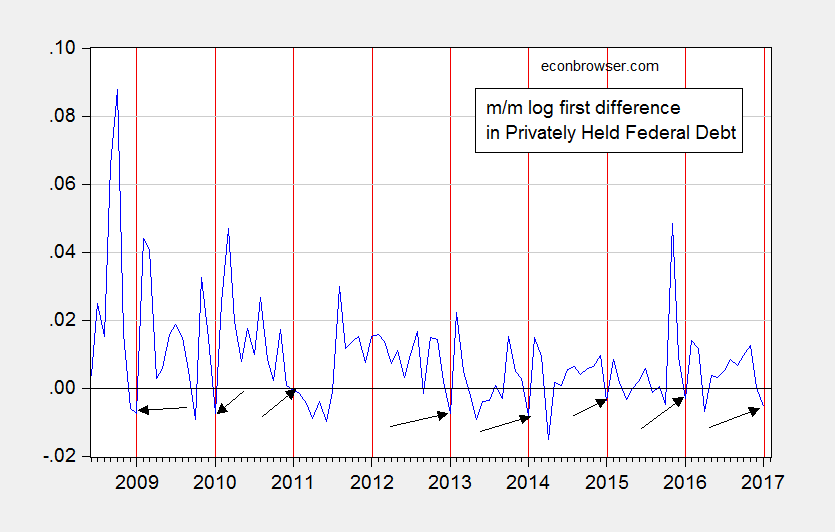

Figure 2: Log first difference of monthly privately held Federal debt (blue), and red lines at January. Arrows at non-positive January entries. Source: Dallas Fed, and author’s calculations.

From Bloomberg:

“Anything that has happened to the debt has been on autopilot since Obama left,” said Laurence Kotlikoff, an economics professor at Boston University. “If anything, he is taking credit for something Obama did.”

It may be wise to allow Trump to take credit for this drop in national debt. Then, he could be compared similarly when to comes to stock gains over the coming years. It follows too that he and his followers routinely ignore variables, and yet they don’t have the foresight to realize that Trump can’t win a ‘variable-free’ comparison when it comes to asset gains over the next several years.

But of course Trump is not very concerned about being caught in lies, claiming for example to have done comparatively well with the electoral college, which shows how cavalier he can be, although, this opportunistic tendency to set an unfair standard could be used against him where and when it matters far more than this ‘little’ lie that won’t hold over time.

Lot of calls in the federal budget balances.

Tax cuts for business and middle class; increase in defense spending, in infrastructure, various other. Right now, the administration remains on track to blow out the budget balance.

Steven Kopits

Tax cuts for business and middle class

I think you meant to say:

Tax cuts for business and middle class, and (especially) the top 1%

There. That’s better.

Funny how all of the old Tea Party folks who visited this blog and ranted endlessly about deficits during the depths of the Great Recession are all on radio silence when it comes to Trump’s deficits.

Not me. I still don’t like deficits. Certainly not given the level of indebtedness and the stage of the business cycle.

That’s the key. Very little reason to be expanding debt right now… especially without addressing long run debt drivers like Medicare.

And as for the top income brackets, yes, they pay most the taxes, and so get most the cuts.

I don’t know, however, that Trump has actually detailed his middle class tax cut plan.

The top 1% will always find ways to avoid paying taxes, even if it means working less and therefore creating less value for society. Taxes should be progressive. However, what is the optimal tax rate for the top 1%, to maximize tax revenue?

Also, we should get rid of negative income taxes or tax credits, not only because of the massive fraud and the incentive to work part-time, but because everyone should contribute something, even if it’s little.

The top 1% pay a whopping share of the taxes. In Connecticut, if I recall correctly, it’s something like 35%. And of course, there’s tax avoidance. My CT hedge fund friends are now operating out of West Palm Beach.

But it’s not a revenue problem, it’s a spending problem.

So the working poor don’t pay FICA taxes? And they don’t pay Medicare taxes? And the don’t pay excise taxes? And they don’t pay fuel taxes? And they don’t pay sales taxes? And they won’t pay for Trump’s wall? And there’s no such thing as tax incidence based on the relative elasticities of labor demand and supply?

As to the optimal revenue maximizing tax rate, there’s plenty of empirical literature on that. We’re nowhere even close to that point. Besides, we could all benefit if the titans of finance would work less…at least they’d being doing less damage if they went fishing or spent the day at the golf course.

Yes, government needs to spend much less, because of all the taxes.

And, everyone would be better off if fewer people went to law school and studied finance instead.

Would you care to guess why the national debt is 12 billion lower? Because the government has been drawing down their operating cash accounts to the tune of $154billion. There are 2 sides to a balance sheet. If debt decreases by 12 billion and assets decrease by $154 billion does any same person consider this progress?